Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks changing hands declining 9 percent and resulting in a 33 percent fall in the value compared to Wednesday, following trading in seven securities, compared with seven on Wednesday with one rising, three declining and three ending unchanged.

Overall, 260,566 shares were traded for US$12,989 compared with 287,125 units at US$19,364 on Wednesday.

Overall, 260,566 shares were traded for US$12,989 compared with 287,125 units at US$19,364 on Wednesday.

Trading averaged 37,224 units at US$1,856 down from 41,018 shares at US$2,766 on Wednesday, with month to date average of 39,121 shares at US$2,311. January ended with an average of 48,604 units for US$4,865.

The JSE USD Equities Index slipped 0.54 points to end at 222.95.

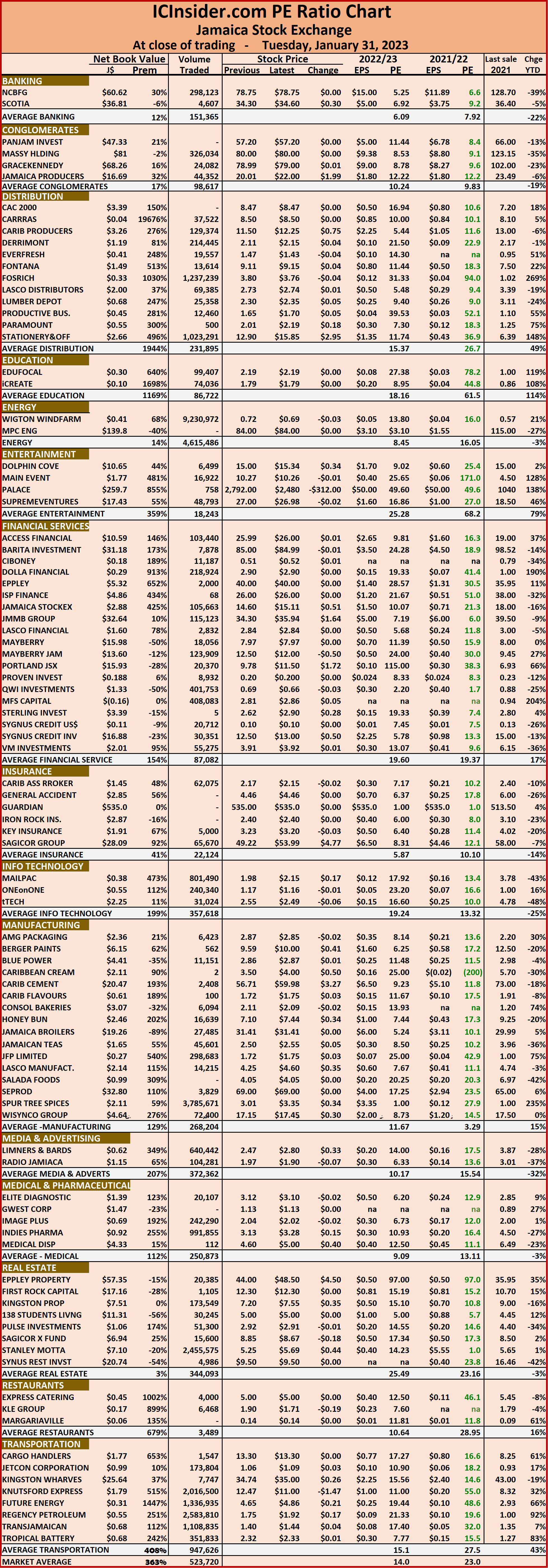

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than the last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share dropped 0.02 of a cent in ending at 6.98 US cents after 35,761 shares were traded,  Proven Investments lost 0.84 of a cent to end at 19.16 US cents while exchanging 16,700 stock units, Sterling Investments popped 0.18 of a cent in closing at 1.99 US cents as 494 stocks passed through the market. Sygnus Credit Investments USD share ended at 9.51 US cents 16,850 units crossing the market and Transjamaican Highway remained at 0.92 of one US cent with investors exchanging 187,273 stocks.

Proven Investments lost 0.84 of a cent to end at 19.16 US cents while exchanging 16,700 stock units, Sterling Investments popped 0.18 of a cent in closing at 1.99 US cents as 494 stocks passed through the market. Sygnus Credit Investments USD share ended at 9.51 US cents 16,850 units crossing the market and Transjamaican Highway remained at 0.92 of one US cent with investors exchanging 187,273 stocks.

In the preference segment, Equityline Mortgage Investment preference share fell 3 cents to US$1.64 after a transfer of 488 units and JMMB Group 6% ended at US$1 trading 3,000 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD market dips for a second day

Another day of slippage for JSE Markets

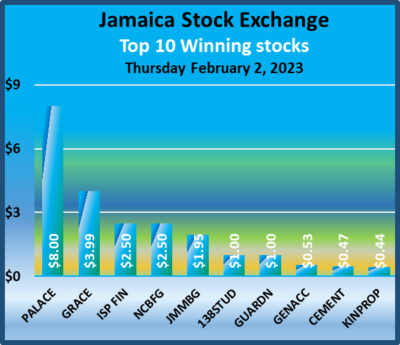

All markets of the Jamaica Stock Exchange dropped on Thursday, continuing the losses on Wednesday, following slippage in trading in the overall market compared with the prior day.

