Paramount Trading dropped out of ICInsider.com following an earnings downgrade to 12 cents per share, with half year results continuing to fall coming from a fall off in revenues. Express Catering joins the ICInsider.com TOP 10 following an earnings upgrade to 55 cents per share and the stock price closing down at $3.61 on Friday in a week that the Main and Junior markets fell one percent during the week but there were some stocks with relatively sizable price changes.

There was just one stock with a notable gain in the Junior Market TOP 10 and four with sizable losses while in the Main Market, only one stock rose with a gain of three percent and 7 declined, with sizable moves by five. Junior Market listed Access Financial, rose 11 percent to $22.68 but Caribbean Cream fell a hefty 23 percent to close at $3.41 followed by a 7 percent fall by Jamaican Teas to $2.40, while Lasco Distributors lost 6 percent to close a $3.85 and Paramount Trading fell 4 percent to $1.54.

There was just one stock with a notable gain in the Junior Market TOP 10 and four with sizable losses while in the Main Market, only one stock rose with a gain of three percent and 7 declined, with sizable moves by five. Junior Market listed Access Financial, rose 11 percent to $22.68 but Caribbean Cream fell a hefty 23 percent to close at $3.41 followed by a 7 percent fall by Jamaican Teas to $2.40, while Lasco Distributors lost 6 percent to close a $3.85 and Paramount Trading fell 4 percent to $1.54.

The Main Market General Accident dropped 17 percent to $4.75, followed by a 12 percent fall in Margaritaville to $15.50, 138 Student Living fell 11 percent to $3.50, while Key Insurance is down 6 percent to $2.19 and Caribbean Producers slipped 5 percent to $8.60.

The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 13.6 and the Junior Market TOP10 sits at 7.2, just over half of the market, with an average of 13.

The Main Market ICTOP10 is projected to gain an average of 311 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 185 percent over the same time frame.

The Main Market ICTOP10 is projected to gain an average of 311 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 185 percent over the same time frame.

In the Main Market ICTOP 10, a total of 15 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 110, with an average of 31 and 21 excluding the highest PE ratios, and a PE of 25 for the top half and 18 excluding the stocks with overweight values.

In the Junior Market, there are 13 stocks, or 27 percent of the market, with PEs from 15 to 50, averaging 21, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks, currently.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes  some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

TOP 10 Stocks, Daily Trading, Jamaican Stocks, Junior Market, Jamaican Stock Exchange,

Express Catering pops into ICTOP10

New high for Transjamaican

Transjamaican Highway traded on Wednesday at a new high of $2.96 on Thursday as traders exchanged 2.66 million shares between $2.88 and $2.97 with the stock gaing 111 percent in the past year.

Transjamaican Highway traded on Wednesday at a new high of $2.96 on Thursday as traders exchanged 2.66 million shares between $2.88 and $2.97 with the stock gaing 111 percent in the past year.

It was only Tuesday that the stock closed at a new high of $2.91 after 4.4 million shares were traded as investors continue to respond to a surge in profits following the acquisition of its subsidiary.

Express Catering drops ICTOP10

Access Financial returns to the Junior Market IC TOP10 after a week’s absence, replacing Express Catering at the end of the week that saw Jamaican Teas as the only Junior Market stocks with any sizable move, as the stock rose 12 percent to $2.59. No other Junior Market stock moved by more than two percent for the week.

There is no change to the Main Market list in the week but General Accident surprisingly jumped 23 percent to $5.75 on limited volume while Scotia Group was up 4 percent to $39.38. Palace Amusement fell 12 percent to $1.23, but supply seems low around these prices and Pulse Investment slipped by 6 percent to $1.85.

There is no change to the Main Market list in the week but General Accident surprisingly jumped 23 percent to $5.75 on limited volume while Scotia Group was up 4 percent to $39.38. Palace Amusement fell 12 percent to $1.23, but supply seems low around these prices and Pulse Investment slipped by 6 percent to $1.85.

