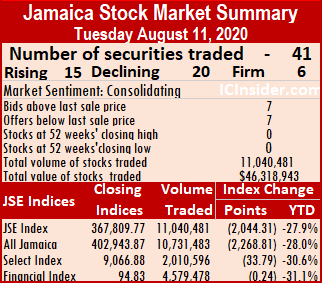

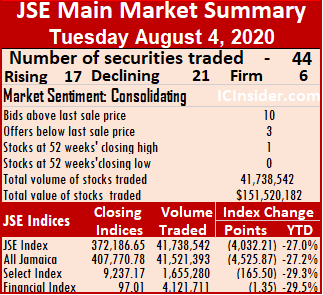

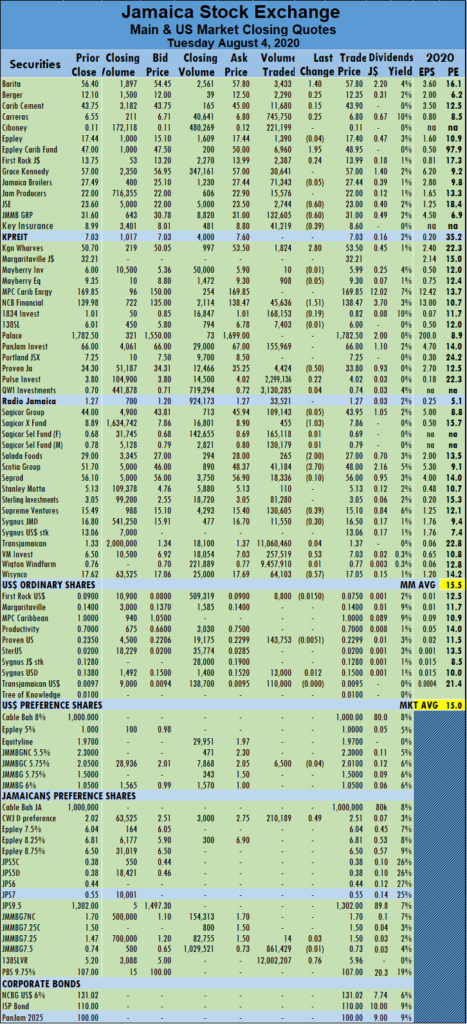

The Jamaica Stock Exchange Main Market closed on Tuesday with a decline after more stocks fell than rose after investors traded 15 percent fewer shares than on Monday.

At the close of the market, the All Jamaican Composite Index carved out a loss of 2,268.81 points to settle at 402,943.87. The JSE Main Index fell 2,044.31 points to end at 367,809.77, the JSE Financial Index fell 0.24 points to settle at 94.83.

At the close of the market, the All Jamaican Composite Index carved out a loss of 2,268.81 points to settle at 402,943.87. The JSE Main Index fell 2,044.31 points to end at 367,809.77, the JSE Financial Index fell 0.24 points to settle at 94.83.

Trading ended with 41 securities changing hands compared to 42 on Monday and ended with the prices of 15 stocks rising, 20 declining and six remaining unchanged and the average PE Ratio of the market ended at 15.5, based on IC Insider.com’s forecast of 2020-21 earnings.

The market closed with an exchange of 11,040,481 shares for $46,318,943 compared to 12,952,662 units at $48,479,413 on Monday, with Wigton Windfarm leading trading with 6.69 million shares for 60.6 percent of total volume. Sagicor Select Financial Fund followed, with 1.39 million units for 12.6 percent of the day’s trade and Transjamaican Highway, with 687,145 units for 6 percent market share.

The day ended with 269,280 units on average trading at $1,129,730 for each security, in comparison to an average of 308,397 shares at $1,154,272 on Monday. The average traded for the month to date is 360,995 units at $1,596,828 for each security, in contrast to 378,165 units at $1,684,276 on Monday. Trading month to date compares well to July with an average of 392,128 shares for $2,444,356.

