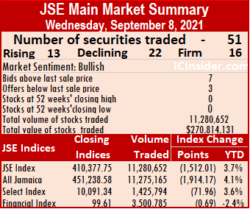

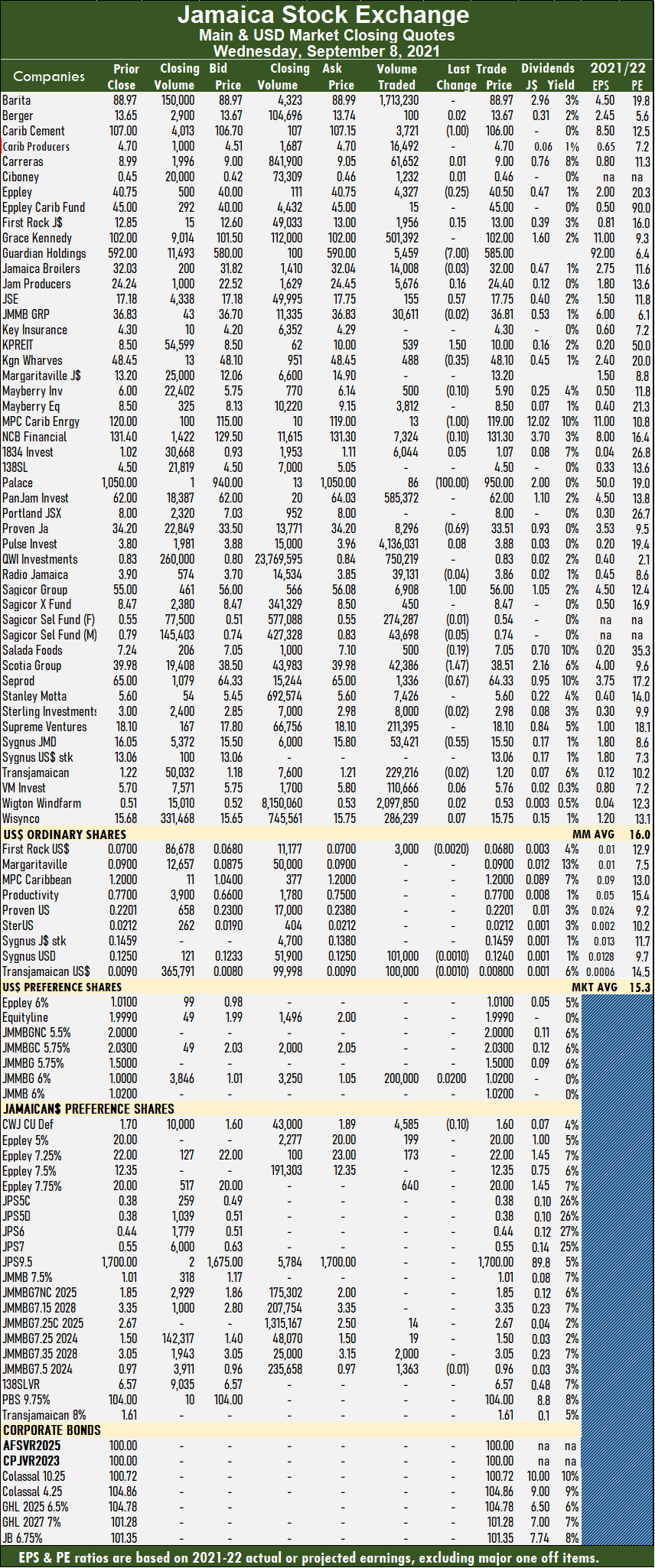

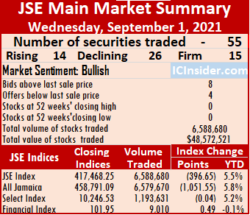

Market activity ended on Wednesday with the volume of shares declining 84 percent and value climbing 84 percent compared to Tuesday after declining stocks exceded rising ones almost two one at the close of the Jamaica Stock Exchange Main Market.

Market activity ended on Wednesday with the volume of shares declining 84 percent and value climbing 84 percent compared to Tuesday after declining stocks exceded rising ones almost two one at the close of the Jamaica Stock Exchange Main Market.

The All Jamaican Composite Index dived 1,914.17 points to 451,238.58, the Main Index dropped 1,512.01 points to 410,377.75 and the JSE Financial Index dipped 0.69 points to 99.61.

Fifty one (51) securities traded compared to 48 on Tuesday, with 13 rising, 22 declining and 16 ending unchanged.

Overall, 11,280,652 shares trading for $270,814,131 versus 71,748,172 units at $147,521,115 on Tuesday. Pulse Investments led with 36.7 percent of total volume after trading 4.14 million shares, followed by Wigton Windfarm 18.6 percent, with 2.10 million units and Barita Investments, with 15.2 percent after an exchange of 1.71 million units.

Trading averages 221,189 units at $5,310,081, versus 1,494,754 shares at $3,073,357 on Tuesday and month to date, an average of 471,739 units at $2,798,752, compared to 522,647 units at $2,288,482 on Tuesday.  August closed with an average of 480,039 units at $8,561,549.

August closed with an average of 480,039 units at $8,561,549.

The PE Ratio, a measure used in computing appropriate stock values, averages 16 based on ICInsider.com’s forecast of 2021-22 earnings.

Investor’s Choice bid-offer indicator reading has seven stocks ending with bids higher than their last selling prices and three stocks with lower offers.

At the close, Caribbean Cement declined $1 to $106 with 3,721 shares crossing the exchange, Eppley lost 25 cents at $40.50 in trading 4,327 units, Guardian Holdings declined $7 to $585 with a transfer of 5,459 stock units. Jamaica Stock Exchange popped 57 cents to $17.75 in exchanging 155 stocks, Kingston Properties rose $1.50 to $10 with the swapping of 539 shares, Kingston Wharves lost 35 cents to settle at $48.10 after owners swapped 488 stocks. MPC Caribbean Clean Energy fell $1 to $119 after exchanging 13 stock units, Palace Amusement dropped $100 to end at $950 in trading 86 units, Proven Investments shed 69 cents to $33.51 with 8,296 stocks changing hands.  Sagicor Group advanced $1 to $56 in transferring 6,908 stock units, Scotia Group declined $1.47 to $38.51 with the swapping of 42,386 units, Seprod fell 67 cents to $64.33 with 1,336 shares crossing the market and Sygnus Credit Investments shed 55 cents to $15.50 in exchanging 53,421 stocks.

