Carib Cement jumped $7.99 to end at a 52 weeks’ closing high of $50.

In moderate trading, the Jamaica Stock Exchange closed down on Monday after the All Jamaica Composite Index hit a new high of 347,919.92 points in early trading.

At the close trading, advancing stocks were the same as stocks, leading to the All Jamaican Composite Index to decline by 880.86 points to 346,120.15 and the JSE Index in shedding 802.56 points to end at a record close of 315,354.54.

Trading in the main market ended with 4,879,200 units valued at over $45,250,338 compared to 11,481,249 units valued $123,719,859 on Friday.

Market activities resulted in 29 securities trading including 2 in the US dollar market compared to 26 securities trading on Friday. At the end of trading, the prices of 9 stocks rose, 9 declined and 11 traded unchanged, including

Caribbean Cement traded at an all-time closing high of $50 with very low volume while the Jamaica Stock Exchange traded at a 52 weeks’ high of $8.50 but pulled back at the close to $8.

The day’s volume was led by, Mayberry Jamaican Equities with 2,626,900 units and 53.84 percent of the main market volume, followed by Jamaica Stock Exchange with 822,926 units and Victoria Mutual Investments with 298,913 units.

The day’s volume was led by, Mayberry Jamaican Equities with 2,626,900 units and 53.84 percent of the main market volume, followed by Jamaica Stock Exchange with 822,926 units and Victoria Mutual Investments with 298,913 units.

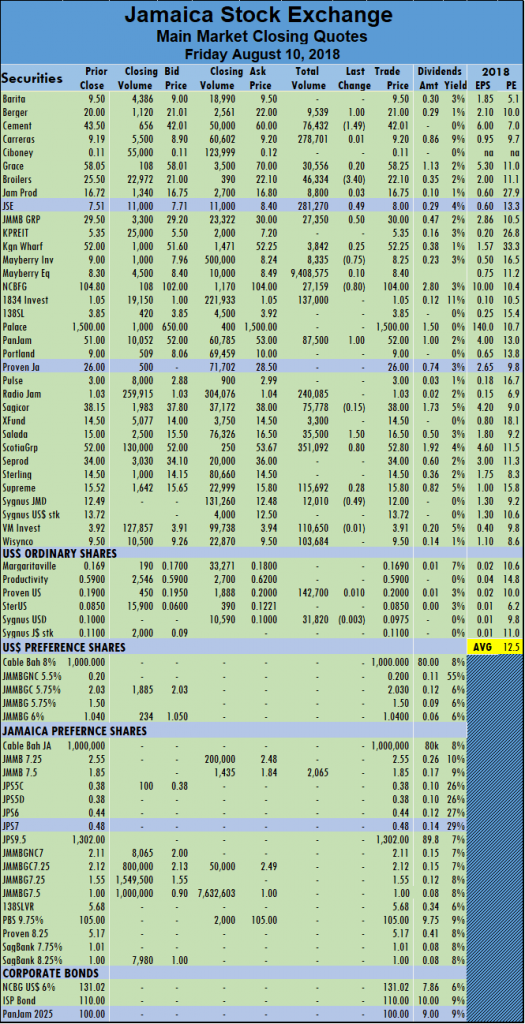

Stocks with major price changes| Barita Investments lost 50 cents and ended at $9, trading 7,186 stock units, Caribbean Cement jumped $7.99 to a 52 weeks’ closing high of $50 exchanging a mere 610 shares, but ended with the being offered at $45 Jamaica Broilers traded 27,922 stock units and added $1.90 to end at $24, Mayberry Investments lost 25 cents to end at $8 trading just 18,821 shares, Kingston Wharves lost 75 cents to end at $51.50, after trading 2,500 stock units, NCB Financial Group lost 50 cents and ended trading at $103.50, exchanging 42,838 shares, Scotia Group traded 9,910 units and shed 80 cents to end at $52, Supreme Ventures fell 29 cents in trading 81,921 at $15.51 and Wisynco Group fell 25 cents to close at $9.25 after trading 197,432 shares.

Trading in the US dollar market closed with 35,200 units valued at US$65,830 as JMMB Group 5.75% preference share rose 12 cents and closed at US$2.15 trading 35,200 shares and Margaritaville rose 1 cent in trading 5,000 shares at 18 US cents. The JSE USD Equities Index rose 0.47 points to 159.31.

Trading in the US dollar market closed with 35,200 units valued at US$65,830 as JMMB Group 5.75% preference share rose 12 cents and closed at US$2.15 trading 35,200 shares and Margaritaville rose 1 cent in trading 5,000 shares at 18 US cents. The JSE USD Equities Index rose 0.47 points to 159.31.

Trading resulted in an average of 180,711 units valued at over $1,675,938, in contrast to 478,385 shares valued at $5,154,994 on Friday. For the month to date an average of 196,186 shares valued at an average of $4,035,512 versus 198,469 shares valued at an average of $4,438,731 on Monday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading shows 10 stocks ended with bids higher than their last selling prices and 4 closing with lower offers.

