The Junior Market of the Jamaica Stock Exchange gave back just under a half of the gains posted on Thursday but the Main and the JSE USD markets rallied to close out the day higher than the opening, with the volume of stocks traded rising moderately, with trading ending with the value rising over the previous trading day and the market closed with prices of 39 shares gaining and 33 declining.

At the close of the market, the JSE Combined Market Index climbed 1,085.09 points to 336,104.77, the All Jamaican Composite Index rallied 1,200.87 points to 360,257.92, the JSE Main Index rose 1,549.21 points to 323,274.84. The Junior Market Index fell 42.00 points to 3,759.37 and the JSE USD Market Index popped 3.31 points to end at 247.45.

At the close of the market, the JSE Combined Market Index climbed 1,085.09 points to 336,104.77, the All Jamaican Composite Index rallied 1,200.87 points to 360,257.92, the JSE Main Index rose 1,549.21 points to 323,274.84. The Junior Market Index fell 42.00 points to 3,759.37 and the JSE USD Market Index popped 3.31 points to end at 247.45.

At the close of trading, 23,219,570 shares were exchanged in all three markets, moderately more than the 23,131,587 units on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $125.91 million, up from $96.67 million trading on the previous day and the JSE USD market closed with an exchange of 670,997 shares for US$26,968 compared to 119,808 units at US$30,732 on Thursday.

Main Market trading was dominated by Wigton Windfarm with 2.90 million shares followed by Transjamaican Highway with 2.44 million units and Sagicor Select Financial Fund ending with 514,757 units.

In the Junior Market, Mailpac Group led trading with 4.76 million shares followed by Dolla Financial with 1.45 million units, Stationery and Office Supplies ended with 1.36 million stocks, Regency Petroleum closed with 1.27 million shares and One Great Studio with 1.14 million units.

At the close of the market, some of the major Main Market stocks that rose are Massy Holdings popped $2 to end at $90, Pan Jamaica rallying $3.90 to $50, Proven Investments advancing $5.05 to $27, Sagicor Group popping $1 to close at $43 as Seprod climbed $2.05 in closing at $85.55.

At the close of the market, some of the major Main Market stocks that rose are Massy Holdings popped $2 to end at $90, Pan Jamaica rallying $3.90 to $50, Proven Investments advancing $5.05 to $27, Sagicor Group popping $1 to close at $43 as Seprod climbed $2.05 in closing at $85.55.

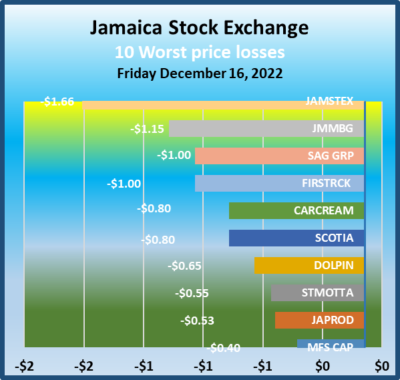

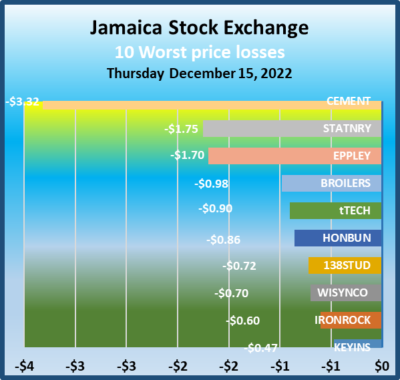

The major declining Main Market stocks include AS Bryden with a loss of 99 cents in ending at $42, Jamaica Producers declining $1.15 to close at $21.66, Scotia Group skidding 96 cents to end at $40.50.

Stocks ending with major gains in the Junior Market are, Caribbean Cream up 34 cents to close at $3.79, Iron Rock Insurance increasing 32 cents and ending at $2.42 and Mailpac Group advancing 25 cents to close at $2.28, the major losing stocks are AMG Packaging dipping 35 cents in closing at $2.60, Dolphin Cove losing 40 cents and ended at $18.60 and Regency Petroleum dropping 23 cents to $2.15.

