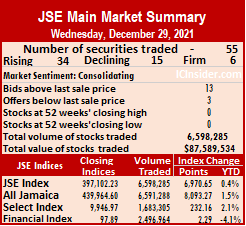

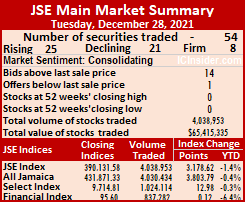

NCB Financial price jumped $3 at the close of market activity on Wednesday and helped with rising stocks more than doubling those declining in sparking a spirited rally and sending the All Jamaican Composite Index up a healthy 8,093.27 points to close at 439,964.60 and pushed the JSE Main Index up by a substantial 6,970.65 points to 397,102.23 at the close of the Jamaica Stock Exchange Main Market.

The JSE Financial Index advanced 2.29 points to settle at 97.89.

The JSE Financial Index advanced 2.29 points to settle at 97.89.

Trading ended with 55 securities up from 54 on Tuesday, with 34 rising, 15 declining and six ending unchanged, with the volume of shares trading rising 63 percent more and the value 34 percent higher more than on Tuesday.

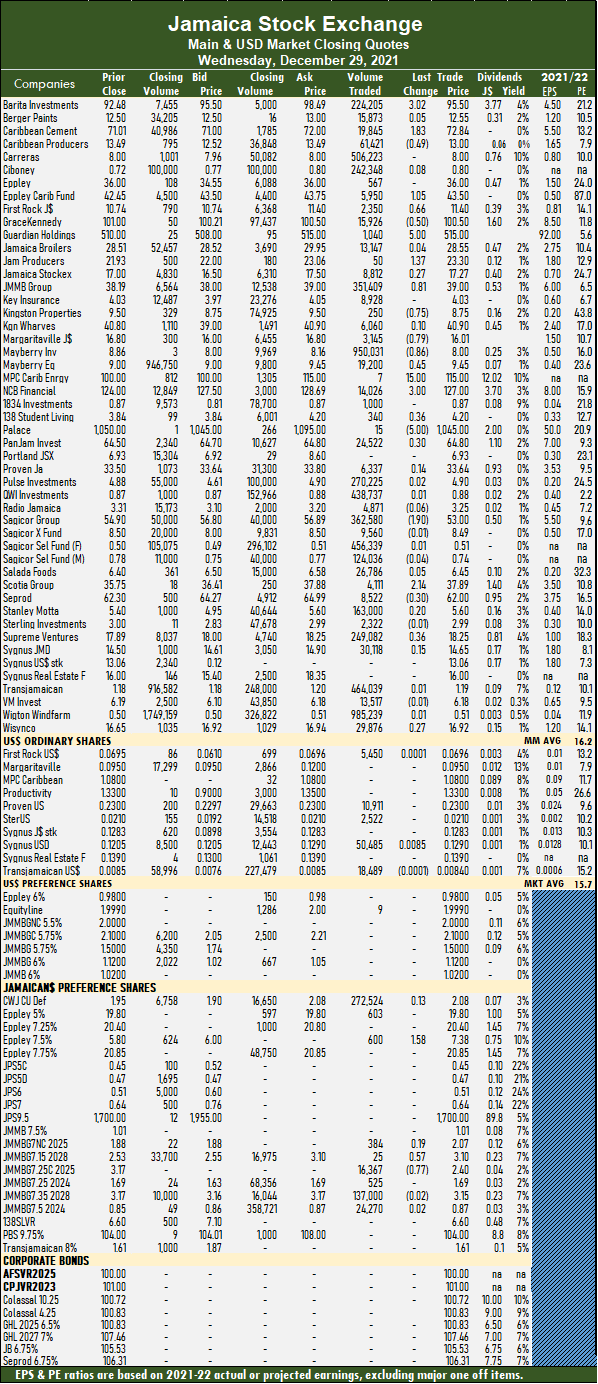

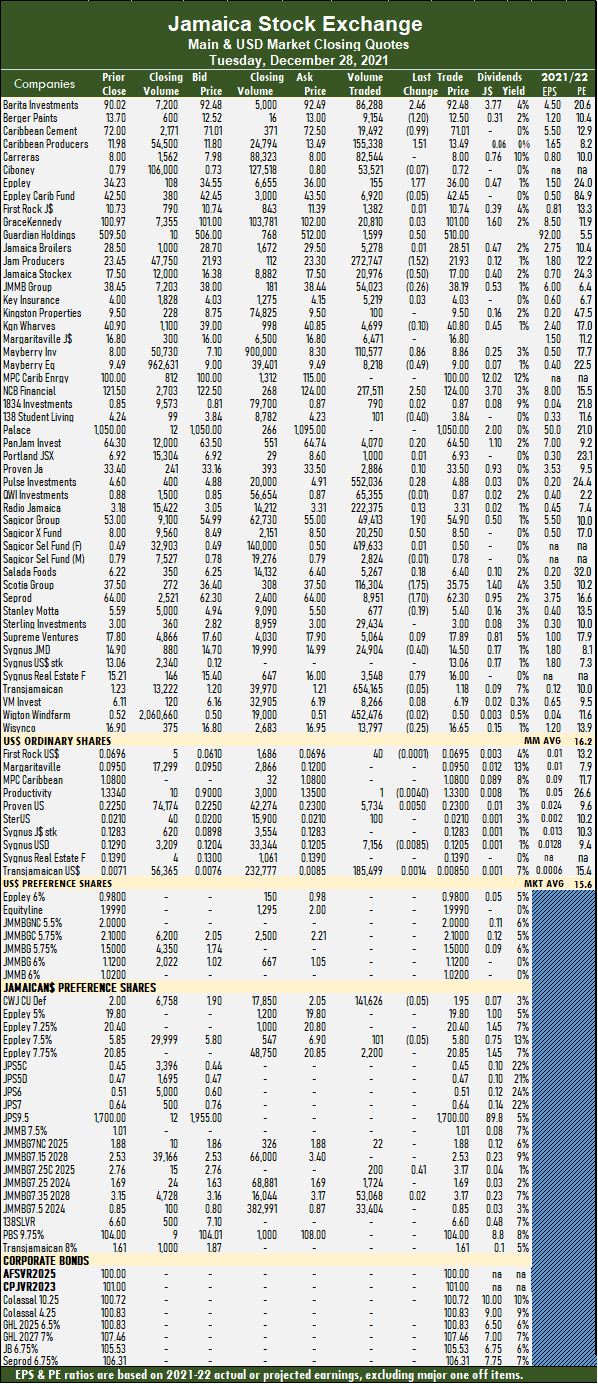

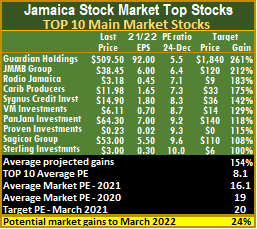

The PE Ratio, a formula for computing appropriate stock values, averages 16.2. The PE ratios for the JSE Main and USD Market closing quotes are based on earnings forecasts by ICInsider.com for companies with financial years ending between the current year and August 2022.

Trading ended with 6,598,285 shares for $87,589,534 versus 4,038,953 units at $65,415,335 on Tuesday. Wigton Windfarm led trading with 985,239 shares for 14.9 percent of total volume followed by Mayberry Investments with 950,031 units for 14.4 percent of the day’s trade and Carreras 506,223 units with a 7.7 percent market share.

Trading averages 119,969 units at $1,592,537 up from 74,795 shares at $1,211,395 on Tuesday and month to date, an average of 393,456 units at $4,220,453, compared to 409,305 units at $4,372,756 on Tuesday. November closed with an average of 233,949 units at $2,695,416.

