Investors on Tuesday traded 75 percent fewer shares with 81 percent less value than Monday on the Jamaica Stock Exchange US dollar market and resulting in 10 active securities compared to 12 on Monday with four rising, two declining and four ending unchanged.

A total of 52,982 shares were traded for US$4,956 compared with 211,152 units at US$25,901 on Monday.

A total of 52,982 shares were traded for US$4,956 compared with 211,152 units at US$25,901 on Monday.

Trading averaged 5,298 shares at US$496, versus 17,596 stock units at US$2,158 on Monday, with a month to date average of 23,958 shares at US$1,461 versus 31,135 units at US$1,832 on the previous day. November ended with an average of 33,854 units for US$3,351.

The JSE US Denominated Equities Index gained 4.81 points to end at 230.15.

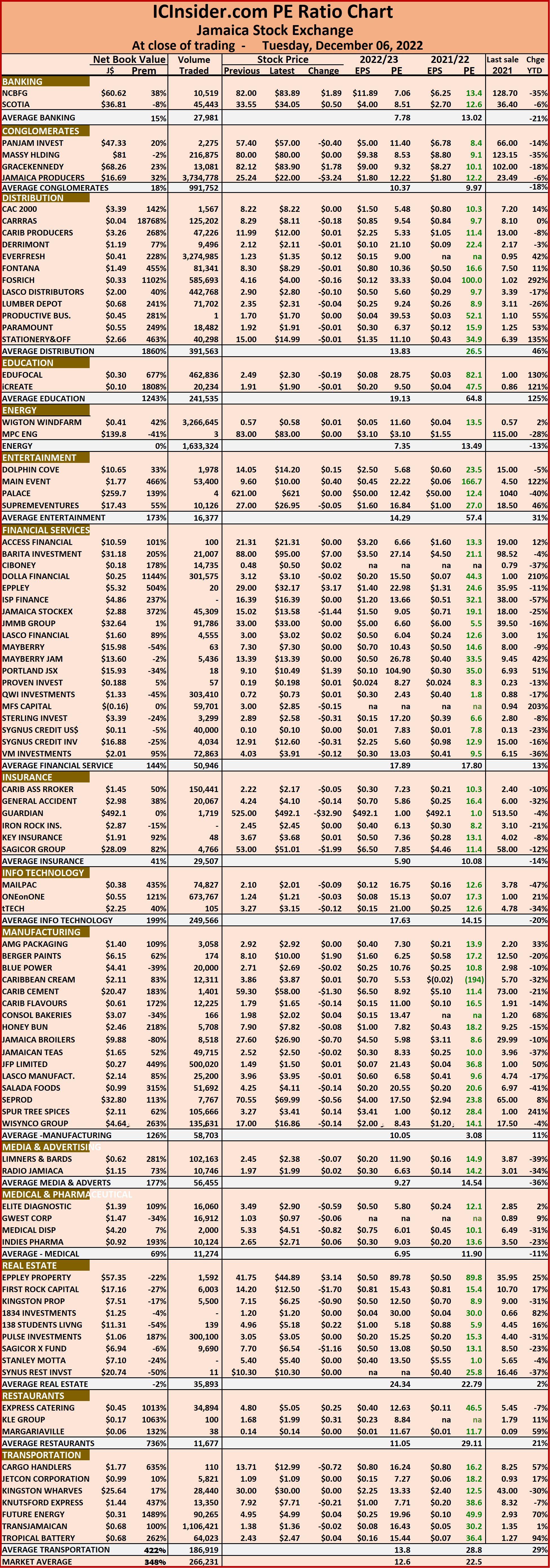

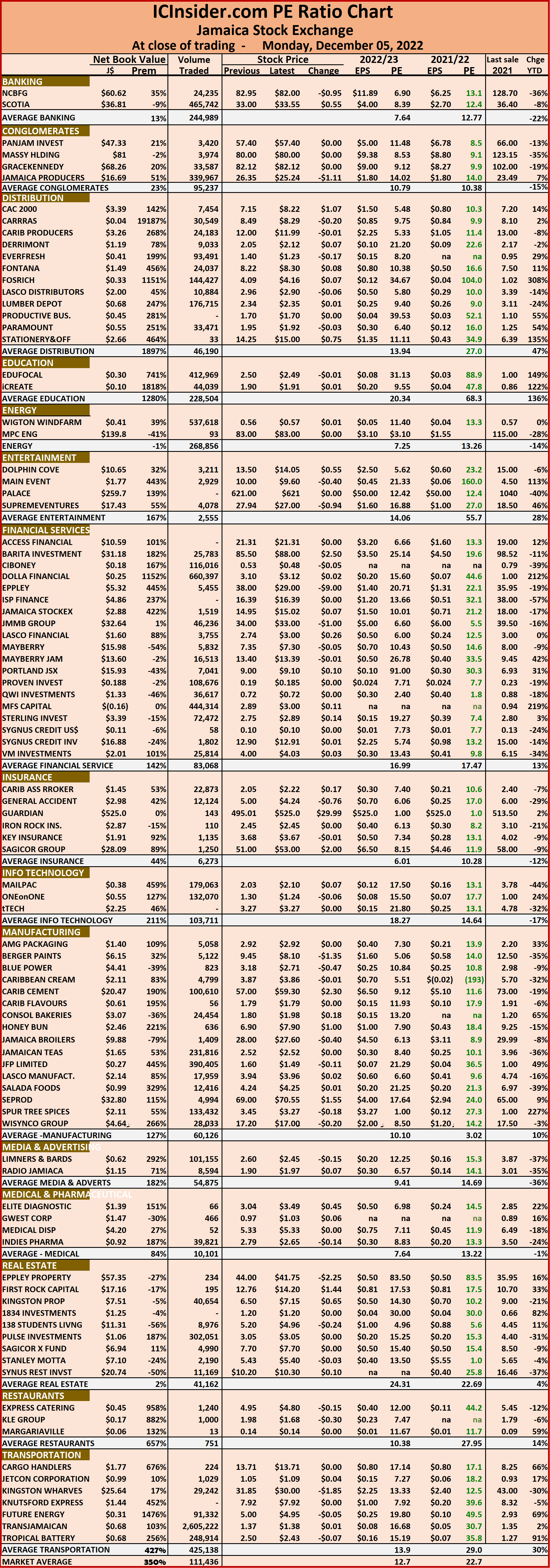

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows no stock ended with a bid higher than the last selling prices and two with lower offers.