Trading ended with an exchange of 11,852,477 shares, down from 19,398,419 units on Wednesday, valued at $51.7 million down from $95.1 million on the previous day. Trading on the JSE USD market resulted in investors exchanging US$12,989 compared with US$19,364 on Wednesday.

Trading ended with an exchange of 11,852,477 shares, down from 19,398,419 units on Wednesday, valued at $51.7 million down from $95.1 million on the previous day. Trading on the JSE USD market resulted in investors exchanging US$12,989 compared with US$19,364 on Wednesday.

At the close, the Combined Market Index dropped 1,059.23 points to 350,729.51, the All Jamaican Composite Index shed 1,290.43 points to end at 380,641.76, the JSE Main Index fell 784.27 points to 336,998.63, the Junior Market fell 35.38 points to 3,960.42 and the JSE US dollar market slipped 0.54 points to close at 222.93.

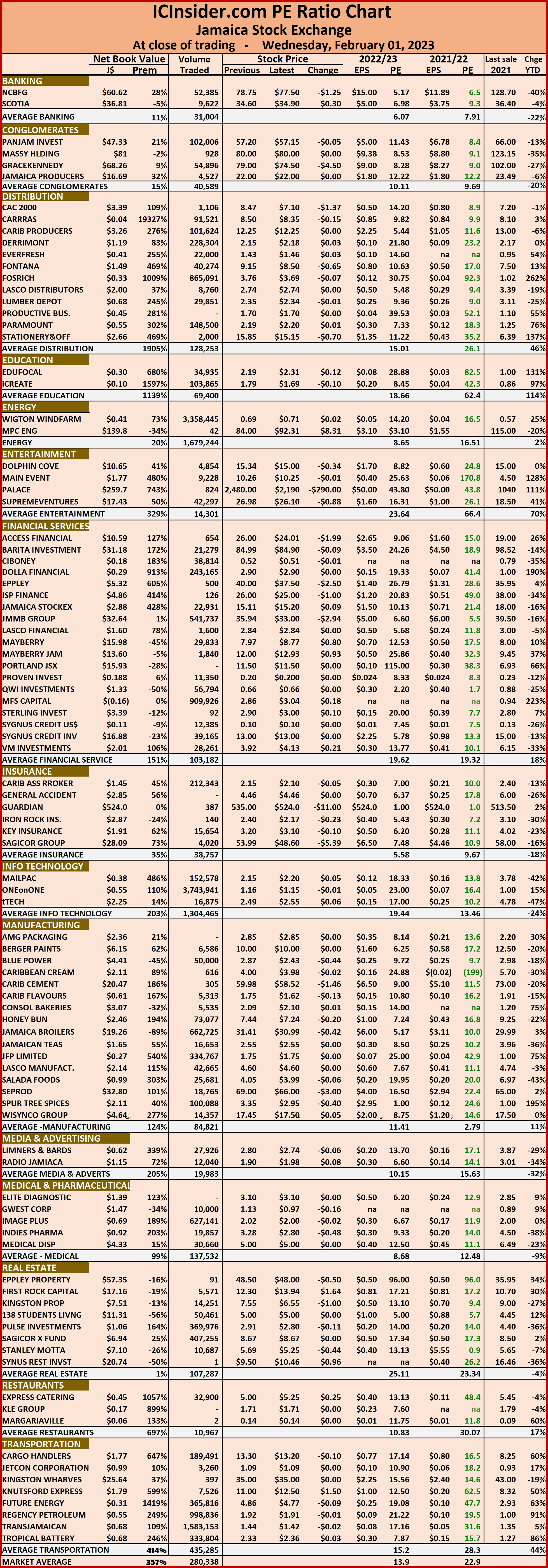

The market’s PE ratio ended at 23.1 based on 2021-22 earnings and 13.8 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Slippage for JSE USD Market

Trading plunged on the Jamaica Stock Exchange US dollar market on Wednesday from Tuesday’s levels with a 74 percent fall in the volume of stocks changing hands with the value declining 48 percent from Tuesday’s level with trading in seven securities compared to eight on Tuesday with the price of one rising, two declining and four ending unchanged.

Overall, 287,125 shares were traded for US$19,364 down from 1,121,685 units at US$37,070 on Tuesday.

Overall, 287,125 shares were traded for US$19,364 down from 1,121,685 units at US$37,070 on Tuesday.

Trading averaged 41,018 units at US$2,766 versus 140,211 shares at US$4,634 on Tuesday. January ended with an average of 48,604 units for US$4,865.

The JSE USD Equities Index lost 1.96 points to end at 223.47.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share remained at 7 US cents as investors exchanged 19,429 shares, Margaritaville dipped 0.07 of a cent ending at 14.1 US cents with two stocks crossing the exchange,  Proven Investments ended at 20 US cents after 11,350 units were traded. Sterling Investments popped 0.01 of a cent to close at 1.81 US cents with 63,007 stock units changing hands, Sygnus Credit Investments USD share ended at 9.51 US cents after exchanging 12,385 stock units and Transjamaican Highway lost 0.07 of a cent to 0.92 of one US cent while exchanging 169,103 units.

Proven Investments ended at 20 US cents after 11,350 units were traded. Sterling Investments popped 0.01 of a cent to close at 1.81 US cents with 63,007 stock units changing hands, Sygnus Credit Investments USD share ended at 9.51 US cents after exchanging 12,385 stock units and Transjamaican Highway lost 0.07 of a cent to 0.92 of one US cent while exchanging 169,103 units.

