Fontana Waterloo Road branch now new completion.

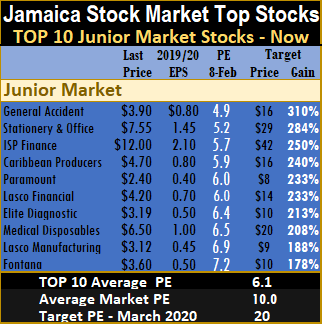

There were some major price movements for the TOP 10 stocks. By the end of the week, Fontana moved up in price to $3.95 and moved out of the list.

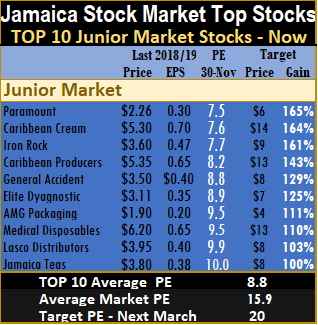

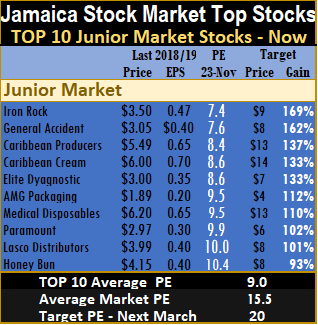

ISP Finance closed with the bid at $13, forecasted earnings was adjusted down to $1.65 for 2019, with the stock existed the TOP 10. Caribbean Cream and Jamaican Teas replaced the above two companies.

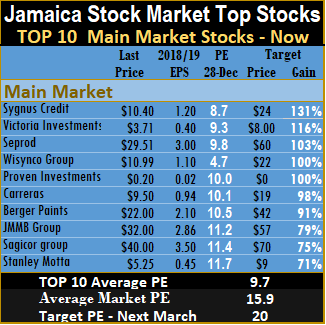

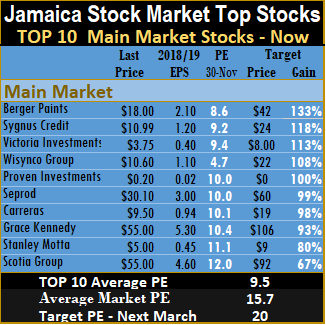

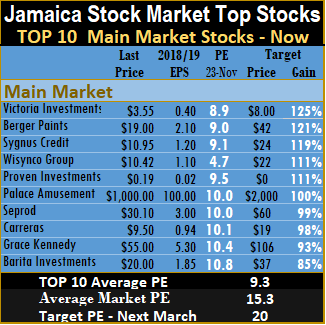

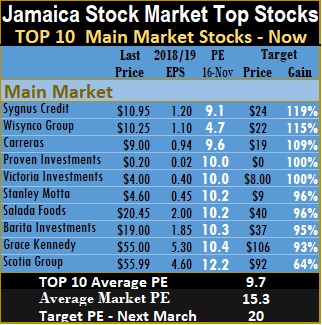

TOP 10 main market selection last week, Wisynco closed the week at $11 and that was enough to move it off the list with Carreras moving back on to the list. Radio Jamaica made a big surge from 80 cents to end the week at $1.20 but with the offer at $1.18 after the company posted strong gains in profit in the December quarter of $168 million versus $79 million in the similar period in 2017. Seprod also enjoyed a big move from $34.85 to $39, both remain in the TOP 10.

Stocks falling out of the TOP 10 should not be ignored, they have much more gains ahead of them, in 2019. Both Fontana and Wisynco earnings are based on June 2019 year-end. Results for the 2020 year will start coming out before the end of this year and could result in increased interest in the stocks.

Medical Disposables fell in price during the week and rose in the TOP 10 to number 2 while Sygnus Credit Investments garnered increased buying interest with the price moving up with the stock just holding on to the number 10 spot on the main market list.

