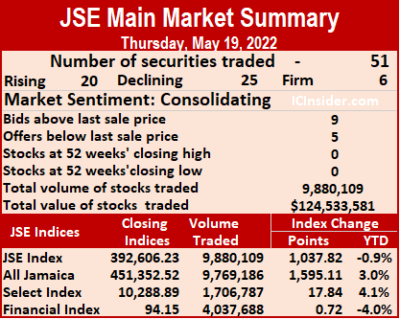

Market activity ended on the Jamaica Stock Exchange Main Market on Thursday, with the volume of stocks traded declining 19 percent and the value diving 63 percent lower than on Wednesday, leading to declining stocks outstripping rising ones.

The All Jamaican Composite Index rose 1,595.11 points to 451,352.52, the JSE Main Index popped 1,037.82 points to 392,606.23 and the JSE Financial Index inched 0.72 points higher to 94.15.

The All Jamaican Composite Index rose 1,595.11 points to 451,352.52, the JSE Main Index popped 1,037.82 points to 392,606.23 and the JSE Financial Index inched 0.72 points higher to 94.15.

Trading ended with 51 securities compared to 53 on Wednesday, with 20 rising, 25 declining and six ending unchanged.

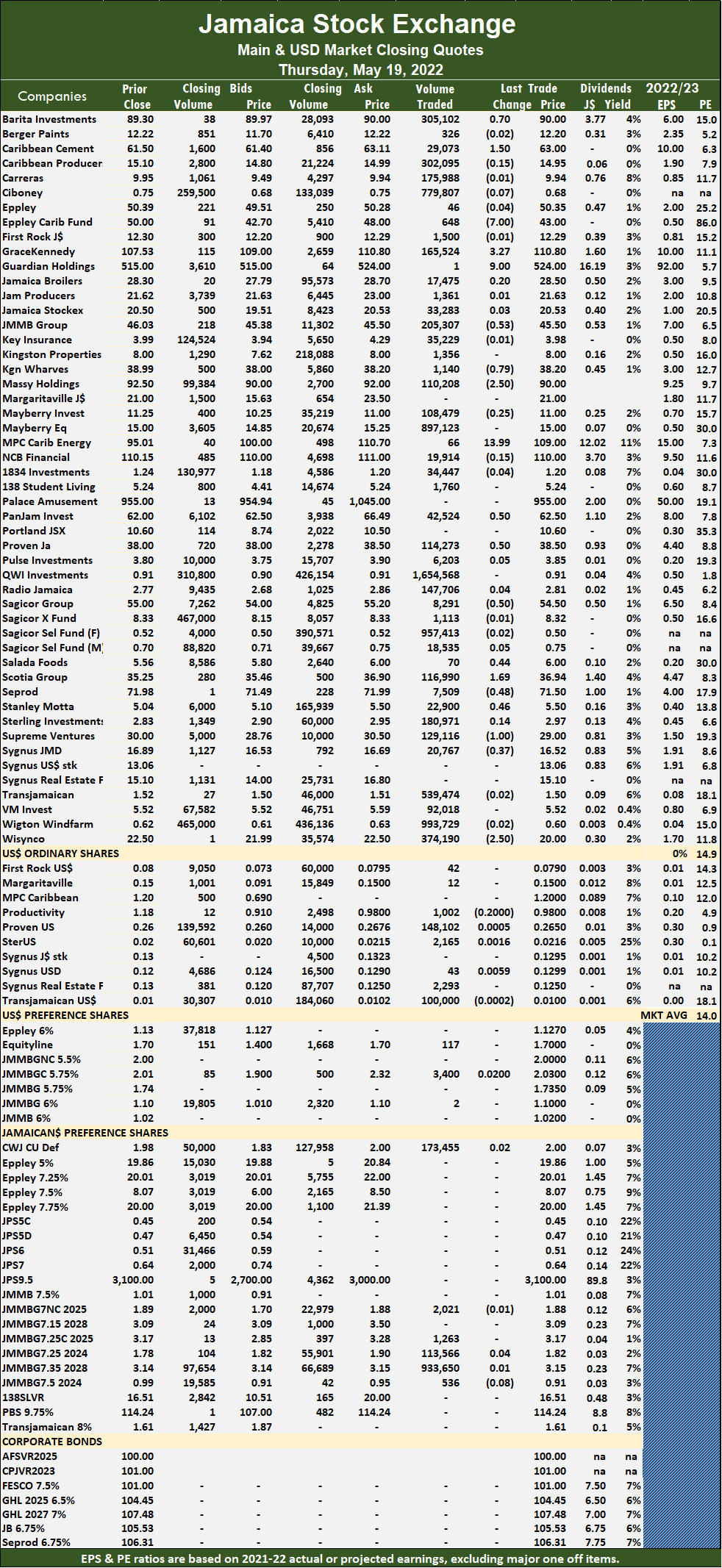

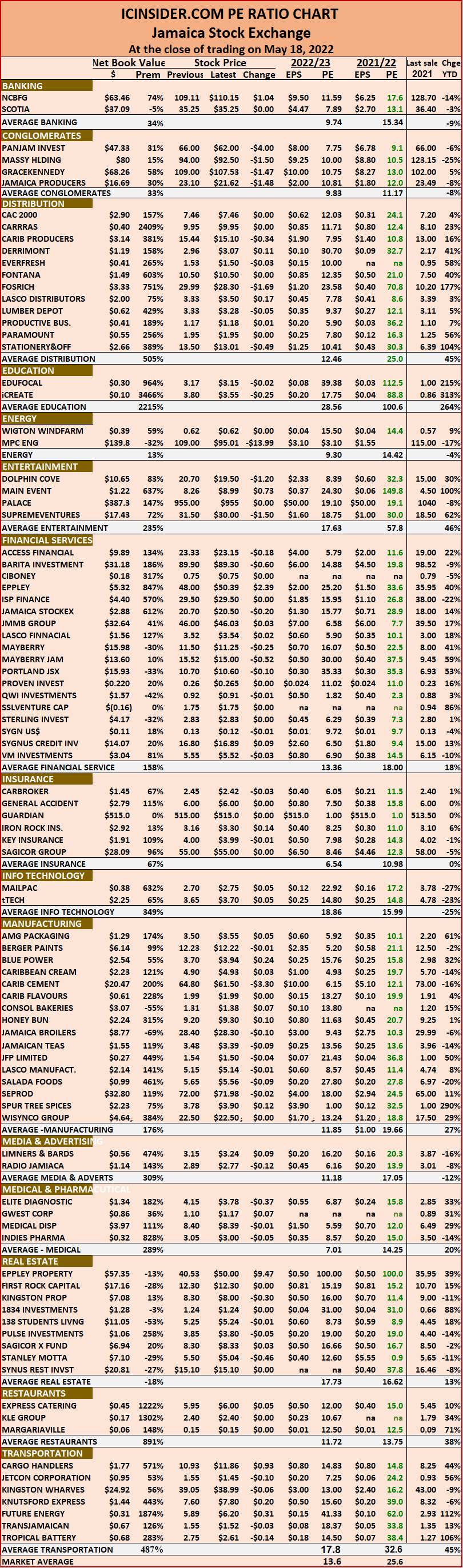

The PE Ratio, a formula for computing appropriate stock values, averages 14.9. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Overall, 9,880,109 shares were traded for $124,533,581 versus 12,251,051 units at $339,534,037 on Wednesday. Trading averages 193,728 units at $2,441,835, compared to 231,152 shares at $6,406,303 on Wednesday and month to date, an average of 238,407 units at $4,386,460, compared to 241,537 units at $4,522,691 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

QWI Investments led trading with 1.65 million shares for 16.7 percent of total volume, followed by Wigton Windfarm, with 993,729 units for 10.1 percent of the day’s trade and Sagicor Select Financial Fund with 957,413 units for 9.7 percent market share.

QWI Investments led trading with 1.65 million shares for 16.7 percent of total volume, followed by Wigton Windfarm, with 993,729 units for 10.1 percent of the day’s trade and Sagicor Select Financial Fund with 957,413 units for 9.7 percent market share.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and five with lower offers.

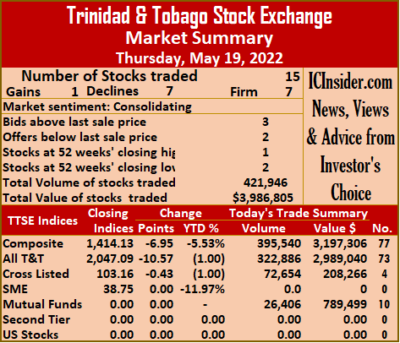

At the close, Barita Investments advanced 70 cents in ending at $90, trading 305,102 shares, Caribbean Cement popped $1.50 in closing at $63 while exchanging 29,073 stock units, Eppley Caribbean Property Fund declined $7 to $43 after 648 stocks changed hands. GraceKennedy climbed $3.27 to end at $110.80 after 165,524 units were exchanged, Guardian Holdings rallied $9 to $524 in an exchange of one stock unit, JMMB Group lost 53 cents in closing at $45.50, with 205,307 shares crossing the market. Kingston Wharves shed 79 cents to end at $38.20 