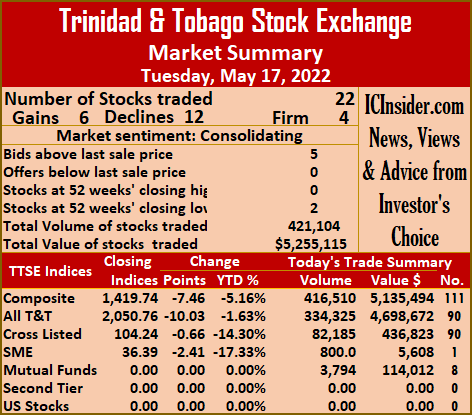

Market activity ended on the Trinidad and Tobago Stock Exchange on Tuesday, with the volume of stocks traded declining 33 percent, with the value down sharply by 81 percent compared to Monday.

As the case on Monday, 22 securities traded on Tuesday, with six rising, 12 declining and four remaining unchanged as two stocks traded at 52 weeks’ lows. The Composite Index fell 7.46 points to 1,419.74, the All T&T Index dipped 10.03 points to 2,050.76 and the Cross-Listed Index lost 0.66 points to settle at 104.24.

As the case on Monday, 22 securities traded on Tuesday, with six rising, 12 declining and four remaining unchanged as two stocks traded at 52 weeks’ lows. The Composite Index fell 7.46 points to 1,419.74, the All T&T Index dipped 10.03 points to 2,050.76 and the Cross-Listed Index lost 0.66 points to settle at 104.24.

A total of 421,104 shares traded for $5,235,115 compared to 623,867 units at $28,183,997 on Monday.

An average of 19,141 units traded at $238,869, down from 28,358 shares at $1,281,091 on Monday, with trading month to date averaging 40,316 units at $471,712 versus 51,687 units at $378,356 on the previous trading day. Trading in April averaged 43,127 units at $458,871.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Angostura Holdings rallied 88 cents to end at $22.89 in trading 358 shares, Ansa McAl declined $1.45 to close at $55.55 after exchanging 500 units, Ansa Merchant Bank ended at $45, with 21 stock units crossing the market. Calypso Macro Investment Fund advanced 2 cents in closing at $18.52 while exchanging ten stocks, Clico Investment Fund dropped 28 cents to $30.48, with an exchange of 3,784 stocks, Endeavour Holdings shed 49 cents to end at a 52 weeks’ low of $7.01 trading 800 stock units. First Citizens Group climbed 6 cents to close at $52.06 after 2,210 shares changed hands, FirstCaribbean International Bank fell 5 cents to $5.40, with 642 units crossing the exchange,  GraceKennedy lost 1 cent in closing at $5.98 after trading 284 units. Guardian Holdings declined 50 cents to $27.50 and ended with 210 stock units trading, JMMB Group lost 7 cents to $2.53, with 16,221 stocks clearing the market, Massy Holdings rose 3 cents to $5.19 after 36,344 shares crossed the market. National Enterprises popped 5 cents to close at $3 in an exchange of 195,680 stock units, National Flour Mills fell 20 cents in closing at $1.60 with the swapping of 28,834 units, and NCB Financial Group shed 4 cents to end at a 52 weeks’ low of $6 in exchanging 65,038 shares. Point Lisas dropped 10 cents to $3.05, with 1,984 stocks changing hands, Republic Financial Holdings dipped 1 cent to $140 in switching ownership of 10,277 units, Scotiabank remained at $78 in exchanging 20,761 shares. Trinidad & Tobago NGL gained 54 cents to end at $20.74 with the swapping of 13,400 stocks, Trinidad Cement finished at $3.60, after 3,000 stock units changed hands, Unilever Caribbean shed 5 cents in closing at $16.50, with 15,733 stocks clearing the market and West Indian Tobacco remained at $23.50 after exchanging 5,013 stock units.

GraceKennedy lost 1 cent in closing at $5.98 after trading 284 units. Guardian Holdings declined 50 cents to $27.50 and ended with 210 stock units trading, JMMB Group lost 7 cents to $2.53, with 16,221 stocks clearing the market, Massy Holdings rose 3 cents to $5.19 after 36,344 shares crossed the market. National Enterprises popped 5 cents to close at $3 in an exchange of 195,680 stock units, National Flour Mills fell 20 cents in closing at $1.60 with the swapping of 28,834 units, and NCB Financial Group shed 4 cents to end at a 52 weeks’ low of $6 in exchanging 65,038 shares. Point Lisas dropped 10 cents to $3.05, with 1,984 stocks changing hands, Republic Financial Holdings dipped 1 cent to $140 in switching ownership of 10,277 units, Scotiabank remained at $78 in exchanging 20,761 shares. Trinidad & Tobago NGL gained 54 cents to end at $20.74 with the swapping of 13,400 stocks, Trinidad Cement finished at $3.60, after 3,000 stock units changed hands, Unilever Caribbean shed 5 cents in closing at $16.50, with 15,733 stocks clearing the market and West Indian Tobacco remained at $23.50 after exchanging 5,013 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

An avalanche of falling stocks in Trinidad

No gains for JSE USD market on Monday

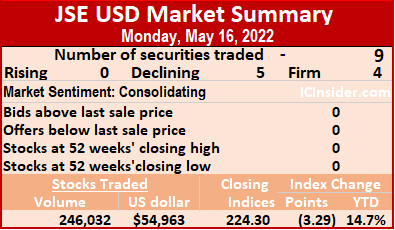

There were no stock recording gains at the close of the Jamaica Stock Exchange US dollar market on Monday after the volume of stocks traded fell 19 percent, with a marginally lower value than on Friday.

A total of nine securities were traded, down from 11 on Friday. No stock recorded gains, five declined and four ended unchanged.