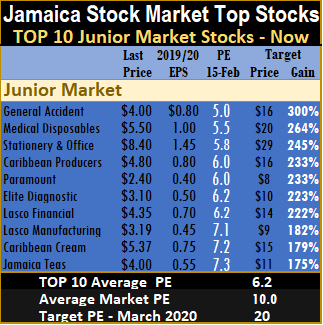

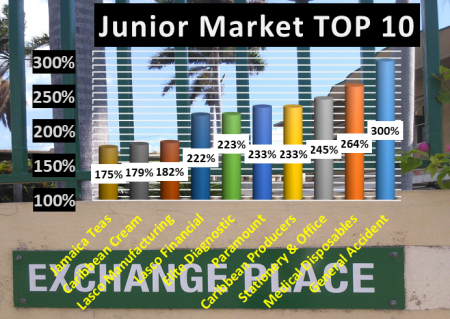

The three leading Junior Market stocks are General Accident, with potential gains of 300 percent, Medical Disposables with 264 percent projected gains and Stationery and Office Supplies 245 percent.

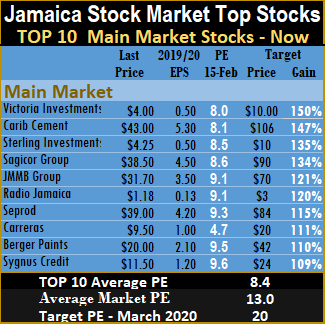

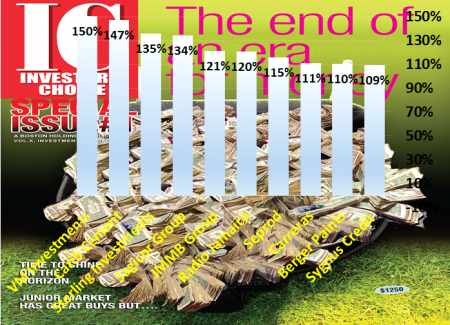

The three leading main market stocks are, Victoria Mutual investments 150 percent likely gains, Caribbean Cement with likely gains of 150 percent and Sterling Investments with 135 percent.

The main market closed the week with the overall PE at 13 and the Junior Market at 10. The PE ratio for Junior Market Top 10 stocks average 6.2 and the main market PE is now 8.4.

The TOP 10 stocks now trade at an average discount of 38 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings. The main market stocks trade at a discount of 35 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns within a 12  months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

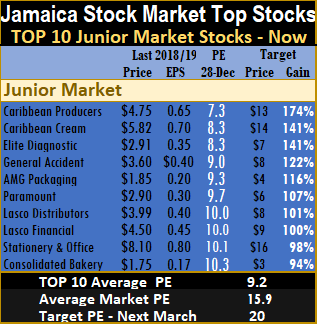

IC Insider.com TOP 10 selections return after a break. The selections, are based on 2019 earnings. Quite a number of the 2018 TOP 10 listings appear again in this year’s lists.

IC Insider.com TOP 10 selections return after a break. The selections, are based on 2019 earnings. Quite a number of the 2018 TOP 10 listings appear again in this year’s lists.

With EPS at 17 cents for the year, to December, full year results could hit 25 cents per share with 2020 moving higher as new product lines deliver more sales and profit.

With EPS at 17 cents for the year, to December, full year results could hit 25 cents per share with 2020 moving higher as new product lines deliver more sales and profit.  upgrade took place in 2018. The company will benefit from increased sales as the construction sector continues to grow and demand more cement to use in building.

upgrade took place in 2018. The company will benefit from increased sales as the construction sector continues to grow and demand more cement to use in building. discount of 37 percent to the overall market.

discount of 37 percent to the overall market.

That could change this year, as the company raised prices late in 2018 and will now be producing all of the cement they sell, thus lowering direct selling cost. For most of 2018, the company imported cement to meet a part of its demand while they were working on upgrading the plant to meet both local and export markets. With continued growth in the economy and strong expansion in the construction sector, the company should continue to enjoy increasing revenues and profit. Cement has partially refinanced some of its US dollar debt and started to pay down the US based debt as well, thus limiting FX losses.