The day ended with 269,280 units on average trading at $1,129,730 for each security, in comparison to an average of 308,397 shares at $1,154,272 on Monday. The average traded for the month to date is 360,995 units at $1,596,828 for each security, in contrast to 378,165 units at $1,684,276 on Monday. Trading month to date compares well to July with an average of 392,128 shares for $2,444,356.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows seven stocks ended with bids higher than their last selling prices and seven, with lower offers.

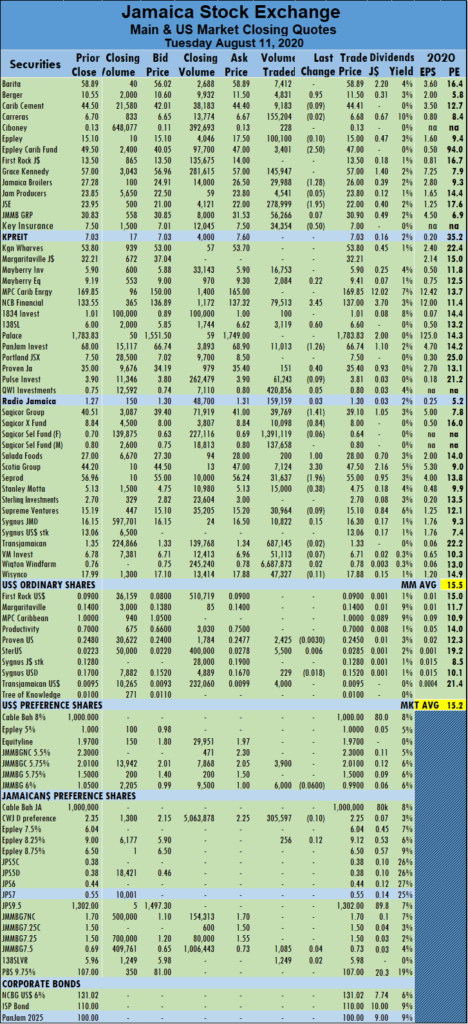

At the close of the market, Berger Paints rose 95 cents to settle at $11.50 after clearing the market ith 4,831 shares, Eppley Caribbean Property Fund declined by $2.50 to $47, trading 3,401 stock units. Jamaica Broilers lost $1.28 to settle at $26, with 29,988 shares changing hands, Jamaica Stock Exchange lost $1.95 to settle at $22 after exchanging 278,999 units,  Key Insurance fell 50 cents to end at $7, with 34,354 shares passing through the market. NCB Financial Group climbed $3.45 to end at $137 after 79,513 shares crossed the exchange, 138 Student Living rose 60 cents to $6.60, finishing trading with 3,119 stock units, PanJam Investment fell $1.26 to $66.74, with an exchange of 11,013 shares, Proven Investments advanced by 40 cents to close at $35.40 trading 151 units. Sagicor Groupfell $1.41 after closing at $39.10 and exchanging 39,769 stocks, Sagicor Real Estate Fund lost 84 cents to end at $8 in trading 10,098 units, Salada Foods climbed $1 to close at $28 and clearing the market with just 200 shares. Scotia Group gained $3.30 to close at $47.50, finishing trading of 7,124 shares, Seprod fell $1.96 to close at $55 after exchanging 31,637 stocks and Stanley Motta declined by 38 cents to settle at $4.75 in trading 15,000 shares.