A total of nine securities were traded, down from 11 on Friday. No stock recorded gains, five declined and four ended unchanged.

The JSE US Denominated Equities Index fell 3.29 points to end at 224.30. The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between August this year to August 2023.

Overall, 246,032 shares traded, for US$54,963 compared to 302,622 units at US$59,279 on Friday.

Trading averaged 27,337 units at US$6,107, compared to 27,511 shares at US$5,389 on Friday, with month to date average of 46,342 shares at US$2,813 versus 48,162 units at US$2,498 on the previous day. April ended with an average of 95,379 units for US$3,929.

Investor’s Choice bid-offer indicator shows no stock ended with a bid higher than the last selling price and none with a lower offer.

At the close, First Rock Capital USD share finished at 7.9 US cents after trading 1,763 shares, Margaritaville ended at 15 US cents, with ten stock units clearing the market and Productive Business Solutions remained at US$1.18 with an exchange of 57 stocks. Proven Investments fell 0.35 of a cent to close at 26.45 US cents after 159,603 units crossed the market, Sterling Investments shed 0.24 of one cent to end at 2 US cents in exchanging 37,600 units, Sygnus Credit Investments USD share declined 0.3 of a cent to 12.65 US cents with 33,609 stock units changing hands and Transjamaican Highway lost 0.04 of one cent in closing at 1.02 US cents after trading 5,400 shares.

Proven Investments fell 0.35 of a cent to close at 26.45 US cents after 159,603 units crossed the market, Sterling Investments shed 0.24 of one cent to end at 2 US cents in exchanging 37,600 units, Sygnus Credit Investments USD share declined 0.3 of a cent to 12.65 US cents with 33,609 stock units changing hands and Transjamaican Highway lost 0.04 of one cent in closing at 1.02 US cents after trading 5,400 shares.

In the preference segment, Equityline Mortgage Investment preference share dropped 27 cents after ending at US$1.70 after trading 116 stock units and JMMB Group 6% remained at US$1.02 after exchanging 7,874 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

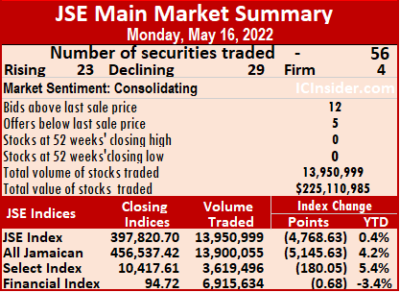

All JSE markets fell

On Monday, all three Jamaica Stock Exchange markets closed lower, with the JSE Combined Index falling 4,753.52 points to close at 411,621.92.

The All Jamaican Composite Index dropped 5,145.63 points to 456,537.42, the JSE Main Index shed 4,768.63 points to 397,820.70, the Junior Market slipped for a third day with a fall of 32.55 points to 4,411.70 and the JSE USD market index dipped 3.29 points to 224.30.

The All Jamaican Composite Index dropped 5,145.63 points to 456,537.42, the JSE Main Index shed 4,768.63 points to 397,820.70, the Junior Market slipped for a third day with a fall of 32.55 points to 4,411.70 and the JSE USD market index dipped 3.29 points to 224.30.

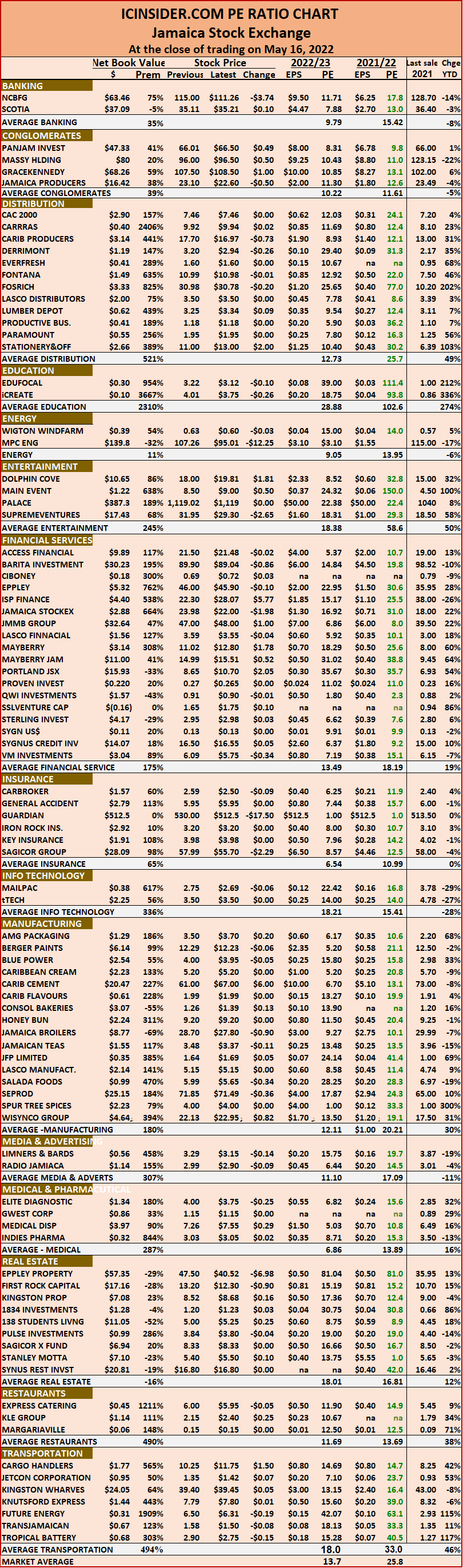

Trading ended with an exchange of 36,150,635 shares in all markets. The value of stocks traded in the Main and Junior markets amounts to $299.9 million and the JSE USD market, US$54,963. The market’s PE ratio ended at 25.8 based on 2021-22 earnings and 13.7 times those for 2022-23 at the close of the Jamaica Stock Exchange.

