Technology consultants, tTech dominated trading activity on the Junior Market of the Jamaica Stock Exchange on Thursday, accounting for 52 million shares in what is another acquisition of controlling interest in the company by Simply Secure Limited a company owned by Kevin Gordon and Rob Mayo-Smith, resulting in a 552 percent rise in the volume of stocks traded, with the value jumping 501 percent more than stocks traded on Wednesday.

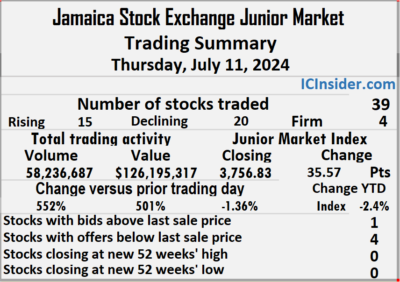

Trading resulted in an exchange of 39 securities down from 40 on Wednesday and ended with prices of 15 rising, 20 declining and four closing unchanged and ended with the Junior Market Index popping 35.57 points to to end trading at 3,756.83, thus recovering 40 percent of yesterday’s loss of 87.25 points.

Trading resulted in an exchange of 39 securities down from 40 on Wednesday and ended with prices of 15 rising, 20 declining and four closing unchanged and ended with the Junior Market Index popping 35.57 points to to end trading at 3,756.83, thus recovering 40 percent of yesterday’s loss of 87.25 points.

The market closed with trading of 58,236,687 shares for $126,195,317 compared with 8,929,651 units at $20,998,580 on Wednesday.

Trading averaged 1,493,248 shares at $3,235,777 compared with 223,241 units at $524,965 on Wednesday with the month to date, averaging 361,089 units at $653,959 compared to 198,758 stock units at $283,771 on the previous day and June with an average of 318,732 units at $696,979.

tTech led trading with 52.01 million shares for 89.3 percent of total volume followed by Jamaican Teas with 3.01 million stocks for 5.2 percent of the day’s trade and iCreate with 553,176 units for 0.9 percent market share.

