Market activity ended on Wednesday and resulted in more stocks rising than falling at the close of trading after the volume of stocks trading dived 66 percent and the value plunged 78 percent compared to Tuesday, at the close of the Trinidad and Tobago Stock Exchange.

A total of 18 securities traded compared to 22 on Tuesday, with six rising, five declining and seven remaining unchanged. The Composite Index declined 0.71 points to 1,454.77, the All T&T Index slipped 0.97 points in ending at 2,107.35 and the Cross-Listed Index declined 0.06 points to 105.93.

A total of 18 securities traded compared to 22 on Tuesday, with six rising, five declining and seven remaining unchanged. The Composite Index declined 0.71 points to 1,454.77, the All T&T Index slipped 0.97 points in ending at 2,107.35 and the Cross-Listed Index declined 0.06 points to 105.93.

Overall, 397,112 shares traded for $5,937,284 compared to 1,175,927 units at $26,923,981 on Tuesday. An average of 22,062 units traded at $329,849 compared to 53,451 shares at $1,223,817 on Tuesday, with trading month to date averaging 34,412 units at $458,624 versus 35,168 units at $466,508 on the previous day of trading. The average trade for February amounts to 47,858 units at $516,870.

Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than their last selling price and one with a lower offer.

At the close, Agostini’s ended unchanged at $49.95 trading 1,000 shares, Angostura Holdings popped 1 cent to a 52 weeks’ high of $20.21, with 35,000 stocks crossing the market, Ansa McAl gained 51 cents in closing at $57.51 after an exchange of 1,200 units. Calypso Macro Investment Fund increased $1.25 to a 52 weeks’ high of $19.75, with 144 stock units changing hands, Clico Investment Fund remained at $29.89 after trading 26,563 shares, First Citizens Group lost 50 cents to close at $54 swapping of 1,053 stocks.  Guardian Holdings fell 25 cents in closing at $28 after trading 1,310 units, JMMB Group shed 1 cent in ending at $2.25 after an exchange of 56,800 stock units, Massy Holdings inched 1 cent higher to end at $6 in exchanging 85,298 stock units. National Enterprises dropped 4 cents to $2.81, with 60,000 shares clearing the market, National Flour Mills finished at $1.84 in switching ownership of 848 units, One Caribbean Media declined 5 cents to $4.15 while exchanging 67,790 stocks. Republic Financial Holdings rallied 1 cent to $141.01, with 16,795 stocks crossing the exchange, Scotiabank popped $1.90 in closing at $81.90 after exchanging 899 shares, Trinidad & Tobago NGL ended unchanged at $20.25 in trading 25,842 units. Trinidad Cement remained at $3.50 with an exchange of 10,486 stock units, Unilever Caribbean finished at $15 after exchanging 2,860 shares and West Indian Tobacco ended at $24 with 3,224 units changing hands.

Guardian Holdings fell 25 cents in closing at $28 after trading 1,310 units, JMMB Group shed 1 cent in ending at $2.25 after an exchange of 56,800 stock units, Massy Holdings inched 1 cent higher to end at $6 in exchanging 85,298 stock units. National Enterprises dropped 4 cents to $2.81, with 60,000 shares clearing the market, National Flour Mills finished at $1.84 in switching ownership of 848 units, One Caribbean Media declined 5 cents to $4.15 while exchanging 67,790 stocks. Republic Financial Holdings rallied 1 cent to $141.01, with 16,795 stocks crossing the exchange, Scotiabank popped $1.90 in closing at $81.90 after exchanging 899 shares, Trinidad & Tobago NGL ended unchanged at $20.25 in trading 25,842 units. Trinidad Cement remained at $3.50 with an exchange of 10,486 stock units, Unilever Caribbean finished at $15 after exchanging 2,860 shares and West Indian Tobacco ended at $24 with 3,224 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading plunges on TTSE

Declining JSE USD stocks beat winners

On Tuesday, trading on the Jamaica Stock Exchange US dollar market ended with the volume of shares changing hands rising 80 percent, with the value 22 percent lower than on Monday, resulting in six securities trading compared to five on Monday, with two rising and four declining.

The JSE US Denominated Equities Index slipped 0.37 points to end at 204.61. The PE Ratio, a measure used in computing appropriate stock values, averages 14.4.

The JSE US Denominated Equities Index slipped 0.37 points to end at 204.61. The PE Ratio, a measure used in computing appropriate stock values, averages 14.4.

The PE ratio uses ICInsider.com earnings forecasts for companies with financial years up to August 2022.

A total of 257,151 shares traded for US$17,522 compared to 143,192 units at US$22,509 on Monday. Trading averaged 42,859 units at US$2,920, versus 28,638 shares at US$4,502 on Monday, with the month to date averaging 52,191 shares at US$5,130 compared to 52,780 units at US$5,270 on the previous day. February ended with an average of 87,719 units for US$9,318.

Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than the last selling price and three with lower offers.