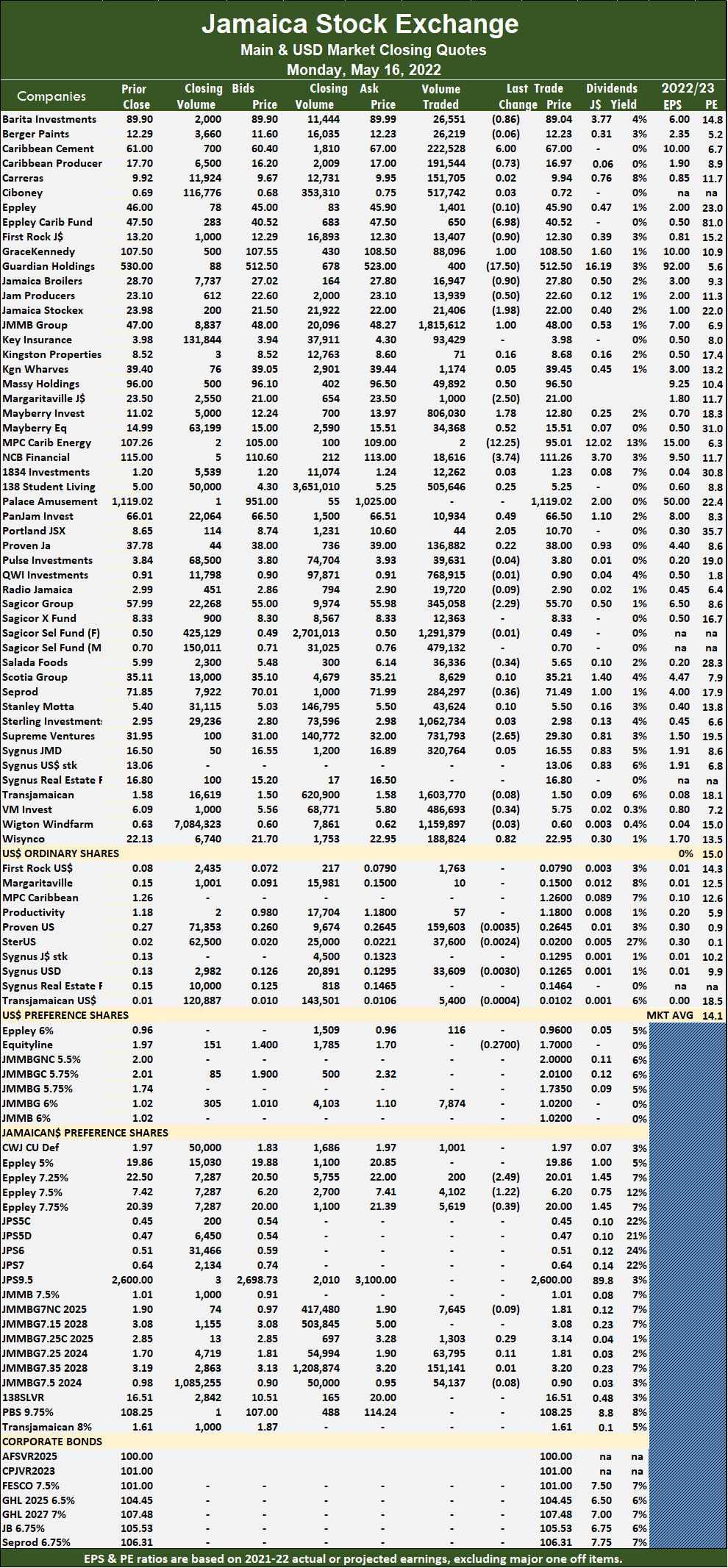

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

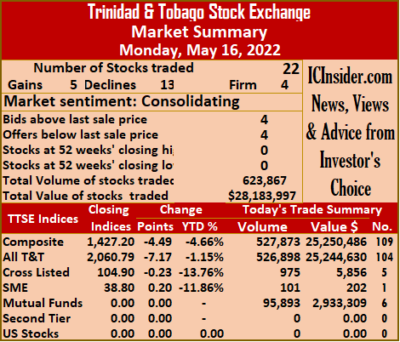

Prices mostly fall on TTSE on Monday

Stocks mostly tumbled on Monday on the Trinidad and Tobago Stock Exchange as investors pumped 344 percent more funds into the market than on Friday, leading to an 18 percent decline in the volume of stocks >trading and a drop in the majority of stocks prices, with a mere hand full rising.

At the close, 22 securities traded, similar to trading on Friday, with five stocks rising, 13 declining and four remaining unchanged. The Composite Index dropped 4.49 points to 1,427.20, the All T&T Index fell 7.17 points to 2,060.79 and the Cross-Listed Index lost 0.23 points to settle at 104.90.

At the close, 22 securities traded, similar to trading on Friday, with five stocks rising, 13 declining and four remaining unchanged. The Composite Index dropped 4.49 points to 1,427.20, the All T&T Index fell 7.17 points to 2,060.79 and the Cross-Listed Index lost 0.23 points to settle at 104.90.

