Trading on the Trinidad and Tobago Stock Exchange ended on Thursday, with a 56 percent drop in the volume of stocks traded following a 34 percent rise in value over that on Wednesday, resulting from trading in 19 securities compared with 20 on Wednesday and ended with five stocks rising, six declining and eight remaining unchanged.

Investors exchanged 136,107 shares for $2,400,320 versus 310,882 stock units at $1,784,800 on Wednesday.

Investors exchanged 136,107 shares for $2,400,320 versus 310,882 stock units at $1,784,800 on Wednesday.

An average of 7,164 units were traded at $126,333 compared to 15,544 shares at $89,240 on Wednesday, with trading month to date averaging 11,461 shares at $107,300 compared with an average for October of 15,711 shares at $151,451.

The Composite Index lost 0.20 points to conclude trading at 1,192.65, the All T&T Index dipped 0.79 points to 1,815.99, the SME Index remained unchanged at 79.99 and the Cross-Listed Index popped 0.06 points to end trading at 73.58.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and four with lower offers.

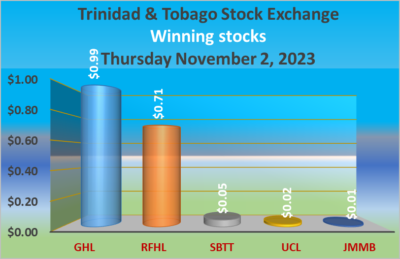

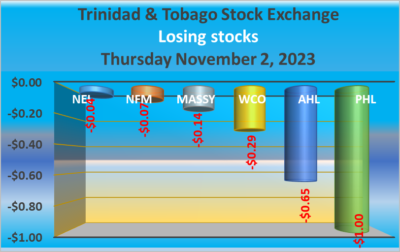

At the close, Agostini’s remained at $65 after investors traded 100 units, Angostura Holdings dipped 65 cents to $21.50 after an exchange of 9,500 stocks, Ansa Merchant Bank ended at $42.12, with 10 shares crossing the market.  Endeavour Holdings remained at $15 after a transfer of 50 stock units, First Citizens Group ended at $49.25, with 4,188 shares changing hands, GraceKennedy remained at $3.40 with investors trading 350 units. Guardian Holdings advanced 99 cents to end at $19.99 in switching the ownership of 7,796 stocks, JMMB Group popped 1 cent in closing at $1.42 as investors exchanged 475 stock units, L.J. Williams B share ended at $2.40 after two shares crossed the market. Massy Holdings lost 14 cents and ended at $4.45 with an exchange of 79,939 stock units, National Enterprises declined 4 cents to $3.51, with 7,787 stocks clearing the market, National Flour Mills fell 7 cents to close at $1.53 with traders dealing in 2,001 units.

Endeavour Holdings remained at $15 after a transfer of 50 stock units, First Citizens Group ended at $49.25, with 4,188 shares changing hands, GraceKennedy remained at $3.40 with investors trading 350 units. Guardian Holdings advanced 99 cents to end at $19.99 in switching the ownership of 7,796 stocks, JMMB Group popped 1 cent in closing at $1.42 as investors exchanged 475 stock units, L.J. Williams B share ended at $2.40 after two shares crossed the market. Massy Holdings lost 14 cents and ended at $4.45 with an exchange of 79,939 stock units, National Enterprises declined 4 cents to $3.51, with 7,787 stocks clearing the market, National Flour Mills fell 7 cents to close at $1.53 with traders dealing in 2,001 units.  NCB Financial remained at $2.84 in an exchange of 7 shares, Prestige Holdings skidded $1 in closing at $10.50 with investors dealing in 4,068 units, Republic Financial increased 71 cents to end at $119, with 2,541 stocks crossing the exchange. Scotiabank climbed 5 cents to $72.65 in trading 14,657 stock units, Trinidad & Tobago NGL ended at $12.50 with shareholders swapping 1,430 shares, Unilever Caribbean rose 2 cents in closing at $10.62 in an exchange of 906 units and West Indian Tobacco dropped 29 cents to end at a 52 weeks’ low of $10.01 after 300 stocks passed through the market.

NCB Financial remained at $2.84 in an exchange of 7 shares, Prestige Holdings skidded $1 in closing at $10.50 with investors dealing in 4,068 units, Republic Financial increased 71 cents to end at $119, with 2,541 stocks crossing the exchange. Scotiabank climbed 5 cents to $72.65 in trading 14,657 stock units, Trinidad & Tobago NGL ended at $12.50 with shareholders swapping 1,430 shares, Unilever Caribbean rose 2 cents in closing at $10.62 in an exchange of 906 units and West Indian Tobacco dropped 29 cents to end at a 52 weeks’ low of $10.01 after 300 stocks passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Declining stocks edged risers on Trinidad Exchange

Trading falls but JSE USD Market rises

Trading on the Jamaica Stock Exchange US dollar market ended on Wednesday, with the volume of stocks changing hands declining 75 percent, valued 85 percent lower than on Tuesday, resulting from trading in seven securities, compared to four on Tuesday with one rising, two declining and four ending unchanged.

A total of 73,498 shares were traded for US$5,221 compared to 296,100 units at US$34,738 on Tuesday.

A total of 73,498 shares were traded for US$5,221 compared to 296,100 units at US$34,738 on Tuesday.

Trading averaged 10,500 units at US$746, versus 74,025 shares at US$8,685 on Tuesday compared to trading in—October with an average of 47,977 units for US$4,392.

The US Denominated Equities Index advanced 3.00 points to finish at 229.02.