At the close, First Rock Real Estate USD share dipped 0.31 cents to end at 7.19 US cents with an exchange of 9,000 shares, Margaritaville ended at 14 US cents in an exchange of 38 stock units, MPC Caribbean Clean Energy popped 5 cents to close at 63 US cents with just three stocks crossing the market. Productive Business Solutions remained at US$1.70 in trading a mere one unit,  Proven Investments rallied 1.34 cents to 19.84 US cents with investors transferring 57 stocks, Sterling Investments ended at 2.09 US cents, with 545 stock units traded. Sygnus Credit Investments USD share gained 0.13 of a cent to end at 9.99 US cents after an exchange of 40,000 units, Sygnus Real Estate Finance USD share declined by 1.7 cents to end at 11 US cents after an exchange of 2,300 shares and Transjamaican Highway climbed 0.06 of a cent in closing at 0.96 of one US cent with an exchange of 1,028 shares.

Proven Investments rallied 1.34 cents to 19.84 US cents with investors transferring 57 stocks, Sterling Investments ended at 2.09 US cents, with 545 stock units traded. Sygnus Credit Investments USD share gained 0.13 of a cent to end at 9.99 US cents after an exchange of 40,000 units, Sygnus Real Estate Finance USD share declined by 1.7 cents to end at 11 US cents after an exchange of 2,300 shares and Transjamaican Highway climbed 0.06 of a cent in closing at 0.96 of one US cent with an exchange of 1,028 shares.

In the preference segment, JMMB Group 6% remained at US$1.02 after a transfer of 10 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE USD Market

Fall for Main and Junior markets

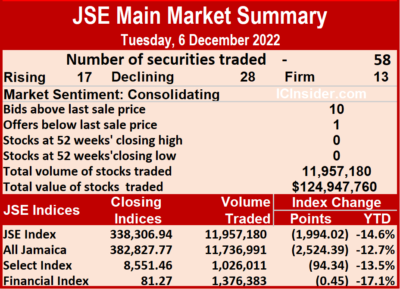

The Jamaica Stock Exchange started Tuesday under pressure with the Main and the Junior market declining but the JSE US dollar market rose early in the morning session as trading ended with the volume and value of shares trading jumping sharply over Monday’s levels.

At the close the Combined Market Index dropped 2,400.01 points to close at 350,841.50, the JSE Main Index lost 1,994.02 points to 338,306.94 while the All Jamaica Composite Index dived 2,524.39 points to 382,827.77 the Junior Market dropped 59.27 points to 3,840.04 and the JSE US dollar market popped 4.81 points to 230.15.

At the close the Combined Market Index dropped 2,400.01 points to close at 350,841.50, the JSE Main Index lost 1,994.02 points to 338,306.94 while the All Jamaica Composite Index dived 2,524.39 points to 382,827.77 the Junior Market dropped 59.27 points to 3,840.04 and the JSE US dollar market popped 4.81 points to 230.15.

Trading ended, with 19,518,971 shares changing hands, for a mere $141.47 million, compared with $58.68 million, with 10,275,805 shares traded in all markets on the previous day. The JSE USD market ended with the value of stocks traded amounting to US$4,956 from US$25,901 on Monday.

The market’s PE ratio ended at 22.5 based on 2021-22 earnings and 12.6 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.  Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Big surge in trading on JSE USD market

Trading picked on Monday on the Jamaica Stock Exchange US dollar market with a 1,450 percent surge in the volume of shares changing hands worth 2,398 percent more than on Friday, resulting from trading in 211,152 shares at US$25,901 compared to a mere 13,619 units at just US$1,037 on Friday, resulting in trading in 12 securities, compared to five on Friday with prices of six rising, three declining and three ending unchanged.

Trading averaged 17,596 units at US$2,158 compared with 2,724 shares at US$207 on Friday, with a month to date average of 31,135 shares at US$1,832 versus 42,739 units at US$1,552 on the previous trading day. November ended with an average of 33,854 units for US$3,351.

Trading averaged 17,596 units at US$2,158 compared with 2,724 shares at US$207 on Friday, with a month to date average of 31,135 shares at US$1,832 versus 42,739 units at US$1,552 on the previous trading day. November ended with an average of 33,854 units for US$3,351.

The JSE US Denominated Equities Index lost 0.90 points to end at 225.34.

The PE Ratio, a measure for computing appropriate stock values, averages 8.3. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling prices and one with a lower offer.

At the close, Margaritaville ended at 14 US cents after finishing trading 13 shares, MPC Caribbean Clean Energy advanced 3 cents in ending at 58 US cents with the swapping of 90 stock units, Proven Investments dipped 0.03 of a cent to end at 18.5 US cents, with 108,676 stocks changing hands. Sterling Investments gained 0.01 of one cent in closing at 2.09 US cents as just 93 units passed through the market, Sygnus Credit Investments USD share popped 0.36 of one cent to close at 9.86 US cents in trading 58 stock units,  Sygnus Real Estate Finance USD share rallied 1.7 cents in closing at 12.7 US cents with an exchange of just 20 units and Transjamaican Highway fell 0.06 of a cent to 0.9 of one US cent after 99,773 stocks were exchanged.

Sygnus Real Estate Finance USD share rallied 1.7 cents in closing at 12.7 US cents with an exchange of just 20 units and Transjamaican Highway fell 0.06 of a cent to 0.9 of one US cent after 99,773 stocks were exchanged.