A total of 623,867 shares traded for $28,183,997 versus 759,312 units at $6,354,523 on Friday. An average of 28,358 units traded at $1,281,091 compared to 34,514 shares at $288,842 on the prior trading day. Trading month to date averages 51,687 units at $378,356 versus 44,350 units at $398,396. The average trade for April amounts to 43,127 units at $458,871.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Agostini’s rallied 75 cents to $48 after trading 8,980 shares, Angostura Holdings lost 89 cents in ending at $22.01, with 769 units crossing the market, Ansa McAl fell 60 cents to $57 in an exchange of 391,564 stock units. Calypso Macro Investment Fund shed $1.10 in closing at $18.50, trading 40 stocks, CinemaOne rose 21 cents to close at $2 with 101 units changing hands, Clico Investment Fund advanced 26 cents to end at $30.76 with the swapping of 95,853 stock units. First Citizens Group finished at $52, with 2,251 stocks clearing the market, GraceKennedy slipped 1 cent in closing at $5.99 after exchanging 775 shares, Guardian Holdings climbed $1 to close at $28 in exchanging 125 stock units.  Guardian Media declined 5 cents to $3.10 after 3,886 stocks crossed the exchange, Massy Holdings fell 2 cents to $5.16 in an exchange of 16,426 units, National Enterprises dipped 5 cents in ending at $2.95 with an exchange of 50,520 shares. National Flour Mills remained at $1.80, with 46 stock units changing hands, NCB Financial Group dipped 1 cent in closing at $6.04 while exchanging 200 stocks and One Caribbean Media declined 18 cents to end at $4 after 832 units crossed the market. Point Lisas ended unchanged at $3.15 in switching ownership of 50 shares, Republic Financial Holdings popped 1 cent to close at $140.01 after exchanging 8,498 shares, Scotiabank lost $3 in ending at $78 after exchanging 4,289 stock units. Trinidad & Tobago NGL shed 80 cents in closing at $20.20, with 13,487 units changing hands, Trinidad Cement finished at $3.60, with 8,477 stocks crossing the market, Unilever Caribbean lost $1.84 in closing at $16.55 after exchanging 16,672 stocks and West Indian Tobacco declined 50 cents to end at $23.50, with 26 units crossing the exchange.

Guardian Media declined 5 cents to $3.10 after 3,886 stocks crossed the exchange, Massy Holdings fell 2 cents to $5.16 in an exchange of 16,426 units, National Enterprises dipped 5 cents in ending at $2.95 with an exchange of 50,520 shares. National Flour Mills remained at $1.80, with 46 stock units changing hands, NCB Financial Group dipped 1 cent in closing at $6.04 while exchanging 200 stocks and One Caribbean Media declined 18 cents to end at $4 after 832 units crossed the market. Point Lisas ended unchanged at $3.15 in switching ownership of 50 shares, Republic Financial Holdings popped 1 cent to close at $140.01 after exchanging 8,498 shares, Scotiabank lost $3 in ending at $78 after exchanging 4,289 stock units. Trinidad & Tobago NGL shed 80 cents in closing at $20.20, with 13,487 units changing hands, Trinidad Cement finished at $3.60, with 8,477 stocks crossing the market, Unilever Caribbean lost $1.84 in closing at $16.55 after exchanging 16,672 stocks and West Indian Tobacco declined 50 cents to end at $23.50, with 26 units crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

72% gains for ICTOP10 winner

Stationery and Office Supplies (SOS) is up 72 percent in 2022 and is heading to more than $20 with projected earnings of $1.25 for the year. SOS made the ICTOP15 list in January at 12 spot to produce a 200 percent gain for the year. It came into TOP10 in the week ending January 21, in the 6th spot and exited the TOP10 on the week ending April 22.

Stationery & Office Supplies – Montego Bay office.

Over the past two weeks, company results have been coming out fast and furious, with many posting solid increased profits over the first quarter of 2021, as the economy continues to recover and cost savings also takes hold to help lift profits to record levels in many cases.

One company to benefit from improved results for the first quarter results to March is SOS, with revenues rising 37 percent to $427 million and profits surging 344 percent to $81 million before gains from the sale of a property, investors belated warmed to the stock pushing it to a 52 week’s high of $11.02 and out of ICTOP10. Based on the results, ICInsider.com upgraded earnings from $1.10 to $1.25. Investors in the stock can look for a possible stock split this year if the price rises.

It is well worth noting that the Junior Market peaked at 4,669.78 points at the market opening on May 10 and pulled back to 4,444.25 on Friday as new quarterly results tempered investors in some overvalued stocks that have started to adjust downwards as reality sets in. Among them is Fesco, which was selling at a PE of 50 times the current year’s earnings. There seem to be more painful adjustments to come for investors in this stock. MailPac also suffered a reversal in price after the first quarter results disappointed investors, with lower revenues and earnings.

It is not unusual for investors to take a break after mid-May each year, with most results released and return in late June or early July just ahead of the new earnings season for the half year. Against this background, trading could move sideways for a month or two, but the Lasco companies, Access and Medical Disposables could light up the market when they release results in a few weeks.

Berger Paints annual report had good news for investors to digest.

In the Main Market, Jamaica Stock Exchange was added to the ICTOP10 recently but slipped out last week and reported solid results for the March quarter, with profit jumping 84 percent after revenues rose 37 percent. The projected earnings were downgraded to $1.30 from $3, leaving the stock just about appropriately valued. Berger Paints came out with solid earnings, resulting in our projection being upgraded from $1.70 to $2.35, helped by a sharp cut in other operating expenses from $160 million in 2021 to $117 million and now heads the Main Market TOP10 list.

Elite Diagnostic gained 3 percent for the week at $4, but the promise that the company showed when it was listed has started to show again, with revenues in the third quarter rising 24 percent to $161 million and profit surging to $28 million from $4.4 million in 2021. Based on the results, earnings for the current year ending in June are projected at 24 cents and 55 cents for the 2022/23 fiscal year.

Former ICTOP10 listing, Tropical Battery earnings were downgraded to 18 cents per share for this year, following the release of March half year results.

Access Financial jumped 22 percent last week, and is down 16 percent this past week at $21.50, and attracted more buying interest as the release of year results approaches. tTech tumbled 8 percent during the week and AMG Packaging 7 percent. Caribbean Assurance Brokers was the only stock with any meaningful gain, with a rise of 6 percent.

