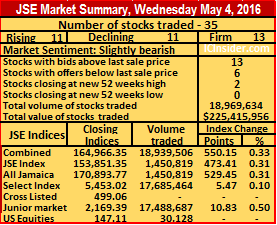

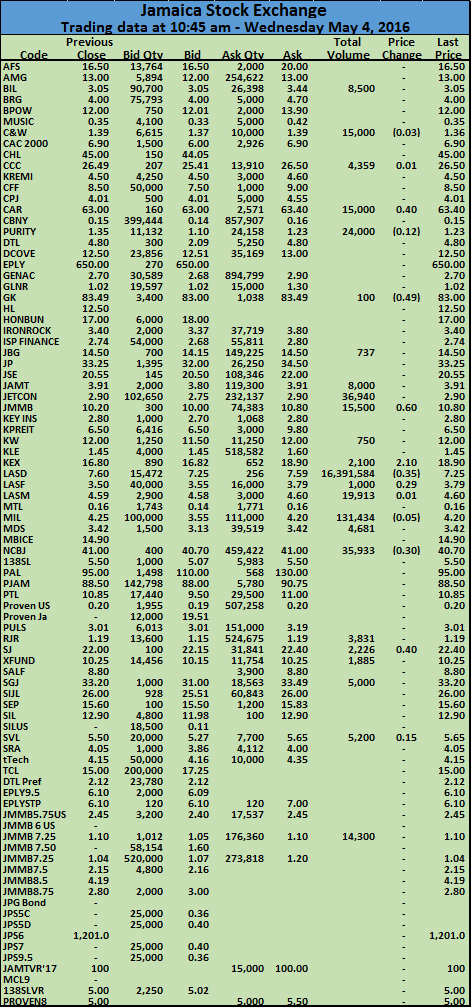

Trading on the Jamaica Stock Exchange on Wednesday ended with low volumes in the main market as just 1.48 million shares traded, well below the junior market. A total of 35 securities changed hands, accounting for 18,969,634 units valued at $146,769,004, in all market segments.

Trading on the Jamaica Stock Exchange on Wednesday ended with low volumes in the main market as just 1.48 million shares traded, well below the junior market. A total of 35 securities changed hands, accounting for 18,969,634 units valued at $146,769,004, in all market segments.

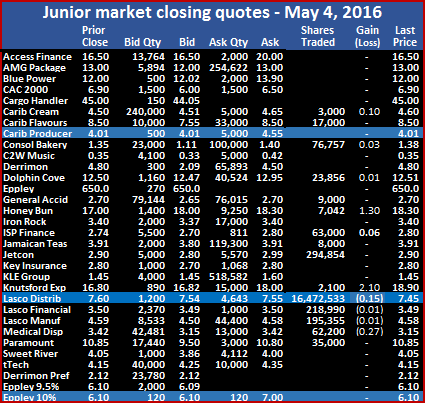

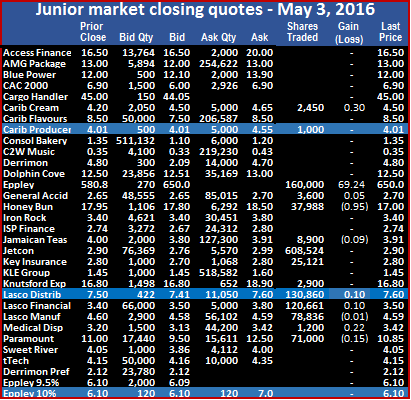

The junior market accounted for 17,488,687 shares valued at $129,088,773. At the close of trading 11 stocks in the overall market gained, 11 declined, including 6 of the stocks rising and 4 declining coming from the junior market. Two stocks ended at 52 weeks’ closing highs in the junior market and none in the main market.

The JSE Market Index gained 473.41 points to end at 153,851.35. The  all Jamaica Composite Index rose 529.45 points to close at 170,893.77 and the JSE combined index climbed 550.16 points, to close at 164,966.35.

all Jamaica Composite Index rose 529.45 points to close at 170,893.77 and the JSE combined index climbed 550.16 points, to close at 164,966.35.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator reading showed 13 stocks with bids higher than their last selling prices and 6 with lower offers.