after finishing trading 1,140 stocks, Massy Holdings dropped $2.50 to close at $90 after exchanging 110,208 units, MPC Caribbean Clean Energy gained $13.99 to $109 with the swapping of 66 stocks. PanJam Investment rose 50 cents to $62.50 after exchanging 42,524 stock units, Proven Investments gained 50 cents in ending at $38.50, with 114,273 units crossing the market, Sagicor Group fell 50 cents to $54.50 while trading 8,291 shares.  Salada Foods gained 44 cents in closing at $6 with an exchange of 70 shares, Scotia Group increased $1.69 to end at $36.94 in switching ownership of 116,990 stock units, Seprod declined 48 cents to $71.50 in exchanging 7,509 stocks. Stanley Motta rallied 46 cents to end at $5.50, with 22,900 units crossing the exchange, Supreme Ventures dropped $1 to $29, with 129,116 units changing hands, Sygnus Credit Investments lost 37 cents to close at $16.52 while exchanging 20,767 stocks and Wisynco Group shed $2.50 in ending at $20 and trading 374,190 stock units.

Salada Foods gained 44 cents in closing at $6 with an exchange of 70 shares, Scotia Group increased $1.69 to end at $36.94 in switching ownership of 116,990 stock units, Seprod declined 48 cents to $71.50 in exchanging 7,509 stocks. Stanley Motta rallied 46 cents to end at $5.50, with 22,900 units crossing the exchange, Supreme Ventures dropped $1 to $29, with 129,116 units changing hands, Sygnus Credit Investments lost 37 cents to close at $16.52 while exchanging 20,767 stocks and Wisynco Group shed $2.50 in ending at $20 and trading 374,190 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Mild rebound for JSE markets

The across the board decline the Jamaica Stock Exchange suffered over the past few days mostly came to a halt on Thursday with mild increases in the Main and Junior Market indices but the JSE USD based stocks had a sizable fall. At the close, the JSE Combined Index rose 1,196.84 points to 406,294.44.

The All Jamaican Composite Index popped 1,595.11 points to 451,352.52, the JSE Main Index added 1,037.82 points to close at 392,606.23, the Junior Market broke the five days losing streak with a rise of 25.36 points to 4,361.52 and the JSE USD market index dropped 11.85 points or 5.6 percent to 211.01.

The All Jamaican Composite Index popped 1,595.11 points to 451,352.52, the JSE Main Index added 1,037.82 points to close at 392,606.23, the Junior Market broke the five days losing streak with a rise of 25.36 points to 4,361.52 and the JSE USD market index dropped 11.85 points or 5.6 percent to 211.01.

