Market activity ended on Thursday, resulting in rising stocks being edged out by those falling, with the market index slipping after trading 80 percent fewer shares, with 63 percent less value than on Wednesday, at the close of the Trinidad and Tobago Stock Exchange.

The market closed with, 19 securities trading compared to 22 on Wednesday, with four stocks rising, five declining and 10 ending unchanged. The Composite Index slipped 1.49 points to 1,428.75, the All T&T Index fell 2.89 points to settle at 1,926.62 and the Cross-Listed Index was unchanged at 125.58.

The market closed with, 19 securities trading compared to 22 on Wednesday, with four stocks rising, five declining and 10 ending unchanged. The Composite Index slipped 1.49 points to 1,428.75, the All T&T Index fell 2.89 points to settle at 1,926.62 and the Cross-Listed Index was unchanged at 125.58.

A total of, 64,644 shares changed hands, for $1,671,339 compared to 323,675 units at $4,515,300 on Wednesday. An average of 3,402 units, traded at $87,965 compared to 14,713 at $205,241 on Wednesday, with trading month to date averaging 9,471 units at $150,958. The average trade for August amounted to 16,186 units at $226,311.

The Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and one with a lower offer.

At the close, Angostura Holdings traded 28 shares at $17.10 Calypso Macro Investment Fund ended at $16.50 after exchanging 1,571 stock units, Clico Investment Fund fell 80 cents to $26 in trading 18,814 units. First Citizens Bank dropped 10 cents to $50.50 in an exchange of 2,125 stocks, FirstCaribbean International Bank remained at $6.65 in exchange of 800 units, GraceKennedy finished at $6.30, with 595 stock units crossing the exchange. Guardian Holdings shed 5 cents to end at $32.85 after exchanging 8,951 stocks,

JMMB Group remained at $2.15 after 2,385 shares crossed the market, L.J. Williams B share remained at $1.35 in trading 1,450 units. Massy Holdings rose 90 cents to $82.90, with 4,062 stock units clearing the market, National Enterprises fell 20 cents in closing at $3.40 with an exchange of 517 shares, Point Lisas ended at $3.20, with 400 stocks changing hands. Prestige Holdings rallied 40 cents to $7.40 in switching ownership of 66 stock units, Republic Financial Holdings popped 3 cents to $135.48 while exchanging 811 shares, Scotiabank remained at $59.49, trading 1,051 units. Trinidad & Tobago NGL lost 6 cents in ending at $17.60 with the swapping of 585 stocks, Trinidad Cement increased 9 cents to $3.99 after exchanging 11,543 shares, Unilever Caribbean ended at $16.40 after 7,855 stocks crossed the market and West Indian Tobacco closed $31.50, after trading 1,035 stock units.

JMMB Group remained at $2.15 after 2,385 shares crossed the market, L.J. Williams B share remained at $1.35 in trading 1,450 units. Massy Holdings rose 90 cents to $82.90, with 4,062 stock units clearing the market, National Enterprises fell 20 cents in closing at $3.40 with an exchange of 517 shares, Point Lisas ended at $3.20, with 400 stocks changing hands. Prestige Holdings rallied 40 cents to $7.40 in switching ownership of 66 stock units, Republic Financial Holdings popped 3 cents to $135.48 while exchanging 811 shares, Scotiabank remained at $59.49, trading 1,051 units. Trinidad & Tobago NGL lost 6 cents in ending at $17.60 with the swapping of 585 stocks, Trinidad Cement increased 9 cents to $3.99 after exchanging 11,543 shares, Unilever Caribbean ended at $16.40 after 7,855 stocks crossed the market and West Indian Tobacco closed $31.50, after trading 1,035 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Archives for September 2021

TT stocks slip on Thursday

Trading picks up for JSE USD market

Trading on Thursday ended with the volume of shares changing hands surging 284 percent more than on Wednesday, on the US dollar market of the Jamaica Stock Exchange, resulting in fewer stocks rising than falling.

Five securities traded, the same as Wednesday, with prices of one stock rising, three declining and one remaining unchanged.

Five securities traded, the same as Wednesday, with prices of one stock rising, three declining and one remaining unchanged.

