Trading on Wednesday, ended with the volume of shares changing hands slipping marginally but with a 94 percent plunge in the value compared to Tuesday’s trading, at the close of the Jamaica Stock Exchange US dollar market and ended with more stocks falling than rising.

Five securities changed hands, compared to seven on Tuesday with one rising, three declining and one ending unchanged. The JSE US Denominated Equities Index rose 0.26 points to end at 203.99.

Five securities changed hands, compared to seven on Tuesday with one rising, three declining and one ending unchanged. The JSE US Denominated Equities Index rose 0.26 points to end at 203.99.

The PE Ratio, a measure used in computing appropriate stock values, averages 12.5. The PE ratios use ICInsider.com earnings forecasts for companies with the financial year up to August 2022.

Overall, 683,860 shares traded, for US$9,230 compared to 689,580 units at US$151,286 on Tuesday.

Trading averaged 136,772 units at US$1,846 versus 98,511 shares at US$21,612 on Tuesday and the month to date averaged 73,420 shares at US$4,701 versus 68,829 units at US$4,908 on the previous day. December ended with an average of 439,975 units for US$68,382.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and none with a lower offer.

At the close, First Rock Capital USD share climbed 0.2 of a cent to 6.5 US cents in exchanging 500 shares, Proven Investments shed 0.44 of one cent to end at 23.5 US cents, with 410 stocks crossing the market, Sterling Investments finished unchanged at 2.1 US cents trading 10,939 units. Sygnus Credit Investments USD share lost 0.4 of one cent in ending at 12 US cents, with 28,861 stock units changing hands and Transjamaican Highway declined 0.03 of a cent in closing at 0.83 US cents after trading 643,150 stock units.

At the close, First Rock Capital USD share climbed 0.2 of a cent to 6.5 US cents in exchanging 500 shares, Proven Investments shed 0.44 of one cent to end at 23.5 US cents, with 410 stocks crossing the market, Sterling Investments finished unchanged at 2.1 US cents trading 10,939 units. Sygnus Credit Investments USD share lost 0.4 of one cent in ending at 12 US cents, with 28,861 stock units changing hands and Transjamaican Highway declined 0.03 of a cent in closing at 0.83 US cents after trading 643,150 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Archives for January 2022

Moderate JSE USD trading

TTSE composite index closes at record high

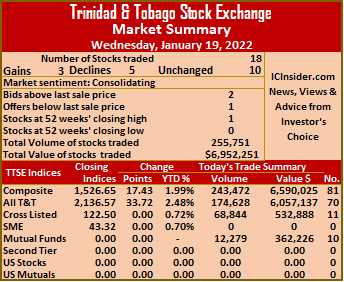

Market activity ended on Wednesday and resulted in slightly fewer stocks rising than falling at the close of trading, after 56 percent more shares were traded, with 41 percent higher value than on Tuesday at the close of the Trinidad and Tobago Stock Exchange.

New record high for the TTSE Composite Index.

A total of 18 securities traded compared to 20 on Tuesday, with three rising, five declining and 10 remaining unchanged. The Composite Index popped 17.43 points to close at a record high of 1,526.65, the All T&T Index surged 33.72 points to 2,136.57 and the Cross-Listed Index ended unchanged at 122.50.

A total of 255,751 shares traded for $6,952,251 compared to 163,749 units at $4,916,412 on Tuesday. An average of 14,208 units traded at $386,236 compared to 8,187 at $245,821 on Tuesday, with trading month to date averaging 50,207 units at $296,887 versus 53,179 units at $289,510 on the prior trading day. The average trade for December amounts to 21,703 units at $306,768.

Investor’s Choice bid-offer indicator shows two stocks ended with the bid higher than their last selling prices and one stock with a lower offer.

At the close, Agostini’s rose 50 cents to a 52 weeks’ high of $39.50 after exchanging 535 shares, Angostura Holdings ended at $19.99, with 2,855 stock units crossing the market, Ansa McAl shed 20 cents in closing at $59.30 after exchanging 1,313 stocks. Ansa Merchant Bank ended unchanged at $43.49 with the swapping of 1,115 units, Clico Investment Fund slipped 1 cent to end at $29.49 trading 12,279 stocks, First Citizens Group rallied $5.90 to $65.91 in an exchange of 492 units.  GraceKennedy finished unchanged at $6.25, with 250 stock units clearing the market, Guardian Holdings dropped 33 cents to close at $30 while swapping 101,786 shares, JMMB Group finished unchanged at $2.35 after 3,200 stocks changed hands. Massy Holdings lost 12 cents to end at $106.12 in trading 16,179 shares, National Enterprises ended at $3.51 after an exchange of 6,750 stock units, NCB Financial Group remained at $8.01 after 65,394 units crossed the exchange. One Caribbean Media ended at $4.20 in switching ownership of 1,200 stock units, Republic Financial Holdings gained $1.25 in closing at $142.50 with an exchange of 217 units, Scotiabank finished trading of 1,500 shares at $70.50. Trinidad & Tobago NGL declined 40 cents to $19.60 in an exchange of 7,449 stocks, Unilever Caribbean remained at $16, with 16,237 stocks changing hands and West Indian Tobacco ended at $27.after trading 17,000 units.