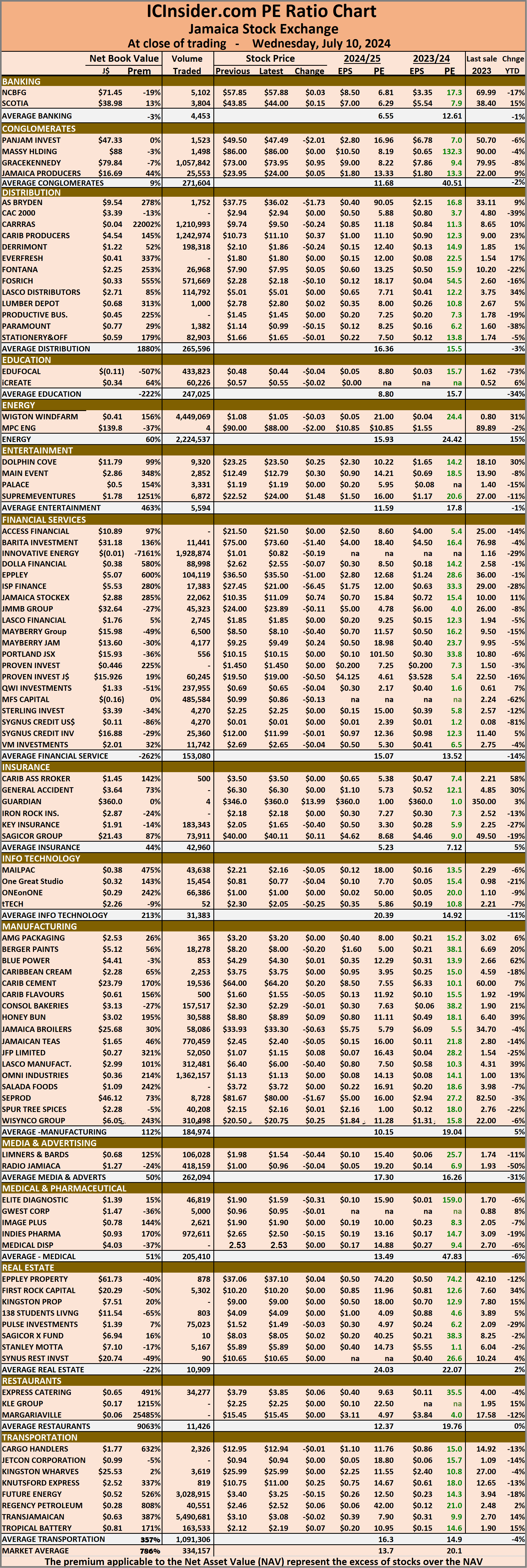

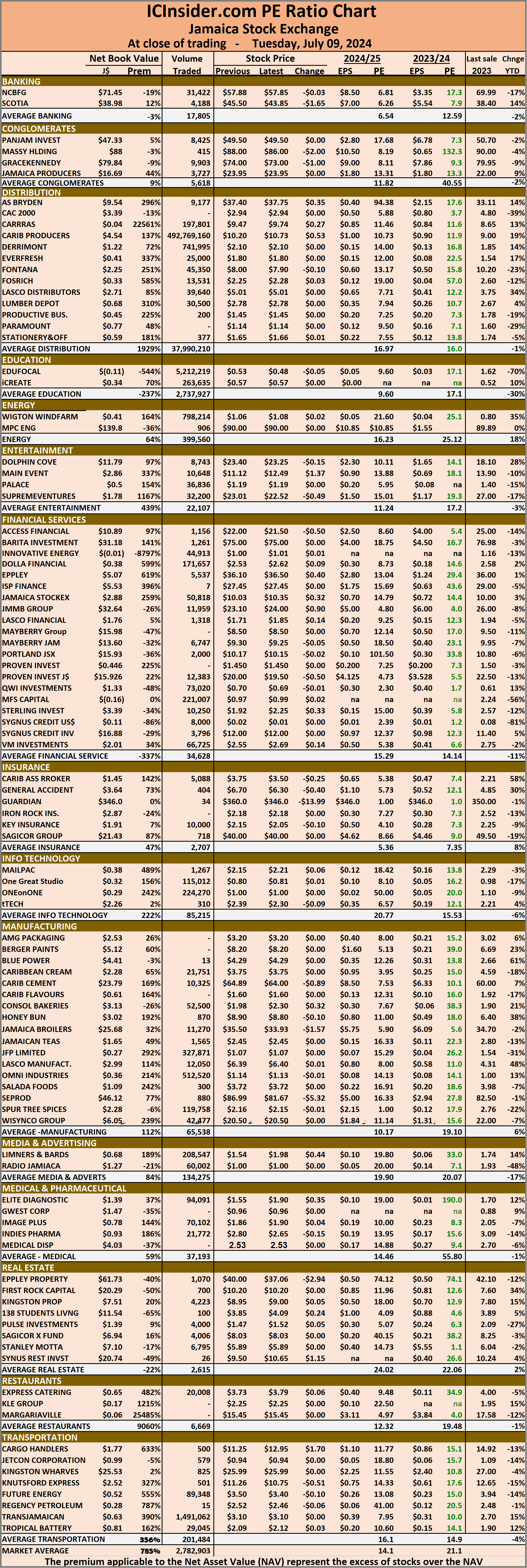

The Junior Market ended trading with an average PE Ratio of 12.7, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.7, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and four with lower offers.

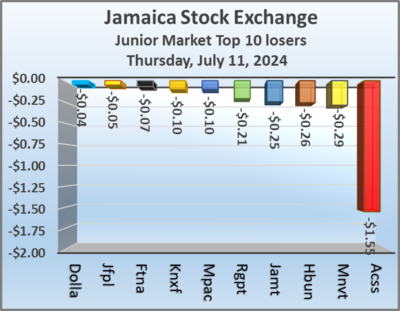

At the close, Access Financial sank $1.55 in closing at $19.95 in an exchange of a mere 182 shares, Caribbean Assurance Brokers gained 25 cents to close at $3.75 with 587 stocks clearing the market, Derrimon Trading rose 23 cents to end at $2.09 and closed after an exchange of 200 shares. Express Catering advanced 20 cents and ended at $4.05 in switching ownership of 10,790 stock units, Fontana dipped 7 cents to close at $7.88 after a transfer of 28,765 shares, Future Energy popped 14 cents to finish at $3.39, with 23,921 stock units crossing the exchange. Honey Bun fell 26 cents to $8.63 in trading 7,290 stocks, ISP Finance climbed $6.30 in closing at $27.30 after an exchange of just 2 units, Jamaican Teas dropped 25 cents to $2.15 in trading 3,010,199 stocks. Knutsford Express shed 10 cents and ended at $10.90, with 6,685 units changing hands, Mailpac Group declined 10 cents to end at $2.06 with traders dealing in 462,596 shares, Main Event lost 29 cents to close at $12.50 in an exchange of 10 stock units. MFS Capital Partners increased 12 cents to 98 cents after trading 50 shares, Omni Industries slipped 8 cents to close at $1.05 with a transfer of 109,639 stocks, Paramount Trading rallied 9 cents and ended at $1.08 with investors swapping 17,203 units. Regency Petroleum sank 21 cents to finish at $2.31 with 49,600 stock units crossing the market and tTech rose 25 cents to end at $2.30 with investors trading 52,014,452 shares, representing 49 percent of the issued shares.

Honey Bun fell 26 cents to $8.63 in trading 7,290 stocks, ISP Finance climbed $6.30 in closing at $27.30 after an exchange of just 2 units, Jamaican Teas dropped 25 cents to $2.15 in trading 3,010,199 stocks. Knutsford Express shed 10 cents and ended at $10.90, with 6,685 units changing hands, Mailpac Group declined 10 cents to end at $2.06 with traders dealing in 462,596 shares, Main Event lost 29 cents to close at $12.50 in an exchange of 10 stock units. MFS Capital Partners increased 12 cents to 98 cents after trading 50 shares, Omni Industries slipped 8 cents to close at $1.05 with a transfer of 109,639 stocks, Paramount Trading rallied 9 cents and ended at $1.08 with investors swapping 17,203 units. Regency Petroleum sank 21 cents to finish at $2.31 with 49,600 stock units crossing the market and tTech rose 25 cents to end at $2.30 with investors trading 52,014,452 shares, representing 49 percent of the issued shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Falling stocks push JSE USD Market down

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks exchanged declining 50 percent after 262 percent more US dollars changed hands than on compared to Wednesday, resulting in trading in seven securities, similar to the previous day with prices of two declining and five ending unchanged.