The US Denominated Equities Index gained 1.52 points to end at 184.41. The PE Ratio, a measure that computes appropriate stock values, averages 11.7 based on ICInsider.com’s forecast of 2021-22 earnings.

Overall, 119,947 shares traded, for US$10,797 up from 31,247 units at US$686 on Wednesday. Trading averaged 23,989 units at US$2,159, up from 6,249 shares at US$137 on Wednesday, while the month to date averages 15,119 shares at US$1,148. August ended with an average of 210,413 units for US$12,959.

Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than the last selling price and three with lower offers.

At the close, Margaritaville shed 0.25 of a cent to close at 8.75 US cents trading 1,366 shares, Proven Investments fell 0.02 of a cent to end at 23.48 US cents with an exchange of 7,715 stock units, Sygnus Credit Investments Ja$ share, climbed 2.39 cents to 14.59 US cents after an exchange of 7,772 stocks. Sygnus Credit Investments US$ share, declined 0.2 of a cent to 12.5 US cents after 59,094 units crossed the market and Transjamaican Highway remained at 0.81 US cents while exchanging 44,000 shares.

At the close, Margaritaville shed 0.25 of a cent to close at 8.75 US cents trading 1,366 shares, Proven Investments fell 0.02 of a cent to end at 23.48 US cents with an exchange of 7,715 stock units, Sygnus Credit Investments Ja$ share, climbed 2.39 cents to 14.59 US cents after an exchange of 7,772 stocks. Sygnus Credit Investments US$ share, declined 0.2 of a cent to 12.5 US cents after 59,094 units crossed the market and Transjamaican Highway remained at 0.81 US cents while exchanging 44,000 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading rises on TTSE on Wednesday

Market activity resumed after the independence holiday and ended on Wednesday, with an even number of stocks rising and falling and the market declining after trading 80 percent more shares, with 9 percent higher value than on Monday, at the close of the Trinidad and Tobago Stock Exchange.

At the close, 22 securities traded compared to 20 on Monday, with six stocks rising, six declining and 10 remaining unchanged. The Composite Index fell 1.59 points to 1,430.24, the All T&T Index dipped 5.40 points to 1,929.51 and the Cross-Listed Index gained 0.35 points to settle at 125.58.

At the close, 22 securities traded compared to 20 on Monday, with six stocks rising, six declining and 10 remaining unchanged. The Composite Index fell 1.59 points to 1,430.24, the All T&T Index dipped 5.40 points to 1,929.51 and the Cross-Listed Index gained 0.35 points to settle at 125.58.

A total of, 323,675 shares traded, for $4,515,314 compared to 180,164 units at $4,129,217 on Monday.

An average of 14,713 units traded at $205,378 compared to 9,008 at $206,461 on Monday. The average trade for August was 16,186 units at $226,311.

The Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Agostini’s had an exchange of 4,188 shares at $24.40, Ansa Mcal fell $1.99 to close at $57, with 154 stocks crossing the exchange, Ansa Merchant Bank ended at $41.04 with an exchange of 45 units. Calypso Macro Investment Fund rallied 30 cents to $16.50, with 1,198 stock units changing hands, Clico Investment Fund declined 15 cents to $26.80 after trading 14,401 units, Endeavour Holdings remained at $7.01 after exchanging 430 shares. First Citizens Bank increased 10 cents to $50.60, with 80 stock units changing hands, FirstCaribbean International Bank traded 140,772 stocks at $6.65, GraceKennedy rose 9 cents to $6.30 in switching ownership of 572 units. Guardian Holdings shed 5 cents in closing at $32.90 in trading 26,641 shares, Guardian Media remained at $3.03 with the swapping of 1,633 stock units, JMMB Group slipped 1 cent to $2.15 while exchanging 18 stocks.  L.J. Williams B share remained at $1.35 while trading 700 stock units, National Flour Mills rose 1 cent to $1.81 after 4,676 units crossed the market, NCB Financial Group popped 2 cents to $8.25 in exchanging 110,667 shares. One Caribbean Media spiked 62 cents to $4.88 in an exchange of 1,000 stock, Point Lisas remained at $3.20 in trading 1,000 shares, Republic Financial Holdings dipped 1 cent to $135.45 with 8,198 stocks clearing the market. Scotiabank remained at $59.49 while exchanging 21 units, Trinidad & Tobago NGL declined 6 cents to $17.66 with the swapping of 5,979 stock units, Unilever Caribbean remained at $16.40 with an exchange of 737 stocks and West Indian Tobacco ended at $31.50 in exchanging 565 units.