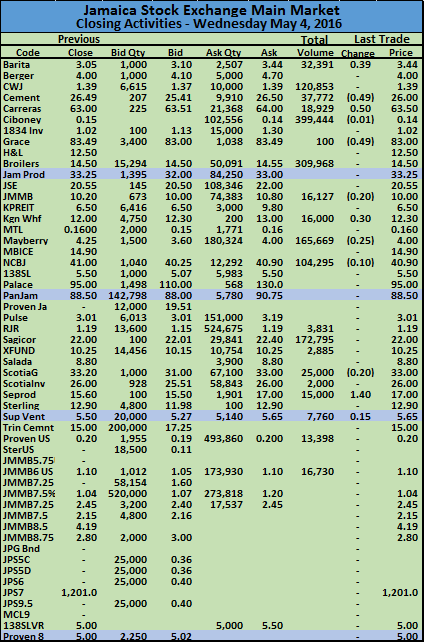

At the end of market activities, Barita Investments traded 32,391 shares and gained 39 cents to close at $3.44, Cable & Wireless closed at $1.39 while trading 120,853 units, Caribbean Cement traded 37,772 shares but the price fell by 49 cents to close at $26, Carreras recovered 50 cents while trading 18,929 shares, to close at $63.50. Ciboney traded 399,444 but lost 1 cent to end at 14 cents, Jamaica Broilers had 309,968 units changing hands, to close at $14.50. JMMB Group lost 20 cents in trading 16,127 shares to close at $10, Kingston Wharves  traded 16,000 shares and gained 30 cents to close at $12.30, Mayberry Investments dropped 25 cents in trading 165,669 shares to close at $4. National Commercial Bank fell 10 cents while trading 104,295 shares to close at $40.90, Sagicor Group fell 40 cents to end with 172,795 shares changing hands at $22, Scotia Group declined by 20 cents to close at $33 while 25,000 units changed hands, Seprod ended with 15,000 units trading but recovered from Tuesday’s loss, by adding $1.40 at $17. Supreme Ventures climbed 15 cents and closed at $5.65 with 7,760 shares changing hands, Proven Investments traded 13,398 share at 20 US cents and JMMB 6% US preference shares traded 16,730 units at $1.10.

traded 16,000 shares and gained 30 cents to close at $12.30, Mayberry Investments dropped 25 cents in trading 165,669 shares to close at $4. National Commercial Bank fell 10 cents while trading 104,295 shares to close at $40.90, Sagicor Group fell 40 cents to end with 172,795 shares changing hands at $22, Scotia Group declined by 20 cents to close at $33 while 25,000 units changed hands, Seprod ended with 15,000 units trading but recovered from Tuesday’s loss, by adding $1.40 at $17. Supreme Ventures climbed 15 cents and closed at $5.65 with 7,760 shares changing hands, Proven Investments traded 13,398 share at 20 US cents and JMMB 6% US preference shares traded 16,730 units at $1.10.

Dealers sold US$7m more than bought – Wednesday

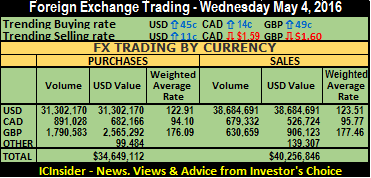

Trading in the Jamaican foreign exchange market saw dealers purchasing US$7 million less they sold on Wednesday, with the rate of the local dollar continuing to be eroded against the critical US dollar. The Jamaican dollar nevertheless gained against the Pound and the Canadian dollar.

Trading in the Jamaican foreign exchange market saw dealers purchasing US$7 million less they sold on Wednesday, with the rate of the local dollar continuing to be eroded against the critical US dollar. The Jamaican dollar nevertheless gained against the Pound and the Canadian dollar.

The market closed with dealers buying the equivalent of US$34,649,112 and selling US$40,256,846, in contrast to US$35,269,451 purchased and US$41,196,078 sold on Tuesday.

In US dollar trading, dealers bought US$31,302,170 compared to US$32,440,716 on Tuesday, as the buying rate for the US dollar rose 45 cents to close at $122.91. A total of US$38,684,691 was sold versus US$39,691,937 on Tuesday with the selling rate rising 11 cents to $123.51.  The Canadian dollar buying rate climbed 14 cents to end at $94.10 with dealers buying C$891,028 and selling C$679,332, at an average rate that slipped $1.59 to $95.77. The rate for buying the British Pound rose 49 cents to $176.09 for the purchase of £1,790,583, while £630,659 was sold, as the rate fell $1.60 to $177.46.

