Обновили на порносайте

pornobolt.tv порно страничку о том как парень выебал пизду мачехи, которая устала от своего муженька

Комиксы, Манга читать онлайн на Русском языке Ei jälkiä pölystä: muista tämän puhdistusliuoksen koostumus - Rauman Varaosahalli

Mitkä kukat puutarhurit istuttavat taimille helmikuussa: 3 suosittua lajia - Rauman Varaosahalli

Älä kiirehdi vaihtamaan älypuhelimen akkua: 6 tapaa säästää latausta - Rauman Varaosahalli

Miksi kokeneet emännät eivät heitä pois munakartonkipakkauksia: 6 tarpeellista käyttötarkoitusta - Rauman Varaosahalli

Hernemato ei enää koskaan ilmesty - agronomi on ehdottanut kahta yksinkertaista toimenpidettä - Rauman Varaosahalli

Valurautaiset paistinpannut pysyvät vapaina rasvasta ja noesta: kokeile tätä välttämätöntä ratkaisua - Rauman Varaosahalli

Älä heitä niitä pois: lääkäri selitti, miksi kirsikan lehdet ovat arvokkaampia kuin itse marjat - Rauman Varaosahalli

Älä heitä tölkkejä pois: 12 tapaa käyttää niitä kotona ja maaseudulla - Rauman Varaosahalli

Älä heitä sipulin kuoria pois: sitä varten tämä 'roska' on ennen uutta vuotta - Rauman Varaosahalli

Kuoren maku yllättää sinut: muista tämä paistettujen perunoiden resepti - Rauman Varaosahalli

Älä heitä vanhaa mattoasi pois: 9 ideaa sen käyttämiseen kotona ja maaseudulla - Rauman Varaosahalli

Ikkunalaudastasi tulee kukkivien orkideoiden tuoksuinen: lehtikirja kauniiden kukkien kasvattamiseen - Rauman Varaosahalli

Älä heitä paperipyyhkeiden hylsyjä pois: 9 tapaa käyttää niitä kotona ja keittiössä - Rauman Varaosahalli

Sekoita ruokasooda ja Fairy: et usko, mitä tämä seos voi tehdä - Rauman Varaosahalli

Älä heitä vanhoja muovipusseja pois: 5 tapaa käyttää niitä kotona ja kodissa - Rauman Varaosahalli

Terveysministeriö kertoi, mitä viruksia Valko-Venäjällä tällä hetkellä liikkuu - Rauman Varaosahalli

Älä heitä sipulin kuoria pois: tulet hämmästymään, miten fiksut puutarhurit käyttävät niitä - Rauman Varaosahalli

Mistä tunnistaa kypsän appelsiinin: muutama lehtitieto kypsien ja maukkaiden hedelmien valintaan - Rauman Varaosahalli

Miksi vetyperoksidia lisätään lattioita puhdistettaessa: kokeneiden kotiäitien menetelmä - Rauman Varaosahalli

Älä heitä paperipyyhkeiden hylsyjä pois: 7 tapaa käyttää niitä kotona ja keittiössä - Rauman Varaosahalli

Älä kiirehdi hankkiutumaan eroon vanhasta matosta: 8 hyödyllistä tapaa käyttää sitä kotona ja maaseudulla - Rauman Varaosahalli

Monet kotiäidit kaatavat väärin kiehuvaa vettä lavuaariin: tässä on, mikä voi vahingoittua - Rauman Varaosahalli

Miksi esi-isämme kantoivat mukanaan laakerinlehteä: muutama niksi isoäideiltämme - Rauman Varaosahalli

Miten saat takaisin pehmeyden vuodevaatteisiisi: 8 vinkkiä fiksuilta ja säästäväisiltä emänniltä - Rauman Varaosahalli

Nokkela muurahaisloukku: tämä on ainoa tapa pelastaa hedelmäpuut tuholaisilta - Rauman Varaosahalli

Do ziemniaków i pierogów: zrób najsmaczniejszy sos grzybowy na Boże Narodzenie - Bludenz

Jeśli przegapiłeś ten smak: jak zrobić chrupiącą sałatkę z zielonej cebuli - Bludenz

Marynowane grzyby w kilka godzin - na stół lub dla odmiany - Bludenz

Zbiory będą zadowolone z obfitości: dodaj kaszę gryczaną do gleby w kwietniu - Bludenz

Sałatka ze szczotką: zwięzły przepis, który pasuje absolutnie do wszystkiego - Bludenz

Nie wyrzucaj klipsów do torebek na chleb: pamiętaj o 9 przydatnych sposobach ich wykorzystania - Bludenz

Wlać bezpośrednio do garnka - mętny bulion stanie się klarowny w ciągu kilku sekund - Bludenz

Idealny przepis dla tych, którzy się spieszą: szybki gulasz z kurczakiem w chińskim stylu - Bludenz

Danie z dawnych czasów: wieloletni przepis na kolache od 'MasterChefa' Vladimira Yaroslavsky'ego - Bludenz

Goście będą oblizywać palce: kanapki z awokado - sekret tkwi w specjalnym sosie - Bludenz

Delikatny, kwaśny i obłędnie pyszny: najlepszy sos do klopsików - goście połkną go językami - Bludenz

Nie wyrzucaj kiełków starych ziemniaków: zręczne gospodynie domowe znalazły dla nich przydatne zastosowania - Bludenz

Królewski luksus na Twoim stole: sekret najbardziej soczystej ryby w piekarniku - Bludenz

Jak jeszcze sprytne hostessy używają folii aluminiowej: 4 niezbędne sytuacje domowe - Bludenz

Oto funkcje, o których istnieniu nawet nie wiedziałeś: nie uwierzysz, co potrafi Twoja kuchenka mikrofalowa - Bludenz

Przepis na magiczny sok dyniowy prosto z Hogwartu: poczuj się jak Harry Potter - Bludenz

Uwaga: Rosjanom powiedziano, jak wybrać gotowe mięso na kebab - Bludenz

Nie wrócisz do innych przepisów - przygotuj ziemniaki w mundurkach metodą Iny Garten - Bludenz

Twarożek czekoladowy i ciasto wiśniowe: palce lizać - Bludenz

Sprzedawane w każdym Magnit: Roskachestvo znalazł najlepsze naleśniki z mięsem - Bludenz

Jedz chipsy w ten sposób: nie szkodzą, tylko bawią - Bludenz

Okulary będą lśnić czystością: pamiętaj o składnikach tego domowego środka czyszczącego - Bludenz

Co najczęściej psuje pralkę: zapamiętaj 5 najczęstszych błędów - Bludenz

Zalej twaróg wrzątkiem: jeśli tak się stanie, wyrzuć go do kosza - Bludenz

Trzy dania, które pokochasz: co zrobić z wczorajszego makaronu? - Bludenz

Kotlety będą soczyste i rozpłyną się w ustach: wystarczy dodać ten produkt do mięsa mielonego - Bludenz

Zostaw łyżkę w worku z mąką - korzyści będą niesamowite: zapomniana sztuczka naszych babć - Bludenz

Pożółkły plastik znów będzie lśnił bielą: wypróbuj ten roztwór czyszczący z mydłem - Bludenz

Nieopisanie świeża i lekka: przepis na pyszną wiosenną sałatkę - Bludenz

Bez piekarnika, bez mąki - pizza na stole w 10 minut - Bludenz

Pasztet z piekarnika w pięć minut, który podbił internet - Bludenz

Najszybszy przepis na delikatne naleśniki - gotują się w kuchence mikrofalowej w 45 sekund - Bludenz

Astrologická předpověď pro 30.04 pro všechna znamení zvěrokruhu - Bludenz

První a nejdůležitější krmení česnekem: 2 lžíce na záhon - velké a šťavnaté hlavy - Dumeto

Rajčata jsou sladká, masitá a téměř 5 kg na keř: zahrádkáři jsou z této nové odrůdy nadšeni - Dumeto