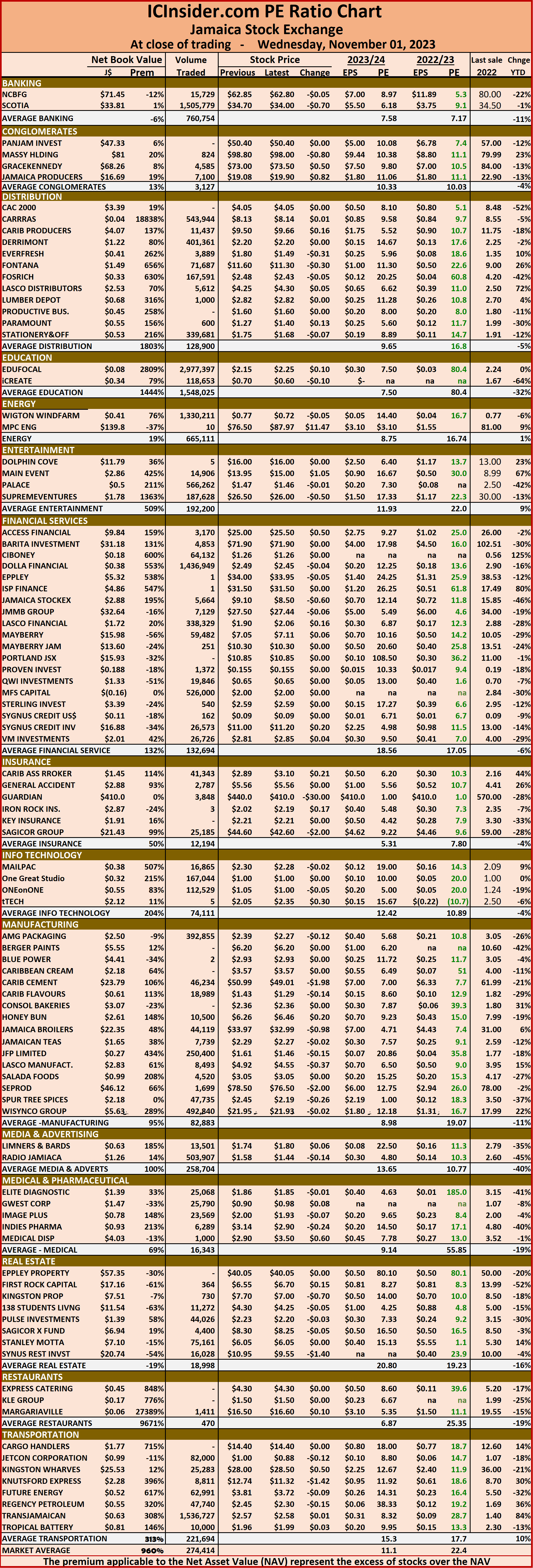

The PE Ratio, a measure used in computing appropriate stock values, averages 8.8. The PE ratio is calculated based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and one with a lower offer.

At the close, First Rock Real Estate USD share ended at 4.37 US cents, with 640 units crossing the market, Margaritaville remained at 12.7 US cents after trading 1,411 stocks,  Proven Investments ended at 15.5 US cents closed with an exchange of 1,372 shares. Sterling Investments advanced 0.26 of a cent in closing at 1.96 US cents in an exchange of 50,816 stocks, Sygnus Credit Investments declined 0.12 of a cent to close at 8.56 US cents with investors transferring 162 shares and Transjamaican Highway remained at 1.65 US cents after exchanging 17,297 units.

Proven Investments ended at 15.5 US cents closed with an exchange of 1,372 shares. Sterling Investments advanced 0.26 of a cent in closing at 1.96 US cents in an exchange of 50,816 stocks, Sygnus Credit Investments declined 0.12 of a cent to close at 8.56 US cents with investors transferring 162 shares and Transjamaican Highway remained at 1.65 US cents after exchanging 17,297 units.

In the preference segment, JMMB Group 5.75% shed 5 cents in closing at US$1.95 after 1,800 stocks passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trinidad Exchange slips into November

Trading ended on the Trinidad and Tobago Stock Exchange on Wednesday, with the volume of stocks traded rising 10 percent with a 25 percent lower value than on Tuesday resulting in the trading of 20 securities compared with 19 on Tuesday, with eight stocks rising, seven declining and five remaining unchanged.

Investors exchanged 310,882 shares for $1,784,800 versus 282,937 stock units at $2,364,755 on Tuesday.

Investors exchanged 310,882 shares for $1,784,800 versus 282,937 stock units at $2,364,755 on Tuesday.

An average of 15,544 shares were exchanged for $89,240 down from 14,891 units at $124,461 on Tuesday, compared to an average for October of 15,711 shares at $151,451.

The Composite Index declined 1.19 points to 1,192.85, the All T&T Index lost 8.12 points to finish at 1,816.78, the SME Index remained unchanged at 79.99 and the Cross-Listed Index advanced 0.87 points to 73.52.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, Angostura Holdings shed 35 cents in closing at $22.15 in an exchange of 51 stock units, Calypso Macro Investment Fund climbed 9 cents to $22.61 after 10 shares passed through the market, Endeavour Holdings ended at $15 as investors exchanged 120 units.  First Citizens Group remained at $49.25 in trading 210 stocks, FirstCaribbean Bank increased 25 cents to close at $7 after a transfer of 25,000 shares, GraceKennedy popped 1 cent to close at $3.40 in switching ownership of 68,412 stocks. Guardian Holdings declined 99 cents and ended at $19 after an exchange of 56 stock units, Guardian Media gained 19 cents in closing at $2.20, with 800 stock units changing hands, L.J. Williams B share rose 1 cent to close at $2.40 after 94 shares crossed the exchange. Massy Holdings lost 1 cent to end at $4.59 with traders dealing in 50,442 stocks, National Enterprises advanced 4 cents in closing at $3.55 while exchanging 302 units, National Flour Mills dipped 3 cents to $1.60 with investors swapping 830 stock units. NCB Financial ended at $2.84 after an exchange of 137,593 shares, Prestige Holdings remained at $11.50 after 14,316 stock units crossed the market, Republic Financial fell 46 cents to end at $118.29 with an exchange of 3,803 units.