Investors exchanged 28,306,948 shares in all markets, with the value of stocks traded in the Main and Junior Markets amounting to $187.7 million and in the JSE USD market, US$48,070.

The market’s PE ratio ended at 25.5 based on 2021-22 earnings and 13.6 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

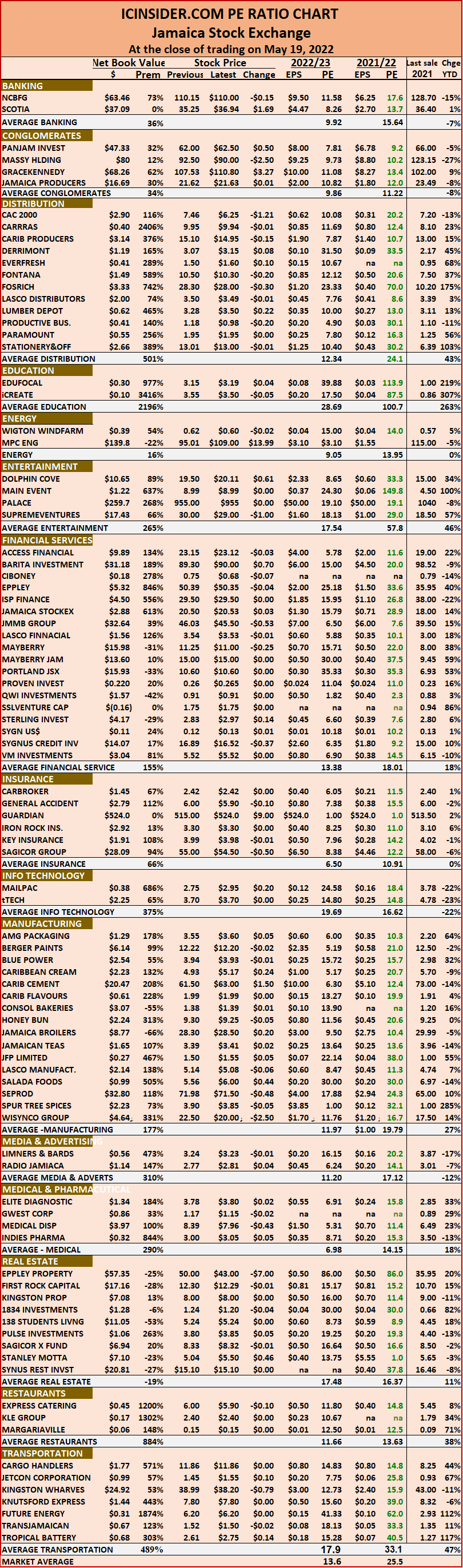

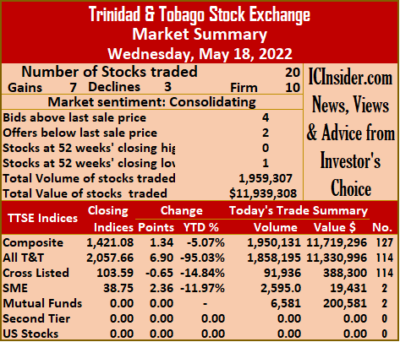

Trading falls on Trinidad and Tobago exchange

Market activity ended on Thursday, at the close of the Trinidad and Tobago Stock Exchange, with the number of securities changing hands falling to 15 securities from 20 on Wednesday and leading to a 78 percent fall in the volume of stocks traded, with a 67 percent lower value than on Wednesday.

The price of one stock rose, seven declined and seven remained unchanged. The Composite Index fell 6.95 points to 1,414.13, the All T&T Index shed 10.57 points to close at 2,047.09 and the Cross-Listed Index fell 0.43 points to settle at 103.16.

The price of one stock rose, seven declined and seven remained unchanged. The Composite Index fell 6.95 points to 1,414.13, the All T&T Index shed 10.57 points to close at 2,047.09 and the Cross-Listed Index fell 0.43 points to settle at 103.16.

A total of 421,946 shares traded for $3,986,805 versus 1,959,307 units at $11,939,308 on Wednesday. An average of 28,130 units traded at $265,787 compared to 97,965 shares at $596,965 on the previous day, with trading month to date averaging 42,520 units at $453,575 versus 45,181 units at $482,282. The average trade for April amounts to 43,127 units at $458,871.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s ended at $47.25, with 400 shares crossing the exchange, Angostura Holdings remained at $22.89, with 605 stock units clearing the market, Clico Investment Fund declined $1.48 to end at $29 with the swapping of 26,406 units. First Citizens Group rose 90 cents in closing at $53 after trading 4,495 stocks, FirstCaribbean International Bank ended unchanged at $5.25 after exchanging 9,684 units,  Guardian Holdings remained at $27.53 in trading 6,800 stock units. JMMB Group lost 5 cents to end at $2.50 in switching ownership of 62,970 shares, Massy Holdings dropped 10 cents to close at $5 with 243,440 stocks changing hands, National Enterprises fell 8 cents to $2.92 in exchanging 16,650 shares. Republic Financial Holdings shed 1 cent to $140, with 2,429 stock units crossing the market Scotiabank finished at $78 while exchanging 126 stocks, Trinidad & Tobago NGL ended unchanged at $20.74 after 7,399 units changed hands. Trinidad Cement fell 10 cents to end at $3.50 with an exchange of 850 stock units, Unilever Caribbean finished at $16.50 trading 24,114 units and West Indian Tobacco dropped 50 cents to close at a 52 weeks’ low of $23, with 15,578 shares changing hands.