Access Financial jumped 22 percent last week, and is down 16 percent this past week at $21.50, and attracted more buying interest as the release of year results approaches. tTech tumbled 8 percent during the week and AMG Packaging 7 percent. Caribbean Assurance Brokers was the only stock with any meaningful gain, with a rise of 6 percent.

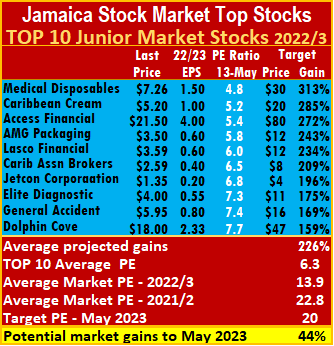

This week, there was no change to ICInsider.com TOP10 Main Market listings, but the Junior Market has two, with Lasco Distributors just slipping out. Jetcon Corporation suffered a big price decline during the week to close at $1.35 to reenter the list. tTech earnings were revised down to 25 cents after the company posted flat sales in the first quarter and a small loss and fell out of the top listing to be replaced by Dolphin Cove is poised to grow much more this year as improving tourism traffic that April numbers show is virtually back to normal provide a big boost to future earnings.

Investors should be on the lookout for companies with March year end that have not yet reported earnings. Amongst the grouping are the three Lasco companies that could get price moving punch from the results. Watch also Access and Medical Disposables sitting on the TOP of the list, with the company said to be generating profit from the acquisition of Cornwall Enterprises, well ahead of the two year target. ICInsider.com earnings projections of 70 cents per share for the 2022 fiscal year assume that earnings would include profit from the subsidiary and should result in a big jump in the stock toward $14.

The primary mover in the main market was Caribbean Cement that fell 12 percent to $61 as buying interest in the stock remains low, even as the first quarter results suggest the stock is highly undervalued, no other stock had any serious change.

The primary mover in the main market was Caribbean Cement that fell 12 percent to $61 as buying interest in the stock remains low, even as the first quarter results suggest the stock is highly undervalued, no other stock had any serious change.

The average PE for the JSE Main Market TOP 10 ends the week at 6.2, well below the market average of 15.3, while the Junior Market PE for the Top 10 sits at 6.3 versus the market at 13.9. The Junior Market TOP10 is projected to gain an average of 226 percent by May 2023 and the Main Market 215 percent.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

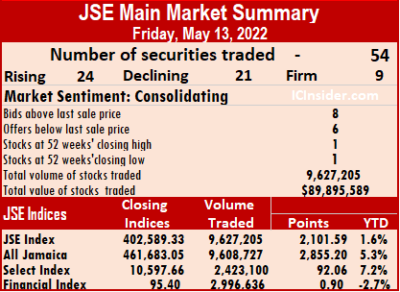

JSE Main Markets rise Juniors fall

Jamaica Stock Exchange markets closed mixed on Friday, with the Main and the US denominated market rising and the Junior Market slipping for a second day, but was only down 20.57 points to 4444.25, compared to a fall of 99.65 points on Thursday. At the close, the JSE Combined Index rose 1,784.92 2,632.85 points to close at 416,375.44.

The All Jamaican Composite Index popped 2,855.20 points to 461,683.05, the JSE Main Index shed 2,101.59 points to 402,589.33 and the JSE USD market index gained 3.62 points to end at 227.59.

The All Jamaican Composite Index popped 2,855.20 points to 461,683.05, the JSE Main Index shed 2,101.59 points to 402,589.33 and the JSE USD market index gained 3.62 points to end at 227.59.

Trading ended with an exchange of 24,928,782 shares in all markets. The value of stocks traded in the Main and Junior Markets amounts to $159.8 million and the JSE USD market, US$59,279. The market’s PE ratio ended at 25.7 based on 2021-22 earnings and 13.5 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Market activity led to 45 securities trading compared to 44 on Friday and ended with 15 rising, 17 declining and 13 closing unchanged.

Market activity led to 45 securities trading compared to 44 on Friday and ended with 15 rising, 17 declining and 13 closing unchanged. At the close, AMG Packaging gained 20 cents to close at $3.70 trading of 82,039 shares, Cargo Handlers popped $1.50 to $11.75 with an exchange of 5,770 stock units, Consolidated Bakeries popped 13 cents to $1.39, with 439,482 stocks crossing the exchange. Derrimon Trading 26 cents to end at $2.94, with 837,205 units passing through the market, Dolphin Cove climbed $1.81 to $19.81, with 71,493 units clearing the market, EduFocal lost 10 cents to close at $3.12, trading 971,822 shares. Elite Diagnostic declined 25 cents to end at $3.75 while exchanging 2,215,388 stock units, Fosrich dropped 20 cents in closing at $30.78 in switching ownership of 135,750 stocks, and Future Energy Source fell 19 cents to $6.31 in an exchange of 1,390,058 units. iCreate declined 26 cents to close at $3.75 after exchanging 74,053 stocks, ISP Finance jumped $5.77 to $28.07, with 35 shares crossing the market, Jamaican Teas dropped 11 cents in closing at $3.37 after 531,901 stock units changed hands. KLE Group gained 25 cents in ending at $2.40 and exchanging 6,000 stock units, Limners and Bards fell 14 cents to close at $3.15 with the swapping of 51,280 units, Main Event rallied 50 cents to end at $9, with 78,728 stocks changing hands.