The market closed on Thursday with an exchange of 222,252 shares for US$66,982 compared to 448,485 units at US$18,478 on Wednesday.

The market closed on Thursday with an exchange of 222,252 shares for US$66,982 compared to 448,485 units at US$18,478 on Wednesday.

Trading averaged 31,750 stock units at US$9,569 versus 64,069 shares at US$2,640 on Wednesday, with a month to date average of 34,379 shares at US$3,294 compared with 34,955 units at US$1,922 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index skidded 6.85 points to end at 224.57.

The PE Ratio, a most used measure for computing appropriate stock values, averages 7.8. The PE ratio is computed based on last traded prices divided by projected earnings done by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close of trading, AS Bryden remained at 22.49 US cents with a transfer of 19,002 units, Proven  Investments ended at 12 US cents as investors exchanged 5,740 stock units, Sterling Investments sank 0.06 of a cent and ended at 1.43 US cents in trading 969 shares. Sygnus Credit Investments ended at 7.5 US cents after a transfer of 649 stock units and Transjamaican Highway remained at 2 US cents with investors trading 149,965 shares.

Investments ended at 12 US cents as investors exchanged 5,740 stock units, Sterling Investments sank 0.06 of a cent and ended at 1.43 US cents in trading 969 shares. Sygnus Credit Investments ended at 7.5 US cents after a transfer of 649 stock units and Transjamaican Highway remained at 2 US cents with investors trading 149,965 shares.

In the preference segment, JMMB Group US8.5% preference share slipped 25 cents to close at US$1 in an exchange of 44,746 stocks and Sygnus Credit Investments E8.5% ended at US$10.40 with traders dealing in 1,181 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Winners & losers evenly split on TTSE

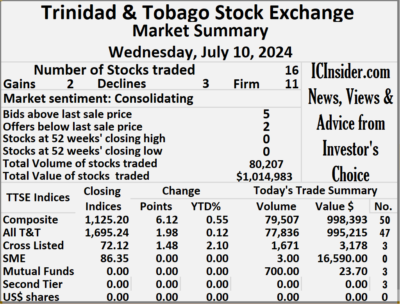

Stocks ended with an almost even split of gains and losses on the Trinidad and Tobago Stock Exchange on Wednesday after the volume of stocks traded rose 14 percent valued at 64 percent more than on Tuesday and resulting in 16 securities trading down from 19 on Tuesday and ending with prices of two stocks rising, three declining and 11 ended firm.

The market closed on Wednesday after 80,207 shares were exchanged for $1,014,983 compared to 70,659 stock units at $619,483 on Tuesday.

The market closed on Wednesday after 80,207 shares were exchanged for $1,014,983 compared to 70,659 stock units at $619,483 on Tuesday.

An average of 5,013 shares were traded at $63,436 compared with 3,719 units at $32,604 on Tuesday, with trading month to date averaging 6,737 shares at $106,677 compared with 6,944 units at $111,879 on the previous day and an average for June of 9,110 shares at $119,497.

The Composite Index rallied 6.12 points to 1,125.20, the All T&T Index rallied 1.98 points to lock up trading at 1,695.24, the SME Index remained unchanged at 86.35 and the Cross-Listed Index rose 1.48 points to culminate at 72.12.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s remained at $69.50 with a transfer of 20 shares, Calypso Macro Investment Fund ended at $23.70 after an exchange of 700 stocks, First Citizens Group remained at $42.75 with investors transferring 581 shares. GraceKennedy ended at $3.69 with 471 stock units changing hands, JMMB Group rose 1 cent to close at $1.20 after a transfer of 1,200 shares, Massy Holdings remained at $3.95 with traders dealing in 26,303 stock units. National Enterprises ended at $3.25 and closed with an exchange of 2,459 units, National Flour Mills remained at $2.12 with 53 stocks changing hands, One Caribbean Media ended at $3.68 with 21,050 units clearing the market.

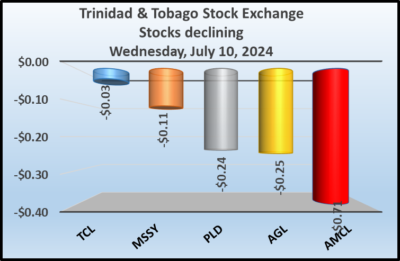

At the close, Agostini’s remained at $69.50 with a transfer of 20 shares, Calypso Macro Investment Fund ended at $23.70 after an exchange of 700 stocks, First Citizens Group remained at $42.75 with investors transferring 581 shares. GraceKennedy ended at $3.69 with 471 stock units changing hands, JMMB Group rose 1 cent to close at $1.20 after a transfer of 1,200 shares, Massy Holdings remained at $3.95 with traders dealing in 26,303 stock units. National Enterprises ended at $3.25 and closed with an exchange of 2,459 units, National Flour Mills remained at $2.12 with 53 stocks changing hands, One Caribbean Media ended at $3.68 with 21,050 units clearing the market.  Prestige Holdings ended at $12.80 with investors dealing in 15 shares, Republic Financial lost 15 cents to close at $115.10 after an exchange of 5,237 stock units, Scotiabank dropped 68 cents to end at $64.32 with investors swapping 57 stocks. Trinidad & Tobago NGL fell 1 cent to $7 in switching ownership of 13,238 shares, Trinidad Cement ended at $3 with investors trading 200 stocks, Unilever Caribbean rallied 19 cents and ended at $11.40, with 2,364 units crossing the market and West Indian Tobacco remained at $8.50 as investors exchanged 6,259 stock units.