Guardian Holdings remained at $27.53 in trading 6,800 stock units. JMMB Group lost 5 cents to end at $2.50 in switching ownership of 62,970 shares, Massy Holdings dropped 10 cents to close at $5 with 243,440 stocks changing hands, National Enterprises fell 8 cents to $2.92 in exchanging 16,650 shares. Republic Financial Holdings shed 1 cent to $140, with 2,429 stock units crossing the market Scotiabank finished at $78 while exchanging 126 stocks, Trinidad & Tobago NGL ended unchanged at $20.74 after 7,399 units changed hands. Trinidad Cement fell 10 cents to end at $3.50 with an exchange of 850 stock units, Unilever Caribbean finished at $16.50 trading 24,114 units and West Indian Tobacco dropped 50 cents to close at a 52 weeks’ low of $23, with 15,578 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Low keyed trading for JSE USD market

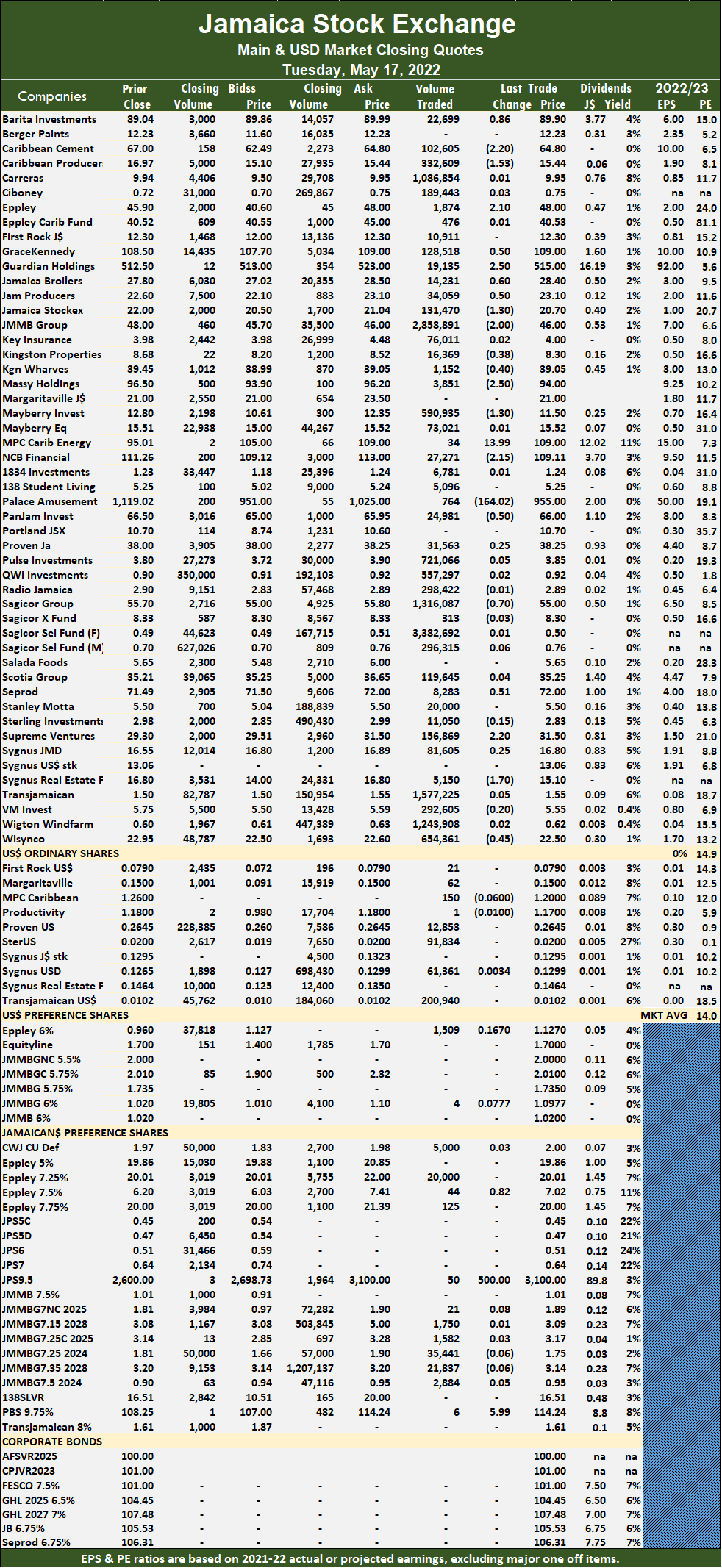

Trading remained low keyed on the Jamaica Stock Exchange US dollar market on Wednesday, with the volume of stocks traded declining 61 percent, with an 8 percent lower value than on Tuesday, and ended, with eight securities trading, against 10 on Tuesday with three rising, two declining and three ending unchanged.

The JSE US Denominated Equities Index slipped 0.32 points to end at 223.86. The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between September 2022 and August 2023.

The JSE US Denominated Equities Index slipped 0.32 points to end at 223.86. The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between September 2022 and August 2023.

Overall, 145,513 shares traded for US$15,594 compared to 368,735 units at US$16,968 on Tuesday. Trading averaged 18,189 units at US$1,949, compared to 36,874 shares at US$1,697 on Tuesday, with a month to date average of 43,699 shares at US$2,664 versus 45,504 units at US$2,714 on the previous day. Tuesday. April ended with an average of 95,379 units for US$3,929.

Investor’s Choice bid-offer indicator shows no stock ending with a bid higher than the last selling price and none with a lower offer.

At the close, First Rock Capital USD share rallied 0.04 of a cent to 7.94 US cents, with 9,698 shares crossing the exchange, Margaritaville remained at 15 US cents in an exchange of 58 stock units, Productive Business Solutions popped 1 cent to end at US$1.18 after exchanging one stock.  Proven Investments finished at 26.45 US cents trading 1,527 stocks, Sterling Investments ended at 2 US cents with the swapping of 40,399 stocks, Sygnus Credit Investments USD share fell 0.59 of a cent to 12.4 US cents, with 81,861 shares clearing the market and Sygnus Real Estate Finance USD share dropped 2.14 cents to 12.5 US cents while exchanging 10,000 units.