Trading averages 119,969 units at $1,592,537 up from 74,795 shares at $1,211,395 on Tuesday and month to date, an average of 393,456 units at $4,220,453, compared to 409,305 units at $4,372,756 on Tuesday. November closed with an average of 233,949 units at $2,695,416.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments popped $3.02 to close at $95.50 after trading 224,205 shares, Caribbean Cement spiked $1.83 to $72.84 in switching ownership of 19,845 stock units. Caribbean Producers declined 49 cents in closing at $13, with 61,421 stocks clearing the market, Eppley Caribbean Property Fund advanced $1.05 in ending at $43.50 in swapping of 5,950 shares, First Rock Capital rallied 66 cents to $11.40 with an exchange of 2,350 units. GraceKennedy dropped 50 cents to close at $100.50 in exchanging 15,926 stocks, Guardian Holdings gained $5 after ending at $515, with 1,040 stock units changing hands, Jamaica Producers increased $1.37 in closing at $23.30 after trading 50 stocks. Jamaica Stock Exchange rose 27 cents to end at $17.27, with 8,812 shares crossing the market, JMMB Group increased 81 cents to $39 with an exchange of 351,409 units, Kingston Properties shed 75 cents to $8.75 in an exchange of 250 stock units. Margaritaville fell 79 cents to close at $16.01 trading 3,145 units, Mayberry Investments lost 86 cents in closing at $8 after 950,031 stock units crossed the market, Mayberry Jamaican Equities gained 45 cents to end at $9.45 trading 19,200 stocks. MPC Caribbean Clean Energy spiked $15 to $115 after exchanging 7 shares, NCB Financial jumped $3 in closing at $127 while exchanging 14,026 shares, 138 Student Living climbed 36 cents to end at $4.20 after exchanging 340 shares, Palace Amusement declined $5 to close at $1045 in switching ownership of 15 stocks.  PanJam Investment rose 30 cents to $64.80 after trading 24,522 stock units, Sagicor Group fell $1.90 to end at $53, with 362,580 units crossing the market, Scotia Group popped $2.14 in ending at $37.89 after exchanging 4,111 stocks. Seprod lost 30 cents to end at $62 after exchanging 8,522 stock units, Supreme Ventures climbed 36 cents to end at $18.25 in an exchange of 249,082 shares and Wisynco Group rallied 27 cents to close at $16.92 after 29,876 units changed hands.

PanJam Investment rose 30 cents to $64.80 after trading 24,522 stock units, Sagicor Group fell $1.90 to end at $53, with 362,580 units crossing the market, Scotia Group popped $2.14 in ending at $37.89 after exchanging 4,111 stocks. Seprod lost 30 cents to end at $62 after exchanging 8,522 stock units, Supreme Ventures climbed 36 cents to end at $18.25 in an exchange of 249,082 shares and Wisynco Group rallied 27 cents to close at $16.92 after 29,876 units changed hands.

In the preference segment, Eppley 7.50% preference share advanced $1.58 in closing at $7.38, with 600 units clearing the market, JMMB Group 7.15% – 2028 popped 57 cents to end at $3.10 in trading 25 shares and JMMB Group 7.25% dropped 77 cents in closing at $2.40 trading 16,367 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

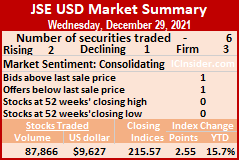

Similar to trading Tuesday, six securities changed hands, with two rising, one declining and three ending unchanged.

Similar to trading Tuesday, six securities changed hands, with two rising, one declining and three ending unchanged. At the close, First Rock Capital USD share popped 0.01 of a cent to close at 6.96 US cents in an exchange of 5,450 shares, Proven Investments ended at 23 US cents after trading 10,911 units, Sterling Investments finished at 2.1 US cents as 2,522 stock units changed hands. Sygnus Credit Investments USD share rose 0.85 of a cent to end at 12.9 US cents, with 50,485 stocks crossing the market and Transjamaican Highway fell 0.01 cents in ending at 0.84 of one US cent, with 18,489 shares changing hands.