In the preference segment, JMMB Group 6% ended at US$1 after trading 11,849 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

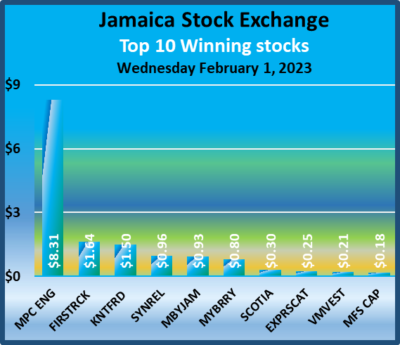

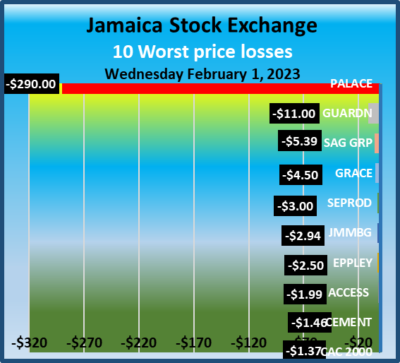

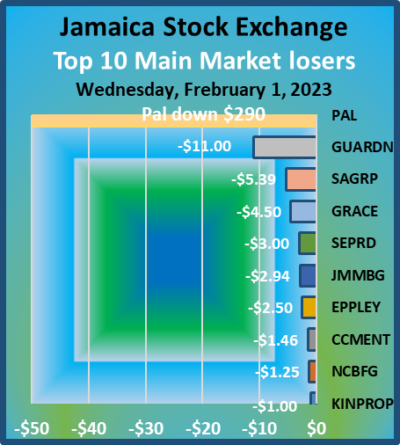

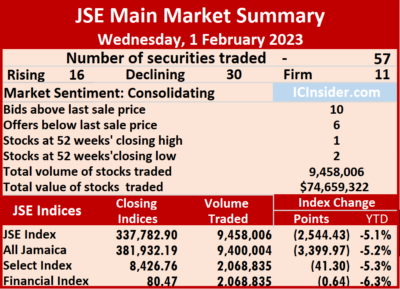

All JSE Markets fall on Wednesday

All markets of the Jamaica Stock Exchange dropped on Wednesday at the start of a new month as is now the monthly norm, following slippage in trading in the overall market.

Trading ended with an exchange of 19,398,419 shares down from 34,401,378 units on Tuesday, valued at $95.1 million down from $183.6 million on the previous day. Trading on the JSE USD market resulted in investors trading US$19,364 down from US$37,070 on Tuesday.

Trading ended with an exchange of 19,398,419 shares down from 34,401,378 units on Tuesday, valued at $95.1 million down from $183.6 million on the previous day. Trading on the JSE USD market resulted in investors trading US$19,364 down from US$37,070 on Tuesday.

At the close, the Combined Market Index dropped 2,950.37 points to 351,788.74, the All Jamaican Composite Index dived 3,399.97 points to close at 381,932.19, the JSE Main Market Index shed 2,544.43 points to 337,782.90, the Junior Market dropped 62.44 points to 3,995.80 and the JSE US dollar market slipped 1.96 points to close at 223.47.

The market’s PE ratio ended at 22.9 based on 2021-22 earnings and 13.9 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Big gain for JSEUSD Market

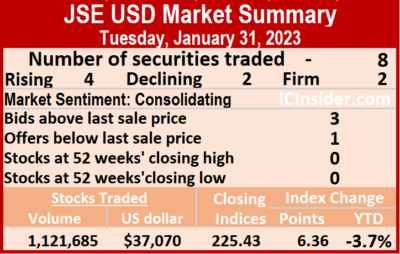

Stocks mostly rose in trading on the Jamaica Stock Exchange US dollar market on Tuesday and resulting in trading in eight securities, compared to 10 on Monday with four rising, two declining and two ending unchanged, following a 96 percent increase in the volume of stocks changing hands but with an 86 percent lower value than on Monday.

Overall, 1,121,685 shares were traded for US$37,070 compared with 571,649 units at US$267,767 on Monday.

Overall, 1,121,685 shares were traded for US$37,070 compared with 571,649 units at US$267,767 on Monday.

Trading averaged 140,211 units at US$4,634 versus 57,165 shares at US$26,777 on Monday, with month to date average of 48,604 shares at US$4,865 compared with 44,293 units at US$4,876 on the previous day. December ended with an average of 39,679 units for US$1,494.

The JSE USD Equities Index gained 6.36 points to end at 225.43.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.1. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than the last selling prices and one stock with a lower offer.

At the close, First Rock Real Estate USD share declined 0.69 of a cent in closing at 7 US cents with a transfer of 21,828 shares, Productive Business Solutions increased 5 cents to US$1.70 after an exchange of 12,460 stock units,  Proven Investments popped 0.01 of a cent to 20 US cents with the swapping of 8,932 stocks. Sterling Investments lost 0.07 of a cent to end at 1.8 US cents with an exchange of 36,993 units, Sygnus Credit Investments USD share rallied 0.01 of a cent to end at 9.51 US cents with an exchange of 20,712 stocks and Transjamaican Highway rose 0.02 of a cent to close at 0.99 of one US cent and closed with an exchange of 1,020,720 shares.