Prestige Holdings ended at $12.80 with investors dealing in 15 shares, Republic Financial lost 15 cents to close at $115.10 after an exchange of 5,237 stock units, Scotiabank dropped 68 cents to end at $64.32 with investors swapping 57 stocks. Trinidad & Tobago NGL fell 1 cent to $7 in switching ownership of 13,238 shares, Trinidad Cement ended at $3 with investors trading 200 stocks, Unilever Caribbean rallied 19 cents and ended at $11.40, with 2,364 units crossing the market and West Indian Tobacco remained at $8.50 as investors exchanged 6,259 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading gains for JSE USD Market

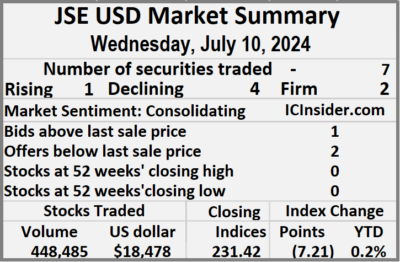

Trading climbed on the Jamaica Stock Exchange US dollar market on Wednesday, with a 35 percent rise in the volume of stocks exchanged after a 20 percent greater value than on Tuesday, resulting in an exchange of seven securities, compared to five on Tuesday with prices of one rising, four declining and two ending unchanged.

The market closed with an exchange of 448,485 shares for US$18,478 compared to 331,393 units at US$15,388 on Tuesday.

The market closed with an exchange of 448,485 shares for US$18,478 compared to 331,393 units at US$15,388 on Tuesday.

Trading averaged 64,069 stock units at US$2,640 versus 66,279 shares at US$3,078 on Tuesday, with a month to date average of 34,955 shares at US$1,922 compared with 26,802 units at US$1,721 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index sank 7.21 points to close at 231.42.

The PE Ratio, a most used measure for computing appropriate stock values, averages 7.9. The PE ratio is computed based on last traded prices divided by projected earnings done by ICInsider.com for companies with financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and two with lower offers.

At the close of the market, AS Bryden shed 2.8 cents to end at 22.49 US cents in switching ownership of 1,240 stock units, Proven Investments declined by 1 cent in closing at 12 US cents after a transfer of 32,159 shares, Sterling Investments remained at 1.49 US cents as investors exchanged 4,270 stocks.  Sygnus Credit Investments rallied 0.75 of one cent to 7.5 US cents and closed after an exchange of 110,398 units and Transjamaican Highway fell 0.09 of a cent and ended at 2 US cents, with 300,345 shares changing hands.

Sygnus Credit Investments rallied 0.75 of one cent to 7.5 US cents and closed after an exchange of 110,398 units and Transjamaican Highway fell 0.09 of a cent and ended at 2 US cents, with 300,345 shares changing hands.

In the preference segment, JMMB Group 5.75% slipped 7 cents to close at US$1.73 with traders dealing in 65 units and Sygnus Credit Investments E8.5% ended at US$10.40 in an exchange of 8 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on JSE USD Market

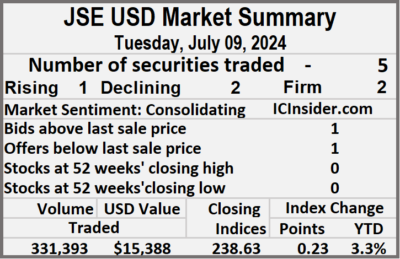

In Tuesday’s trading on the Jamaica Stock Exchange US dollar market, the volume of stocks that were exchanged rose 32 percent, with a 24 percent lower value than on Monday, resulting in trading in five securities, similar to trading on Monday, with prices of one rising, two declining and two ending unchanged.

The market closed with an exchange of 331,393 shares for US$15,388 up from 250,977 stock units at US$20,236 on Monday.

The market closed with an exchange of 331,393 shares for US$15,388 up from 250,977 stock units at US$20,236 on Monday.

Trading averaged 66,279 stocks at US$3,078 compared to 50,195 shares at US$4,047 on Monday, with a month to date average of 26,802 shares at US$1,721 compared with 16,933 units at US$1,381 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index advanced 0.15 points to cease trading at 238.63.

The PE Ratio, a most used measure for computing appropriate stock values, averages 7.8. The PE ratio is computed based on last traded prices divided by projected earnings done by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and one with a lower offer.

At the close of trading, MPC Caribbean Clean Energy ended at 61 US cents after an exchange of 200 units, Proven Investments remained at 13 US cents with investors trading 70,726 stocks, Sterling Investments dipped 0.04 of a cent to close at 1.49 US cents, with 8,000 shares passing through the exchange. Sygnus Credit Investments gained 0.7 of one cent to finish at 6.75 US cents with traders dealing in 14,667 stock units and Transjamaican Highway fell 0.02 of a cent and ended at 2.09 US cents after 237,800 shares passed through the market.

