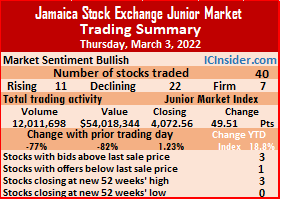

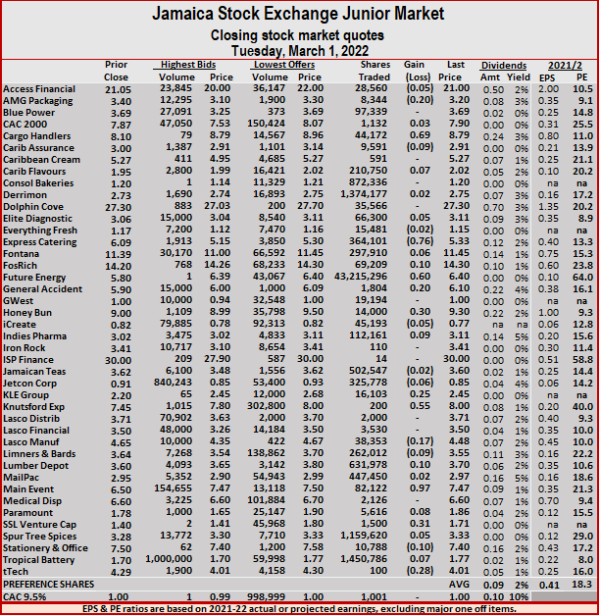

The Junior Market Index gained 49.51 points to end at a record closing high of 4,072.56, after posting a record high of 4,098.56 shortly after the market opened on Thursday and bettering the previous record close of 4,058.99 on February 14 and ended with the volume of stocks traded declining 77 percent from the elevated level on Tuesday and the value falling by 82 percent from Tuesday.

New record high for the JSE Junior Market.

Market activity led to 40 securities trading compared to 43 on Tuesday and ended with 11 rising, 22 declining and seven closing unchanged, but the market closed with three stocks ending at 52 weeks’ high and one trading at a 52 weeks’ intraday high.