At the close, First Rock Capital USD share lost 0.5 of one cent to end at 8 US cents after trading 687 shares, Proven Investments shed 0.37 of a cent to close at 23.03 US cents with an exchange of 51,611 stocks, Sterling Investments fell 0.3 of a cent to 2 US cents in an exchange of 10,540 units and Sygnus Credit Investments USD share declined 0.01 of a cent in closing at 12.94 US cents after exchanging 24,071 stock units.

At the close, First Rock Capital USD share lost 0.5 of one cent to end at 8 US cents after trading 687 shares, Proven Investments shed 0.37 of a cent to close at 23.03 US cents with an exchange of 51,611 stocks, Sterling Investments fell 0.3 of a cent to 2 US cents in an exchange of 10,540 units and Sygnus Credit Investments USD share declined 0.01 of a cent in closing at 12.94 US cents after exchanging 24,071 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks up on JSE USD Market

Trading on Monday, ended on the Jamaica Stock Exchange US dollar market with the volume of shares changing hands jumping 169 percent more than on Friday with 62 percent higher value as five securities traded, compared to six on Friday with three rising, none declining and two ending unchanged.

The JSE US Denominated Equities Index slipped 0.18 points to end at 204.98.

The JSE US Denominated Equities Index slipped 0.18 points to end at 204.98.

The PE Ratio, a measure used in computing appropriate stock values, averages 14.7. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years, up to August 2022.

Overall, 143,192 shares traded, for US$22,509 compared to 53,317 units at US$13,919 on Friday. Trading averaged 28,638 units at US$4,502, compared to 8,886 shares at US$2,320 on Friday, with the month to date averaging 52,780 shares at US$5,270 versus 54,122 units at US$5,313 on Friday. February ended with an average of 87,719 units for US$9,318.

Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than the last selling price and two stocks with lower offers.

At the close, First Rock Capital USD share popped 0.01 of a cent to 8.5 US cents, with 50 shares changing hands, Margaritaville increased 1.95 cents in ending at 19.95 US cents in exchanging 11 units, Proven Investments ended at 23.4 US cents trading 89,381 stocks. Sygnus Credit Investments USD share rose 0.45 cents to close at 12.95 US cents after 9,415 stock units crossed the exchange and Transjamaican Highway ended unchanged at 0.88 of a US cent in an exchange of 44,335 shares.

At the close, First Rock Capital USD share popped 0.01 of a cent to 8.5 US cents, with 50 shares changing hands, Margaritaville increased 1.95 cents in ending at 19.95 US cents in exchanging 11 units, Proven Investments ended at 23.4 US cents trading 89,381 stocks. Sygnus Credit Investments USD share rose 0.45 cents to close at 12.95 US cents after 9,415 stock units crossed the exchange and Transjamaican Highway ended unchanged at 0.88 of a US cent in an exchange of 44,335 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Stocks prices down in Trinidad

Declining stocks overpowered those rising market activity on the Trinidad and Tobago Stock Exchange on Monday, following slightly fewer shares trading, but with a 31 percent higher value than on Friday.

Twenty two securities traded on Monday versus 21 on Friday, with three stocks rising, eight declining and 11 remaining unchanged.

Twenty two securities traded on Monday versus 21 on Friday, with three stocks rising, eight declining and 11 remaining unchanged.

The Composite Index fell 3.07 points to 1,452.86, the All T&T Index shed 8.17 points to end at 2,105.37 and the Cross-Listed Index rallied 0.33 points to settle at 105.67.

Overall 491,545 shares traded for $5,591,208 compared to 497,249 units at $4,251,322 on Friday. An average of 22,343 units traded at $254,146 compared to 23,679 shares at $202 averaging 33,689 units at $405,256 versus 34,688 at $418,553. The average trade for February amounts to 47,858 units at $516,870.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and no stock with a lower offer.

At the close, Agostini’s shed 5 cents in ending at $49.95 after trading 1,946 shares, Angostura Holdings remained at $20, with 2,500 units crossing the market, Ansa McAl finished at $57 after exchanging 4,067 stocks. Calypso Macro Investment Fund ended unchanged at $18 with the swapping of 1,752 stock units, CinemaOne ended at $3.95 after trading 200 units, Clico Investment Fund ended unchanged at $29.94, while 44,234 stocks changed hands. First Citizens Group declined $2.80 to close at $54.70 in switching ownership of 675 stock units, FirstCaribbean International Bank fell 6 cents to end at $6 trading 13,500 shares, GraceKennedy remained at $5.99 with an exchange of 2,311 stocks.  Guardian Holdings ended at $28.25 in exchanging 353 shares, JMMB Group dropped 10 cents to end at $2.25, with 79,707 units changing hands, L.J Williams B share slipped 10 cents to $2 with 284 stock units clearing the market. Massy Holdings remained at $6 after 184,173 stocks crossed the market, National Flour Mills finished at $1.84 after trading 1,000 units, NCB Financial Group rose 1 cent in closing at $6.02 in an exchange of 76,053 shares. Prestige Holdings fell 15 cents to end at $6.90 in trading 155 stock units, Republic Financial Holdings ended unchanged at $141.75 with 856 units crossing the exchange, Scotiabank rallied $2 to $80 in exchanging 3,719 stock units. Trinidad & Tobago NGL advanced 15 cents to close at $20.65 with the swapping of 29,517 shares, Trinidad Cement shed 20 cents in closing at $3.50 with an exchange of 5,000 stocks, Unilever Caribbean lost 24 cents to close at a 52 weeks’ low $15, with 687 stocks crossing the market and West Indian Tobacco finished at $24, with 38,856 units changing hands.