Key Insurance fell 50 cents to end at $7, with 34,354 shares passing through the market. NCB Financial Group climbed $3.45 to end at $137 after 79,513 shares crossed the exchange, 138 Student Living rose 60 cents to $6.60, finishing trading with 3,119 stock units, PanJam Investment fell $1.26 to $66.74, with an exchange of 11,013 shares, Proven Investments advanced by 40 cents to close at $35.40 trading 151 units. Sagicor Groupfell $1.41 after closing at $39.10 and exchanging 39,769 stocks, Sagicor Real Estate Fund lost 84 cents to end at $8 in trading 10,098 units, Salada Foods climbed $1 to close at $28 and clearing the market with just 200 shares. Scotia Group gained $3.30 to close at $47.50, finishing trading of 7,124 shares, Seprod fell $1.96 to close at $55 after exchanging 31,637 stocks and Stanley Motta declined by 38 cents to settle at $4.75 in trading 15,000 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

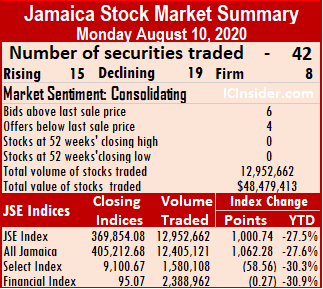

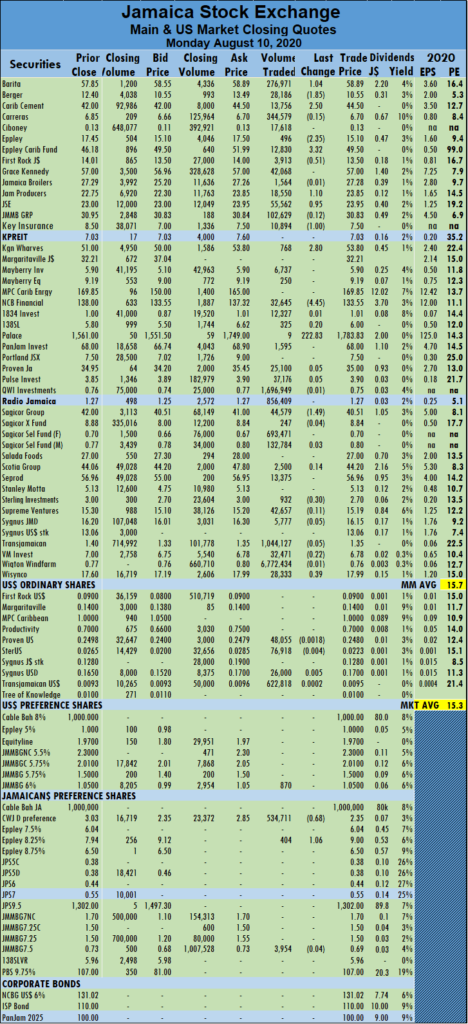

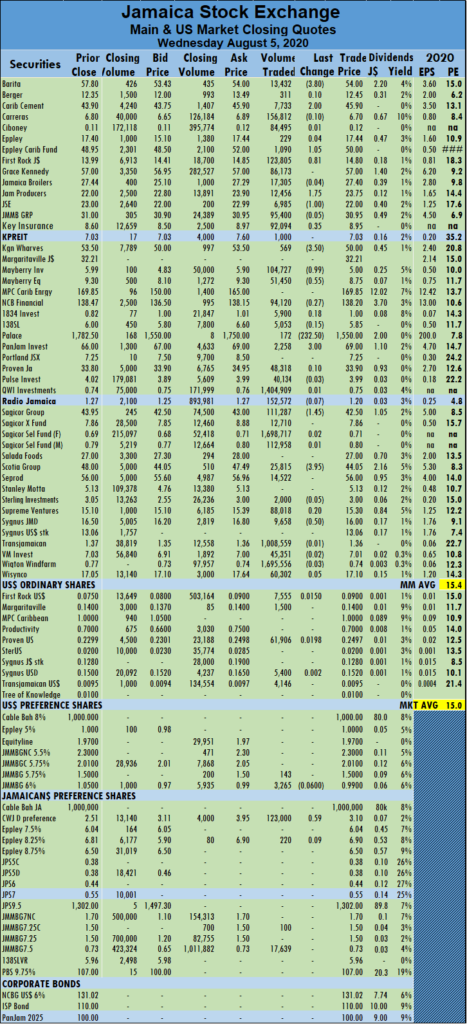

At the close, the All Jamaican Composite Index advanced by 1,062.28 points to settle at 405,212.68, the Main Index carved out a gain of 1,000.74 points to 369,854.08, the JSE Financial Index slipped 0.27 points to close at 95.07.