In the preference segment, Eppley 7.25% preference share shed $1.90 to close at $17, Eppley 7.75% dropped $4.95 to end at $18, 138 Student Living preference share rose $28.84 in closing at $221.12, Productive Business Solutions 10.5% gained $125 and ended at $1200 clearing the market with 170 stocks and recently listed Sygnus Credit Investments c10.5% advanced $2 to $107.

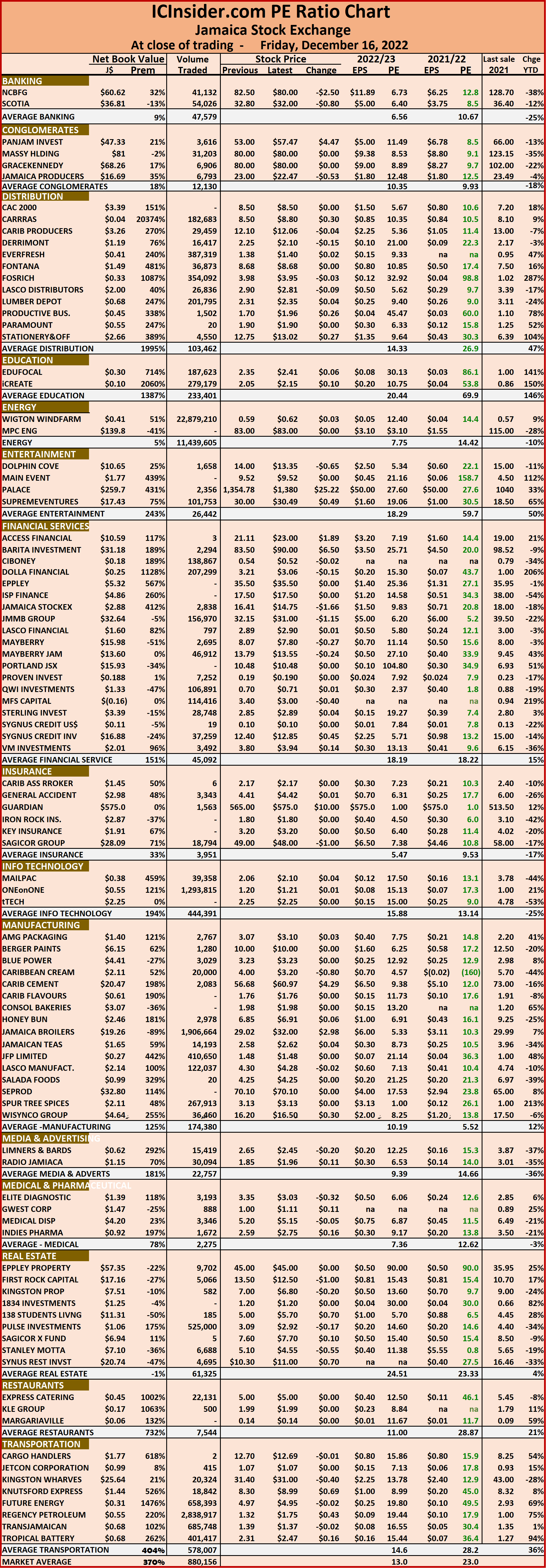

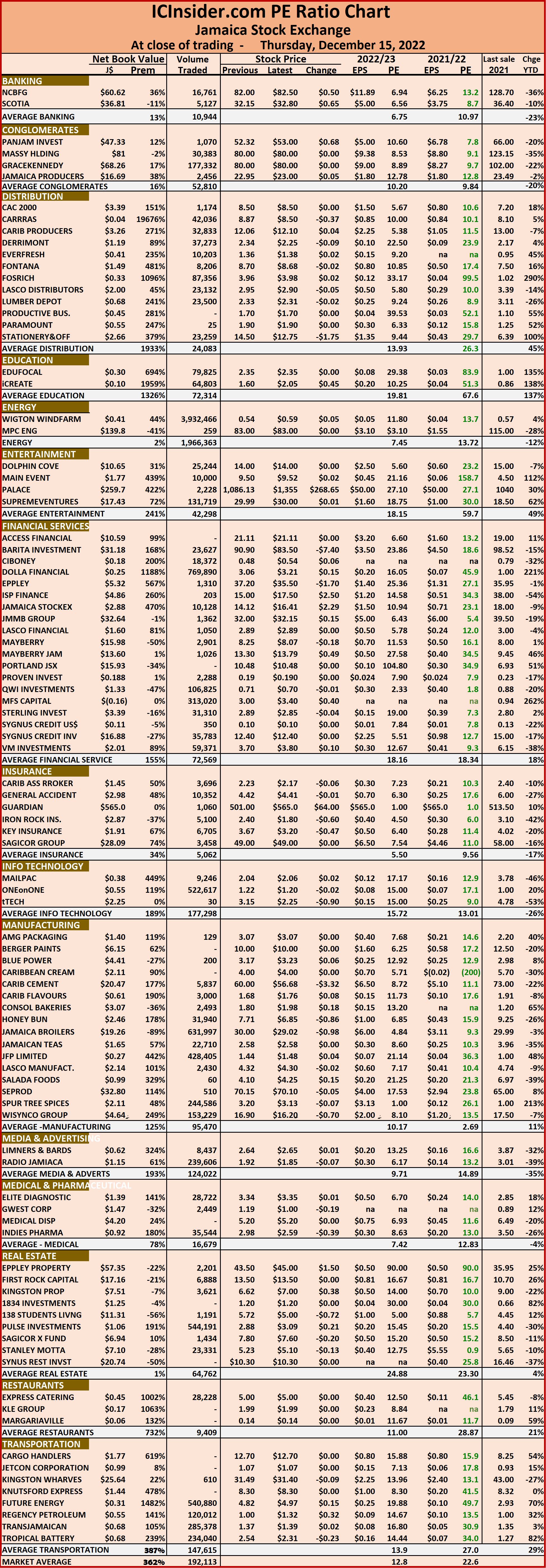

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.8 on 2022-23 earnings and 14 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The  ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Scotia is back in ICTOP10

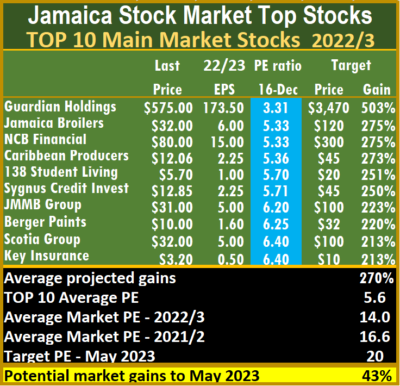

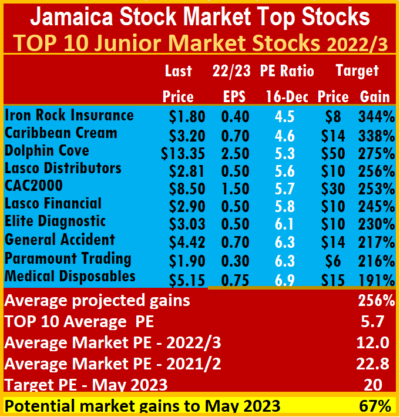

The Jamaica Stock Exchange had mixed results during the past week, with both the Junior Market and the Main Market closing slightly lower than at the close of the previous week and impacting the listings in varying degrees, resulting in the Main Market’s Scotia Group reentering the TOP10 at the expense of Radio Jamaica, with no Junior Market changes following the listing Regency Petroleum listing on Thursday and rising 75% in two days of trading.

Five Junior Market TOP10 stocks declined between one and 25 percent and just two gained one to 4 percent this past week, while the Main Market 10 had five rising and Three declining.

In the Junior Market, Elite Diagnostic popped 4 percent to $3.03 as the sole main gaining stock, But Iron Rock Insurance dropped 25 percent to $1.80, followed by Caribbean Cream, down 17 percent and Dolphin Cove 6 percent to $13.35.

In the Main Market, Jamaica Broilers jumped 19 percent to $32, 138 Student Living rose 10 percent to $5.70 and Guardian Holdings followed with a rise of 9 percent to $575, but Key Insurance slipped 9 percent to $3.20.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 14.  At the same time, the Junior Market Top 10 PE sits at 5.7 versus the market at 12, important indicators of the level of the undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 256 percent and the Main Market TOP10, an average now of 270 percent, to May 2023.

At the same time, the Junior Market Top 10 PE sits at 5.7 versus the market at 12, important indicators of the level of the undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 256 percent and the Main Market TOP10, an average now of 270 percent, to May 2023.