In the preference segment, Productive Business 9.25% preference share rose 10 cents to US$11.10 in switching ownership of 65 shares, Equityline Mortgage Investment preference share ended at US$1.67 after an exchange of one stock unit. JMMB Group 5.75% ended at US$1.50 after a transfer of one share, JMMB Group 5.75% shed 4 cents to close at US$1.95 with an exchange of 1,690 stocks and JMMB Group 6% popped 2 cents up to US$1.02, with 672 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

About 5.3% of Regency IPO shares for the Public

Initial public share issues continue to disappoint many investors, with investors in the Regency Petroleum issue allocated the first 10,000 shares applied for plus approximately 5.3% thereafter, a release from the lead broker, GK Capital Management, stated.

Strategic Partners, Employees and applicants converting loans got a full allocation of amounts applied for, the report also indicated.

Strategic Partners, Employees and applicants converting loans got a full allocation of amounts applied for, the report also indicated.

Applications in the general pool with the same JCSD number were consolidated and treated as one.

The prospectus indicates that listing of the shares is expected to take place within 21 days of the closing of the issue, with ten days elapsing since the issue closed on November 25, the listing should take place before the end of next week.

A total of 287,157,354 Ordinary Shares were for sale at $1 each, with only 115,196,354 shares that were available to the public.

Gains for Main and Junior Markets

The Junior and the Main Market just held its head above water at the close of trading on the Jamaica Stock Exchange on Monday and the JSE USD market declined moderately as trading ended with the volume and value of shares trading declining from Friday’s levels.

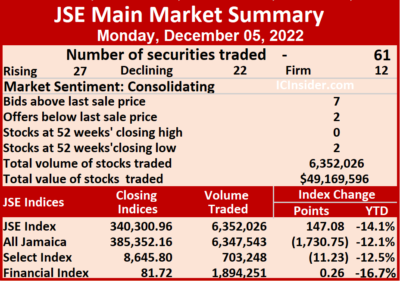

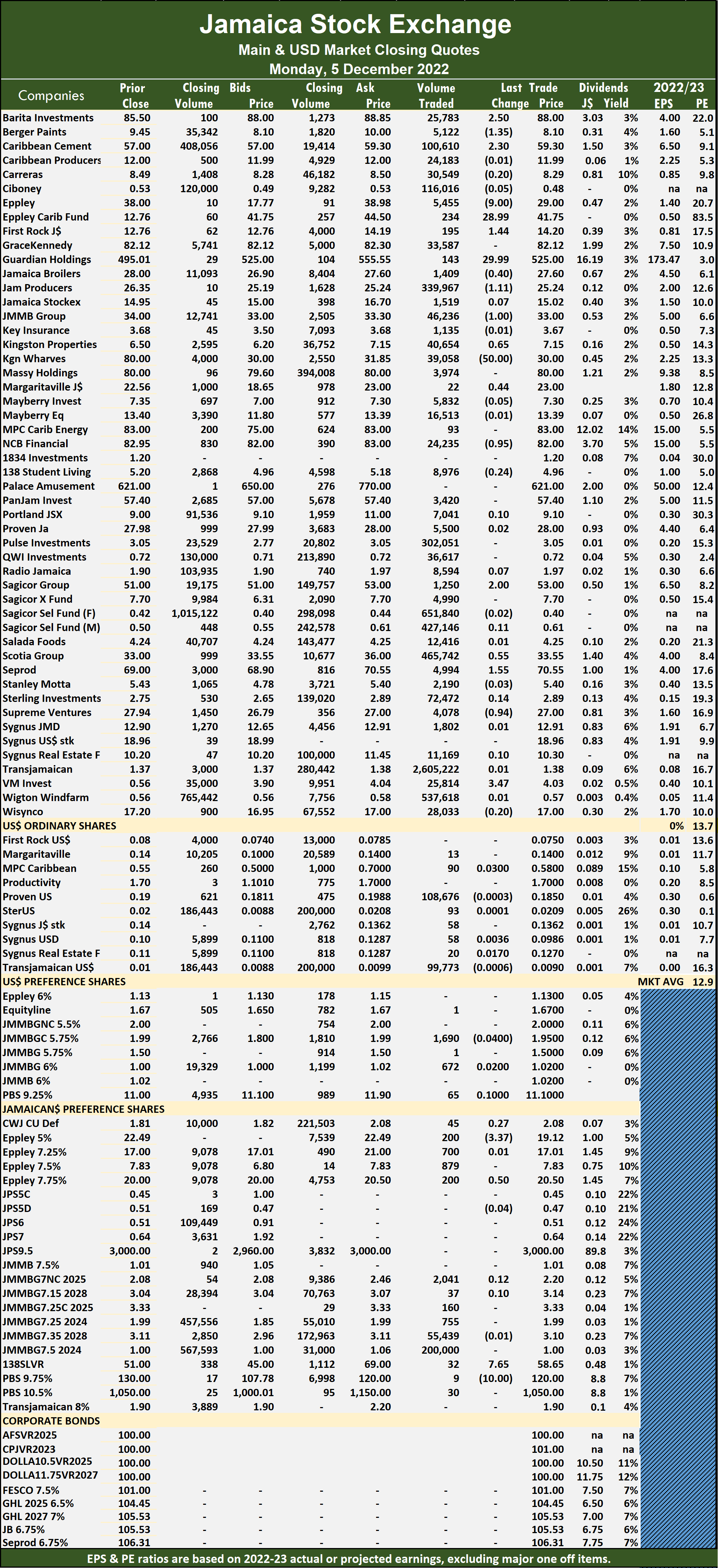

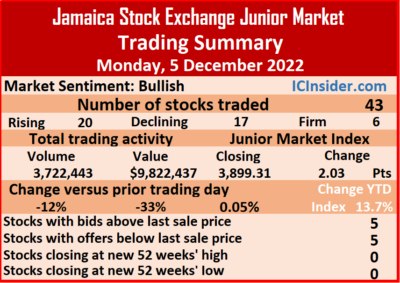

The Combined Market Index popped 155.79 points to close at 353,241.51, the JSE Main Index rose 147.08 points to 340,300.96 while the All Jamaica Composite Index dived 1,730.75 points to 387,5,352.16, the Junior Market rallied 2.03 points to 3,899.31 and the JSE US dollar market slipped 0.90 points to 225.34.