At the close, AMG Packaging gained 20 cents to close at $3.70 trading of 82,039 shares, Cargo Handlers popped $1.50 to $11.75 with an exchange of 5,770 stock units, Consolidated Bakeries popped 13 cents to $1.39, with 439,482 stocks crossing the exchange. Derrimon Trading 26 cents to end at $2.94, with 837,205 units passing through the market, Dolphin Cove climbed $1.81 to $19.81, with 71,493 units clearing the market, EduFocal lost 10 cents to close at $3.12, trading 971,822 shares. Elite Diagnostic declined 25 cents to end at $3.75 while exchanging 2,215,388 stock units, Fosrich dropped 20 cents in closing at $30.78 in switching ownership of 135,750 stocks, and Future Energy Source fell 19 cents to $6.31 in an exchange of 1,390,058 units. iCreate declined 26 cents to close at $3.75 after exchanging 74,053 stocks, ISP Finance jumped $5.77 to $28.07, with 35 shares crossing the market, Jamaican Teas dropped 11 cents in closing at $3.37 after 531,901 stock units changed hands. KLE Group gained 25 cents in ending at $2.40 and exchanging 6,000 stock units, Limners and Bards fell 14 cents to close at $3.15 with the swapping of 51,280 units, Main Event rallied 50 cents to end at $9, with 78,728 stocks changing hands.  Medical Disposables climbed 29 cents to $7.55 in trading 205,196 shares, SSL Venture gained 10 cents in closing at $1.75 after exchanging 518,833 units, Stationery and Office Supplies climbed $2 to a 52 weeks’ closing high of $13 after 219,069 stock units crossed the market and Tropical Battery shed 15 cents to close at $2.75 while exchanging 2,742,878 shares.

Medical Disposables climbed 29 cents to $7.55 in trading 205,196 shares, SSL Venture gained 10 cents in closing at $1.75 after exchanging 518,833 units, Stationery and Office Supplies climbed $2 to a 52 weeks’ closing high of $13 after 219,069 stock units crossed the market and Tropical Battery shed 15 cents to close at $2.75 while exchanging 2,742,878 shares. The All Jamaican Composite Index lost 5,145.63 points to close at 456,537.42, the JSE Main Index and the JSE Financial Index dipped 0.68 points to settle at 94.72.

The All Jamaican Composite Index lost 5,145.63 points to close at 456,537.42, the JSE Main Index and the JSE Financial Index dipped 0.68 points to settle at 94.72. At the close, Barita Investments shed 86 cents to close at $89.04 in trading 26,551 shares, Caribbean Cement rose $6 to $67 after exchanging 222,528 stock units, Caribbean Producers lost 73 cents in closing at $16.97 after exchanging 191,544 units. Eppley Caribbean Property Fund dropped $6.98 to $40.52, with 650 stocks clearing the market, First Rock Capital fell 90 cents to $12.30, with 13,407 stock units crossing the market, GraceKennedy gained $1 to end at $108.50 with the swapping of 88,096 stocks. Guardian Holdings dropped $17.50 to $512.50, with400 units crossing the market, Jamaica Broilers lost 90 cents to close at $27.80 after trading 16,947 shares, Jamaica Producers declined 50 cents in closing at $22.60, with 13,939 stocks changing hands. Jamaica Stock Exchange dropped $1.98 in ending at $22 in an exchange of 21,406 units, JMMB Group advanced $1 to close at $48 with 1,815,612 shares changing hands, Margaritaville fell $2.50 to $21 while exchanging 1,000 stock units. Massy Holdings climbed 50 cents in closing at $96.50 in swapping ownership of 49,892 units, Mayberry Investments popped $1.78 to end at a 52 weeks’ closing high of $12.80 in switching ownership of 806,030 stock units, Mayberry Jamaican Equities gained 52 cents in ending at $15.51 after trading 34,368 shares. MPC Caribbean Clean Energy shed $12.25 to end at $95.01 after two shares crossed the exchange, NCB Financial declined $3.74 to $111.26 in trading 18,616 shares, PanJam Investment rallied 49 cents to end at $66.50 after exchanging 10,934 units.

At the close, Barita Investments shed 86 cents to close at $89.04 in trading 26,551 shares, Caribbean Cement rose $6 to $67 after exchanging 222,528 stock units, Caribbean Producers lost 73 cents in closing at $16.97 after exchanging 191,544 units. Eppley Caribbean Property Fund dropped $6.98 to $40.52, with 650 stocks clearing the market, First Rock Capital fell 90 cents to $12.30, with 13,407 stock units crossing the market, GraceKennedy gained $1 to end at $108.50 with the swapping of 88,096 stocks. Guardian Holdings dropped $17.50 to $512.50, with400 units crossing the market, Jamaica Broilers lost 90 cents to close at $27.80 after trading 16,947 shares, Jamaica Producers declined 50 cents in closing at $22.60, with 13,939 stocks changing hands. Jamaica Stock Exchange dropped $1.98 in ending at $22 in an exchange of 21,406 units, JMMB Group advanced $1 to close at $48 with 1,815,612 shares changing hands, Margaritaville fell $2.50 to $21 while exchanging 1,000 stock units. Massy Holdings climbed 50 cents in closing at $96.50 in swapping ownership of 49,892 units, Mayberry Investments popped $1.78 to end at a 52 weeks’ closing high of $12.80 in switching ownership of 806,030 stock units, Mayberry Jamaican Equities gained 52 cents in ending at $15.51 after trading 34,368 shares. MPC Caribbean Clean Energy shed $12.25 to end at $95.01 after two shares crossed the exchange, NCB Financial declined $3.74 to $111.26 in trading 18,616 shares, PanJam Investment rallied 49 cents to end at $66.50 after exchanging 10,934 units.  Portland JSX gained $2.05 to $10.70, with 44 stocks crossing the market, Sagicor Group shed $2.29 to close at $55.70 while exchanging 345,058 stock units, Salada Foods dipped 34 cents in closing at $5.65, with 36,336 units clearing the market. Seprod lost 36 cents to end at $71.49 with an exchange of 284,297 stocks, Supreme Ventures fell $2.65 in ending at $29.30 after exchanging 731,793 stock units, Victoria Mutual Investments fell 34 cents to close at $5.75, trading 486,693 shares and Wisynco Group advanced 82 cents to $22.95 with an exchange of 188,824 shares.