The Junior Market has 14 stocks representing 30 percent of the market, with PEs from 15 to 33, averaging 19.5 compared with the above average of the market. The top half of the market has an average PE of 17 and shows the extent of potential gains that lie ahead for the TOP 10 stocks. The situation in the Main Market is similar, with the 17 highest valued stocks priced at a PE of 15 to 105, with an average of 32 and 23 excluding the highest valued ones and 21 for the top half excluding the highest valued stock.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always.  ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks, helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks, helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Image Plus Consultants IPO looks attractive but…

Yet another company is heading to the Junior Market of the Jamaica Stock Exchange on the heels of the recent successful Regency Petroleum public issue that culminated in a listing on Thursday. The prospectus of Image Plus Consultants limited offers up to 247.89 million new ordinary shares at the price of $2 each, projected to raise $495,779,872 before expenses and to list on the Junior Market.

The issue will amount to 20 percent of the increased share capital of 1.2394 billion shares, up from 991.56 million currently issued. The offer values the company at $2.5 billion and that should rise to around $5 billion sometime after listing.

The issue will amount to 20 percent of the increased share capital of 1.2394 billion shares, up from 991.56 million currently issued. The offer values the company at $2.5 billion and that should rise to around $5 billion sometime after listing.

The issue opens on December 28 and is slated to close on January 11, but should close on the same date of opening or soon thereafter. Based on recent IPOS, if $5 billion goes into the Public allocation, investors can expect to get around eight percent of the offered amount.

Image Plus Consultants Services owns and operates the 25 years old Apex Radiology a Medical Imaging Company that was established in 1996. Services provided include multiple modalities such as X-Ray, Ultrasound, CT Scan, Fluoroscopy and Nuclear Medicine at three locations in Kingston and one in Ocho Rios. The prospectus states that “With a view to growing at a faster pace, the Board took the decision to employ professional management experience and recruited a Chief Executive Officer in late January 2020. That step has resulted in very evident benefits demonstrated by the significant increases in patient cases, revenue and net profit margin over the last thirty months.”

Shareholders’ equity of $267 million in February 2022 was up 55 percent over the previous year and moved to $362 million in August. Profits before tax of $113 million increased 318 percent over the fiscal year to February 2021, representing the return of equity of 43 percent that flowed from revenues of $778 million which was up 10 percent over the prior year.

Total assets stood at $619 million at the end of August this year. Current assets ended the half year at $325 million and include receivables of $248 million that climbed from just $99 million at the end of August last year and from $139 million at the end of February this year. Current liabilities amount to $$124 million, while borrowed funds ended at $132 million.

Dr. Karlene McDonnough – Chairman of Image Plus Consultants Ltd.

Results to August show revenues and profits growing with revenues up 53 percent to $555 million from $363 million in 2021 with profit before tax of $153 million up 237 percent above the 2021 outcome of $45 million. Prior to the current year directors’ fees were paid at a higher rate than normal but are expected to reflect market rates going forward as a result the $66.5 million expensed in 2022 will drop sharply in the fiscal year 2023 and should result in a fall in administrative expenses.

“The Company intends to use funds raised to strategically and sustainably grow the business by acquiring property to be identified in Kingston which is suitable to relocate our largest operations, thereby ensuring control of our revenue and allowing for even further expansion of our offerings. Procuring suitable new bio-medical equipment to offer additional diagnostic modalities at our Ocho Rios location. Expand our offering of interventional procedures, maximizing this fast growing area of diagnostic imaging” the prospectus states.

The PE ratio will be just 7 times current year’s earnings and puts the stock in a strong position to move towards $6 during 2023. A comparison with Elite Diagnostic makes for interesting reading. While the reported profit is better for Image Plus, most other measures are in favour of Elite. The best comparison is EBITDA which shows Image with $152 million versus Elite with $190 million for the 2022 fiscal year. The interim figures annualized show Image with $359 million versus Elite with $220 million for the 2023 fiscal year. At $2 per share for the Image IPO, the stock is priced at 5.6 times EBITDA and Elite trades around 5.3 times. With three locations Elite net fixed assets amount to $885 million versus Image with $279 million and resulting in Depreciation charge being more than three times that of Image with four locations and higher finance costs as well.