The Combined Market Index popped 155.79 points to close at 353,241.51, the JSE Main Index rose 147.08 points to 340,300.96 while the All Jamaica Composite Index dived 1,730.75 points to 387,5,352.16, the Junior Market rallied 2.03 points to 3,899.31 and the JSE US dollar market slipped 0.90 points to 225.34.

Trading ended, with 10,275,805 shares changing hands, for a mere $58.68 million, versus $88.01 million, with 10,797,661 shares traded in all markets on the previous day. The JSE USD market ended with the value of stocks traded amounting to US$25,901 from US$1,037 on Friday.

The market’s PE ratio ended at 22.7 based on 2021-22 earnings and 12.7 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Kingston Wharves left for dead

Peculiarities of the local stock market can be seen in many areas with the performance of Kingston Wharves since 2019 highlighting the exuberance of many investors. They pushed the stock up to a high of $78 in 2019 with earnings per share of $1.82 from profits of $2.6 billion, up from a profit of $1.97 million in 2018, with earnings per share of $1.36, but the stock was selling at an enormous price earnings ratio in excess of 43 times 2019 earnings.

Kingston Wharves’ profit rose 8% in Q3.

Investors could not care less about a stock that was excessively overvalued, with the valuation well ahead of the market average at the time, around 22 times at the end of 2019. The company reported a profit of $3.25 billion in 2021 versus $2.28 billion in 2020 for earnings per share of $2.24 up from $1.57 in the previous year. Investors who were paying nearly $80 per share in 2019 are now scared to buy the stock around the $32 level even with improved earnings since 2019.

Admittedly, interest rates on Government of Jamaica Treasury bills at 1.6 percent in December 2019 were very attractive but it was at an unsustainable level and is now just over eight percent. This would result in a reduction in share valuation. But it does not explain why a stock that was priced at twice the rest of the market is no longer having a premium over the market.

For the current year to September, Kingston Wharves reported flat earnings of $2.1 billion compared to the previous year, but the third quarter reflects a 7.7 percent improvement in profits to $837 million in 2022 from $778 million in 2021.

Other operating revenues came in at $135.5 million in the September 2022 quarter, up from $53 million in 2021 and for the year to date, $155.8 billion down from $316 billion in 2021.

Cost of sales in the September quarter amounted to $1.267 billion versus $1.06 billion in 2021 and for the nine months $3.6 billion versus $3.1 billion, resulting in a gross profit of $1.18 billion for the September 2022 quarter, a slight improvement over the $1.16 billion in the previous year and for the nine months, $3.39 billion versus $3.1 billion. The gross profit margin slipped from 52 percent in the September 2021 quarter to 48 percent in 2022 with the year to date dipping from 50 percent in 2021 to 48 percent this year.

Administrative expenses amounted to $335 million in the September 2022 quarter, up 16 percent from $290 million in 2021 and for the nine months, rose 23 percent to $1.1 billion from $899 million in the previous year. Finance costs accounted for $25 million in the September 2022 quarter, up from $20.55 million last year and for the nine months, $32 million, down from $90 million in the previous year’s nine months. Taxation accounted for $117 million versus $127 million in the 2021 September quarter and $304 million for the nine months to September 2022, from $342 million in the previous year.

Administrative expenses amounted to $335 million in the September 2022 quarter, up 16 percent from $290 million in 2021 and for the nine months, rose 23 percent to $1.1 billion from $899 million in the previous year. Finance costs accounted for $25 million in the September 2022 quarter, up from $20.55 million last year and for the nine months, $32 million, down from $90 million in the previous year’s nine months. Taxation accounted for $117 million versus $127 million in the 2021 September quarter and $304 million for the nine months to September 2022, from $342 million in the previous year.

Shareholders’ equity ended the period at $36.66 billion. Total borrowed funds amounted to just $1.7 billion while it holds cash funds and investments of $9.5 billion. Current assets amount to $11 billion and current liabilities of $1.96 billion. Cash flows from operation generated inflows of $3.3 billion, after spending $1.5 billion on the purchase of property and $873 million on paying dividends and loan repayment of $500 million, the company used up all the inflows for the nine months.

Net book value per share amounts to $25.64, with the stock priced at $31.85 for a 24 percent premium. ICInsider.com projects earnings for the current year at $2.25 and $3 for 2023. These earnings suggest a stock price in 2023 in the $40 to $50 region at a PE of around 16 and it could be higher as interest rates should start to moderate by the middle of 2023 if not before. Going forward growth in the local economy is expected to continue for some time, accordingly, the wharf should be enjoying increased through put and result in increased revenues and profits.

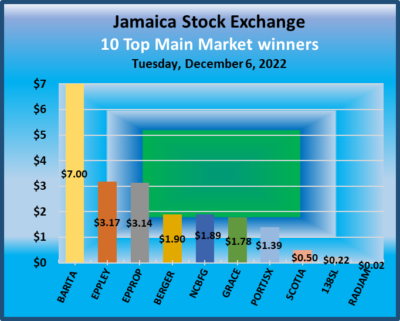

A total of 11,957,180 shares were traded for $124,947,760, up from 6,352,026 units at $49,169,596 on Monday.

