Trading jumped on the Jamaica Stock Exchange US dollar market on Monday, leading to a fall in the market with the volume of stocks changing hands rising 127 percent, valued 770 percent more than on Friday and resulting in nine securities traded, compared to seven on Friday with five rising, two declining and two ending unchanged.

Trading accounted for 620,736 shares for US$61,293, compared with 273,362 units at US$7,044 on Friday.

Trading accounted for 620,736 shares for US$61,293, compared with 273,362 units at US$7,044 on Friday.

Trading on Monday averaged 68,971 shares at US$6,810, compared with 39,052 units at US$1,006 on Friday, with a month to date average of 174,793 shares at US$14,495 compared with 182,063 units at US$15,023 on the prior trading day. February ended with an average of 43,793 units for US$2,015.

The JSE USD Equities Index dived 24.22 points to end at 191.48. The PE Ratio, a measure used in computing appropriate stock values, averages 8.9. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share gained 0.18 of a cent to end at 6.25 US cents, with 288,908 shares clearing the market, Margaritaville increased 0.05 of a cent after finishing at 11 US cents, while 37 stocks passed through the market, Productive Business Solutions declined 40 cents to close at US$1.35 trading 248 units.  Proven Investments shed 0.5 of a cent to end at 16.5 US cents after 258,719 stock units passed through the market, Sygnus Credit Investments advanced 0.5 of a cent in closing at 9.5 US cents while exchanging 1,024 units. Sygnus Real Estate Finance USD share remained at 7.18 US cents after an exchange of 1,375 shares and Transjamaican Highway rallied 0.06 of a cent to 0.94 of one US cent, with investors transferring 70,422 stock units.

Proven Investments shed 0.5 of a cent to end at 16.5 US cents after 258,719 stock units passed through the market, Sygnus Credit Investments advanced 0.5 of a cent in closing at 9.5 US cents while exchanging 1,024 units. Sygnus Real Estate Finance USD share remained at 7.18 US cents after an exchange of 1,375 shares and Transjamaican Highway rallied 0.06 of a cent to 0.94 of one US cent, with investors transferring 70,422 stock units.

In the preference segment, Eppley 6% preference share popped 8.88 cents to end at a 52 weeks’ high of US$1.40 as investors exchanged two stocks and Equityline Mortgage Investment preference share ended at US$1.64 after a transfer of 1 stock unit.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big fall for JSE USD market

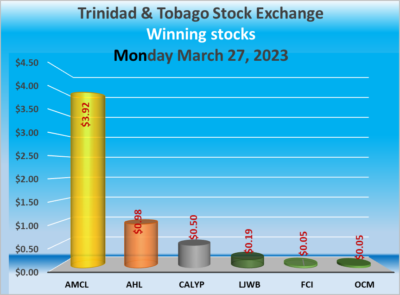

Gains for Trinidad & Tobago Exchange

Trading popped on the Trinidad and Tobago Stock Exchange on Monday, with the volume of stocks traded rising 19 percent with a 48 percent greater value than Friday, resulting in 16 securities trading compared with 17 on Friday, with six stocks rising, five declining and five remaining unchanged.

Trading climbed to 131,348 shares for $1,504,412 up from 110,426 stock units at $1,177,661 on Friday.

Trading climbed to 131,348 shares for $1,504,412 up from 110,426 stock units at $1,177,661 on Friday.

An average of 8,209 shares were traded at $94,026 compared to 6,496 units at $69,274 on Friday, with trading month to date averaging 21,561 shares at $225,265 versus 22,190 units at $231,441 on the previous day. The average trade for February amounts to 51,996 shares at $458,520.

The Composite Index rose 7.75 points to 1,329.65, the All T&T Index jumped 17.55 points to 1,989.12, the SME Index remained at 61.52 and the Cross-Listed Index slipped 0.38 points to close at 87.33.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Angostura Holdings popped 98 cents to $59.75 after trading 12,605 shares, Ansa McAl traded 80 shares and jumped $3.92 to $54.75, First Citizens Group ended at $50 with an exchange of 3,979 stocks, FirstCaribbean International Bank popped 5 cents to $7.20, with 49.900 stock units clearing the market. GraceKennedy lost 14 cents in ending at $4.46 after an exchange of 3,100 units, JMMB Group slipped 5 cents in ending at $1.70 with a transfer of 17,555 shares, L.J. Williams B share rose 19 cents to close at $2.75 after investors traded 200 units.  Massy Holdings ended market activity at $4.55 after an exchange of 29,148 stock units, National Enterprises had an exchange of 1,327 stocks in closing at $3.72 after slipping by a cent, NCB Financial fell 1 cent to $3.89, with 855 stock units crossing the market. One Caribbean Media gained 5 cents to end at $3.55, with 5,350 units changing hands, Prestige Holdings remained at $7.49 in switching ownership of 55 shares. Republic Financial closed at $138 after 3,021 shares crossed the market, Scotiabank remained at $78 while exchanging just 18 stock units and Trinidad Cement lost 3 cents in ending at $3.51 while 1,330 stocks passed through the market.