GraceKennedy finished unchanged at $6.25, with 250 stock units clearing the market, Guardian Holdings dropped 33 cents to close at $30 while swapping 101,786 shares, JMMB Group finished unchanged at $2.35 after 3,200 stocks changed hands. Massy Holdings lost 12 cents to end at $106.12 in trading 16,179 shares, National Enterprises ended at $3.51 after an exchange of 6,750 stock units, NCB Financial Group remained at $8.01 after 65,394 units crossed the exchange. One Caribbean Media ended at $4.20 in switching ownership of 1,200 stock units, Republic Financial Holdings gained $1.25 in closing at $142.50 with an exchange of 217 units, Scotiabank finished trading of 1,500 shares at $70.50. Trinidad & Tobago NGL declined 40 cents to $19.60 in an exchange of 7,449 stocks, Unilever Caribbean remained at $16, with 16,237 stocks changing hands and West Indian Tobacco ended at $27.after trading 17,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

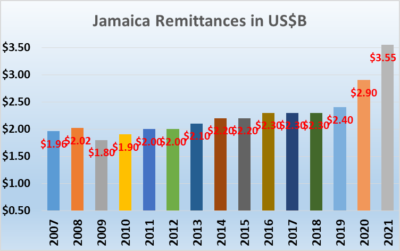

Remittances on track to exceed US$3.5B

Remittances inflows to Jamaica surged to US$3.18 billion for the first 11 months of 2021 after pulling in US$274.5 million in November, an increase of 15.6 percent or US$37 million over the comparative period in 2020, data out of the Bank of Jamaica shows.

The performance for November puts the total intake for 2021 above the US$2.9 billion hauled in for January to December 2020. The outturn for 2021 seems set to exceed $3.5 billion for the year when the final numbers are tallied for December.

The performance for November puts the total intake for 2021 above the US$2.9 billion hauled in for January to December 2020. The outturn for 2021 seems set to exceed $3.5 billion for the year when the final numbers are tallied for December.

Based on the performance to date and the consistency of the monthly increase the 2021 inflows seem set to exceed by $1.1 billion the inflows of US$2.406 billion the country received in 2019 and just over $600 million more than the total for over 2020.

Data show Jamaica receiving around $2 billion more inflows in the last two years over and above the trend up to 2019. Between 2007 and 2019 inflows grew around US$1 00 million per annum, with no growth in inflows in 2015, 2017 and 2018. The increase in 2020 and 2021 broke the trend of low growth experienced since 2007.

Persons within the financial sector attribute the increased flows to a number of factors including many Jamaica who lives abroad buying real estate and contributing to the building boom in Jamaica others are of the view that the transfer of funds by the government’s fiscal stimulus to individuals, primarily in the United States is also a big contributor.

Trading picks up on JSE USD market

Trading on Tuesday ended with the volume of shares changing hands declining 18 percent with a 1,050 percent surge in the value of trades than on Monday, at the close of the Jamaica Stock Exchange US dollar market, resulting in declining stocks edging out those that rose.

Seven securities traded, compared to eight on Monday with two rising, three declining and two ending unchanged. The JSE US Denominated Equities Index popped 1.49 points to end at 203.73.

Seven securities traded, compared to eight on Monday with two rising, three declining and two ending unchanged. The JSE US Denominated Equities Index popped 1.49 points to end at 203.73.

The PE Ratio, a measure used in computing appropriate stock values, averages 12.5. The PE ratio uses ICInsider.com earnings forecasts for companies with the financial year, up to August 2022.

Overall, 689,580 shares traded, for US$151,286 compared to 842,964 units at US$13,152 on Monday.

Trading averaged 98,511 units at US$21,612, compared to 105,371 shares at US$1,644 on Monday and month to date averages 68,829 shares at US$4,908 versus 65,478 units at US$3,022 on Monday. December ended with an average of 439,975 units for US$68,382.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and none with a lower offer.

At the close, First Rock Capital USD share fell 0.59 of a cent to 6.3 US cents trading 1,083 shares, Margaritaville remained at 11.5 US cents as 56,639 stock units were swapped, Proven Investments climbed 1.22 cents in closing at 23.94 US cents after exchanging 598,780 stocks. Sygnus Credit Investments USD share declined 0.3 of a cent before ending at 12.4 US cents and trading 10,437 units, Sygnus Real Estate Finance USD share finished at 14 US cents in exchanging 41 stock units and Transjamaican Highway popped 0.01 of a cent to 0.86 of one US cent with an exchange of 17,600 shares.