There are some developments in the market and in some stocks that are worth noting as they could surprise to the upside. Buying for Scotia Group is gradually improving and selling is not and the price could move solidly into the $40 range this coming week. Transjamaican Highway a previous TOP10 stock climbed this week to close at $2.84, up from $2.71 the previous week as the supply of the stock faded and demand has increased. AS Bryden has just two offers at the close of the week but the price seems to be above the average for the market, at a PE of 23, but be careful. Jamaican Teas has undisclosed selling at $2.59 by an institution but there was more buying by insiders than selling during the week. Junior Market TOP10 listed AMG Packaging climbed on Friday as investors quickly snapped up nearly 600,000 shares that were on offer at $2.40 before the stock closed at $3.17 ahead of first quarter results that show a solid 64 percent jump in profit to $39.86 million from $24.34 million in 2022.  Caribbean Cement has both limited buying and selling currently, suggesting the price may stay around the mid $50 range for some time. Selling in General Accident is down but buyers are not yet close to the prices for limited stocks on offer. Watch Seprod as a visible supply of the stock below the $90 range is very limited. Stanley Motta has only three offers amounting to 10,437 shares between $6.04 and $8

Caribbean Cement has both limited buying and selling currently, suggesting the price may stay around the mid $50 range for some time. Selling in General Accident is down but buyers are not yet close to the prices for limited stocks on offer. Watch Seprod as a visible supply of the stock below the $90 range is very limited. Stanley Motta has only three offers amounting to 10,437 shares between $6.04 and $8

The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 13.6 and the Junior Market TOP10 sits at 7.2, just over half of the market, with an average of 13.

The Main Market ICTOP10 is projected to gain an average of 287 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 191 percent over the same time frame.

In the Main Market ICTOP 10, a total of 14 of the most highly valued stocks representing 29 percent of the Main Market are priced at a PE of 15 to 110, with an average of 32 and 22 excluding the highest PE ratios, and a PE of 25 for the top half and 18 excluding the stocks with overweight values.

In the Junior Market, there are 13 stocks, or 27 percent of the market, with PEs from 15 to 49, averaging 21, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Honey Bun jumps into ICTOP 10

Honey Bun jumped into the Junior Market IC TOP10 this week in the sixth place, while Access Financial dropped out in a week when both of the Main and Junior markets declined in value compared to the 2023 year end close. Honey Bun rose to the ICTOP 10 following the release of the 2023 full year results, showing profit after tax rising 14 percent to $232 million, with indications that the 2024 performance should see profits hitting 80 cents per share with a PE of 8 currently.

Honey Bun sales income rose 16 percent for the fiscal year but only 8 percent in the final quarter.

Honey Bun sales income rose 16 percent for the fiscal year but only 8 percent in the final quarter.

t the close of the market on Friday, five Junior Market stocks gained between two and eight percent and three fell by 2 percent and 18 percent, while just two Main Market stocks rose at 2 and to four percent and seven fell by 7 percent or less.

The Main Market ICTOP10 ended with, 138 Student Living gaining 4 percent to $4.05. Declining stocks include JMMB Group down seven percent to $24.25, Pulse Investments with a six percent fall to $1.97 and General Accident down four percent to $4.66.

The Junior Market ended the week, with Lasco Manufacturing rising eight percent to $4.64, Lasco Distributors up seven percent to $4 and AMG Packaging climbing six percent to $3.20. Jamaican Teas dropped eighteen percent to $2.31, as investors seem to ignore a positive report on the group that was published in the Financial Gleaner on Friday.

The average PE for the JSE Main Market ICTOP 10 stands at 5.2, well below the market average of 13.4 and the Junior Market TOP10 sits at 7.3, just over half of the market, with an average of 13.4.

The average PE for the JSE Main Market ICTOP 10 stands at 5.2, well below the market average of 13.4 and the Junior Market TOP10 sits at 7.3, just over half of the market, with an average of 13.4.

The Main Market ICTOP10 is projected to gain an average of 292 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 189 percent over the same time frame.

In the Main Market ICTOP 10, a total of 14 of the most highly valued stocks representing 29 percent of the Main Market are priced at a PE of 15 to 110, with an average of 32 and 21 excluding the highest PE ratios, and a PE of 25 for the top half and 18 excluding the stocks with overweight values.

In the Junior Market, there are 12 stocks, or 25 percent of the market, with PEs from 15 to 50, averaging 23, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

ICTOP10 bounce as Main Market breaks higher

2023 was not a great year for the Jamaica Stock Market, with all three JSE markets declining moderately and sending powerful messages to investors, with several companies reporting increased profit, enjoying increased prices. Transjamaican Highway delivered an outstanding performance, ending the year up 93 percent and paid a 19 cents dividend for an overall return of 106 percent for the year.