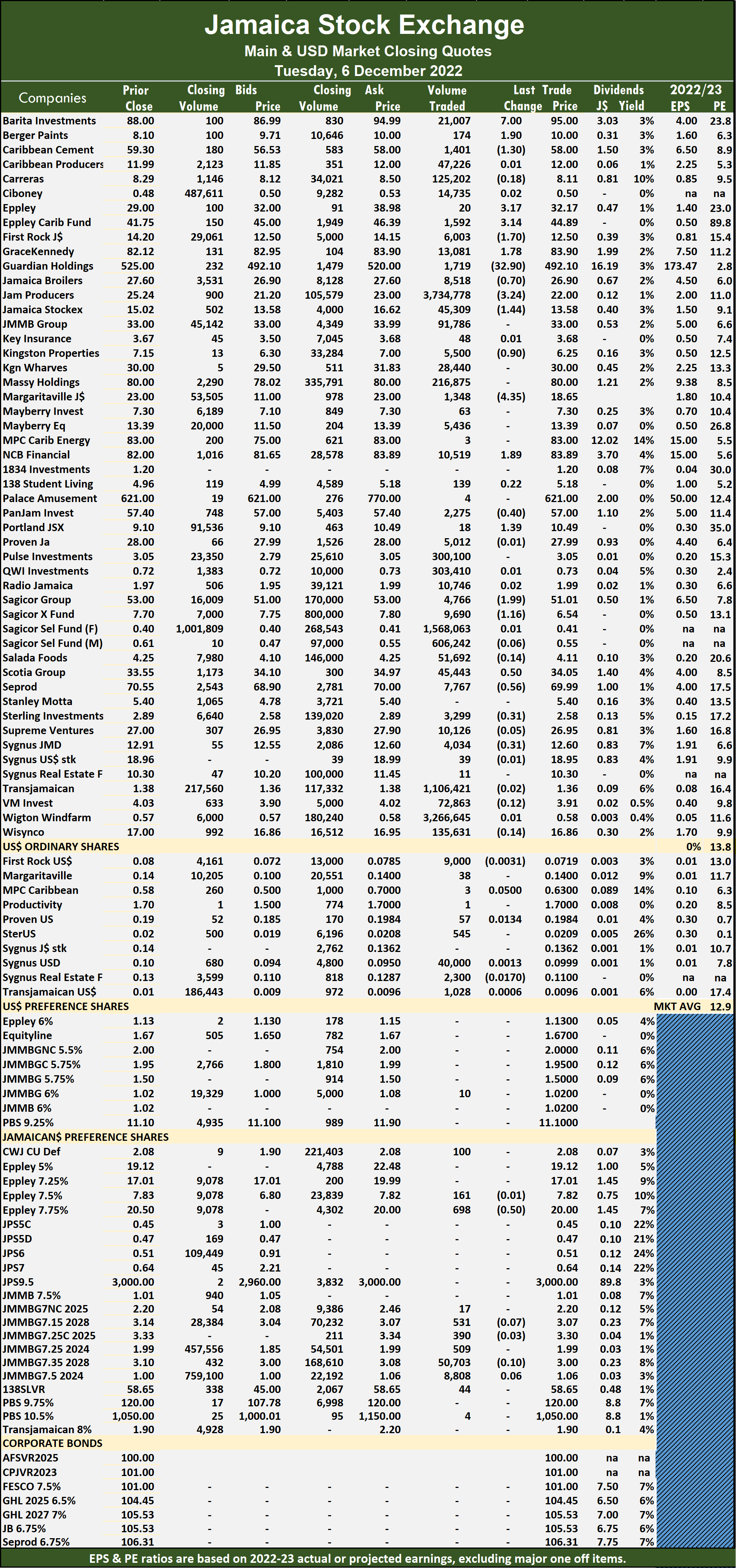

A total of 11,957,180 shares were traded for $124,947,760, up from 6,352,026 units at $49,169,596 on Monday. The PE Ratio a formula to ascertain appropriate stock values, averages 13.8 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

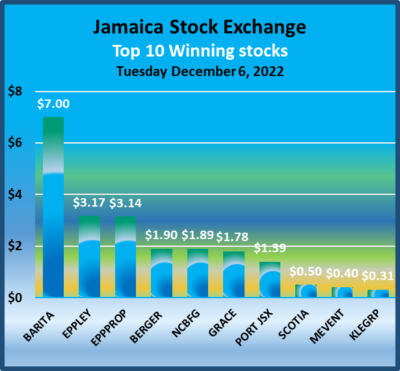

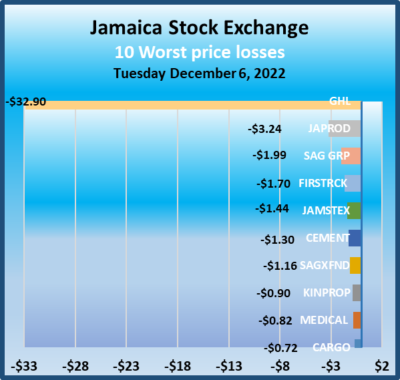

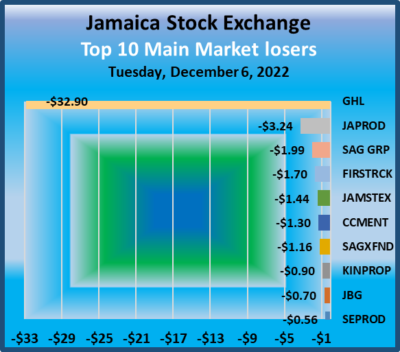

The PE Ratio a formula to ascertain appropriate stock values, averages 13.8 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. GraceKennedy rallied $1.78 to $83.90 after trading 13,081 stock units, Guardian Holdings dropped $32.90 to end at $492.10 with the swapping of 1,719 shares, Jamaica Broilers dipped 70 cents to $26.90 with 8,518 shares changing hands. Jamaica Producers declined $3.24 in closing at $22 after trading 3,734,778 stock units, Jamaica Stock Exchange shed $1.44 to settle at $13.58 after exchanging 45,309 units, Kingston Properties lost 90 cents to end at $6.25 in switching ownership of 5,500 stocks, Margaritaville dipped $4.35 to $18.65 with an exchange of 1,348 shares, NCB Financial gained $1.89 after ending at $83.89 in transferring 10,519 stock units, PanJam Investment lost 40 cents to close at $57 with 2,275 stocks clearing the market. Portland JSX rose $1.39 to $10.49 in switching ownership of 18 units, Sagicor Group fell $1.99 to $51.01 in exchanging 4,766 stock units, Sagicor Real Estate Fund shed $1.16 to end at $6.54 with the swapping of 9,690 shares.