Guardian Holdings ended at $28.25 in exchanging 353 shares, JMMB Group dropped 10 cents to end at $2.25, with 79,707 units changing hands, L.J Williams B share slipped 10 cents to $2 with 284 stock units clearing the market. Massy Holdings remained at $6 after 184,173 stocks crossed the market, National Flour Mills finished at $1.84 after trading 1,000 units, NCB Financial Group rose 1 cent in closing at $6.02 in an exchange of 76,053 shares. Prestige Holdings fell 15 cents to end at $6.90 in trading 155 stock units, Republic Financial Holdings ended unchanged at $141.75 with 856 units crossing the exchange, Scotiabank rallied $2 to $80 in exchanging 3,719 stock units. Trinidad & Tobago NGL advanced 15 cents to close at $20.65 with the swapping of 29,517 shares, Trinidad Cement shed 20 cents in closing at $3.50 with an exchange of 5,000 stocks, Unilever Caribbean lost 24 cents to close at a 52 weeks’ low $15, with 687 stocks crossing the market and West Indian Tobacco finished at $24, with 38,856 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

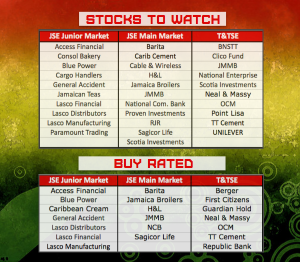

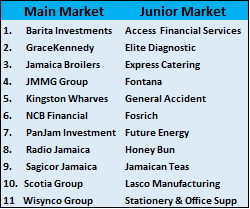

More changes to ICTOP10

The only major move in the Junior Market ICTOP10 listing, this week was a fall of 8 percent for Tropical Battery, while in the Main Market, Carreras rose 6 percent followed by Caribbean Producers with 5 percent, both dropped out of the TOP10, while Guardian Holdings and 138 Student Living both lost 5 percent for the week. The week’s movements resulted in no change to the ICTOP10 Junior Market stocks but Transjamaican Highway and Jamaica Broilers return to the list.

BuyRated stocks from the long-ago past

The Junior Market index closed up to 4,052.19 points, ahead of the 4,031 close of the previous week, helped by the strong gains in the two newly listed companies; JFP limited and EducFocal that jumped sharply during the week, with the former topping out at $2 to close the week up by 36 percent at $1.36, with a PE of 19 times projected 2022 earnings, while the latter jumped to $3.07 for an incredible gain of 207 percent with a PE of 38 based on projected earnings of 8 cents for 2022. Meanwhile, the Main Market continues to consolidate at a support level of around 440,000 points using the All Jamaica Composite Index, but the market drifted down below that level in the latter part of the week as NCB Financial dropped to a multi-year low of $91.01 on Wednesday, with little demand for the stock currently, but it may find support around the $105 level.

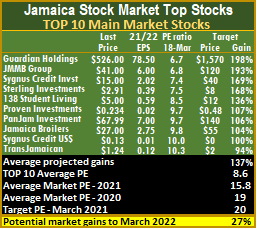

The Junior Market potential gains for the TOP 10 Junior Market stocks stand at 109 percent, much lower than the Main Market at 137 percent, an indication that Main Market is greatly undervalued. The top three stocks in the Junior Market are Elite Diagnostic, Medical Disposables followed by AMG Packaging, to gain between 122 and 133 percent.

The Junior Market potential gains for the TOP 10 Junior Market stocks stand at 109 percent, much lower than the Main Market at 137 percent, an indication that Main Market is greatly undervalued. The top three stocks in the Junior Market are Elite Diagnostic, Medical Disposables followed by AMG Packaging, to gain between 122 and 133 percent.

The potential gains for Main Market stocks moved from 127 percent last week to this weeks’ 137 percent, with the top three being Guardian Holdings, JMMB Group followed by Sygnus Credit Investments all projected to gain between 169 and 198 percent versus 168 to 193 percent last week.

The average PE for Junior Market is well ahead of the average of 17 times 2020 earnings achieved at the end of March last year in moving to 21.8 based on ICInsider.com’s 2021-22 earnings, pushed up mainly by five stocks, with EduFocal and Main Event over 100 times 2021 earnings. Excluding the 5 highest PE ratios over 40, the average would be around 18. The JSE Main and USD Markets at 15.8 is well off from 19 in 2021. The TOP 10 stocks trade at a PE of a mere 8.6, with a 45 percent discount to that market’s average.