Odstraňte tyto části stromu: příští rok bude růst s bláznivou silou - Dumeto

Tyto 4 druhy zeleniny můžete bez obav sázet i v červenci: sklizeň bude zajištěna - Dumeto

Kde začít s výukou angličtiny: zkuste se naučit první slovíčka - Dumeto

Gladioly potěší bujnými květy - vysazujte je pouze podle těchto pravidel - Dumeto

Mají železné zdraví: 4 dlouhověká plemena koček, která se dožívají až 25 let - Dumeto

Zvyšte výnosy půdy bez kapky 'chemie': metody zkušených dachařů - Dumeto

Jak znovu použít hliníkovou fólii: sedm osvědčených způsobů pro domácnost - Dumeto

Po medvědovi nezůstane ani stopa: jak zachránit brambory před zákeřným škůdcem - geniální trik - Dumeto

Zbavte se plevele pouze v těchto dnech: účinek je okamžitý - Dumeto

Pračka přestane při odstřeďování skákat: 4 tipy pro odstranění vibrací - Dumeto

Vaše sazenice obsadili roztoči - žádný problém: lidový lék za pár drobných vaše sazenice zachrání - Dumeto

Nejmódnější manikúra podzimu-2023: stylová varianta v kávovém odstínu (foto) - Dumeto

Jak ještě šikovné hospodyňky používají mouku v domácnosti: 6 užitečných lifehacků pro domácnost a kuchyň - Dumeto

Rusové 'trik', jak ušetřit peníze na dovolené u moře - technika je velmi jednoduchá - Dumeto

Tento krásný siderát je 100krát lepší než hořčice: zvýší výnosy rajčat a zbaví je plevele - Dumeto

Půdní mušky si zapomenou cestu k sazenicím - prolijte je tímto přípravkem - Dumeto

Budete vypadat jako buran: stylista jmenuje hlavní chybu při výběru kabelky - Dumeto

Nevyhazujte staré plastové karty: 5 způsobů, jak je využít doma i v domácnosti - Dumeto

Venku je -30 °C a sněhová vánice, ale u vás doma je teplo: už žádný průvan z okna - 1 geniální způsob - Dumeto

Nevyhazujte svou starou bundu: 9 užitečných způsobů využití nepotřebného oblečení - Dumeto

Stejně dobré jako luxusní, ale za hubičku: 4 nejlepší levné rtěnky a lesky na rty - Dumeto

Nenechávejte špinavé nádobí přes noc venku: bojte se bakterií a negativní energie - Dumeto

4 věci, které ničí i dokonalé vztahy - Dumeto

Expertul în somn dezvăluie: Bea această poțiune magică și spune adio sforăitului pentru totdeauna - Chelsea Larabee

Fericitul câștigător a 100.000 de cărți de răzuit: 'Oamenii ar fi crezut că sunt nebun.' - Chelsea Larabee

V-ați săturat de calcar în baie? Află cele mai eficiente sfaturi ale experților pentru a scăpa de el - Chelsea Larabee

Kim Kardashian cu vești nebănuite - Chelsea Larabee

Economisiți bani la factura de încălzire: Iată 7 sfaturi eficiente - Chelsea Larabee

Un concurent de la 'Holder vi et år' dezvăluie: Nu vezi asta în program - Chelsea Larabee

O tânără de 22 de ani a postat o fotografie online: 37 de minute mai târziu, și-a dat seama de grozăvia jenantă - Chelsea Larabee

Toată lumea ar trebui să știe acest lucru despre caloriferul lor: Cum să evitați o factură prea mare - Chelsea Larabee

Expert: Trebuie să acționăm curând, altfel Ucraina este doar începutul - Chelsea Larabee

Nicole a încercat să oprească alarma de pe Apple Watch-ul iubitului ei: Apoi a făcut o descoperire care i-a zguduit lumea - Chelsea Larabee

Îl lasă în pantofi peste noapte - pantofii redevin ca și cum ar fi noi - Chelsea Larabee

Un medic avertizează asupra unei pandemii invizibile: Mă tem de ea mai mult decât de Corona - Chelsea Larabee

Coaforul danez oferă 3 motive probabile pentru care părul tău pare decolorat - Chelsea Larabee

Majoritatea oamenilor recunosc o broască la prima vedere: doar câțiva recunosc calul în mai puțin de 10 secunde - Chelsea Larabee

O mamă și-a lăsat fiul de 9 ani singur, fără acces la apă și căldură, timp de doi ani: Atât de lungă este pedeapsa - Chelsea Larabee

Își face un tatuaj cu un breton pentru a-și acoperi chelia, dar izbucnește în lacrimi din cauza rezultatului dezastruos - Chelsea Larabee

Economisiți mii de lire sterline în această iarnă cu ajutorul acestui mnemonic simplu - Chelsea Larabee

Un clip sălbatic devine viral: Transportă o întreagă colonie de albine pe braț - Chelsea Larabee

De aceea, mingile de tenis și bilele de staniol sunt de aur pentru rufele tale - Chelsea Larabee

Un bărbat aflat într-un Range Rover a intrat direct într-o mulțime de oameni pe o stradă pietonală din Germania - Chelsea Larabee

Experții avertizează: Nu ignorați niciodată aceste mirosuri - Chelsea Larabee

Donald Trump, cu o soluție drastică la o problemă care se agravează: Împușcați-i - Chelsea Larabee

Trucul cu staniol pe balcon: La ce se folosește? - Chelsea Larabee

Testul de vedere: Ai ochi de șoim dacă poți vedea ce ardei iute este desenat - Chelsea Larabee

O femeie deschide o conservă de fasole cumpărată din supermarket - și găsește un șarpe - Chelsea Larabee