At the close, First Rock Capital USD share fell 0.59 of a cent to 6.3 US cents trading 1,083 shares, Margaritaville remained at 11.5 US cents as 56,639 stock units were swapped, Proven Investments climbed 1.22 cents in closing at 23.94 US cents after exchanging 598,780 stocks. Sygnus Credit Investments USD share declined 0.3 of a cent before ending at 12.4 US cents and trading 10,437 units, Sygnus Real Estate Finance USD share finished at 14 US cents in exchanging 41 stock units and Transjamaican Highway popped 0.01 of a cent to 0.86 of one US cent with an exchange of 17,600 shares.

In the preference segment, JMMB Group 6% lost 4 cents in closing at US$1.01 in an exchange of 5,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

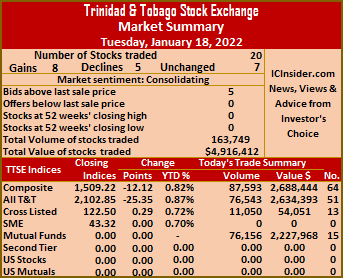

TTSE market indices plunge

Rising stocks outpaced those declining on Tuesday but a big fall in the price of First Citizens Group push the Trinidad and Tobago Stock Exchange into a big decline at the close of trading, after trading resulted in 29 percent more shares, changing hands with 66 percent higher value than Monday.

The market closed with 20 securities trading versus 21 on Monday, with nine rising, five declining and six ending unchanged. The Composite Index shed 12.12 points to 1,509.22, the All T&T Index lost 25.35 points to close at 2,102.85 and the Cross-Listed Index popped 0.29 points to settle at 122.50.

The market closed with 20 securities trading versus 21 on Monday, with nine rising, five declining and six ending unchanged. The Composite Index shed 12.12 points to 1,509.22, the All T&T Index lost 25.35 points to close at 2,102.85 and the Cross-Listed Index popped 0.29 points to settle at 122.50.

A total of 163,749 shares traded for $4,916,412 compared to 126,559 units at $2,961,338 on Monday. An average of 8,187 units traded at $245,821 compared to 6,027 at $142,771 on Monday. Trading month to date averaged 53,179 units at $289,510 against 57,724 units at $293,923 on the previous trading day. December ended with an average of 21,703 units at $306,768.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Agostini’s traded 151 shares at $39, Angostura Holdings gained $1.98 to end at $19.99 while exchanging 14 stocks, Ansa Merchant Bank fell 1 cent to close at $43.49 with an exchange of 200 stock units. Calypso Macro Investment Fund rallied 1 cent in closing at $16.66 after exchanging 1,451 units, Clico Investment Fund shed 50 cents in ending at $29.50 after an exchange of 74,705 shares, First Citizens Group dropped $4.99 to close at $60.01 after 1,500 stocks changed hands. FirstCaribbean International Bank remained at $6.15, with 1,654 units crossing the exchange, GraceKennedy advanced 5 cents to $6.25, after trading 655 stock units, Guardian Holdings increased 33 cents to end at $30.33 with 200 stocks crossing the market.  JMMB Group climbed 5 cents to $2.35 trading 5,341 shares, Massy Holdings popped 24 cents to close at $106.24, with 17,320 units changing hands, National Enterprises declined 24 cents to $3.51 after an exchange of 1,300 stock units. National Flour Mills lost 3 cents in closing at $1.92 after 2,200 units switched owners, NCB Financial Group rose 1 cent to end at $8.01 in switching ownership of 3,400 stock units, Prestige Holdings finished the trading of 100 shares at $7.05. Scotiabank finished at $70.50 in trading 6,641 stocks, Trinidad & Tobago NGL ended unchanged at $20, with 50 shares clearing the market, Trinidad Cement popped 1 cent to $3.76 with an exchange of 45,312 stocks. Unilever Caribbean remained at $16, with 485 stock units crossing the exchange and West Indian Tobacco advanced 49 cents to $27.99 with the swapping of 1,070 units.

JMMB Group climbed 5 cents to $2.35 trading 5,341 shares, Massy Holdings popped 24 cents to close at $106.24, with 17,320 units changing hands, National Enterprises declined 24 cents to $3.51 after an exchange of 1,300 stock units. National Flour Mills lost 3 cents in closing at $1.92 after 2,200 units switched owners, NCB Financial Group rose 1 cent to end at $8.01 in switching ownership of 3,400 stock units, Prestige Holdings finished the trading of 100 shares at $7.05. Scotiabank finished at $70.50 in trading 6,641 stocks, Trinidad & Tobago NGL ended unchanged at $20, with 50 shares clearing the market, Trinidad Cement popped 1 cent to $3.76 with an exchange of 45,312 stocks. Unilever Caribbean remained at $16, with 485 stock units crossing the exchange and West Indian Tobacco advanced 49 cents to $27.99 with the swapping of 1,070 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Volume up value down

Trading on Monday, on the Jamaica Stock Exchange US dollar market ended with the volume of shares changing hands surging 295 percent but the value ended 63 percent lower than on Friday and resulted in more stocks rising than falling.