Proven Investments finished at 26.45 US cents trading 1,527 stocks, Sterling Investments ended at 2 US cents with the swapping of 40,399 stocks, Sygnus Credit Investments USD share fell 0.59 of a cent to 12.4 US cents, with 81,861 shares clearing the market and Sygnus Real Estate Finance USD share dropped 2.14 cents to 12.5 US cents while exchanging 10,000 units.

In the preference segment, JMMB Group 6% climbed 0.23 of one cent in closing at US$1.10 after 1,969 stock units changed hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

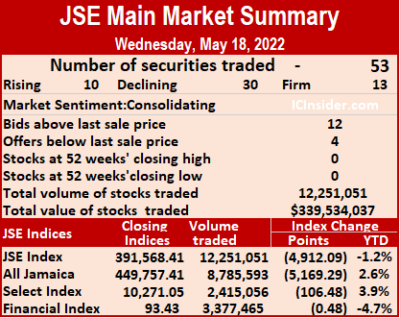

Decline for JSE markets again

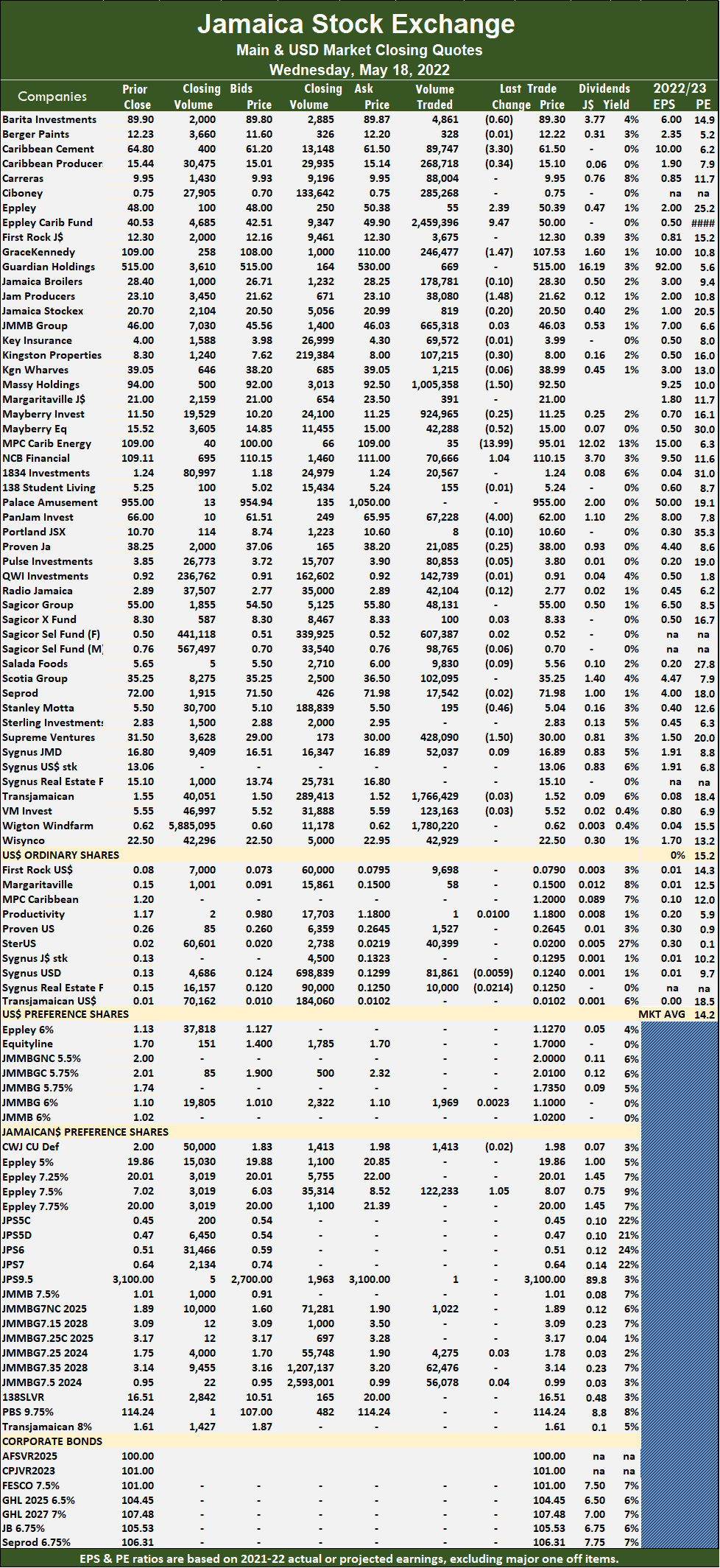

The Jamaica Stock Exchange continues to fall following the release of first quarter results and closed trading on Wednesday. The JSE Combined Index dropped 4,941.31 points to 405,097.60, with all three markets closed for the day, with investors continuing to pull in their horns until late June or early July.

In the main market, the All Jamaican Composite Index dipped 5,169.29 points to 449,757.41. The JSE Main Index shed 4,912.09 points to close at 391,568.41, the Junior Market slipped for a fourth day by 38.57 points to 4,336.16 and the JSE USD market index dipped 0.32 points to 222.86.

In the main market, the All Jamaican Composite Index dipped 5,169.29 points to 449,757.41. The JSE Main Index shed 4,912.09 points to close at 391,568.41, the Junior Market slipped for a fourth day by 38.57 points to 4,336.16 and the JSE USD market index dipped 0.32 points to 222.86.

Investors exchanged 18,816,440 shares in all markets, with the value of stocks traded in the Main and Junior Markets amounting to $368.34 million and in the JSE USD market, US$15,594.

The market’s PE ratio ended at 25.6 based on 2021-22 earnings and 13.6 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Winning TTSE stocks overpower decliners

Market activity ended on Wednesday on the Trinidad and Tobago Stock Exchange with the volume of stocks traded surging 365 percent, with a value that was 127 percent more than on Tuesday, and closed with more than twice the number of shares rising as falling.