Proven Investments popped 0.01 of a cent to 20 US cents with the swapping of 8,932 stocks. Sterling Investments lost 0.07 of a cent to end at 1.8 US cents with an exchange of 36,993 units, Sygnus Credit Investments USD share rallied 0.01 of a cent to end at 9.51 US cents with an exchange of 20,712 stocks and Transjamaican Highway rose 0.02 of a cent to close at 0.99 of one US cent and closed with an exchange of 1,020,720 shares.

In the preference segment, Productive Business 9.25% preference share remained at US$11.11 in trading 27 stock units and JMMB Group 6% ended at US$1, with 13 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

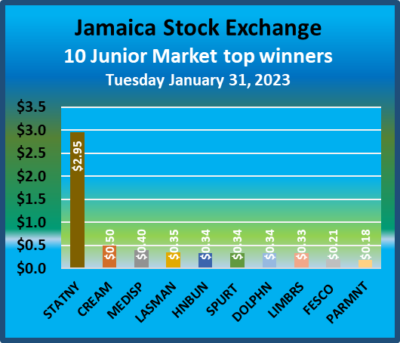

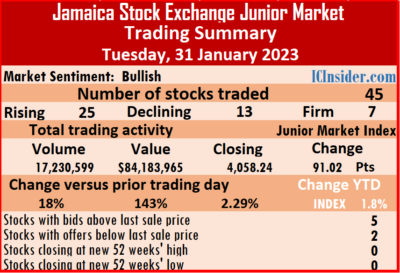

Big bounce for Junior Market on Tuesday

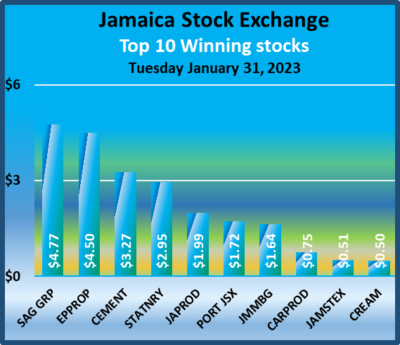

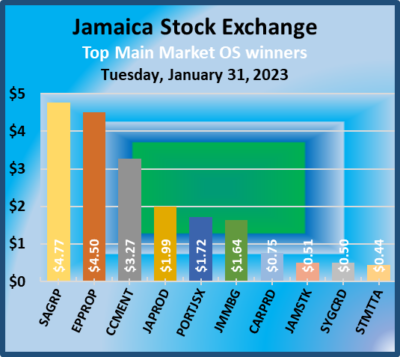

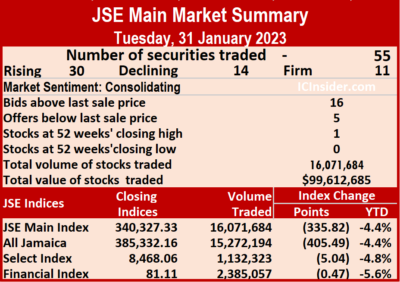

The Junior Market of the Jamaica Stock Exchange surged sharply to close out the first month of 2023 positively and the JSE USD index climbed on top of Monday’s strong gains but the Main Market fell back to remain negative for the year to date.

Trading ended with an exchange of 34,401,378 shares up from 33,340,369 units on Monday, valued at $183.6 million versus $357.1 million on the previous day. Trading on the JSE USD market resulted in investors trading US$37,070 versus US$267,767 on Monday.

Trading ended with an exchange of 34,401,378 shares up from 33,340,369 units on Monday, valued at $183.6 million versus $357.1 million on the previous day. Trading on the JSE USD market resulted in investors trading US$37,070 versus US$267,767 on Monday.

At the close, the Combined Market Index rose 532.70 points to close at 354,739.11, while the All Jamaican Composite Index dipped 405.49 points to 385,332.16, the JSE Main Market Index fell 335.82 points to 340,327.33, the Junior Market jumped 91.02 points to 4,058.24 and the JSE US dollar market climbed 6.36 points to close at 225.43.

The market’s PE ratio ended at 23 based on 2021-22 earnings and 14 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.  Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

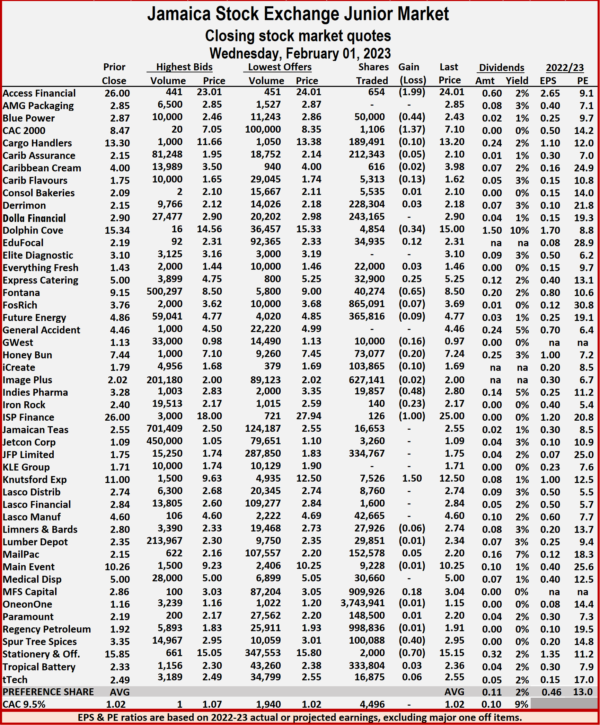

A total of 10,060,543 shares were traded for $24,020,110 compared to 17,230,599 units at $84,183,965 on Tuesday.

