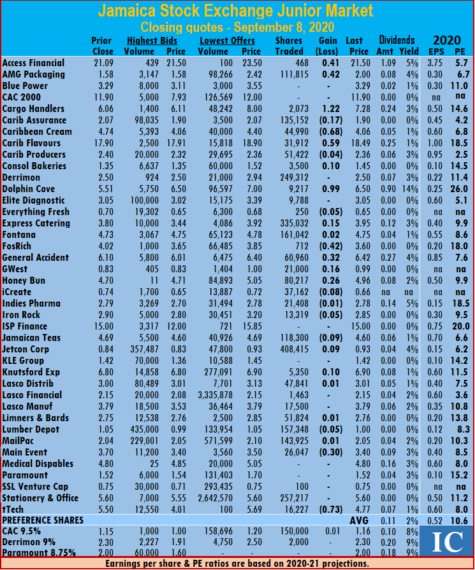

Lasco Distributors and Medical Disposables are back in the Junior Market IC TOP 10 while there are no changes to the Main Market IC TOP 10 listing.

Stationery and Office Supplies and Jetcon Corporation dropped out of the Junior Market list, the former earning, was revised down for 2020, with the loss incurred in the June quarter while Jetcon price inched up, to be squeezed out of the top stocks.

Stationery and Office Supplies and Jetcon Corporation dropped out of the Junior Market list, the former earning, was revised down for 2020, with the loss incurred in the June quarter while Jetcon price inched up, to be squeezed out of the top stocks.

The top three stocks in each market saw little change in ranking, leaving the top three Junior Market stocks, with the potential to gain between 292 to 695 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic, the focus on all three is on the 2021 fiscal year results that are projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 205 to 264 percent are Berger Paints followed by Radio Jamaica and JMMB Group, all three suffered declines during the week.

The targeted average PE ratio of the market is 20 based on the profit of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, an indication of the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10.8, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap.

The targeted average PE ratio of the market is 20 based on the profit of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, an indication of the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10.8, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap.  The PE ratio for the Junior Market Top 10 stocks average a mere 6 at just 56 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.1 or 54 percent of the PE of the overall market.

The PE ratio for the Junior Market Top 10 stocks average a mere 6 at just 56 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.1 or 54 percent of the PE of the overall market.

The average projected gain for the Junior Market IC TOP 10 stocks is 279 percent, and 157 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially, greater gains in the Junior Market than in the Main Market.

IC TOP 10 stocks are likely to deliver  the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

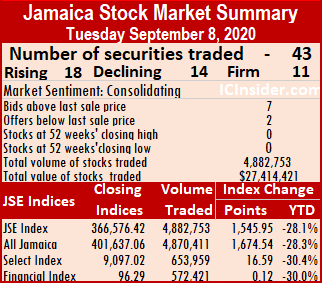

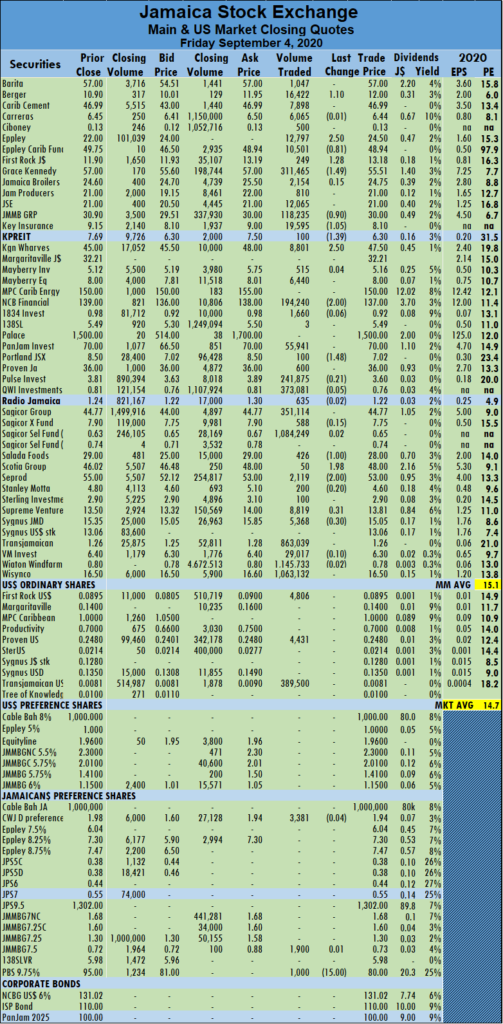

Trading concluded with 36 securities changing hands compared to 32 on Monday and ended with the prices of 17 stocks rising, the prices of 12 stocks declining and seven stocks with prices remaining unchanged.