L.J. Williams B share remained at $1.35 while trading 700 stock units, National Flour Mills rose 1 cent to $1.81 after 4,676 units crossed the market, NCB Financial Group popped 2 cents to $8.25 in exchanging 110,667 shares. One Caribbean Media spiked 62 cents to $4.88 in an exchange of 1,000 stock, Point Lisas remained at $3.20 in trading 1,000 shares, Republic Financial Holdings dipped 1 cent to $135.45 with 8,198 stocks clearing the market. Scotiabank remained at $59.49 while exchanging 21 units, Trinidad & Tobago NGL declined 6 cents to $17.66 with the swapping of 5,979 stock units, Unilever Caribbean remained at $16.40 with an exchange of 737 stocks and West Indian Tobacco ended at $31.50 in exchanging 565 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD Market falters on Wednesday

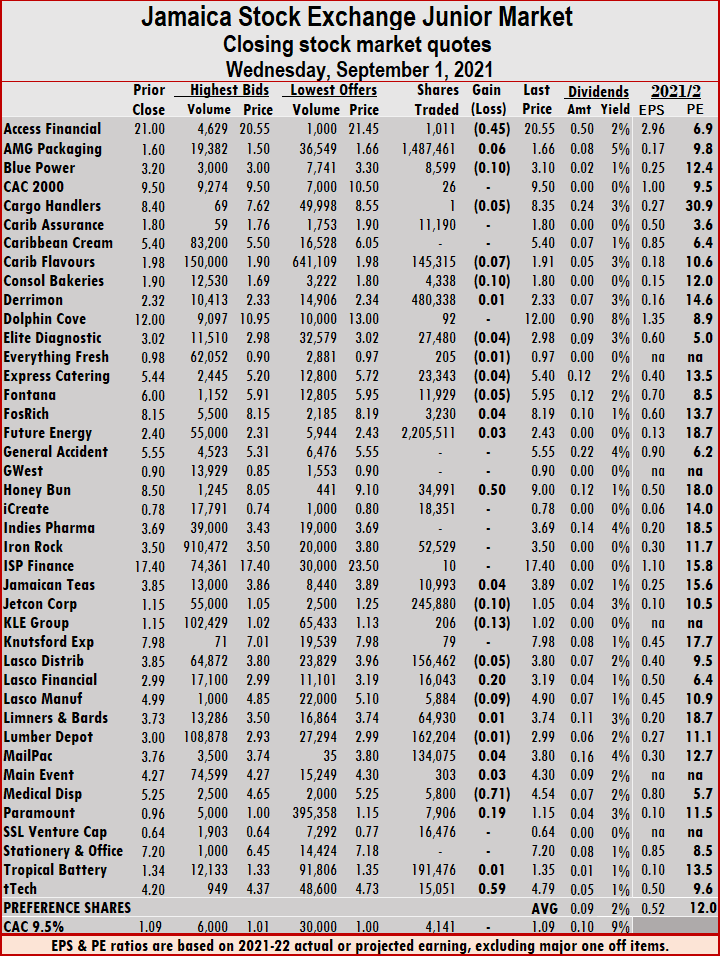

Trading on the USD market ended on Wednesday with the JSE US Denominated Equities Index slipping 2.40 points to end at 182.89 after a transfer of 94 percent fewer shares for 93 percent less the value than on Tuesday, resulting from more stocks declining than rising.

Five securities changed hands, compared to six on Tuesday with none rising, three declining and two remaining unchanged.

Five securities changed hands, compared to six on Tuesday with none rising, three declining and two remaining unchanged.

The PE Ratio, a measure that computes appropriate stock values, averages 11.6 based on ICInsider.com’s forecast of 2021-22 earnings.