If listed, the company would be the second such entity of the exchange following Elite Diagnostic. A successful IPO will raise the Junior Market listings to 48 and the total to list on that market to 52, including three that migrated to the Main Market and one that failed.

The board of directors is dominated by doctors in the medical profession and could do with some other directors with wide-ranging business experience. The directors are Karlene McDonnough, Lilieth Bridgewater, Gordon Bradshaw, Steve Lewis, Marian Vaughn and Leon Vaughn all medical-related doctors, Carolyn DaCosta, Jacqueline Leckie and Kisha Anderson.

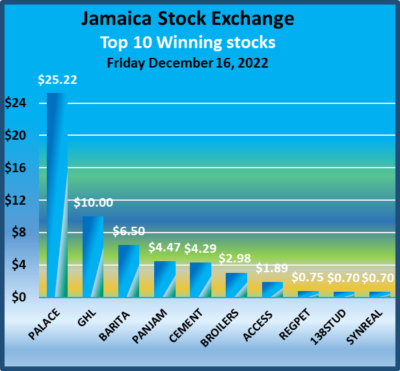

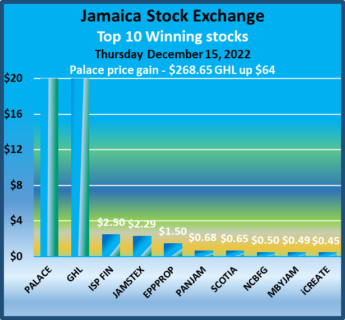

Palace jumps to $1380, Regency at $1.75

As the 48th listing is heading for the Junior Market of the Jamaica Stock Exchange to fill the pockets of young investors, Regency Petroleum that was listed on the Junior Market on Thursday jumped 75 percent to $1.75 on Friday and seems poised to move higher when trading opens next week.  At the same time, the Palace Amusement stock has come to life with the prospects of a stock split and hit a new 52 weeks’ intraday high of $1,699 but closed at $1,380 as the Main Market slipped from Thursday’s close and the Junior Market closed higher.

At the same time, the Palace Amusement stock has come to life with the prospects of a stock split and hit a new 52 weeks’ intraday high of $1,699 but closed at $1,380 as the Main Market slipped from Thursday’s close and the Junior Market closed higher.

At the close of the market, the volume and the value of stocks traded rose well above that on Thursday.

At the close, the Combined Market Index dropped 744.44 points to 351,765.66, the JSE Main Index fell 1,031.70 points to 338,773.99, while the All Jamaica Composite Index lost 1,890.91 points to settle at 380,283.51, the Junior Market climbed 23.76 points to settle at 3,893.49 and the JSE US dollar market jumped 2.56 points to 231.39.

Trading ended, with 35,469,567 shares changing hands, for $120 million, versus $68.76 million, with 11,071,300 shares traded in all markets on the previous trading day.  The JSE USD market ended with the value of stocks traded amounting to US$5,115 from US$5,493 on Thursday.

The JSE USD market ended with the value of stocks traded amounting to US$5,115 from US$5,493 on Thursday.

The market’s PE ratio ended at 23 based on 2021-22 earnings and 13 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Image Plus Consultants the next IPO

Yet another company is heading to list on the Jamaica Stock Exchange and is coming on the heels of Regency Petroleum that was listed on Thursday. Image Plus Consultants Limited announced its intention to go public and that seems imminent with the Junior Market seems the most likely target.

Image Plus Consultants Services owns and operates the 25 years old Apex Radiology a Medical Imaging Company that was established in 1996. Services provided include multiple modalities such as X-Ray, Ultrasound, CT Scan, Fluoroscopy and Nuclear Medicine at three locations in Kingston and one in Ocho Rios.

Image Plus Consultants Services owns and operates the 25 years old Apex Radiology a Medical Imaging Company that was established in 1996. Services provided include multiple modalities such as X-Ray, Ultrasound, CT Scan, Fluoroscopy and Nuclear Medicine at three locations in Kingston and one in Ocho Rios.

According to an advertisement in the newspapers, shareholder’s equity stood at $267 million in February 2022 and was up 55 percent over the previous year, with profits before tax of $113 million that increasing by 318 percent over 2021, representing the return of equity of 43 percent that flowed from revenue of $778 million which was up 10 percent over the prior year. Total assets amounted to $447 million at the end of February this year.