Massy Holdings ended market activity at $4.55 after an exchange of 29,148 stock units, National Enterprises had an exchange of 1,327 stocks in closing at $3.72 after slipping by a cent, NCB Financial fell 1 cent to $3.89, with 855 stock units crossing the market. One Caribbean Media gained 5 cents to end at $3.55, with 5,350 units changing hands, Prestige Holdings remained at $7.49 in switching ownership of 55 shares. Republic Financial closed at $138 after 3,021 shares crossed the market, Scotiabank remained at $78 while exchanging just 18 stock units and Trinidad Cement lost 3 cents in ending at $3.51 while 1,330 stocks passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

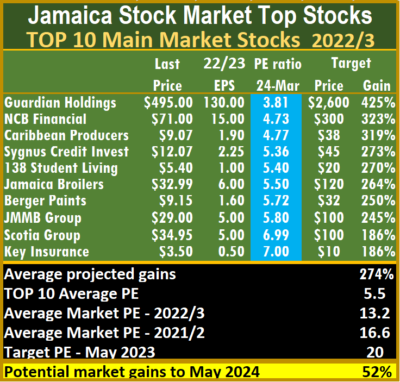

Key Insurance highest ICTOP10 jumps 37%

Stocks dropped to their lowest levels this past week after falling even lower than they did to close of the previous week as investors continue to shun the market, but the time is not far off that Bank of Jamaica will begin lowering interest rates and fuel a market resurgence as they sent the clearest signal that interest rates have not only peaked but will be headed downwards this past week.

The first signs of an easing of rate came this past week with BOJ CDs rates plunging 16 percent to an average of 8.85 percent from over 10 percent where it stood for several months. Importantly, the central bank cut the stock of CDS it holds from a peak of $109.5 billion on March 3, down to $82 billion at the latest auction, far less than from mid-January to the end of February, as more than $58 billion chasing after the $18 billion that was offered last week. While this happened the foreign exchange market looks very liquid with the rate falling under $152 to one US dollar from $155 earlier in February.

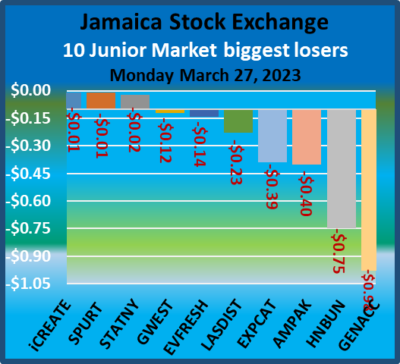

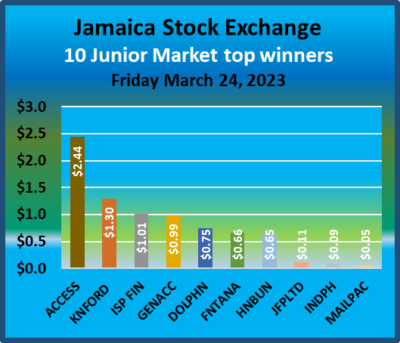

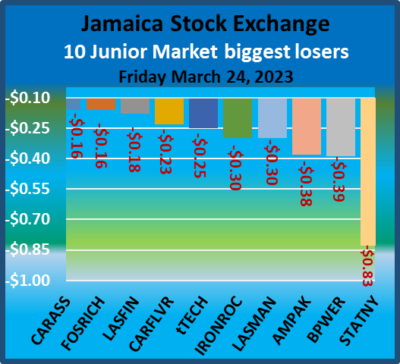

Performance in the past week for the Junior Market TOP10 saw only two stocks rising and seven falling, the majority of the declining stocks registering fell by 3 percent or less. General Accident jumped 20 percent to $5.98, but the bids are not there at the close, to support the price, but selling has abated for this stock currently. Everything Fresh rose 9 percent to close at $1.55 and actually traded at $1.65 during the week. Iron Rock Insurance fell 13 percent to $2 and Caribbean Assurance Brokers lost 6 percent to $1.90.

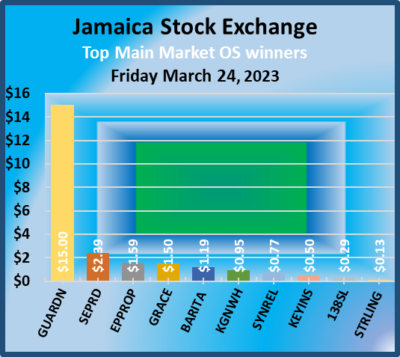

The Main Market TOP10 saw the highest gaining stock rising just 34 percent, after Key Insurance jumped to $3.50 and was followed by 138 Student Living with an 8 percent rise to $5.40, but Caribbean Producers dropped 8 percent to $9.07. All other movements were 3 percent or less.