The Canadian dollar buying rate climbed 14 cents to end at $94.10 with dealers buying C$891,028 and selling C$679,332, at an average rate that slipped $1.59 to $95.77. The rate for buying the British Pound rose 49 cents to $176.09 for the purchase of £1,790,583, while £630,659 was sold, as the rate fell $1.60 to $177.46.

At the end of trading, the selling rate for Euro, climbed 30 cents to close at J$142.13, from Tuesday’s rate, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$141.04 for a fall of 8 cents from Tuesday’s rate. The US dollar equivalent of other currencies traded amounts to US$99,484 being bought, while US$139,307 was sold.

The US dollar equivalent of other currencies traded amounts to US$99,484 being bought, while US$139,307 was sold.

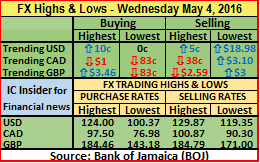

Highs & Lows| Notable changes to the highest and lowest traded rates for the Jamaican dollar against the main currencies on Wednesday are, a rise of $18.98 in the lowest selling rate of the US dollar to end at $119.35, a fall of $1 in the highest buying rate of the Canadian dollar to end at $97.50 and an increase of $3.10 in the lowest selling rate to $90.30, a rise of $3.46 in the highest buying rate for the British Pound to end at $184.46, a fall of $2.59 in the highest selling rate to $184.79 and a rise of $3 in the lowest selling rate to $171.

LasD big day on Wednesday

The Lasco Distributors traded 16.5m shares on Wednesday.

There were two 52 weeks’ highs with 15 active securities trading, as 6 advanced and 4 declined and the junior market index rose 10.83 points, to end at 2,169.39. A total of 3 stocks closed with bids higher than their last selling prices and 5 ended with lower offers.

At the end of trading in the market, Caribbean Cream traded 3,000 units and rose 15 cents to end at $4.60, Caribbean Flavours traded 17,000 units at $8.50, Consolidated Bakery gained 3 cents with 76,757 shares changing hands at $1.38, Dolphin Cove gained 1 cent 23,856 to end at $12.51. General Accident ended trading 9,000 shares to close at $2.70, Honey Bun jumped $1.30 to end at a 52 weeks’ high of $18.30 with 7,042 shares trading,

ISP Finance gained 6 cents to close at a 52 weeks’ high of $2.80 with 63,000 shares. Jamaican Teas traded 8,000 shares to end at $3.91, Jetcon Corporation ended at $2.90 while 294,854 units traded, Knutsford Express had 2,100 shares trading and gained $2.10 to close at $18.90, Lasco Financial lost 1 cent to close at $3.49 with 218,990 shares changing hands. Lasco Manufacturing lost 1 cent to close at $4.58 with 195,355 shares trading, Medical Disposables traded 62,200 shares to close 27 cents lower at $3.15 and Paramount Trading ended with 35,000 shares changing hands at $10.85.

ISP Finance gained 6 cents to close at a 52 weeks’ high of $2.80 with 63,000 shares. Jamaican Teas traded 8,000 shares to end at $3.91, Jetcon Corporation ended at $2.90 while 294,854 units traded, Knutsford Express had 2,100 shares trading and gained $2.10 to close at $18.90, Lasco Financial lost 1 cent to close at $3.49 with 218,990 shares changing hands. Lasco Manufacturing lost 1 cent to close at $4.58 with 195,355 shares trading, Medical Disposables traded 62,200 shares to close 27 cents lower at $3.15 and Paramount Trading ended with 35,000 shares changing hands at $10.85.

All TTSE index down 8% in 2016 – Wednesday

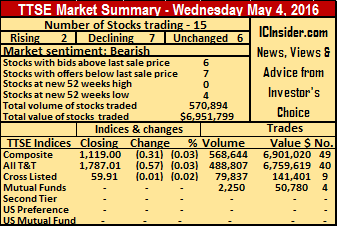

Trading ended for the second consecutive days with 4 stocks closing at 52 weeks’ lows as demand for stocks remain low on the Trinidad & Tobago Stock Exchange as sellers offload stocks at lower prices, helping to push the all Trinidad index down nearly 10 percent for the year to date.