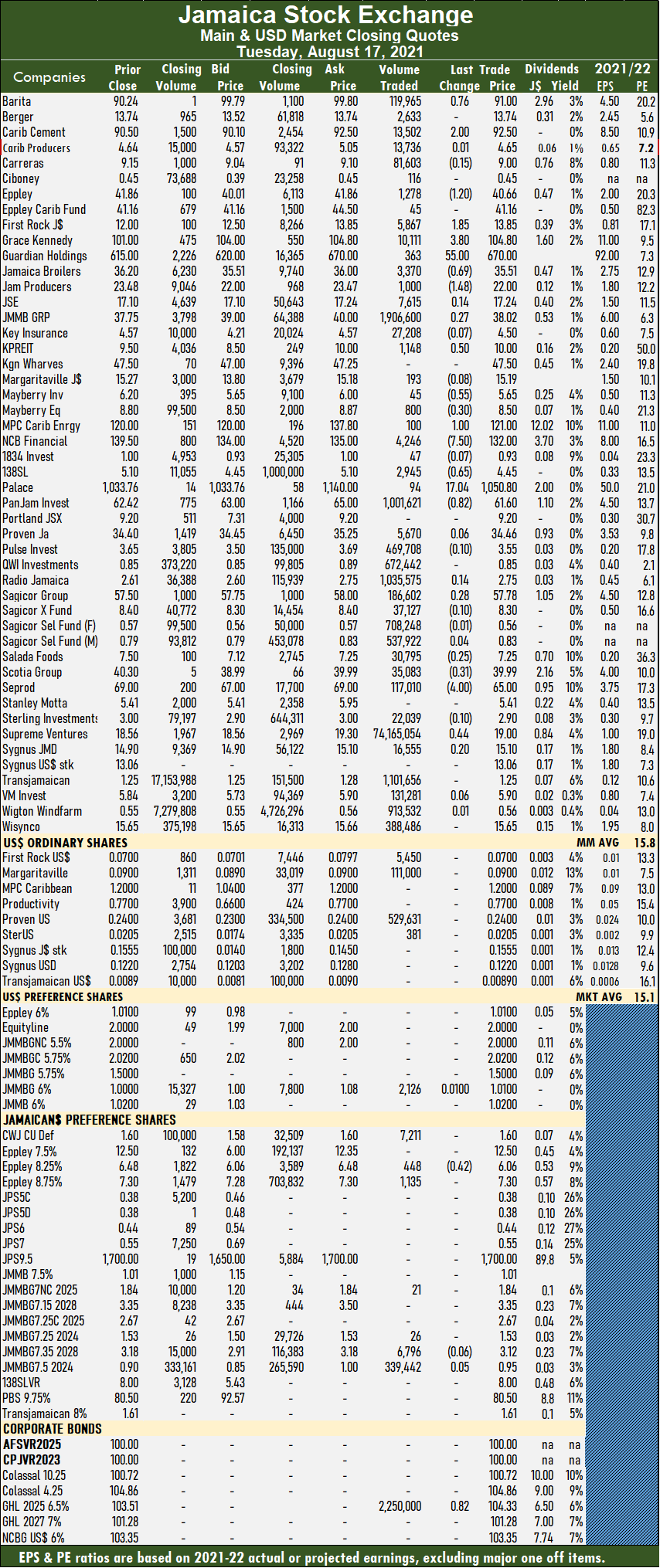

Trading averaged 1,649,728 units at $31,269,659, compared to 672,476 shares at $37,672,811 on Monday. Trading month to date averages 391,623 units at $8,187,803, in contrast to 245,797 units at $5,512,406 on Monday. July ended with an average of 322,932 units at $15,201,099.

Trading averaged 1,649,728 units at $31,269,659, compared to 672,476 shares at $37,672,811 on Monday. Trading month to date averages 391,623 units at $8,187,803, in contrast to 245,797 units at $5,512,406 on Monday. July ended with an average of 322,932 units at $15,201,099. ry Investments slipped 55 cents to $5.65 with 45 units crossing the exchange. Mayberry Jamaican Equities shed 30 cents to $8.50 with the swapping of 800 stocks, MPC Caribbean Clean Energy spiked $1 to $121 with an exchange of 100 stock units, NCB Financial dropped $7.50 to $132 with an exchange of 4,246 shares. 138 Student Living dropped 65 cents to $4.45 in switching ownership of 2,945 stock units, Palace Amusement rallied $17.04 to $1,050.80 after 94 stocks cleared the market, PanJam Investment shed 82 cents to $61.60 with a transfer of 1,001,621 shares, Radio Jamaica gained 14 cents in closing at a 52 weeks’ high of $2.75 while exchanging 1,035,575 unit, Sagicor Group popped 28 cents to close at $57.78 with 186,602 stocks changing hands. Salada Foods shed 25 cents to end at $7.25 in exchanging 30,795 units. Scotia Group lost 31 cents to finish at $39.99 in an exchange of 35,083 stock units, Seprod dropped $4 to close at $65 with the swapping of 117,010 stocks, Supreme Ventures rose 44 cents in ending at $19 after 74,165,054 shares crossed the market and Sygnus Credit Investments popped 20 cents to $15.10 with 16,555 stocks changing hands.

ry Investments slipped 55 cents to $5.65 with 45 units crossing the exchange. Mayberry Jamaican Equities shed 30 cents to $8.50 with the swapping of 800 stocks, MPC Caribbean Clean Energy spiked $1 to $121 with an exchange of 100 stock units, NCB Financial dropped $7.50 to $132 with an exchange of 4,246 shares. 138 Student Living dropped 65 cents to $4.45 in switching ownership of 2,945 stock units, Palace Amusement rallied $17.04 to $1,050.80 after 94 stocks cleared the market, PanJam Investment shed 82 cents to $61.60 with a transfer of 1,001,621 shares, Radio Jamaica gained 14 cents in closing at a 52 weeks’ high of $2.75 while exchanging 1,035,575 unit, Sagicor Group popped 28 cents to close at $57.78 with 186,602 stocks changing hands. Salada Foods shed 25 cents to end at $7.25 in exchanging 30,795 units. Scotia Group lost 31 cents to finish at $39.99 in an exchange of 35,083 stock units, Seprod dropped $4 to close at $65 with the swapping of 117,010 stocks, Supreme Ventures rose 44 cents in ending at $19 after 74,165,054 shares crossed the market and Sygnus Credit Investments popped 20 cents to $15.10 with 16,555 stocks changing hands.

