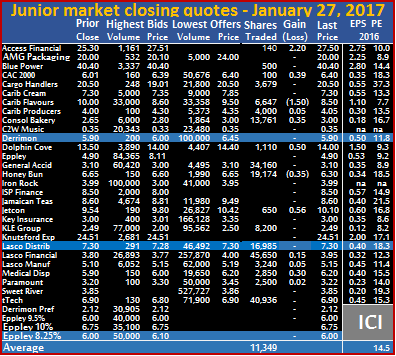

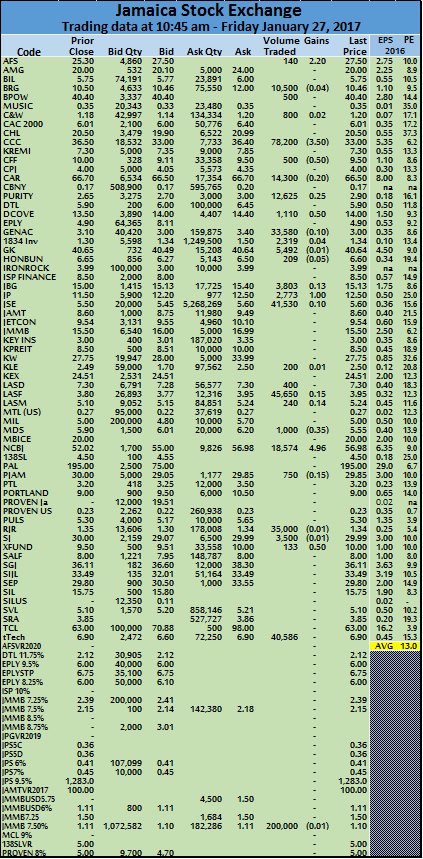

Access Financial Services’ traded at a new high of $27.50 on Friday.

The market ended with very low volume of stocks changing hands, ending at 204,282 units valued at $1,106,948 passing through the market, compared to 542,606 units valued at $3,545,918, on Thursday.

An average of a mere 11,349 units with an average value of $61,497 traded, compared to 33,913 units with an average value of $221,620 2 on the previous trading day. The average for the month to date is 177,108 units with an average value of $939,121 versus 186,317 units with an average value of $987,878 for the preceding trading day. The average for December, ended at 131,147 units, with an average value of $672,488.

The market closed with 12 stocks with bids higher than their last sale and 1 with a lower offer than the last sale.

The market closed with 12 stocks with bids higher than their last sale and 1 with a lower offer than the last sale.At the close of trading, investors pushed Access Financial $2.20 to close at a 52 weeks’ high of $27.50 with 140 units changing hands, Blue Power closed with 500 units changing hands at $40.40, CAC 2000 traded 100 shares and gained 39 cents to end at $6.40, Cargo Handlers end at $20.50, after 3,679 shares were traded. Caribbean Flavours pushed through 6,647 units and lost $1.50 to end at $8.50, Caribbean Producers exchanged 4,000 shares but fell 15 cents to $4, Consolidated Bakeries rose 35 cents in trading 13,761 shares to close at $3, Dolphin Cove ended at $14 with 1,110 shares trading to gain 50 cents. General Accident gained 10 cents at the close of trading, with 34,160 shares at $3.10, Honey Bun shed 35 cents and closed with 19,174 shares changed hands at $6.30,

Jetcon Corporation closed trading with just 650 shares, to end with a gain of 56 cents to $10.10. KLE Group ended with 8,200 units changing hands at $2.49, Lasco Distributors ended trading with 16,985 units changing hands to end at $7.30. Lasco Financial had 45,650 shares changing hands and rose 15 cents to end at $3.95, Lasco Manufacturing with 3,240 units changing hands and closed with a gain of 5 cents at $5.15, Medical Disposables gained 30 cents to end at a 52 weeks’ high of $6.20 with 2,850 shares trading. Paramount Trading closed with a gain of 2 cents at $3.22 with 2,500 shares changing hands and tTech closed trading with 40,936 units changing hands to end at a record $6.90.