Sagicor Group advanced $1 to $56 in transferring 6,908 stock units, Scotia Group declined $1.47 to $38.51 with the swapping of 42,386 units, Seprod fell 67 cents to $64.33 with 1,336 shares crossing the market and Sygnus Credit Investments shed 55 cents to $15.50 in exchanging 53,421 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

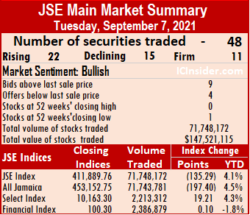

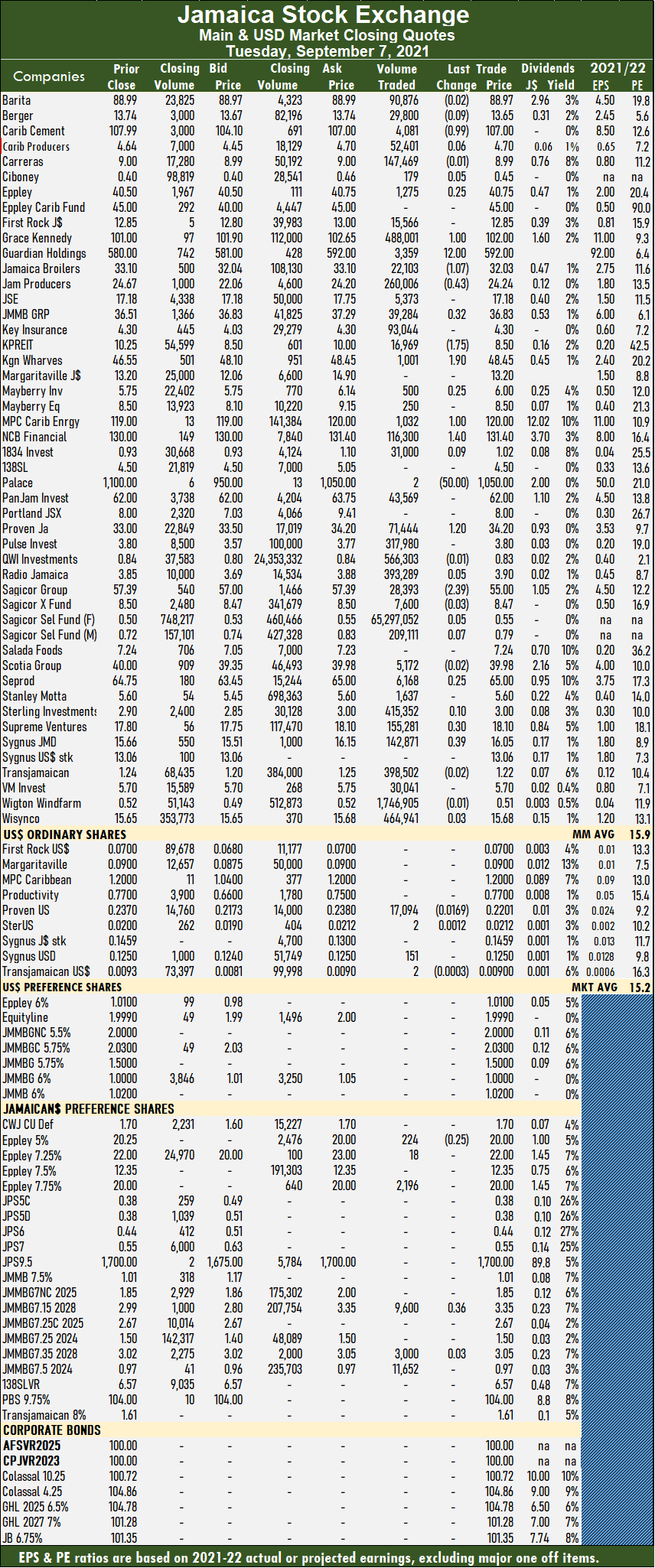

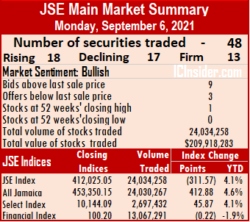

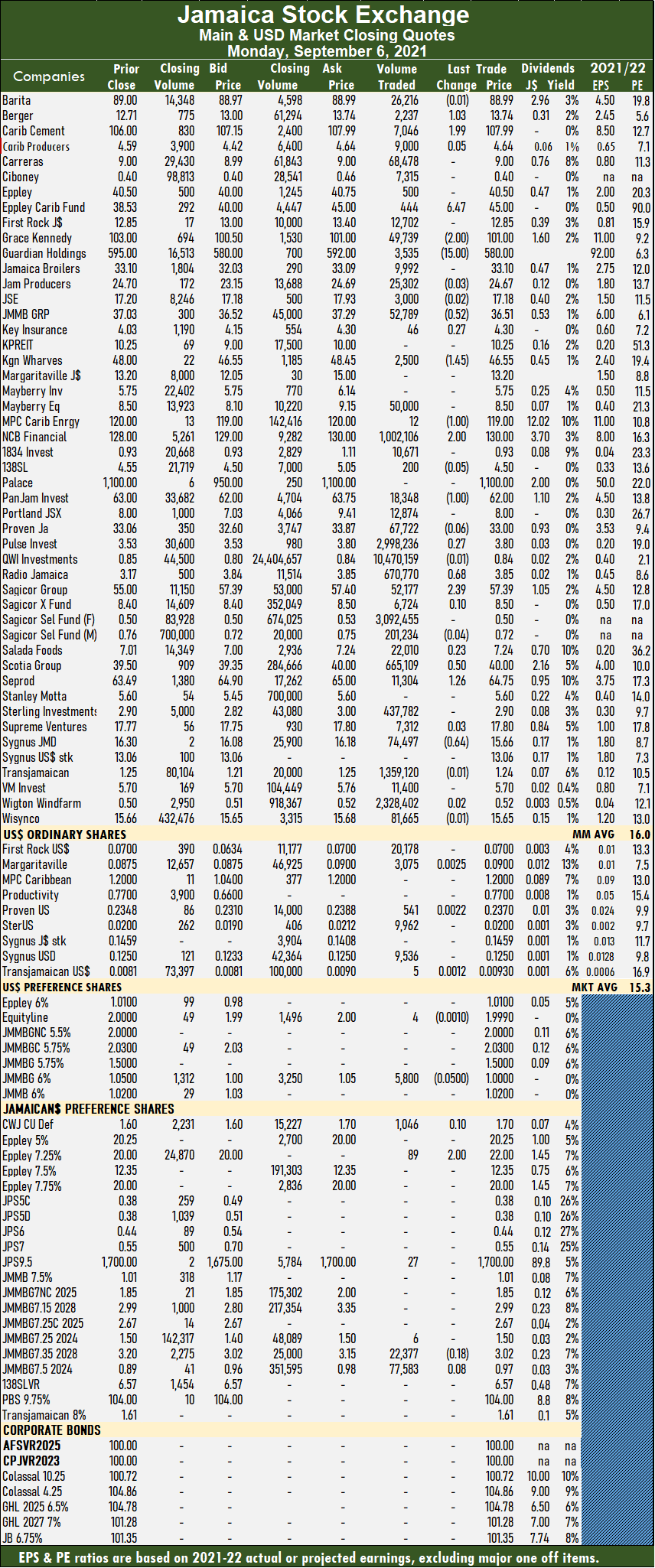

The All Jamaican Composite Index dropped 197.40 points to 453,152.75, the Main Index shed 135.29 points to end at 411,889.76 and the JSE Financial Index popped 0.10 points to settle at 100.30.

The All Jamaican Composite Index dropped 197.40 points to 453,152.75, the Main Index shed 135.29 points to end at 411,889.76 and the JSE Financial Index popped 0.10 points to settle at 100.30. Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and four with lower offers. Seprod climbed 25 cents to end at $65, with 6,168 units clearing the market, Supreme Ventures rose 30 cents to $18.10 with the swapping of 155,281 stock units and Sygnus Credit Investments rallied 39 cents to $16.05 after trading 142,871 units.

Seprod climbed 25 cents to end at $65, with 6,168 units clearing the market, Supreme Ventures rose 30 cents to $18.10 with the swapping of 155,281 stock units and Sygnus Credit Investments rallied 39 cents to $16.05 after trading 142,871 units. A total 24,034,258 shares traded for $209,918,283 compared to 15,882,164 units at $73,938,627 on Friday.

A total 24,034,258 shares traded for $209,918,283 compared to 15,882,164 units at $73,938,627 on Friday. Trading averages 500,714 units at $4,373,298 compared to 324,126 shares at $1,508,952 on Friday and month to date, an average of 292,789 units at $2,102,896, compared to 228,400 units at $1,399,804 on Friday. August closed with an average of 480,039 units at $8,561,549.