Overall, 31,247 shares traded for US$686, down from 511,853 units at US$9,997 on Tuesday. Trading averaged 6,249 units at US$137, in contrast to 85,309 shares at US$1,666 on Tuesday. August ended with an average of 210,413 units for US$12,959.

Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than its last selling price and two with lower offers.

At the close, Margaritaville remained at 9 US cents with 2,000 shares traded, Proven Investments fell 0.4 of a cent to 23.5 US cents with 1,050 stocks changing hands, Sygnus Credit Investments JMD stock settled at 12.2 US cents with 3 units changing hands. Sygnus Credit Investments USD stock lost 0.3 of a cent to settle at 12.7 US cents with investors switching ownership of 194 units and Transjamaican Highway declined by 0.09 of a cent to 0.81 US cents with 28,000 shares crossing the exchange.

At the close, Margaritaville remained at 9 US cents with 2,000 shares traded, Proven Investments fell 0.4 of a cent to 23.5 US cents with 1,050 stocks changing hands, Sygnus Credit Investments JMD stock settled at 12.2 US cents with 3 units changing hands. Sygnus Credit Investments USD stock lost 0.3 of a cent to settle at 12.7 US cents with investors switching ownership of 194 units and Transjamaican Highway declined by 0.09 of a cent to 0.81 US cents with 28,000 shares crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

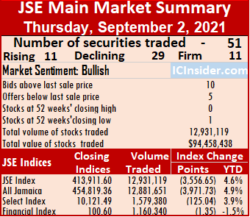

The All Jamaican Composite Index declined 3,971.73 points to settle at 454,819.36, the Main Index fell 3,556.65 points to 413,911.60 and the JSE Financial Index shed 1.35 points to close at 100.60.

The All Jamaican Composite Index declined 3,971.73 points to settle at 454,819.36, the Main Index fell 3,556.65 points to 413,911.60 and the JSE Financial Index shed 1.35 points to close at 100.60. At the close, Caribbean Cement shed 96 cents in closing at $106.24 in an exchange of 7,444 units, Eppley Caribbean Property Fund declined $1.47 to $38.53 with 47,391 shares crossing the market, First Rock Capital fell $1.11 to $12.61 with 21,248 stocks changing hands. GraceKennedy dipped 50 cents to $101 with the swapping of 79,434 shares, Jamaica Broilers shed 96 cents to close at $32.04 after 305,900 units crossed the exchange, Jamaica Producers advanced $2.45 to $24.50 in transferring 5,955 stocks. JMMB Group lost 50 cents to end at $37.50, with the swapping of 112,533 shares, Kingston Wharves dipped 60 cents to $48 in exchanging 1,095 stock units. Margaritaville fell $1.95 to close at a 52 weeks’ low of $13.20, with an exchange of 634 stock units. Mayberry Investments lost 25 cents in ending at $5.75 and trading 44 stocks. MPC Caribbean Clean Energy dropped $5.50 to $120 in trading 555 shares, NCB Financial fell 70 cents to $129.30 in switching ownership of 205,686 stock units, 138 Student Living popped 59 cents to $5.09 in an exchange of 4,448 shares, Palace Amusement surged $101 to $1,100 with 2 units crossing the exchange. Proven Investments rose 57 cents to $33.60 in transferring 3,380 stocks, Pulse Investments rallied 43 cents to $3.98 with the swapping of 4,641,053 shares, Radio Jamaica lost 25 cents to end at $3.50 in switching ownership of 311,137 stocks.