Jetcon Corporation closed trading with just 650 shares, to end with a gain of 56 cents to $10.10. KLE Group ended with 8,200 units changing hands at $2.49, Lasco Distributors ended trading with 16,985 units changing hands to end at $7.30. Lasco Financial had 45,650 shares changing hands and rose 15 cents to end at $3.95, Lasco Manufacturing with 3,240 units changing hands and closed with a gain of 5 cents at $5.15, Medical Disposables gained 30 cents to end at a 52 weeks’ high of $6.20 with 2,850 shares trading. Paramount Trading closed with a gain of 2 cents at $3.22 with 2,500 shares changing hands and tTech closed trading with 40,936 units changing hands to end at a record $6.90.

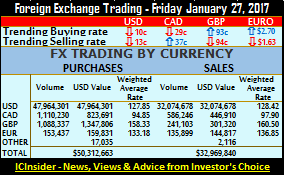

Up to the end of foreign exchange trading on Friday, Jamaica enjoyed a surplus of US$153 million for January. On Friday the central bank reported net inflows US$17 million with the selling rates for the main currencies for the Jamaican dollar gaining but for the Canadian dollar.

Up to the end of foreign exchange trading on Friday, Jamaica enjoyed a surplus of US$153 million for January. On Friday the central bank reported net inflows US$17 million with the selling rates for the main currencies for the Jamaican dollar gaining but for the Canadian dollar.  The Canadian dollar buying rate fell 29 cents to $94.85, with dealers buying C$1,110,230 and selling C$586,246 at an average rate that climbed 37 cents to end at $97.90. The average rate for buying the British Pound rose 93 cents to $158.33 for the purchase of £1,088,337 while £241,103 was sold with a decline of 94 cents, to end at $160.50.

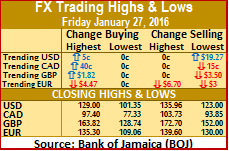

The Canadian dollar buying rate fell 29 cents to $94.85, with dealers buying C$1,110,230 and selling C$586,246 at an average rate that climbed 37 cents to end at $97.90. The average rate for buying the British Pound rose 93 cents to $158.33 for the purchase of £1,088,337 while £241,103 was sold with a decline of 94 cents, to end at $160.50. Highs & Lows| Notable changes to the highest and lowest rates for the regularly traded foreign currencies on Friday, include a jump in the lowest selling rate of the US dollar by $19.27 to $123. The highest buying rate for the British Pound jumped $1.82 to $163.82 while the lowest selling rate dropped $3.50 to $152. The highest buying rate for the Euro fell $4.47 to close at $135.30, the highest selling rate fell $6.70 to $139.60 and the lowest selling rate lost $3 to $130.

Highs & Lows| Notable changes to the highest and lowest rates for the regularly traded foreign currencies on Friday, include a jump in the lowest selling rate of the US dollar by $19.27 to $123. The highest buying rate for the British Pound jumped $1.82 to $163.82 while the lowest selling rate dropped $3.50 to $152. The highest buying rate for the Euro fell $4.47 to close at $135.30, the highest selling rate fell $6.70 to $139.60 and the lowest selling rate lost $3 to $130. The Trinidad & Tobago Stock Exchange closed on Friday with an increased number of 16 securities changing hands compared to 15 on Thursday. A total of 6 stocks advanced, 4 were unchanged and 6 declined as 662,006 units were exchanged, for $5,506,299 compared to 482,036 shares valued at $3,773,912 on Thursday.

The Trinidad & Tobago Stock Exchange closed on Friday with an increased number of 16 securities changing hands compared to 15 on Thursday. A total of 6 stocks advanced, 4 were unchanged and 6 declined as 662,006 units were exchanged, for $5,506,299 compared to 482,036 shares valued at $3,773,912 on Thursday.  Republic Financial Holdings closed at $108.28, after falling 6 cents with 9,302 shares being exchanged at a value of $1,007,221, Trinidad Cement slid 5 cents to $4.50, with 18,402 shares traded and West Indian Tobacco exchanged 100 units to close at $127.

Republic Financial Holdings closed at $108.28, after falling 6 cents with 9,302 shares being exchanged at a value of $1,007,221, Trinidad Cement slid 5 cents to $4.50, with 18,402 shares traded and West Indian Tobacco exchanged 100 units to close at $127. movers contributing in a major way to the gains in the main market indices.

movers contributing in a major way to the gains in the main market indices. Jamaica Producers jumped to $12.50, a new high with 2,773 and Access Financial traded at $27.50 for a new high.