Trading averages 500,714 units at $4,373,298 compared to 324,126 shares at $1,508,952 on Friday and month to date, an average of 292,789 units at $2,102,896, compared to 228,400 units at $1,399,804 on Friday. August closed with an average of 480,039 units at $8,561,549. NCB Financial spiked $2 to $130 in trading 1,002,106 shares, PanJam Investment lost $1 to close at $62 in an exchange of 18,348 stocks, Pulse Investments popped advanced 27 cents to $3.80 after exchanging 2,998,236 units. Radio Jamaica jumped 68 cents to $3.85, trading 670,770 units, Sagicor Group popped $2.39 to $57.39 after trading 52,177 stocks, Scotia Group gained 50 cents in ending at $40, with 665,109 shares crossing the exchange. Seprod rallied $1.26 to $64.75, trading 11,304 stock units and Sygnus Credit Investments declined 64 cents to $15.66, trading 74,497 shares.

NCB Financial spiked $2 to $130 in trading 1,002,106 shares, PanJam Investment lost $1 to close at $62 in an exchange of 18,348 stocks, Pulse Investments popped advanced 27 cents to $3.80 after exchanging 2,998,236 units. Radio Jamaica jumped 68 cents to $3.85, trading 670,770 units, Sagicor Group popped $2.39 to $57.39 after trading 52,177 stocks, Scotia Group gained 50 cents in ending at $40, with 665,109 shares crossing the exchange. Seprod rallied $1.26 to $64.75, trading 11,304 stock units and Sygnus Credit Investments declined 64 cents to $15.66, trading 74,497 shares.

Elsewhere,

Elsewhere,  This past week the average gains projected for the Junior Market rose from 191 percent to 198 percent and Main Market stocks from 168 percent to 173 percent.