Trading ended for the second consecutive days with 4 stocks closing at 52 weeks’ lows as demand for stocks remain low on the Trinidad & Tobago Stock Exchange as sellers offload stocks at lower prices, helping to push the all Trinidad index down nearly 10 percent for the year to date.

The market closed with 15 active securities changing hands on Wednesday with only 2 stocks gaining, 7 declining while 6 remained unchanged as selling pressure continues in the market. Trading ended with 570,894 shares valued at $6,951,799 changing hands. The Composite Index declined by 0.31 points to close at 1,119.00, the All T&T Index eased 0.57 points to close at 1,787.01 and the Cross Listed Index declined by 0.01 points to 59.91. Interestingly, the index for cross listed stocks is up 21 percent for the year to date and helped to negate the fall in the Composite Index to just 4 percent, the All T&T Index has lost 8 percent and seems destined to decline some more with weak demand for Trinidad stocks.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with 6 stocks with the bid higher than the last selling prices and 7 with offers that were lower.

Gains| Trinidad and Tobago NGL gained 7 cents, to close at $19.62 with 4,461 shares trading and Guardian Holdings traded 470,714 shares valued at $6,119,282 to close at $13 after rising by 1 cent.

Losses| Clico Investment Fund traded 2,250 units at $22.55 after shedding 5 cents, First Citizens Bank traded 325 shares but fell 8 cents to end at a new 52 weeks’ low of $33.10, Massy Holdings lost 1 cent to close at 52 weeks’ low of $49.99 with 119 shares. Republic Financial fell to a 52 weeks’ low of $108.80 with a loss of 15 cents as 2,909 units changed hands, Sagicor Financial Corporation traded 69 units but fell 2 cents to $7.13. Scotiabank had 2,525 shares trading at $54.97 after falling 3 cents for a 52 weeks’ low and Scotia Investments traded 57,768 shares and fell 2 cents to close at $1.62.

Scotiabank had 2,525 shares trading at $54.97 after falling 3 cents for a 52 weeks’ low and Scotia Investments traded 57,768 shares and fell 2 cents to close at $1.62.

Firm Trades| Guardian Media closed at $19.75 with 495 shares traded, JMMB Group closed at 58 cents with 2,000 shares changing hands. National Commercial Bank closed with 20,000 shares trading at $2.35, One Caribbean Media traded just 70 shares and ended at $21.48, Point Lisas Industrial Port Development traded 9,000 at $3.94 and West Indian Tobacco traded 650 shares to close at $126.36.

LasD big early trade – Wednesday

Lasco Distributors dominated trading in the morning session on the Jamaica Stock Exchange with 16,391,584 shares valued at $124,452,572, the stock traded down to $7.25 from $7.60 at the close on Tuesday.  The only other trade in with six digits is Mayberry Investments with 131,434 units at $4.2o down from $4.50 it traded ta earlier in the morning.

The only other trade in with six digits is Mayberry Investments with 131,434 units at $4.2o down from $4.50 it traded ta earlier in the morning.

After 75 minutes of trading, on Wednesday, all main indices rose. The average volume traded amounts to 697,832 units per active stock, compared to an average of 25,536 units in the mid-morning session on Tuesday. The big Lasco Distributors trade, pushed up the average today.

Trading resulted in activity in 24 securities, accounting for 16,747,973 shares changing hands as 8 stocks gained and 6 declined.

The market saw the all Jamaica Composite Index gained 873.76 points to 171,238.08, the JSE Market Index rose 781.28 points to 154,159.22, the JSE combined index ended with a rise of 926.69 points to 165,340.89 and the junior market index gained 19.50 points to 2,178.06.

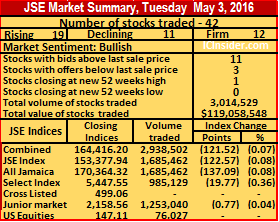

Rising stocks dominate on JSE – Tuesday

Scotia Group jumped by $2.70 on Tuesday

At the close of trading there were 2 new 52 weeks’ closing highs in the junior market.

The JSE Market Index fell 122.57 points to end at 153,377.94. The all Jamaica Composite Index declined by 137.09 points to close at 170,364.32 and the JSE combined index eased 121.52 points, to close at 164,416.20.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator reading showed 14 stocks with bids higher than their last selling prices and 5 with lower offers.