First Citizens Group remained at $49.25 in trading 210 stocks, FirstCaribbean Bank increased 25 cents to close at $7 after a transfer of 25,000 shares, GraceKennedy popped 1 cent to close at $3.40 in switching ownership of 68,412 stocks. Guardian Holdings declined 99 cents and ended at $19 after an exchange of 56 stock units, Guardian Media gained 19 cents in closing at $2.20, with 800 stock units changing hands, L.J. Williams B share rose 1 cent to close at $2.40 after 94 shares crossed the exchange. Massy Holdings lost 1 cent to end at $4.59 with traders dealing in 50,442 stocks, National Enterprises advanced 4 cents in closing at $3.55 while exchanging 302 units, National Flour Mills dipped 3 cents to $1.60 with investors swapping 830 stock units. NCB Financial ended at $2.84 after an exchange of 137,593 shares, Prestige Holdings remained at $11.50 after 14,316 stock units crossed the market, Republic Financial fell 46 cents to end at $118.29 with an exchange of 3,803 units.  Scotiabank rallied 9 cents to $72.60 after investors ended trading 738 stocks, Trinidad & Tobago NGL rose $1 to $12.50 with an exchange of 5,242 units, Trinidad Cement skidded 3 cents to close at $2.90 and closed with an exchange of 1,254 stocks. Unilever Caribbean remained at $10.60 with investors transferring 1,251 shares and West Indian Tobacco dipped 1 cent to end at a 52 weeks’ low of $10.30, with 358 stock units crossing the market.

Scotiabank rallied 9 cents to $72.60 after investors ended trading 738 stocks, Trinidad & Tobago NGL rose $1 to $12.50 with an exchange of 5,242 units, Trinidad Cement skidded 3 cents to close at $2.90 and closed with an exchange of 1,254 stocks. Unilever Caribbean remained at $10.60 with investors transferring 1,251 shares and West Indian Tobacco dipped 1 cent to end at a 52 weeks’ low of $10.30, with 358 stock units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading jumps on JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the volume of stocks changing hands rising 125 percent as the value surged 895 percent more than on Monday, resulting from trading in four securities, compared to nine on Monday with three rising and one declining.

Overall, 296,100 shares were traded for US$34,738 compared to 131,600 units at US$3,492 on Monday.

Overall, 296,100 shares were traded for US$34,738 compared to 131,600 units at US$3,492 on Monday.

Trading averaged 74,025 units at US$8,685 compared to 14,622 shares at US$388 on Monday. Trading for the month to date averages 47,977 shares at US$4,392 up from 47,163 units at US$4,258 on the previous day. trading in September ended with an average of 73,281 units for US$5,102.

The US Denominated Equities Index popped 12.76 points to settle at 226.01.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and none with a lower offer.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close of the market, Productive Business Solutions rallied 20 cents and ended at US$1.60 after exchanging 3,546 units, Proven Investments increased 0.9 of one cent to 15.5 US cents with a transfer of 186,386 stocks, Sygnus Credit Investments dipped 0.02 of a cent to end at 8.68 US cents and closed, with 39 shares being traded and Transjamaican Highway climbed 0.11 of a cent in closing at 1.65 US cents with investors transferring 106,129 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