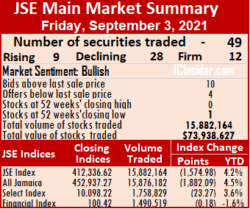

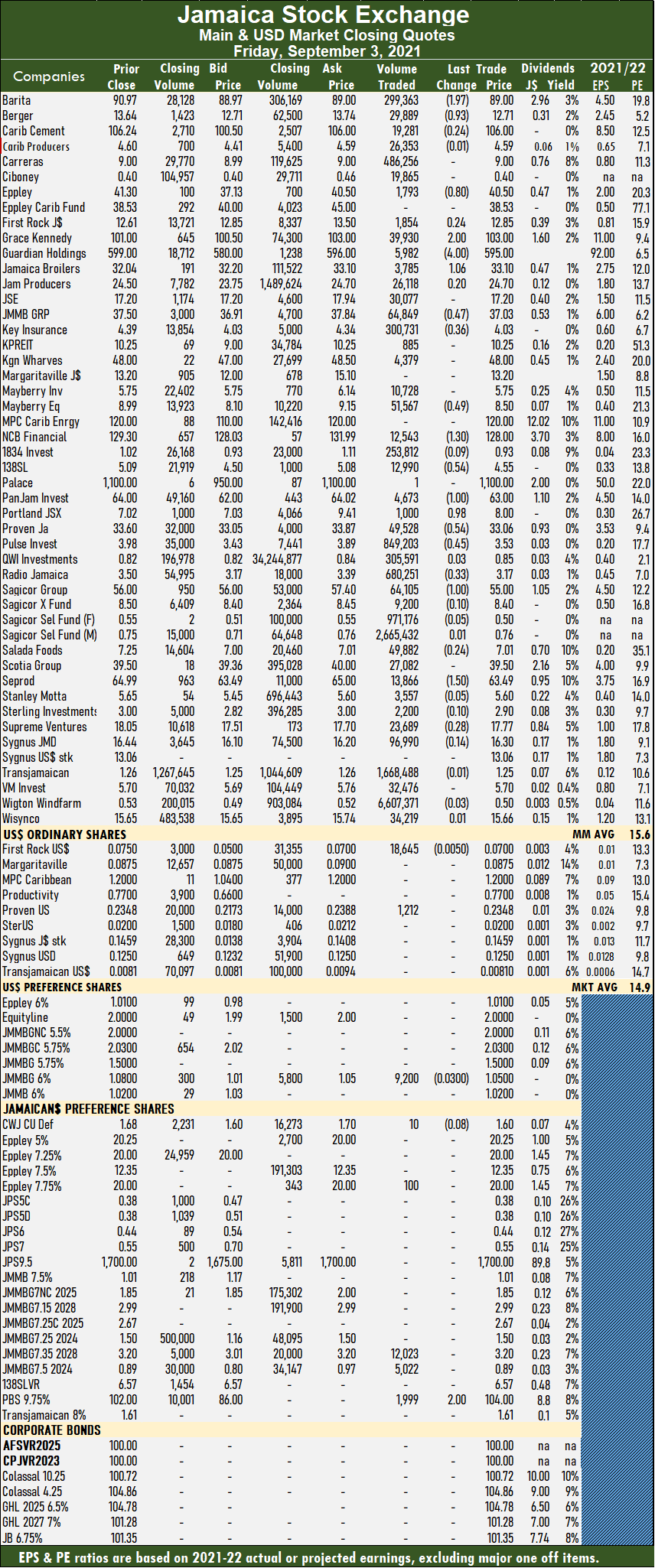

This past week the average gains projected for the Junior Market rose from 191 percent to 198 percent and Main Market stocks from 168 percent to 173 percent. The JSE Main Market ended the week with an overall PE of 15.6, a little distance from the 19 the market ended at in March, suggesting a 22 percent rise at a PE of 19 and 28 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.6, with a 51 percent discount to the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 15.6, a little distance from the 19 the market ended at in March, suggesting a 22 percent rise at a PE of 19 and 28 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.6, with a 51 percent discount to the PE of that market, well off the potential of 20. ICInsider.com ranks stocks to filter out the bigger winners, allowing investors to focus on potentially huge winners and helping to keep out emotional attachments to stocks that often result in costly mistakes being made.

ICInsider.com ranks stocks to filter out the bigger winners, allowing investors to focus on potentially huge winners and helping to keep out emotional attachments to stocks that often result in costly mistakes being made. Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and four stocks with lower offers.

Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and four stocks with lower offers. Sagicor Group fell $1 to $55 with the swapping of 64,105 shares, Salada Foods lost 24 cents in closing at $7.01 after 49,882 stock units crossed the market, Seprod shed $1.50 to settle at $63.49 with 13,866 stocks changing hands, Supreme Ventures lost 28 cents to close at $17.77 in trading 23,689 shares and Wigton Windfarm lost 3 cents to close at a 52 weeks’ low of 50 cents, trading 6,607,371 stocks, as investors continue to desert the stock.

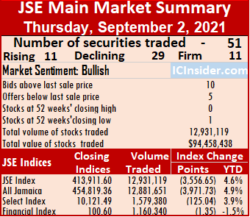

Sagicor Group fell $1 to $55 with the swapping of 64,105 shares, Salada Foods lost 24 cents in closing at $7.01 after 49,882 stock units crossed the market, Seprod shed $1.50 to settle at $63.49 with 13,866 stocks changing hands, Supreme Ventures lost 28 cents to close at $17.77 in trading 23,689 shares and Wigton Windfarm lost 3 cents to close at a 52 weeks’ low of 50 cents, trading 6,607,371 stocks, as investors continue to desert the stock. The All Jamaican Composite Index declined 3,971.73 points to settle at 454,819.36, the Main Index fell 3,556.65 points to 413,911.60 and the JSE Financial Index shed 1.35 points to close at 100.60.