Transjamaican Highway gained 93% for 2023.

Readers of this publication would have gotten a good lead ahead of the first set of results in the year with the stock listed as a Stock to Watch in April, with the price then at $1.77 and gained 53 percent since, plus the dividend.

Other notable gains were recorded by Ciboney at 107 percent, following a change in ownership of the company, Main Event rising 55 percent, Regency Petroleum rallied at 47 percent, Knutsford Express at 45 percent and Dolphin Cove at 39 percent plus paying dividends of $1.85 during the year thus raising the returns to 53 percent.

There were several disappointing performances but one message is the import of proper stock selections and the benefits of portfolio diversification.

The Main Market all Jamaica Composite Index rose 17,082 points or 5 percent and the Junior Market just 2 percent during December, with technical indicators showing the Main Market now in a bullish state, having broken out sharply from a wedge formation, but the Junior Market remains under pressure for the time being, except for a limited number of stocks.

At the close of the market, four Junior Market stocks gained between eight and 26 percent and 5 fell by 7 percent and less, while three Main Market stocks rose between one to 15 percent and two fell by 6 percent each.

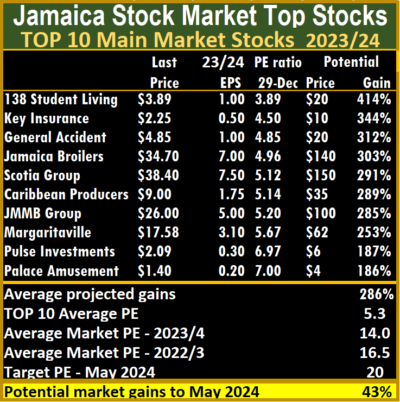

The Main Market ICTOP10 ended with, Palace Amusement gaining 15 percent to $1.40, followed by JMMB Group up 4 percent to $26 and Margaritaville 3 percent to $17.58, while 138 Student Living and Key Insurance declined 6 percent each two $3.89 and $2.25 respectively.

The Main Market ICTOP10 ended with, Palace Amusement gaining 15 percent to $1.40, followed by JMMB Group up 4 percent to $26 and Margaritaville 3 percent to $17.58, while 138 Student Living and Key Insurance declined 6 percent each two $3.89 and $2.25 respectively.

The Junior Market ended the week, with Caribbean Cream jumping 26 percent to $4.59, Jamaican Teas popping 21 percent to $2.80, a 52 weeks’ high. AMG Packaging climbed 12 percent to $3.02 and Tropical Battery rose 8 percent to end the week at $1.90. Lasco Manufacturing fell 7 percent to $4.31, Lasco Distributors and Paramount Trading fell by 4 percent each to $3.75 and $1.60 respectively.

Tropical Battery dropped out of the IC Junior Market TOP10, and Access Financial replaced it.

Indications of where stock prices could be by May 2024 can be seen from stocks with the highest values in the Main and Junior Markets.

The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 14 and the Junior Market TOP10 sits at 7.3, just over half of the market, with an average of 14.1.

The Main Market ICTOP10 is projected to gain an average of 286 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 184 percent over the same time frame.

In the Main Market ICTOP 10, a total of 15 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 108, with an average of 32 and 23 excluding the highest PE ratios, and a PE of 26 for the top half and 19 excluding the stocks with overweight values.

In the Main Market ICTOP 10, a total of 15 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 108, with an average of 32 and 23 excluding the highest PE ratios, and a PE of 26 for the top half and 19 excluding the stocks with overweight values.

In the Junior Market, there are 16 stocks, or 33 percent of the market, with PEs from 15 to 55, averaging 22, well above the market’s average. The top half of the market has an average PE of 20, possibly the lowest fair value for stocks.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Mostly price gains for ICTOP10

The Main Market of the JSE rose around two percent and Junior Market just under one percent for the week and led the top 10 mostly higher, with 7 Main Market and 4 Junior Market stocks rising with declining stocks recording losses of 4 percent or less, at the same time one stock moved out of the TOP10.

The Main Market ICTOP10 ended with, General Accident declined 11 percent to $4.50. Buying interest picked up during the week for Scotia Group pushing the stock to several 52 weeks’ highs and a rose of 7 percent for the week to a 52 weeks’ closing high of $38.40. This stock has much more juice left that should take it into the $40 range by early 2024. Caribbean Producers rallied 6 percent to $9, while Margaritaville also rose 6 percent and closed at $17 and Pulse Investments rose 5 percent to $2.09 and Key Insurance slipped 4 percent to $2.40.