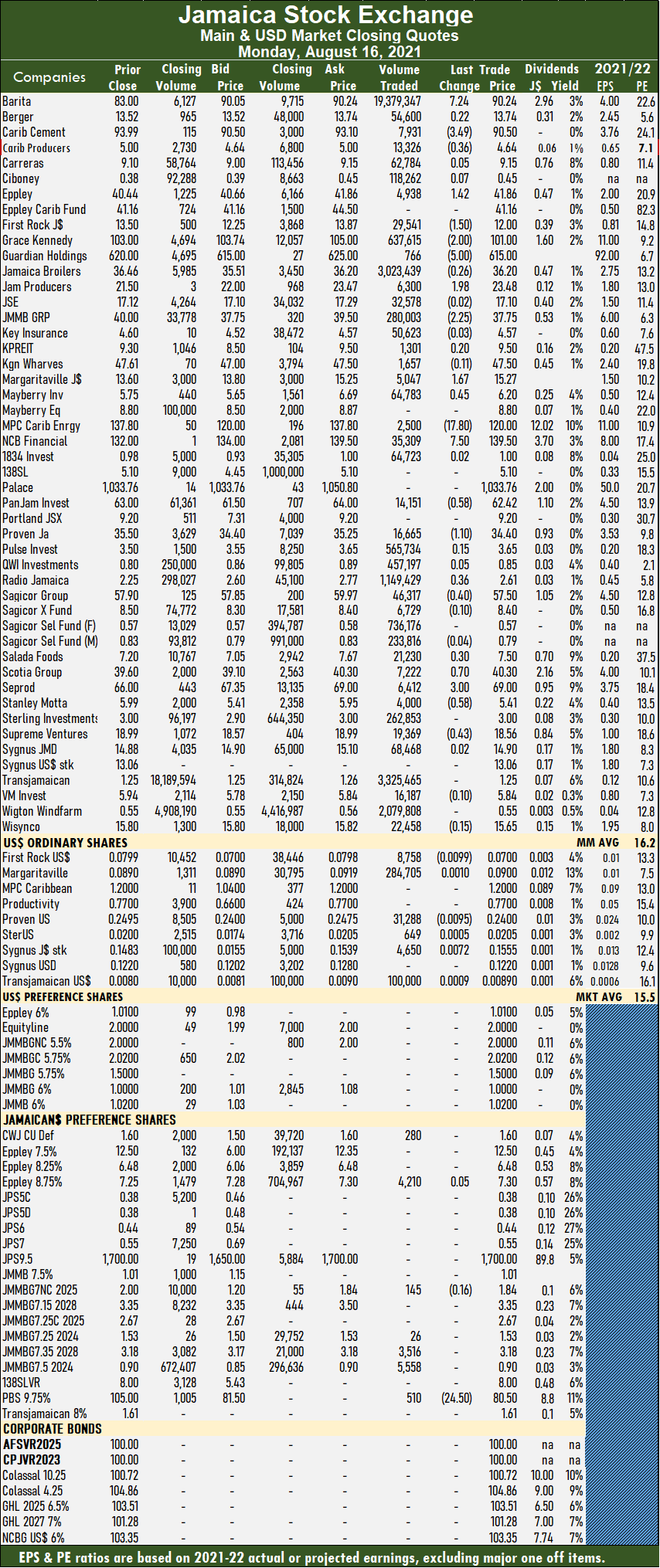

At the close, Barita Investments spiked $7.24 to $90.24 with an exchange of 19,379,347 shares, Berger Paints gained 22 cents in ending at $13.74 after trading 54,600 stock units, Caribbean Cement fell $3.49 to $90.50, with the swapping of 7,931 stocks. Caribbean Producers dipped 36 cents $4.64 in transferring 13,326 units, Eppley rose $1.42 to $41.86 with 4,938 stock units crossing the market, First Rock Capital shed $1.50 to $12 with 29,541 stocks clearing the market, GraceKennedy fell $2 to $101 in switching ownership of 637,615 shares. Guardian Holdings slid $5 to $615 in trading 766 units, Jamaica Broilers lost 26 cents to end at $36.20 with 3,023,439 shares changing hands, Jamaica Producers rallied $1.98 to $23.48 in trading 6,300 stock units. JMMB Group declined $2.25 to $37.75 with 280,003 stocks crossing the exchange after trading at an intraday high of $43.47, Kingston Properties popped 20 cents to $9.50 after exchanging 1,301 stocks, Margaritaville popped $1.67 to $15.27 in an exchange of 5,047 shares, Mayberry Investments rose 45 cents to $6.20 in transferring 64,783 stock units. MPC Caribbean Clean Energy dropped $17.80 to $120 with an exchange of 2,500 units, NCB Financial spiked $7.50 to $139.50 after 35,309 stocks crossed the exchange, PanJam Investment shed 58 cents to $62.42 with 14,151 stock units clearing the market.

At the close, Barita Investments spiked $7.24 to $90.24 with an exchange of 19,379,347 shares, Berger Paints gained 22 cents in ending at $13.74 after trading 54,600 stock units, Caribbean Cement fell $3.49 to $90.50, with the swapping of 7,931 stocks. Caribbean Producers dipped 36 cents $4.64 in transferring 13,326 units, Eppley rose $1.42 to $41.86 with 4,938 stock units crossing the market, First Rock Capital shed $1.50 to $12 with 29,541 stocks clearing the market, GraceKennedy fell $2 to $101 in switching ownership of 637,615 shares. Guardian Holdings slid $5 to $615 in trading 766 units, Jamaica Broilers lost 26 cents to end at $36.20 with 3,023,439 shares changing hands, Jamaica Producers rallied $1.98 to $23.48 in trading 6,300 stock units. JMMB Group declined $2.25 to $37.75 with 280,003 stocks crossing the exchange after trading at an intraday high of $43.47, Kingston Properties popped 20 cents to $9.50 after exchanging 1,301 stocks, Margaritaville popped $1.67 to $15.27 in an exchange of 5,047 shares, Mayberry Investments rose 45 cents to $6.20 in transferring 64,783 stock units. MPC Caribbean Clean Energy dropped $17.80 to $120 with an exchange of 2,500 units, NCB Financial spiked $7.50 to $139.50 after 35,309 stocks crossed the exchange, PanJam Investment shed 58 cents to $62.42 with 14,151 stock units clearing the market.  Proven Investments slipped $1.10 to $34.40 in exchanging 16,665 shares, Radio Jamaica gained 36 cents to close at a 52 weeks’ high of $2.61 with the swapping of 1,149,429 shares, Sagicor Group lost 40 cents t close at $57.50 with an exchange of 46,317 stock units, Salada Foods rallied 30 cents to $7.50 with the swapping of 21,230 shares, Scotia Group rose 70 cents to $40.30 with 7,222 stocks crossing the exchange. Seprod advanced $3 to $69 with 6,412 units changing hands, Stanley Motta dipped 58 cents to $5.41 in transferring 4,000 stock units and Supreme Ventures dipped 43 cents to $18.56 with 19,369 shares changing hands.

Proven Investments slipped $1.10 to $34.40 in exchanging 16,665 shares, Radio Jamaica gained 36 cents to close at a 52 weeks’ high of $2.61 with the swapping of 1,149,429 shares, Sagicor Group lost 40 cents t close at $57.50 with an exchange of 46,317 stock units, Salada Foods rallied 30 cents to $7.50 with the swapping of 21,230 shares, Scotia Group rose 70 cents to $40.30 with 7,222 stocks crossing the exchange. Seprod advanced $3 to $69 with 6,412 units changing hands, Stanley Motta dipped 58 cents to $5.41 in transferring 4,000 stock units and Supreme Ventures dipped 43 cents to $18.56 with 19,369 shares changing hands. The bad news is that many persons ignore ICInnsider.com’s forecast of great things to come from the company, with many chasing after it on Friday after the release of the results on Thursday. Some readers bought into the vision but not all. The good news is that, with projected earnings of 45 cents per share, there is much room for this stock to run. The other good news is that there is much more to be gained by owning the stock as the company completes projects that will boost revenues and grow profits in the years to come.

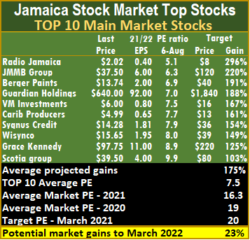

The bad news is that many persons ignore ICInnsider.com’s forecast of great things to come from the company, with many chasing after it on Friday after the release of the results on Thursday. Some readers bought into the vision but not all. The good news is that, with projected earnings of 45 cents per share, there is much room for this stock to run. The other good news is that there is much more to be gained by owning the stock as the company completes projects that will boost revenues and grow profits in the years to come. With those strong results and the promise of 45 cents per share to be earned for this year and 80 cents in the next year, one would be forgiven if they felt that RJR should be dislodged from the ICTOP10 listing. Well, the top three Main Market stocks are headed again by Radio Jamaica, but the potential gains rose from 296 percent to 300 percent, even as the price moved up to a 52 weeks’ closing high of $2.25 from $2.02 last week, due to upgrading in the earnings to 45 cents per share or $1.1 billion. RJR is followed by

With those strong results and the promise of 45 cents per share to be earned for this year and 80 cents in the next year, one would be forgiven if they felt that RJR should be dislodged from the ICTOP10 listing. Well, the top three Main Market stocks are headed again by Radio Jamaica, but the potential gains rose from 296 percent to 300 percent, even as the price moved up to a 52 weeks’ closing high of $2.25 from $2.02 last week, due to upgrading in the earnings to 45 cents per share or $1.1 billion. RJR is followed by The PE Ratio of the TOP 10 Junior Market stocks trade at a 44 percent discount to the market average and Main Market stocks 54 percent, indicating the potential gains in these stocks compared with many of those outsides of them.

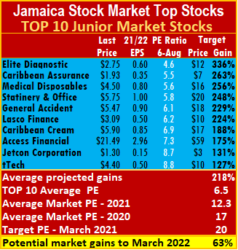

The PE Ratio of the TOP 10 Junior Market stocks trade at a 44 percent discount to the market average and Main Market stocks 54 percent, indicating the potential gains in these stocks compared with many of those outsides of them. This past week, the average gains projected for the Junior Market moved from 218 percent to 193 percent and Main Market stocks to 180 percent from 175 percent.

This past week, the average gains projected for the Junior Market moved from 218 percent to 193 percent and Main Market stocks to 180 percent from 175 percent. The Junior Market Top 10 stocks average PE is a mere 6.9, just 54 percent of the market average, indicating substantial gains ahead.

The Junior Market Top 10 stocks average PE is a mere 6.9, just 54 percent of the market average, indicating substantial gains ahead.