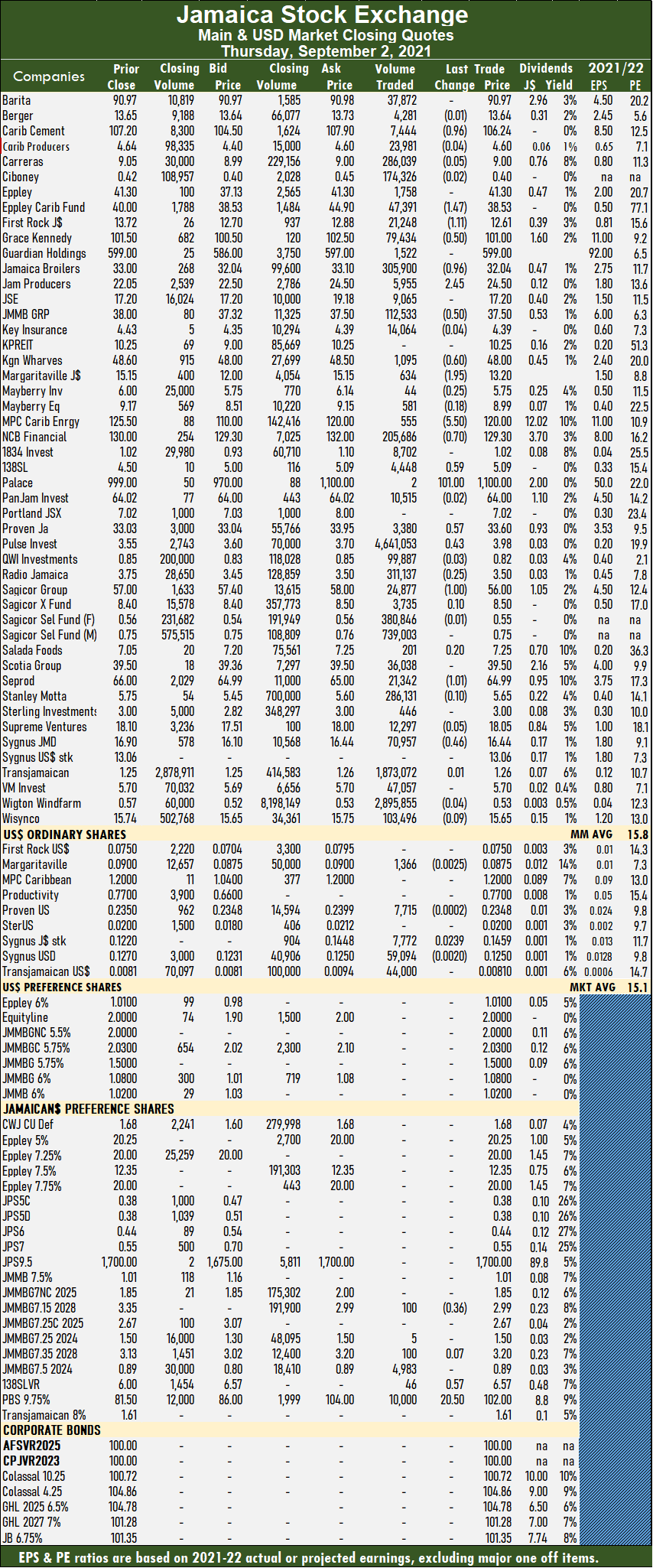

The All Jamaican Composite Index declined 3,971.73 points to settle at 454,819.36, the Main Index fell 3,556.65 points to 413,911.60 and the JSE Financial Index shed 1.35 points to close at 100.60. At the close, Caribbean Cement shed 96 cents in closing at $106.24 in an exchange of 7,444 units, Eppley Caribbean Property Fund declined $1.47 to $38.53 with 47,391 shares crossing the market, First Rock Capital fell $1.11 to $12.61 with 21,248 stocks changing hands. GraceKennedy dipped 50 cents to $101 with the swapping of 79,434 shares, Jamaica Broilers shed 96 cents to close at $32.04 after 305,900 units crossed the exchange, Jamaica Producers advanced $2.45 to $24.50 in transferring 5,955 stocks. JMMB Group lost 50 cents to end at $37.50, with the swapping of 112,533 shares, Kingston Wharves dipped 60 cents to $48 in exchanging 1,095 stock units. Margaritaville fell $1.95 to close at a 52 weeks’ low of $13.20, with an exchange of 634 stock units. Mayberry Investments lost 25 cents in ending at $5.75 and trading 44 stocks. MPC Caribbean Clean Energy dropped $5.50 to $120 in trading 555 shares, NCB Financial fell 70 cents to $129.30 in switching ownership of 205,686 stock units, 138 Student Living popped 59 cents to $5.09 in an exchange of 4,448 shares, Palace Amusement surged $101 to $1,100 with 2 units crossing the exchange. Proven Investments rose 57 cents to $33.60 in transferring 3,380 stocks, Pulse Investments rallied 43 cents to $3.98 with the swapping of 4,641,053 shares, Radio Jamaica lost 25 cents to end at $3.50 in switching ownership of 311,137 stocks.

At the close, Caribbean Cement shed 96 cents in closing at $106.24 in an exchange of 7,444 units, Eppley Caribbean Property Fund declined $1.47 to $38.53 with 47,391 shares crossing the market, First Rock Capital fell $1.11 to $12.61 with 21,248 stocks changing hands. GraceKennedy dipped 50 cents to $101 with the swapping of 79,434 shares, Jamaica Broilers shed 96 cents to close at $32.04 after 305,900 units crossed the exchange, Jamaica Producers advanced $2.45 to $24.50 in transferring 5,955 stocks. JMMB Group lost 50 cents to end at $37.50, with the swapping of 112,533 shares, Kingston Wharves dipped 60 cents to $48 in exchanging 1,095 stock units. Margaritaville fell $1.95 to close at a 52 weeks’ low of $13.20, with an exchange of 634 stock units. Mayberry Investments lost 25 cents in ending at $5.75 and trading 44 stocks. MPC Caribbean Clean Energy dropped $5.50 to $120 in trading 555 shares, NCB Financial fell 70 cents to $129.30 in switching ownership of 205,686 stock units, 138 Student Living popped 59 cents to $5.09 in an exchange of 4,448 shares, Palace Amusement surged $101 to $1,100 with 2 units crossing the exchange. Proven Investments rose 57 cents to $33.60 in transferring 3,380 stocks, Pulse Investments rallied 43 cents to $3.98 with the swapping of 4,641,053 shares, Radio Jamaica lost 25 cents to end at $3.50 in switching ownership of 311,137 stocks. Sagicor Group declined $1 to $56 in exchanging 24,877 shares, Salada Foods traded 201 shares and gained 20 cents to close at $7.25, Seprod shed $1.01 in ending at $64.99 after 21,342 stock units crossed the market and Sygnus Credit Investments lost 46 cents in closing at $16.44 in switching ownership of 70,957 stocks.