At the close, the All Jamaican Composite Index advanced by 1,062.28 points to settle at 405,212.68, the Main Index carved out a gain of 1,000.74 points to 369,854.08, the JSE Financial Index slipped 0.27 points to close at 95.07. An average of 378,165 units traded for the month to date at $1,684,276 for each security, in contrast to 394,720 units at $1,810,039. Trading month to date compares adversely to July that ended with an average of 392,128 shares for $2,444,356.

An average of 378,165 units traded for the month to date at $1,684,276 for each security, in contrast to 394,720 units at $1,810,039. Trading month to date compares adversely to July that ended with an average of 392,128 shares for $2,444,356. First Rock Capital lost 51 cents to end at $13.50, clearing the market with 3,913 stock units, Jamaica Producers Group carved out a gain of $1.10 to close at $23.85 after exchanging 18,550 stock units, Jamaica Stock Exchange rose 95 cents to settle at $23.95, with 55,562 stock units crossing the exchange. Key Insurance fell by $1 closing at $7.50, with 10,894 units changing hands, Kingston Wharves rose $2.80 ending at $53.80 with an exchange of 768 units, NCB Financial Group dropped $4.45 to end at $133.55 while trading 32,645 units. Palace climbed $222.83 to $1,783.83 and 9 stock units passing through the market, Sagicor Group dipped $1.49 to settle at $40.51 exchanging 44,579 units. Sterling Investments lost 30 cents to end at $2.70 with investors swapping 932 shares and Wisynco Group gained 39 cents to end at $17.99 with an exchange of 28,333 stock units.

First Rock Capital lost 51 cents to end at $13.50, clearing the market with 3,913 stock units, Jamaica Producers Group carved out a gain of $1.10 to close at $23.85 after exchanging 18,550 stock units, Jamaica Stock Exchange rose 95 cents to settle at $23.95, with 55,562 stock units crossing the exchange. Key Insurance fell by $1 closing at $7.50, with 10,894 units changing hands, Kingston Wharves rose $2.80 ending at $53.80 with an exchange of 768 units, NCB Financial Group dropped $4.45 to end at $133.55 while trading 32,645 units. Palace climbed $222.83 to $1,783.83 and 9 stock units passing through the market, Sagicor Group dipped $1.49 to settle at $40.51 exchanging 44,579 units. Sterling Investments lost 30 cents to end at $2.70 with investors swapping 932 shares and Wisynco Group gained 39 cents to end at $17.99 with an exchange of 28,333 stock units.

Caribbean Producers heads the list, followed by Lasco Financial and Stationery and Office Supplies.

Caribbean Producers heads the list, followed by Lasco Financial and Stationery and Office Supplies. The company declared a dividend of $2.216 per share payable on October 7, with an Ex-dividend date, of September 21.

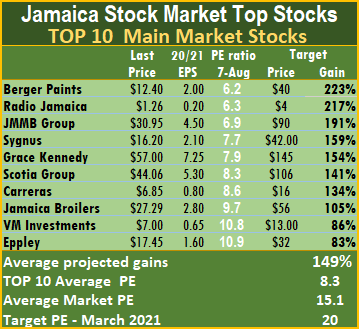

The company declared a dividend of $2.216 per share payable on October 7, with an Ex-dividend date, of September 21. The average projected gain for the IC TOP 10 stocks is 257 percent, for the Junior Market and 149 percent for the JSE Main Market, based on 2020-21 earnings, an indication that there is the potential to make greater gains in the Junior Market than in the Main Market.