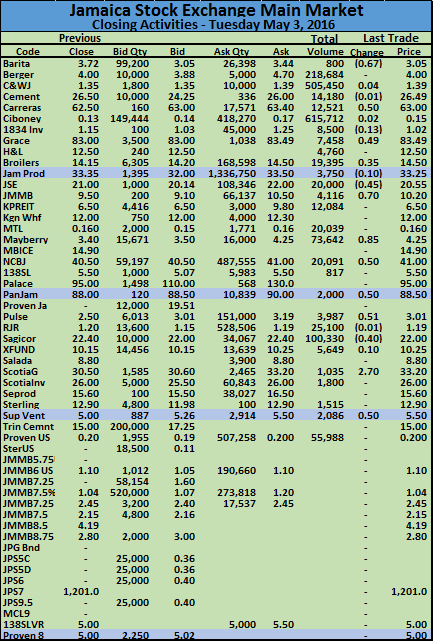

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator reading showed 14 stocks with bids higher than their last selling prices and 5 with lower offers.At the end of market activities, Berger Paints traded 218,684 shares to close at $4, Cable & Wireless gained 4 cents and closed at $1.39 in trading 505,450 units, Caribbean Cement traded 14,180 shares but the price fell by 1 cent to close at $26.49, Carreras recovered 50 cents while trading 12,521 shares, to close at $63. Ciboney traded 615,712 and gained 2 cents to 15 cents, Rebranded Gleaner Company, 1834 Investments, fell 13 cent to close at $1.02 in trading only 8,500 shares, Jamaica Broilers gained 35 cents with 19,395 units changing hands, to close at $14.50. Jamaica Stock Exchange traded 20,000 shares but lost 45 cents to end at $20.55, JMMB Group rose 70 cents in trading 4,116 shares to close at $10.20, Kingston Properties traded 12,084 shares to close at $6.50, Mayberry Investments jumped 85 cents as it traded 73,642 shares to close at $4.25.

National Commercial Bank gained 50 cents while 20,091 shares traded, to close at $41, Pan Jamaican closed with a gain of 50 cents at $88.50 with 2,000 shares changing hands. Pulse Investments rose 51 cents to close at $3.01 as 3,987 units changed hands, Radio Jamaica traded 25,100 shares and lost 1 cent to close at $1.19, Sagicor Group fell 40 cents to end with 100,330 shares changing hands at $22, Scotia Group jumped $2.70 to close at $33.20 while only 1,035 units changed hands. Scotia Investments closed with 8,374 shares trading with a gain of 50 cents to $26, Seprod ended with 19,777 units trading with a loss of $1.30 at $15.60, Supreme Ventures climbed 50 cents and closed at $5.50 with 2,086 shares changing hands and Proven Investments traded 55,988 share at 20 US cents.

National Commercial Bank gained 50 cents while 20,091 shares traded, to close at $41, Pan Jamaican closed with a gain of 50 cents at $88.50 with 2,000 shares changing hands. Pulse Investments rose 51 cents to close at $3.01 as 3,987 units changed hands, Radio Jamaica traded 25,100 shares and lost 1 cent to close at $1.19, Sagicor Group fell 40 cents to end with 100,330 shares changing hands at $22, Scotia Group jumped $2.70 to close at $33.20 while only 1,035 units changed hands. Scotia Investments closed with 8,374 shares trading with a gain of 50 cents to $26, Seprod ended with 19,777 units trading with a loss of $1.30 at $15.60, Supreme Ventures climbed 50 cents and closed at $5.50 with 2,086 shares changing hands and Proven Investments traded 55,988 share at 20 US cents.

US$7m more FX sold than bought – Tuesday

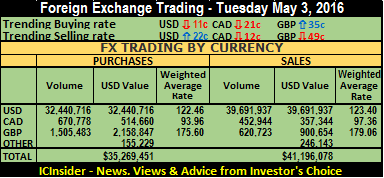

Trading in the Jamaican foreign exchange market saw dealers selling US$7 million more in US currency than they purchased on Tuesday, with the rate of the local dollar continuing to be eroded against the critical US dollar. But the Jamaican dollar gained against the Pound and the Canadian dollar.

Trading in the Jamaican foreign exchange market saw dealers selling US$7 million more in US currency than they purchased on Tuesday, with the rate of the local dollar continuing to be eroded against the critical US dollar. But the Jamaican dollar gained against the Pound and the Canadian dollar.