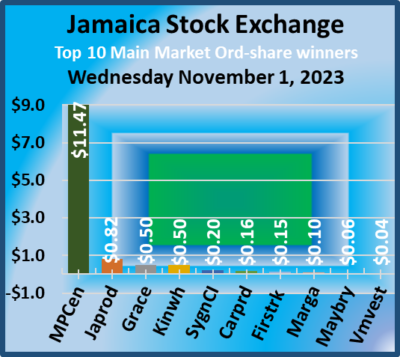

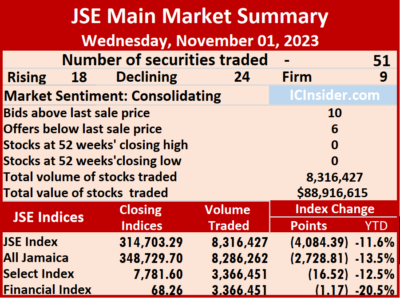

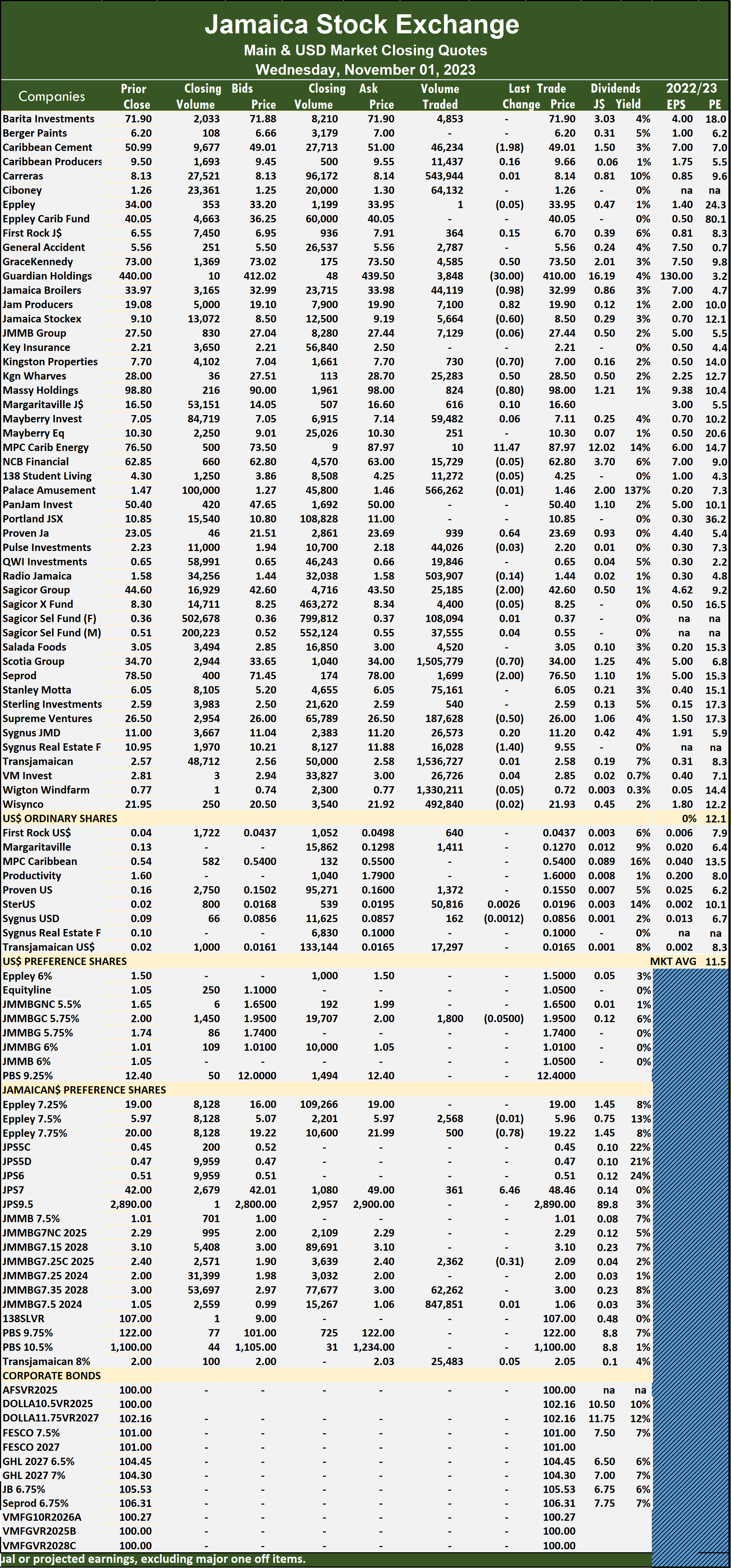

A total of 8,316,427 shares were traded valued at $88,916,615 compared with 7,470,394 units at $65,380,690 on Tuesday.

A total of 8,316,427 shares were traded valued at $88,916,615 compared with 7,470,394 units at $65,380,690 on Tuesday. The Main Market ended trading with an average PE Ratio of 12.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

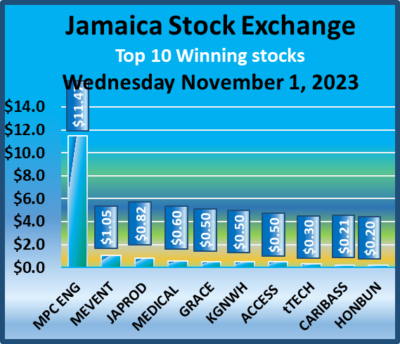

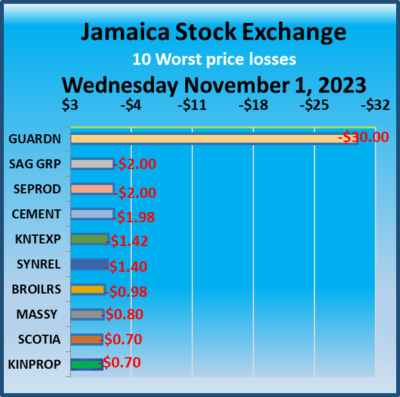

The Main Market ended trading with an average PE Ratio of 12.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. Kingston Properties dipped 70 cents to close at $7, with 730 units changing hands, Kingston Wharves advanced 50 cents in closing at $28.50 in an exchange of 25,283 stock units, Massy Holdings dropped 80 cents to end at $98, with 824 shares crossing the market. MPC Caribbean Clean Energy rose $11.47 and ended at $87.97 after exchanging 10 stock units, Proven Investments gained 64 cents to finish the day at $23.69 in trading 939 units, Sagicor Group shed $2 and ended at $42.60, with 25,185 stocks crossing the exchange. Scotia Group declined 70 cents to end at $34 with a transfer of 1,505,779 units, Seprod lost $2 in closing at $76.50 with stakeholders exchanging 1,699 stocks, Supreme Ventures shed 50 cents to close at $26, with 187,628 shares crossing the market and Sygnus Real Estate Finance dropped $1.40 to $9.55 with an exchange of 16,028 stock units.

Kingston Properties dipped 70 cents to close at $7, with 730 units changing hands, Kingston Wharves advanced 50 cents in closing at $28.50 in an exchange of 25,283 stock units, Massy Holdings dropped 80 cents to end at $98, with 824 shares crossing the market. MPC Caribbean Clean Energy rose $11.47 and ended at $87.97 after exchanging 10 stock units, Proven Investments gained 64 cents to finish the day at $23.69 in trading 939 units, Sagicor Group shed $2 and ended at $42.60, with 25,185 stocks crossing the exchange. Scotia Group declined 70 cents to end at $34 with a transfer of 1,505,779 units, Seprod lost $2 in closing at $76.50 with stakeholders exchanging 1,699 stocks, Supreme Ventures shed 50 cents to close at $26, with 187,628 shares crossing the market and Sygnus Real Estate Finance dropped $1.40 to $9.55 with an exchange of 16,028 stock units. In the preference segment, Eppley 7.75% preference share fell 78 cents to end at $19.22 after 500 shares passed through the market and Jamaica Public Service 7% increased $6.46 in closing at $48.46 while exchanging 361 stock units.

In the preference segment, Eppley 7.75% preference share fell 78 cents to end at $19.22 after 500 shares passed through the market and Jamaica Public Service 7% increased $6.46 in closing at $48.46 while exchanging 361 stock units. Investors traded 7,788,092 shares for $17,379,281, down from 35,689,862 units at $96,708,978 on Tuesday.