The Main Market TOP10 saw the highest gaining stock rising just 34 percent, after Key Insurance jumped to $3.50 and was followed by 138 Student Living with an 8 percent rise to $5.40, but Caribbean Producers dropped 8 percent to $9.07. All other movements were 3 percent or less.

The Junior Market has a long term pattern, with the market starting to rise around a month before quarterly results are due and declining shortly after results are released. This is a pattern worth noting that can be built into investment decisions that can improve returns.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.5, well below the market average of 13.2, while the Junior Market Top 10 PE sits at 5.9 compared with the market at 10.6. The differences are important indicators of the level of likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 248 percent and the Main Market TOP10 an average of 274 percent, to May 2024, based on 2023 forecasted earnings.

The Junior Market has 9 stocks representing 19 percent of the market, with PEs from 15 to 24, averaging 19, well above the average of the market. The top half of the market has an average PE of 15, suggesting that this may be a logical value for junior market stocks currently.

The Main Market 16 most valued stocks are priced at a PE of 15 to 100, with an average of 29 and 19 excluding the highest valued stocks and 18 for the top half excluding the stocks with the highest valuation. The above average shows the extent of potential gains for the TOP 10 stocks.

The Main Market 16 most valued stocks are priced at a PE of 15 to 100, with an average of 29 and 19 excluding the highest valued stocks and 18 for the top half excluding the stocks with the highest valuation. The above average shows the extent of potential gains for the TOP 10 stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

JSE USD market pulled back on Friday

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks changing hands declining 99 percent valued being 100 percent lower than the huge trades that took place on Thursday, resulting in trading seven securities, compared to six on Thursday with none rising, five declining and two ending unchanged.

Overall, 273,362 shares were traded for US$7,044 compared with 21,983,490 units at US$1,628,700 on Thursday.

Overall, 273,362 shares were traded for US$7,044 compared with 21,983,490 units at US$1,628,700 on Thursday.

Trading averaged 39,052 shares at US$1,006 down from 3,663,915 units at US$271,450 on Thursday. The average trade month to date amounts to 182,063 shares at US$15,023 compared to 190,136 units at US$15,814 on the previous day. February ended with an average of 43,793 units for US$2,015.

The JSE USD Equities Index fell 1.66 points to end at 215.70.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.8. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than the last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share shed 0.01 of a cent to to close at 6.07 US cents after investors traded 900 shares, Margaritaville dipped 0.04 of a cent to end at 10.95 US cents with an exchange of 87 units, Proven Investments lost 0.5 of a cent to close at 17 US cents in switching ownership of 4,964 stocks. Sygnus Credit Investments dipped 0.5 of a cent to end at 9 US cents with traders exchanging 3,900 stock units, Sygnus Real Estate Finance USD share remained at 7.18 US cents with investors transferring 858 stocks and Transjamaican Highway fell 0.06 of a cent in ending at 0.88 of one US cent in an exchange of 260,960 shares.

At the close, First Rock Real Estate USD share shed 0.01 of a cent to to close at 6.07 US cents after investors traded 900 shares, Margaritaville dipped 0.04 of a cent to end at 10.95 US cents with an exchange of 87 units, Proven Investments lost 0.5 of a cent to close at 17 US cents in switching ownership of 4,964 stocks. Sygnus Credit Investments dipped 0.5 of a cent to end at 9 US cents with traders exchanging 3,900 stock units, Sygnus Real Estate Finance USD share remained at 7.18 US cents with investors transferring 858 stocks and Transjamaican Highway fell 0.06 of a cent in ending at 0.88 of one US cent in an exchange of 260,960 shares.

In the preference segment, JMMB Group 5.75% ended at US$2 with the trading of 1,693 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

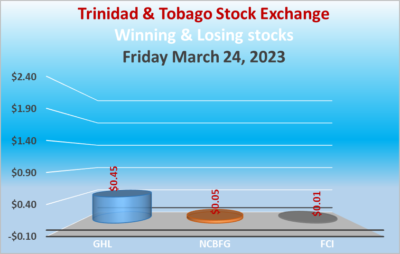

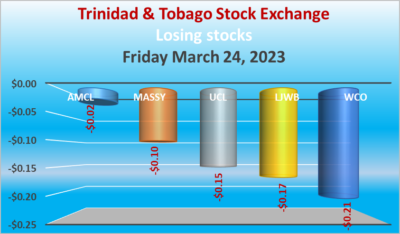

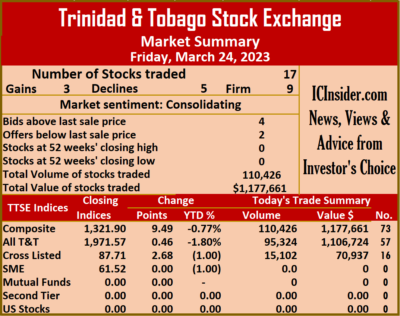

Trading drops on Trinidad Exchange

Trading dropped by the close of the Trinidad and Tobago Stock Exchange on Friday, with the volume of stocks traded declining by 23 percent with the value 48 percent lower than on Thursday, resulting in 17 securities trading compared with 20 on Thursday, with three stocks rising, five declining and nine remaining unchanged.