Trading ended with eight securities changing hands, compared to nine on Friday with two rising, one declining and five ending unchanged.

Trading ended with eight securities changing hands, compared to nine on Friday with two rising, one declining and five ending unchanged.

The JSE US Denominated Equities Index lost 2.48 points to end at 202.24.

The PE Ratio, a measure used in computing appropriate stock values, averages 12.6. The PE ratio uses ICInsider.com earnings forecasts for companies with the financial year up to August 2022.

A total of 842,964 shares traded for US$13,152 compared to 213,364 units at US$35,831 on Friday. Trading averaged 105,371 units at US$1,644, compared to 23,707 shares at US$3,981 on Friday, with the month to date averaging 65,478 shares at US$3,022 versus 59,568 units at US$3,226 on the prior trading day. December ended with an average of 439,975 units for US$68,382.

Investor’s Choice bid-offer indicator shows no stock ended with a bid higher than the last selling price nor with a lower offer.

At the close, 5,894 shares of Margaritaville were exchanged at 11.5 US cents, Proven Investments ended at 22.72 US cents, with 15,029 stock units crossing the market, Sterling Investments swapped 11,211 stocks at 2.1 US cents. Sygnus Credit Investments USD share rallied 0.3 of a cent to close at 12.7 US cents, with 14,105 units changing hands, Sygnus Real Estate Finance USD share traded 494 shares at 14 US cents and Transjamaican Highway lost 0.05 of a cent in closing at 0.85 of one US cents after exchanging 796,064 stocks.

Sygnus Credit Investments USD share rallied 0.3 of a cent to close at 12.7 US cents, with 14,105 units changing hands, Sygnus Real Estate Finance USD share traded 494 shares at 14 US cents and Transjamaican Highway lost 0.05 of a cent in closing at 0.85 of one US cents after exchanging 796,064 stocks.

In the preference segment, Eppley 6% ended unchanged at 98 US cents in switching ownership of 101 units and JMMB Group 5.75% rose 23.5 cents to close at US$1.735 trading 66 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

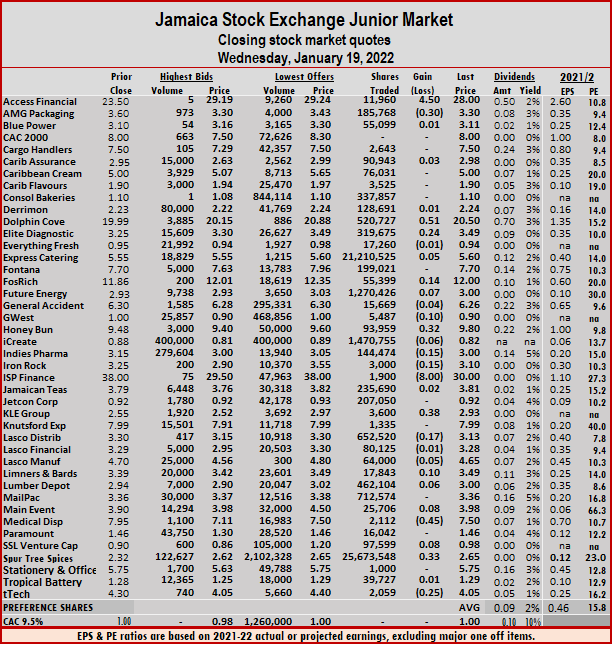

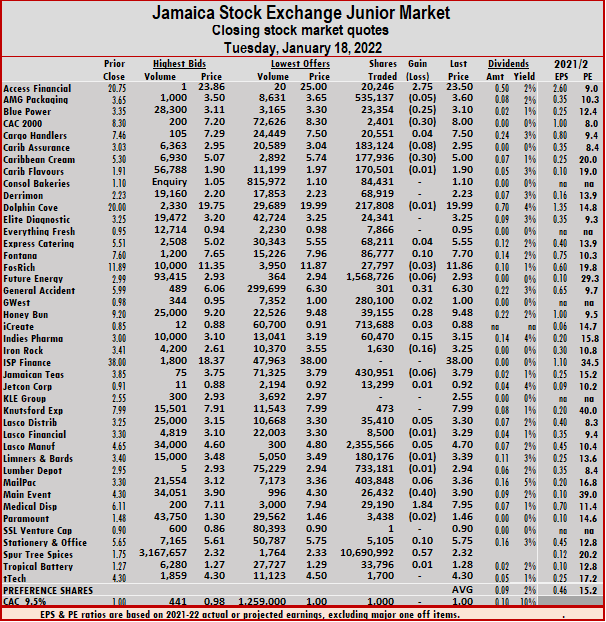

A total of 41 securities traded on Wednesday similar to Tuesday and ended with 18 rising, 13 declining and 10 closing unchanged. At the close, the Junior Market Index shed 15.44 points to settle at 3,502.75.