At the close, First Rock Capital USD share popped 0.01 of a cent to close at 6.96 US cents in an exchange of 5,450 shares, Proven Investments ended at 23 US cents after trading 10,911 units, Sterling Investments finished at 2.1 US cents as 2,522 stock units changed hands. Sygnus Credit Investments USD share rose 0.85 of a cent to end at 12.9 US cents, with 50,485 stocks crossing the market and Transjamaican Highway fell 0.01 cents in ending at 0.84 of one US cent, with 18,489 shares changing hands. Market activity led to 37 securities trading compared to 40 on Tuesday and ended with 14 rising, 10 declining and 13, closing unchanged.

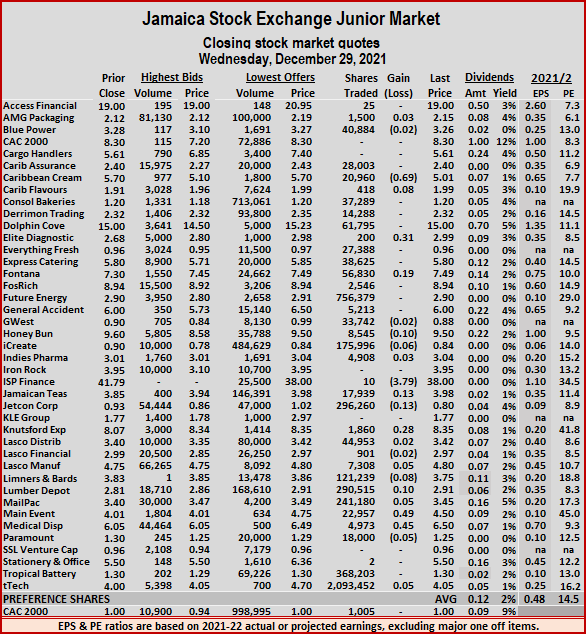

Market activity led to 37 securities trading compared to 40 on Tuesday and ended with 14 rising, 10 declining and 13, closing unchanged. Trading averaged 130,981 shares at $474,943 in contrast to 655,369 shares at $2,534,714 on Tuesday and month to date, an average of 397,606 units at $1,288,906, compared to 412,242 units at $1,333,589 on Tuesday. November closed with an average of 160,358 units at $581,730.

Trading averaged 130,981 shares at $474,943 in contrast to 655,369 shares at $2,534,714 on Tuesday and month to date, an average of 397,606 units at $1,288,906, compared to 412,242 units at $1,333,589 on Tuesday. November closed with an average of 160,358 units at $581,730. Knutsford Express gained 28 cents to close at $8.35 in an exchange of 1,860 stock units, Lasco Manufacturing increased 5 cents to $4.80, with the swapping of 7,308 stocks, Limners and Bards dropped 8 cents to $3.75, with 121,239 units clearing the market. Lumber Depot popped 10 cents in closing at $2.91, with 290,515 shares crossing the market, Mailpac Group rallied 5 cents to end at $3.45 in trading 241,180 stocks, Main Event increased 49 cents to $4.50 trading 22,957 stock units. Medical Disposables advanced 45 cents in closing at $6.50 after exchanging 4,973 units, Paramount Trading shed 5 cents to $1.25, with 18,000 shares crossing the market and tTech popped 5 cents to close at $4.05 in trading 2,093,452 stocks.

Knutsford Express gained 28 cents to close at $8.35 in an exchange of 1,860 stock units, Lasco Manufacturing increased 5 cents to $4.80, with the swapping of 7,308 stocks, Limners and Bards dropped 8 cents to $3.75, with 121,239 units clearing the market. Lumber Depot popped 10 cents in closing at $2.91, with 290,515 shares crossing the market, Mailpac Group rallied 5 cents to end at $3.45 in trading 241,180 stocks, Main Event increased 49 cents to $4.50 trading 22,957 stock units. Medical Disposables advanced 45 cents in closing at $6.50 after exchanging 4,973 units, Paramount Trading shed 5 cents to $1.25, with 18,000 shares crossing the market and tTech popped 5 cents to close at $4.05 in trading 2,093,452 stocks. Trading ended Wednesday, with two stocks hitting 52 weeks’ high as an equal number of stocks rising and falling after trading 299 percent more shares, valued 142 percent more than on Tuesday, at the close of trading on the Trinidad and Tobago Stock Exchange.