Trading concluded with 36 securities changing hands compared to 32 on Monday and ended with the prices of 17 stocks rising, the prices of 12 stocks declining and seven stocks with prices remaining unchanged. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows three stocks ended with bids higher than their last selling prices and two with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows three stocks ended with bids higher than their last selling prices and two with lower offers. Iron Rock Insurance declined 5 cents to settle at $2.85 with investors switching ownership of 13,319 stock units, Jamaican Teas lost 9 cents to close at $4.60 with 118,300 stock units changing hands, Jetcon Corporation rose 9 cents and exchanged 408,415 shares to end at 93 cents. Knutsford Express gained 10 cents to end at $6.90 with investors transferring 5,350 shares, Lasco Distributors rose 1 cent to settle at $3.01 with an exchange of 47,841 units, Limners and Bards closed 1 cent higher at $2.76 with 51,824 stock units changing hands. Lumber Depot fell 5 cents to end at $1 with 157,348 shares passing through the market, Mailpac Group added 1 cent and exchanged 143,925 stocks to settle at $2.05, Main Event declined 30 cents to close at $3.40 with 26,047 stock units traded and tTech dropped 73 cents to end at $4.77 with 16,227 units crossing the exchange.

Iron Rock Insurance declined 5 cents to settle at $2.85 with investors switching ownership of 13,319 stock units, Jamaican Teas lost 9 cents to close at $4.60 with 118,300 stock units changing hands, Jetcon Corporation rose 9 cents and exchanged 408,415 shares to end at 93 cents. Knutsford Express gained 10 cents to end at $6.90 with investors transferring 5,350 shares, Lasco Distributors rose 1 cent to settle at $3.01 with an exchange of 47,841 units, Limners and Bards closed 1 cent higher at $2.76 with 51,824 stock units changing hands. Lumber Depot fell 5 cents to end at $1 with 157,348 shares passing through the market, Mailpac Group added 1 cent and exchanged 143,925 stocks to settle at $2.05, Main Event declined 30 cents to close at $3.40 with 26,047 stock units traded and tTech dropped 73 cents to end at $4.77 with 16,227 units crossing the exchange. At the close, the All Jamaican Composite Index advanced by 1,674.54 points to 401,637.06, the Main Index carved out a gain of 1,545.95 points to 366,576.42 and the JSE Financial Index rose 0.12 points to close at 96.29.

At the close, the All Jamaican Composite Index advanced by 1,674.54 points to 401,637.06, the Main Index carved out a gain of 1,545.95 points to 366,576.42 and the JSE Financial Index rose 0.12 points to close at 96.29. Trading ended with an average of 113,552 units changing hands at $637,545, in comparison to an average of 241,851 shares at $1,208,807 on Monday. The average trade for the month to date ended at 185,696 units at $1,300,931 for each security, in contrast to 200,398 units at $1,436,123 on Monday. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

Trading ended with an average of 113,552 units changing hands at $637,545, in comparison to an average of 241,851 shares at $1,208,807 on Monday. The average trade for the month to date ended at 185,696 units at $1,300,931 for each security, in contrast to 200,398 units at $1,436,123 on Monday. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Jamaica Broilers Group declined by 45 cents in closing at $25 and 33,295 shares crossing the exchange, Jamaica Stock Exchange carved out a gain of 62 cents to end at $18.62 trading 12,262 units, Mayberry Investments settled at $5.69, with a rise of 57 cents, with 2,000 units passing through the market. Mayberry Jamaican Equities shed 43 cents to end at $8.07 with investors swapping 122 stock units, NCB Financial fell 60 cents to settle at $135, after exchanging 48,381 shares, Palace Amusement dived $400 in closing at $1,100, in trading 20 shares. Proven Investments climbed $1.75 to settle at $35.90, with 1,191 units changing hands, Scotia Group lost $1 to end at $47 with 7,120 units crossing the exchange and Seprod climbed $1.40 to close at $52.40 with investors switching ownership of 63,478 shares.