At the close of trading, MPC Caribbean Clean Energy ended at 61 US cents after an exchange of 200 units, Proven Investments remained at 13 US cents with investors trading 70,726 stocks, Sterling Investments dipped 0.04 of a cent to close at 1.49 US cents, with 8,000 shares passing through the exchange. Sygnus Credit Investments gained 0.7 of one cent to finish at 6.75 US cents with traders dealing in 14,667 stock units and Transjamaican Highway fell 0.02 of a cent and ended at 2.09 US cents after 237,800 shares passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

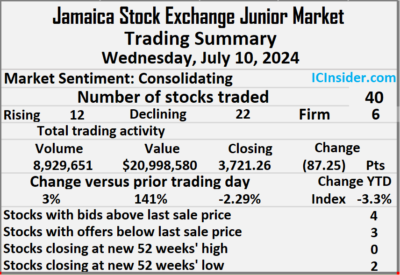

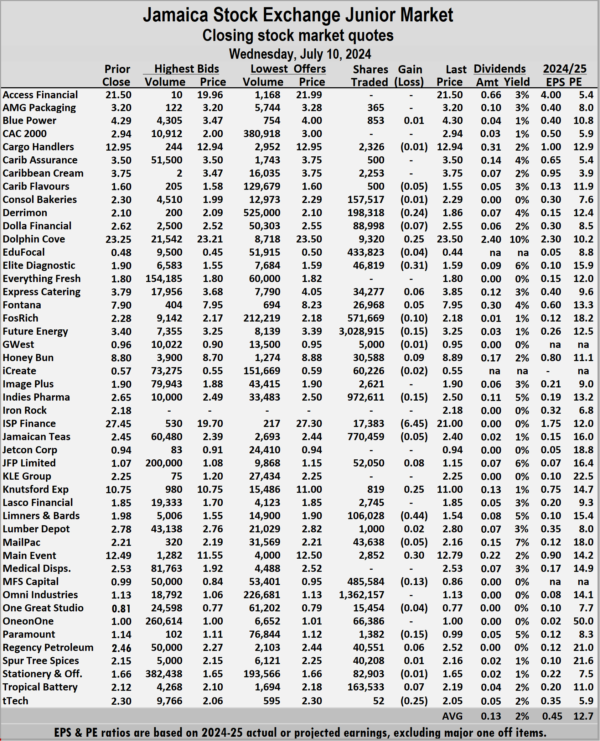

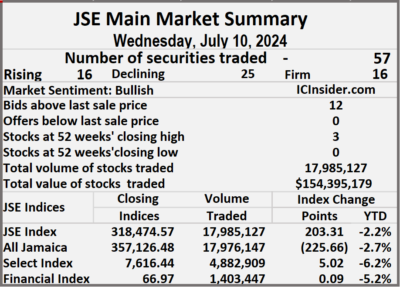

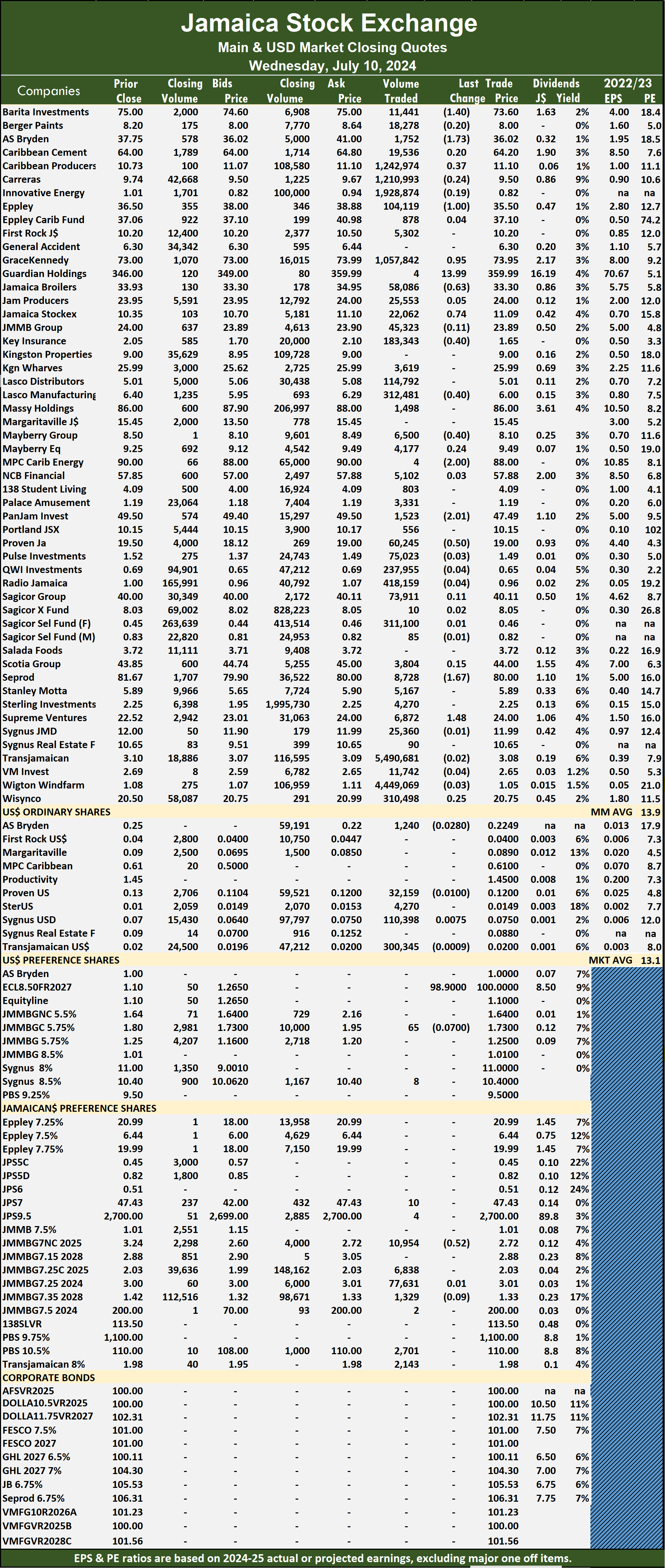

Investors traded 8,929,651 shares with a 141 percent increase in value to $20,998,580 compared with 8,664,446 units at $8,710,916 on Tuesday.

Investors traded 8,929,651 shares with a 141 percent increase in value to $20,998,580 compared with 8,664,446 units at $8,710,916 on Tuesday. Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and six with lower offers.

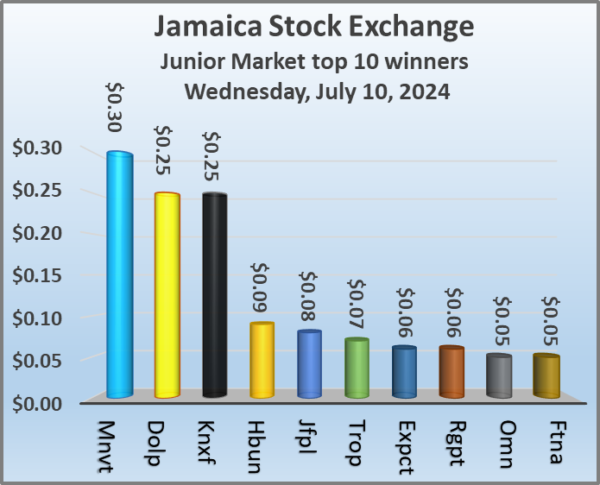

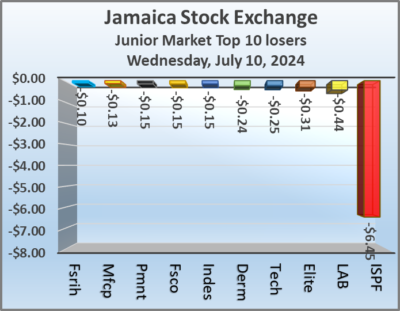

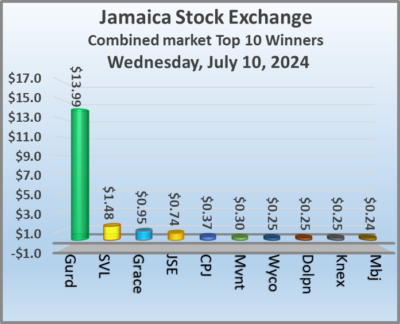

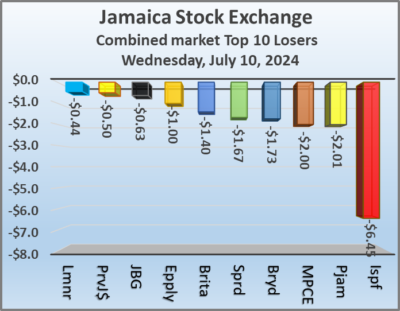

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and six with lower offers. JFP Ltd gained 8 cents to end at $1.15, with 52,050 stock units crossing the market, Knutsford Express popped 25 cents in closing at $11 with investors transferring 819 units, Limners and Bards shed 44 cents to finish at $1.54 after an exchange of 106,028 stocks. Main Event advanced 30 cents to $12.79 after 2,852 shares passed through the market, MFS Capital Partners dipped 13 cents to close at 86 cents in switching ownership of 485,584 stock units, Paramount Trading sank 15 cents to finish at a 52 weeks’ low of 99 cents with an exchange of 1,382 stocks. Tropical Battery rallied 7 cents and ended at $2.19 in trading 163,533 units and tTech dipped 25 cents in closing at $2.05 after an exchange of 52 stocks.

JFP Ltd gained 8 cents to end at $1.15, with 52,050 stock units crossing the market, Knutsford Express popped 25 cents in closing at $11 with investors transferring 819 units, Limners and Bards shed 44 cents to finish at $1.54 after an exchange of 106,028 stocks. Main Event advanced 30 cents to $12.79 after 2,852 shares passed through the market, MFS Capital Partners dipped 13 cents to close at 86 cents in switching ownership of 485,584 stock units, Paramount Trading sank 15 cents to finish at a 52 weeks’ low of 99 cents with an exchange of 1,382 stocks. Tropical Battery rallied 7 cents and ended at $2.19 in trading 163,533 units and tTech dipped 25 cents in closing at $2.05 after an exchange of 52 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

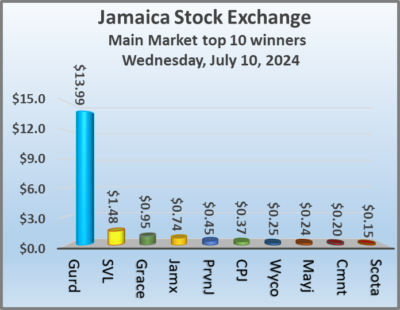

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of the market Caribbean Producers traded at an intraday 52 weeks’ high of $13.89 before closing at $11.10, Key Insurance ended at a 52 weeks’ closing low of $1.65 and Innovative Energy closed at a 52 weeks’ low of 82 cents.