The average PE for Junior Market is well ahead of the average of 17 times 2020 earnings achieved at the end of March last year in moving to 21.8 based on ICInsider.com’s 2021-22 earnings, pushed up mainly by five stocks, with EduFocal and Main Event over 100 times 2021 earnings. Excluding the 5 highest PE ratios over 40, the average would be around 18. The JSE Main and USD Markets at 15.8 is well off from 19 in 2021. The TOP 10 stocks trade at a PE of a mere 8.6, with a 45 percent discount to that market’s average.

The average PE for the JSE Main Market is 20 percent less than the PE of 19 at the end of March and 24 percent below the target of 20 to the end of March this year. The Main Market TOP 10 average PE is 8.6 representing a 45 percent discount to the market, well below the potential of 20.  The depressed PE of the main market is an indication that bigger investors are reluctant to be aggressive in buying into the market currently, with inflation, rising interest rates and war populating the headlines.

The depressed PE of the main market is an indication that bigger investors are reluctant to be aggressive in buying into the market currently, with inflation, rising interest rates and war populating the headlines.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

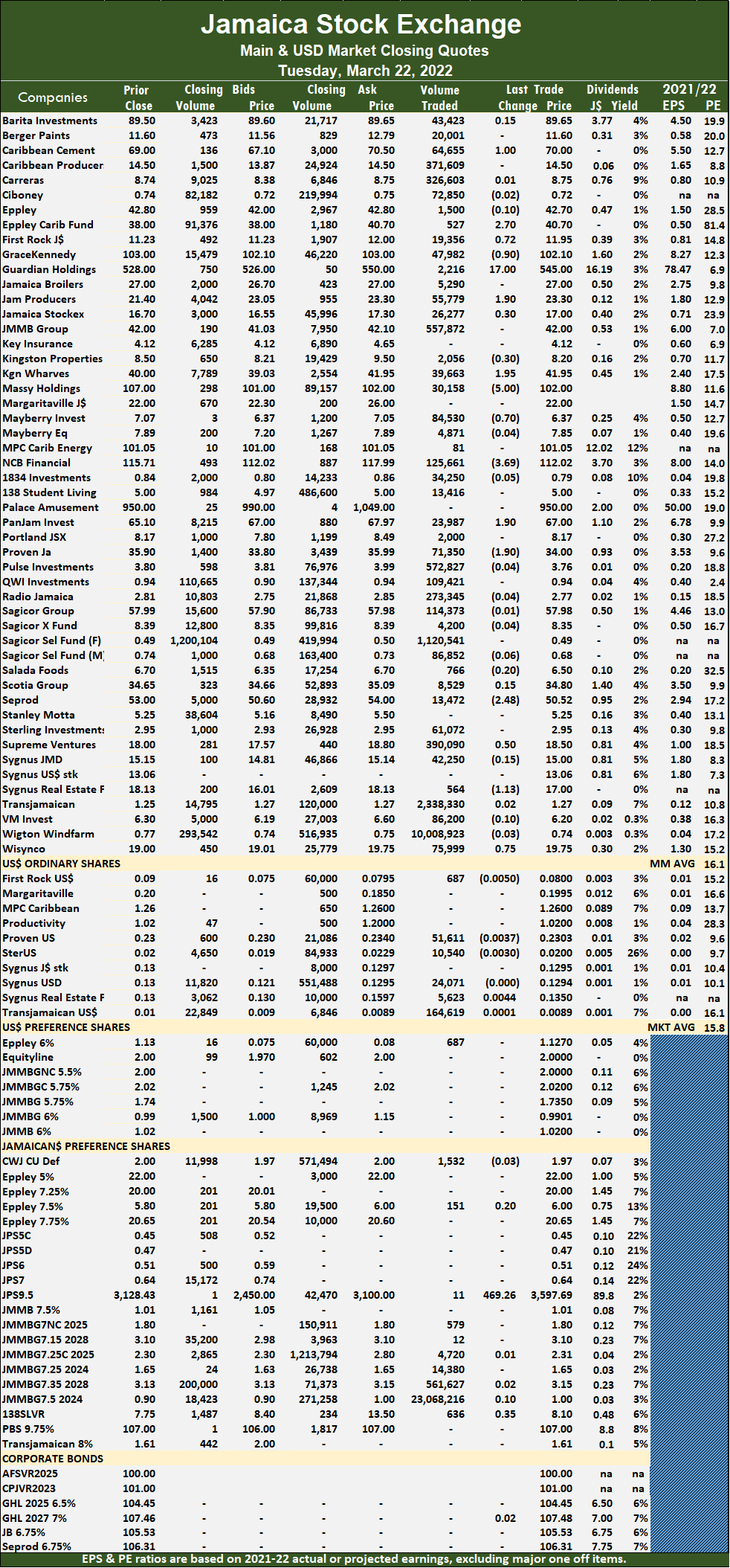

The All Jamaican Composite Index dropped 1,389.99 points to settle at 432,905.41, the JSE Main Index fell 2,176.27 points to 385,233.79 and the JSE Financial Index shed 0.48 points to settle at 93.31.