A total of 20 securities traded compared to 22 on Tuesday, with seven stocks rising, three declining and ten remaining unchanged. The Composite Index advanced 1.34 points to 1,421.08, the All T&T Index advanced 6.90 points to 2,057.66 and the Cross-Listed Index shed 0.65 points to settle at 103.59.

A total of 20 securities traded compared to 22 on Tuesday, with seven stocks rising, three declining and ten remaining unchanged. The Composite Index advanced 1.34 points to 1,421.08, the All T&T Index advanced 6.90 points to 2,057.66 and the Cross-Listed Index shed 0.65 points to settle at 103.59.

A total of 1,959,307 shares traded for $11,939,308 compared to 421,104 units at $5,255,115 on Tuesday.

An average of 97,965 units traded at $596,965 compared to 19,141 shares at $238,869 on Tuesday, with trading month to date averaging 45,182 units at $482,282 versus 40,316 units at $471,712. The average trade for April amounts to 43,127 units at $458,871.

Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s fell 75 cents to end at $47.25, with 682 shares crossing the market, Angostura Holdings ended unchanged at $22.89, trading 18 units, Ansa McAl increased $1.45 to close at $57 while exchanging 2,013 stocks. Clico Investment Fund remained at $30.48, trading 6,581 stock units, Endeavour Holdings rallied 49 cents in closing at $7.50 after trading 2,595 stock units, First Citizens Group gained 4 cents to $52.10 in exchanging 203 stocks. FirstCaribbean International Bank dropped 15 cents in ending at $5.25, with 50,901 units clearing the market, GraceKennedy at $5.98 after trading three shares, Guardian Holdings climbed 3 cents to close at $27.53, with 7,046 shares crossing the exchange.  JMMB Group popped 2 cents to end at $2.55 with 37,110 stock units changing hands, Massy Holdings shed 9 cents to close at $5.10 after exchanging 1,706,596 units, National Enterprises ended unchanged at $3 with the swapping of 51,211 stocks. National Flour Mills rose 5 cents in closing at $1.65 with an exchange of 100 stock units, NCB Financial Group remained at $6, with 3,922 stocks changing hands, One Caribbean Media finished at $4 in an exchange of one share. Republic Financial Holdings advanced 1 cent to $140.01 in switching ownership of 600 units, Scotiabank remained at $78 in exchanging 1,964 units, Trinidad & Tobago NGL ended unchanged at $20.74, with 25,144 shares clearing the market, Unilever Caribbean finished at $16.50 with the swapping of 38,675 stocks and West Indian Tobacco finished at $23.50 after exchanging 23,942 stock units.

JMMB Group popped 2 cents to end at $2.55 with 37,110 stock units changing hands, Massy Holdings shed 9 cents to close at $5.10 after exchanging 1,706,596 units, National Enterprises ended unchanged at $3 with the swapping of 51,211 stocks. National Flour Mills rose 5 cents in closing at $1.65 with an exchange of 100 stock units, NCB Financial Group remained at $6, with 3,922 stocks changing hands, One Caribbean Media finished at $4 in an exchange of one share. Republic Financial Holdings advanced 1 cent to $140.01 in switching ownership of 600 units, Scotiabank remained at $78 in exchanging 1,964 units, Trinidad & Tobago NGL ended unchanged at $20.74, with 25,144 shares clearing the market, Unilever Caribbean finished at $16.50 with the swapping of 38,675 stocks and West Indian Tobacco finished at $23.50 after exchanging 23,942 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

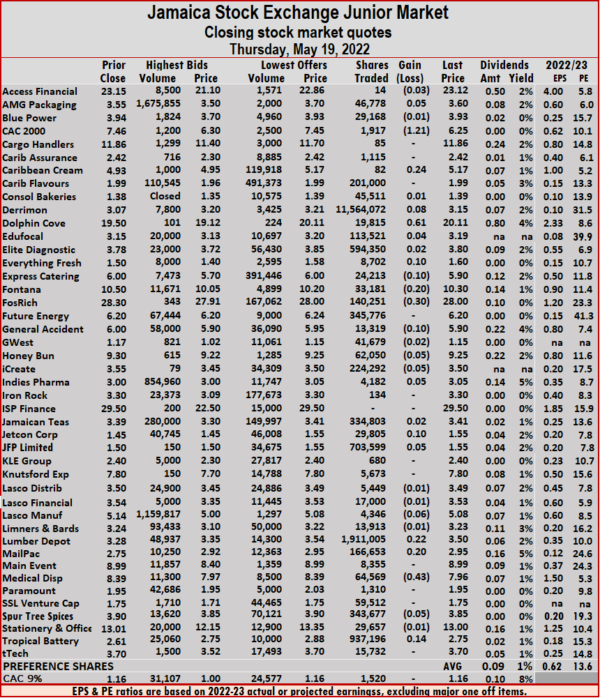

Like Wednesday, all but one of the 45 listed securities traded on Thursday, with 15 rising, 17 declining and 12 closing unchanged. The Junior Market Index gained 25.36 points to 4,361.52.

Like Wednesday, all but one of the 45 listed securities traded on Thursday, with 15 rising, 17 declining and 12 closing unchanged. The Junior Market Index gained 25.36 points to 4,361.52. Derrimon Trading led market activity, with 11.56 million shares for 63.6 percent of total volume, followed by Lumber Depot with 1.91 million units for 10.5 percent of the day’s trade and Tropical Battery with 937,196 units for 5.2 percent market share.

Derrimon Trading led market activity, with 11.56 million shares for 63.6 percent of total volume, followed by Lumber Depot with 1.91 million units for 10.5 percent of the day’s trade and Tropical Battery with 937,196 units for 5.2 percent market share. Lumber Depot rallied 22 cents to close at $3.50 in switching ownership of 1,911,005 shares, Mailpac Group rose 20 cents to $2.95, with 166,653 stocks clearing the market, Medical Disposables dropped 43 cents in closing at $7.96 with an exchange of 64,569 units and Tropical Battery popped 14 cents to end at $2.75 with the swapping of 937,196 shares.

