Scotiabank dominated trading on the TTSE

Activity on the Trinidad & Tobago Stock Exchange on Wednesday resulted in 15 securities changing hands compared to 16 on Tuesday with all indices recording gains. Scotiabank was the lead trade with 68 percent of the value of securities traded.

At the close, 4 stocks advanced, 2 declined and 9 were unchanged as a mere 270,045 shares traded at a value of $9,569,576 compared to Tuesday’s trades of 1,180,284 units valued at $18,912,930.

The Composite Index gained 0.43 points to 1,241.97, the All T&T Index gained 0.46 points to 1,789.42 and the Cross Listed Index added 0.05 points to 93.28 points.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended with 2 stocks with bids higher than last selling prices and 4 with lower offers.

Gains| The last traded prices of securities rising and the volume changing hands are JMMB Group with a gain of 1 cent and closed at $1.31 with 8,210 shares, National Enterprises closed at $10.48, with a 1 cent gain trading 148 units, Scotiabank closed 7 cents higher to $58.10 with 111,430 shares valued at $6,474,077, and Trinidad & Tobago NGL ended with a gain of 1 cent, in closing at $22.01 with 9,598 shares.

Losses| Clico Investment slumped to a 52 weeks’ low of $20.59, having lost 1 cent to close at $20.50 with 63,948 shares valued at $1,314,018 changing hands and Republic Financial Holdings traded 1 cent lower to $101.90 with 1,246 shares.

Losses| Clico Investment slumped to a 52 weeks’ low of $20.59, having lost 1 cent to close at $20.50 with 63,948 shares valued at $1,314,018 changing hands and Republic Financial Holdings traded 1 cent lower to $101.90 with 1,246 shares.

Firm Trades| The last traded prices and volume of securities traded unchanged at the close of trading are Ansa Merchant Bank closed at $40 with 400 shares, First Citizens exchanged 12,130 shares at $31.68 valued at $384,341, First Caribbean International traded 30,333 shares at $8, Grace Kennedy closed at $2.85 with 9,413 shares. Guardian Holdings remained at $16.60 with 9,059 shares, Massy Holdings held firm at $48.92 with 12,065 shares, One Caribbean Media exchanged 500 shares at $14.50, Prestige Holdings closed at $10.65 with 50 shares and Sagicor Financial ended the day at $8.50 with 1,515 units changing hands.

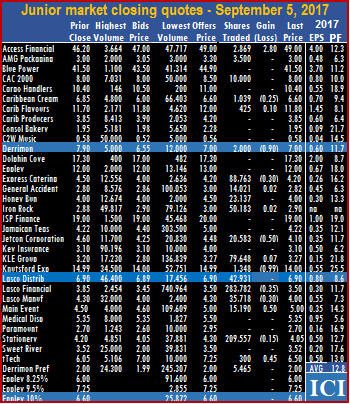

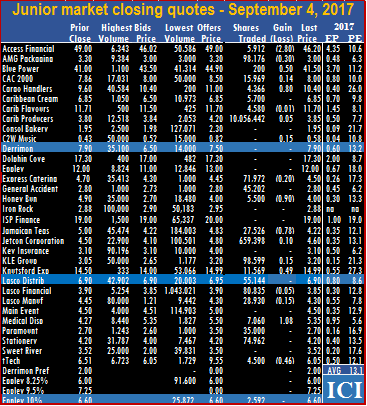

At the close of the market the volume of stocks changing hands and their last traded price are: Access Financial that settled $2.80 higher to $49 with 2,869 shares changing hands, AMG Packaging ended at $3 with 3,500 stocks, CAC 2000 finished at $8 with 10,000 shares, Caribbean Cream ended with a loss of 25 cents at $6.60, with 1,039 stock units, Caribbean Flavours traded 10 cents higher at $11.80 with 425 shares, Derrimon Trading settled with a loss of 90 cents at $7, with 2,000 units, Express Catering concluded trading with a loss of 30 cents at $4.20, with 88,763 stock units, General Accident ended 2 cents higher at $2.82 with 14,021 units, Honey Bun traded at an intraday low of $3 before recovering to close at $4 with 23,137 shares changing hands, Iron Rock finished 2 cents higher at $2.90 with 50,183 stocks,

At the close of the market the volume of stocks changing hands and their last traded price are: Access Financial that settled $2.80 higher to $49 with 2,869 shares changing hands, AMG Packaging ended at $3 with 3,500 stocks, CAC 2000 finished at $8 with 10,000 shares, Caribbean Cream ended with a loss of 25 cents at $6.60, with 1,039 stock units, Caribbean Flavours traded 10 cents higher at $11.80 with 425 shares, Derrimon Trading settled with a loss of 90 cents at $7, with 2,000 units, Express Catering concluded trading with a loss of 30 cents at $4.20, with 88,763 stock units, General Accident ended 2 cents higher at $2.82 with 14,021 units, Honey Bun traded at an intraday low of $3 before recovering to close at $4 with 23,137 shares changing hands, Iron Rock finished 2 cents higher at $2.90 with 50,183 stocks,  Jetcon Corporation lost 50 cents to $4.10 with 20,583 units, KLE Group ended 7 cents higher at $3.27 with 79,648 stock units. Knutsford Express concluded market activity with a loss of 99 cents at $14, with 1,348 units changing ownership, Lasco Distributors ended at $6.90 with 42,931 units, Lasco Financial concluded trading with a loss of 35 cents to $3.50 with 283,782 stock units, Lasco Manufacturing concluded with a loss of 30 cents, to a 52 weeks’ low of $4 with 35,718 units traded, but fell as low as $3.80 during the day. Main Event ended 50 cents higher at $5 with 15,190 shares, Stationery and Office settled with a loss of 15 cents, at $4.05 with 209,557 stocks trading, tTech settled 45 cents higher at $6.50 with just 300 units and Derrimon Trading concluded trading at $2 with 5,465 units.