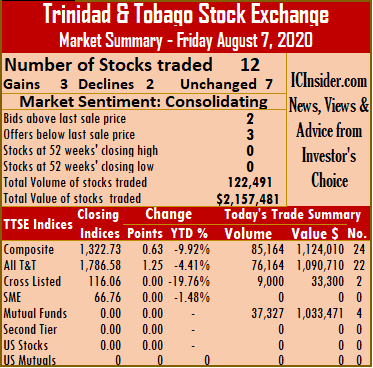

The average projected gain for the IC TOP 10 stocks is 257 percent, for the Junior Market and 149 percent for the JSE Main Market, based on 2020-21 earnings, an indication that there is the potential to make greater gains in the Junior Market than in the Main Market. The market closed with twelve securities trading with three advancing, two declining and seven stocks remaining unchanged. Trading resulted in 122,491 shares valued at $2,157,481 passing through the market, down from 131,310 stocks for $2,321,854 on Thursday from 17 securities.

The market closed with twelve securities trading with three advancing, two declining and seven stocks remaining unchanged. Trading resulted in 122,491 shares valued at $2,157,481 passing through the market, down from 131,310 stocks for $2,321,854 on Thursday from 17 securities. Stocks rising│ Republic Financial Holdings gained 50 cents to close at $141.50, with 2,281 units changing hands, Trinidad Cement ended 10 cents higher at $2.10, in trading 50,000 shares and Unilever Caribbean had 5,000 stock units exchanged at $17, after picking up 10 cents.

Stocks rising│ Republic Financial Holdings gained 50 cents to close at $141.50, with 2,281 units changing hands, Trinidad Cement ended 10 cents higher at $2.10, in trading 50,000 shares and Unilever Caribbean had 5,000 stock units exchanged at $17, after picking up 10 cents. At the close, the All Jamaican Composite Index declined 714.74 points to close at 404,150.40, the Main Index shed 703.29 points to settle at 368,853.34 and JSE Financial Index fell 0.43 points to end at 95.34.

At the close, the All Jamaican Composite Index declined 714.74 points to close at 404,150.40, the Main Index shed 703.29 points to settle at 368,853.34 and JSE Financial Index fell 0.43 points to end at 95.34. Trading month to date compares well to July that ended with an average of 392,128 shares for $2,444,356.

Trading month to date compares well to July that ended with an average of 392,128 shares for $2,444,356. Kingston Wharves gained $1 to end at $51, with 3,270 stocks changing hands. Mayberry Investments climbed 90 cents to close at $5.90 with an exchange of 300 shares, Mayberry Jamaican Equities advanced by 44 cents to end at $9.19 with investors switching ownership of 10,750 units, Palace Amusement rose $11 to close at $1561, with nine units clearing the market. PanJam Investment shed $1 to close at $68 trading 6,594 stocks, Proven Investments carved out a gain of $1.05 to finish at $34.95 with investors switching ownership of 4,371 stock units, Sagicor Group dropped 50 cents to close at $42 with investors exchanging 33,395 stocks. Sagicor Real Estate Fund gained $1.02 to end at $8.88 while exchanging 110 stock units, Seprod gained 96 cents to settle at $56.96, with 36,600 shares crossing the exchange and Wisynco Group advanced 50 cents to $17.60 with investors wapping 85,689 stock units.