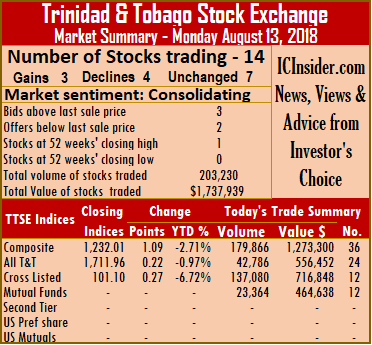

The average volume and value for the month to date amounts to 201,586 units valued at $1,097,411, compared to 213,423 units valued at $1,178,519 previous trading day. Trading in July, averaged 154,060 units valued at $655,146 for each security traded.

The average volume and value for the month to date amounts to 201,586 units valued at $1,097,411, compared to 213,423 units valued at $1,178,519 previous trading day. Trading in July, averaged 154,060 units valued at $655,146 for each security traded.

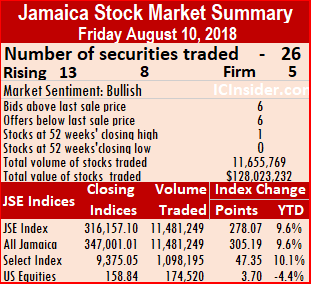

The main market of Jamaica Stock Market indices chalked up more records last and closed the week at another record high on Friday and the Junior Market closed at a 9 months’ high as the markets continue the usual summer bounce.

The main market of Jamaica Stock Market indices chalked up more records last and closed the week at another record high on Friday and the Junior Market closed at a 9 months’ high as the markets continue the usual summer bounce.

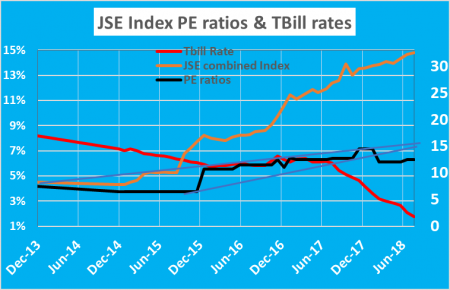

suggest that the PE ratio is likely to end around 16 times earnings by year as investors continue to gradually upgrade the multiple they are prepared to pay for stocks, which would lift prices sharply over the next several months from current levels.

suggest that the PE ratio is likely to end around 16 times earnings by year as investors continue to gradually upgrade the multiple they are prepared to pay for stocks, which would lift prices sharply over the next several months from current levels.

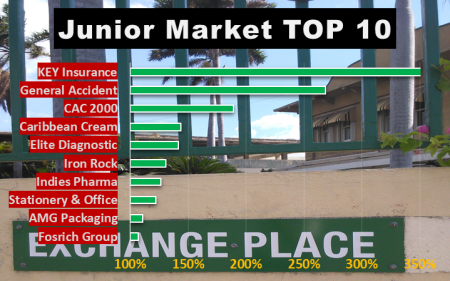

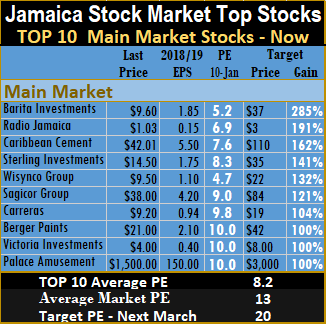

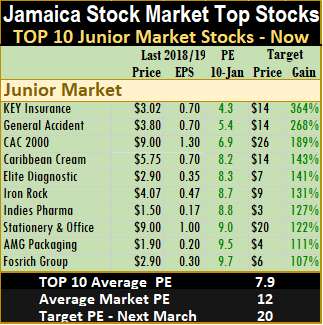

Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

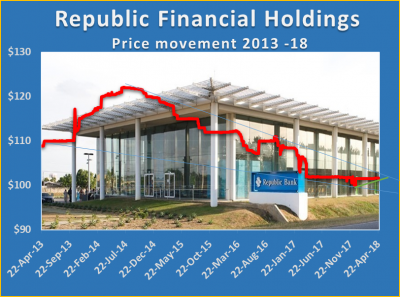

Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well. The stock market combined index climbed from 82,934.95 points at the end of 2013 to 324,801.52 on Friday, for increase of 292 percent but the average PE ratio has moved from 7.3 by just under 100 percent to peak at an average of 14.5 times last year December.

The stock market combined index climbed from 82,934.95 points at the end of 2013 to 324,801.52 on Friday, for increase of 292 percent but the average PE ratio has moved from 7.3 by just under 100 percent to peak at an average of 14.5 times last year December. The other factor is that interest rates have fallen faster in 2018 than for some time, investors seem to need more time to digest the rapid change in rates and determine how long it likely to remain at very low levels.

The other factor is that interest rates have fallen faster in 2018 than for some time, investors seem to need more time to digest the rapid change in rates and determine how long it likely to remain at very low levels.