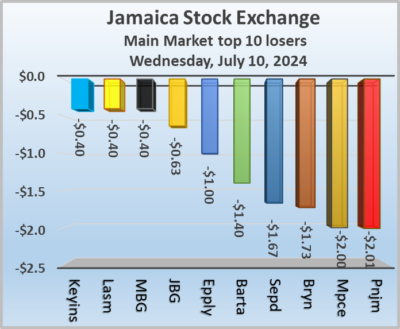

At the close of the market Caribbean Producers traded at an intraday 52 weeks’ high of $13.89 before closing at $11.10, Key Insurance ended at a 52 weeks’ closing low of $1.65 and Innovative Energy closed at a 52 weeks’ low of 82 cents. The All Jamaican Composite Index skidded 225.66 points to wrap up trading at 357,126.48, the JSE Main Index rose 203.31 points to close at 318,474.57 and the JSE Financial Index popped 0.09 points to 66.97.

The All Jamaican Composite Index skidded 225.66 points to wrap up trading at 357,126.48, the JSE Main Index rose 203.31 points to close at 318,474.57 and the JSE Financial Index popped 0.09 points to 66.97. Jamaica Stock Exchange rose 74 cents to $11.09 in trading 22,062 units, Key Insurance dropped 40 cents in closing at a 52 weeks’ low of $1.65 after an exchange of 183,343 stock units, Lasco Manufacturing fell 40 cents to finish at $6 with investors trading 312,481 shares. Mayberry Group skidded 40 cents and ended at $8.10 in an exchange of 6,500 stocks, MPC Caribbean Clean Energy slipped $2 to end at $88 with a mere 4 units crossing the market, Pan Jamaica dipped $2.01 to close at $47.49 with an exchange of 1,523 stock units. Proven Investments fell 50 cents to $19 with 60,245 shares clearing the market, Seprod shed $1.67 and ended at $80 in an exchange of 8,728 units and Supreme Ventures gained $1.48 in closing at $24 with investors dealing in 6,872 stocks.

Jamaica Stock Exchange rose 74 cents to $11.09 in trading 22,062 units, Key Insurance dropped 40 cents in closing at a 52 weeks’ low of $1.65 after an exchange of 183,343 stock units, Lasco Manufacturing fell 40 cents to finish at $6 with investors trading 312,481 shares. Mayberry Group skidded 40 cents and ended at $8.10 in an exchange of 6,500 stocks, MPC Caribbean Clean Energy slipped $2 to end at $88 with a mere 4 units crossing the market, Pan Jamaica dipped $2.01 to close at $47.49 with an exchange of 1,523 stock units. Proven Investments fell 50 cents to $19 with 60,245 shares clearing the market, Seprod shed $1.67 and ended at $80 in an exchange of 8,728 units and Supreme Ventures gained $1.48 in closing at $24 with investors dealing in 6,872 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index shed 423.64 points to close at 331,235.62, the All Jamaican Composite Index skidded 225.66 points to wrap up trading at 357,126.48, the JSE Main Index rose 203.31 points to lock up trading at 318,474.57. The Junior Market Index sank 87.25 points to wrap-up trading at 3,721.26 and the JSE USD Market Index fell 7.18 points to conclude trading at 231.45.

At the close of trading, the JSE Combined Market Index shed 423.64 points to close at 331,235.62, the All Jamaican Composite Index skidded 225.66 points to wrap up trading at 357,126.48, the JSE Main Index rose 203.31 points to lock up trading at 318,474.57. The Junior Market Index sank 87.25 points to wrap-up trading at 3,721.26 and the JSE USD Market Index fell 7.18 points to conclude trading at 231.45. In Junior Market trading, Future Energy led trading with 3.03 million shares followed by Omni Industries with 1.36 million units and Indies Pharma with 972,611 stocks.

In Junior Market trading, Future Energy led trading with 3.03 million shares followed by Omni Industries with 1.36 million units and Indies Pharma with 972,611 stocks. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. At the close of trading, the JSE Combined Market Index slipped 98.55 points to close at 331,659.26, the All Jamaican Composite Index popped 58.72 points to end at 357,352.14, the JSE Main Index declined 315.16 points to 318,271.26. The Junior Market Index rallied 28.67 points to 3,808.51 and the JSE USD Market Index rose 0.15 points to 238.63.

At the close of trading, the JSE Combined Market Index slipped 98.55 points to close at 331,659.26, the All Jamaican Composite Index popped 58.72 points to end at 357,352.14, the JSE Main Index declined 315.16 points to 318,271.26. The Junior Market Index rallied 28.67 points to 3,808.51 and the JSE USD Market Index rose 0.15 points to 238.63. In the preference segment, Sygnus Credit Investments C10.5% rose $2 to close at $110.