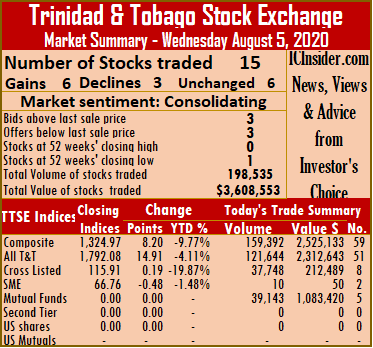

Kingston Wharves gained $1 to end at $51, with 3,270 stocks changing hands. Mayberry Investments climbed 90 cents to close at $5.90 with an exchange of 300 shares, Mayberry Jamaican Equities advanced by 44 cents to end at $9.19 with investors switching ownership of 10,750 units, Palace Amusement rose $11 to close at $1561, with nine units clearing the market. PanJam Investment shed $1 to close at $68 trading 6,594 stocks, Proven Investments carved out a gain of $1.05 to finish at $34.95 with investors switching ownership of 4,371 stock units, Sagicor Group dropped 50 cents to close at $42 with investors exchanging 33,395 stocks. Sagicor Real Estate Fund gained $1.02 to end at $8.88 while exchanging 110 stock units, Seprod gained 96 cents to settle at $56.96, with 36,600 shares crossing the exchange and Wisynco Group advanced 50 cents to $17.60 with investors wapping 85,689 stock units. Stocks trading firm│ Agostini’s traded 62 shares at $25. Angostura Holdings exchanged 7,297 units at $15.30, Ansa McAl exchanged 3,310 stocks and closed at $50, Calypso Micro Index Fund traded 370 shares to close at $14. Clico Investments closed at $27.85, with a transfer of 36,232 shares, First Caribbean International Bank closed at $7 after transferring 2,000 stock units. Massy Holdings traded 2,316 units at $58, NCB Financial ended at $7.86, with 393 stock units crossing the market, One Caribbean Media exchanged 19,920 stock units at $5.25. Prestige Holdings closed at $8.35 in exchanging a mere five stocks and Republic Financial Holdings closed at $141 after an exchange of 356 shares and Unilever Caribbean traded 29,303 stocks to end at $16.90.

Stocks trading firm│ Agostini’s traded 62 shares at $25. Angostura Holdings exchanged 7,297 units at $15.30, Ansa McAl exchanged 3,310 stocks and closed at $50, Calypso Micro Index Fund traded 370 shares to close at $14. Clico Investments closed at $27.85, with a transfer of 36,232 shares, First Caribbean International Bank closed at $7 after transferring 2,000 stock units. Massy Holdings traded 2,316 units at $58, NCB Financial ended at $7.86, with 393 stock units crossing the market, One Caribbean Media exchanged 19,920 stock units at $5.25. Prestige Holdings closed at $8.35 in exchanging a mere five stocks and Republic Financial Holdings closed at $141 after an exchange of 356 shares and Unilever Caribbean traded 29,303 stocks to end at $16.90. West Indian Tobacco closed $4 higher at $39, in trading 36,652 shares.

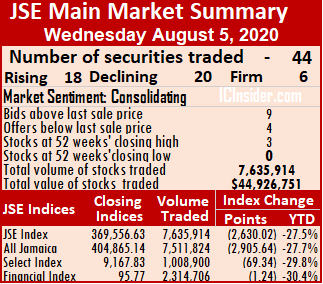

West Indian Tobacco closed $4 higher at $39, in trading 36,652 shares. At the close, the All Jamaican Composite Index dropped 2,905.64 points to close at 404,865.14, the Main Index shed 2,630.02 points to settle at 369,556.63 and the JSE Financial Index 1.24 points to close at 95.77.

At the close, the All Jamaican Composite Index dropped 2,905.64 points to close at 404,865.14, the Main Index shed 2,630.02 points to settle at 369,556.63 and the JSE Financial Index 1.24 points to close at 95.77. Trading month to date compares well to July that ended with an average of 392,128 shares for $2,444,356.

Trading month to date compares well to July that ended with an average of 392,128 shares for $2,444,356. Kingston Wharves carved out a loss $3.50, with $50 569 units passing through the market. Mayberry Investments lost 99 cents to close at $5 trading 104,727 stocks, Mayberry Jamaican Equities lost 55 cents to end at $8.75 in trading 51,450 units, Palace Amusement dropped by $232.50 to end at $1,550 while exchanging 172 shares. PanJam Investment gained $3 to sit at $69, with 2,258 shares crossing the exchange, Sagicor Group carved out a loss $1.45 to close at $42.50, after 111,287 units changed hands, Scotia Group fell $3.95 to $44.05 in an exchange of 25,815 shares and Sygnus Credit Investments declined by 50 cents to settle at $16 while exchanging 9,658 stock units.