Trading dipped to 110,426 shares for $1,177,661 down from 144,329 stock units at $2,249,219 on Thursday. An average of 6,496 shares were traded at $69,274 compared to 7,216 shares at $112,461 on Thursday. Trading for the month to date averaged 22,190 shares at $231,441 versus 23,016 units at $239,976 on the previous day. The average trade for February was 51,996 shares at $458,520.

Trading dipped to 110,426 shares for $1,177,661 down from 144,329 stock units at $2,249,219 on Thursday. An average of 6,496 shares were traded at $69,274 compared to 7,216 shares at $112,461 on Thursday. Trading for the month to date averaged 22,190 shares at $231,441 versus 23,016 units at $239,976 on the previous day. The average trade for February was 51,996 shares at $458,520.

The Composite Index increased 9.49 points to 1,321.90, the All T&T Index climbed 0.46 points to 1,971.57, the SME Index remained at 61.52 and the Cross-Listed Index gained 2.68 points to close at 87.71.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Ansa McAl declined 2 cents to $50.83 after trading 162 shares, First Citizens Group ended at $50 with an exchange of 1,912 stocks, FirstCaribbean International Bank popped 1 cent to end at $7.15, with 8,207 stock units clearing the market. Guardian Holdings popped 45 cents in ending at $25.50 after an exchange of 4,332 units, JMMB Group remained at $1.75 with a transfer of 6,734 shares, L.J. Williams B share fell 17 cents to close at $2.56 after investors traded 10,000 units. Massy Holdings lost 10 cents to end at $4.55 after an exchange of 5,846 stock units, National Enterprises had an exchange of 53,739 stocks in closing at $3.73, NCB Financial rose 5 cents to $3.90, with 161 stock units crossing the market.

At the close, Ansa McAl declined 2 cents to $50.83 after trading 162 shares, First Citizens Group ended at $50 with an exchange of 1,912 stocks, FirstCaribbean International Bank popped 1 cent to end at $7.15, with 8,207 stock units clearing the market. Guardian Holdings popped 45 cents in ending at $25.50 after an exchange of 4,332 units, JMMB Group remained at $1.75 with a transfer of 6,734 shares, L.J. Williams B share fell 17 cents to close at $2.56 after investors traded 10,000 units. Massy Holdings lost 10 cents to end at $4.55 after an exchange of 5,846 stock units, National Enterprises had an exchange of 53,739 stocks in closing at $3.73, NCB Financial rose 5 cents to $3.90, with 161 stock units crossing the market.  One Caribbean Media remained at $3.50, with 5,000 units changing hands, Point Lisas ended trading at $3.59 with the swapping of 50 stocks, Prestige Holdings remained at $7.49 in switching ownership of 362 shares. Republic Financial closed trading at $138, with 1,820 shares crossing the market, Scotiabank ended at $78 while exchanging 2,690 stock units, Trinidad & Tobago NGL ended at $20.01 while 1,330 stocks passed through the market. Unilever Caribbean dipped 15 cents to $14.50 after an exchange of 145 units and West Indian Tobacco shed 21 cents to end at $16.79 as investors traded 7,936 stocks.

One Caribbean Media remained at $3.50, with 5,000 units changing hands, Point Lisas ended trading at $3.59 with the swapping of 50 stocks, Prestige Holdings remained at $7.49 in switching ownership of 362 shares. Republic Financial closed trading at $138, with 1,820 shares crossing the market, Scotiabank ended at $78 while exchanging 2,690 stock units, Trinidad & Tobago NGL ended at $20.01 while 1,330 stocks passed through the market. Unilever Caribbean dipped 15 cents to $14.50 after an exchange of 145 units and West Indian Tobacco shed 21 cents to end at $16.79 as investors traded 7,936 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Profit bolted 45% at Derrimon in 2023

Profit popped 45 percent higher in 2022 at Derrimon Trading Company to $580 million for shareholders, following a mere 3.8 percent rise in revenues to $18.4 billion from $17.74 billion in 2021 and following a fall in cost of sales to $13.78 billion from $14.34 billion in 2021 resulting in gross profit rising a solid 36 percent to $4.6 billion from just $3.4 billion, with profit margin climbing to 25.2 percent from just 19.2 percent in 2021.

Sales revenue fell in the final quarter compared with 2021, with $4.6 billion generated in the December 2022 quarter, down from $5.6 billion in 2021, as segment data shows the wholesale and retail segment suffering a $1.8 billion decline for the year to $8.4 billion. “We took deliberate strategic steps to focus more on our retail business that has greater margins and improves cash flows,” Derrick Cotterell, Managing Director, advised ICInsder.com in response to a question about the reasons for the lower sales in the December quarter. He continued to indicate that “going forward, there will be more focus on brands with a higher margin and less on bulk products.” He said it does not mean they are getting out of the bilk products.