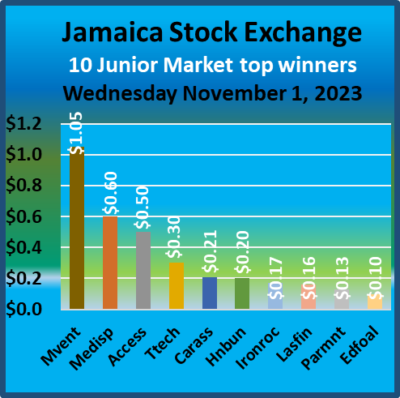

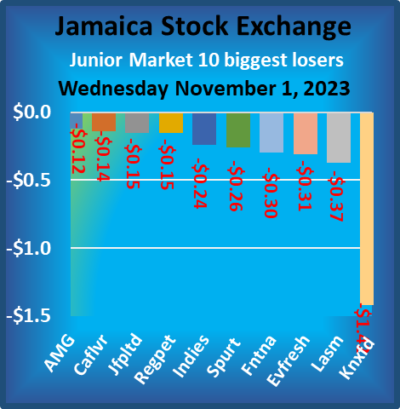

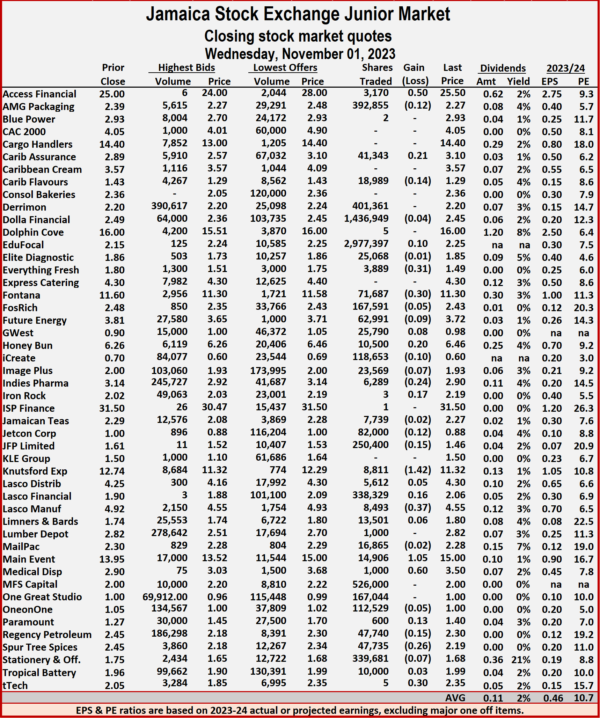

Investors traded 7,788,092 shares for $17,379,281, down from 35,689,862 units at $96,708,978 on Tuesday. At the close, Access Financial increased 50 cents and ended at $25.50 after an exchanging of 3,170 stock units, AMG Packaging lost 12 cents to $2.27 close as 392,855 shares changed hands, Caribbean Assurance Brokers climbed 21 cents to close at $3.10 with stakeholders exchanging 41,343 units. Caribbean Flavours fell 14 cents in closing at $1.29 after a transfer of 18,989 stocks, EduFocal popped 10 cents to end at $2.25 with traders dealing in 2,977,397 shares, Everything Fresh dropped 31 cents in closing at $1.49 after an exchange of 3,889 stock units. Fontana shed 30 cents to close at $11.30 after trading 71,687 stocks, Future Energy declined 9 cents to close at $3.72 while 62,991 units were traded, GWest Corporation gained 8 cents and ended at 98 cents in switching ownership of 25,790 shares. Honey Bun rose 20 cents to end at $6.46, with 10,500 units crossing the exchange, iCreate dipped 10 cents to 60 cents with a transfer of 118,653 stocks, Indies Pharma skidded 24 cents and ended at $2.90 with investors dealing in 6,289 stock units.

At the close, Access Financial increased 50 cents and ended at $25.50 after an exchanging of 3,170 stock units, AMG Packaging lost 12 cents to $2.27 close as 392,855 shares changed hands, Caribbean Assurance Brokers climbed 21 cents to close at $3.10 with stakeholders exchanging 41,343 units. Caribbean Flavours fell 14 cents in closing at $1.29 after a transfer of 18,989 stocks, EduFocal popped 10 cents to end at $2.25 with traders dealing in 2,977,397 shares, Everything Fresh dropped 31 cents in closing at $1.49 after an exchange of 3,889 stock units. Fontana shed 30 cents to close at $11.30 after trading 71,687 stocks, Future Energy declined 9 cents to close at $3.72 while 62,991 units were traded, GWest Corporation gained 8 cents and ended at 98 cents in switching ownership of 25,790 shares. Honey Bun rose 20 cents to end at $6.46, with 10,500 units crossing the exchange, iCreate dipped 10 cents to 60 cents with a transfer of 118,653 stocks, Indies Pharma skidded 24 cents and ended at $2.90 with investors dealing in 6,289 stock units.  Iron Rock Insurance advanced 17 cents to close at $2.19 in an exchange of 3 shares, Jetcon Corporation fell 12 cents to end at 88 cents after 82,000 stocks crossed the market, JFP Ltd shed 15 cents in closing at $1.46 in trading 250,400 units. Knutsford Express declined $1.42 to $11.32 with shareholders swapping 8,811 stock units, Lasco Financial rallied 16 cents to $2.06 in an exchange of 338,329 shares, Lasco Manufacturing lost 37 cents and ended at $4.55, with 8,493 stocks clearing the market. Main Event increased $1.05 to end at $15 with an exchange of 14,906 units, Medical Disposables climbed 60 cents to close at $3.50, with 1,000 stock units changing hands, Paramount Trading popped 13 cents to $1.40 after 600 shares passed through the market. Regency Petroleum skidded 15 cents to end at $2.30 as investors exchanged 47,740 stock units,

Iron Rock Insurance advanced 17 cents to close at $2.19 in an exchange of 3 shares, Jetcon Corporation fell 12 cents to end at 88 cents after 82,000 stocks crossed the market, JFP Ltd shed 15 cents in closing at $1.46 in trading 250,400 units. Knutsford Express declined $1.42 to $11.32 with shareholders swapping 8,811 stock units, Lasco Financial rallied 16 cents to $2.06 in an exchange of 338,329 shares, Lasco Manufacturing lost 37 cents and ended at $4.55, with 8,493 stocks clearing the market. Main Event increased $1.05 to end at $15 with an exchange of 14,906 units, Medical Disposables climbed 60 cents to close at $3.50, with 1,000 stock units changing hands, Paramount Trading popped 13 cents to $1.40 after 600 shares passed through the market. Regency Petroleum skidded 15 cents to end at $2.30 as investors exchanged 47,740 stock units,  Spur Tree Spices dropped 26 cents in closing at $2.19, with 47,735 units crossing the market and tTech gaining 30 cents and ended at $2.35 with investors transferring five stocks.

Spur Tree Spices dropped 26 cents in closing at $2.19, with 47,735 units crossing the market and tTech gaining 30 cents and ended at $2.35 with investors transferring five stocks. At close, the JSE Combined Market Index dived 3,567.53 points to close at 329,247.85, while the All Jamaican Composite Index dropped 2,746.69 points to 348,729.70, the JSE Main Index sank 4,097.53 points to end trading at 314,703.29. The Junior Market Index rose 29.83 points to close at 3,892.70 and the JSE USD Market Index rallied 2.94 points to end at 229.02.