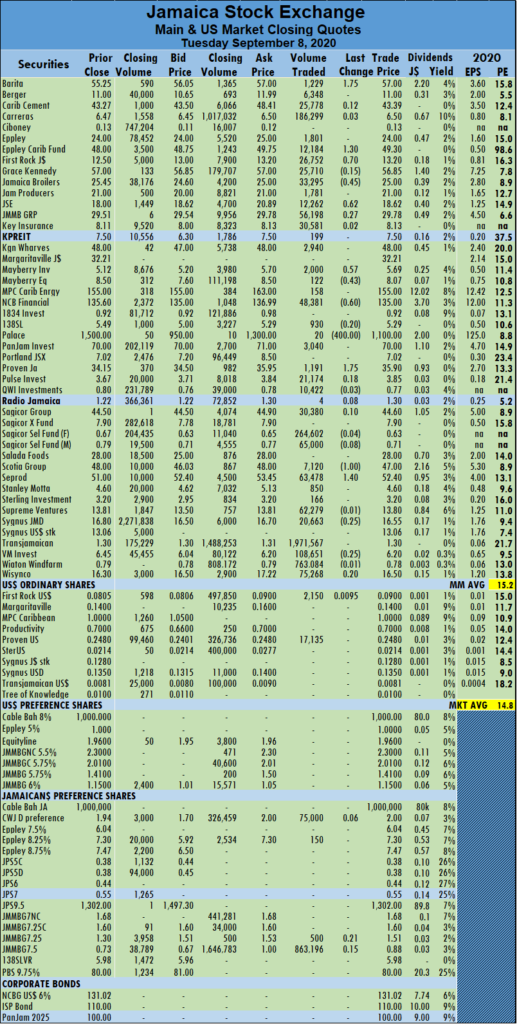

Jamaica Broilers Group declined by 45 cents in closing at $25 and 33,295 shares crossing the exchange, Jamaica Stock Exchange carved out a gain of 62 cents to end at $18.62 trading 12,262 units, Mayberry Investments settled at $5.69, with a rise of 57 cents, with 2,000 units passing through the market. Mayberry Jamaican Equities shed 43 cents to end at $8.07 with investors swapping 122 stock units, NCB Financial fell 60 cents to settle at $135, after exchanging 48,381 shares, Palace Amusement dived $400 in closing at $1,100, in trading 20 shares. Proven Investments climbed $1.75 to settle at $35.90, with 1,191 units changing hands, Scotia Group lost $1 to end at $47 with 7,120 units crossing the exchange and Seprod climbed $1.40 to close at $52.40 with investors switching ownership of 63,478 shares. At the close of the market, trading ended with two securities changing hands compared to one on Monday and ended with the prices of one stock rising, none declining and one remaining unchanged.

At the close of the market, trading ended with two securities changing hands compared to one on Monday and ended with the prices of one stock rising, none declining and one remaining unchanged. By comparison, August ended with an average of 83,402 units for US$7,526.

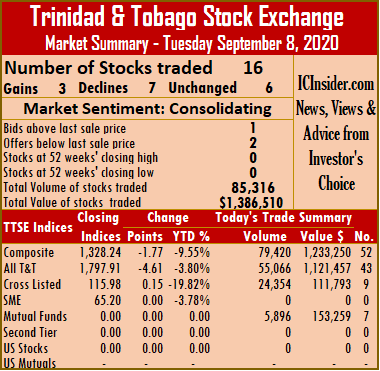

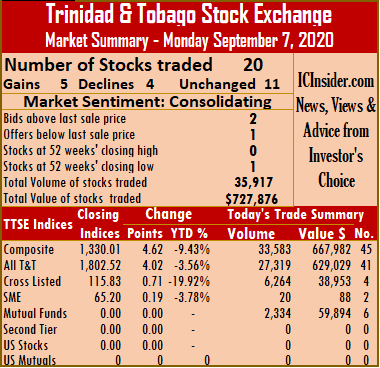

By comparison, August ended with an average of 83,402 units for US$7,526. The market closed with sixteen securities trading with the prices of three stocks advancing, seven declining and six companies’ shares closing unchanged. The volume of stocks passing through the market amounted to 85,316 shares valued at $1,386,510 compared to 35,937 shares for $727,964 on Monday from 20 securities.