The market closed with dealers buying the equivalent of US$35,269,451 and selling US$41,196,078, in contrast to US$55,574,036 purchased and US$47,693,027 sold on Monday.

In US dollar trading, dealers bought US$32,440,716 compared to US$52,708,850 on Monday, as the buying rate for the US dollar fell 11 cents to close at $122.46.  A total of US$39,691,937 was sold versus US$44,797,667 on Monday with the selling rate rising 22 cents to $123.40. The Canadian dollar buying rate dropped 21 cents to end at $93.96 with dealers buying C$670,778 and selling C$452,944, at an average rate that slipped 12 cents to $97.36. The rate for buying the British Pound rose 35 cents to $175.60 for the purchase of £1,505,483, while £620,723 was sold, as the rate fell 49 cents to $179.06.

A total of US$39,691,937 was sold versus US$44,797,667 on Monday with the selling rate rising 22 cents to $123.40. The Canadian dollar buying rate dropped 21 cents to end at $93.96 with dealers buying C$670,778 and selling C$452,944, at an average rate that slipped 12 cents to $97.36. The rate for buying the British Pound rose 35 cents to $175.60 for the purchase of £1,505,483, while £620,723 was sold, as the rate fell 49 cents to $179.06.

At the end of trading, the selling rate for Euro, climbed 78 cents to close at J$141.83, from Monday’s rate, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$141.12 for a rise of 96 cents from Monday’s rate. The US dollar equivalent of other currencies traded amounts to US$155,229 being bought, while US$246,143 was sold.

The US dollar equivalent of other currencies traded amounts to US$155,229 being bought, while US$246,143 was sold.

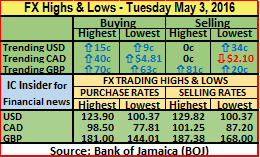

Highs & Lows| Notable changes to the highest and lowest traded rates for the Jamaican dollar against the main currencies on Tuesday are, a rise of $4.81 in the lowest buying rate of the Canadian dollar to end at $77.81 and a fall of $2.10 in the lowest selling rate to $87.20, a rise of 70 cents in the highest buying rate for the British Pound to end at $181 and a rise in the highest selling rate of 81 cents to $187.38.

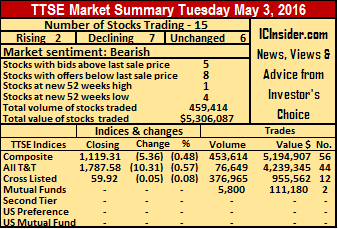

4 new lows on TTSE – Tuesday

Trading ended with 4 stocks closing at 52 weeks’ lows and 1 at a 52 weeks’ high as demand for stocks remain low on the Trinidad & Tobago Stock Exchange. The market close with 15 active securities changing hands on Tuesday with only 2 stocks gaining, 7 declining while 6 remained unchanged as trading as selling pressure continues in the market.

Trading ended with 4 stocks closing at 52 weeks’ lows and 1 at a 52 weeks’ high as demand for stocks remain low on the Trinidad & Tobago Stock Exchange. The market close with 15 active securities changing hands on Tuesday with only 2 stocks gaining, 7 declining while 6 remained unchanged as trading as selling pressure continues in the market.

Trading ended with 459,414 shares valued at $5,306,087 changing hands. The Composite Index declined by 5.36 points to close at 1,119.31, the All T&T Index eased 10.31 points to close at 1,787.58 and the Cross Listed Index declined by 0.05 points to 59.92.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with 5 stocks with the bid higher than the last selling prices and 8 with offers that were lower.

Gains| Trinidad and Tobago NGL gained 7 cents, to close at $19.62 with 4,461 shares trading and West Indian Tobacco traded 20,130 shares valued at $2,543,626 to close at 52 weeks’ high of $126.36 after rising 1 cent.

Losses| ANSA McAL lost 49 cents in trading 50 to close at 52 weeks’ low of $62.49, Firstcaribbean International Bank fell 1 cent to close at $6.51 with 965 shares, Massy Holdings lost $1.01 to close at 52 weeks’ low of $49.99 with 22,080 shares valued at $1,103,975 changing hands. National Enterprises contributed 26,828 shares with a value of $301,542 but lost 15 cents in closing at $11.20. One Caribbean Media lost 2 cents to close at $21.48 while trading 100 shares,  Republic Financial fell to a 52 weeks’ low of $108.95 with a loss of 4 cents as 800 units changed hands and Scotiabank had 2,000 shares trading at $55 after falling $1.43 for a 52 weeks’ low.