The Main Market ICTOP10 ended with, General Accident declined 11 percent to $4.50. Buying interest picked up during the week for Scotia Group pushing the stock to several 52 weeks’ highs and a rose of 7 percent for the week to a 52 weeks’ closing high of $38.40. This stock has much more juice left that should take it into the $40 range by early 2024. Caribbean Producers rallied 6 percent to $9, while Margaritaville also rose 6 percent and closed at $17 and Pulse Investments rose 5 percent to $2.09 and Key Insurance slipped 4 percent to $2.40.

The Junior Market ended the week, with AMG Packaging climbing 17 percent to $2.70, buying is not aggressive currently while supplies up to $3.15 is limited, with none on offer until $10. Investors should expect a big bounce in the first quarter profits due by mid-January. The company states that they are exploring the possibility of new equipment and expanded facilities that could shape a future expansion of momentous proportions. Caribbean Cream rose 10 percent to $3.64 and Stationery and Office Supplies gained 9 percent and dropped out of the TOP10 and is replaced by Tropical Battery. There were no notable declines at the end of the week.

There was no new addition to the IC Main Market TOP10.

Indications of where stock prices could be by May 2024 can be seen from stocks with the highest values in the Main and Junior Markets.

The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 13.1. The Main Market ICTOP10 is projected to gain an average of 288 percent by May 2024, based on 2023 forecasted earnings and now provides better values than the Junior Market with the potential to gain 195 percent over the same time frame.

The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 13.1. The Main Market ICTOP10 is projected to gain an average of 288 percent by May 2024, based on 2023 forecasted earnings and now provides better values than the Junior Market with the potential to gain 195 percent over the same time frame.

In the Main Market ICTOP10, 15 of the most highly valued stocks, 31 percent of the Main Market are priced at a PE of 15 to 108, with an average of 29 and 18 excluding the highest PE ratios, and a PE of 24 for the top half and 16 excluding the stocks with overweight values.

The PE of the Junior Market TOP10 sits at 7, just over half of the market, with an average of 13.2. There are 14 stocks, or 29 percent of the market, with PEsfrom 15 to 49, averaging 21, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Big price movements for ICTOP10

The Main and Junior Markets closed the week slightly lower, resulting in big gains and losses in the Junior Market while movements in the Main Market were more moderate than the Junior Market stocks and surprisingly there is only one new entrant into the top 10 listings, this week.

Scotia Group released full year results with EPS of $5.54 and announced the payments of a dividend of 40 cents per share, with the price hitting a new one year high on Friday. The dividend suggests a minimum payment of $1.60 per share over the next twelve months. Based on historical norms of 40-50 percent payout of profits it should be a higher payout. With the release of 2023 full year results, ICInsider.com switched over to 2024 earnings, with EPS at $7.50. Buying interest picked up during the week. The stock trades at an extremely low PE of 4.8 times projected 2024 earnings and still only 6.5 times based on earnings for 2023. AMG Packaging trades at 6.5 times 2024 earnings with only 58,816 shares on offer at the close on Friday and so is Jamaica Teas, with offers now generally above $2.53, with buyers mostly at $2.30, some selling came in for Access Financial this week, Caribbean Cement also has limited stocks on offer and so does Seprod.

Scotia Group released full year results with EPS of $5.54 and announced the payments of a dividend of 40 cents per share, with the price hitting a new one year high on Friday. The dividend suggests a minimum payment of $1.60 per share over the next twelve months. Based on historical norms of 40-50 percent payout of profits it should be a higher payout. With the release of 2023 full year results, ICInsider.com switched over to 2024 earnings, with EPS at $7.50. Buying interest picked up during the week. The stock trades at an extremely low PE of 4.8 times projected 2024 earnings and still only 6.5 times based on earnings for 2023. AMG Packaging trades at 6.5 times 2024 earnings with only 58,816 shares on offer at the close on Friday and so is Jamaica Teas, with offers now generally above $2.53, with buyers mostly at $2.30, some selling came in for Access Financial this week, Caribbean Cement also has limited stocks on offer and so does Seprod.