The All Jamaican Composite Index dropped 1,389.99 points to settle at 432,905.41, the JSE Main Index fell 2,176.27 points to 385,233.79 and the JSE Financial Index shed 0.48 points to settle at 93.31. At the close, Caribbean Cement increased $1 in closing at $70 after trading 64,655 shares, Eppley Caribbean Property Fund rallied $2.70 to close at $40.70 while exchanging 527 stocks, First Rock Capital advanced 72 cents to end at $11.95 after exchanging 19,356 units. GraceKennedy fell 90 cents to $102.10, trading 47,982 stock units, Guardian Holdings rose $17 to $545 in exchanging 2,216 stocks, Jamaica Producers climbed $1.90 to $23.30 in switching ownership of 55,779 units. Jamaica Stock Exchange popped 30 cents in ending at $17 after trading 26,277 shares, Kingston Properties dropped 30 cents in closing at $8.20 with the swapping of 2,056 stock units, Kingston Wharves gained $1.95 to end at $41.95, with 39,663 units crossing the exchange. Massy Holdings shed $5 to close at $102 after an exchange of 30,158 stocks, Mayberry Investments declined 70 cents in closing at $6.37, with 84,530 stock units crossing the market, NCB Financial lost $3.69 to end at $112.02 in an exchange of 125,661 shares. PanJam Investment popped $1.90 to $67, with 23,987 stock units clearing the market, Proven Investments fell $1.90 to $34, with 71,350 stocks changing hands, Seprod shed $2.48 to close at $50.52 with an exchange of 13,472 shares.

At the close, Caribbean Cement increased $1 in closing at $70 after trading 64,655 shares, Eppley Caribbean Property Fund rallied $2.70 to close at $40.70 while exchanging 527 stocks, First Rock Capital advanced 72 cents to end at $11.95 after exchanging 19,356 units. GraceKennedy fell 90 cents to $102.10, trading 47,982 stock units, Guardian Holdings rose $17 to $545 in exchanging 2,216 stocks, Jamaica Producers climbed $1.90 to $23.30 in switching ownership of 55,779 units. Jamaica Stock Exchange popped 30 cents in ending at $17 after trading 26,277 shares, Kingston Properties dropped 30 cents in closing at $8.20 with the swapping of 2,056 stock units, Kingston Wharves gained $1.95 to end at $41.95, with 39,663 units crossing the exchange. Massy Holdings shed $5 to close at $102 after an exchange of 30,158 stocks, Mayberry Investments declined 70 cents in closing at $6.37, with 84,530 stock units crossing the market, NCB Financial lost $3.69 to end at $112.02 in an exchange of 125,661 shares. PanJam Investment popped $1.90 to $67, with 23,987 stock units clearing the market, Proven Investments fell $1.90 to $34, with 71,350 stocks changing hands, Seprod shed $2.48 to close at $50.52 with an exchange of 13,472 shares.  Supreme Ventures climbed 50 cents in closing at $18.50 after 390,090 units crossed the market, Sygnus Real Estate Finance declined $1.13 to $17 in exchanging 564 stock units and Wisynco Group rallied 75 cents to close at $19.75, trading 75,999 units.

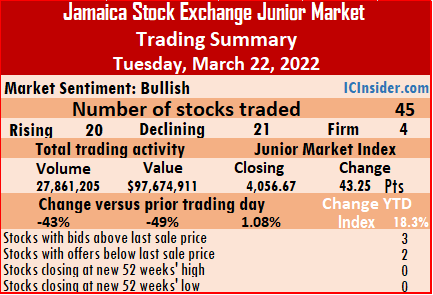

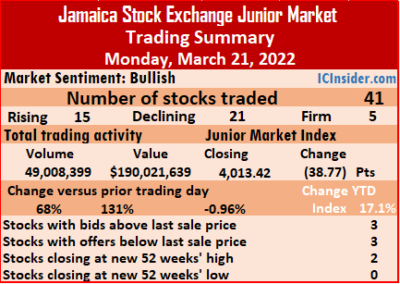

Supreme Ventures climbed 50 cents in closing at $18.50 after 390,090 units crossed the market, Sygnus Real Estate Finance declined $1.13 to $17 in exchanging 564 stock units and Wisynco Group rallied 75 cents to close at $19.75, trading 75,999 units. Trading ended with 20 stocks rising, 21 declining and four closing unchanged, leading to the Junior Market Index popping 43.25 points to settle at 4,056.67.