That could change this year, as the company raised prices late in 2018 and will now be producing all of the cement they sell, thus lowering direct selling cost. For most of 2018, the company imported cement to meet a part of its demand while they were working on upgrading the plant to meet both local and export markets. With continued growth in the economy and strong expansion in the construction sector, the company should continue to enjoy increasing revenues and profit. Cement has partially refinanced some of its US dollar debt and started to pay down the US based debt as well, thus limiting FX losses. Sagicor Group PE 9. The company has not delivered much in 2018 partially due to losses incurred in the write down of Barbados bonds that it holds. The company will benefit from increased revenues from the acquisition of the Scotia Group’s insurance business going forward and will also gain from investments in the local stock market as well as from the growth in the local economy and increased employment that should facilitate increased sales of life policies.

Sagicor Group PE 9. The company has not delivered much in 2018 partially due to losses incurred in the write down of Barbados bonds that it holds. The company will benefit from increased revenues from the acquisition of the Scotia Group’s insurance business going forward and will also gain from investments in the local stock market as well as from the growth in the local economy and increased employment that should facilitate increased sales of life policies.

211 percent rise in contrast to the stunning gains by Barita. Salada Foods ended the year with a jump in price to $35 on strong gains in profit, to capture the number 2 best performing spot rising by 211 percent for the year, followed by Palace Amusement with gains of 159 percent, the third year in a row that it is occupying the top 10 list. Kingston Wharves grew 135 percent to be one of 4 stocks to reappear in the top 10 for two consecutive years. Jamaica Broilers gained 67 percent. Pulse Investments reappeared in the Top 10 with a rise of 66 percent and heavy weight, PanJam Investment put in a strong showing of 65 percent, while Supreme Ventures chipped in with 57 percent, Mayberry Investments rose 52 percent and NCB Financial with 50 percent to retain one of the Top 10 spots for the second year in a row.

211 percent rise in contrast to the stunning gains by Barita. Salada Foods ended the year with a jump in price to $35 on strong gains in profit, to capture the number 2 best performing spot rising by 211 percent for the year, followed by Palace Amusement with gains of 159 percent, the third year in a row that it is occupying the top 10 list. Kingston Wharves grew 135 percent to be one of 4 stocks to reappear in the top 10 for two consecutive years. Jamaica Broilers gained 67 percent. Pulse Investments reappeared in the Top 10 with a rise of 66 percent and heavy weight, PanJam Investment put in a strong showing of 65 percent, while Supreme Ventures chipped in with 57 percent, Mayberry Investments rose 52 percent and NCB Financial with 50 percent to retain one of the Top 10 spots for the second year in a row. with most of the proceeds distributed as a dividend thus reducing the value of its assets to a few million dollars. 138 Student Living was next with a fall of 42 percent with Portland JSX ending with a loss for the year of 25 percent following on from Kingston Properties with 22 percent and Sygnus Credit Investments with 20 percent from it 2018 IPO price. Both Ciboney and Carreras that are in the top 10 worst performing stocks in 2018 are coming from the top 10 in 2017.

with most of the proceeds distributed as a dividend thus reducing the value of its assets to a few million dollars. 138 Student Living was next with a fall of 42 percent with Portland JSX ending with a loss for the year of 25 percent following on from Kingston Properties with 22 percent and Sygnus Credit Investments with 20 percent from it 2018 IPO price. Both Ciboney and Carreras that are in the top 10 worst performing stocks in 2018 are coming from the top 10 in 2017.

Derrimon Trading was on the TOP 10 list on November 17, last year, but moved to $8 from $6.50 at the end of the following week and then exited the list and climbed in 2018 after a stock split and acquisition of new business.