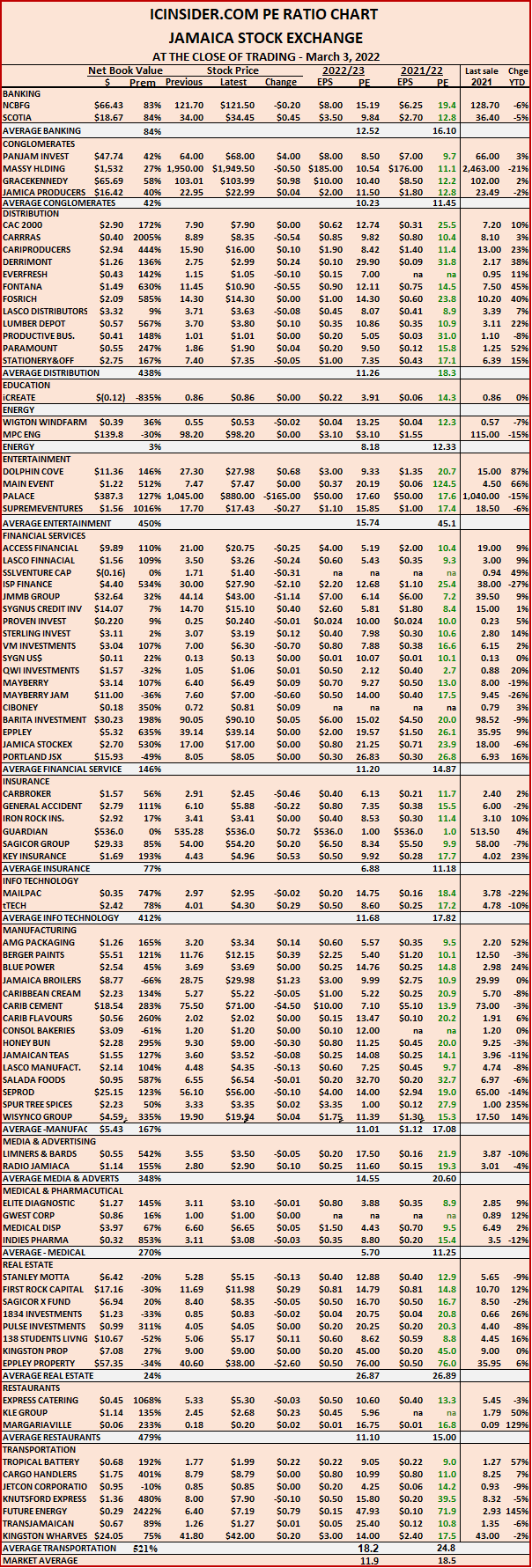

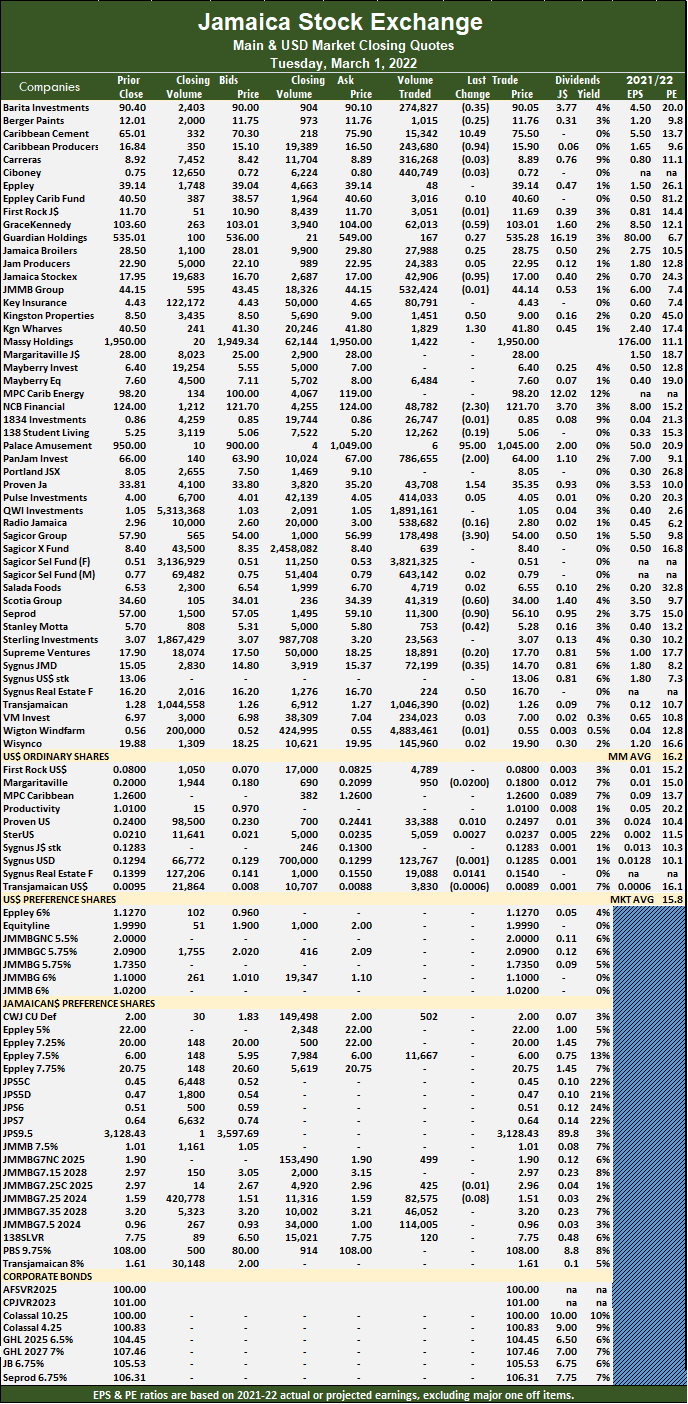

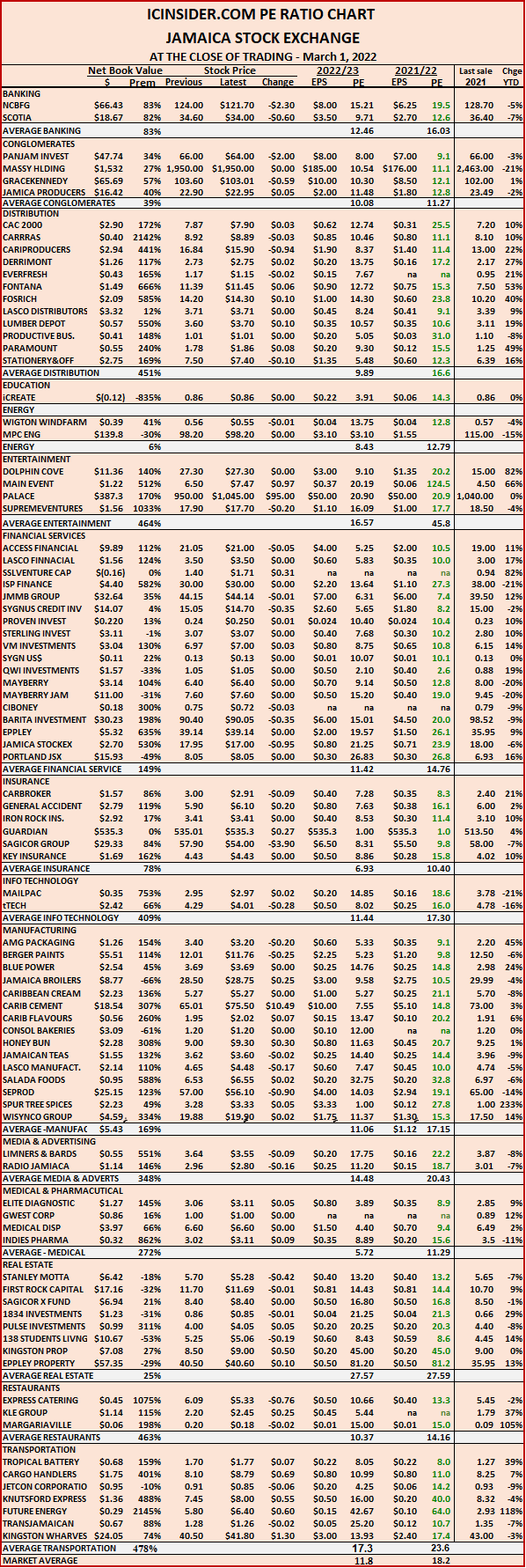

The PE Ratio, a measure used to compute appropriate stock values, averages 18.8. The PE ratio of each stock in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

Overall, 12,011,698 shares traded for $54,018,344 down from 51,846,941 units at $294,976,122 on Tuesday, with Future Energy Source led trading with 3.42 million shares for 28.4 percent of total volume followed by Derrimon Trading, 2.87 million units with 23.9 percent of the day’s trade and Tropical Battery, 841,887 units with 7 percent market share.

Trading averaged 300,292 shares at $1,350,459 in contrast to 1,205,743 shares at $6,859,910 on Tuesday and month to date, averaging 769,381 units at $4,204,753, compared to 1,205,743 units at $6,859,910 on Tuesday. February closed with an average of 370,064 units at $1,402,517.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and one stock with a lower offer.