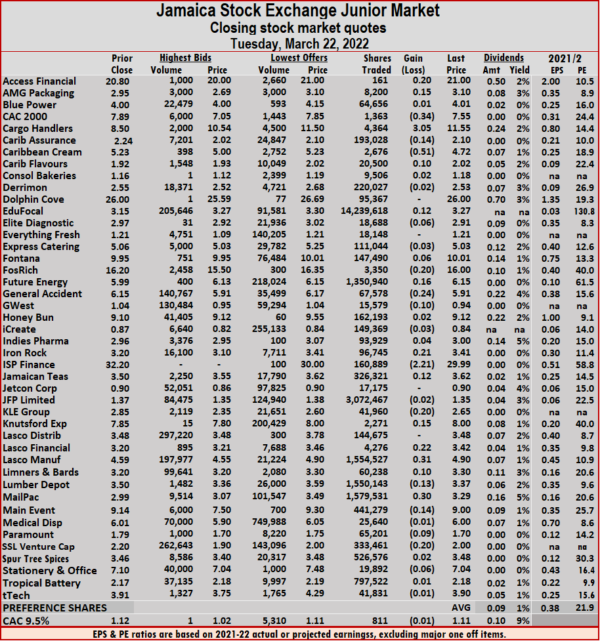

Trading ended with 20 stocks rising, 21 declining and four closing unchanged, leading to the Junior Market Index popping 43.25 points to settle at 4,056.67. At the close, Access Financial rose 20 cents to end at $21 after trading 161 shares, AMG Packaging popped 15 cents in closing at $3.10 after exchanging 8,200 units, CAC 2000 lost 34 cents after ending at $7.55, with 1,363 stock units crossing the market. Cargo Handlers increased $3.05 to $11.55 and closed trading with 4,364 stocks, Caribbean Assurance Brokers declined 14 cents to close at $2.10 after 193,028 stocks crossed the market, Caribbean Cream shed 51 cents to end at $4.72 in exchanging 2,676 stock units. Caribbean Flavours gained 10 cents to close at $2.02 with 20,500 units changing hands, EduFocal rallied 12 cents to $3.27 after trading 14,239,618 shares, Fosrich fell 20 cents in closing at $16 in finishing trading with 3,350 shares. Future Energy Source advanced 16 cents to $6.15 in an exchange of 1,350,940 stock units, General Accident dropped 24 cents to $5.91 in exchanging 67,578 units, GWest Corporation declined 10 cents to 94 cents in switching ownership of 15,579 stocks. Iron Rock Insurance climbed 21 cents to $3.41 with the swapping of 96,745 units, ISP Finance shed $2.21 to close at $29.99 with an exchange of 160,889 stocks, Jamaican Teas climbed 12 cents in closing at $3.62 in trading 326,321 shares.

At the close, Access Financial rose 20 cents to end at $21 after trading 161 shares, AMG Packaging popped 15 cents in closing at $3.10 after exchanging 8,200 units, CAC 2000 lost 34 cents after ending at $7.55, with 1,363 stock units crossing the market. Cargo Handlers increased $3.05 to $11.55 and closed trading with 4,364 stocks, Caribbean Assurance Brokers declined 14 cents to close at $2.10 after 193,028 stocks crossed the market, Caribbean Cream shed 51 cents to end at $4.72 in exchanging 2,676 stock units. Caribbean Flavours gained 10 cents to close at $2.02 with 20,500 units changing hands, EduFocal rallied 12 cents to $3.27 after trading 14,239,618 shares, Fosrich fell 20 cents in closing at $16 in finishing trading with 3,350 shares. Future Energy Source advanced 16 cents to $6.15 in an exchange of 1,350,940 stock units, General Accident dropped 24 cents to $5.91 in exchanging 67,578 units, GWest Corporation declined 10 cents to 94 cents in switching ownership of 15,579 stocks. Iron Rock Insurance climbed 21 cents to $3.41 with the swapping of 96,745 units, ISP Finance shed $2.21 to close at $29.99 with an exchange of 160,889 stocks, Jamaican Teas climbed 12 cents in closing at $3.62 in trading 326,321 shares.  KLE Group fell 20 cents to $2.65, with 41,960 stock units changing hands, Knutsford Express advanced 15 cents to end at $8 while exchanging 2,271 shares, Lasco Financial rose 22 cents to $3.42 in trading 4,276 stocks. Lasco Manufacturing popped 31 cents in closing at $4.90 while 1,554,527 units crossed the exchange, Limners and Bards gained 10 cents to close at $3.30 after exchanging 60,238 stock units, Lumber Depot lost 13 cents to close at $3.37 with 1,550,143 stock units switching owners. Mailpac Group rose 30 cents to $3.29 after 1,579,531 units changed hands, Main Event dropped 14 cents to $9 while exchanging 441,279 stocks and SSL Venture fell 20 cents to end at $2 after finishing trading of 333,461 shares.

KLE Group fell 20 cents to $2.65, with 41,960 stock units changing hands, Knutsford Express advanced 15 cents to end at $8 while exchanging 2,271 shares, Lasco Financial rose 22 cents to $3.42 in trading 4,276 stocks. Lasco Manufacturing popped 31 cents in closing at $4.90 while 1,554,527 units crossed the exchange, Limners and Bards gained 10 cents to close at $3.30 after exchanging 60,238 stock units, Lumber Depot lost 13 cents to close at $3.37 with 1,550,143 stock units switching owners. Mailpac Group rose 30 cents to $3.29 after 1,579,531 units changed hands, Main Event dropped 14 cents to $9 while exchanging 441,279 stocks and SSL Venture fell 20 cents to end at $2 after finishing trading of 333,461 shares. The All Jamaican Composite Index jumped 5,036.59 points to close at 434,295.40, the JSE Main Index rose 3,059.12 points to 387,410.06 and the JSE Financial Index increased 1.43 points to settle at 93.79.