Three Junior Market stocks gained 9 to 21 percent and three ended with 10 to 20 percent losses, while the Main Market had two stocks with worthwhile gains of 9 and 13 percent and three with sizable losses of 6 to 11 percent.

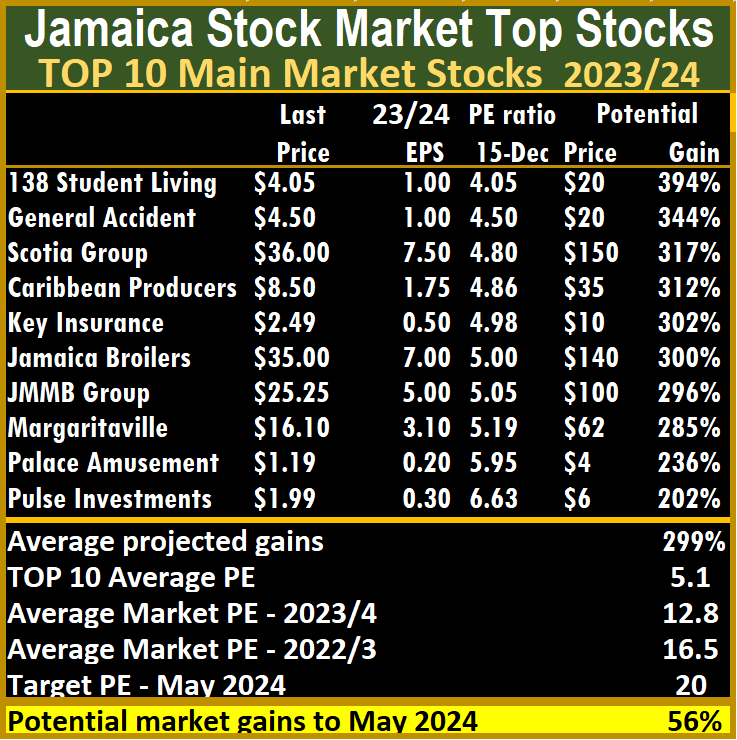

The Main Market ICTOP10 ended with, Key Insurance popping 13 percent to $2.49 and Scotia Group up 9 percent, while General Accident declined 11 percent to $4.50, Palace Amusement down 8 percent to $1.19 and  Caribbean Producers lost 6 percent to close at $8.50.

Caribbean Producers lost 6 percent to close at $8.50.

The Junior Market ended, with Iron Rock Insurance jumping 21 percent to $2.50, followed by Lasco Distributors and Lasco Manufacturing rising 9 percent each to $3.93 and $4.63 respectively. AMG Packaging dropped 20 percent to $2.30, Caribbean Cream and Jamaica Teas fell 10 percent to $3.31 and $2.30 respectively.

Tropical Battery dropped out of the Junior Market ICTOP10 and is replaced by Elite Diagnostic. There were no changes in the IC Main Market TOP10

Indications of where stock prices could be by May 2024 can be seen from stocks with the highest values in the Main and Junior Markets.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 12.8. The Main Market ICTOP10 is projected to gain an average of 299 percent by May 2024, based on 2023 forecasted earnings and now provides better values than the Junior Market with the potential to gain 204 percent over the same time frame.

In the Main Market ICTOP 10, a total of 15 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 108, with an average of 28 and 18 excluding the highest PE ratios and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

The PE of the Junior Market TOP10 sits at 6.8, over half of the market, with an average of 13.2. There are 13 stocks, or 27 percent of the market, with PEs from b>15 to 50, averaging 21, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Scotia Group selling dwarfed by buying

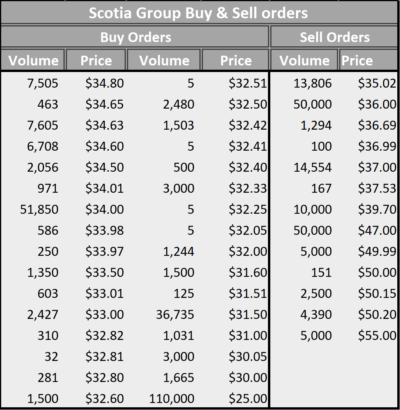

Scotia Group traded at a 52 weeks’ high on Friday, following the release of record profit results on Monday for the year to October, with the stock having a bit of selling in recent weeks. That seems to have abated with the major seller now appearing to be taken out.