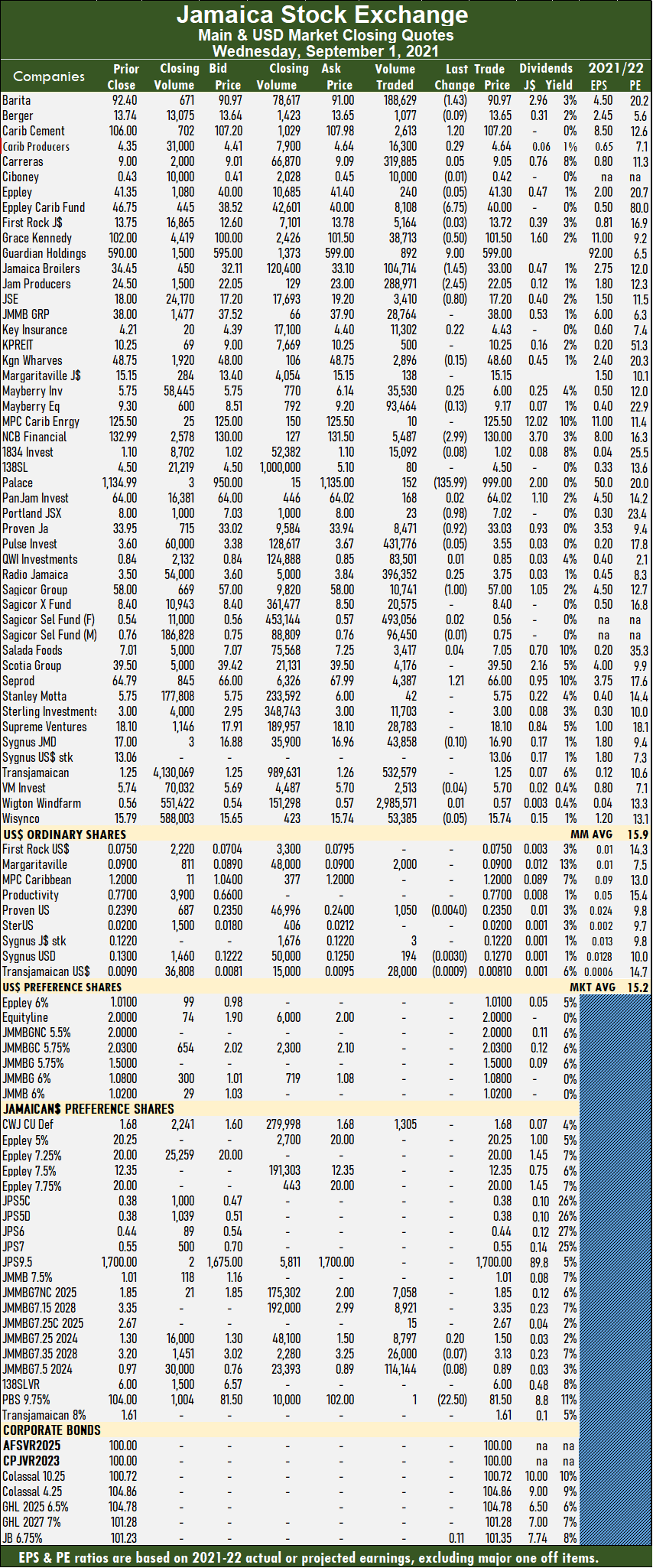

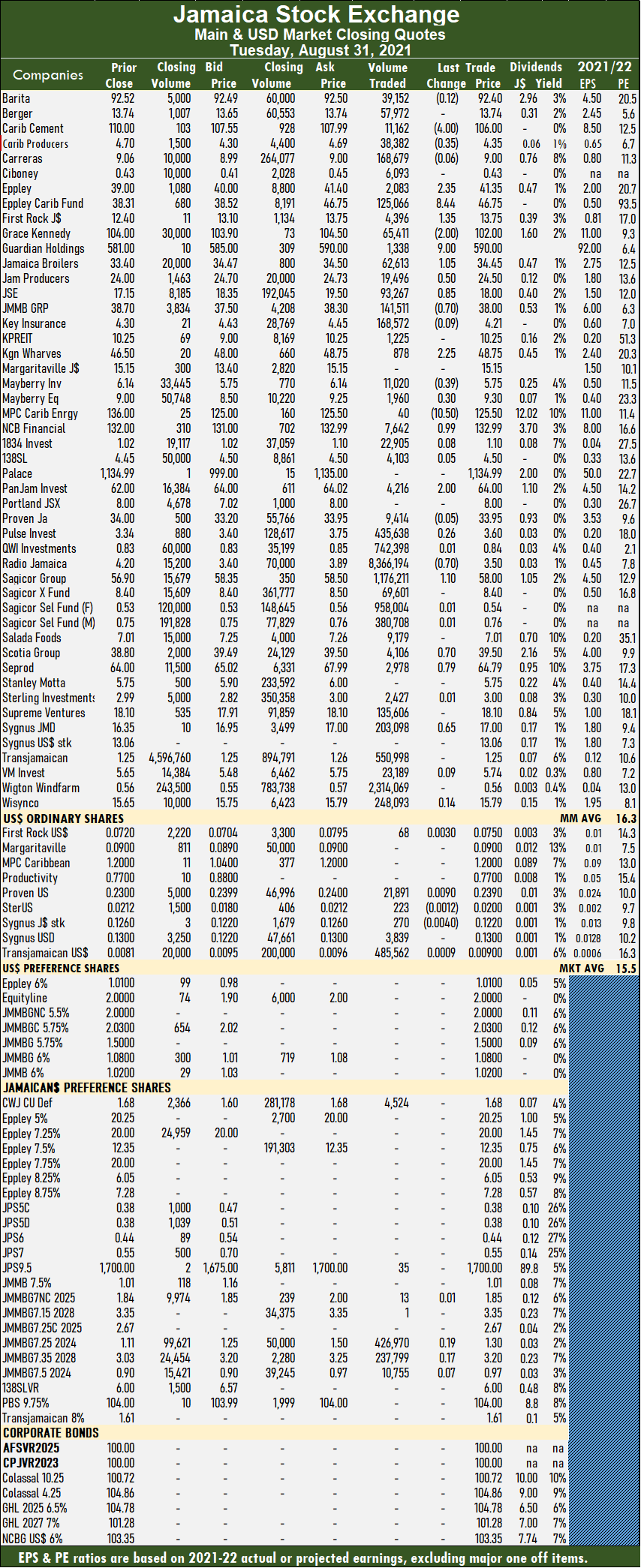

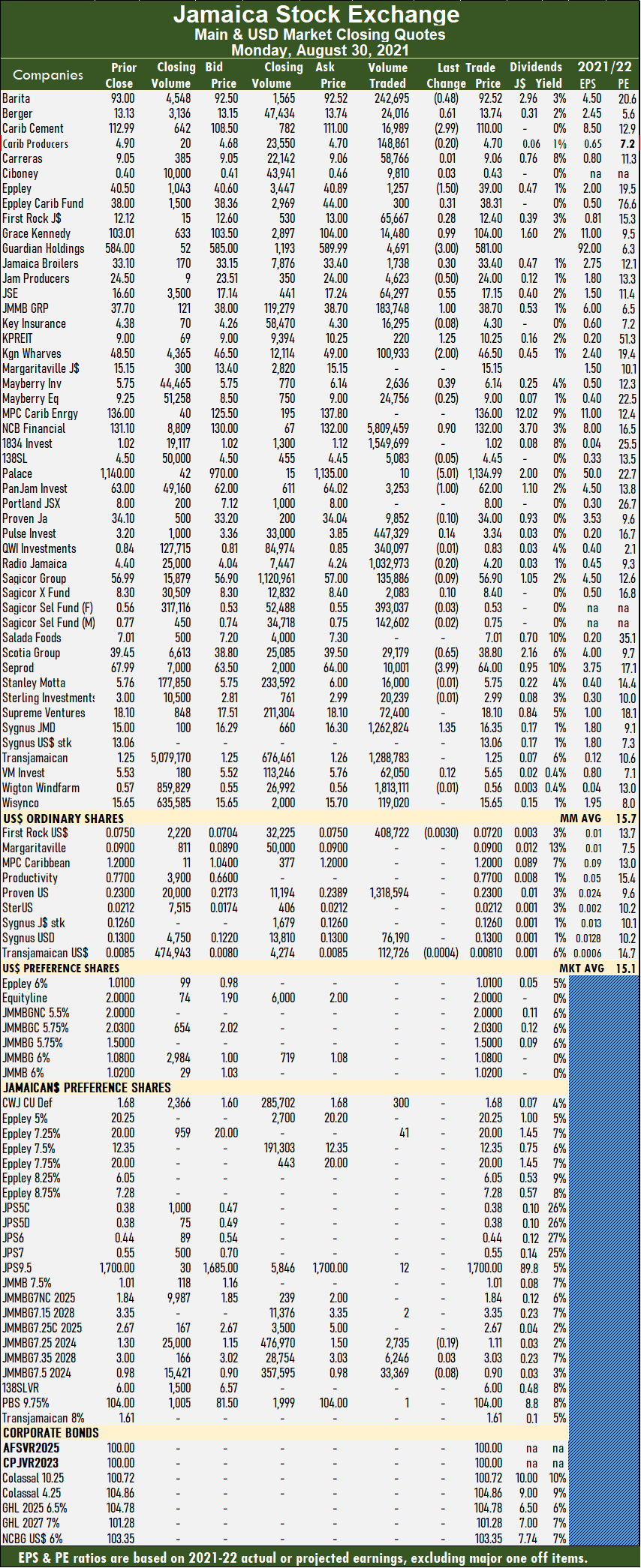

Sagicor Group declined $1 to $56 in exchanging 24,877 shares, Salada Foods traded 201 shares and gained 20 cents to close at $7.25, Seprod shed $1.01 in ending at $64.99 after 21,342 stock units crossed the market and Sygnus Credit Investments lost 46 cents in closing at $16.44 in switching ownership of 70,957 stocks. At the close, Barita Investments fell $1.43 to $90.97 in switching ownership of 188,629 shares, Caribbean Cement rose $1.20 to $107.20 in exchanging 2,613 stocks, Caribbean Producers gained 29 cents to end at $4.64 with 16,300 shares crossing the exchange, Eppley Caribbean Property Fund dropped $6.75 to $40 in trading 8,108 stock units, GraceKennedy slipped 50 cents to $101.50 with a transfer of 38,713 stocks, Guardian Holdings spiked $9 to $599 with 892 units changing hands, Jamaica Broilers fell $1.45 to $33 with the swapping of 104,714 shares. Jamaica Producers declined $2.45 to $22.05 after 288,971 stocks cleared the market, Jamaica Stock Exchange shed 80 cents to close at $17.20 in transferring 3,410 stock units, Key Insurance popped 22 cents to $4.43 after exchanging 11,302 stocks. Mayberry Investments rallied 25 cents to $6 in exchanging 35,530 units, NCB Financial declined $2.99 to $130 in switching ownership of 5,487 shares, Palace Amusement dropped $135.99 to end at $999 with 152 stock units changing hands, Portland JSX shed 98 cents to $7.02 with the swapping of 23 stocks.

At the close, Barita Investments fell $1.43 to $90.97 in switching ownership of 188,629 shares, Caribbean Cement rose $1.20 to $107.20 in exchanging 2,613 stocks, Caribbean Producers gained 29 cents to end at $4.64 with 16,300 shares crossing the exchange, Eppley Caribbean Property Fund dropped $6.75 to $40 in trading 8,108 stock units, GraceKennedy slipped 50 cents to $101.50 with a transfer of 38,713 stocks, Guardian Holdings spiked $9 to $599 with 892 units changing hands, Jamaica Broilers fell $1.45 to $33 with the swapping of 104,714 shares. Jamaica Producers declined $2.45 to $22.05 after 288,971 stocks cleared the market, Jamaica Stock Exchange shed 80 cents to close at $17.20 in transferring 3,410 stock units, Key Insurance popped 22 cents to $4.43 after exchanging 11,302 stocks. Mayberry Investments rallied 25 cents to $6 in exchanging 35,530 units, NCB Financial declined $2.99 to $130 in switching ownership of 5,487 shares, Palace Amusement dropped $135.99 to end at $999 with 152 stock units changing hands, Portland JSX shed 98 cents to $7.02 with the swapping of 23 stocks.  Proven Investments fell 92 cents to $33.03 with 8,471 stock units crossing the market, Radio Jamaica rallied 25 cents to $3.75 in an exchange of 396,352 shares. Sagicor Group shed $1 in, ending at $57 after switching ownership of 10,741 stocks, Seprod popped $1.21 to $66 in trading 4,387 shares.

