Two changes took place in the main market TOP 10 and one in the Junior Market as market activity pushed out some stocks from the list this past week.

Two changes took place in the main market TOP 10 and one in the Junior Market as market activity pushed out some stocks from the list this past week.

Palace Amusement and Barita Investments had big price gains during the week and exited the main market top list while Honey Bun reported full year profit of 18 cents per share and dropped out of the top tier stocks but it still showed strong signs of better days ahead as it starts the new fiscal year with increased volume sales.

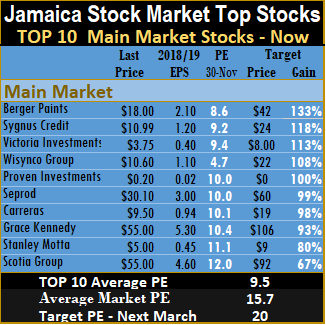

New Entrants this week are, Stanley Motta and Scotia Group for the main market and Jamaican Teas for the Junior Market. Barita Investments jumped to a record $28 on Friday as investors continue to bid up the stock with talk on the road of positive developments surrounding the company. This publication expects good gains from the company’s investment portfolio and the performance of the stock market should also result in growth in the equity-based unit trust and therefo

New Entrants this week are, Stanley Motta and Scotia Group for the main market and Jamaican Teas for the Junior Market. Barita Investments jumped to a record $28 on Friday as investors continue to bid up the stock with talk on the road of positive developments surrounding the company. This publication expects good gains from the company’s investment portfolio and the performance of the stock market should also result in growth in the equity-based unit trust and therefo re boost fee income. In addition, word out is that they have acquired an investment portfolio that will add to revenues. At the current price, a stock split also seems assured for 2019.

re boost fee income. In addition, word out is that they have acquired an investment portfolio that will add to revenues. At the current price, a stock split also seems assured for 2019.

During the week news broke that Scotia Group had entered into an agreement to sell their insurance arm to Sagicor Financial, the news helped to drive prices of Scotia Group, Sagicor Group and PanJam Investment up and created excitement in the market.

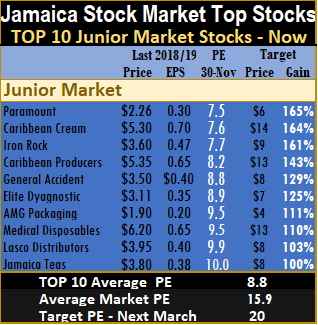

The main market closed the week with the overall PE remains at 15.7, the PE of the Junior market is at 15.9. The PE ratio for Junior Market Top 10 stocks average 8.8 and the main market PE is now 9.5.

The TOP 10 stocks now trade at an average discount of 45 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings. The main market stocks trade at a discount of 39 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.