Derrimon Trading was on the TOP 10 list on November 17, last year, but moved to $8 from $6.50 at the end of the following week and then exited the list and climbed in 2018 after a stock split and acquisition of new business.

for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well. The volatility in the Jamaican stock market seems to have ended with the closure of the very popular

The volatility in the Jamaican stock market seems to have ended with the closure of the very popular

portfolio. In the main market TOP 10, Sagicor Group that came into the list this past week, is now out and is replaced by

portfolio. In the main market TOP 10, Sagicor Group that came into the list this past week, is now out and is replaced by  an indication that there may be more gains to be had from these Junior market stocks than those in the main market.

an indication that there may be more gains to be had from these Junior market stocks than those in the main market. for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well. The Jamaican stock market saw quite a bit of volatility during the past week resulting from some sharp price movement of some stocks.

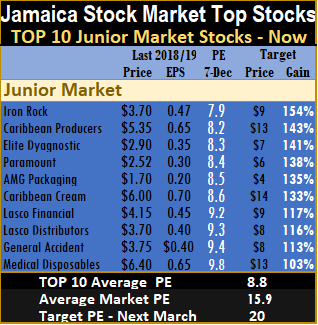

The Jamaican stock market saw quite a bit of volatility during the past week resulting from some sharp price movement of some stocks.

displaced Jamaican Teas TOP 10 last week. In the main market TOP 10 two changes took place with Sagicor Group having fallen to $41 and JMMB Group trading at $34 replacing

displaced Jamaican Teas TOP 10 last week. In the main market TOP 10 two changes took place with Sagicor Group having fallen to $41 and JMMB Group trading at $34 replacing  now 9.9. The top Junior market stocks are selling at a discount of 13 percent to those of the main market stocks even as the overall average PE for both markets are almost equal. This is an indication that there may be more gains to be had from these Junior Market stocks than those in the main market.

now 9.9. The top Junior market stocks are selling at a discount of 13 percent to those of the main market stocks even as the overall average PE for both markets are almost equal. This is an indication that there may be more gains to be had from these Junior Market stocks than those in the main market. on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well. Two changes took place in the main market TOP 10 and one in the Junior Market as market activity pushed out some stocks from the list this past week.

Two changes took place in the main market TOP 10 and one in the Junior Market as market activity pushed out some stocks from the list this past week.

New Entrants this week are, Stanley Motta and Scotia Group for the main market and Jamaican Teas for the Junior Market. Barita Investments jumped to a record $28 on Friday as investors continue to bid up the stock with talk on the road of positive developments surrounding the company. This publication expects good gains from the company’s investment portfolio and the performance of the stock market should also result in growth in the equity-based unit trust and therefo

New Entrants this week are, Stanley Motta and Scotia Group for the main market and Jamaican Teas for the Junior Market. Barita Investments jumped to a record $28 on Friday as investors continue to bid up the stock with talk on the road of positive developments surrounding the company. This publication expects good gains from the company’s investment portfolio and the performance of the stock market should also result in growth in the equity-based unit trust and therefo re boost fee income. In addition, word out is that they have acquired an investment portfolio that will add to revenues. At the current price, a stock split also seems assured for 2019.

re boost fee income. In addition, word out is that they have acquired an investment portfolio that will add to revenues. At the current price, a stock split also seems assured for 2019.

cents from 38 cents in 2017.

cents from 38 cents in 2017.  For the full year earnings could hit $3 per share. That should put the stock back in the $40 range before too long.

For the full year earnings could hit $3 per share. That should put the stock back in the $40 range before too long. preventing same. That should result in better sales and profit than in the 2017 final quarter. In the final quarter of 2016 pretax profit was $233 million compared to just $67 million for the similar period in 2017, when the disruptions occurred.

preventing same. That should result in better sales and profit than in the 2017 final quarter. In the final quarter of 2016 pretax profit was $233 million compared to just $67 million for the similar period in 2017, when the disruptions occurred.

Thee are no change to the TOP 10 main market list. The Junior Market has two changes with

Thee are no change to the TOP 10 main market list. The Junior Market has two changes with

Earnings for General Accident have been adjusted down to 40 cents per share with the latest results now out, but it still holds on to the TOP 10.

Earnings for General Accident have been adjusted down to 40 cents per share with the latest results now out, but it still holds on to the TOP 10. earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.