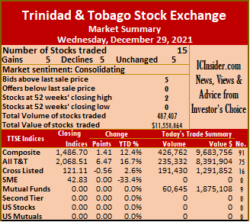

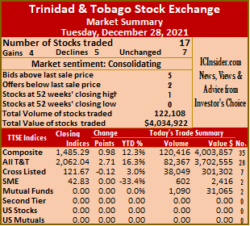

Trading ended Wednesday, with two stocks hitting 52 weeks’ high as an equal number of stocks rising and falling after trading 299 percent more shares, valued 142 percent more than on Tuesday, at the close of trading on the Trinidad and Tobago Stock Exchange. GraceKennedy declined 13 cents to close at $6.05, with 120,000 stocks changing hands, Guardian Holdings shed 33 cents to close at $30 with the swapping of 7,914 units, JMMB Group dropped 2 cents in ending at $2.24 after exchanging 330 stocks. Massy Holdings climbed $1 to close at a 52 weeks’ high of $106 in an exchange of 12,238 stock units, National Enterprises advanced 1 cent in closing at $3.30 after 6,000 shares changed hands, NCB Financial Group remained at $8 in switching ownership of 69,100 units. One Caribbean Media lost 11 cents to close at $4.69 in trading 5 stocks, Republic Financial Holdings spiked $2.02 to end at $140.02, with 22,011 stock units crossing the market, Scotiabank finished unchanged at $68, with 243 shares clearing the market. Trinidad & Tobago NGL popped $1.35 in closing at $21 after trading 185,866 units, Unilever Caribbean ended unchanged at $16.20 after trading 158 stocks and West Indian Tobacco remained at $28.44 while exchanging 457 stock units.

GraceKennedy declined 13 cents to close at $6.05, with 120,000 stocks changing hands, Guardian Holdings shed 33 cents to close at $30 with the swapping of 7,914 units, JMMB Group dropped 2 cents in ending at $2.24 after exchanging 330 stocks. Massy Holdings climbed $1 to close at a 52 weeks’ high of $106 in an exchange of 12,238 stock units, National Enterprises advanced 1 cent in closing at $3.30 after 6,000 shares changed hands, NCB Financial Group remained at $8 in switching ownership of 69,100 units. One Caribbean Media lost 11 cents to close at $4.69 in trading 5 stocks, Republic Financial Holdings spiked $2.02 to end at $140.02, with 22,011 stock units crossing the market, Scotiabank finished unchanged at $68, with 243 shares clearing the market. Trinidad & Tobago NGL popped $1.35 in closing at $21 after trading 185,866 units, Unilever Caribbean ended unchanged at $16.20 after trading 158 stocks and West Indian Tobacco remained at $28.44 while exchanging 457 stock units. Trading averages 74,795 units at $1,211,395, down from 272,298 shares at $4,027,023 on Friday and month to date, an average of 409,305 units at $4,372,756, compared to 429,488 units at $4,563,497 on Friday. Trading in November averaged 233,949 units at $2,695,416.

Trading averages 74,795 units at $1,211,395, down from 272,298 shares at $4,027,023 on Friday and month to date, an average of 409,305 units at $4,372,756, compared to 429,488 units at $4,563,497 on Friday. Trading in November averaged 233,949 units at $2,695,416. Sagicor Real Estate Fund climbed 50 cents to close at $8.50 with an exchange of 20,250 shares, Scotia Group dropped $1.75 to $35.75 trading 116,304 shares, Seprod declined $1.70 to $62.30, with 8,951 stocks clearing the market. Sygnus Credit Investments fell 40 cents to $14.50 after an exchange of 24,904 stock units, Sygnus Real Estate Finance rallied 79 cents in closing at $16 with 3,548 units changing hands and Wisynco Group fell 25 cents to $16.65 in exchanging 13,797 stock units.