Republic Financial fell to a 52 weeks’ low of $108.95 with a loss of 4 cents as 800 units changed hands and Scotiabank had 2,000 shares trading at $55 after falling $1.43 for a 52 weeks’ low.

Firm Trades| Clico Investment Fund traded 4,800 units at $22.60, Grace Kennedy closed at $5.15 with 160,000 shares traded, for a valued of $824,000, JMMB Group closed at 58 cents with 216,000 shares changing hands. National Flour Mills traded 100 shares at $2.30, Praetorian Property Mutual Fund traded 1,000 at $2.70 and Trinidad Cement traded 100 shares to end at $3.35.

Jamaican Teas traded 8,900 shares and lost 9 cents to end at $3.91, Jetcon Corporation ended at $2.90 while 608,524 units traded. Key Insurance traded 25,121 shares to end at $2.80, Knutsford Express had 2,900 shares trading unchanged at $16.80. Lasco Distributors gained 10 cents and ended at $7.60 with 130,860 shares trading, Lasco Financial gained 10 cents to close at $3.50 with 120,661 shares changing hands. Lasco Manufacturing lost 1 cent to close at $4.59 with 78,836 shares trading, Medical Disposables traded 1,200 shares to close 22 cents higher at $3.42 and Paramount Trading fell 15 cents to end with 71,000 shares changing hands at $10.85.

Jamaican Teas traded 8,900 shares and lost 9 cents to end at $3.91, Jetcon Corporation ended at $2.90 while 608,524 units traded. Key Insurance traded 25,121 shares to end at $2.80, Knutsford Express had 2,900 shares trading unchanged at $16.80. Lasco Distributors gained 10 cents and ended at $7.60 with 130,860 shares trading, Lasco Financial gained 10 cents to close at $3.50 with 120,661 shares changing hands. Lasco Manufacturing lost 1 cent to close at $4.59 with 78,836 shares trading, Medical Disposables traded 1,200 shares to close 22 cents higher at $3.42 and Paramount Trading fell 15 cents to end with 71,000 shares changing hands at $10.85.

Where are Gleaner’s Q4 results?

I get the impression that the Jamaica Stock Exchange (JSE) no longer balances shareholder interests with listed companies’ interests. Here’s what I mean.

1. Duke Corporation (PriceWaterHouse) failed to pay the Scotia Group’s dividend on April 15th, and claimed that they notified the public via print and electronic media on April 14th. They further claim that they notified the JSE at the same time. Up to today, no such notice has appeared on the JSE website.

2. Supreme Ventures announced a directors’ meeting for April 28th to consider a dividend payment. Despite the JSE rules requiring companies to inform the public of the result of such meetings, with 48 hours, so far, nothing has appeared on the JSE website about it.

3. Gleaner should have published 2015 results up to December, but chose to change their financial to March 31st (i.e. 5 quarters for 2015). No problem, but does that change eliminates their responsibility to publish information for the quarter ending December 2015? What could possibly justify shareholders being kept in the dark about the company’s financial information from October 2015 to March, 2016 – which will not be seen until the end of May, 2016?

A concerned investor.

IC Insider’s Comments

Your views are well founded. For example the issue of the non-reporting of Gleaners December quarterly result was discussed with the stock exchange. The RMOD department gave some flimsy excuse for not requiring it. The JSE rules require either audited accounts within 60 days of the year-end or quarterly report within 45 days of each quarter. Since Gleaner had shifted the year-end then the rules require that they must submit the quarterly to December within 45 days. Discussions were also held with the General Manager of the exchange who agreed that the quarterly is required. To date shareholders are still in the dark on the financial data. Why the Gleaner never saw it wise to keep their shareholders informed by releasing the data, is a big puzzle. After all, other companies in the past that changed year-ends have release the 4th quarter results. As recently as December, last year Access released theirs having changed their year-end to March.

There seems to be a failure in the system to appreciate that the maintenance of the integrity of the system is paramount to protecting investors while at the same time sending a clear message that the system works and can be relied on. Quite a bit of what is allowed to take place is inimical to the growth and development of the capital market.