A total of 10,060,543 shares were traded for $24,020,110 compared to 17,230,599 units at $84,183,965 on Tuesday. Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and two with lower offers.

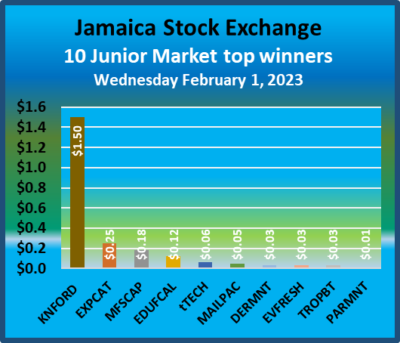

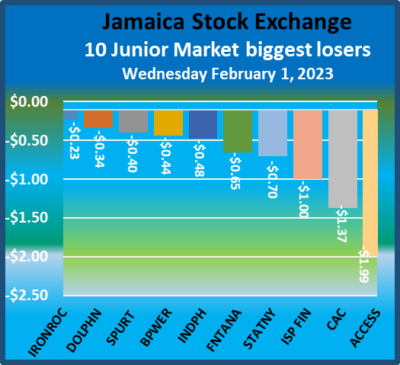

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and two with lower offers. Future Energy Source lost 9 cents in ending at $4.77 afte365,816 stock units were traded, GWest Corporation fell 16 cents to end at 97 cents with 10,000 shares crossing the market. Honey Bun dipped 20 cents to $7.24 as investors exchanged 73,077 stocks, iCreate lost 10 cents to close at $1.69 after a transfer of 103,865 units, Indies Pharma shed 48 cents in closing at $2.80 with 19,857 shares changing hands. Iron Rock Insurance fell 23 cents to finish at $2.17 trading 140 stock units, ISP Finance declined $1 ending at $25 after clearing the market with 126 stocks, Knutsford Express advanced $1.50 to $12.50 with investors transferring 7,526 stock units. MFS Capital Partners gained 18 cents to end at $3.04 with 909,926 shares changing hands,

Future Energy Source lost 9 cents in ending at $4.77 afte365,816 stock units were traded, GWest Corporation fell 16 cents to end at 97 cents with 10,000 shares crossing the market. Honey Bun dipped 20 cents to $7.24 as investors exchanged 73,077 stocks, iCreate lost 10 cents to close at $1.69 after a transfer of 103,865 units, Indies Pharma shed 48 cents in closing at $2.80 with 19,857 shares changing hands. Iron Rock Insurance fell 23 cents to finish at $2.17 trading 140 stock units, ISP Finance declined $1 ending at $25 after clearing the market with 126 stocks, Knutsford Express advanced $1.50 to $12.50 with investors transferring 7,526 stock units. MFS Capital Partners gained 18 cents to end at $3.04 with 909,926 shares changing hands,  Spur Tree Spices lost 40 cents in closing at $2.95 with the swapping of 100,088 units and Stationery and Office Supplies fell 70 cents to $15.15 after transferring 2,000 units.