At the close of the market on Friday, there were only 13 offers to sell stocks in the market and 48 bids to buy. The chart below shows the extent of the imbalance between buying and selling as reflected on the Jamaica Stock Exchange trading platform at the close on Friday.

At the close of the market on Friday, there were only 13 offers to sell stocks in the market and 48 bids to buy. The chart below shows the extent of the imbalance between buying and selling as reflected on the Jamaica Stock Exchange trading platform at the close on Friday.

There are only seven offers below $40 per share while bids are cautiously being made. There is interest in buying 247,300 shares as low as $25 and selling amounting to 156,962 shares up to $55.

Bids and offers are just indicative of demand and supply, as there could be more interest that could show up in the days ahead and change the picture. Barring new major developments the data suggest upward price movements ahead. This should be read in conjunction with the posting of why Scotia Group should be on your buy list.

Why Scotia Group should be on your buy list

Scotia Group recently reported record profits for the year to October, surging 67 percent to $17.23 billion with earnings of $5.54 per share, from revenues that jumped 29 percent to $59.64 billion but based on the reaction of investors the results seem to hardly matter with the stock valued a mere 6.5 times historical earnings compared with a market average of 13, nevertheless, the price hit a yearly high of $36.69 this past Friday as selling has eased considerably, with a few open offers to sell.

The group declared a dividend payable in January of 40 cents for a second consecutive quarter putting it at $1.60 annualised, for a 4.6 percent yield based on the current price. Traditionally the group was committed to paying 40 to 50 percent of profits, this seems to have temporarily changed with the fallout from the Covid-19 pandemic but could return in the near future.

The group declared a dividend payable in January of 40 cents for a second consecutive quarter putting it at $1.60 annualised, for a 4.6 percent yield based on the current price. Traditionally the group was committed to paying 40 to 50 percent of profits, this seems to have temporarily changed with the fallout from the Covid-19 pandemic but could return in the near future.

The October quarter saw profit popping a robust 49 percent to $4.4 billion from $2.98 billion in 2022 with revenues rising 24 percent to $15.79 billion from 12.8 billion.

The good news does not end there. ICinsider.com is forecasting earnings of $7.50 for the 2024 fiscal year, with the PE ratio at just 4.8 times earnings making it a stunning buy at the current price of $36, the stock closed at on Friday. The group has many of the qualities for an excellent investment, good management, quality products and services that are in demand, a growing business and increasing profitability and best of all the stock price is well below the market average, with the potential for a major rise in the near term.

While the 2023 performance looks dramatic compared with the pre-Covid period it is more one of recovery as opposed to rapid growth as the increase over 2019 is just 31 percent, representing a 6 percent increase per annum as loans grew 31 percent as well since the end of 2019.

Highlights of the good performance came from interest income, with the quarter jumping 22 percent to $11.6 billion from $9.5 billion in 2022 and by 31 percent for the full year to $40.8 billion with loans disbursed growing a robust 15 percent to $269 billion from $234.7 billion in 2022, after loan loss provisions. Non-accrual loans stood at $4.5 billion compared to $4 billion at the end of October 2022 and represent 1.6 percent of gross loans compared to October 2022 at 1.7 percent.

Highlights of the good performance came from interest income, with the quarter jumping 22 percent to $11.6 billion from $9.5 billion in 2022 and by 31 percent for the full year to $40.8 billion with loans disbursed growing a robust 15 percent to $269 billion from $234.7 billion in 2022, after loan loss provisions. Non-accrual loans stood at $4.5 billion compared to $4 billion at the end of October 2022 and represent 1.6 percent of gross loans compared to October 2022 at 1.7 percent.

Also contributing to the growth in interest income was an increase in funds held in cash resources and investments of $343 billion up from $316 billion in 2022.

Insurance revenues fell 5 percent from $1 billion to $961 million in the quarter and surged 49 percent from $1.87 billion to $2.79 billion for the year.

Audrey Tugwell Henry Scotia group’s CEO

Deposits grew 12.7 percent from $399 billion to $449 billion, but the cost of funds grew 138 percent from $580 million in 2022 to $1.38 billion and 207 percent from $152 million in the final quarter to $466 million as interest rates rose sharply following Bank of Jamaica’s increase in the overnight rate in during late 2021 into 2022 and the maintenance of tight liquidity in the system by the country’s central bank.