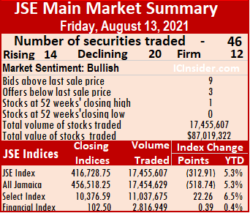

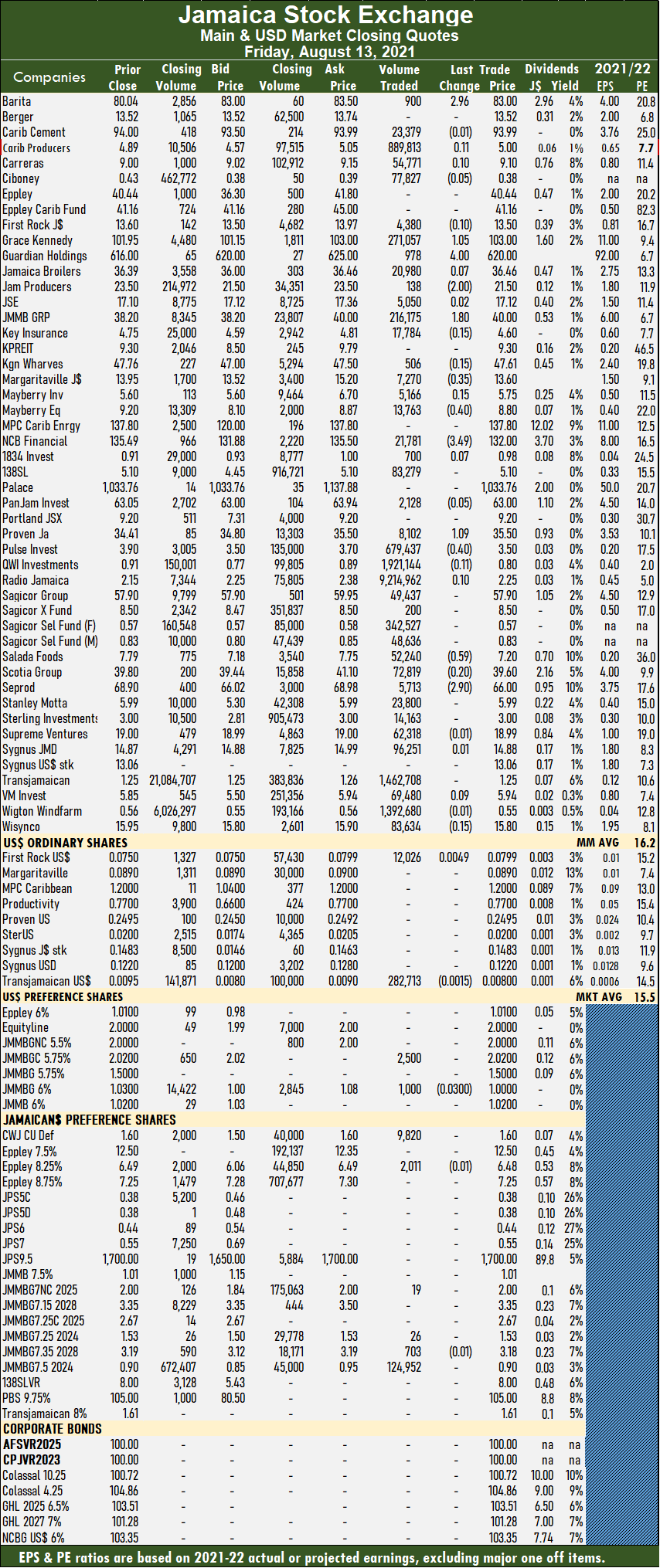

Trading averaged 379,470 units at $1,891,724, up from 186,829 shares at $859,293 on Thursday. Trading month to date averages 192,325 units at $1,482,074, in contrast to 167,373 units at $1,427,454 on Thursday. July ended with an average of 322,932 units at $15,201,099.

Trading averaged 379,470 units at $1,891,724, up from 186,829 shares at $859,293 on Thursday. Trading month to date averages 192,325 units at $1,482,074, in contrast to 167,373 units at $1,427,454 on Thursday. July ended with an average of 322,932 units at $15,201,099. Pulse Investments fell 40 cents to $3.50 with the swapping of 679,437 shares, Salada Foods lost 59 cents in ending at $7.20 in an exchange of 52,240 stock units, after posting results that exceeded that of 2020 but well below amounts required to support the stock at recently elevated prices, Scotia Group shed 20 cents in closing at $39.60 and trading 72,819 stocks and Seprod fell $2.90 to $66 with 5,713 shares clearing the market.

Pulse Investments fell 40 cents to $3.50 with the swapping of 679,437 shares, Salada Foods lost 59 cents in ending at $7.20 in an exchange of 52,240 stock units, after posting results that exceeded that of 2020 but well below amounts required to support the stock at recently elevated prices, Scotia Group shed 20 cents in closing at $39.60 and trading 72,819 stocks and Seprod fell $2.90 to $66 with 5,713 shares clearing the market. We projected revenues of $1.465 billion and they delivered $1.449 billion in the quarter. Our forecast for TV revenues was $626.344 million, they reported $639.377. Radio revenues came in at $199.605, somewhat higher than ICInsider.com’s projection of $184.05 and the print division delivered $610,217 million versus ICI’s forecast of $635,697. Other income amounts to $29 million versus IC forecast of $19 million.

We projected revenues of $1.465 billion and they delivered $1.449 billion in the quarter. Our forecast for TV revenues was $626.344 million, they reported $639.377. Radio revenues came in at $199.605, somewhat higher than ICInsider.com’s projection of $184.05 and the print division delivered $610,217 million versus ICI’s forecast of $635,697. Other income amounts to $29 million versus IC forecast of $19 million.