A total of 41 securities traded on Wednesday similar to Tuesday and ended with 18 rising, 13 declining and 10 closing unchanged. At the close, the Junior Market Index shed 15.44 points to settle at 3,502.75. Trading averaged 1,329,645 shares at $4,805,596 up from 471,623 shares at $1,411,805 on Tuesday with month to date, averaging 302,573 units at $1,199,046, compared to 209,819 units at $873,344 previously. December closed with an average of 409,209 units at $1,318,877.

Trading averaged 1,329,645 shares at $4,805,596 up from 471,623 shares at $1,411,805 on Tuesday with month to date, averaging 302,573 units at $1,199,046, compared to 209,819 units at $873,344 previously. December closed with an average of 409,209 units at $1,318,877. Limners and Bards gained 10 cents to close at $3.49 after trading 17,843 stock units, Medical Disposables fell 45 cents in closing at $7.50 with the swapping of 2,112 shares, Spur Tree Spices advanced 33 cents to end at 52 weeks’ high of $2.65 and closed with 25,673,548 stocks changing hands and tTech declined 25 cents in closing at $4.05 after exchanging 2,059 units.

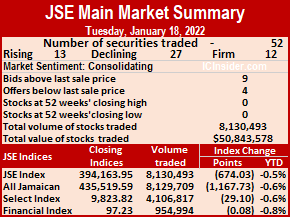

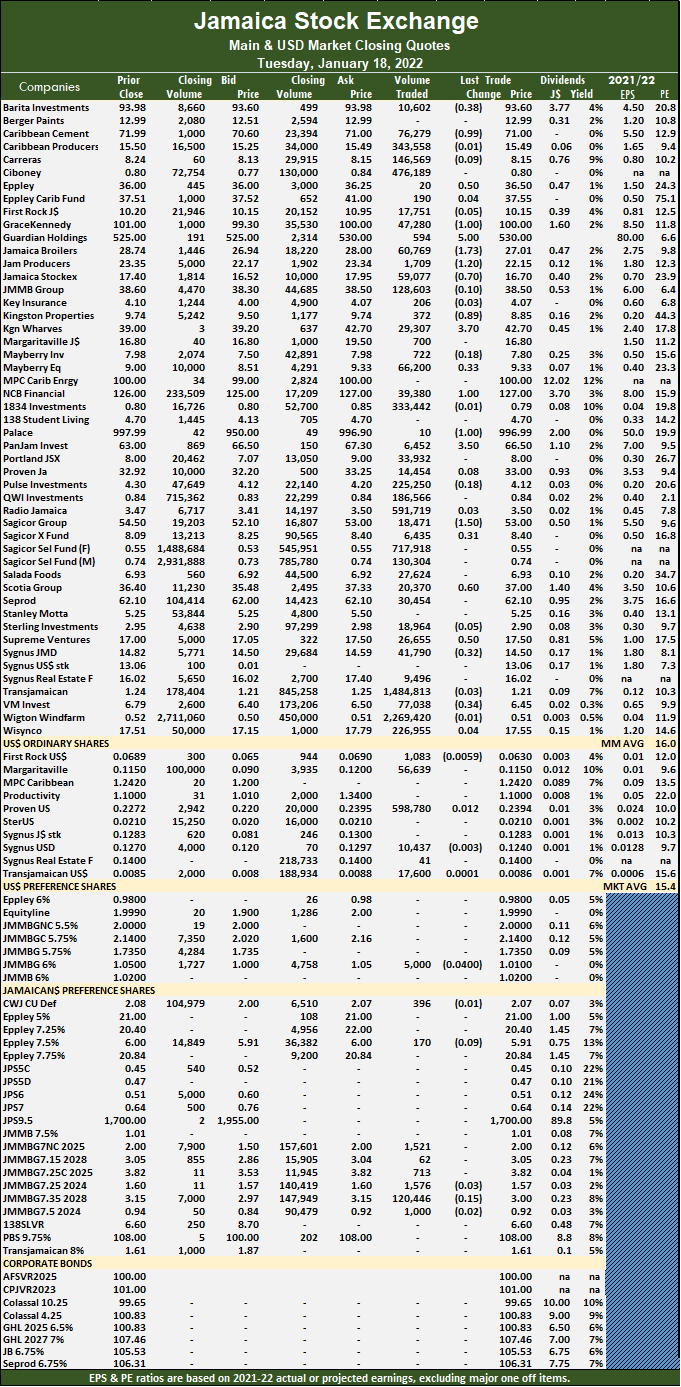

Limners and Bards gained 10 cents to close at $3.49 after trading 17,843 stock units, Medical Disposables fell 45 cents in closing at $7.50 with the swapping of 2,112 shares, Spur Tree Spices advanced 33 cents to end at 52 weeks’ high of $2.65 and closed with 25,673,548 stocks changing hands and tTech declined 25 cents in closing at $4.05 after exchanging 2,059 units. The All Jamaican Composite Index fell 1,167.73 points to 435,519.59, the Main Index shed 674.03 points to 394,163.95 and the JSE Financial Index lost 0.08 points to close at 97.23.