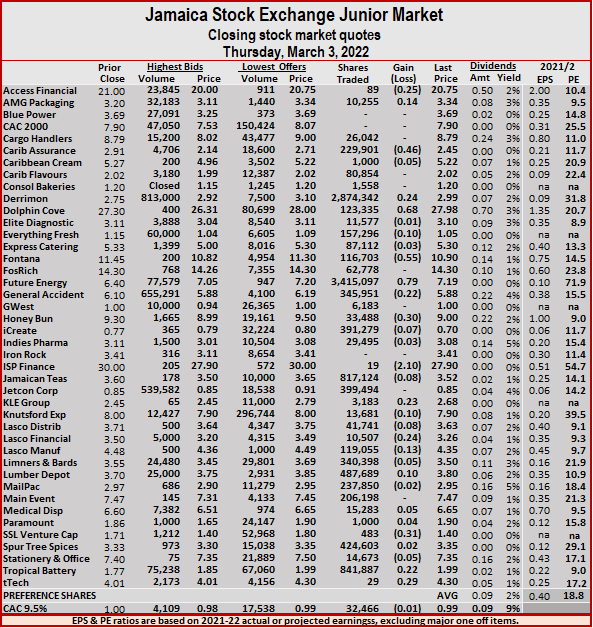

At the close, Access Financial declined 25 cents in closing at $20.75 with 89 shares changing owners, AMG Packaging rose 14 cents to $3.34 with an exchange of 10,255 stocks, Caribbean Assurance Brokers lost 46 cents to close at $2.45 in trading 229,901 stock units. Derrimon Trading climbed 24 cents to end at $2.99 in switching ownership of 2,874,342 units, Dolphin Cove rallied 68 cents to $27.98 as 123,335 shares changed hands, Everything Fresh shed 10 cents to $1.05, with 157,296 stock units clearing the market. Fontana dropped 55 cents to end at $10.90 in exchanging 116,703 units, Future Energy Source popped 79 cents in ending at a record close of $7.19, after trading 3,415,097 stocks, General Accident fell 22 cents to $5.88 with 345,951 units crossing the market. Honey Bun shed 30 cents to close at $9 in an exchange of 33,488 stocks, ISP Finance lost $2.10 to close at $27.90, with 19 stock units crossing the exchange, KLE Group gained 23 cents in closing at $2.68 after exchanging 3,183 shares. Knutsford Express declined 10 cents to $7.90 in exchanging 13,681 shares, Lasco Financial fell 24 cents to $3.26 with the swapping of 10,507 stock units, Lasco Manufacturing dropped 13 cents to $4.35, with 119,055 stocks crossing the market.

At the close, Access Financial declined 25 cents in closing at $20.75 with 89 shares changing owners, AMG Packaging rose 14 cents to $3.34 with an exchange of 10,255 stocks, Caribbean Assurance Brokers lost 46 cents to close at $2.45 in trading 229,901 stock units. Derrimon Trading climbed 24 cents to end at $2.99 in switching ownership of 2,874,342 units, Dolphin Cove rallied 68 cents to $27.98 as 123,335 shares changed hands, Everything Fresh shed 10 cents to $1.05, with 157,296 stock units clearing the market. Fontana dropped 55 cents to end at $10.90 in exchanging 116,703 units, Future Energy Source popped 79 cents in ending at a record close of $7.19, after trading 3,415,097 stocks, General Accident fell 22 cents to $5.88 with 345,951 units crossing the market. Honey Bun shed 30 cents to close at $9 in an exchange of 33,488 stocks, ISP Finance lost $2.10 to close at $27.90, with 19 stock units crossing the exchange, KLE Group gained 23 cents in closing at $2.68 after exchanging 3,183 shares. Knutsford Express declined 10 cents to $7.90 in exchanging 13,681 shares, Lasco Financial fell 24 cents to $3.26 with the swapping of 10,507 stock units, Lasco Manufacturing dropped 13 cents to $4.35, with 119,055 stocks crossing the market. Lumber Depot advanced 10 cents in closing at $3.80, with 487,689 units changing hands, SSL Venture dropped 31 cents ending at $1.40 while exchanging 483 stock units, Tropical Battery increased 22 cents to end at $1.99 whilst trading 841,887 shares and tTech advanced 29 cents to close at $4.30 with the swapping of 29 units.

Lumber Depot advanced 10 cents in closing at $3.80, with 487,689 units changing hands, SSL Venture dropped 31 cents ending at $1.40 while exchanging 483 stock units, Tropical Battery increased 22 cents to end at $1.99 whilst trading 841,887 shares and tTech advanced 29 cents to close at $4.30 with the swapping of 29 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market stocks closed at yet another record closing high on Thursday after hitting an all-time intraday high of 4,098.08 shortly after the market opened and ended with a rise of 49.51 index points to 4,072.56, with the market up almost 19 percent for the year to date, with Future Energy hitting a new record of $7.19 with a PE of 72 and Derrimon Trading closing at $2.99 after posting a lower profit for 2021 than in 2020 and earnings per share of just 9.4 cents for a PE of 30.

Junior Market stocks closed at yet another record closing high on Thursday after hitting an all-time intraday high of 4,098.08 shortly after the market opened and ended with a rise of 49.51 index points to 4,072.56, with the market up almost 19 percent for the year to date, with Future Energy hitting a new record of $7.19 with a PE of 72 and Derrimon Trading closing at $2.99 after posting a lower profit for 2021 than in 2020 and earnings per share of just 9.4 cents for a PE of 30. The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market. The Company intends to apply to the Jamaica Stock Exchange for admission of the shares on the Junior Market and will bring the total listings on that market to 45.