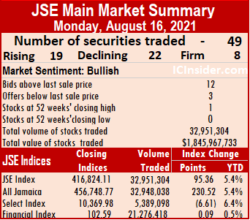

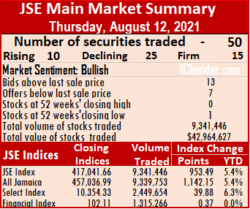

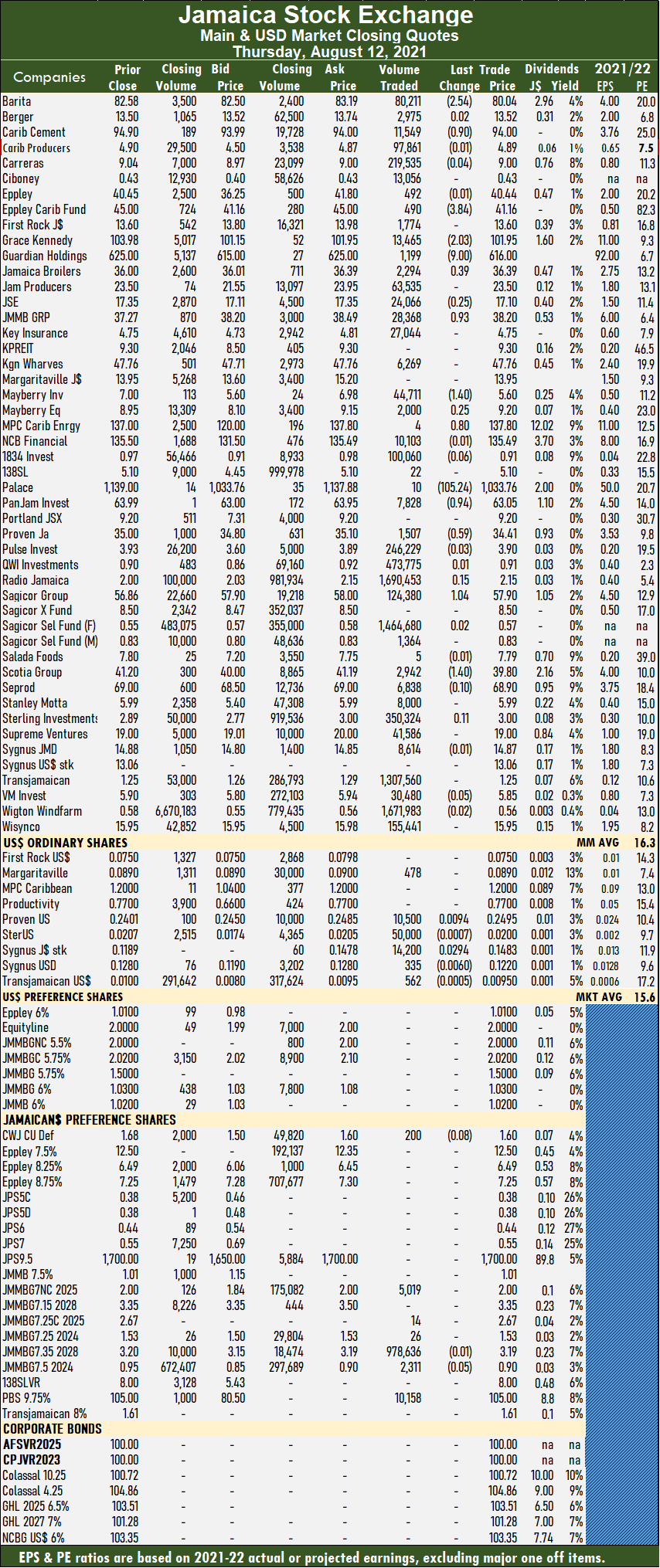

The Jamaica stock market closed on Thursday with the market recovering some of Wednesday’s losses, with the movement not strong enough to wipe those losses even as the market moved well above Wednesday’s close in early morning trading, by the close, declining stocks clobbered advancing more than two to one, with the volume and value of shares traded falling 26 percent and 67 percent respectively compared to Wednesday, on the Jamaica Stock Exchange Main Market.

The Jamaica stock market closed on Thursday with the market recovering some of Wednesday’s losses, with the movement not strong enough to wipe those losses even as the market moved well above Wednesday’s close in early morning trading, by the close, declining stocks clobbered advancing more than two to one, with the volume and value of shares traded falling 26 percent and 67 percent respectively compared to Wednesday, on the Jamaica Stock Exchange Main Market.  Trading averaged 186,829 units at $859,293, compared to 264,717 shares at $2,753,192 on Wednesday. Trading month to date averages 167,373 units at $1,427,454, in contrast to 164,075 units at $1,523,753 on Wednesday. July ended with an average of 322,932 units at $15,201,099.

Trading averaged 186,829 units at $859,293, compared to 264,717 shares at $2,753,192 on Wednesday. Trading month to date averages 167,373 units at $1,427,454, in contrast to 164,075 units at $1,523,753 on Wednesday. July ended with an average of 322,932 units at $15,201,099. Mayberry Jamaican Equities gained 25 cents to close at $9.20 after exchanging 2,000 units, MPC Caribbean Clean Energy rose 80 cents to $137.80 in trading 4 stock units, Palace Amusement plunged $105.24 to $1,033.76, with a transfer of 10 shares. PanJam Investment shed 94 cents to end at $63.05 after 7,828 stocks crossed the market, Proven Investments fell 59 cents to $34.41 in exchanging 1,507 stock units, Radio Jamaica gained 15 cents to close at $2.15, with 1,690,453 share changing hands, Sagicor Group spiked $1.04 to $57.90 with 124,380 shares clearing the market and Scotia Group fell $1.40 to $39.80 in trading 2,942 stock units.

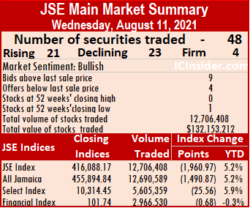

Mayberry Jamaican Equities gained 25 cents to close at $9.20 after exchanging 2,000 units, MPC Caribbean Clean Energy rose 80 cents to $137.80 in trading 4 stock units, Palace Amusement plunged $105.24 to $1,033.76, with a transfer of 10 shares. PanJam Investment shed 94 cents to end at $63.05 after 7,828 stocks crossed the market, Proven Investments fell 59 cents to $34.41 in exchanging 1,507 stock units, Radio Jamaica gained 15 cents to close at $2.15, with 1,690,453 share changing hands, Sagicor Group spiked $1.04 to $57.90 with 124,380 shares clearing the market and Scotia Group fell $1.40 to $39.80 in trading 2,942 stock units. At the close, the All Jamaican Composite Index plunged 1,490.87 points to 455,894.84, the Main Index dived 1,960.9 points to 416,088.17 and the JSE Financial Index lost 0.68 points to settle at 101.74.

At the close, the All Jamaican Composite Index plunged 1,490.87 points to 455,894.84, the Main Index dived 1,960.9 points to 416,088.17 and the JSE Financial Index lost 0.68 points to settle at 101.74. 264,717 units at $2,753,192, up from 108,192 shares at $461,546 on Tuesday. Trading month to date averages 164,075 units at $1,523,753, compared to 144,517 units at $1,284,834 on Tuesday. July ended with an average of 322,932 units at $15,201,099.

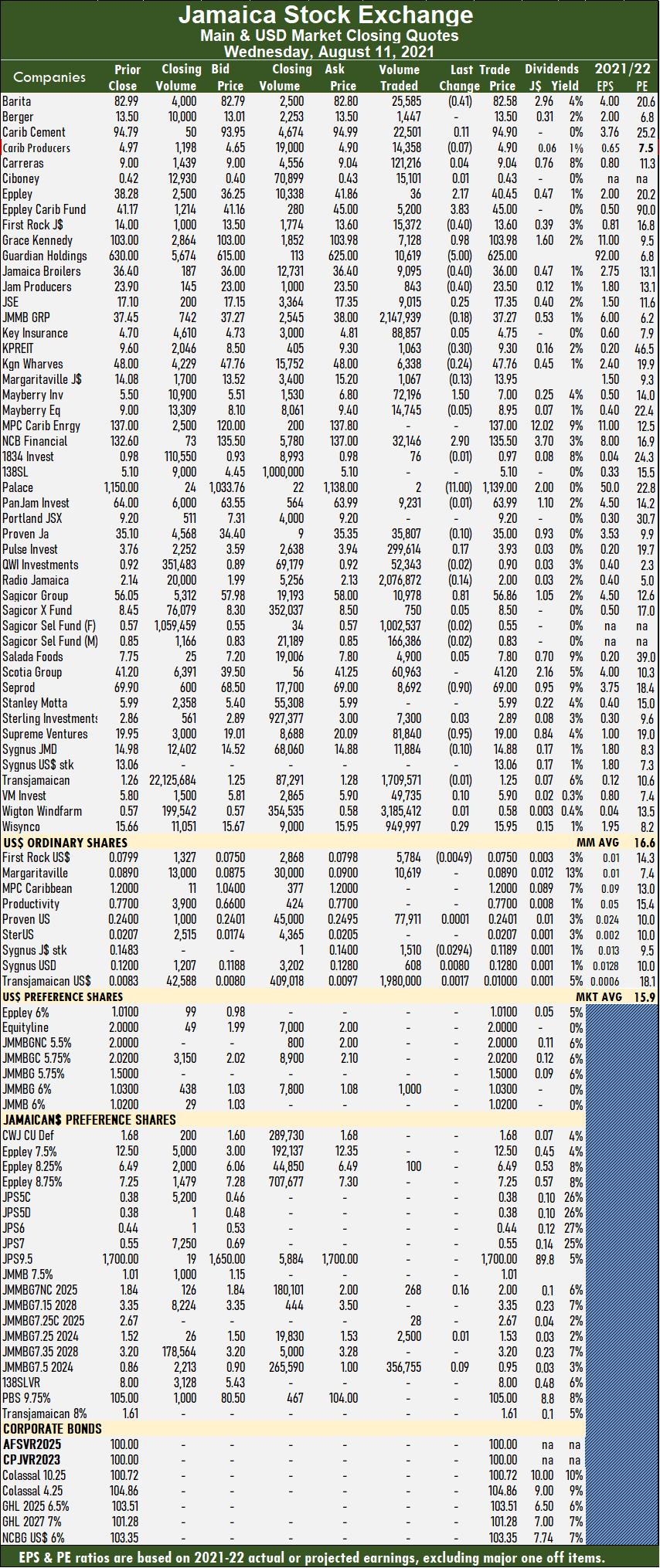

264,717 units at $2,753,192, up from 108,192 shares at $461,546 on Tuesday. Trading month to date averages 164,075 units at $1,523,753, compared to 144,517 units at $1,284,834 on Tuesday. July ended with an average of 322,932 units at $15,201,099. Kingston Wharves shed 24 cents to close at $47.76 with an exchange of 6,338 shares, Mayberry Investments spiked $1.50 to end at $7 in exchanging 72,196 units. NCB Financial popped $2.90 to $135.50 with 32,146 stock units changing hands, Palace Amusement dropped $11 to $1,139 with a transfer of two shares. Sagicor Group rallied 81 cents to $56.86 in an exchange of 10,978 stocks, Seprod shed 90 cents to close at $69 with the trading of 8,692 stock units, Supreme Ventures slipped 95 cents to $19, with 81,840 shares clearing the market and Wisynco Group gained 29 cents to close at $15.95 after exchanging 949,997 stock units.