Portland JSX gained $2.05 to $10.70, with 44 stocks crossing the market, Sagicor Group shed $2.29 to close at $55.70 while exchanging 345,058 stock units, Salada Foods dipped 34 cents in closing at $5.65, with 36,336 units clearing the market. Seprod lost 36 cents to end at $71.49 with an exchange of 284,297 stocks, Supreme Ventures fell $2.65 in ending at $29.30 after exchanging 731,793 stock units, Victoria Mutual Investments fell 34 cents to close at $5.75, trading 486,693 shares and Wisynco Group advanced 82 cents to $22.95 with an exchange of 188,824 shares. The All Jamaican Composite Index rallied 2,855.20 points to close at 461,683.05, the JSE Main Index rose 2,101.59 points to 402,589.33 and the JSE Financial Index popped 0.90 points to settle at 95.40.

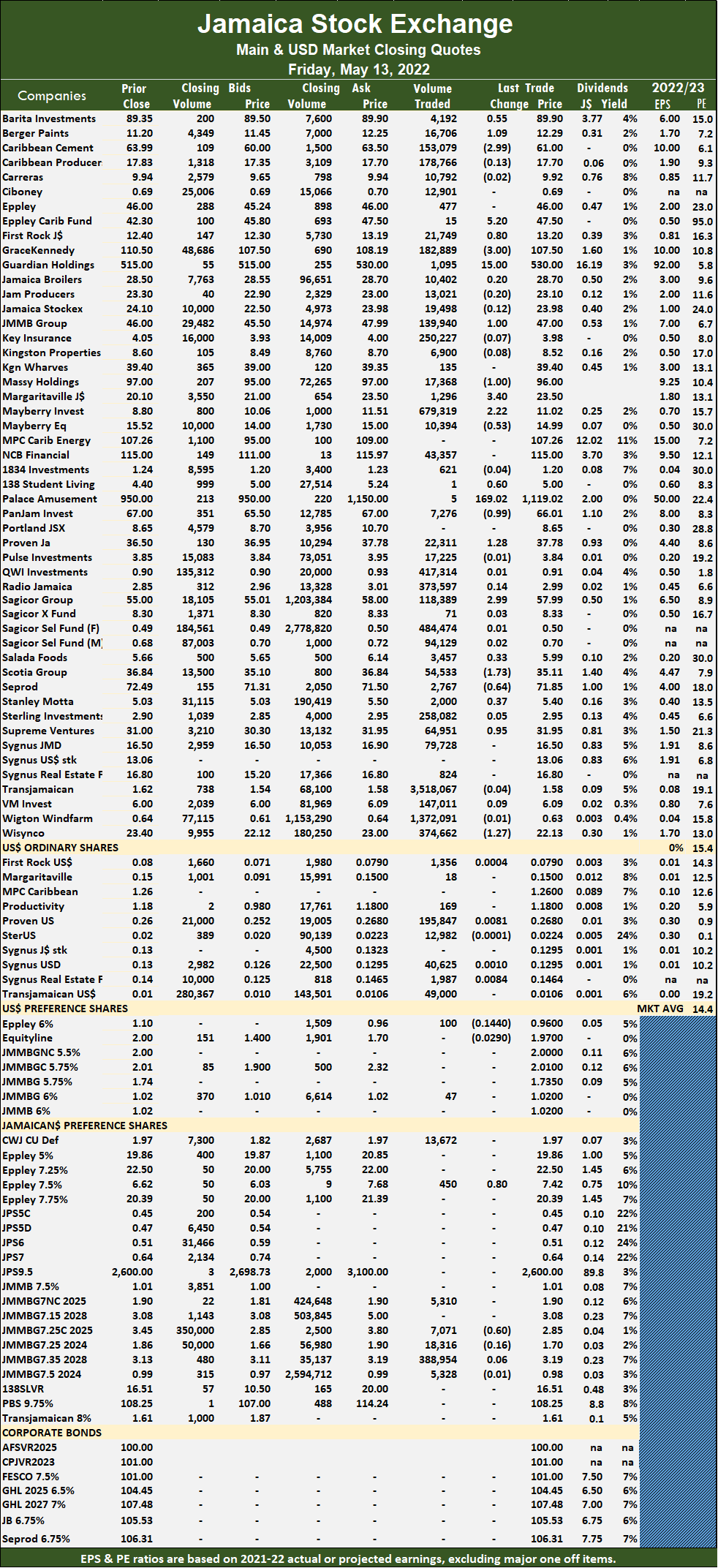

The All Jamaican Composite Index rallied 2,855.20 points to close at 461,683.05, the JSE Main Index rose 2,101.59 points to 402,589.33 and the JSE Financial Index popped 0.90 points to settle at 95.40. At the close, Barita Investments popped 55 cents to close at $89.90 with an exchange of 4,192 shares, Berger Paints advanced $1.09, in closing at $12.29 in an exchange of 6,706 stocks, Caribbean Cement lost $2.99 to end at $61, with 153,079 units crossing the exchange. Eppley Caribbean Property Fund gained $5.20 in ending at $47.50, with 15 stock units changing hands, First Rock Capital rose 80 cents to $13.20 after trading 21,749 stocks, GraceKennedy dropped $3 to $107.50 with 182,889 stock units changing hands. Guardian Holdings climbed $15 in ending at $530, with 1,095 shares crossing the market, JMMB Group rose $1 to close at $47 after 139,940 units changed hands, Massy Holdings fell $1 in closing at $96 while exchanging 17,368 shares. Mayberry Investments rallied $2.22 to end at $11.02 in trading 679,319 stocks, Mayberry Jamaican Equities shed 53 cents to end at $14.99, with 10,394 units clearing the market, 138 Student Living popped 60 cents to $5 after exchanging one stock unit. Palace Amusement advanced $169.02 to $1119.02 in trading five stocks, PanJam Investment declined 99 cents to $66.01 in trading 7,276 shares, Proven Investments increased $1.28 to close at $37.78 with the swapping of 22,311 stock units.