Sales revenue fell in the final quarter compared with 2021, with $4.6 billion generated in the December 2022 quarter, down from $5.6 billion in 2021, as segment data shows the wholesale and retail segment suffering a $1.8 billion decline for the year to $8.4 billion. “We took deliberate strategic steps to focus more on our retail business that has greater margins and improves cash flows,” Derrick Cotterell, Managing Director, advised ICInsder.com in response to a question about the reasons for the lower sales in the December quarter. He continued to indicate that “going forward, there will be more focus on brands with a higher margin and less on bulk products.” He said it does not mean they are getting out of the bilk products.

Other operating income includes rental, $82 million from a gain on acquiring a subsidiary, management fees and dividend. Debt recovery generated $237 million in 2022, up from $104 million in 2021.

Operating and administrative expenses rose 28.7 percent to $2.995 billion in 2022 from $2.33 billion in the previous year. Sales and distribution expenses increased by a hefty 71 percent to $689 million from $402 million in 2021. The shift in focusing on retail business is also based on increased borrowing costs, with interest rates having risen sharply in the country and forcing attention on improving cash flows to keep borrowings down and, by extension, interest cost. Finance costs more than doubled to $464 million from $231 million in 2021.

Going forward, the group will benefit from opening a supermarket in May Pen in the last quarter, which Cotterell says is doing very well.

Going forward, the group will benefit from opening a supermarket in May Pen in the last quarter, which Cotterell says is doing very well.

Gross cash flow brought in $1.25 billion, which was used to fund increased working capital of $720 million, capital expenditure amounted to $1.47 billion that was partially financed by loans inflows net of repayment of $600 million.

At the end of December, shareholders’ equity stood at $6.1 billion, with long term borrowings at $4.7 billion and short term at $476 million. Current assets ended the period at $7.3 billion inclusive of trade and other receivables of $2.2 billion, cash and bank balances of $900 million. Current liabilities ended at $4.3 billion and net current assets at $2.9 billion.

Earnings per share came out at 12.8 cents for the year, up from 9.4 cents in 2021. IC Insider.com forecasts 16 cents per share for 2023, with a PE of 14 times the current year’s earnings based on the price of $2.10, the stock traded at on the Jamaica Stock Exchange Junior Market.

The company did not pay a dividend during the year and ended with a net asset value at the end of the year at $1.22, with the stock selling at 1.73 book value.

First Rock steals the show on the JSE USD market

An unusually large block of 19.35 million First Rock Real Estate shares passed through the Jamaica Stock Exchange US dollar market on Thursday, at the same time 2.63 million shares trading in Proven Investments driving the volume of stocks changing hands in the market and value sharply higher than Wednesday following trading in five securities, compared to seven on Wednesday with three rising and two declining.

Overall, 21,983,490 shares were traded for US$1,624,041 up from 193,894 shares for US$13,133 on Wednesday.

Overall, 21,983,490 shares were traded for US$1,624,041 up from 193,894 shares for US$13,133 on Wednesday.

Trading on Thursday ended with an average of 4,396,698 shares at US$324,808, up sharply from 32,316 shares at US$2,189 on Wednesday, with a month to date average of 191,682 shares at US$15,905 compared with 13,503 units at US$2,816 on the previous day. February ended with an average of 43,793 units for US$2,015.

The JSE USD Equities Index popped 1.22 points to end at 217.36.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.2. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than the last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share slipped 0.42 of a cent to end at 6.08 US cents in an exchange of 19,350,000 shares, Proven Investments rose 1 cent to 17.5 US cents, with 2,631,050 stocks clearing the market. Sterling Investments rose 0.022 cents to close at 2 cents after trading just 5 shares, Sygnus Credit Investments slipped 0.05 cents to 09.5 US cents after 250 units crossing the market and Transjamaican Highway popped 0.04 of a cent to close at 0.94 of one US cent with a transfer of 1,800 shares.

At the close, First Rock Real Estate USD share slipped 0.42 of a cent to end at 6.08 US cents in an exchange of 19,350,000 shares, Proven Investments rose 1 cent to 17.5 US cents, with 2,631,050 stocks clearing the market. Sterling Investments rose 0.022 cents to close at 2 cents after trading just 5 shares, Sygnus Credit Investments slipped 0.05 cents to 09.5 US cents after 250 units crossing the market and Transjamaican Highway popped 0.04 of a cent to close at 0.94 of one US cent with a transfer of 1,800 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