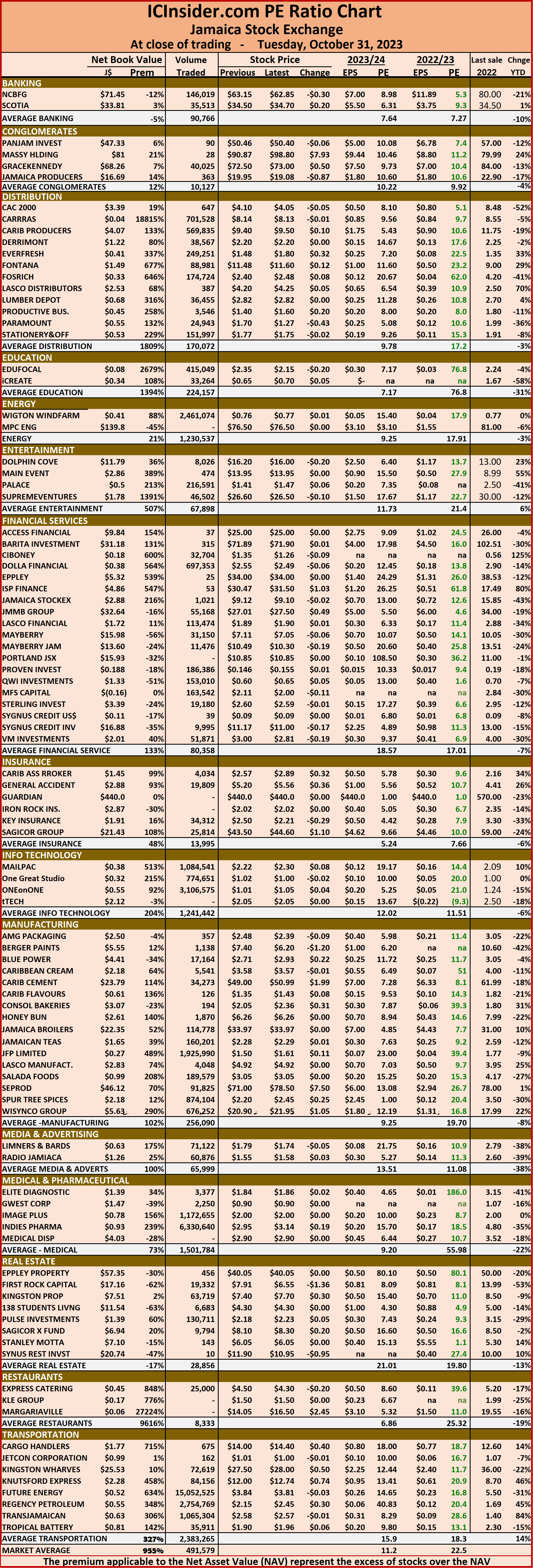

At close, the JSE Combined Market Index dived 3,567.53 points to close at 329,247.85, while the All Jamaican Composite Index dropped 2,746.69 points to 348,729.70, the JSE Main Index sank 4,097.53 points to end trading at 314,703.29. The Junior Market Index rose 29.83 points to close at 3,892.70 and the JSE USD Market Index rallied 2.94 points to end at 229.02. The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items. The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

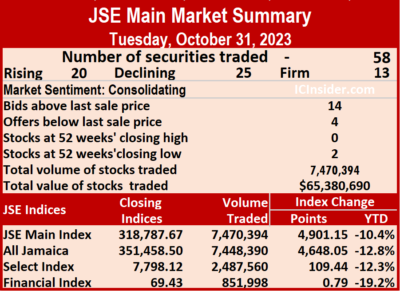

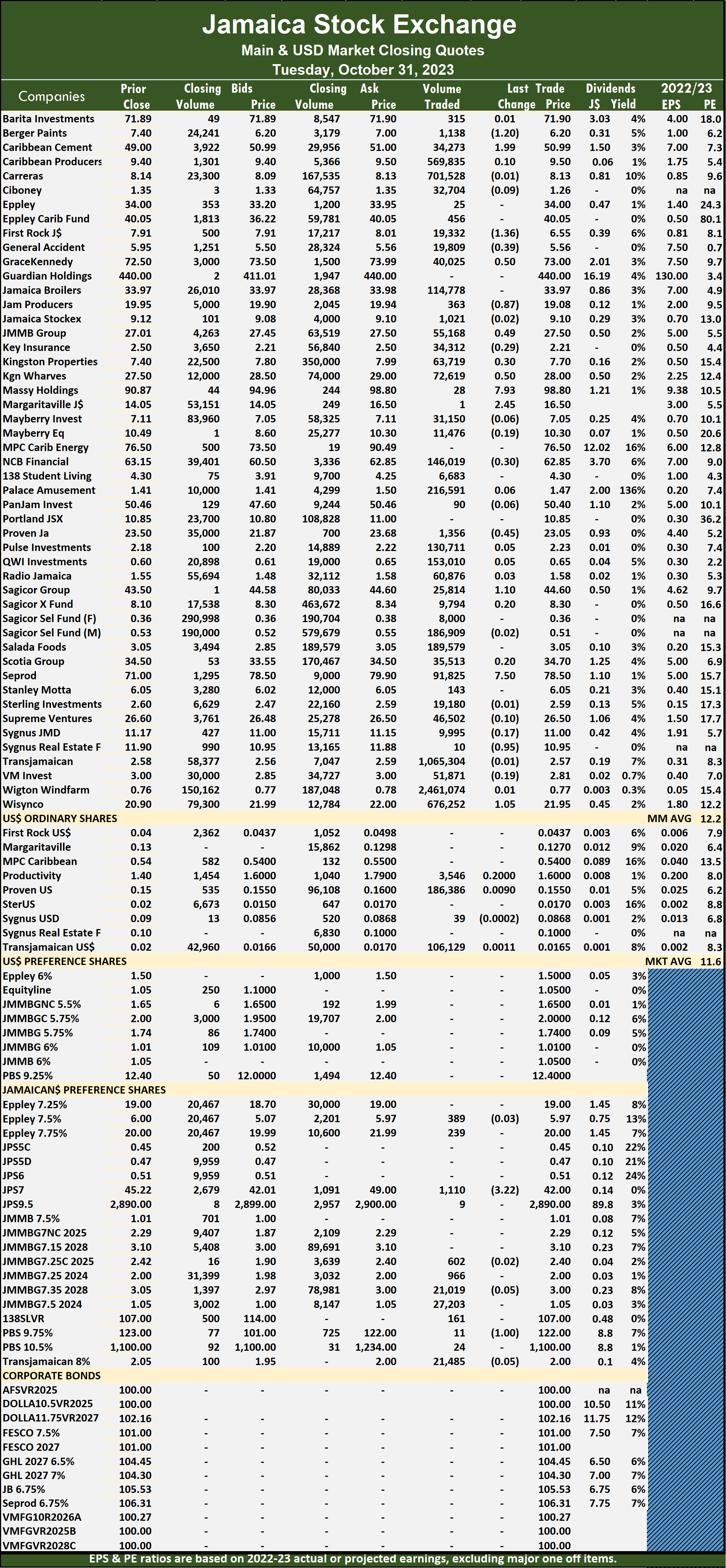

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. A total of 7,470,394 shares were traded for $65,380,690 compared with 5,763,109 units at $15,955,473 on Monday.