GraceKennedy rallied $1.78 to $83.90 after trading 13,081 stock units, Guardian Holdings dropped $32.90 to end at $492.10 with the swapping of 1,719 shares, Jamaica Broilers dipped 70 cents to $26.90 with 8,518 shares changing hands. Jamaica Producers declined $3.24 in closing at $22 after trading 3,734,778 stock units, Jamaica Stock Exchange shed $1.44 to settle at $13.58 after exchanging 45,309 units, Kingston Properties lost 90 cents to end at $6.25 in switching ownership of 5,500 stocks, Margaritaville dipped $4.35 to $18.65 with an exchange of 1,348 shares, NCB Financial gained $1.89 after ending at $83.89 in transferring 10,519 stock units, PanJam Investment lost 40 cents to close at $57 with 2,275 stocks clearing the market. Portland JSX rose $1.39 to $10.49 in switching ownership of 18 units, Sagicor Group fell $1.99 to $51.01 in exchanging 4,766 stock units, Sagicor Real Estate Fund shed $1.16 to end at $6.54 with the swapping of 9,690 shares.  Scotia Group rallied 50 cents to close at $34.05 trading 45,443 units, Seprod lost 56 cents in ending at $69.99 after 7,767 stocks passed through the market.

Scotia Group rallied 50 cents to close at $34.05 trading 45,443 units, Seprod lost 56 cents in ending at $69.99 after 7,767 stocks passed through the market. A total of 7,508,809 shares were traded for $16,523,628 compared to 3,722,443 units at $9,822,437 on Monday.

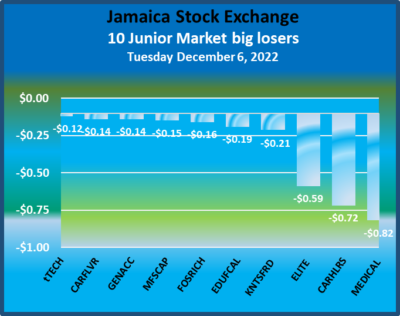

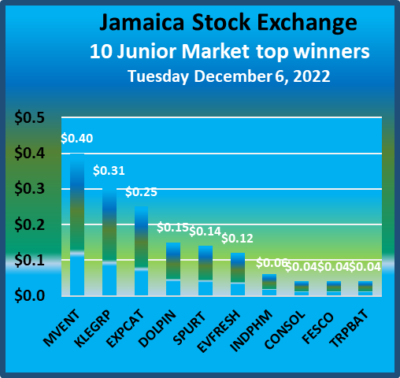

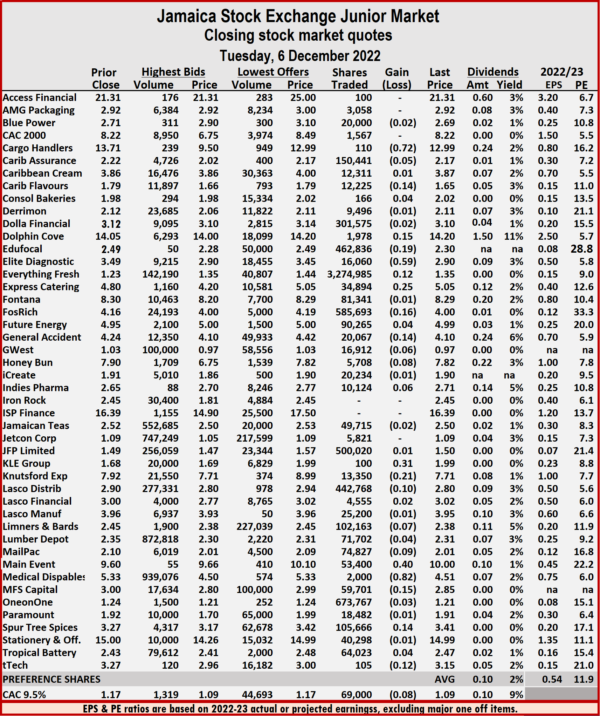

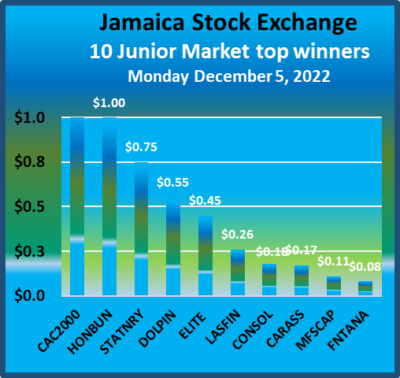

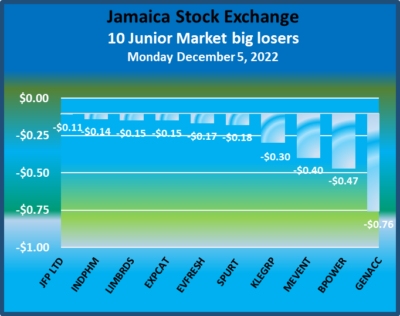

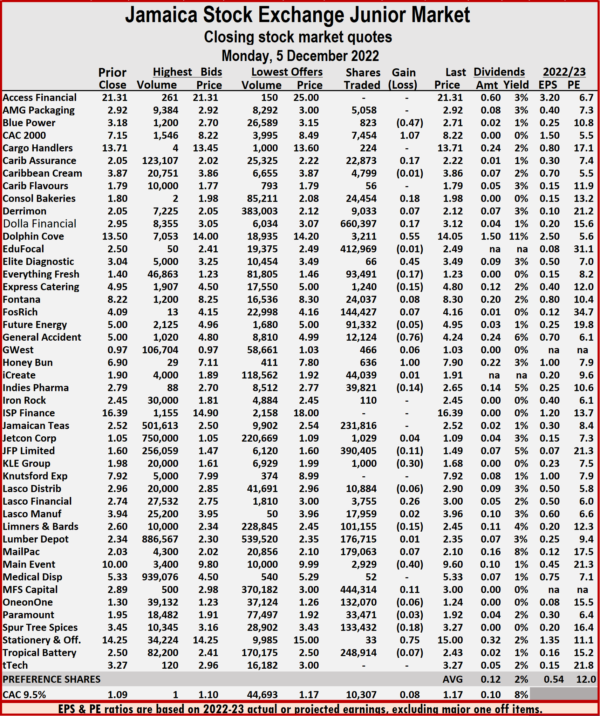

A total of 7,508,809 shares were traded for $16,523,628 compared to 3,722,443 units at $9,822,437 on Monday. The PE Ratio, a measure of computing appropriate stock values, averages 11.9. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for companies with financial year end that falls between November this year and August 2023.