Lumber Depot rallied 22 cents to close at $3.50 in switching ownership of 1,911,005 shares, Mailpac Group rose 20 cents to $2.95, with 166,653 stocks clearing the market, Medical Disposables dropped 43 cents in closing at $7.96 with an exchange of 64,569 units and Tropical Battery popped 14 cents to end at $2.75 with the swapping of 937,196 shares. The All Jamaican Composite Index sank 5,169.29 points to 449,757.41, the JSE Main Index dropped 4,912.09 points to close at 391,568.41 and the JSE Financial Index dipped 0.48 points to settle at 93.43. Trading ended with 53 securities down from 57 on Tuesday, with ten rising, 30 declining and 13 ending unchanged.

The All Jamaican Composite Index sank 5,169.29 points to 449,757.41, the JSE Main Index dropped 4,912.09 points to close at 391,568.41 and the JSE Financial Index dipped 0.48 points to settle at 93.43. Trading ended with 53 securities down from 57 on Tuesday, with ten rising, 30 declining and 13 ending unchanged. At the close, Barita Investments fell 60 cents to $89.30 with the swapping of 4,861 shares, Caribbean Cement dropped $3.30 to close at $61.50, trading 89,747 stocks, Caribbean Producers shed 34 cents in closing at $15.10, with 268,718 stock units crossing the exchange. Eppley increased $2.39 to $50.39, with 55 units changing hands, Eppley Caribbean Property Fund rallied $9.47 to end at $50 after trading 2,459,396 stocks, GraceKennedy lost $1.47 to $107.53 after an exchange of 246,477 units. Jamaica Producers declined $1.48 to close at $21.62 in an exchange of 38,080 shares, Kingston Properties shed 30 cents to end at $8 with an exchange of 107,215 stock units, Massy Holdings dropped $1.50 in closing at $92.50 while exchanging 1,005,358 stocks. Mayberry Jamaican Equities fell 52 cents to end at $15 in switching ownership of 42,288 units, MPC Caribbean Clean Energy lost $13.99 to end at $95.01 in trading 35 stock units, NCB Financial advanced $1.04 to $110.15, exchanging 70,666 shares.

At the close, Barita Investments fell 60 cents to $89.30 with the swapping of 4,861 shares, Caribbean Cement dropped $3.30 to close at $61.50, trading 89,747 stocks, Caribbean Producers shed 34 cents in closing at $15.10, with 268,718 stock units crossing the exchange. Eppley increased $2.39 to $50.39, with 55 units changing hands, Eppley Caribbean Property Fund rallied $9.47 to end at $50 after trading 2,459,396 stocks, GraceKennedy lost $1.47 to $107.53 after an exchange of 246,477 units. Jamaica Producers declined $1.48 to close at $21.62 in an exchange of 38,080 shares, Kingston Properties shed 30 cents to end at $8 with an exchange of 107,215 stock units, Massy Holdings dropped $1.50 in closing at $92.50 while exchanging 1,005,358 stocks. Mayberry Jamaican Equities fell 52 cents to end at $15 in switching ownership of 42,288 units, MPC Caribbean Clean Energy lost $13.99 to end at $95.01 in trading 35 stock units, NCB Financial advanced $1.04 to $110.15, exchanging 70,666 shares.  PanJam Investment declined $4 after ending at $62, with 67,228 stocks crossing the market, Stanley Motta shed 46 cents in closing at $5.04 after exchanging 195 units and Supreme Ventures dropped $1.50 to close at $30 after finishing trading of 428,090 stock units.

PanJam Investment declined $4 after ending at $62, with 67,228 stocks crossing the market, Stanley Motta shed 46 cents in closing at $5.04 after exchanging 195 units and Supreme Ventures dropped $1.50 to close at $30 after finishing trading of 428,090 stock units. At the close, Access Financial slipped 18 cents to $23.15, with ten shares changing hands, Blue Power advanced 24 cents to $3.94 in an exchange of 110 stock units, Cargo Handlers rose 93 cents in closing at $11.86 after an exchange of 55 units. Derrimon Trading gained 11 cents to end at $3.07, trading 170,395 stocks, Dolphin Cove dropped $1.20 to close at $19.50, with 26,607 shares crossing the exchange, Elite Diagnostic declined 37 cents to close at $3.78 in switching ownership of 340,612 stock units. Fosrich fell $1.69 to $28.30 with an exchange of 234,432 units, Future Energy Source climbed 31 cents to end at $6.20 in exchanging 494,350 stocks, Honey Bun rallied 10 cents to $9.30 after 18,462 units crossed the market. iCreate shed 25 cents in closing at $3.55 while exchanging 191,897 stocks, Iron Rock Insurance increased 14 cents in ending at $3.30 after trading 125 stock units, Jetcon Corporation lost 10 cents to close at $1.45 after 438,574 shares changed hands. Knutsford Express popped 20 cents in closing at $7.80 in trading 18,743 shares, Lasco Distributors gained 17 cents to $3.50 with the swapping of 226,885 units, Main Event climbed 73 cents to end at $8.99 with 43,200 stock units clearing the market.