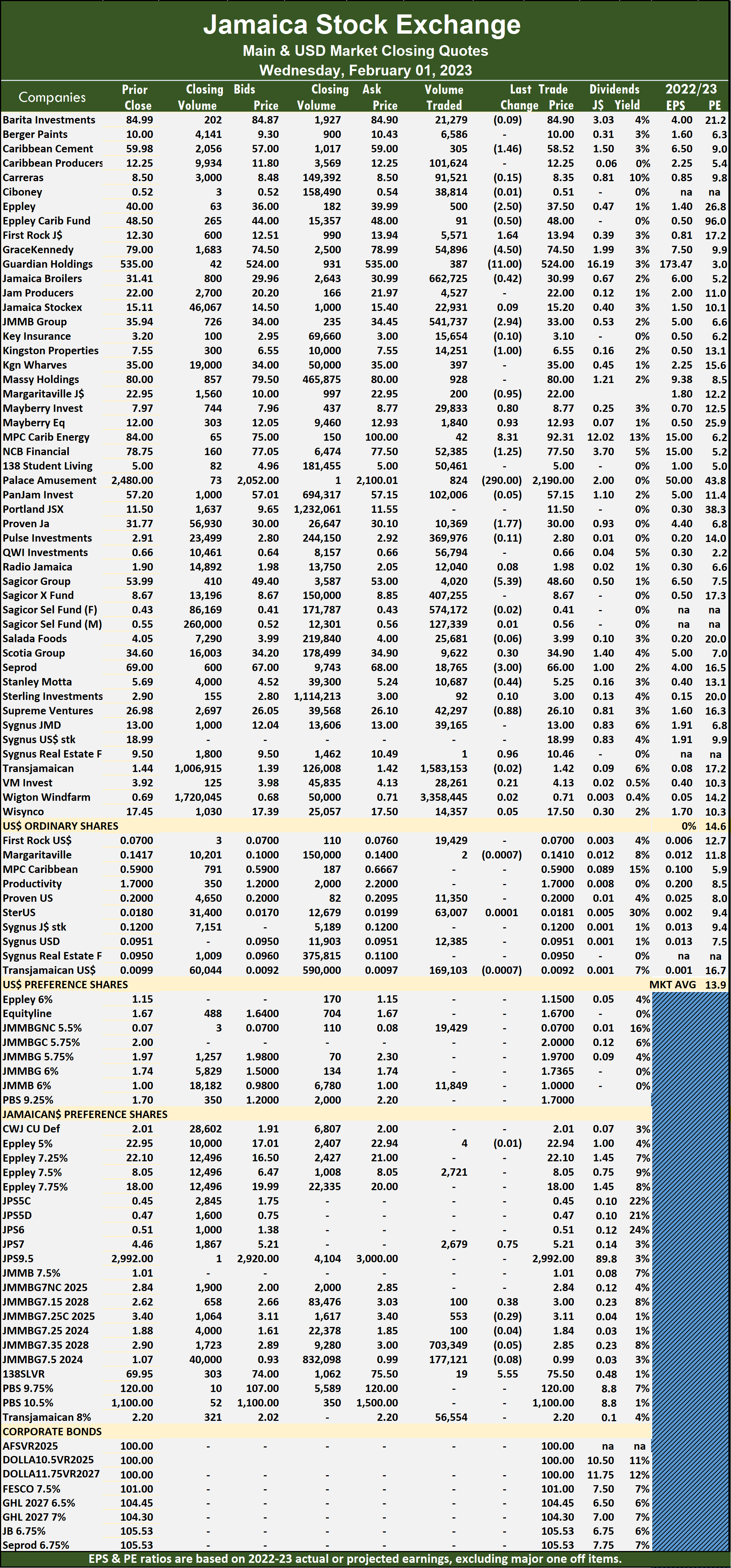

Spur Tree Spices lost 40 cents in closing at $2.95 with the swapping of 100,088 units and Stationery and Office Supplies fell 70 cents to $15.15 after transferring 2,000 units. A total of 9,458,006 shares were traded for $74,659,322 down from 16,071,684 units at $99,612,685 on Tuesday.

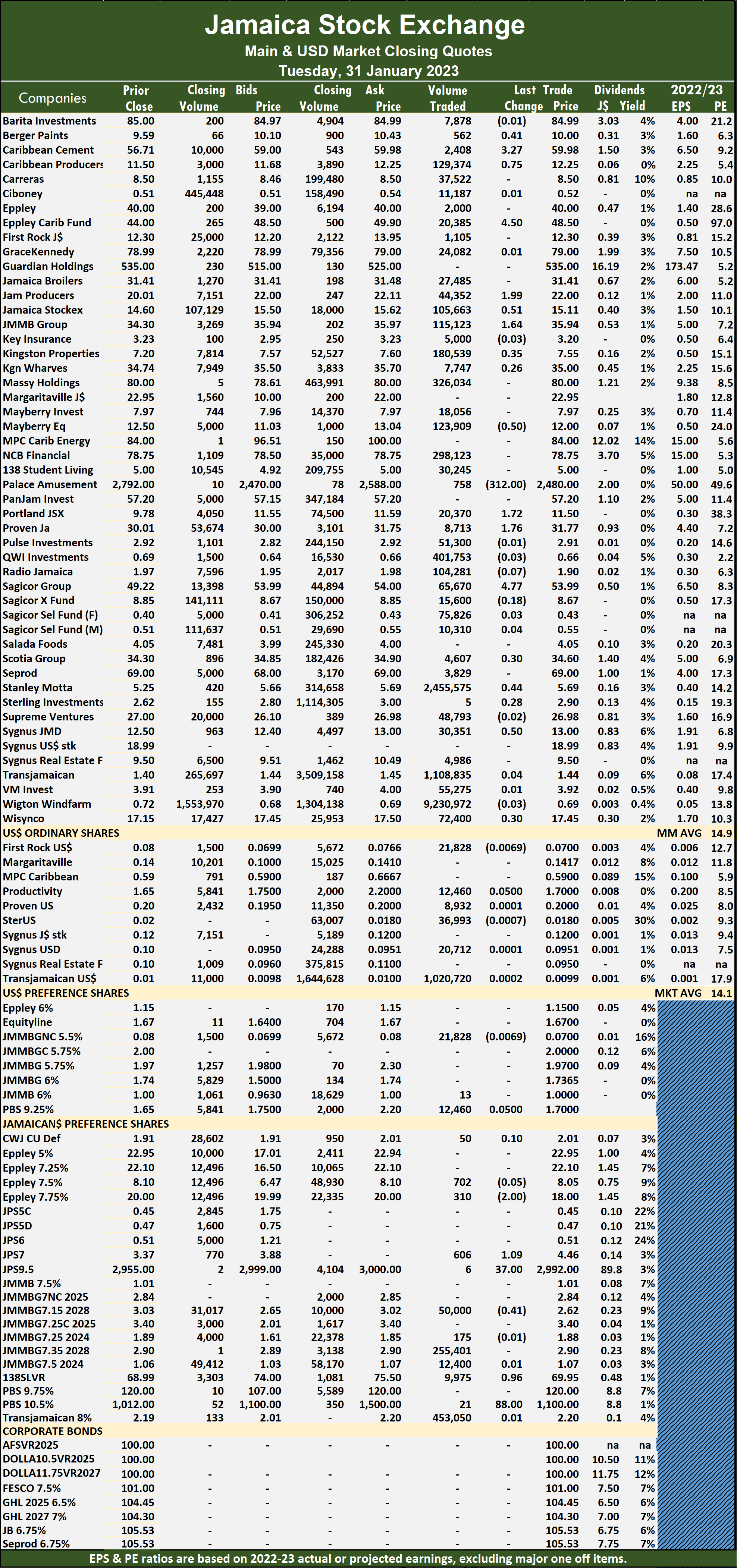

A total of 9,458,006 shares were traded for $74,659,322 down from 16,071,684 units at $99,612,685 on Tuesday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasts by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