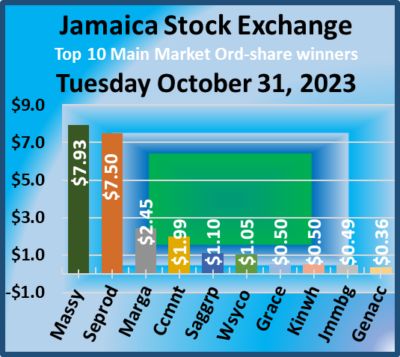

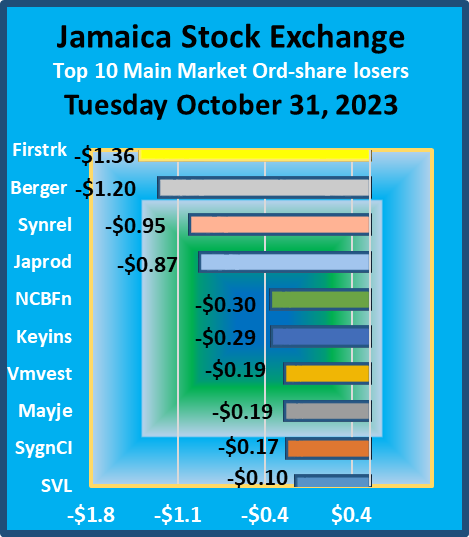

A total of 7,470,394 shares were traded for $65,380,690 compared with 5,763,109 units at $15,955,473 on Monday. The Main Market ended trading with an average PE Ratio of 12.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

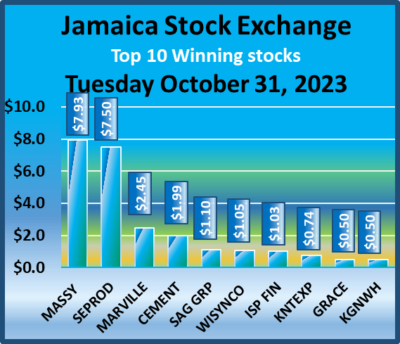

The Main Market ended trading with an average PE Ratio of 12.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. Kingston Wharves gained 50 cents to end at $28, with 72,619 stocks changing hands, Margaritaville advanced $2.45 to $16.50, after just one unit passed through the market, Massy Holdings popped $7.93 and ended at $98.80 after a transfer of 28 stock units. NCB Financial shed 30 cents to end at $62.85, with 146,019 shares crossing the exchange, Proven Investments declined 45 cents in closing at $23.05 with investors dealing in 1,356 stock units, Sagicor Group rallied $1.10 to close at $44.60 after 25,814 stocks crossed the market. Sagicor Real Estate Fund increased 20 cents to $8.30 after an exchange of 9,794 units, Scotia Group climbed 20 cents in closing at $34.70, with 35,513 stocks clearing the market, Seprod rose $7.50 and ended at $78.50 with an exchange of 91,825 units. Sygnus Real Estate Finance dipped 95 cents to close at $10.95 as investors exchanged 10 shares and Wisynco Group advanced $1.05 to end at $21.95 in trading 676,252 stock units.

Kingston Wharves gained 50 cents to end at $28, with 72,619 stocks changing hands, Margaritaville advanced $2.45 to $16.50, after just one unit passed through the market, Massy Holdings popped $7.93 and ended at $98.80 after a transfer of 28 stock units. NCB Financial shed 30 cents to end at $62.85, with 146,019 shares crossing the exchange, Proven Investments declined 45 cents in closing at $23.05 with investors dealing in 1,356 stock units, Sagicor Group rallied $1.10 to close at $44.60 after 25,814 stocks crossed the market. Sagicor Real Estate Fund increased 20 cents to $8.30 after an exchange of 9,794 units, Scotia Group climbed 20 cents in closing at $34.70, with 35,513 stocks clearing the market, Seprod rose $7.50 and ended at $78.50 with an exchange of 91,825 units. Sygnus Real Estate Finance dipped 95 cents to close at $10.95 as investors exchanged 10 shares and Wisynco Group advanced $1.05 to end at $21.95 in trading 676,252 stock units. In the preference segment, Jamaica Public Service 7% fell $3.22 to $42 after exchanging 1,110 shares and Productive Business Solutions 9.75% preference share shed $1 and ended at $122 with a transfer of 11 stock units.

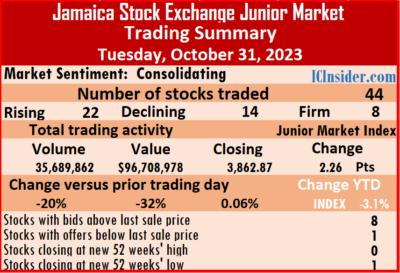

In the preference segment, Jamaica Public Service 7% fell $3.22 to $42 after exchanging 1,110 shares and Productive Business Solutions 9.75% preference share shed $1 and ended at $122 with a transfer of 11 stock units. Investors traded 35,689,862 shares for $96,708,978, compared to 44,475,233 units at $142,291,683 on Monday.