Proven Investments fell 92 cents to $33.03 with 8,471 stock units crossing the market, Radio Jamaica rallied 25 cents to $3.75 in an exchange of 396,352 shares. Sagicor Group shed $1 in, ending at $57 after switching ownership of 10,741 stocks, Seprod popped $1.21 to $66 in trading 4,387 shares. The All Jamaican Composite Index spiked 2,773.29 points to 459,842.64, the JSE Main Index climbed 2,670.20 points to 417,864.90 and the JSE Financial Index popped 0.59 points to close trading at 101.46.

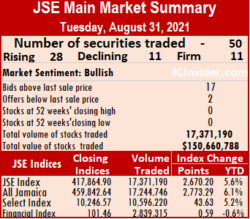

The All Jamaican Composite Index spiked 2,773.29 points to 459,842.64, the JSE Main Index climbed 2,670.20 points to 417,864.90 and the JSE Financial Index popped 0.59 points to close trading at 101.46. Investor’s Choice bid-offer indicator reading has 17 stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator reading has 17 stocks ending with bids higher than their last selling prices and two with lower offers. PanJam Investment popped $2 to end at $64, with 4,216 stock units clearing the market, Pulse Investments rallied 26 cents to close at $3.60 after exchanging 435,638 units. Radio Jamaica dived 70 cents to $3.50 after exchanging 8,366,194 stock units, Sagicor Group rose $1.10 to end at $58 in trading 1,176,211 units, Scotia Group rallied 70 cents in closing at $39.50, with 4,106 stock units crossing the market. Seprod rose 79 cents to $64.79 in exchanging 2,978 shares and Sygnus Credit Investments popped 65 cents to $17 with the swapping of 203,098 units.

PanJam Investment popped $2 to end at $64, with 4,216 stock units clearing the market, Pulse Investments rallied 26 cents to close at $3.60 after exchanging 435,638 units. Radio Jamaica dived 70 cents to $3.50 after exchanging 8,366,194 stock units, Sagicor Group rose $1.10 to end at $58 in trading 1,176,211 units, Scotia Group rallied 70 cents in closing at $39.50, with 4,106 stock units crossing the market. Seprod rose 79 cents to $64.79 in exchanging 2,978 shares and Sygnus Credit Investments popped 65 cents to $17 with the swapping of 203,098 units. Trading averaged 305,774 units at $16,700,628, compared to 319,594 shares at $3,515,324 on Friday and month to date an average of 487,063 units at $8,855,423, in contrast to 497,417 units at $8,407,376 on Friday. July closed with an average of 322,932 units at $15,201,099.