The Company intends to apply to the Jamaica Stock Exchange for admission of the shares on the Junior Market and will bring the total listings on that market to 45.

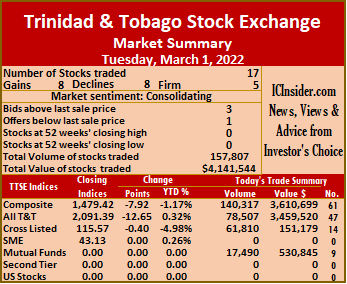

Massy Holdings ended at $106, with 84,897 units changing hands, National Enterprises lost 14 cents to $3.10 in switching ownership of 51,000 shares, NCB Financial Group fell 5 cents to $7.25 in exchanging 82,735 stock units. One Caribbean Media remained at $4.20 with the swapping of 117 shares, Prestige Holdings finished at $7.10, with 35 stocks changing hands, Republic Financial Holdings dropped $1.92 in closing at $140.08 with an exchange of 125 units. Scotiabank popped $2.50 to a 52 weeks’ high of $75 in trading 5,294 shares, Trinidad & Tobago NGL ended unchanged at $20.50 trading 10,210 stock units, Trinidad Cement remained at $3.70 after an exchange of 66,800 units and Unilever Caribbean finished at $15.50 after exchanging 2,000 stocks.

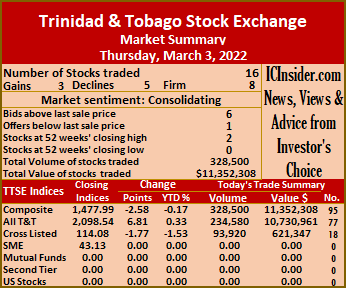

Massy Holdings ended at $106, with 84,897 units changing hands, National Enterprises lost 14 cents to $3.10 in switching ownership of 51,000 shares, NCB Financial Group fell 5 cents to $7.25 in exchanging 82,735 stock units. One Caribbean Media remained at $4.20 with the swapping of 117 shares, Prestige Holdings finished at $7.10, with 35 stocks changing hands, Republic Financial Holdings dropped $1.92 in closing at $140.08 with an exchange of 125 units. Scotiabank popped $2.50 to a 52 weeks’ high of $75 in trading 5,294 shares, Trinidad & Tobago NGL ended unchanged at $20.50 trading 10,210 stock units, Trinidad Cement remained at $3.70 after an exchange of 66,800 units and Unilever Caribbean finished at $15.50 after exchanging 2,000 stocks. A total of 18 securities traded, up from 17 on Tuesday, with four rising, six declining and eight remaining unchanged. The Composite Index rose 1.15 points to 1,480.57, the All T&T Index popped 0.34 points to 2,091.73 and the Cross-Listed Index advanced 0.28 points to settle at 115.85.

A total of 18 securities traded, up from 17 on Tuesday, with four rising, six declining and eight remaining unchanged. The Composite Index rose 1.15 points to 1,480.57, the All T&T Index popped 0.34 points to 2,091.73 and the Cross-Listed Index advanced 0.28 points to settle at 115.85. National Enterprises ended at $3.24 with the swapping of 27,300 stock units, National Flour Mills remained at $1.95, with 300 units crossing the exchange, NCB Financial Group finished at $7.30, with 4,474 shares changing hands. One Caribbean Media advanced 10 cents to $4.20 while exchanging 2,280 stocks, Republic Financial Holdings shed $1 to end at $142 after investors traded 735 shares, Scotiabank dropped 75 cents to end at $72.50 in exchanging 1,333 units. Trinidad & Tobago NGL fell 50 cents to $20.50 in an exchange of 6,087 stock units, Unilever Caribbean dropped 25 cents after ending at $15.50, with 3,432 stock units crossing the market and West Indian Tobacco ended at $25 after exchanging 600 shares.