The PE Ratio, a measure of computing appropriate stock values, averages 11.9. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for companies with financial year end that falls between November this year and August 2023. Diagnostic shed 59 cents in closing at $2.90 after hitting an intraday 52 weeks’ low of $2.50after 16,060 stocks changed hands, Everything Fresh gained 12 cents in closing at $1.35 trading 3,274,985 stock units. Express Catering advanced 25 cents to $5.05 with an exchange of 34,894 units, but only after hitting an intraday 52 weeks’ low of $4.15, Fosrich dipped 16 cents to $4 in transferring 585,693 shares, General Accident lost 14 cents to close at $4.10 with an exchange of 20,067 units. KLE Group climbed 31 cents to $1.99 with the swapping of just 100 shares, Knutsford Express declined 21 cents to $7.71 in switching ownership of 13,350 stocks, Lasco Distributors fell 10 cents to $2.80 in trading 442,768 stock units. Main Event advanced 40 cents to $10 after 53,400 stock units passed through the market, Medical Disposables dipped 82 cents to $4.51 after trading 2,000 stocks,

Diagnostic shed 59 cents in closing at $2.90 after hitting an intraday 52 weeks’ low of $2.50after 16,060 stocks changed hands, Everything Fresh gained 12 cents in closing at $1.35 trading 3,274,985 stock units. Express Catering advanced 25 cents to $5.05 with an exchange of 34,894 units, but only after hitting an intraday 52 weeks’ low of $4.15, Fosrich dipped 16 cents to $4 in transferring 585,693 shares, General Accident lost 14 cents to close at $4.10 with an exchange of 20,067 units. KLE Group climbed 31 cents to $1.99 with the swapping of just 100 shares, Knutsford Express declined 21 cents to $7.71 in switching ownership of 13,350 stocks, Lasco Distributors fell 10 cents to $2.80 in trading 442,768 stock units. Main Event advanced 40 cents to $10 after 53,400 stock units passed through the market, Medical Disposables dipped 82 cents to $4.51 after trading 2,000 stocks,  MFS Capital Partners shed 15 cents to close at $2.85 with the swapping of 59,701 units. Spur Tree Spices rallied 14 cents in ending at $3.41 after a transfer of 105,666 shares and tTech lost 12 cents to close at $3.15 in an exchange of a mere 105 shares.

MFS Capital Partners shed 15 cents to close at $2.85 with the swapping of 59,701 units. Spur Tree Spices rallied 14 cents in ending at $3.41 after a transfer of 105,666 shares and tTech lost 12 cents to close at $3.15 in an exchange of a mere 105 shares. A total of 6,352,026 shares were traded for $49,169,596 down from 6,541,604 units at $73,470,799 on Friday.

A total of 6,352,026 shares were traded for $49,169,596 down from 6,541,604 units at $73,470,799 on Friday. The All Jamaican Composite Index dipped 1,730.75 points to 385,352.16, the JSE Main Index popped 147.08 points to 340,300.96 and the JSE Financial Index rose 0.26 points to settle at 81.72.