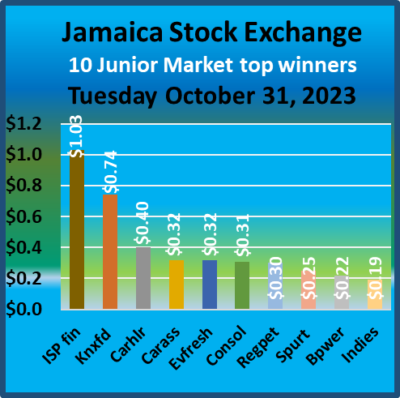

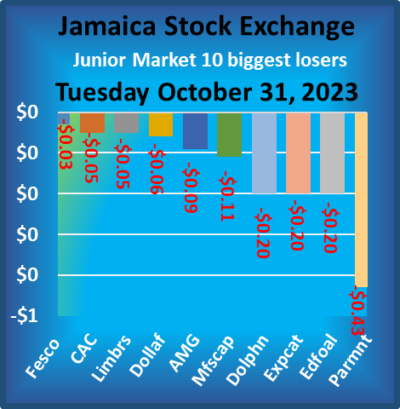

Investors traded 35,689,862 shares for $96,708,978, compared to 44,475,233 units at $142,291,683 on Monday. The Junior Market ended trading with an average PE Ratio of 10.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending between November 2023 and August 2024.

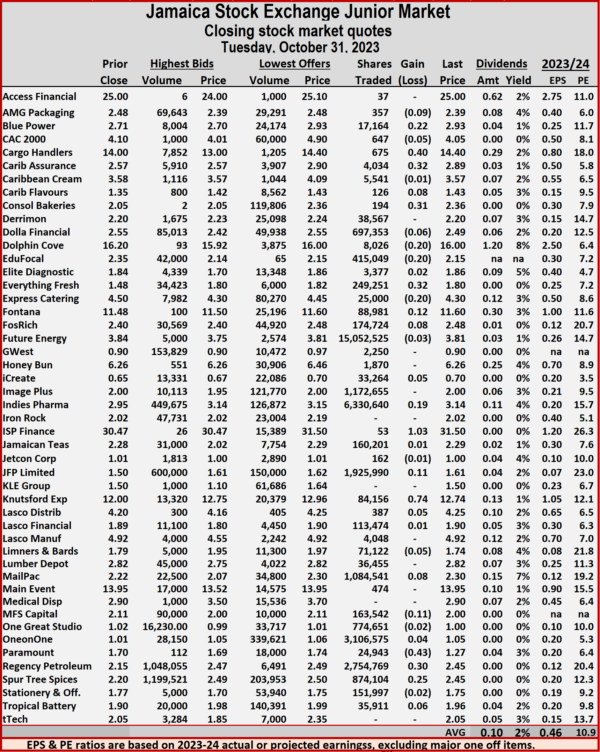

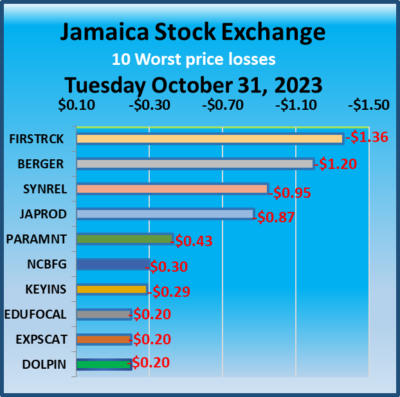

The Junior Market ended trading with an average PE Ratio of 10.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending between November 2023 and August 2024. Express Catering lost 20 cents and ended at $4.30, with 25,000 stocks crossing the market, Fontana climbed 12 cents to $11.60 after investors exchanged 88,981 units, Fosrich increased 8 cents and ended at $2.48 after a transfer of 174,724 stock units. Indies Pharma climbed 19 cents to end at $3.14 while exchanging 6,330,640 shares, ISP Finance rose $1.03 in closing at $31.50 with investors dealing in 53 stocks, JFP Ltd rallied 11 cents to close at $1.61 after an exchange of 1,925,990 units. Knutsford Express popped 74 cents to $12.74, with 84,156 stock units changing hands, Mailpac Group gained 8 cents and ended at $2.30 with stakeholders exchanging 1,084,541 shares, MFS Capital Partners skidded 11 cents to end at $2 in trading 163,542 units. Paramount Trading shed 43 cents in closing at $1.27, with 24,943 stocks crossing the exchange,

Express Catering lost 20 cents and ended at $4.30, with 25,000 stocks crossing the market, Fontana climbed 12 cents to $11.60 after investors exchanged 88,981 units, Fosrich increased 8 cents and ended at $2.48 after a transfer of 174,724 stock units. Indies Pharma climbed 19 cents to end at $3.14 while exchanging 6,330,640 shares, ISP Finance rose $1.03 in closing at $31.50 with investors dealing in 53 stocks, JFP Ltd rallied 11 cents to close at $1.61 after an exchange of 1,925,990 units. Knutsford Express popped 74 cents to $12.74, with 84,156 stock units changing hands, Mailpac Group gained 8 cents and ended at $2.30 with stakeholders exchanging 1,084,541 shares, MFS Capital Partners skidded 11 cents to end at $2 in trading 163,542 units. Paramount Trading shed 43 cents in closing at $1.27, with 24,943 stocks crossing the exchange,  Regency Petroleum advanced 30 cents to close at $2.45 with a transfer of 2,754,769 stock units and Spur Tree Spices rose 25 cents to $2.45 and closed after 874,104 shares were traded.

Regency Petroleum advanced 30 cents to close at $2.45 with a transfer of 2,754,769 stock units and Spur Tree Spices rose 25 cents to $2.45 and closed after 874,104 shares were traded. At close, the JSE Combined Market Index popped 4,618.54 points to close at 332,815.38, the All Jamaican Composite Index surged 4,665.94 points to 351,476.39, the JSE Main Index rallied 4,914.30 points to end October at 318,800.82. The Junior Market Index rose 2.26 points to close at 3,862.87 and the JSE USD Market Index climbed 12.75 points to close out October at 226.08.

At close, the JSE Combined Market Index popped 4,618.54 points to close at 332,815.38, the All Jamaican Composite Index surged 4,665.94 points to 351,476.39, the JSE Main Index rallied 4,914.30 points to end October at 318,800.82. The Junior Market Index rose 2.26 points to close at 3,862.87 and the JSE USD Market Index climbed 12.75 points to close out October at 226.08. The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 22.5 on 2022-23 earnings and 11.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 22.5 on 2022-23 earnings and 11.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making. The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.