Trading in July, averaged 154,060 units valued at $655,146 for each security traded.

Trading in July, averaged 154,060 units valued at $655,146 for each security traded. Jamaican Teas ended trading with a loss of 15 cents at $3.90, with 5,000 stock units, Jetcon Corporation traded at $4, with 29,302 units, Key Insurance finished trading 12,547 shares with a loss of 45 cents to end at $3.02,

Jamaican Teas ended trading with a loss of 15 cents at $3.90, with 5,000 stock units, Jetcon Corporation traded at $4, with 29,302 units, Key Insurance finished trading 12,547 shares with a loss of 45 cents to end at $3.02,  The Jamaica Stock Exchange took another sizable jump to end at a record close on Friday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.

The Jamaica Stock Exchange took another sizable jump to end at a record close on Friday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.

Proven Investments fell 1 cent and closed at 19 US cents trading 3,200 shares and Sygnus Credit Investments fell 0.25 cents in trading 12,010 at 0.0975 US cents. The JSE USD Equities Index rose 3.70 and closed at 154.43

Proven Investments fell 1 cent and closed at 19 US cents trading 3,200 shares and Sygnus Credit Investments fell 0.25 cents in trading 12,010 at 0.0975 US cents. The JSE USD Equities Index rose 3.70 and closed at 154.43

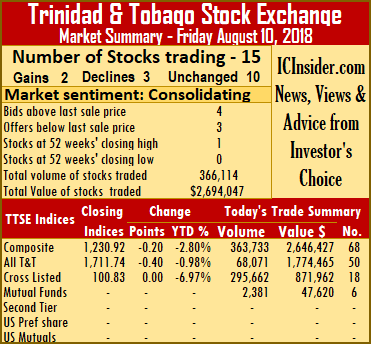

Trinidad & Tobago NGL share fell 1 cent and ended at $30, after exchanging 40,150 shares and Trinidad Cement shed 5 cents and completed trading at $2.90, after exchanging 100 shares.

Trinidad & Tobago NGL share fell 1 cent and ended at $30, after exchanging 40,150 shares and Trinidad Cement shed 5 cents and completed trading at $2.90, after exchanging 100 shares.

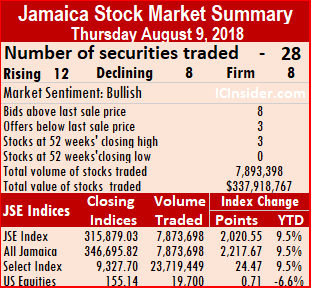

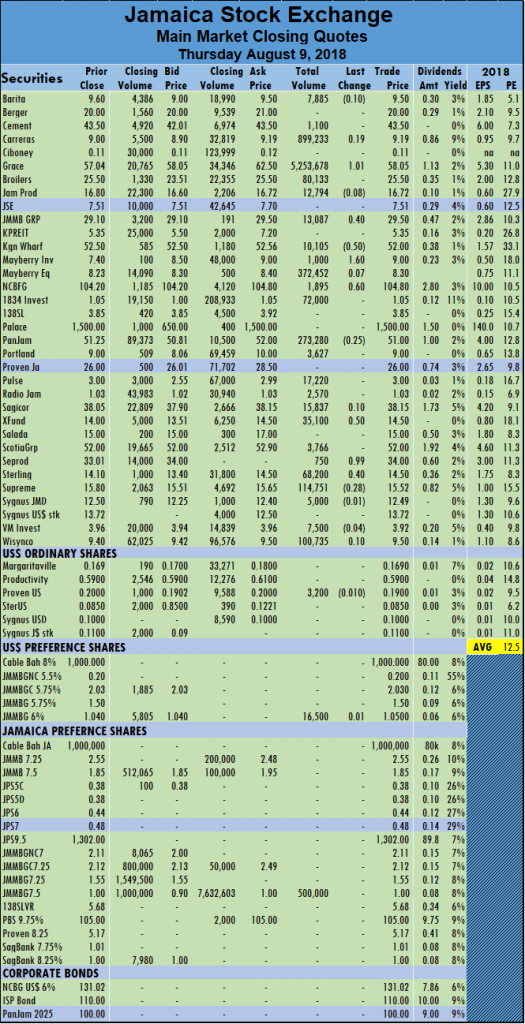

The Jamaica Stock Exchange took another sizable jump to end at a record close on Thursday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.

The Jamaica Stock Exchange took another sizable jump to end at a record close on Thursday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.  followed by Carreras with 899,233 units or just 11.42 percent of the day’s volume and JMMB Group 7.50% preference share with 500,000 units and 6.35 percent of the day’s volume.

followed by Carreras with 899,233 units or just 11.42 percent of the day’s volume and JMMB Group 7.50% preference share with 500,000 units and 6.35 percent of the day’s volume. completed trading of 16,500 stock units and rose 1 cent to end at $1.05,

completed trading of 16,500 stock units and rose 1 cent to end at $1.05,