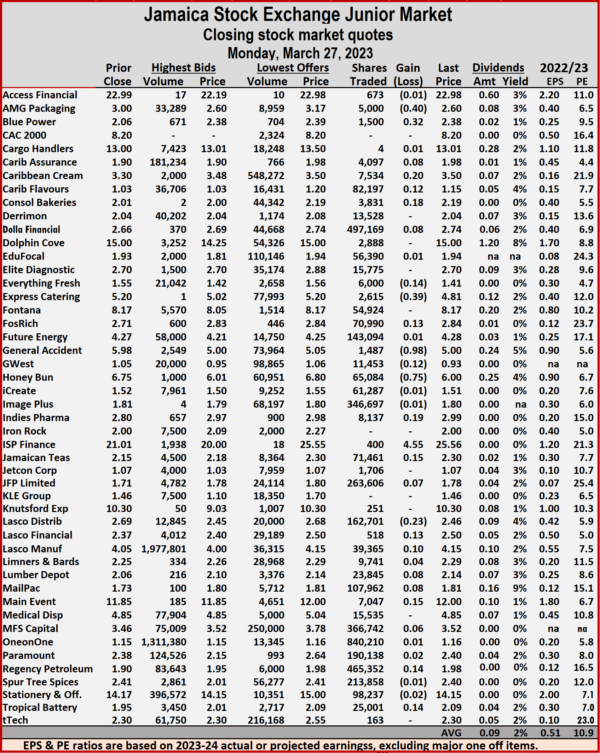

A total of 4,366,193 shares were exchanged for $11,400,138 down from 6,478,077 units at $16,544,909 on Friday.

A total of 4,366,193 shares were exchanged for $11,400,138 down from 6,478,077 units at $16,544,909 on Friday. Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers. Fosrich advanced 13 cents after ending at $2.84 while 70,990 stock units crossed the market, General Accident lost 98 cents to close at $5 after exchanging 1,487 shares, GWest Corporation fell 12 cents to end at 93 cents with 11,453 units clearing the market. Honey Bun declined 75 cents in closing at $6, with 65,084 stock units crossing the exchange, Indies Pharma rose 19 cents to $2.99 after an exchange of 8,137 stocks, ISP Finance gained $4.55 after ending at $25.56 with 400 shares being traded. Jamaican Teas climbed 15 cents to end at $2.30 in switching ownership of 71,461 units, Lasco Distributors lost 23 cents to close at $2.46, with 162,701 units crossing the market, Lasco Financial increased 13 cents to $2.50 in an exchange of 518 stocks. Lasco Manufacturing popped 10 cents in closing at $4.15 after trading 39,365 shares, Lumber Depot rallied 8 cents to $2.14 with investors transferring 23,845 stock units, Mailpac Group advanced 8 cents to end at $1.81 after a transfer of 107,962 stock units.

Fosrich advanced 13 cents after ending at $2.84 while 70,990 stock units crossed the market, General Accident lost 98 cents to close at $5 after exchanging 1,487 shares, GWest Corporation fell 12 cents to end at 93 cents with 11,453 units clearing the market. Honey Bun declined 75 cents in closing at $6, with 65,084 stock units crossing the exchange, Indies Pharma rose 19 cents to $2.99 after an exchange of 8,137 stocks, ISP Finance gained $4.55 after ending at $25.56 with 400 shares being traded. Jamaican Teas climbed 15 cents to end at $2.30 in switching ownership of 71,461 units, Lasco Distributors lost 23 cents to close at $2.46, with 162,701 units crossing the market, Lasco Financial increased 13 cents to $2.50 in an exchange of 518 stocks. Lasco Manufacturing popped 10 cents in closing at $4.15 after trading 39,365 shares, Lumber Depot rallied 8 cents to $2.14 with investors transferring 23,845 stock units, Mailpac Group advanced 8 cents to end at $1.81 after a transfer of 107,962 stock units. Main Event popped 15 cents in closing at $12 as 7,047 shares passed through the market, Regency Petroleum advanced 8 cents after ending at $1.98 with a transfer of 465,352 units and Tropical Battery increased 14 cents to close at $2.09, with 25,001 stocks crossing the market.