The market closed with sixteen securities trading with the prices of three stocks advancing, seven declining and six companies’ shares closing unchanged. The volume of stocks passing through the market amounted to 85,316 shares valued at $1,386,510 compared to 35,937 shares for $727,964 on Monday from 20 securities. Massy Holdings ended 50 cents lower at $58.50, in transferring 373 units, National Enterprises lost 2 cents to settle at $4, with an exchange of 9,626 stock units. Prestige Holdings finished at $8, after losing 20 cents trading 1,352 units and West Indian Tobacco lost 1 cent exchanging 1,638 units to close at $36.99.

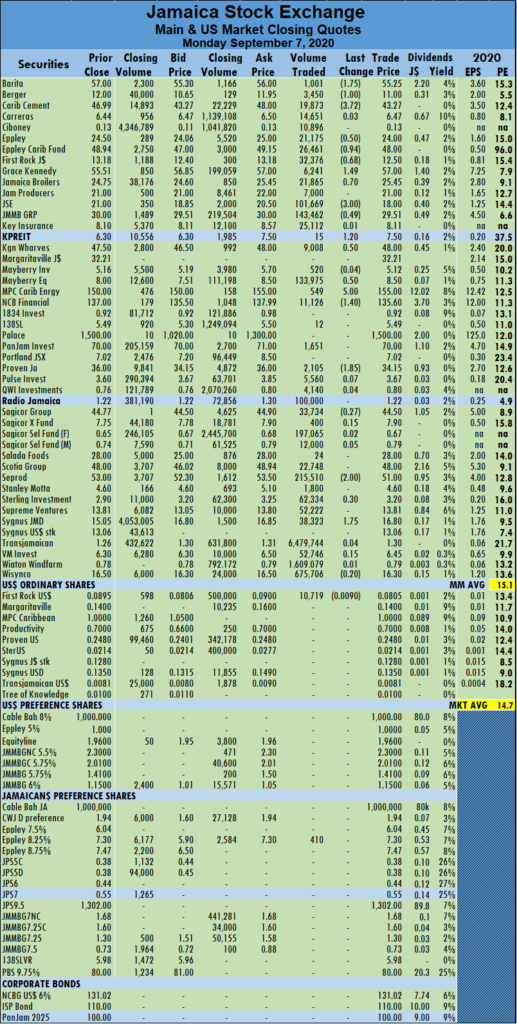

Massy Holdings ended 50 cents lower at $58.50, in transferring 373 units, National Enterprises lost 2 cents to settle at $4, with an exchange of 9,626 stock units. Prestige Holdings finished at $8, after losing 20 cents trading 1,352 units and West Indian Tobacco lost 1 cent exchanging 1,638 units to close at $36.99. At the close, the All Jamaican Composite Index declined by 2,285.96 points to 399,962.52, the Main Index lost 2,070.30 points to 365,030.47, while the JSE Financial Index shed 0.92 points to close at 96.17.

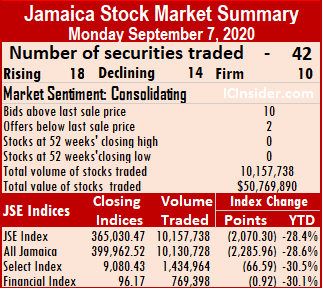

At the close, the All Jamaican Composite Index declined by 2,285.96 points to 399,962.52, the Main Index lost 2,070.30 points to 365,030.47, while the JSE Financial Index shed 0.92 points to close at 96.17. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Jamaica Stock Exchange declined by $3 to settle at $18 after 101,669 shares changed hands. JMMB Group shed 49 cents to end at $29.51, in exchanging 143,462 stock units, Kingston Properties advanced $1.20 to $7.50 with an exchange of 15 stock units, Kingston Wharves gained 50 cents, trading 9,008 units to end at $48. Mayberry Jamaican Equities rose 50 cents to $8.50, with 133,975 shares changing hands, MPC Caribbean Clean Energy climbed $5 to $155 and cleared the market with 549 units, NCB Financial fell $1.40 to $135.60, in exchanging 11,126 stock units. Proven Investments lost $1.85 to end at $34.15, after trading 2,105 units, Seprod dropped $2 to settle at $51 with investors switching ownership of 215,510 shares, Sterling Investments gained 30 cents ending at $3.20, with 62,334 stock units crossing the exchange and Sygnus Credit Investments climbed $1.75 to close at $16.80 trading 38,323 shares.