At the close, Caribbean Cement shed 96 cents in closing at $106.24 in an exchange of 7,444 units, Eppley Caribbean Property Fund declined $1.47 to $38.53 with 47,391 shares crossing the market, First Rock Capital fell $1.11 to $12.61 with 21,248 stocks changing hands. GraceKennedy dipped 50 cents to $101 with the swapping of 79,434 shares, Jamaica Broilers shed 96 cents to close at $32.04 after 305,900 units crossed the exchange, Jamaica Producers advanced $2.45 to $24.50 in transferring 5,955 stocks. JMMB Group lost 50 cents to end at $37.50, with the swapping of 112,533 shares, Kingston Wharves dipped 60 cents to $48 in exchanging 1,095 stock units. Margaritaville fell $1.95 to close at a 52 weeks’ low of $13.20, with an exchange of 634 stock units. Mayberry Investments lost 25 cents in ending at $5.75 and trading 44 stocks. MPC Caribbean Clean Energy dropped $5.50 to $120 in trading 555 shares, NCB Financial fell 70 cents to $129.30 in switching ownership of 205,686 stock units, 138 Student Living popped 59 cents to $5.09 in an exchange of 4,448 shares, Palace Amusement surged $101 to $1,100 with 2 units crossing the exchange. Proven Investments rose 57 cents to $33.60 in transferring 3,380 stocks, Pulse Investments rallied 43 cents to $3.98 with the swapping of 4,641,053 shares, Radio Jamaica lost 25 cents to end at $3.50 in switching ownership of 311,137 stocks. Sagicor Group declined $1 to $56 in exchanging 24,877 shares, Salada Foods traded 201 shares and gained 20 cents to close at $7.25, Seprod shed $1.01 in ending at $64.99 after 21,342 stock units crossed the market and Sygnus Credit Investments lost 46 cents in closing at $16.44 in switching ownership of 70,957 stocks.

Sagicor Group declined $1 to $56 in exchanging 24,877 shares, Salada Foods traded 201 shares and gained 20 cents to close at $7.25, Seprod shed $1.01 in ending at $64.99 after 21,342 stock units crossed the market and Sygnus Credit Investments lost 46 cents in closing at $16.44 in switching ownership of 70,957 stocks. Trading ended with 38 active securities compared to 37 on Wednesday, with 12 rising, 18 declining and eight finishing unchanged.