Kingston Wharves shed 24 cents to close at $47.76 with an exchange of 6,338 shares, Mayberry Investments spiked $1.50 to end at $7 in exchanging 72,196 units. NCB Financial popped $2.90 to $135.50 with 32,146 stock units changing hands, Palace Amusement dropped $11 to $1,139 with a transfer of two shares. Sagicor Group rallied 81 cents to $56.86 in an exchange of 10,978 stocks, Seprod shed 90 cents to close at $69 with the trading of 8,692 stock units, Supreme Ventures slipped 95 cents to $19, with 81,840 shares clearing the market and Wisynco Group gained 29 cents to close at $15.95 after exchanging 949,997 stock units. At the close, the All Jamaican Composite Index rose 200.20 points to 457,385.71, the JSE Main Index popped 148.16 points to end at 418,049.14, and the JSE Financial Index shed 0.03 points to 102.42.

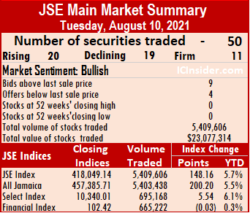

At the close, the All Jamaican Composite Index rose 200.20 points to 457,385.71, the JSE Main Index popped 148.16 points to end at 418,049.14, and the JSE Financial Index shed 0.03 points to 102.42. Trading averaged 108,192 units at $461,546, compared to 199,394 shares at $1,473,633 on Monday. Trading month to date averages 144,517 units at $1,284,834, in contrast to 153,737 units at $1,493,790 on Monday. July ended with an average of 322,932 units at $15,201,099.

Trading averaged 108,192 units at $461,546, compared to 199,394 shares at $1,473,633 on Monday. Trading month to date averages 144,517 units at $1,284,834, in contrast to 153,737 units at $1,493,790 on Monday. July ended with an average of 322,932 units at $15,201,099. Palace Amusement spiked $116.24 to $1,150 in switching ownership of 2 stock units, Pan Jam Investment rose 95 cents to $64 with an exchange of 700 stocks, Pulse Investments slipped 20 cents to $3.76 in transferring 238,941 shares, Sagicor Group dropped $2.45 to $56.05 with the swapping of 8,209 stock units, Salada Foods fell 25 cents to $7.75 in trading 80,748 shares. Scotia Group advanced $1.90 $41.20 after clearing the market of 4,197 shares, Seprod rose 88 cents to $69.90 in trading 5,876 stock units and Victoria Mutual Investments lost 20 cents to close at $5.80 with 22,233 stocks crossing the market.

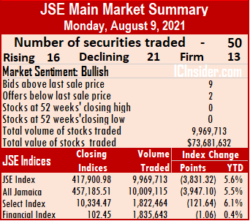

Palace Amusement spiked $116.24 to $1,150 in switching ownership of 2 stock units, Pan Jam Investment rose 95 cents to $64 with an exchange of 700 stocks, Pulse Investments slipped 20 cents to $3.76 in transferring 238,941 shares, Sagicor Group dropped $2.45 to $56.05 with the swapping of 8,209 stock units, Salada Foods fell 25 cents to $7.75 in trading 80,748 shares. Scotia Group advanced $1.90 $41.20 after clearing the market of 4,197 shares, Seprod rose 88 cents to $69.90 in trading 5,876 stock units and Victoria Mutual Investments lost 20 cents to close at $5.80 with 22,233 stocks crossing the market. The All Jamaican Composite Index dropped 3,947.10 points to 457,185.51, the Main Index dived 3,831.32 points to 417,900.98 and the JSE Financial Index slipped 1.06 points to end at 102.45.