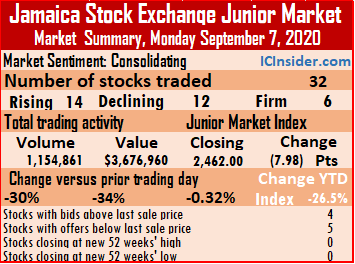

Jamaica Stock Exchange declined by $3 to settle at $18 after 101,669 shares changed hands. JMMB Group shed 49 cents to end at $29.51, in exchanging 143,462 stock units, Kingston Properties advanced $1.20 to $7.50 with an exchange of 15 stock units, Kingston Wharves gained 50 cents, trading 9,008 units to end at $48. Mayberry Jamaican Equities rose 50 cents to $8.50, with 133,975 shares changing hands, MPC Caribbean Clean Energy climbed $5 to $155 and cleared the market with 549 units, NCB Financial fell $1.40 to $135.60, in exchanging 11,126 stock units. Proven Investments lost $1.85 to end at $34.15, after trading 2,105 units, Seprod dropped $2 to settle at $51 with investors switching ownership of 215,510 shares, Sterling Investments gained 30 cents ending at $3.20, with 62,334 stock units crossing the exchange and Sygnus Credit Investments climbed $1.75 to close at $16.80 trading 38,323 shares. Trading ended with 32 securities changing hands compared to 28 on Friday and ended with the prices of 14 stocks rising, the prices of 12 stocks falling and six remaining unchanged.

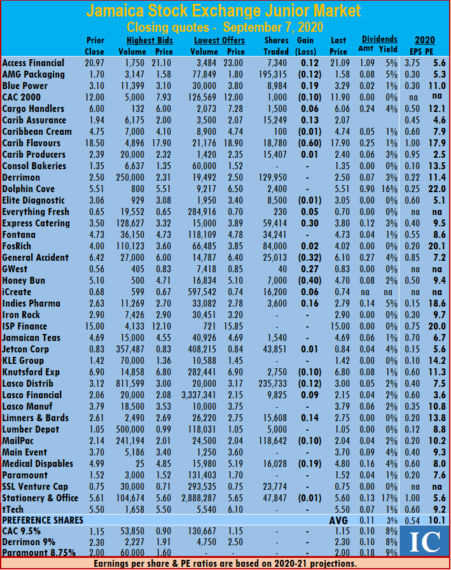

Trading ended with 32 securities changing hands compared to 28 on Friday and ended with the prices of 14 stocks rising, the prices of 12 stocks falling and six remaining unchanged. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows four stocks ending with bids higher than their last selling prices and five with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows four stocks ending with bids higher than their last selling prices and five with lower offers. Honey Bun closed at $4.70 after losing 40 cents in transferring 7,000 stock units, iCreate gained 6 cents clearing the market with 16,200 shares to end at 74 cents, Indies Pharma closed 16 cents higher at $2.79 after trading 3,600 units. Jetcon Corporation gained 1 cent to end at 84 cents, with 43,851 shares passing through the market, Knutsford Express shed 10 cents in ending at $6.80 and trading 2,750 units, Lasco Distributors lost 12 cents to settle at $3, with an exchange of 235,733 shares. Lasco Financial gained 9 cents to end at $2.15, after transferring 9,825 stock units, Limners and Bards gained 14 cents and ended at $2.75, in trading 15,608 units, MailPac Group shed 10 cents to close at $2.04, with an exchange of 118,642 shares. Medical Disposables lost 19 ents, with 16,028 stock units changing hands to end at $4.80 and Stationery and Office Supplies lost 1 cent to close at $5.60, with investors swapping 47,847 stock units.

Honey Bun closed at $4.70 after losing 40 cents in transferring 7,000 stock units, iCreate gained 6 cents clearing the market with 16,200 shares to end at 74 cents, Indies Pharma closed 16 cents higher at $2.79 after trading 3,600 units. Jetcon Corporation gained 1 cent to end at 84 cents, with 43,851 shares passing through the market, Knutsford Express shed 10 cents in ending at $6.80 and trading 2,750 units, Lasco Distributors lost 12 cents to settle at $3, with an exchange of 235,733 shares. Lasco Financial gained 9 cents to end at $2.15, after transferring 9,825 stock units, Limners and Bards gained 14 cents and ended at $2.75, in trading 15,608 units, MailPac Group shed 10 cents to close at $2.04, with an exchange of 118,642 shares. Medical Disposables lost 19 ents, with 16,028 stock units changing hands to end at $4.80 and Stationery and Office Supplies lost 1 cent to close at $5.60, with investors swapping 47,847 stock units. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows three stocks ending with bids higher than their last selling prices and one with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows three stocks ending with bids higher than their last selling prices and one with lower offers.