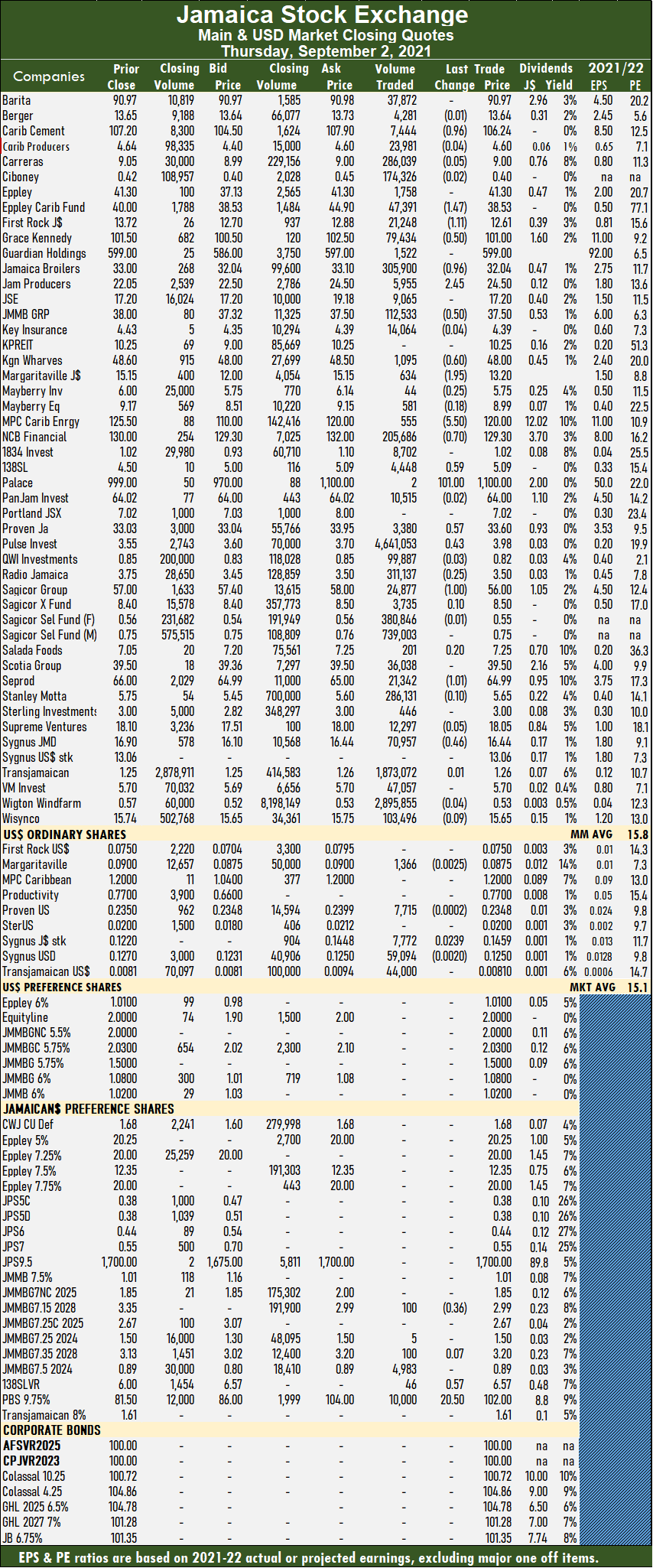

Trading ended with 38 active securities compared to 37 on Wednesday, with 12 rising, 18 declining and eight finishing unchanged. At the close, AMG Packaging lost 6 cents to close at $1.60,, trading 4,101 shares, Blue Power rose 20 cents to $3.30 in an exchange of 300 stocks, CAC 2000 slipped 20 cents to $9.30 in trading 10,868 stock units. Cargo Handlers lost 20 cents to end at $8.15 with 3,065 units changing hands, Caribbean Cream popped 60 cents to $6 in trading 925 stock units, Caribbean Flavours rallied 7 cents to $1.98 after exchanging 20,494 units. Express Catering popped 32 cents to $5.72 with a transfer of 3,007 stock units. Future Energy Source shed 23 cents to $2.20 with 3,195,686 shares crossing the exchange, Honey Bun gained 20 cents to close at $9.20 in exchanging 114,740 units, Indies Pharma declined 26 cents to $3.43 after an exchange of 5,000 stocks. Jamaican Teas fell 29 cents to $3.60 in transferring 36,859 shares, Jetcon Corporation lost 6 cents to finish at 99 cents in switching ownership of 122,699 stocks, Lasco Manufacturing gained 10 cents to end at $5 in an exchange of 4,505 stock units, Limners and Bards shed 24 cents to close at $3.50 with 121,200 units crossing the market. Mailpac Group declined 20 cents to $3.60 with the swapping of 145,936 stock units, Medical Disposables rallied 11 cents to $4.65 in trading 10,047 units,

At the close, AMG Packaging lost 6 cents to close at $1.60,, trading 4,101 shares, Blue Power rose 20 cents to $3.30 in an exchange of 300 stocks, CAC 2000 slipped 20 cents to $9.30 in trading 10,868 stock units. Cargo Handlers lost 20 cents to end at $8.15 with 3,065 units changing hands, Caribbean Cream popped 60 cents to $6 in trading 925 stock units, Caribbean Flavours rallied 7 cents to $1.98 after exchanging 20,494 units. Express Catering popped 32 cents to $5.72 with a transfer of 3,007 stock units. Future Energy Source shed 23 cents to $2.20 with 3,195,686 shares crossing the exchange, Honey Bun gained 20 cents to close at $9.20 in exchanging 114,740 units, Indies Pharma declined 26 cents to $3.43 after an exchange of 5,000 stocks. Jamaican Teas fell 29 cents to $3.60 in transferring 36,859 shares, Jetcon Corporation lost 6 cents to finish at 99 cents in switching ownership of 122,699 stocks, Lasco Manufacturing gained 10 cents to end at $5 in an exchange of 4,505 stock units, Limners and Bards shed 24 cents to close at $3.50 with 121,200 units crossing the market. Mailpac Group declined 20 cents to $3.60 with the swapping of 145,936 stock units, Medical Disposables rallied 11 cents to $4.65 in trading 10,047 units,  Paramount Trading lost 15 cents to close at $1 with 5,000 shares changing hands, SSL Venture gained 13 cents in ending at 77 cents with 28,050 stock units crossing the market. Stationery and Office Supplies fell 75 cents to $6.45 in trading 300 stocks, Tropical Battery rose 5 cents to $1.40 with 275,806 units clearing the market and tTech fell 42 cents to $4.37, finishing with a transfer of 1,049 shares.