Jamaica Producers jumped to $12.50, a new high with 2,773 and Access Financial traded at $27.50 for a new high. The payment of dividends is only one element to consider in investing in stocks. Investing companies that do not pay dividends should not matter seriously, in the short.

The payment of dividends is only one element to consider in investing in stocks. Investing companies that do not pay dividends should not matter seriously, in the short.

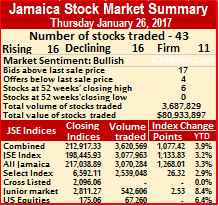

with an average value of $987,878 versus 195,282 units with an average value of $1,013,387 for the preceding trading day. The average for December, ended at 131,147 units, with an average of $672,488.

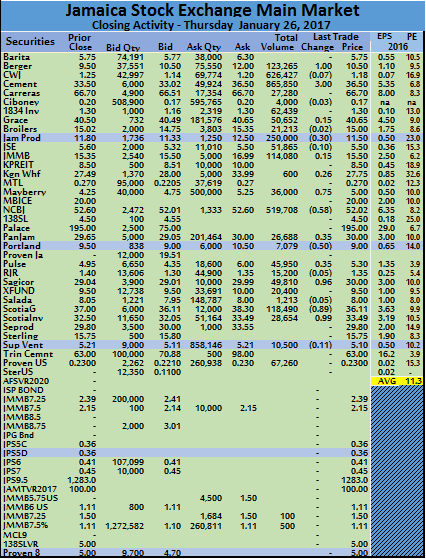

with an average value of $987,878 versus 195,282 units with an average value of $1,013,387 for the preceding trading day. The average for December, ended at 131,147 units, with an average of $672,488. KLE Group ended with 100 units changing hands at $2.49, Lasco Distributors ended trading with 73,952 units changing hands to end at $7.30. Lasco Financial had 28,397 shares changing hands to end at $3.80, Lasco Manufacturing with 44,145 units changing hands, closed with a fall of 10 cents at $5.10, Medical Disposables gained 35 cents to end at a 52 weeks’ high of $5.90 with 100 shares trading. Paramount Trading closed at $3.20 with 12,800 shares changing hands, tTech closed trading with 20,000 units changing hands and gained 89 cents to end at a record $6.90 and Derrimon preference share, rose 12 cents to close at $2.12 as 4,395 units passed through the market.

KLE Group ended with 100 units changing hands at $2.49, Lasco Distributors ended trading with 73,952 units changing hands to end at $7.30. Lasco Financial had 28,397 shares changing hands to end at $3.80, Lasco Manufacturing with 44,145 units changing hands, closed with a fall of 10 cents at $5.10, Medical Disposables gained 35 cents to end at a 52 weeks’ high of $5.90 with 100 shares trading. Paramount Trading closed at $3.20 with 12,800 shares changing hands, tTech closed trading with 20,000 units changing hands and gained 89 cents to end at a record $6.90 and Derrimon preference share, rose 12 cents to close at $2.12 as 4,395 units passed through the market.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator reading shows 21 stocks with bids higher than their last selling prices and 3 with lower offers.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator reading shows 21 stocks with bids higher than their last selling prices and 3 with lower offers. Mayberry Investments traded 36,000 shares with gains of 75 cents, to close at $5,

Mayberry Investments traded 36,000 shares with gains of 75 cents, to close at $5,

Losses| Clico Investment lost 8 cents, closing at $22.50 with trades of 86,187 shares valued at $1,939,787, Massy Holdings closed at $51.42, a loss of 2 cents with 578 units traded, Sagicor Financial closed down by 5 cents to $8.50 with 22,247 shares being exchanged. Scotiabank traded 331 units, closing at $58.70, after a loss of 5 cents and Trinidad Cement traded just 500 shares to close at $4.55, after losing 50 cents.

Losses| Clico Investment lost 8 cents, closing at $22.50 with trades of 86,187 shares valued at $1,939,787, Massy Holdings closed at $51.42, a loss of 2 cents with 578 units traded, Sagicor Financial closed down by 5 cents to $8.50 with 22,247 shares being exchanged. Scotiabank traded 331 units, closing at $58.70, after a loss of 5 cents and Trinidad Cement traded just 500 shares to close at $4.55, after losing 50 cents. The Jamaica Stock Exchange latest potential listing on junior market,

The Jamaica Stock Exchange latest potential listing on junior market,