The All Jamaican Composite Index jumped 5,036.59 points to close at 434,295.40, the JSE Main Index rose 3,059.12 points to 387,410.06 and the JSE Financial Index increased 1.43 points to settle at 93.79. At the close, Berger Paints shed $1.19 in closing at $11.60 after an exchange of 4,766 shares, Caribbean Producers dropped 50 cents in ending at $14.50, with 252,566 stocks crossing the market, Eppley advanced $2.85 to $42.80 after exchanging 7,444 stock units. First Rock Capital fell 72 cents to $11.23, trading 4,016 units, GraceKennedy increased $1 to close at $103 after trading 178,518 stocks, Guardian Holdings gained $2 to end at $528 in switching ownership of 223 shares. Jamaica Stock Exchange fell 90 cents to $16.70 after exchanging 33,161 units, JMMB Group rose $1 to end at $42 with 68,169 stock units changing hands, Key Insurance declined 55 cents to close at $4.12 with the swapping of 5,309 shares. Kingston Properties shed $1 in closing at $8.50 in an exchange of 2,070 stocks, Kingston Wharves rallied 51 cents to $40 after 5,650 units crossed the exchange, Margaritaville declined $2.20 in closing at $22, with 84 stock units crossing the market. Massy Holdings dropped $2 to close at $107 with 165,400 units changing hands, Mayberry Investments popped 92 cents to $7.07 while exchanging 216 shares, Mayberry Jamaican Equities climbed 78 cents to end at $7.89, with 21,200 stocks clearing the market.

At the close, Berger Paints shed $1.19 in closing at $11.60 after an exchange of 4,766 shares, Caribbean Producers dropped 50 cents in ending at $14.50, with 252,566 stocks crossing the market, Eppley advanced $2.85 to $42.80 after exchanging 7,444 stock units. First Rock Capital fell 72 cents to $11.23, trading 4,016 units, GraceKennedy increased $1 to close at $103 after trading 178,518 stocks, Guardian Holdings gained $2 to end at $528 in switching ownership of 223 shares. Jamaica Stock Exchange fell 90 cents to $16.70 after exchanging 33,161 units, JMMB Group rose $1 to end at $42 with 68,169 stock units changing hands, Key Insurance declined 55 cents to close at $4.12 with the swapping of 5,309 shares. Kingston Properties shed $1 in closing at $8.50 in an exchange of 2,070 stocks, Kingston Wharves rallied 51 cents to $40 after 5,650 units crossed the exchange, Margaritaville declined $2.20 in closing at $22, with 84 stock units crossing the market. Massy Holdings dropped $2 to close at $107 with 165,400 units changing hands, Mayberry Investments popped 92 cents to $7.07 while exchanging 216 shares, Mayberry Jamaican Equities climbed 78 cents to end at $7.89, with 21,200 stocks clearing the market.  NCB Financial rose 71 cents to $115.71, with 37,858 stock units changing hands, Palace Amusement lost $25 in ending at $950 in trading 33 stocks, PanJam Investment fell $2.89 in closing at $65.10 in switching ownership of 606 shares. Portland JSX rallied 72 cents to close at $8.17 after trading 5,325 units, Scotia Group dropped 44 cents to end at $34.65 in exchanging 38,534 stock units, Seprod lost $1 in closing at $53 after 5,335 shares changed hands. Supreme Ventures gained 40 cents to end at $18 in exchanging 240,147 stocks, Sygnus Real Estate Finance rose $1.63 to $18.13, with 8,108 units crossing the exchange and Victoria Mutual Investments fell 45 cents to close at $6.30 in trading 66,161 stock units.