The All Jamaican Composite Index fell 1,167.73 points to 435,519.59, the Main Index shed 674.03 points to 394,163.95 and the JSE Financial Index lost 0.08 points to close at 97.23. Transjamaican Highway with 18.3 percent for 1.48 million units and Sagicor Select Financial Fund with 8.8 percent for 717,918 units changing hands.

Transjamaican Highway with 18.3 percent for 1.48 million units and Sagicor Select Financial Fund with 8.8 percent for 717,918 units changing hands. Palace Amusement shed $1 to end at $996.99 after trading 10 stock units, PanJam Investment rose $3.50 to $66.50 with 6,452 stocks changing hands, Sagicor Group fell $1.50 in closing at $53 with the swapping of 18,471 shares. Sagicor Real Estate Fund gained 31 cents to end at $8.40 after exchanging 6,435 units, Scotia Group rallied 60 cents to close at $37 in transferring 20,370 stock units, Supreme Ventures popped 50 cents to end at $17.50 with an exchange of 26,655 units. Sygnus Credit Investments lost 32 cents in closing at $14.50 after 41,790 stocks crossed the market and VM Investments declined 34 cents to $6.45 in exchanging 77,038 shares.

Palace Amusement shed $1 to end at $996.99 after trading 10 stock units, PanJam Investment rose $3.50 to $66.50 with 6,452 stocks changing hands, Sagicor Group fell $1.50 in closing at $53 with the swapping of 18,471 shares. Sagicor Real Estate Fund gained 31 cents to end at $8.40 after exchanging 6,435 units, Scotia Group rallied 60 cents to close at $37 in transferring 20,370 stock units, Supreme Ventures popped 50 cents to end at $17.50 with an exchange of 26,655 units. Sygnus Credit Investments lost 32 cents in closing at $14.50 after 41,790 stocks crossed the market and VM Investments declined 34 cents to $6.45 in exchanging 77,038 shares. Market activity led to 41 securities trading compared to 39 on Monday and ended with 17 rising, 16 declining and eight, closing unchanged.

Market activity led to 41 securities trading compared to 39 on Monday and ended with 17 rising, 16 declining and eight, closing unchanged. At the close, Access Financial rose $2.75 ending at $23.50, the highest price since January 2021, with the swapping of 20,246 shares, AMG Packaging shed 5 cents to end at $3.60, with 535,137 stock units crossing the exchange, Blue Power declined 25 cents in closing at $3.10 after 23,354 units changed hands. CAC 2000 fell 30 cents to close at $8 while exchanging 2,401 stocks, Caribbean Assurance Brokers dipped 8 cents to $2.95 after trading 183,124 units, Caribbean Cream lost 30 cents to close at $5, with an exchange of 177,936 stocks. Fontana gained 10 cents in closing at $7.70 trading 86,777 stock units, Future Energy Source lost 6 cents after ending at $2.93 in exchanging 1,568,726 shares, General Accident popped 31 cents to $6.30, with 301 stocks clearing the market. Honey Bun climbed 28 cents to end at $9.48 in exchanging 39,155 shares, Indies Pharma rallied 15 cents to end at $3.15, with 60,470 units crossing the market, Iron Rock Insurance shed 16 cents at $3.25 with an exchange of 1,630 stock units. Jamaican Teas dropped 6 cents in closing at $3.79, with 430,951 stock units changing hands, Lasco Distributors advanced 5 cents to close at $3.30 in exchanging 35,410 units, Lasco Manufacturing gained 5 cents to end at $4.70 in switching ownership of 2,355,566 shares.