Paramount Trading lost 15 cents to close at $1 with 5,000 shares changing hands, SSL Venture gained 13 cents in ending at 77 cents with 28,050 stock units crossing the market. Stationery and Office Supplies fell 75 cents to $6.45 in trading 300 stocks, Tropical Battery rose 5 cents to $1.40 with 275,806 units clearing the market and tTech fell 42 cents to $4.37, finishing with a transfer of 1,049 shares. Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and four with lower offers.

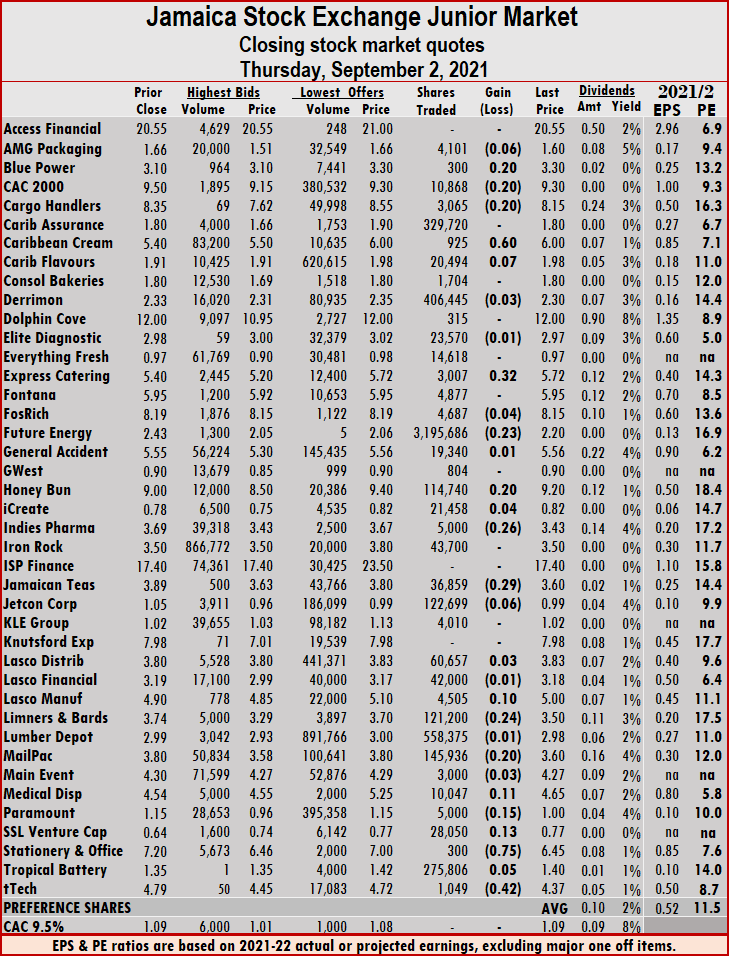

Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and four with lower offers. Lasco Distributors slipped 5 cents to $3.80 with 156,462 stocks changing hands, Lasco Financial rallied 20 cents to $3.19, with 16,043 shares passing through the market. Lasco Manufacturing fell 9 cents to $4.90 with 5,884 stock units traded, Medical Disposables shed 71 cents to end at $4.54 with a transfer of 5,800 stocks, Paramount Trading climbed 19 cents to $1.15, with 7,906 units changing hands and tTech jumped 59 cents to $4.79 with 15,051 shares crossing the exchange.