Sagicor Real Estate Fund climbed 50 cents to close at $8.50 with an exchange of 20,250 shares, Scotia Group dropped $1.75 to $35.75 trading 116,304 shares, Seprod declined $1.70 to $62.30, with 8,951 stocks clearing the market. Sygnus Credit Investments fell 40 cents to $14.50 after an exchange of 24,904 stock units, Sygnus Real Estate Finance rallied 79 cents in closing at $16 with 3,548 units changing hands and Wisynco Group fell 25 cents to $16.65 in exchanging 13,797 stock units. Trading ended with six securities changing hands, compared to seven on Friday with prices of two rising, three declining and one left unchanged.

Trading ended with six securities changing hands, compared to seven on Friday with prices of two rising, three declining and one left unchanged. At the close, First Rock Capital USD share dropped 0.01 of a cent to close at 6.95 US cents, with 40 shares changing hands, Productive Business Solutions declined 0.4 of a cent in closing at US$1.33 in trading one unit, Proven Investments rose half a cent to end at 23 US cents in exchanging 5,734 stocks. Sterling Investments finished at 2.1 US cents after trading 100 stock units, Sygnus Credit Investments USD share fell 0.85 of a cent to 12.05 US cents in an exchange of 7,156 stock units and Transjamaican Highway popped 0.14 of one cent to end at 0.85 of a US cent trading 185,499 shares.

At the close, First Rock Capital USD share dropped 0.01 of a cent to close at 6.95 US cents, with 40 shares changing hands, Productive Business Solutions declined 0.4 of a cent in closing at US$1.33 in trading one unit, Proven Investments rose half a cent to end at 23 US cents in exchanging 5,734 stocks. Sterling Investments finished at 2.1 US cents after trading 100 stock units, Sygnus Credit Investments USD share fell 0.85 of a cent to 12.05 US cents in an exchange of 7,156 stock units and Transjamaican Highway popped 0.14 of one cent to end at 0.85 of a US cent trading 185,499 shares. Other leading trades were Fosrich, with 1.1 million units for 4.2 percent of the day’s trade and Lumber Depot, with 1.04 million units for 4 percent market share.