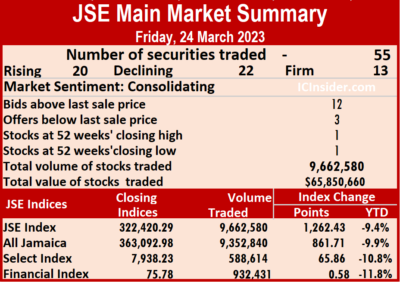

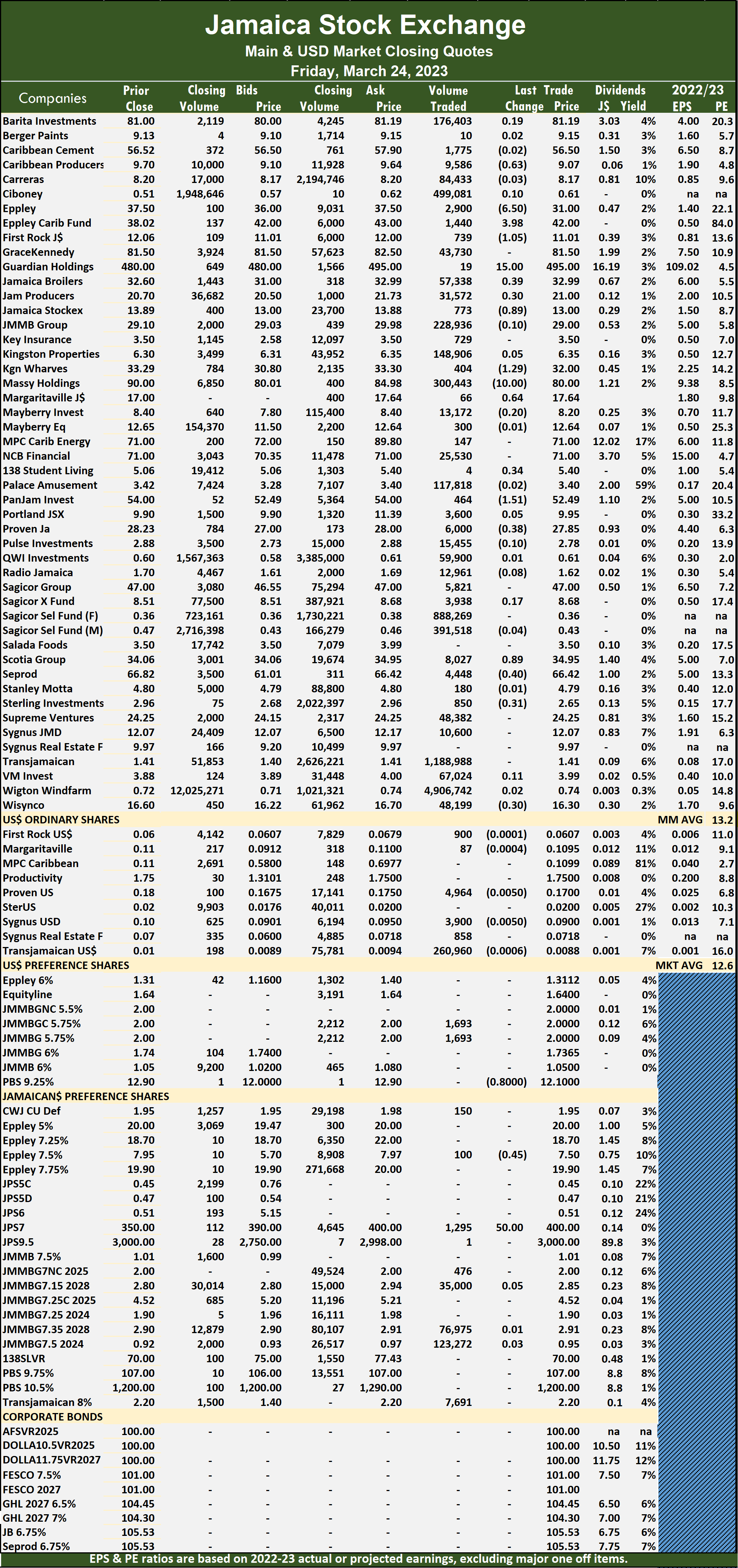

Main Event popped 15 cents in closing at $12 as 7,047 shares passed through the market, Regency Petroleum advanced 8 cents after ending at $1.98 with a transfer of 465,352 units and Tropical Battery increased 14 cents to close at $2.09, with 25,001 stocks crossing the market. A total of 9,662,580 shares were exchanged for $65,850,660 versus 5,709,003 units at $49,903,876 on Thursday.

A total of 9,662,580 shares were exchanged for $65,850,660 versus 5,709,003 units at $49,903,876 on Thursday. The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Jamaica Stock Exchange fell 89 cents to $13 after exchanging 773 units, Kingston Wharves dropped $1.29 to $32 as investors exchanged 404 stocks. Margaritaville popped 64 cents to close at $17.64 in trading 66 shares, Massy Holdings shed $10 to close at $80, with 300,443 stock units changing hands, 138 Student Living rose 34 cents to $5.40 with an exchange of 4 units. PanJam Investment fell $1.51 to $52.49, with 464 shares crossing the market, Proven Investments shed 38 cents to end at $27.85, with 6,000 stock units passing through the exchange, Scotia Group gained 89 cents in closing at $34.95 after 8,027 units changed hands. Seprod declined 40 cents to close at $66.42 while exchanging 4,448 stocks, Sterling Investments dipped 31 cents to $2.65 in switching ownership of 850 units and Wisynco Group dropped 30 cents to $16.30 after a transfer of 48,199 stock units.