At the close, Access Financial slipped 18 cents to $23.15, with ten shares changing hands, Blue Power advanced 24 cents to $3.94 in an exchange of 110 stock units, Cargo Handlers rose 93 cents in closing at $11.86 after an exchange of 55 units. Derrimon Trading gained 11 cents to end at $3.07, trading 170,395 stocks, Dolphin Cove dropped $1.20 to close at $19.50, with 26,607 shares crossing the exchange, Elite Diagnostic declined 37 cents to close at $3.78 in switching ownership of 340,612 stock units. Fosrich fell $1.69 to $28.30 with an exchange of 234,432 units, Future Energy Source climbed 31 cents to end at $6.20 in exchanging 494,350 stocks, Honey Bun rallied 10 cents to $9.30 after 18,462 units crossed the market. iCreate shed 25 cents in closing at $3.55 while exchanging 191,897 stocks, Iron Rock Insurance increased 14 cents in ending at $3.30 after trading 125 stock units, Jetcon Corporation lost 10 cents to close at $1.45 after 438,574 shares changed hands. Knutsford Express popped 20 cents in closing at $7.80 in trading 18,743 shares, Lasco Distributors gained 17 cents to $3.50 with the swapping of 226,885 units, Main Event climbed 73 cents to end at $8.99 with 43,200 stock units clearing the market.  Spur Tree Spices increased 12 cents ending at $3.90, with 946,973 stocks crossing the market, Stationery and Office Supplies shed 49 cents to $13.01 in swopping ownership of 79,888 shares and Tropical Battery dipped 14 cents to close at $2.61, with 624,509 units changing hands.

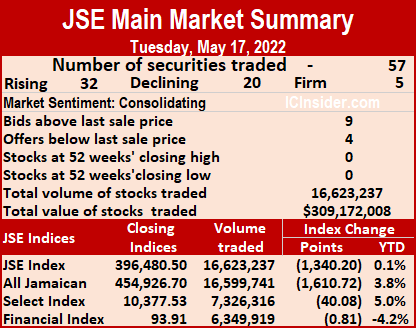

Spur Tree Spices increased 12 cents ending at $3.90, with 946,973 stocks crossing the market, Stationery and Office Supplies shed 49 cents to $13.01 in swopping ownership of 79,888 shares and Tropical Battery dipped 14 cents to close at $2.61, with 624,509 units changing hands. Trading ended with 57 securities compared to 56 on Monday, with 32 rising, 20 declining and five ending unchanged.

Trading ended with 57 securities compared to 56 on Monday, with 32 rising, 20 declining and five ending unchanged. At the close, Barita Investments rose 86 cents to $89.90 after exchanging 22,699 shares, Caribbean Cement fell $2.20 to close at $64.80 after trading 102,605 stocks, Caribbean Producers shed $1.53 to $15.44, with an exchange of 332,609 stock units. Eppley advanced $2.10 to end at $48, trading 1,874 units, GraceKennedy popped 50 cents in closing at $109, with 128,518 shares changing hands, Guardian Holdings gained $2.50 to close at $515 with the swapping of 19,135 units. Jamaica Broilers climbed 60 cents to $28.40 in trading 14,231 stocks, Jamaica Producers gained 50 cents to $23.10 after exchanging 34,059 stock units, Jamaica Stock Exchange declined $1.30 to $20.70, with 131,470 stock units crossing the market. JMMB Group dropped $2 to end at $46 in an exchange of 2,858,891 shares, Kingston Properties lost 38 cents at $8.30 in switching ownership of 16,369 units, Kingston Wharves declined 40 cents in closing at $39.05, with 1,152 stocks clearing the market. Massy Holdings fell $2.50 to $94 with an exchange of 3,851 shares, Mayberry Investments shed $1.30 to close at $11.50, with 590,935 stocks changing hands, MPC Caribbean Clean Energy rallied $13.99 to end at $109 while exchanging 34 stock units. NCB Financial lost $2.15 in closing at $109.11 after 27,271 units crossed the market, Palace Amusement dropped $164.02 to $955 in exchanging 764 units, PanJam Investment fell 50 cents to $66 after an exchange of 24,981 stock units. Sagicor Group shed 70 cents to end at $55 in switching ownership of 1,316,087 stocks, Seprod increased 51 cents to $72 while exchanging 8,283 shares and Supreme Ventures rallied $2.20 in closing at $31.50 after trading 156,869 shares.

At the close, Barita Investments rose 86 cents to $89.90 after exchanging 22,699 shares, Caribbean Cement fell $2.20 to close at $64.80 after trading 102,605 stocks, Caribbean Producers shed $1.53 to $15.44, with an exchange of 332,609 stock units. Eppley advanced $2.10 to end at $48, trading 1,874 units, GraceKennedy popped 50 cents in closing at $109, with 128,518 shares changing hands, Guardian Holdings gained $2.50 to close at $515 with the swapping of 19,135 units. Jamaica Broilers climbed 60 cents to $28.40 in trading 14,231 stocks, Jamaica Producers gained 50 cents to $23.10 after exchanging 34,059 stock units, Jamaica Stock Exchange declined $1.30 to $20.70, with 131,470 stock units crossing the market. JMMB Group dropped $2 to end at $46 in an exchange of 2,858,891 shares, Kingston Properties lost 38 cents at $8.30 in switching ownership of 16,369 units, Kingston Wharves declined 40 cents in closing at $39.05, with 1,152 stocks clearing the market. Massy Holdings fell $2.50 to $94 with an exchange of 3,851 shares, Mayberry Investments shed $1.30 to close at $11.50, with 590,935 stocks changing hands, MPC Caribbean Clean Energy rallied $13.99 to end at $109 while exchanging 34 stock units. NCB Financial lost $2.15 in closing at $109.11 after 27,271 units crossed the market, Palace Amusement dropped $164.02 to $955 in exchanging 764 units, PanJam Investment fell 50 cents to $66 after an exchange of 24,981 stock units. Sagicor Group shed 70 cents to end at $55 in switching ownership of 1,316,087 stocks, Seprod increased 51 cents to $72 while exchanging 8,283 shares and Supreme Ventures rallied $2.20 in closing at $31.50 after trading 156,869 shares. Sygnus Real Estate Finance lost $1.70 to $15.10 after 5,150 units changed hands and Wisynco Group declined 45 cents to $22.50 in trading 654,361 stocks.

Sygnus Real Estate Finance lost $1.70 to $15.10 after 5,150 units changed hands and Wisynco Group declined 45 cents to $22.50 in trading 654,361 stocks.