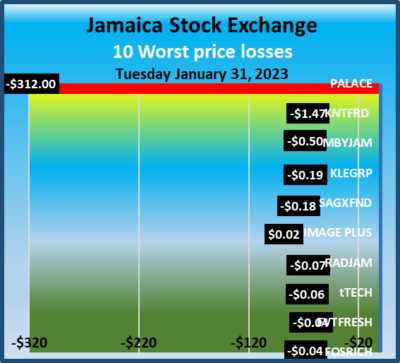

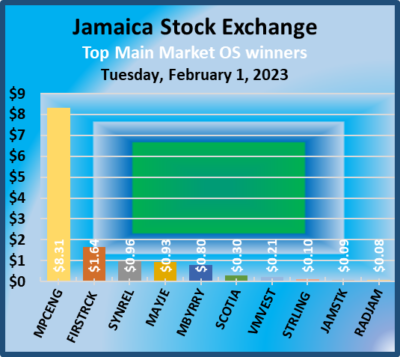

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasts by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Kingston Properties fell $1 to $6.55 after a transfer of 14,251 stocks. Margaritaville fell 95 cents to close at $22 with an exchange of 200 stock units, Mayberry Investments rose 80 cents to $8.77 in trading 29,833 shares, Mayberry Jamaican Equities advanced 93 cents to close at $12.93 with 1,840 units changing hands. MPC Caribbean Clean Energy climbed $8.31 to end at $92.31, with 42 stocks clearing the market, NCB Financial declined $1.25 in closing at a 52 weeks’ low of $77.50 in switching ownership of 52,385 stock units, Palace Amusement dropped $290 in ending at $2,190 trading 824 shares. Proven Investments dipped $1.77 to $30 after a transfer of 10,369 units, Sagicor Group declined $5.39 to end at $48.60 after trading 4,020 units, Seprod shed $3 to close at $66 with the swapping of 18,765 shares. Stanley Motta lost 44 cents in ending at $5.25 with investors transferring 10,687 stock units,

Kingston Properties fell $1 to $6.55 after a transfer of 14,251 stocks. Margaritaville fell 95 cents to close at $22 with an exchange of 200 stock units, Mayberry Investments rose 80 cents to $8.77 in trading 29,833 shares, Mayberry Jamaican Equities advanced 93 cents to close at $12.93 with 1,840 units changing hands. MPC Caribbean Clean Energy climbed $8.31 to end at $92.31, with 42 stocks clearing the market, NCB Financial declined $1.25 in closing at a 52 weeks’ low of $77.50 in switching ownership of 52,385 stock units, Palace Amusement dropped $290 in ending at $2,190 trading 824 shares. Proven Investments dipped $1.77 to $30 after a transfer of 10,369 units, Sagicor Group declined $5.39 to end at $48.60 after trading 4,020 units, Seprod shed $3 to close at $66 with the swapping of 18,765 shares. Stanley Motta lost 44 cents in ending at $5.25 with investors transferring 10,687 stock units,  Supreme Ventures dipped 88 cents to $26.10 with 42,297 stocks changing hands and Sygnus Real Estate Finance rallied 96 cents to close at $10.46 in trading one stock unit.

Supreme Ventures dipped 88 cents to $26.10 with 42,297 stocks changing hands and Sygnus Real Estate Finance rallied 96 cents to close at $10.46 in trading one stock unit. A total of 16,071,684 shares were exchanged for $99,612,685 versus 18,191,600 units at $322,436,055 on Monday.

A total of 16,071,684 shares were exchanged for $99,612,685 versus 18,191,600 units at $322,436,055 on Monday. Market Index fell 335.82 points to 340,327.33 and the JSE Financial Index shed 0.47 points to close at 81.11.

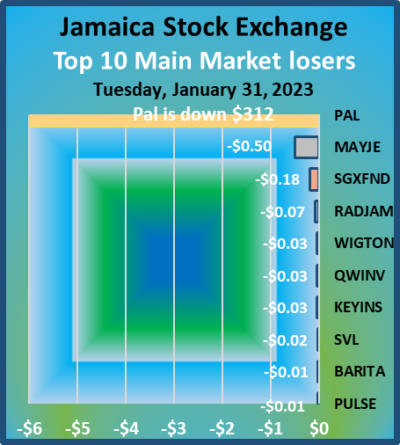

Market Index fell 335.82 points to 340,327.33 and the JSE Financial Index shed 0.47 points to close at 81.11. JMMB Group advanced $1.64 to end at $35.94 in an exchange of 115,123 stock units, Mayberry Jamaican Equities dipped 50 cents to close at $12 with 123,909 shares changing hands, Palace Amusement dropped $312 to $2,480 with the swapping of 758 units. Portland JSX rose $1.72 to $11.50 after an exchange of 20,370 stocks, Proven Investments advanced $1.76 to $31.77 in trading 8,713 shares, Sagicor Group climbed $4.77 to t $53.99 in transferring 65,670 stock units. Stanley Motta popped 44 cents in closing at $5.69, with 2,455,575 stock units crossing the market and Sygnus Credit Investments gained 50 cents ending at $13 in trading 30,351 units.