Based on the profit, the company’s market value is just over $2 billion after the shares are listed.

If listed the company would be the second such entity of the exchange following Elite Diagnostic. A successful IPO will raise the Junior Market listings to 48.

Palace more than doubles, Regency gains 32%

Palace Amusement jumped just over $268 on Thursday to $1,354.75 and has risen 118.5 percent since Monday in response to a proposed stock split. Elsewhere, the recent IPO, Regency Petroleum was listed on the Junior Market and traded at $1.32 for a gain of 32 percent and closed with the bid for 3.6 million shares at 41.32. At the close of the market, the volume and value of stocks traded declined from that on Wednesday.

The Main Market of the Jamaica Stock Exchange recorded gains in the market indices but the Junior Market and JSE USD markets dipped at the close.

The Main Market of the Jamaica Stock Exchange recorded gains in the market indices but the Junior Market and JSE USD markets dipped at the close.

At the close, the Combined Market Index popped 480.40 points to 352,510.10, the JSE Main Index gained 850.19 points to 339,805.69, the All Jamaica Composite Index rallied 1,068.13 points to 382,174.42, the Junior Market lost 34.08 points to close at 3,869.73 and the JSE US dollar market dipped 0.13 points to 228.96.

Trading ended, with 11,071,300 shares changing hands, for $68.76 million, versus $266.2 million, with 12,607,683 shares traded in all markets on the previous trading day. The JSE USD market ended with the value of stocks traded amounting to US$5,493 from US$5,795 on Tuesday.

The market’s PE ratio ended at 22.6 based on 2021-22 earnings and 12.8 times those for 2022-23 at the close of trading.

The market’s PE ratio ended at 22.6 based on 2021-22 earnings and 12.8 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

About 5.3% of Regency IPO shares for the Public

Initial public share issues continue to disappoint many investors, with investors in the Regency Petroleum issue allocated the first 10,000 shares applied for plus approximately 5.3% thereafter, a release from the lead broker, GK Capital Management, stated.

Strategic Partners, Employees and applicants converting loans got a full allocation of amounts applied for, the report also indicated.

Strategic Partners, Employees and applicants converting loans got a full allocation of amounts applied for, the report also indicated.

Applications in the general pool with the same JCSD number were consolidated and treated as one.

The prospectus indicates that listing of the shares is expected to take place within 21 days of the closing of the issue, with ten days elapsing since the issue closed on November 25, the listing should take place before the end of next week.

A total of 287,157,354 Ordinary Shares were for sale at $1 each, with only 115,196,354 shares that were available to the public.

Regency IPO opens on Thursday for a $1

Regency Petroleum Co. Limited a company based in Westmoreland is offering up to 287,157,354 Ordinary Shares for sale at $1 each. The offer opens on Thursday, November 24 and should bring the total Junior Market listings to 48 and the number of companies to 47. Only 115,196,354 shares will be available to the public.

The company reported revenues of $332 million in the half year results to June this year, up from $248 million in 2021, with profit after tax of $51 million compared with $35 million in 2021, putting the earnings per share for this year at 98 cents, with the PE at 10 times this year’s pretax earnings versus the Junior Market average of just over 12, but below the peak of recent new issues of approximately 20. ICInsider.com expects the offer to close quickly after opening and the price to soar into the $2 range after listing.

The company reported revenues of $332 million in the half year results to June this year, up from $248 million in 2021, with profit after tax of $51 million compared with $35 million in 2021, putting the earnings per share for this year at 98 cents, with the PE at 10 times this year’s pretax earnings versus the Junior Market average of just over 12, but below the peak of recent new issues of approximately 20. ICInsider.com expects the offer to close quickly after opening and the price to soar into the $2 range after listing.

Revenues for the 2021 fiscal year were $607 million a big jump from $194 million in 2020 and just $45 million in 2019, with a profit of $59 million in 2021, after taxation of $18 million, up from $14 million with taxation of $3 million in 2020.

The company’s operations span Jamaica as a petroleum marketing company licensed to distribute bulk petroleum products. The company was founded by Andrew Williams, Chief Executive Officer. Revenues are currently generated from sales of LPG Cooking Gas, Automotive Petroleum and Transportation of gasoline.