Trading averaged 305,774 units at $16,700,628, compared to 319,594 shares at $3,515,324 on Friday and month to date an average of 487,063 units at $8,855,423, in contrast to 497,417 units at $8,407,376 on Friday. July closed with an average of 322,932 units at $15,201,099. Kingston Properties climbed $1.25 to $10.25 with 220 stock units traded, Kingston Wharves dropped $2 to $46.50 with an exchange of100,933 shares, Mayberry Investments advanced 39 cents to $6.14 with investors switching ownership of 2,636 units. Mayberry Jamaican Equities lost 25 cents to end at $9 with 24,756 stocks changing hands, NCB Financial Group climbed 90 cents to $132 with an exchange of 5,809,459 shares, Palace Amusement shed $5.01 to close at $1134.99 with 10 stocks traded.PanJam Investment dropped $1 to $62 with a transfer of 3,253 units, Scotia Group fell 65 cents to $38.80 with 29,179 stock units passing through the market, Seprod declined $3.99 to $64 with 10,001 stocks changing hands and Sygnus Credit Investments advanced $1.35 to $16.35 with 1,262,824 shares crossing the exchange after the company posted strong gains in full year’s profit.

Kingston Properties climbed $1.25 to $10.25 with 220 stock units traded, Kingston Wharves dropped $2 to $46.50 with an exchange of100,933 shares, Mayberry Investments advanced 39 cents to $6.14 with investors switching ownership of 2,636 units. Mayberry Jamaican Equities lost 25 cents to end at $9 with 24,756 stocks changing hands, NCB Financial Group climbed 90 cents to $132 with an exchange of 5,809,459 shares, Palace Amusement shed $5.01 to close at $1134.99 with 10 stocks traded.PanJam Investment dropped $1 to $62 with a transfer of 3,253 units, Scotia Group fell 65 cents to $38.80 with 29,179 stock units passing through the market, Seprod declined $3.99 to $64 with 10,001 stocks changing hands and Sygnus Credit Investments advanced $1.35 to $16.35 with 1,262,824 shares crossing the exchange after the company posted strong gains in full year’s profit.

Wigton price collapses

Wigton Windfarms’ shares traded below the IPO price of 50 cents on Friday as attempts to shield the price from falling after announcing a drop in revenues is finally giving way to selling pressure. The Wigton syndrome continues to plaque the Jamaica Stock market with irrational behavior of investors to be seen in the prices of many stocks.

Wigton traded nearly 90% of shares on Thursday.

On August 25, investors bought 5 million shares of Future Energy, up to $2.85 and for the next two trading day’s they just over 10 million units up to $3.29, with 15 million shares trading on the 30th at an average of $2.96. The stock is now trading at $2.04, with a PE ratio of 16, to be one of the more highly priced Junior Market stocks. What is happening here, when viewed against stocks with much lower PEs and good growth prospects?

There are thousands of new investors in the market brought on by several new listings on the market, with most listings creating good returns in a relatively short time for early investors.

There are thousands of new investors in the market brought on by several new listings on the market, with most listings creating good returns in a relatively short time for early investors.

Radio Jamaica another stock that traded as high as $4.65 on August 25, traded on Friday at $3.11 at a PE ratio of 7. Salada Foods continues to trade around the $7 region at a PE ratio of 43 times current year’s earnings. Wigton Windfarms that investors were not informed until late last year that the contract for their number 2 turbine provide for a reduction in rates for the supplying of electricity to JPS, belatedly traded down to 46 cents on Friday with few bids left in the system, and now trades at a PE of 12.5.

The stock market is a wonderful creation that has helped to enrich participants over the years, like any endeavor the more time spent studying and understanding it the better off those investors will be.

In the past, investors and scholars developed systems and methods to act as a guide to better investment decisions and thus reduce the love or dislike for a stock or other types of investments and thus reduce emotional decisions.

Technical analysis is a very useful tool used in the investment arena that carries coded messages for persons who understand them. They help investors to avoid excessive behavior in markets and telegraph future trends by using past market movements as the base.

The recent price movements for Radio Jamaica and Fesco show them breaking out of a channel that goes back for months, both companies released results that were price movers and both broke out, with the market not fully there as yet as prices moved too far too fast as such prices pulled back.

A few months after Wigton shares were listed in 2019, ICINsider.com wrote a piece to help investors better understand stock market behavior and prevent losses in the market. The piece captioned “Wigton price dreamers” was published in May of 2019. In light of the irrational trading in Fesco and Salada shares, elements of the article are highlighted below.

Salada Foods traded at a all-time high of $18 on Tuesday.

“Buy now, Ride the $3 wave”. That is the advice of one online investor to another, regarding the likely performance of the Wigton Windfarm stock after trading, on the first day of listing at 83 cents with a PE of 14, placing the value in the upper half of the most valued main market stocks. The premium over net asset value another measure of valuation is 291 percent above the net asset value. At $3, the stock would trade at a stunningly high PE ratio of 50 times 2019 and 2020 earnings. The only main market stock close to that valuation is Kingston Wharves (KW) at 35 times 2019 earnings and that is coming down from more than 50 times 2018 earnings when it traded at $85.

Unlike KW, which has less than 10 percent of the shareholding that will trade, amounting to a few million units, Wigton has billion of shares that will trade. The high liquidity of the shares almost ensures that they will not become overvalued.

Most investors who would be big buyers are more professional and are versed in the valuation levels of stocks. Accordingly, they are unlikely to be buying a stock that has doubtful expansion credentials at an inflated value. The most popular valuation tool, the PE ratio does not support a price much higher than $1.20, with EPS of 60 cents per share. A price of $1.20 equates to a high PE ratio of 20. Only a few stocks are valued close to this multiple and many of them have prospects for profits to grow. Wigton has no immediate prospects for growth in earnings, pricing it at 20 times EPS would therefore be unwise. The market will speak but the heavy selling on Friday when it first traded is more in line with the thinking that the top is not far off. Investors who buy shares above the accepted market norm will likely get crushed.

In the investment world staying close to the crowd with pricing is a prudent investment practice that tends to be less costly than trying to predict lofty heights for stocks to reach.

PE ratios are there to give a sense of appropriate values, when investors try to break away from where the bulk of investors place a value of a stock, they usually end up regret the move.