Stocks trading firm│ Angostura Holdings closed at $16.99, in trading 150 units, Calypso Macro Index Fund traded 240 shares at $14, Clico Investments exchanged 2,094 stock units at $27. First Citizens Bank closed at $46.25, with 1,371 units crossing the market, Guardian Holdings remained at $19.50, in exchanging 7,315 stock units, Grace Kennedy traded 704 stocks at $3.49. Guardian Media was unchanged at $5, with 4,280 stock units changing hands, JMMB Group transferred 1,301 units at $1.84, Massy Holdings ended, with 1,760 units changing hands at $59. NCB Financial Group closed at $8, with 4,259 stock units crossing the exchange and West Indian Tobacco held firm at $37, trading 2,926 units.

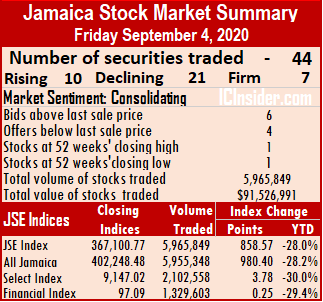

Stocks trading firm│ Angostura Holdings closed at $16.99, in trading 150 units, Calypso Macro Index Fund traded 240 shares at $14, Clico Investments exchanged 2,094 stock units at $27. First Citizens Bank closed at $46.25, with 1,371 units crossing the market, Guardian Holdings remained at $19.50, in exchanging 7,315 stock units, Grace Kennedy traded 704 stocks at $3.49. Guardian Media was unchanged at $5, with 4,280 stock units changing hands, JMMB Group transferred 1,301 units at $1.84, Massy Holdings ended, with 1,760 units changing hands at $59. NCB Financial Group closed at $8, with 4,259 stock units crossing the exchange and West Indian Tobacco held firm at $37, trading 2,926 units. At the close, the All Jamaican Composite Index advanced 980.40 points to 402,248.48, the Main Index rose 858.57 points to 367,100.77 and the JSE Financial Index added 0.25 points to close at 97.09.

At the close, the All Jamaican Composite Index advanced 980.40 points to 402,248.48, the Main Index rose 858.57 points to 367,100.77 and the JSE Financial Index added 0.25 points to close at 97.09. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Key Insurance declined by $1.05 to settle at $8.10, in transferring 19,595 stock units, Kingston Properties fell by $1.39 to $6.30, while exchanging 100 units, Kingston Wharves closed $2.50 higher at $47.50, with an exchange of 8,801 units. NCB Financial declined $2 to $137, trading 194,240 shares, Portland JSX fell $1.48, in ending at $7.02 with 100 units changing hands. Salada Foods closed at $28, with a loss of $1 after trading 426 shares. Scotia Group climbed $1.98 to $48, with investors switching the ownership of 50 stocks, Seprod declined $2 to settle at $53, in exchanging 2,119 units, Supreme Ventures gained 31 cents to close $13.81, in transferring 8,819 stock units and Sygnus Credit Investments lost 30 cents to close at $15.05, with 5,368 stock units crossing the market.

Key Insurance declined by $1.05 to settle at $8.10, in transferring 19,595 stock units, Kingston Properties fell by $1.39 to $6.30, while exchanging 100 units, Kingston Wharves closed $2.50 higher at $47.50, with an exchange of 8,801 units. NCB Financial declined $2 to $137, trading 194,240 shares, Portland JSX fell $1.48, in ending at $7.02 with 100 units changing hands. Salada Foods closed at $28, with a loss of $1 after trading 426 shares. Scotia Group climbed $1.98 to $48, with investors switching the ownership of 50 stocks, Seprod declined $2 to settle at $53, in exchanging 2,119 units, Supreme Ventures gained 31 cents to close $13.81, in transferring 8,819 stock units and Sygnus Credit Investments lost 30 cents to close at $15.05, with 5,368 stock units crossing the market.