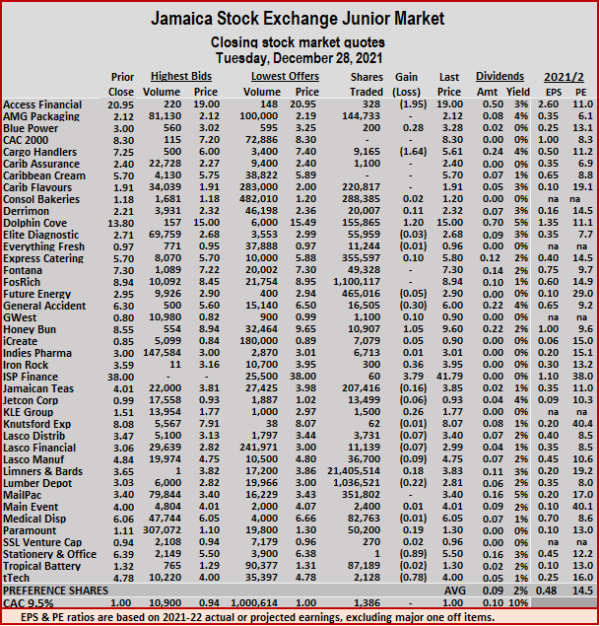

Other leading trades were Fosrich, with 1.1 million units for 4.2 percent of the day’s trade and Lumber Depot, with 1.04 million units for 4 percent market share. At the close, Access Financial shed $1.95 in closing at $19 after trading 328 shares, Blue Power climbed 28 cents to close at $3.28 with an exchange of 200 units, Cargo Handlers declined $1.64 to end at a 52 weeks’ low of $5.61 in an exchange of 9,165 stock units. Derrimon Trading increased 11 cents to $2.32 trading 20,007 stocks, Dolphin Cove rose $1.20 to $15, with 155,865 units crossing the exchange, Elite Diagnostic dropped 3 cents to $2.68 trading 55,959 stocks. Express Catering advanced 10 cents to end at $5.80 with 355,597 shares changing hands, Future Energy Source lost 5 cents in closing at $2.90 after an exchange of 465,016 stock units, General Accident fell 30 cents to close at $6 in trading 16,505 units. GWest Corporation rallied 10 cents to 90 cents, with 1,100 shares changing hands, Honey Bun spiked $1.05 to end at $9.60 with the swapping of 10,907 stock units, iCreate added 5 cents to close at 90 cents in switching ownership of 7,079 stocks. Iron Rock Insurance popped 36 cents to $3.95 while exchanging 300 units, ISP Finance jumped $3.79 to $41.79 in an exchange of 60 shares, Jamaican Teas dropped 16 cents to $3.85, with 207,416 stocks clearing the market. Jetcon Corporation fell 6 cents to close at 93 cents trading 13,499 stock units, KLE Group popped 26 cents in ending at $1.77 after 1,500 units crossed the market, Lasco Distributors lost 7 cents to $3.40 with the swapping of 3,731 shares.

At the close, Access Financial shed $1.95 in closing at $19 after trading 328 shares, Blue Power climbed 28 cents to close at $3.28 with an exchange of 200 units, Cargo Handlers declined $1.64 to end at a 52 weeks’ low of $5.61 in an exchange of 9,165 stock units. Derrimon Trading increased 11 cents to $2.32 trading 20,007 stocks, Dolphin Cove rose $1.20 to $15, with 155,865 units crossing the exchange, Elite Diagnostic dropped 3 cents to $2.68 trading 55,959 stocks. Express Catering advanced 10 cents to end at $5.80 with 355,597 shares changing hands, Future Energy Source lost 5 cents in closing at $2.90 after an exchange of 465,016 stock units, General Accident fell 30 cents to close at $6 in trading 16,505 units. GWest Corporation rallied 10 cents to 90 cents, with 1,100 shares changing hands, Honey Bun spiked $1.05 to end at $9.60 with the swapping of 10,907 stock units, iCreate added 5 cents to close at 90 cents in switching ownership of 7,079 stocks. Iron Rock Insurance popped 36 cents to $3.95 while exchanging 300 units, ISP Finance jumped $3.79 to $41.79 in an exchange of 60 shares, Jamaican Teas dropped 16 cents to $3.85, with 207,416 stocks clearing the market. Jetcon Corporation fell 6 cents to close at 93 cents trading 13,499 stock units, KLE Group popped 26 cents in ending at $1.77 after 1,500 units crossed the market, Lasco Distributors lost 7 cents to $3.40 with the swapping of 3,731 shares.  Lasco Financial shed 7 cents in closing at $2.99 after trading 11,139 stocks, Lasco Manufacturing declined 9 cents to end at $4.75 with the swapping of 36,700 stock units, Limners and Bards rose 18 cents in ending at $3.83 in switching ownership of 21,405,514 stocks. Lumber Depot shed 22 cents in closing at $2.81, with 1,036,521 shares clearing the market, Paramount Trading advanced 19 cents to $1.30 after exchanging 50,200 stock units, Stationery and Office Supplies dropped 89 cents to end at $5.50 while exchanging one unit and tTech dropped 78 cents to close at $4, with 2,128 shares changing hands.