Amounts set aside for expected credit losses fell 16 percent to $741 million in the quarter from the 2022 quarter’s $880 million and from $3.06 billion for the year in 2022 to $2.4 billion in 2023.

Other Income delivered $3.23 billion in the final quarter of the year versus $2.26 billion in 2022 and for the 2023 year ending October an increase of 22 percent to $16 billion from $13 billion in 2022, with foreign exchange trading and fees and commission dominating.

Operating expenses rose 6 percent in the final quarter to $6.8 billion from $6.39 billion in 2022 and for the twelve months to $27.6 billion up 11.7 percent from $24.7 billion.

The group’s Shareholders’ equity ended the fiscal year at $126.5 billion, increasing by $20 billion, compared to the previous fiscal year, due primarily to re-measurement of defined benefit pension plan assets,  lower fair value losses on the investment portfolio, recognition of the insurance finance reserve on the adoption of IFRS 17 and profit generated for the year, partially offset by dividends paid. Total assets grew by $70 billion to $665 billion at October 2023.

lower fair value losses on the investment portfolio, recognition of the insurance finance reserve on the adoption of IFRS 17 and profit generated for the year, partially offset by dividends paid. Total assets grew by $70 billion to $665 billion at October 2023.

ICInsider.com rates the stock a strong buy, with the potential to deliver attractive dividend yields going forward and a huge increase in the stock price in the months ahead. The future appears bright with continued growth in the local economy that sets the stage for more lending. 2024 could well deliver some negatives as the Bank of Jamaica holds interest rates at excessively high levels and ushers in a recession. Additionally, interest rates could start to decline and negatively affect net interest income. Regardless the stock is priced so low currently that most bad news to come if any is more than taken into consideration by the current pricing.

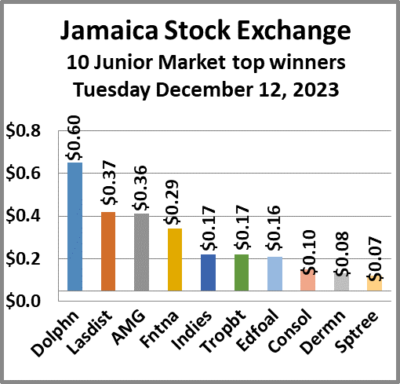

Junior Market surge

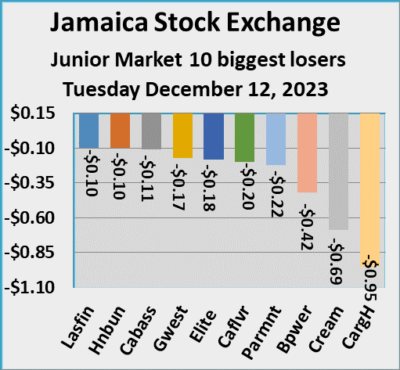

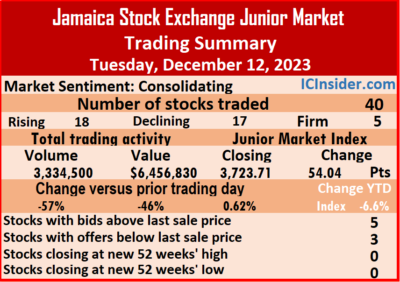

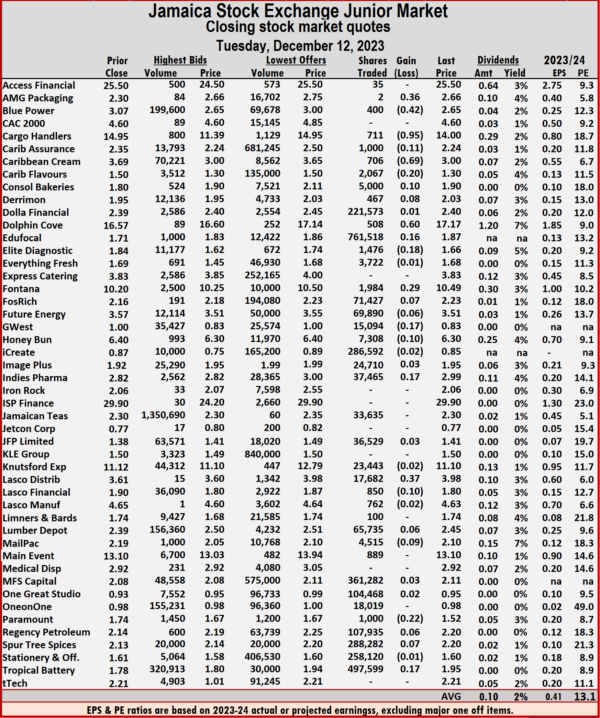

Trading activity sent the Junior Market of the Jamaica Stock Exchange surging on Tuesday by 54.04 points to 3,723.71, following a sharp reduction in the volume and value of stocks traded, as volume dropped 57 percent from that on Monday, with a 46 percent lower value following trading in 40 securities compared with 38 on Monday and ended with the prices of 18 rising, 17 declining and five closing unchanged.