Kingston Wharves carved out a loss $3.50, with $50 569 units passing through the market. Mayberry Investments lost 99 cents to close at $5 trading 104,727 stocks, Mayberry Jamaican Equities lost 55 cents to end at $8.75 in trading 51,450 units, Palace Amusement dropped by $232.50 to end at $1,550 while exchanging 172 shares. PanJam Investment gained $3 to sit at $69, with 2,258 shares crossing the exchange, Sagicor Group carved out a loss $1.45 to close at $42.50, after 111,287 units changed hands, Scotia Group fell $3.95 to $44.05 in an exchange of 25,815 shares and Sygnus Credit Investments declined by 50 cents to settle at $16 while exchanging 9,658 stock units. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows 10 stocks ended with bids higher than their last selling prices and three with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows 10 stocks ended with bids higher than their last selling prices and three with lower offers. Sagicor Real Estate Fund dropped $1.03 to end at $7.86 trading 455 stocks. Salada Foods shed $2 to close at $27 in an exchange of 265 stock units, Scotia Group lost $3.70 to settle at $48 with 41,184 shares traded, Supreme Ventures lost 39 cents to finish at $15.10 with 130,605 shares changing hands. Sygnus Credit Investments fell 30 cents to end at $16.50, with an exchange of 11,550 stock units, Victoria Mutual Investments gained 53 cents to finish at $7.03, with investors transferring 257,519 units and Wisynco Group carved out a loss 57 cents to close at $17.05 with 64,103 units crossing the exchange.

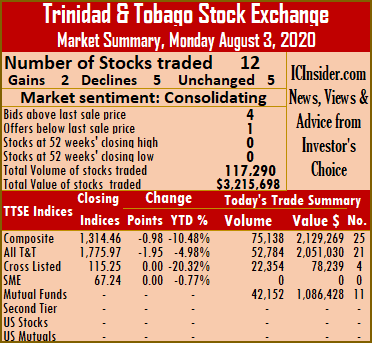

Sagicor Real Estate Fund dropped $1.03 to end at $7.86 trading 455 stocks. Salada Foods shed $2 to close at $27 in an exchange of 265 stock units, Scotia Group lost $3.70 to settle at $48 with 41,184 shares traded, Supreme Ventures lost 39 cents to finish at $15.10 with 130,605 shares changing hands. Sygnus Credit Investments fell 30 cents to end at $16.50, with an exchange of 11,550 stock units, Victoria Mutual Investments gained 53 cents to finish at $7.03, with investors transferring 257,519 units and Wisynco Group carved out a loss 57 cents to close at $17.05 with 64,103 units crossing the exchange. The market closed with twelve securities trading with two advancing, five declining and five remained unchanged. Trading accounted for 117,290 shares valued at $3,215,698 compared to 232,343 stocks for $5,720,884 from 13 securities on Friday.

The market closed with twelve securities trading with two advancing, five declining and five remained unchanged. Trading accounted for 117,290 shares valued at $3,215,698 compared to 232,343 stocks for $5,720,884 from 13 securities on Friday. Republic Financial Holdings dropped $3.50 to close at $136, in exchange for 130 units. Trinidad Cement shed 10 cents to settle at $2, with 500 units changing hands and Unilever Caribbean closed 5 cents lower at $16.90 after trading 738 units.

Republic Financial Holdings dropped $3.50 to close at $136, in exchange for 130 units. Trinidad Cement shed 10 cents to settle at $2, with 500 units changing hands and Unilever Caribbean closed 5 cents lower at $16.90 after trading 738 units.