At the close, Barita Investments popped 55 cents to close at $89.90 with an exchange of 4,192 shares, Berger Paints advanced $1.09, in closing at $12.29 in an exchange of 6,706 stocks, Caribbean Cement lost $2.99 to end at $61, with 153,079 units crossing the exchange. Eppley Caribbean Property Fund gained $5.20 in ending at $47.50, with 15 stock units changing hands, First Rock Capital rose 80 cents to $13.20 after trading 21,749 stocks, GraceKennedy dropped $3 to $107.50 with 182,889 stock units changing hands. Guardian Holdings climbed $15 in ending at $530, with 1,095 shares crossing the market, JMMB Group rose $1 to close at $47 after 139,940 units changed hands, Massy Holdings fell $1 in closing at $96 while exchanging 17,368 shares. Mayberry Investments rallied $2.22 to end at $11.02 in trading 679,319 stocks, Mayberry Jamaican Equities shed 53 cents to end at $14.99, with 10,394 units clearing the market, 138 Student Living popped 60 cents to $5 after exchanging one stock unit. Palace Amusement advanced $169.02 to $1119.02 in trading five stocks, PanJam Investment declined 99 cents to $66.01 in trading 7,276 shares, Proven Investments increased $1.28 to close at $37.78 with the swapping of 22,311 stock units. Sagicor Group gained $2.99 to end at $57.99 in switching ownership of 118,389 units, Salada Foods climbed 33 cents in ending at $5.99 after exchanging 3,457 shares, Scotia Group declined $1.73 to close at $35.11 after 54,533 stocks changed hands. Seprod lost 64 cents to close at $71.85, trading 2,767 units, Stanley Motta rose 37 cents to $5.40, with 2,000 stock units changing hands, Supreme Ventures rallied 95 cents to $31.95 in trading 64,951 stocks and Wisynco Group fell $1.27 to close at $22.13, with 374,662 units crossing the market.

Sagicor Group gained $2.99 to end at $57.99 in switching ownership of 118,389 units, Salada Foods climbed 33 cents in ending at $5.99 after exchanging 3,457 shares, Scotia Group declined $1.73 to close at $35.11 after 54,533 stocks changed hands. Seprod lost 64 cents to close at $71.85, trading 2,767 units, Stanley Motta rose 37 cents to $5.40, with 2,000 stock units changing hands, Supreme Ventures rallied 95 cents to $31.95 in trading 64,951 stocks and Wisynco Group fell $1.27 to close at $22.13, with 374,662 units crossing the market. At the close, Access Financial rose 59 cents to $21.50 after exchanging 149 shares, Cargo Handlers lost $2.75 to $10.25 in an exchange of 23,829 units, Caribbean Assurance Brokers popped 15 cents in closing at $2.59 while trading 45,112 stocks. Dolphin Cove declined $3.20 in ending at $18 in exchanging 105,134 stock units, EduFocal fell 13 cents to close at $3, with 642,761 stocks crossing the market, Fontana advanced 89 cents to $10.99 in an exchange of 85,158 stock units. Fosrich lost $1 in ending at $30.98 with 122,203 units changing hands, Future Energy Source shed 38 cents to close at $6.50 in switching ownership of 1,017,033 shares, General Accident lost 15 cents to close at $5.95, with 13,000 units clearing the market. Honey Bun dropped 15 cents to $9.20 after finishing trading of 1,206,963 stocks, Iron Rock Insurance shed 25 cents to close at $3.20 in an exchange of 26,771 stock units, Jetcon Corporation fell 26 cents to end at $1.35, trading 102,085 shares. Lasco Distributors climbed 10 cents to $3.50, with 828,816 shares crossing the market, Lasco Financial gained 19 cents to $3.59 in trading 539,344 units, Main Event declined 49 cents in closing at $8.50 with the swapping of 325,825 stocks.

At the close, Access Financial rose 59 cents to $21.50 after exchanging 149 shares, Cargo Handlers lost $2.75 to $10.25 in an exchange of 23,829 units, Caribbean Assurance Brokers popped 15 cents in closing at $2.59 while trading 45,112 stocks. Dolphin Cove declined $3.20 in ending at $18 in exchanging 105,134 stock units, EduFocal fell 13 cents to close at $3, with 642,761 stocks crossing the market, Fontana advanced 89 cents to $10.99 in an exchange of 85,158 stock units. Fosrich lost $1 in ending at $30.98 with 122,203 units changing hands, Future Energy Source shed 38 cents to close at $6.50 in switching ownership of 1,017,033 shares, General Accident lost 15 cents to close at $5.95, with 13,000 units clearing the market. Honey Bun dropped 15 cents to $9.20 after finishing trading of 1,206,963 stocks, Iron Rock Insurance shed 25 cents to close at $3.20 in an exchange of 26,771 stock units, Jetcon Corporation fell 26 cents to end at $1.35, trading 102,085 shares. Lasco Distributors climbed 10 cents to $3.50, with 828,816 shares crossing the market, Lasco Financial gained 19 cents to $3.59 in trading 539,344 units, Main Event declined 49 cents in closing at $8.50 with the swapping of 325,825 stocks.  Stationery and Office Supplies rallied $3.40 to a 52 weeks’ high of $11 after 429,937 stock units changed hands and tTech fell 25 cents to end at $3.50, with 26,531 stocks crossing the exchange.

Stationery and Office Supplies rallied $3.40 to a 52 weeks’ high of $11 after 429,937 stock units changed hands and tTech fell 25 cents to end at $3.50, with 26,531 stocks crossing the exchange.