Revenues are set to climb in 2023 with the ongoing construction of two service stations which should be open to the public by the end of the March quarter of next year, the company stated in its prospectus. A service station to be opened in Negril, which Regency will lease, is located upon entering the town from the east, will increase the visibility of the brand and generate additional revenues and profit. In addition, the company is likely to see increased business due to the exposure from the IPO and trading in the shares after listing on the exchange.

The company states that it has purchased delivery vehicles to reduce costs and improve efficiency and create greater economic value in the future. Currently, only 90 Octane Fuel and Diesel are sold at the service station, the opening of the new service stations will see the introduction of ULSD and 87 Octane Fuel at the pumps. The new products should attract added demand and provide a more inclusive retail market product line.

The company states that it has purchased delivery vehicles to reduce costs and improve efficiency and create greater economic value in the future. Currently, only 90 Octane Fuel and Diesel are sold at the service station, the opening of the new service stations will see the introduction of ULSD and 87 Octane Fuel at the pumps. The new products should attract added demand and provide a more inclusive retail market product line.

Expansion plans call for the purchase of additional cylinders to supply increased demand for its cooking gas to reduce cost of sales and improve efficiency, the Company will also acquire a fuel tank trailer, the prospectus states.

Of the total issue 171,961,000 shares are reserved as follows – 55.5 million for Employees & Key Strategic Partners, 100 million for GK Investments to convert loan balance and 16.46 million for Associates Loan Conversion.

The company is relatively small, with Shareholders’ Equity of $111 million at the end of June this year, accordingly, there is much room for growth going forward.

The directors of the company are Dr André Foote, Andrew Williams, Andrew Cocking, Radcliff Knibbs and Edgar Bennett.

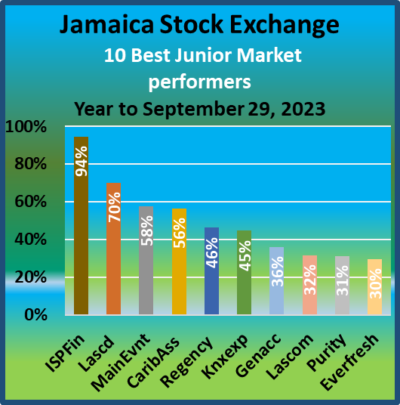

Junior Market stocks fared better than their

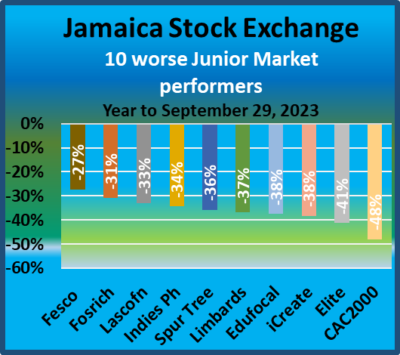

Junior Market stocks fared better than their Elite Diagnostic struggling to overcome machine failures, declined by 46 percent, Medical Disposables suffered a fall of 44 percent as profit collapsed in 2023, helped by increased finance costs. CAC2000 fell 43 percent and 2022 highflyer, Fosrich dropped 38 percent. Advertising and public relations firm Limners and Bards fell 38 percent, money transfer and micro lender, Lasco Financial dropped 33 percent and petroleum distributor Future Energy a 2022 high flying stock retreated with a loss of 28 percent.

Elite Diagnostic struggling to overcome machine failures, declined by 46 percent, Medical Disposables suffered a fall of 44 percent as profit collapsed in 2023, helped by increased finance costs. CAC2000 fell 43 percent and 2022 highflyer, Fosrich dropped 38 percent. Advertising and public relations firm Limners and Bards fell 38 percent, money transfer and micro lender, Lasco Financial dropped 33 percent and petroleum distributor Future Energy a 2022 high flying stock retreated with a loss of 28 percent.