JMMB Group advanced $1.64 to end at $35.94 in an exchange of 115,123 stock units, Mayberry Jamaican Equities dipped 50 cents to close at $12 with 123,909 shares changing hands, Palace Amusement dropped $312 to $2,480 with the swapping of 758 units. Portland JSX rose $1.72 to $11.50 after an exchange of 20,370 stocks, Proven Investments advanced $1.76 to $31.77 in trading 8,713 shares, Sagicor Group climbed $4.77 to t $53.99 in transferring 65,670 stock units. Stanley Motta popped 44 cents in closing at $5.69, with 2,455,575 stock units crossing the market and Sygnus Credit Investments gained 50 cents ending at $13 in trading 30,351 units. Jamaica Public Service 7% gained $1.09 to end at 52 weeks’ high of $4.46 in switching ownership of 606 shares, Jamaica Public Service 9.5% rallied $37 in ending at $2,992 with six stock units crossing the market. JMMB Group 7.15% – 2028 fell 41 cents to close at $2.62 with the swapping of 50,000 stocks and 138 Student Living preference share rose 96 cents to $69.95 with an exchange of 9,975 units.

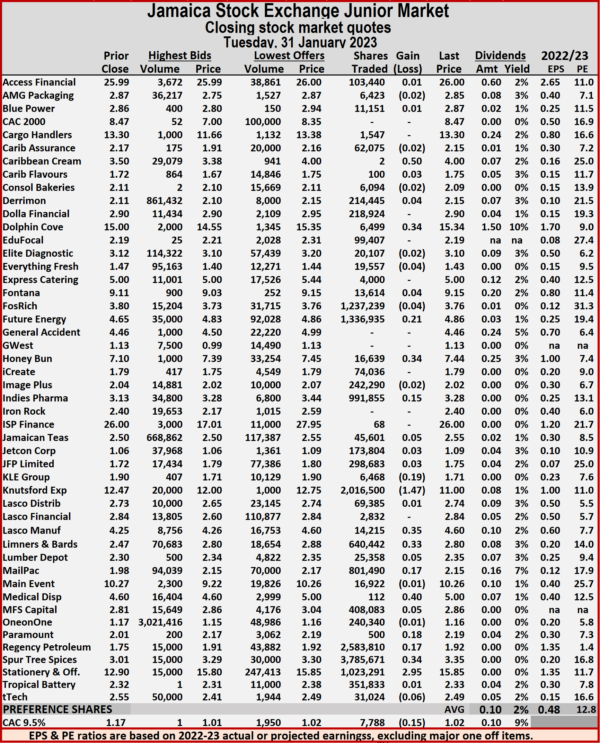

Jamaica Public Service 7% gained $1.09 to end at 52 weeks’ high of $4.46 in switching ownership of 606 shares, Jamaica Public Service 9.5% rallied $37 in ending at $2,992 with six stock units crossing the market. JMMB Group 7.15% – 2028 fell 41 cents to close at $2.62 with the swapping of 50,000 stocks and 138 Student Living preference share rose 96 cents to $69.95 with an exchange of 9,975 units. A total of 17,230,599 shares were traded for $84,183,965, compared with 14,577,720 units at $34,703,364 on Monday.

A total of 17,230,599 shares were traded for $84,183,965, compared with 14,577,720 units at $34,703,364 on Monday. Knutsford Express fell $1.47 to close at $11 with an exchange of 2,016,500 stocks, Lasco Manufacturing gained 35 cents to finish at $4.60 after 14,215 shares cleared the market, Limners and Bards rallied 33 cents to end at $2.80 in an exchange of 640,442 shares. Mailpac Group gained 17 cents in ending at $2.15 after investors transferred 801,490 stock units, Medical Disposables rose 40 cents to $5 in trading 112 units, Paramount Trading rallied 18 cents to $2.19 trading 500 stocks. Regency Petroleum popped 17 cents to end at $1.92 after 2,583,810 stock units passed through the market, Spur Tree Spices gained 34 cents in closing at $3.35 with the swapping of 3,785,671 stocks and

Knutsford Express fell $1.47 to close at $11 with an exchange of 2,016,500 stocks, Lasco Manufacturing gained 35 cents to finish at $4.60 after 14,215 shares cleared the market, Limners and Bards rallied 33 cents to end at $2.80 in an exchange of 640,442 shares. Mailpac Group gained 17 cents in ending at $2.15 after investors transferred 801,490 stock units, Medical Disposables rose 40 cents to $5 in trading 112 units, Paramount Trading rallied 18 cents to $2.19 trading 500 stocks. Regency Petroleum popped 17 cents to end at $1.92 after 2,583,810 stock units passed through the market, Spur Tree Spices gained 34 cents in closing at $3.35 with the swapping of 3,785,671 stocks and  Stationery and Office Supplies advanced $2.95 to close at $15.85 with the swapping of 1,023,291 units.

Stationery and Office Supplies advanced $2.95 to close at $15.85 with the swapping of 1,023,291 units.