At the close, Access Financial rose $2.75 ending at $23.50, the highest price since January 2021, with the swapping of 20,246 shares, AMG Packaging shed 5 cents to end at $3.60, with 535,137 stock units crossing the exchange, Blue Power declined 25 cents in closing at $3.10 after 23,354 units changed hands. CAC 2000 fell 30 cents to close at $8 while exchanging 2,401 stocks, Caribbean Assurance Brokers dipped 8 cents to $2.95 after trading 183,124 units, Caribbean Cream lost 30 cents to close at $5, with an exchange of 177,936 stocks. Fontana gained 10 cents in closing at $7.70 trading 86,777 stock units, Future Energy Source lost 6 cents after ending at $2.93 in exchanging 1,568,726 shares, General Accident popped 31 cents to $6.30, with 301 stocks clearing the market. Honey Bun climbed 28 cents to end at $9.48 in exchanging 39,155 shares, Indies Pharma rallied 15 cents to end at $3.15, with 60,470 units crossing the market, Iron Rock Insurance shed 16 cents at $3.25 with an exchange of 1,630 stock units. Jamaican Teas dropped 6 cents in closing at $3.79, with 430,951 stock units changing hands, Lasco Distributors advanced 5 cents to close at $3.30 in exchanging 35,410 units, Lasco Manufacturing gained 5 cents to end at $4.70 in switching ownership of 2,355,566 shares.  Mailpac Group advanced 6 cents to $3.36 in an exchange of 403,848 stocks, Main Event fell 40 cents to $3.90 trading 26,432 stocks, Medical Disposables increased $1.84 to a 52 weeks’ high of $7.95, with 29,190 stock units crossing the exchange. Spur Tree Spices rallied 57 cents to end at $2.32 in trading 10,690,992 units and Stationery and Office Supplies popped 10 cents to close at $5.75 finishing at 5,105 shares.

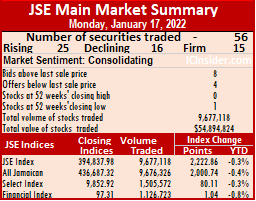

Mailpac Group advanced 6 cents to $3.36 in an exchange of 403,848 stocks, Main Event fell 40 cents to $3.90 trading 26,432 stocks, Medical Disposables increased $1.84 to a 52 weeks’ high of $7.95, with 29,190 stock units crossing the exchange. Spur Tree Spices rallied 57 cents to end at $2.32 in trading 10,690,992 units and Stationery and Office Supplies popped 10 cents to close at $5.75 finishing at 5,105 shares. The All Jamaican Composite Index climbed 2,000.74 points to 436,687.32, the Main Index climbed 2,047.08 points to close at 394,837.98 and the JSE Financial Index rose 1.04 points to 97.31.