ISP Finance, a microfinancing company led the Junior Market following news that two new directors with experience in the financial service sector and who had worked with in the past in arranging deals for them were appointed to the board. There was also speculation that the majority shares could probably change hands sooner rather than later. There is also the expectation for increased lending to customers is expected to impact revenues and profit positively following a decline in the half year profit when loans jumped to nearly a billion dollars from under $800 million. Lasco Distributors profits for the fiscal year to March jumped and was followed by improved results in the June Quarter as investors rewarded the performance with s solid price movement. Main Event continued to recover from the damage to revenues and profits during the COVID, bouncing back as profit more than doubled to $216 million from $104 million for the nine months to July. Movement in Caribbean Assurance Brokers’ stock price follows profit jumping from just $4.5 million in the June 2022 half year to $18 million this year. Regency Petroleum profit fell from $51 million to $25 million for the half year but hope for improved profits drove the stock with new gas stations being opened or to be opened. General Accident migrated from the Junior Market to the Main Market on the last day of the month, with the increased stock price spurred by profit surging 195 percent to $165 million in the 2023 half year.

ISP Finance, a microfinancing company led the Junior Market following news that two new directors with experience in the financial service sector and who had worked with in the past in arranging deals for them were appointed to the board. There was also speculation that the majority shares could probably change hands sooner rather than later. There is also the expectation for increased lending to customers is expected to impact revenues and profit positively following a decline in the half year profit when loans jumped to nearly a billion dollars from under $800 million. Lasco Distributors profits for the fiscal year to March jumped and was followed by improved results in the June Quarter as investors rewarded the performance with s solid price movement. Main Event continued to recover from the damage to revenues and profits during the COVID, bouncing back as profit more than doubled to $216 million from $104 million for the nine months to July. Movement in Caribbean Assurance Brokers’ stock price follows profit jumping from just $4.5 million in the June 2022 half year to $18 million this year. Regency Petroleum profit fell from $51 million to $25 million for the half year but hope for improved profits drove the stock with new gas stations being opened or to be opened. General Accident migrated from the Junior Market to the Main Market on the last day of the month, with the increased stock price spurred by profit surging 195 percent to $165 million in the 2023 half year. Fesco stock price declined sharply for the period even as the net profits for the June quarter were marginally higher than that of the similar 2022 period, with revenues marginally higher. The stock price pulled back from heady levels in 2022 to adjust to the earnings in the last fiscal year of just under 23 cents per share with indications that it may not significantly improve in the current fiscal year to warrant the high premium it had in 2022. Fosrich, on the other hand, had a sharp decline in profits for the second quarter and the half year but it too enjoyed a big premium in the stock price in 2022, investors readjusted their expectations by marking the price down, although both stocks got a two day bounce at the end of September that improved their performance year to date. Lasco Financial had a third less profit in the 2023 fiscal year than the prior year and reported vastly poorer results in the third quarter to June and that seemed to have encouraged more selling of the stock. Revenues and profit bounced in the third quarter for Limners and Bards but are still down year to date compared with last year and that did not help the stock that lost value during the period. Edufocal profit bounced in 2023 and may not necessarily justify the 38 percent fall in the stock price, while iCreate had totally disastrous results in the 2022 fiscal year as well as in the first half of 2023, with the company’s performance continuing to raise questions about its future. Elite and CAC 2000 suffered a reversal in fortune that is reflected in the decline in stock prices of both companies.

Fesco stock price declined sharply for the period even as the net profits for the June quarter were marginally higher than that of the similar 2022 period, with revenues marginally higher. The stock price pulled back from heady levels in 2022 to adjust to the earnings in the last fiscal year of just under 23 cents per share with indications that it may not significantly improve in the current fiscal year to warrant the high premium it had in 2022. Fosrich, on the other hand, had a sharp decline in profits for the second quarter and the half year but it too enjoyed a big premium in the stock price in 2022, investors readjusted their expectations by marking the price down, although both stocks got a two day bounce at the end of September that improved their performance year to date. Lasco Financial had a third less profit in the 2023 fiscal year than the prior year and reported vastly poorer results in the third quarter to June and that seemed to have encouraged more selling of the stock. Revenues and profit bounced in the third quarter for Limners and Bards but are still down year to date compared with last year and that did not help the stock that lost value during the period. Edufocal profit bounced in 2023 and may not necessarily justify the 38 percent fall in the stock price, while iCreate had totally disastrous results in the 2022 fiscal year as well as in the first half of 2023, with the company’s performance continuing to raise questions about its future. Elite and CAC 2000 suffered a reversal in fortune that is reflected in the decline in stock prices of both companies.