In the preference segment, Sygnus Credit Investments C10.5% rose $2 to close at $110. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

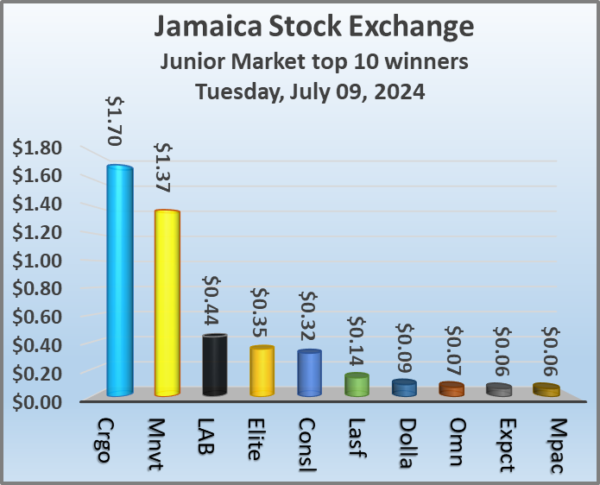

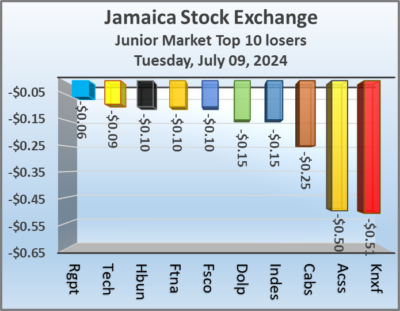

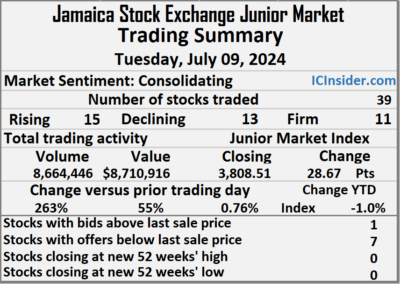

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. Trading concluded with 8,664,446 shares changing hands for $8,710,916 up from 2,388,003 units at $5,605,364 on Monday.

Trading concluded with 8,664,446 shares changing hands for $8,710,916 up from 2,388,003 units at $5,605,364 on Monday. Investor’s Choice bid-offer indicator is flashing negative readings for Wednesday, with just one stock ending with a bid higher than the last selling price and seven with lower offers.

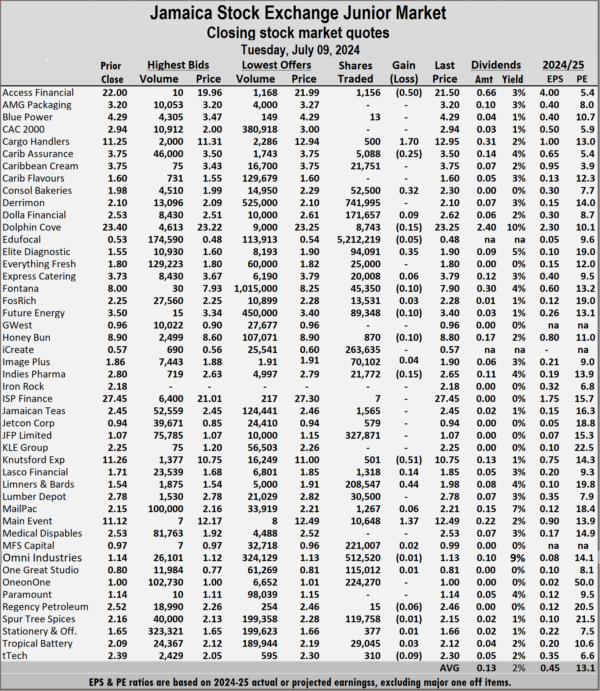

Investor’s Choice bid-offer indicator is flashing negative readings for Wednesday, with just one stock ending with a bid higher than the last selling price and seven with lower offers. Honey Bun declined 10 cents and ended at $8.80 with investors dealing in 870 stock units, Indies Pharma dropped 15 cents to end at $2.65 with a transfer of 21,772 units, Knutsford Express skidded 51 cents to close at $10.75 with investors swapping 501 stocks. Lasco Financial popped 14 cents to close at $1.85, with 1,318 shares changing hands, Limners and Bards rose 44 cents in closing at $1.98 after 208,547 stock units passed through the market, Main Event rallied $1.37 and ended at $12.49 after closing with an exchange of 10,648 units and tTech dipped 9 cents to close at $2.30 with 310 stocks changing hands.

Honey Bun declined 10 cents and ended at $8.80 with investors dealing in 870 stock units, Indies Pharma dropped 15 cents to end at $2.65 with a transfer of 21,772 units, Knutsford Express skidded 51 cents to close at $10.75 with investors swapping 501 stocks. Lasco Financial popped 14 cents to close at $1.85, with 1,318 shares changing hands, Limners and Bards rose 44 cents in closing at $1.98 after 208,547 stock units passed through the market, Main Event rallied $1.37 and ended at $12.49 after closing with an exchange of 10,648 units and tTech dipped 9 cents to close at $2.30 with 310 stocks changing hands. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.