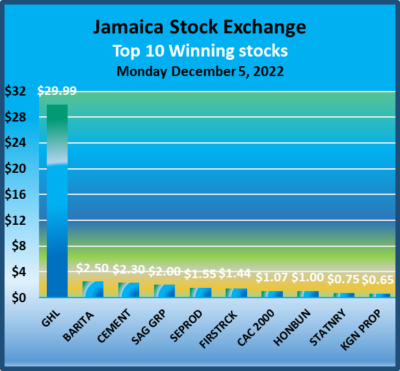

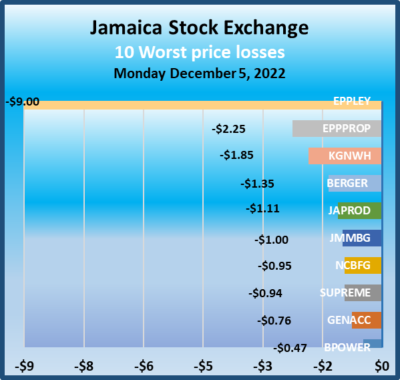

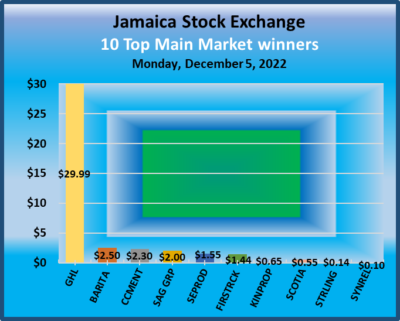

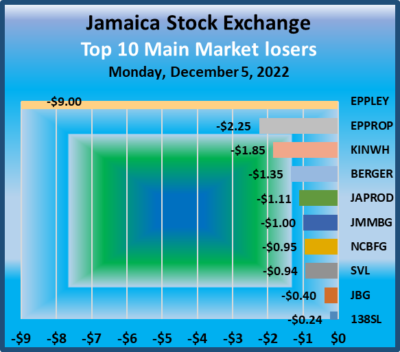

The All Jamaican Composite Index dipped 1,730.75 points to 385,352.16, the JSE Main Index popped 147.08 points to 340,300.96 and the JSE Financial Index rose 0.26 points to settle at 81.72. Eppley dropped $9 to close at a 52 weeks’ low of $29 with an exchange of 5,455 stocks, Eppley Caribbean Property Fund shed $2.25 to end at $41.75 after trading 234 stocks, First Rock Real Estate popped $1.44 to end at $14.20 as investors exchanged 195 units. Guardian Holdings climbed $29.99 to $525 with a transfer of 143 stock units, Jamaica Broilers lost 40 cents in closing at $27.60 after a transfer of 1,409 shares, Jamaica Producers dipped $1.11 to $25.24 with 339,967 stocks changing hands. JMMB Group fell $1 to close at $33 in transferring 46,236 shares, Kingston Properties gained 65 cents to settle at $7.15 with 40,654 units crossing the market, Kingston Wharves dropped $1.85 to $30 in trading 39,058 stock units. Margaritaville advanced 44 cents to $23 in an exchange of 22 units, NCB Financial declined 95 cents to $82 with the swapping of 24,235 shares, Sagicor Group rose $2 to $53 after an exchange of 1,250 stock units. Scotia Group advanced 55 cents to $33.55 after 465,742 stocks passed through the market, Seprod rose $1.55 to $70.55 in an exchange of 4,994 stock units and Supreme Ventures dipped 94 cents to $27 in switching ownership of 4,078 shares.

Eppley dropped $9 to close at a 52 weeks’ low of $29 with an exchange of 5,455 stocks, Eppley Caribbean Property Fund shed $2.25 to end at $41.75 after trading 234 stocks, First Rock Real Estate popped $1.44 to end at $14.20 as investors exchanged 195 units. Guardian Holdings climbed $29.99 to $525 with a transfer of 143 stock units, Jamaica Broilers lost 40 cents in closing at $27.60 after a transfer of 1,409 shares, Jamaica Producers dipped $1.11 to $25.24 with 339,967 stocks changing hands. JMMB Group fell $1 to close at $33 in transferring 46,236 shares, Kingston Properties gained 65 cents to settle at $7.15 with 40,654 units crossing the market, Kingston Wharves dropped $1.85 to $30 in trading 39,058 stock units. Margaritaville advanced 44 cents to $23 in an exchange of 22 units, NCB Financial declined 95 cents to $82 with the swapping of 24,235 shares, Sagicor Group rose $2 to $53 after an exchange of 1,250 stock units. Scotia Group advanced 55 cents to $33.55 after 465,742 stocks passed through the market, Seprod rose $1.55 to $70.55 in an exchange of 4,994 stock units and Supreme Ventures dipped 94 cents to $27 in switching ownership of 4,078 shares. In the preference segment, Eppley 5% preference share shed $3.37 in closing at $19.12 in switching ownership of 200 stocks, Eppley 7.75% preference share gained 50 cents to settle at $20.50 after a transfer of 200 units, 138 Student Living preference share surged $7.65 to $58.65 with 32 units clearing the market and Productive Business Solutions 9.75% preference share dropped $10 to close at $120 with investors transferring nine stocks.

In the preference segment, Eppley 5% preference share shed $3.37 in closing at $19.12 in switching ownership of 200 stocks, Eppley 7.75% preference share gained 50 cents to settle at $20.50 after a transfer of 200 units, 138 Student Living preference share surged $7.65 to $58.65 with 32 units clearing the market and Productive Business Solutions 9.75% preference share dropped $10 to close at $120 with investors transferring nine stocks. A total of 3,722,443 shares were exchanged for $9,822,437 against 4,242,438 units at $14,592,692 on Friday.

A total of 3,722,443 shares were exchanged for $9,822,437 against 4,242,438 units at $14,592,692 on Friday. Investor’s Choice bid-offer Indicator shows five stocks ending with bids higher than their last selling prices and five with lower offers.

Investor’s Choice bid-offer Indicator shows five stocks ending with bids higher than their last selling prices and five with lower offers. Diagnostic rallied 45 cents in closing at $3.49 with investors transferring 66 stocks. Everything Fresh dropped 17 cents to end at $1.23, with 93,491 units clearing the market, Express Catering declined 15 cents in ending at $4.80 with an exchange of 1,240 shares, General Accident fell 76 cents to $4.24 after trading at 12,124 stocks. Honey Bun advanced $1 to close at $7.90 while exchanging 636 shares, Indies Pharma lost 14 cents to end at $2.65 after an exchange of 39,821 units, JFP Ltd dipped 11 cents to close at $1.49 after 390,405 stock units changed hands. KLE Group dropped 30 cents in closing at $1.68 in exchanging 1,000 units, Lasco Financial popped 26 cents in ending at $3 trading 3,755 shares, Limners and Bards dipped 15 cents to $2.45 as 101,155 stock units passed through the market. Main Event lost 40 cents to end at $9.60, with stocks 2,929 crossing the market, MFS Capital Partners popped 11 cents to close at $3 with 444,314 units changing hands,

Diagnostic rallied 45 cents in closing at $3.49 with investors transferring 66 stocks. Everything Fresh dropped 17 cents to end at $1.23, with 93,491 units clearing the market, Express Catering declined 15 cents in ending at $4.80 with an exchange of 1,240 shares, General Accident fell 76 cents to $4.24 after trading at 12,124 stocks. Honey Bun advanced $1 to close at $7.90 while exchanging 636 shares, Indies Pharma lost 14 cents to end at $2.65 after an exchange of 39,821 units, JFP Ltd dipped 11 cents to close at $1.49 after 390,405 stock units changed hands. KLE Group dropped 30 cents in closing at $1.68 in exchanging 1,000 units, Lasco Financial popped 26 cents in ending at $3 trading 3,755 shares, Limners and Bards dipped 15 cents to $2.45 as 101,155 stock units passed through the market. Main Event lost 40 cents to end at $9.60, with stocks 2,929 crossing the market, MFS Capital Partners popped 11 cents to close at $3 with 444,314 units changing hands,  Spur Tree Spices shed 18 cents in closing at $3.27 in exchanging 133,432 stocks and Stationery and Office Supplies rose 75 cents to $15 in switching ownership of a mere 33 shares.

Spur Tree Spices shed 18 cents in closing at $3.27 in exchanging 133,432 stocks and Stationery and Office Supplies rose 75 cents to $15 in switching ownership of a mere 33 shares.