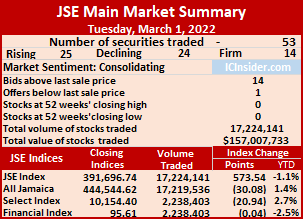

National Enterprises ended at $3.24 with the swapping of 27,300 stock units, National Flour Mills remained at $1.95, with 300 units crossing the exchange, NCB Financial Group finished at $7.30, with 4,474 shares changing hands. One Caribbean Media advanced 10 cents to $4.20 while exchanging 2,280 stocks, Republic Financial Holdings shed $1 to end at $142 after investors traded 735 shares, Scotiabank dropped 75 cents to end at $72.50 in exchanging 1,333 units. Trinidad & Tobago NGL fell 50 cents to $20.50 in an exchange of 6,087 stock units, Unilever Caribbean dropped 25 cents after ending at $15.50, with 3,432 stock units crossing the market and West Indian Tobacco ended at $25 after exchanging 600 shares. The All Jamaican Composite Index fell 30.08 points to settle at 444,544.62, the JSE Main Index popped 573.54 points to 391,696.74 and the JSE Financial Index lost 0.04 points to end at 95.61.

The All Jamaican Composite Index fell 30.08 points to settle at 444,544.62, the JSE Main Index popped 573.54 points to 391,696.74 and the JSE Financial Index lost 0.04 points to end at 95.61. Trading averaged 324,984 shares at $2,962,410, up from 252,978 stock units at $2,400,224 on Monday. February losed with an average of 392,520 units at $3,199,976.

Trading averaged 324,984 shares at $2,962,410, up from 252,978 stock units at $2,400,224 on Monday. February losed with an average of 392,520 units at $3,199,976. PanJam Investment declined $2 to close at $64 with 786,655 shares changing hands, Proven Investments rallied $1.54 to $35.35 with the swapping of 43,708 stocks, Sagicor Group fell $3.90 in closing at $54 after the transferring of 178,498 stock units. Scotia Group shed 60 cents to end at $34 after trading 41,319 stocks, Seprod slipped 90 cents to $56.10 with 11,300 shares changing hands, Stanley Motta lost 42 cents to close at $5.28 with a transfer of 753 units. Sygnus Credit Investments dipped 35 cents to end at $14.70 with an exchange of 72,199 shares and Sygnus Real Estate Finance gained 50 cents to close at $16.70 with the swapping of 224 stocks.

PanJam Investment declined $2 to close at $64 with 786,655 shares changing hands, Proven Investments rallied $1.54 to $35.35 with the swapping of 43,708 stocks, Sagicor Group fell $3.90 in closing at $54 after the transferring of 178,498 stock units. Scotia Group shed 60 cents to end at $34 after trading 41,319 stocks, Seprod slipped 90 cents to $56.10 with 11,300 shares changing hands, Stanley Motta lost 42 cents to close at $5.28 with a transfer of 753 units. Sygnus Credit Investments dipped 35 cents to end at $14.70 with an exchange of 72,199 shares and Sygnus Real Estate Finance gained 50 cents to close at $16.70 with the swapping of 224 stocks. A total of seven securities traded, down from 11 on Monday, with four rising, three declining and none ending unchanged. The JSE US Denominated Equities Index rose 1.84 points to end at 207.82.

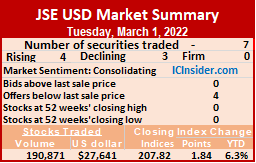

A total of seven securities traded, down from 11 on Monday, with four rising, three declining and none ending unchanged. The JSE US Denominated Equities Index rose 1.84 points to end at 207.82. Proven Investments gained 0.97 of one cent in closing at 24.97 US cents, with 33,388 stocks clearing the market. Sterling Investments rallied 0.27 of a cent to close at 2.37 US cents after 5,059 stock units changed hands, Sygnus Credit Investments USD share declined 0.09 of a cent to 12.85 US cents with an exchange of 123,767 stock units, Sygnus Real Estate Finance USD share advanced 1.41 cents to 15.4 US cents in switching ownership of 19,088 shares and Transjamaican Highway lost 0.06 of a cent in closing at 0.89 of one US cent after exchanging 3,830 units.

Proven Investments gained 0.97 of one cent in closing at 24.97 US cents, with 33,388 stocks clearing the market. Sterling Investments rallied 0.27 of a cent to close at 2.37 US cents after 5,059 stock units changed hands, Sygnus Credit Investments USD share declined 0.09 of a cent to 12.85 US cents with an exchange of 123,767 stock units, Sygnus Real Estate Finance USD share advanced 1.41 cents to 15.4 US cents in switching ownership of 19,088 shares and Transjamaican Highway lost 0.06 of a cent in closing at 0.89 of one US cent after exchanging 3,830 units.