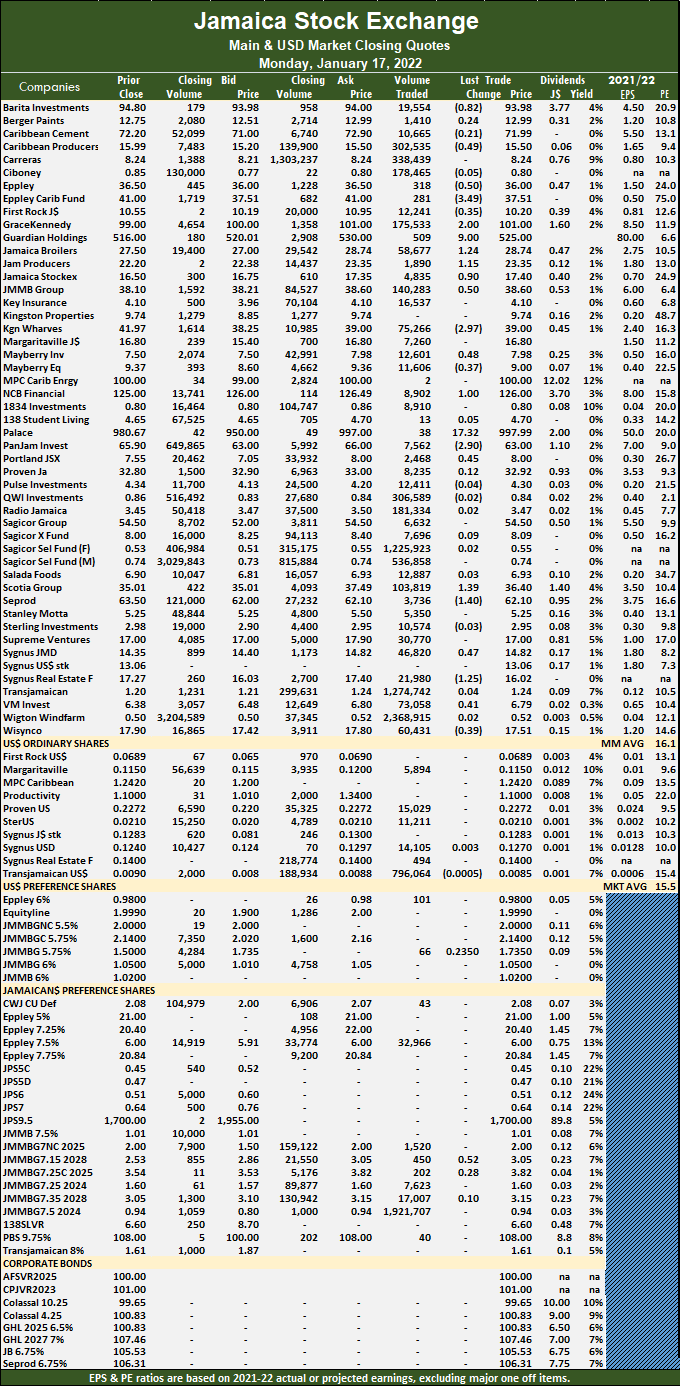

The All Jamaican Composite Index climbed 2,000.74 points to 436,687.32, the Main Index climbed 2,047.08 points to close at 394,837.98 and the JSE Financial Index rose 1.04 points to 97.31. At the close, Barita Investments shed 82 cents to end at $93.98 with 19,554 shares crossing the market, Caribbean Producers dipped 49 cents at $15.50 in trading 302,535 units, Eppley lost 50 cents to finish at $36 with an exchange of 318 stocks. Eppley Caribbean Property Fund declined $3.49 in closing at $37.51 in switching ownership of 281 stock units, First Rock Capital lost 35 cents to close at $10.20 with 12,241 shares crossing the market, GraceKennedy advanced $2 to $101 after exchanging 175,533 stock units. Guardian Holdings popped $9 to $525 with the swapping of 509 units, Jamaica Broilers advanced $1.24 to $28.74 in transferring 58,677 stocks, Jamaica Producers rose $1.15 to $23.35 after trading 1,890 stock units. Jamaica Stock Exchange rallied 90 cents to $17.40 with 4,835 shares changing hands, JMMB Group gained 50 cents to end at $38.60 after 140,283 units cleared the market, Kingston Wharves fell $2.97 to close at $39 in an exchange of 75,266 shares. Mayberry Investments gained 48 cents to finish at $7.98 in trading 12,601 stocks, Mayberry Jamaican Equities lost 37 cents after ending at $9 in switching ownership of 11,606 stock units, NCB Financial advanced $1 to $126 with an exchange of 8,902 shares. Palace Amusement climbed $17.32 to end at $997.99 with 38 units changing hands, PanJam Investment declined $2.90 to $63 with the swapping of 7,562 units, Portland JSX popped 45 cents to $8 with a transfer of 2,468 shares.

At the close, Barita Investments shed 82 cents to end at $93.98 with 19,554 shares crossing the market, Caribbean Producers dipped 49 cents at $15.50 in trading 302,535 units, Eppley lost 50 cents to finish at $36 with an exchange of 318 stocks. Eppley Caribbean Property Fund declined $3.49 in closing at $37.51 in switching ownership of 281 stock units, First Rock Capital lost 35 cents to close at $10.20 with 12,241 shares crossing the market, GraceKennedy advanced $2 to $101 after exchanging 175,533 stock units. Guardian Holdings popped $9 to $525 with the swapping of 509 units, Jamaica Broilers advanced $1.24 to $28.74 in transferring 58,677 stocks, Jamaica Producers rose $1.15 to $23.35 after trading 1,890 stock units. Jamaica Stock Exchange rallied 90 cents to $17.40 with 4,835 shares changing hands, JMMB Group gained 50 cents to end at $38.60 after 140,283 units cleared the market, Kingston Wharves fell $2.97 to close at $39 in an exchange of 75,266 shares. Mayberry Investments gained 48 cents to finish at $7.98 in trading 12,601 stocks, Mayberry Jamaican Equities lost 37 cents after ending at $9 in switching ownership of 11,606 stock units, NCB Financial advanced $1 to $126 with an exchange of 8,902 shares. Palace Amusement climbed $17.32 to end at $997.99 with 38 units changing hands, PanJam Investment declined $2.90 to $63 with the swapping of 7,562 units, Portland JSX popped 45 cents to $8 with a transfer of 2,468 shares.  Scotia Group advanced $1.39 to close at $36.40 after exchanging 103,819 stocks, Seprod declined $1.40 in closing at $62.10 in trading 3,736 stock units, Sygnus Credit Investments gained 47 cents to settle at $14.82 with a transfer of 46,820 shares. Sygnus Real Estate Finance fell $1.25 to $16.02 with 21,980 stocks changing hands, Victoria Mutual Investments rallied 41 cents to close at $6.79 with an exchange of 73,058 shares and Wisynco Group lost 39 cents to end at $17.51 in switching ownership of 60,431 units.

Scotia Group advanced $1.39 to close at $36.40 after exchanging 103,819 stocks, Seprod declined $1.40 in closing at $62.10 in trading 3,736 stock units, Sygnus Credit Investments gained 47 cents to settle at $14.82 with a transfer of 46,820 shares. Sygnus Real Estate Finance fell $1.25 to $16.02 with 21,980 stocks changing hands, Victoria Mutual Investments rallied 41 cents to close at $6.79 with an exchange of 73,058 shares and Wisynco Group lost 39 cents to end at $17.51 in switching ownership of 60,431 units.