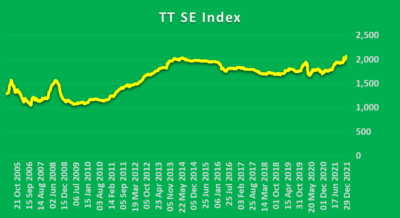

Lasco Financial shed 7 cents in closing at $2.99 after trading 11,139 stocks, Lasco Manufacturing declined 9 cents to end at $4.75 with the swapping of 36,700 stock units, Limners and Bards rose 18 cents in ending at $3.83 in switching ownership of 21,405,514 stocks. Lumber Depot shed 22 cents in closing at $2.81, with 1,036,521 shares clearing the market, Paramount Trading advanced 19 cents to $1.30 after exchanging 50,200 stock units, Stationery and Office Supplies dropped 89 cents to end at $5.50 while exchanging one unit and tTech dropped 78 cents to close at $4, with 2,128 shares changing hands. Overall, 17 securities traded against 16 on Friday, with four rising, five declining and eight unchanged. The Composite Index inched 0.98 points higher to 1,485.29, the All T&T Index rose 2.71 points to 2,052.04 and the Cross-Listed Index slipped 0.12 points to 121.67.

Overall, 17 securities traded against 16 on Friday, with four rising, five declining and eight unchanged. The Composite Index inched 0.98 points higher to 1,485.29, the All T&T Index rose 2.71 points to 2,052.04 and the Cross-Listed Index slipped 0.12 points to 121.67. Endeavour Holdings ended at $7.93 after exchanging two stocks, GraceKennedy shed 6 cents to $6.18 in 1,020 stock units crossing the exchange, Guardian Holdings fell 67 cents in closing at $30.33 after trading 55,007 stocks. JMMB Group closed at $2.26 after 215 shares changed hands, L.J. Williams B share remained at $1.84, with 200 units clearing the market, Massy Holdings climbed 40 cents to $105, with 19,060 shares changing hands. National Enterprises advanced 4 cents to close at $3.29 in exchanging 5,820 stocks, National Flour Mills finished at $1.90 in trading 1,710 stock units, NCB Financial Group ended at $8 with an exchange of 36,814 units. One Caribbean Media popped 35 cents to $4.80 after trading 10 units, Prestige Holdings ended at $7 after swapping of 100 stock units, Scotiabank had an exchange of 15 stocks at $68. Trinidad & Tobago NGL declined 9 cents in closing at $19.65 in exchanging 371 shares and West Indian Tobacco dropped 6 cents to end at $28.44, trading 43 units.

Endeavour Holdings ended at $7.93 after exchanging two stocks, GraceKennedy shed 6 cents to $6.18 in 1,020 stock units crossing the exchange, Guardian Holdings fell 67 cents in closing at $30.33 after trading 55,007 stocks. JMMB Group closed at $2.26 after 215 shares changed hands, L.J. Williams B share remained at $1.84, with 200 units clearing the market, Massy Holdings climbed 40 cents to $105, with 19,060 shares changing hands. National Enterprises advanced 4 cents to close at $3.29 in exchanging 5,820 stocks, National Flour Mills finished at $1.90 in trading 1,710 stock units, NCB Financial Group ended at $8 with an exchange of 36,814 units. One Caribbean Media popped 35 cents to $4.80 after trading 10 units, Prestige Holdings ended at $7 after swapping of 100 stock units, Scotiabank had an exchange of 15 stocks at $68. Trinidad & Tobago NGL declined 9 cents in closing at $19.65 in exchanging 371 shares and West Indian Tobacco dropped 6 cents to end at $28.44, trading 43 units.

The big news for the market for the past week was the release of the prospectus of the long-awaited Initial Public offer of

The big news for the market for the past week was the release of the prospectus of the long-awaited Initial Public offer of  The public offer for Spur Tree Spices shares opens on Wednesday this week and should be heavily oversubscribed, with closure likely by the end of the week.

The public offer for Spur Tree Spices shares opens on Wednesday this week and should be heavily oversubscribed, with closure likely by the end of the week. The average gains projected for the TOP 10 Junior Market stocks moved from 149 percent last week to 151 percent and Main Market stocks moved from 155 percent to this weeks’ 154 percent.

The average gains projected for the TOP 10 Junior Market stocks moved from 149 percent last week to 151 percent and Main Market stocks moved from 155 percent to this weeks’ 154 percent. Eleven stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level, similar to last week, indicating that many others will rise towards the 17 mark in the months ahead.

Eleven stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level, similar to last week, indicating that many others will rise towards the 17 mark in the months ahead. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.