Trading ended with an average of 1,205,743 shares at $6,859,910 in up from 346,57 shares at $1,213,704 on Monday. February closed with an average of 370,064 units at $1,402,517.

Trading ended with an average of 1,205,743 shares at $6,859,910 in up from 346,57 shares at $1,213,704 on Monday. February closed with an average of 370,064 units at $1,402,517. Lasco Manufacturing dropped 17 cents to $4.48 in an exchange of 38,353 stock units, Lumber Depot rallied 10 cents to close at $3.70 in switching ownership of 631,978 shares, Main Event climbed 97 cents in closing at a 52 weeks’ high of $7.47 with the swapping of 82,122 stocks. SSL Venture advanced 31 cents in ending at $1.71 with 1,500 stock units changing hands, Stationery and Office Supplies shed 10 cents to end at $7.40 after trading 10,788 units and tTech fell 28 cents to $4.01 after trading 100 shares.

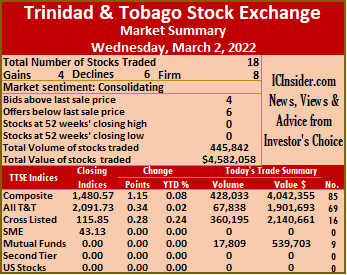

Lasco Manufacturing dropped 17 cents to $4.48 in an exchange of 38,353 stock units, Lumber Depot rallied 10 cents to close at $3.70 in switching ownership of 631,978 shares, Main Event climbed 97 cents in closing at a 52 weeks’ high of $7.47 with the swapping of 82,122 stocks. SSL Venture advanced 31 cents in ending at $1.71 with 1,500 stock units changing hands, Stationery and Office Supplies shed 10 cents to end at $7.40 after trading 10,788 units and tTech fell 28 cents to $4.01 after trading 100 shares. Just 17 securities traded down from 23 on Monday, with six rising, six declining and five remaining unchanged. The Composite Index dropped 7.92 points to 1,479.42, the All T&T Index lost 12.65 points to close at 2,091.39 and the Cross-Listed Index declined 0.40 points to settle at 115.57.

Just 17 securities traded down from 23 on Monday, with six rising, six declining and five remaining unchanged. The Composite Index dropped 7.92 points to 1,479.42, the All T&T Index lost 12.65 points to close at 2,091.39 and the Cross-Listed Index declined 0.40 points to settle at 115.57. GraceKennedy fell 1 cent to $5.99 in trading 1,620 units, Guardian Holdings ended at $29.75 after an exchange of 975 stock units, JMMB Group lost 5 cents in closing at $2.25, with 58,935 shares changing hands. Massy Holdings rallied 2 cents to close at $106 after trading 23,779 units, National Enterprises remained at $3.24 in an exchange of 1,000 stock units, NCB Financial Group gained 5 cents to end at $7.30 after 100 stocks crossed the exchange. Scotiabank rose 25 cents in closing at $73.25 with an exchange of 1,895 units, Trinidad & Tobago NGL declined 50 cents to $21 with the swapping of 4,345 stocks, Trinidad Cement declined 5 cents to close at $3.70 after 23,588 stock units changed hands. Unilever Caribbean climbed 38 cents to $15.75 trading 623 shares and West Indian Tobacco finished at $25 after exchanging 2,295 units.

GraceKennedy fell 1 cent to $5.99 in trading 1,620 units, Guardian Holdings ended at $29.75 after an exchange of 975 stock units, JMMB Group lost 5 cents in closing at $2.25, with 58,935 shares changing hands. Massy Holdings rallied 2 cents to close at $106 after trading 23,779 units, National Enterprises remained at $3.24 in an exchange of 1,000 stock units, NCB Financial Group gained 5 cents to end at $7.30 after 100 stocks crossed the exchange. Scotiabank rose 25 cents in closing at $73.25 with an exchange of 1,895 units, Trinidad & Tobago NGL declined 50 cents to $21 with the swapping of 4,345 stocks, Trinidad Cement declined 5 cents to close at $3.70 after 23,588 stock units changed hands. Unilever Caribbean climbed 38 cents to $15.75 trading 623 shares and West Indian Tobacco finished at $25 after exchanging 2,295 units. Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.