Jetcon Corporation lost 50 cents to $4.10 with 20,583 units, KLE Group ended 7 cents higher at $3.27 with 79,648 stock units. Knutsford Express concluded market activity with a loss of 99 cents at $14, with 1,348 units changing ownership, Lasco Distributors ended at $6.90 with 42,931 units, Lasco Financial concluded trading with a loss of 35 cents to $3.50 with 283,782 stock units, Lasco Manufacturing concluded with a loss of 30 cents, to a 52 weeks’ low of $4 with 35,718 units traded, but fell as low as $3.80 during the day. Main Event ended 50 cents higher at $5 with 15,190 shares, Stationery and Office settled with a loss of 15 cents, at $4.05 with 209,557 stocks trading, tTech settled 45 cents higher at $6.50 with just 300 units and Derrimon Trading concluded trading at $2 with 5,465 units.

The All Jamaica index of main market stocks of the Jamaica Stock Exchange blast through the critical resistance level of 290,000 during the morning session on Tuesday and held above it at the close to end at a record close as

The All Jamaica index of main market stocks of the Jamaica Stock Exchange blast through the critical resistance level of 290,000 during the morning session on Tuesday and held above it at the close to end at a record close as  The main market ended trading with an average of 122,501 units valued at $2,168,932 for each security traded compared to an average of 309,660 units valued at $7,056,282. The average volume and value for the month to date ended at 189,094 units with an average value of $3,574,886 compared with an average of 222,390 units with an average value of $4,277,863 on the previous trading day. The average volume and value for August ended at 184,094 units with an average value of $4,336,090.

The main market ended trading with an average of 122,501 units valued at $2,168,932 for each security traded compared to an average of 309,660 units valued at $7,056,282. The average volume and value for the month to date ended at 189,094 units with an average value of $3,574,886 compared with an average of 222,390 units with an average value of $4,277,863 on the previous trading day. The average volume and value for August ended at 184,094 units with an average value of $4,336,090. Trading in the Jamaican foreign exchange market jumped sharply on Tuesday, resulted in US$53.88 of purchases by dealers of all currencies and outflows of US$42.39 million.

Trading in the Jamaican foreign exchange market jumped sharply on Tuesday, resulted in US$53.88 of purchases by dealers of all currencies and outflows of US$42.39 million.

JMMB Group with a loss of 1 cent to close at $1.30 with 1,930 shares and West Indian Tobacco with a loss of 2 cents, closed at a 52 weeks’ low of $125.47 with 490 shares.

JMMB Group with a loss of 1 cent to close at $1.30 with 1,930 shares and West Indian Tobacco with a loss of 2 cents, closed at a 52 weeks’ low of $125.47 with 490 shares.

Helped by a jump of $2.99 in the price of

Helped by a jump of $2.99 in the price of  Trading activity rose on Monday in the main market of the Jamaica Stock Exchange with 9,375,844 units valued at $169,350,761 changing hands, but one stock,

Trading activity rose on Monday in the main market of the Jamaica Stock Exchange with 9,375,844 units valued at $169,350,761 changing hands, but one stock,  Portland JSX exchanged 2,000 shares at $9.25, Pulse Investments lost 4 cents, closing at $1.95 with 195,848 shares, Radio Jamaica closed at $1.23, adding 1 cent with 36,482 stock units changing hands, Sagicor Group closed $1.25 lower to $32.85 trading 8,070 shares, Sagicor Real Estate Fund ended at $10.99, after losing 97 cents with 10,000 shares trading, Salada Foods closed at $8.50 with 200,000 shares, Scotia Group jumped $2, to a record close of $52 with 93,121 shares traded, Sterling Investments gained 10 cents, closing at $12.85 with 100 units, Supreme Ventures closed at $12.90 with 505,077 shares. Margaritaville Turks US ordinary share closed at 30 US cents with 2,904 units, Proven Investments US ordinary shares closed at 24 US cents with 2,298 units, recently listed Productive Business Solutions US ordinary share closed at a record high of 72 US cents, gaining US12 cents with 500 units, JMMB Group 7.5% preference share ended at $1.16 with 50,000 units and Productive Business Solutions 9.75% cumulative redeemable share closed with a gain of $5 at a record high of $105 with 900 shares.

Portland JSX exchanged 2,000 shares at $9.25, Pulse Investments lost 4 cents, closing at $1.95 with 195,848 shares, Radio Jamaica closed at $1.23, adding 1 cent with 36,482 stock units changing hands, Sagicor Group closed $1.25 lower to $32.85 trading 8,070 shares, Sagicor Real Estate Fund ended at $10.99, after losing 97 cents with 10,000 shares trading, Salada Foods closed at $8.50 with 200,000 shares, Scotia Group jumped $2, to a record close of $52 with 93,121 shares traded, Sterling Investments gained 10 cents, closing at $12.85 with 100 units, Supreme Ventures closed at $12.90 with 505,077 shares. Margaritaville Turks US ordinary share closed at 30 US cents with 2,904 units, Proven Investments US ordinary shares closed at 24 US cents with 2,298 units, recently listed Productive Business Solutions US ordinary share closed at a record high of 72 US cents, gaining US12 cents with 500 units, JMMB Group 7.5% preference share ended at $1.16 with 50,000 units and Productive Business Solutions 9.75% cumulative redeemable share closed with a gain of $5 at a record high of $105 with 900 shares.