The 2021 calendar year ended on Friday, with the Junior Market rising a near 30 percent and the Main Market just holding above the close of the prior year. Against this backdrop ICInsider.com TOP 15 stocks at the start of the year had a 53 percent average gain in the Junior Market but 64 percent when Honey Bun that was reported on in December 2020 and Future Energy Sources (Fesco) that was Buy Rated when the IPO hit the market was up and impressive 64 percent.

IC Buy Rated Caribbean Producers was by far the best performing stock on the JSE for 2021.

Only three Junior Market stocks declined amongst our selection with Elite being the worse with a loss of 11 percent.

TOP10 MM stock did not do as well as the JM but that was told to readers at the start of the year. The average gain for the TOP15 Main Market stocks was 10 percent that excludes Caribbean Producers. The highest gaining stock from the list was Radio Jamaica up 61 percent and Grace Kennedy 58 percent, the two worse performers were Berger Paints and Scotia Group down 12 percent each.

The big news for the market for the past week continues to be the Initial Public offer of Spur Tree Spices priced at $1 per share that was heavily oversubscribed.

Medical Disposables rose 7 percent for the week to $6.49 and dropped out of the TOP10 and was replaced by General Accident that comes in at $6. In the Main Market TOP10, Sagicor Group rose 9 percent for the week to close at $58 and was replaced by Scotia Group at $36.

Medical Disposables rose 7 percent for the week to $6.49 and dropped out of the TOP10 and was replaced by General Accident that comes in at $6. In the Main Market TOP10, Sagicor Group rose 9 percent for the week to close at $58 and was replaced by Scotia Group at $36.

During the week AMG Packaging rose 4 percent to $2.20, Access Financial Services lost 9 percent to $19, Lasco Distributors rose 6 percent to $3.47, Elite Diagnostic rose 5 percent to $2.85 and Honey Bun gained 8 percent to $9.25. In the Main Market, Caribbean Producers popped 9 percent to $13, JMMB Group and PanJam Investment rose 3 percent, while losses were suffered by Radio Jamaica down 5 percent and Sterling Investments with a fall of 7 percent

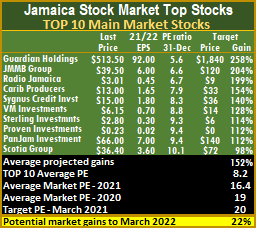

The top three Main Market stocks, this week are Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 199 and 258 percent up from 183 and 261 percent last week.

The top three Main Market stocks, this week are Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 199 and 258 percent up from 183 and 261 percent last week.

The Junior Market top three stocks changed a bit during the week, with AMG Packaging leading, followed by Caribbean Assurance Brokers and Access Financial Services. All three can gain between 174 and 218 percent versus 158 and 230 percent, previously.

The average gains projected for the TOP 10 Junior Market stocks remained unchanged at 149 percent and Main Market stocks moved from 154 percent to this weeks’ 152 percent.

The Junior Market closed the week, with an average PE of 14.8 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings.  The TOP 10 stocks trade at a PE of a mere 8.2, with a 45 percent discount to that market’s average.

The TOP 10 stocks trade at a PE of a mere 8.2, with a 45 percent discount to that market’s average.

The Junior Market can gain 35 percent to March next year, based on an average PE of 20 and 15 percent based on an average PE of 17.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.2 representing a 50 percent discount to the market and well below the potential of 20. A total of 13 stocks or 28 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Investors kept up the bullish stance in trading on the Jamaica Stock Exchange on the first trading day of the year with the All Jamaican Composite Index surging 8,895.04 points to 447,223.41, up from 438,328.37 at the close on Friday, with the Junior Market index(AJI) rising 45.88 points to 3474.18 from 3,428.30 on Friday.

Investors kept up the bullish stance in trading on the Jamaica Stock Exchange on the first trading day of the year with the All Jamaican Composite Index surging 8,895.04 points to 447,223.41, up from 438,328.37 at the close on Friday, with the Junior Market index(AJI) rising 45.88 points to 3474.18 from 3,428.30 on Friday. With 155 million reserved shares fully taken up, the 180 million units available to the public was oversubscribed by more than five and a half times, which would result in each applicant getting around 15 percent of what they applied for based on a proportional level of allocation of the shares offered to the general public. The Company reserves the right to allot shares to applicants on a basis to be determined by it in its sole discretion, including on a pro-rata basis.

With 155 million reserved shares fully taken up, the 180 million units available to the public was oversubscribed by more than five and a half times, which would result in each applicant getting around 15 percent of what they applied for based on a proportional level of allocation of the shares offered to the general public. The Company reserves the right to allot shares to applicants on a basis to be determined by it in its sole discretion, including on a pro-rata basis. The company recently completed the purchase of Exotic Products Jamaica that processes and cans ackees. “Ackee is a highly demanded strategic product in our export markets and the Company plans to rationalize the operations of this newly acquired entity to double production over the next two years. This, combined with our plans to expand and grow the current Spur Tree product range, while expanding current markets both locally and overseas and accessing new markets should significantly improve our sales and profit performance in the coming years”, the company stated.

The company recently completed the purchase of Exotic Products Jamaica that processes and cans ackees. “Ackee is a highly demanded strategic product in our export markets and the Company plans to rationalize the operations of this newly acquired entity to double production over the next two years. This, combined with our plans to expand and grow the current Spur Tree product range, while expanding current markets both locally and overseas and accessing new markets should significantly improve our sales and profit performance in the coming years”, the company stated.