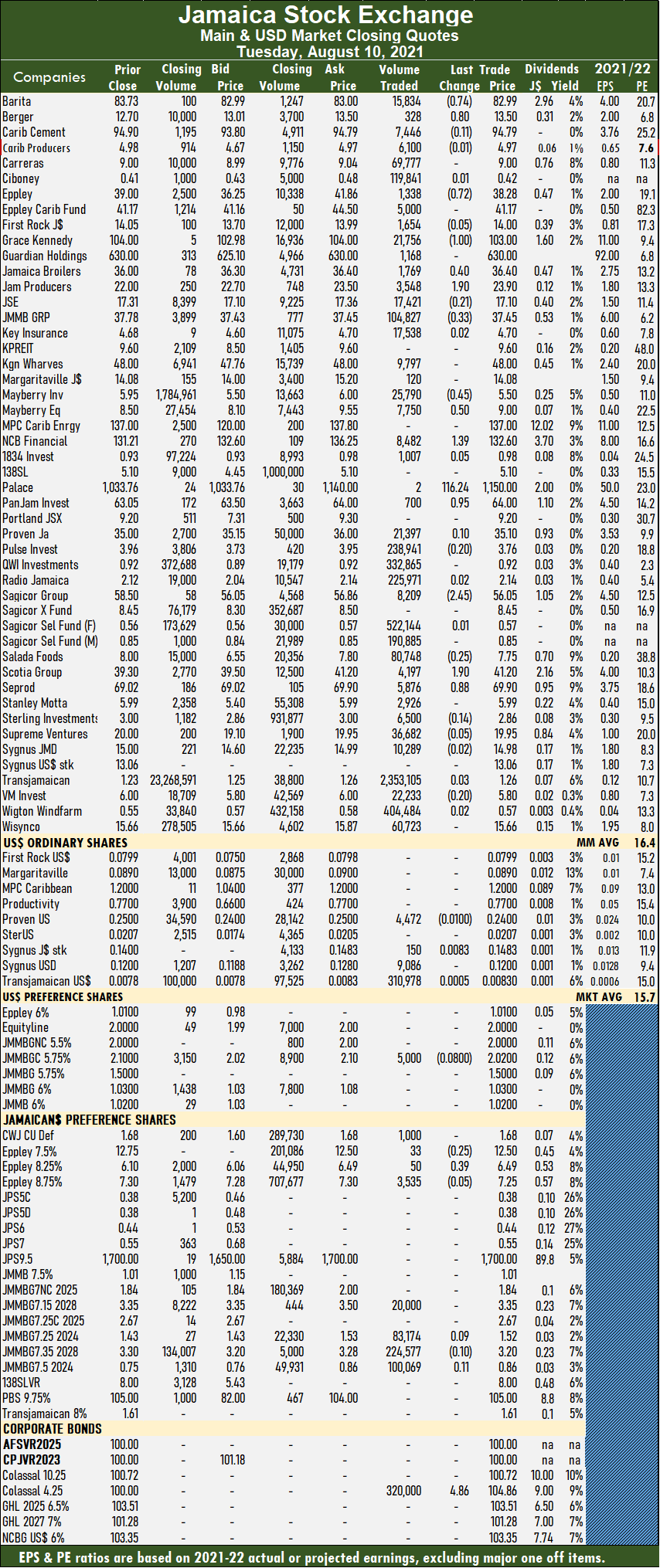

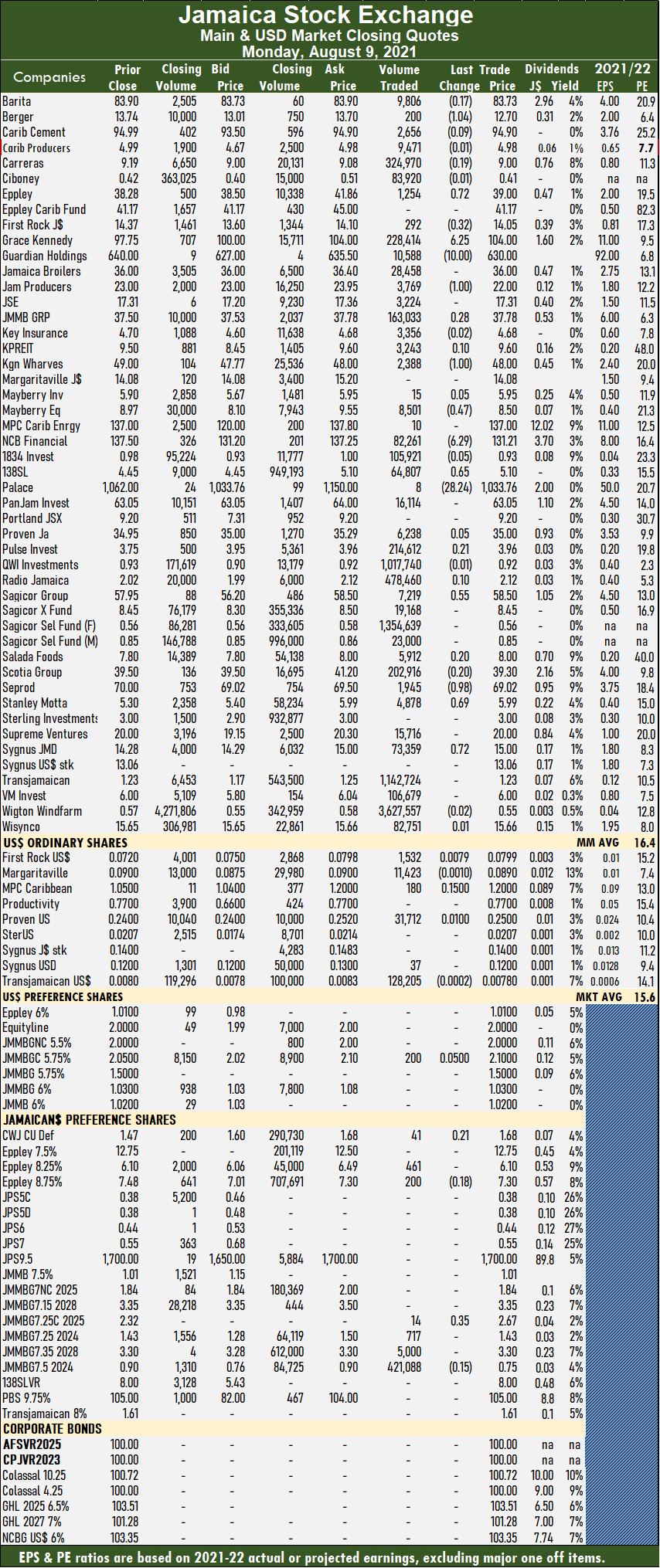

The All Jamaican Composite Index dropped 3,947.10 points to 457,185.51, the Main Index dived 3,831.32 points to 417,900.98 and the JSE Financial Index slipped 1.06 points to end at 102.45. At the close, Berger Paints fell $1.04 to $12.70 after exchanging 200 shares, Eppley spiked 72 cents to $39 in an exchange of 1,254 units, First Rock Capital fell 32 cents to end at $14.05 in exchanging 292 stock units. GraceKennedy popped $6.25 to $104, with 228,414 shares crossing the market, Guardian Holdings shed $10 to $630 with the swapping of 10,588 stocks, Jamaica Producers declined $1 in closing at $22 trading 3,769 stock units. JMMB Group rallied 28 cents to close at $37.78, with 163,033 shares clearing the market, Kingston Wharves lost $1 to end at $48 while exchanging 2,388 units. Mayberry Jamaican Equities dropped 47 cents to $8.50 after trading 8,501 units, NCB Financial Group shed $6.29 to close at $131.21 after an exchange of 82,261 stock units. 138 Student Living rallied 65 cents to $5.10, with 64,807 shares changing hands, Palace Amusement dropped $28.24 to $1033.76, with an exchange of 8 stocks, Pulse Investments rose 21 cents in closing at $3.96 trading 214,612 stock units. Sagicor Group popped 55 cents to $58.50 in exchanging 7,219 shares, Salada Foods gained 20 cents ending at $8, with 5,912 stocks crossing the market.

At the close, Berger Paints fell $1.04 to $12.70 after exchanging 200 shares, Eppley spiked 72 cents to $39 in an exchange of 1,254 units, First Rock Capital fell 32 cents to end at $14.05 in exchanging 292 stock units. GraceKennedy popped $6.25 to $104, with 228,414 shares crossing the market, Guardian Holdings shed $10 to $630 with the swapping of 10,588 stocks, Jamaica Producers declined $1 in closing at $22 trading 3,769 stock units. JMMB Group rallied 28 cents to close at $37.78, with 163,033 shares clearing the market, Kingston Wharves lost $1 to end at $48 while exchanging 2,388 units. Mayberry Jamaican Equities dropped 47 cents to $8.50 after trading 8,501 units, NCB Financial Group shed $6.29 to close at $131.21 after an exchange of 82,261 stock units. 138 Student Living rallied 65 cents to $5.10, with 64,807 shares changing hands, Palace Amusement dropped $28.24 to $1033.76, with an exchange of 8 stocks, Pulse Investments rose 21 cents in closing at $3.96 trading 214,612 stock units. Sagicor Group popped 55 cents to $58.50 in exchanging 7,219 shares, Salada Foods gained 20 cents ending at $8, with 5,912 stocks crossing the market.  Scotia Group fell 20 cents to $39.30 in switching ownership of 202,916 stock units, Seprod dropped 98 cents to $69.02, with 1,945 units crossing the market, Stanley Motta spiked 69 cents to $5.99 after 4,878 stocks crossed the exchange and Sygnus Credit Investments rallied 72 cents to $15, with 73,359 shares changing hands.

Scotia Group fell 20 cents to $39.30 in switching ownership of 202,916 stock units, Seprod dropped 98 cents to $69.02, with 1,945 units crossing the market, Stanley Motta spiked 69 cents to $5.99 after 4,878 stocks crossed the exchange and Sygnus Credit Investments rallied 72 cents to $15, with 73,359 shares changing hands.

The top three stocks in the Junior Market, continue to be Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 256 percent and 336 percent compared to 221 and 287 percent, last week. Medical Disposables continues the addition of new products to its portfolio that will add revenues and profit going forward. The acquisition of the 60 percent majority ownership in Cornwall Enterprises, will result in economies of scale and an expanded portfolio to market nationally to an expanded clientele.

The top three stocks in the Junior Market, continue to be Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 256 percent and 336 percent compared to 221 and 287 percent, last week. Medical Disposables continues the addition of new products to its portfolio that will add revenues and profit going forward. The acquisition of the 60 percent majority ownership in Cornwall Enterprises, will result in economies of scale and an expanded portfolio to market nationally to an expanded clientele. The Top10 Main Market leader Radio Jamaica continues to enjoy buying interest that is whittling away the supply of stocks on offer in the market. A barrage of new results are due this coming week as the final reporting day for the period will be Saturday this coming week.

The Top10 Main Market leader Radio Jamaica continues to enjoy buying interest that is whittling away the supply of stocks on offer in the market. A barrage of new results are due this coming week as the final reporting day for the period will be Saturday this coming week. The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 54 percent discount to the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 54 percent discount to the PE of that market, well off the potential of 20. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.