Investors traded 3,334,500 shares for $6,456,830 compared with 7,705,493 units at $11,922,249 on Monday.

Investors traded 3,334,500 shares for $6,456,830 compared with 7,705,493 units at $11,922,249 on Monday.

Trading averaged 83,363 shares at $161,421, compared with 202,776 units at $313,743 on Monday with the month to date, averaging 134,174 units at $292,953 compared with 141,459 stock units at $311,810 on the previous day. November closed with an average of 262,280 units at $587,545.

EduFocal led trading with 761,518 shares for 22.8 percent of total volume, Tropical Battery followed with 497,599 units for 14.9 percent of the day’s trade and MFS Capital Partners with 361,282 units for 10.8 percent market share.

he Junior Market ended trading with an average PE Ratio of 13.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AMG Packaging rose 36 cents to end at $2.66 with just two stocks crossing the exchange, Blue Power shed 42 cents to $2.65 with a transfer of 400 units, ahead of the company reporting profit for the second quarter surging 221 per cent to $33 million, Cargo Handlers declined 95 cents and ended at $14 with investors dealing in 711 shares. Caribbean Assurance Brokers lost 11 cents to close at $2.24 in an exchange of 1,000 stock units, Caribbean Cream dropped 69 cents in closing at $3 with 706 shares clearing the market, Caribbean Flavours fell 20 cents to $1.30 after a transfer of 2,067 units. Consolidated Bakeries rallied 10 cents to end at $1.90, with 5,000 stocks crossing the market, Derrimon Trading popped 8 cents in closing at $2.03 with an exchange of 467 stock units, Dolphin Cove gained 60 cents to close at $17.17 after 508 shares changed hands.  EduFocal increased 16 cents and ended at $1.87 with traders dealing in 761,518 units, Elite Diagnostic dipped 18 cents to $1.66 after an exchange of 1,476 stocks, Fontana climbed 29 cents and ended at $10.49 with investors transferring 1,984 stock units. GWest Corporation skidded 17 cents in closing at 83 cents after 15,094 shares passed through the market, Honey Bun fell 10 cents to end at $6.30 with stakeholders exchanging 7,308 stock units, Indies Pharma advanced 17 cents to close at $2.99 in trading 37,465 units. Lasco Distributors popped 37 cents to $3.98 with 17,682 stock units crossing the market, Lasco Financial lost 10 cents in closing at $1.80 as investors exchanged 850 shares, Mailpac Group declined 9 cents to end at $2.10 with investors trading 4,515 stocks. Paramount Trading shed 22 cents and ended at $1.52 with shareholders swapping 1,000 units and Tropical Battery climbed 17 cents to close at $1.95 in an exchange of 497,599 stock units.

EduFocal increased 16 cents and ended at $1.87 with traders dealing in 761,518 units, Elite Diagnostic dipped 18 cents to $1.66 after an exchange of 1,476 stocks, Fontana climbed 29 cents and ended at $10.49 with investors transferring 1,984 stock units. GWest Corporation skidded 17 cents in closing at 83 cents after 15,094 shares passed through the market, Honey Bun fell 10 cents to end at $6.30 with stakeholders exchanging 7,308 stock units, Indies Pharma advanced 17 cents to close at $2.99 in trading 37,465 units. Lasco Distributors popped 37 cents to $3.98 with 17,682 stock units crossing the market, Lasco Financial lost 10 cents in closing at $1.80 as investors exchanged 850 shares, Mailpac Group declined 9 cents to end at $2.10 with investors trading 4,515 stocks. Paramount Trading shed 22 cents and ended at $1.52 with shareholders swapping 1,000 units and Tropical Battery climbed 17 cents to close at $1.95 in an exchange of 497,599 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 65

- Next Page »