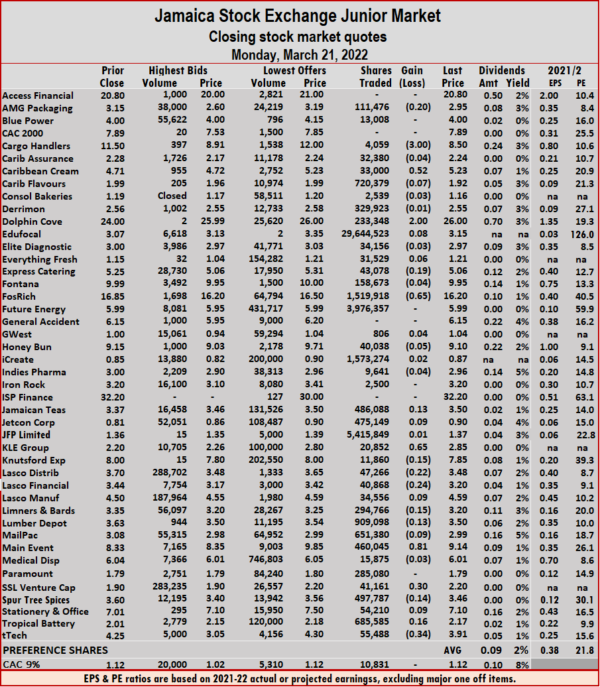

NCB Financial rose 71 cents to $115.71, with 37,858 stock units changing hands, Palace Amusement lost $25 in ending at $950 in trading 33 stocks, PanJam Investment fell $2.89 in closing at $65.10 in switching ownership of 606 shares. Portland JSX rallied 72 cents to close at $8.17 after trading 5,325 units, Scotia Group dropped 44 cents to end at $34.65 in exchanging 38,534 stock units, Seprod lost $1 in closing at $53 after 5,335 shares changed hands. Supreme Ventures gained 40 cents to end at $18 in exchanging 240,147 stocks, Sygnus Real Estate Finance rose $1.63 to $18.13, with 8,108 units crossing the exchange and Victoria Mutual Investments fell 45 cents to close at $6.30 in trading 66,161 stock units. At the close, AMG Packaging dropped 20 cents to close at $2.95 after trading 111,476 shares, Cargo Handlers fell $3 to $8.50, with 4,059 stocks clearing the market, Caribbean Cream rallied 52 cents in closing at $5.23 after switching ownership of 33,000 stock units. Dolphin Cove increased $2 to $26, with 233,348 units crossing the market, Express Catering lost 19 cents to end at $5.06 trading 43,078 stock units, Fosrich shed 65 cents in closing at $16.20 while exchanging 1,519,918 shares. Jamaican Teas rose 13 cents to end at $3.50, with 486,088 stocks changing hands, KLE Group popped 65 cents to $2.85 with the swapping of 20,852 units, Knutsford Express declined 15 cents to close at $7.85 in trading 11,860 stocks. Lasco Distributors fell 22 cents in ending at $3.48 after 47,266 stock units crossed the market, Lasco Financial shed 24 cents in closing at $3.20 with an exchange of 40,868 units, Limners and Bards declined 15 cents to end at $3.20 in exchanging 294,766 shares.

At the close, AMG Packaging dropped 20 cents to close at $2.95 after trading 111,476 shares, Cargo Handlers fell $3 to $8.50, with 4,059 stocks clearing the market, Caribbean Cream rallied 52 cents in closing at $5.23 after switching ownership of 33,000 stock units. Dolphin Cove increased $2 to $26, with 233,348 units crossing the market, Express Catering lost 19 cents to end at $5.06 trading 43,078 stock units, Fosrich shed 65 cents in closing at $16.20 while exchanging 1,519,918 shares. Jamaican Teas rose 13 cents to end at $3.50, with 486,088 stocks changing hands, KLE Group popped 65 cents to $2.85 with the swapping of 20,852 units, Knutsford Express declined 15 cents to close at $7.85 in trading 11,860 stocks. Lasco Distributors fell 22 cents in ending at $3.48 after 47,266 stock units crossed the market, Lasco Financial shed 24 cents in closing at $3.20 with an exchange of 40,868 units, Limners and Bards declined 15 cents to end at $3.20 in exchanging 294,766 shares.  Lumber Depot dropped 13 cents to $3.50 in an exchange of 909,098 stocks, Main Event gained 81 cents ending at a 52 weeks’ high of $9.14 after an exchange of 460,045 units, Spur Tree Spices lost 14 cents to close at $3.46, with 497,787 shares changing hands. SSL Venture climbed 30 cents to close at $2.20 after exchanging 41,161 stock units, Tropical Battery advanced 16 cents after ending at $2.17 and trading 685,585 stocks and tTech lost 34 cents to end at 3.91 with 55,488 units changing hands.

Lumber Depot dropped 13 cents to $3.50 in an exchange of 909,098 stocks, Main Event gained 81 cents ending at a 52 weeks’ high of $9.14 after an exchange of 460,045 units, Spur Tree Spices lost 14 cents to close at $3.46, with 497,787 shares changing hands. SSL Venture climbed 30 cents to close at $2.20 after exchanging 41,161 stock units, Tropical Battery advanced 16 cents after ending at $2.17 and trading 685,585 stocks and tTech lost 34 cents to end at 3.91 with 55,488 units changing hands. In more recent times, some investors are demonstrating levels of exuberance in buying some stocks at excessive values that will take a long time to generate a reasonable return on investment.

In more recent times, some investors are demonstrating levels of exuberance in buying some stocks at excessive values that will take a long time to generate a reasonable return on investment.

The numbers climbed to 11 each as we could not separate the 11th ones from the lists. The listings are a compilation based on inputs from some knowledgeable investors as well as ICInsider.com’s own assessment. The selections are based on an evaluation of the quality of management, products and services each company offers to their customers, and prospects for growth by these companies and the economies they service.

The numbers climbed to 11 each as we could not separate the 11th ones from the lists. The listings are a compilation based on inputs from some knowledgeable investors as well as ICInsider.com’s own assessment. The selections are based on an evaluation of the quality of management, products and services each company offers to their customers, and prospects for growth by these companies and the economies they service.