Jamaica Stock Exchange fell 89 cents to $13 after exchanging 773 units, Kingston Wharves dropped $1.29 to $32 as investors exchanged 404 stocks. Margaritaville popped 64 cents to close at $17.64 in trading 66 shares, Massy Holdings shed $10 to close at $80, with 300,443 stock units changing hands, 138 Student Living rose 34 cents to $5.40 with an exchange of 4 units. PanJam Investment fell $1.51 to $52.49, with 464 shares crossing the market, Proven Investments shed 38 cents to end at $27.85, with 6,000 stock units passing through the exchange, Scotia Group gained 89 cents in closing at $34.95 after 8,027 units changed hands. Seprod declined 40 cents to close at $66.42 while exchanging 4,448 stocks, Sterling Investments dipped 31 cents to $2.65 in switching ownership of 850 units and Wisynco Group dropped 30 cents to $16.30 after a transfer of 48,199 stock units. In the preference segment, Eppley 7.50% preference share lost 45 cents in closing at $7.50 in an exchange of 100 shares and Jamaica Public Service 7% gained $50 to a record high of $400 with the swapping of 1,295 stocks.

In the preference segment, Eppley 7.50% preference share lost 45 cents in closing at $7.50 in an exchange of 100 shares and Jamaica Public Service 7% gained $50 to a record high of $400 with the swapping of 1,295 stocks. A total of 6,478,077 shares were traded for $16,544,909 compared with 15,501,984 units at $52,166,724 on Thursday.

A total of 6,478,077 shares were traded for $16,544,909 compared with 15,501,984 units at $52,166,724 on Thursday. The PE ratios of Junior Market stocks are computed using the last traded stock price in conjunction with ICInsider.com’s projected earnings for the financial years ending between November 2022 and August 2023.

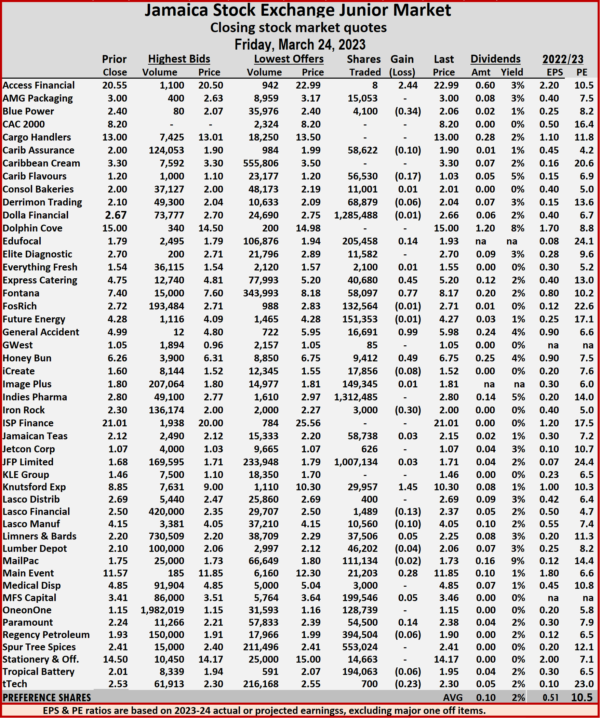

The PE ratios of Junior Market stocks are computed using the last traded stock price in conjunction with ICInsider.com’s projected earnings for the financial years ending between November 2022 and August 2023. Fontana climbed 77 cents in closing at $8.17 after 58,097 stocks crossed the exchange, General Accident rallied 99 cents to close at $5.98 in an exchange of 16,691 stock units, Honey Bun gained 49 cents to close at $6.75 in an exchange of 9,412 shares. iCreate dipped 8 cents to $1.52 after investors traded 17,856 units, Iron Rock Insurance slipped 30 cents to $2 after trading 3,000 stock units, Knutsford Express increased $1.45 to close at $10.30 as 29,957 stocks changed hands. Lasco Financial fell 13 cents to end at $2.37 with a transfer of 1,489 stocks, Lasco Manufacturing dipped 10 cents to $4.05 with the swapping of 10,560 shares, Main Event gained 28 cents in closing at $11.85 after an exchange of 21,203 stock units. Paramount Trading rose 14 cents to end at $2.38, with 54,500 units crossing the market,

Fontana climbed 77 cents in closing at $8.17 after 58,097 stocks crossed the exchange, General Accident rallied 99 cents to close at $5.98 in an exchange of 16,691 stock units, Honey Bun gained 49 cents to close at $6.75 in an exchange of 9,412 shares. iCreate dipped 8 cents to $1.52 after investors traded 17,856 units, Iron Rock Insurance slipped 30 cents to $2 after trading 3,000 stock units, Knutsford Express increased $1.45 to close at $10.30 as 29,957 stocks changed hands. Lasco Financial fell 13 cents to end at $2.37 with a transfer of 1,489 stocks, Lasco Manufacturing dipped 10 cents to $4.05 with the swapping of 10,560 shares, Main Event gained 28 cents in closing at $11.85 after an exchange of 21,203 stock units. Paramount Trading rose 14 cents to end at $2.38, with 54,500 units crossing the market,  Stationery and Office Supplies declined 33 cents to close at $14.17 as 14,663 units passed through the market and tTech shed 23 cents in closing at $2.30 with investors transferring 700 shares.

Stationery and Office Supplies declined 33 cents to close at $14.17 as 14,663 units passed through the market and tTech shed 23 cents in closing at $2.30 with investors transferring 700 shares.