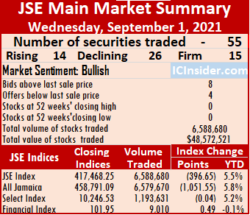

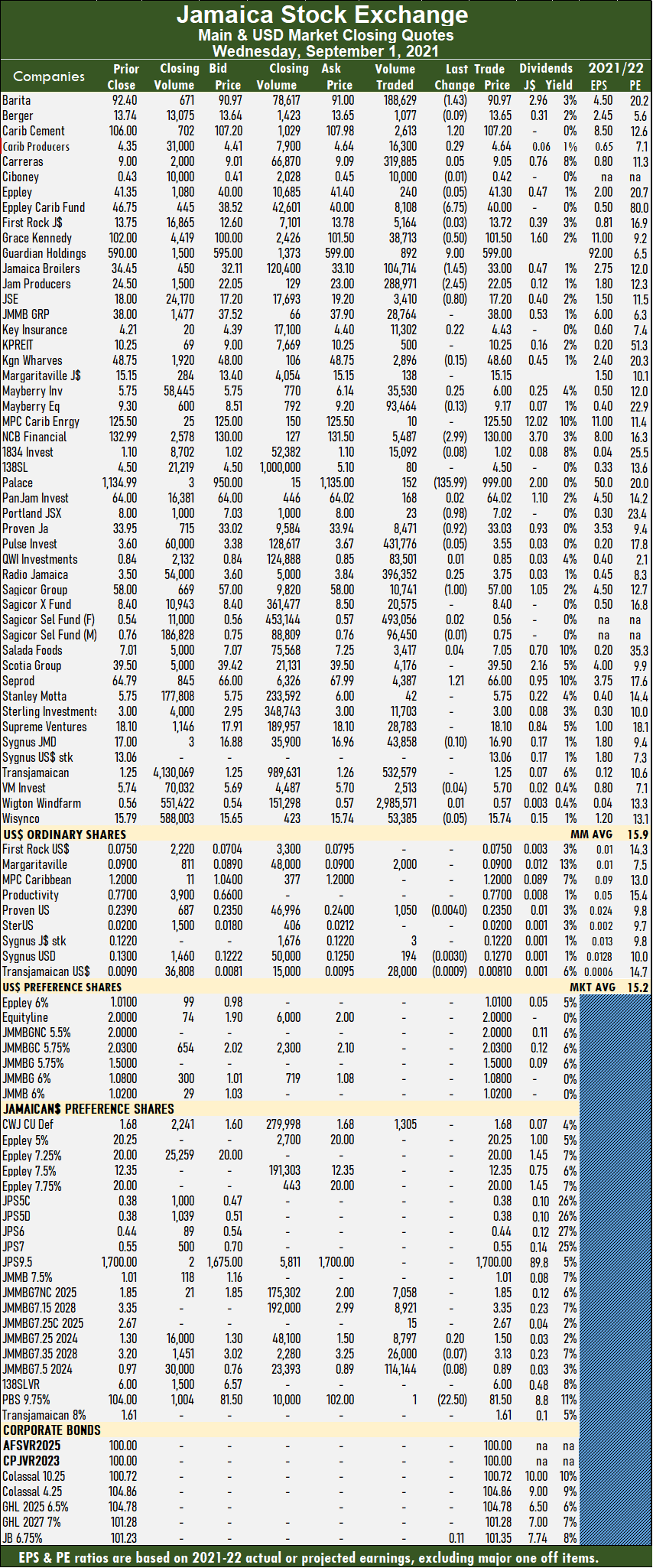

Lasco Distributors slipped 5 cents to $3.80 with 156,462 stocks changing hands, Lasco Financial rallied 20 cents to $3.19, with 16,043 shares passing through the market. Lasco Manufacturing fell 9 cents to $4.90 with 5,884 stock units traded, Medical Disposables shed 71 cents to end at $4.54 with a transfer of 5,800 stocks, Paramount Trading climbed 19 cents to $1.15, with 7,906 units changing hands and tTech jumped 59 cents to $4.79 with 15,051 shares crossing the exchange. At the close, Barita Investments fell $1.43 to $90.97 in switching ownership of 188,629 shares, Caribbean Cement rose $1.20 to $107.20 in exchanging 2,613 stocks, Caribbean Producers gained 29 cents to end at $4.64 with 16,300 shares crossing the exchange, Eppley Caribbean Property Fund dropped $6.75 to $40 in trading 8,108 stock units, GraceKennedy slipped 50 cents to $101.50 with a transfer of 38,713 stocks, Guardian Holdings spiked $9 to $599 with 892 units changing hands, Jamaica Broilers fell $1.45 to $33 with the swapping of 104,714 shares. Jamaica Producers declined $2.45 to $22.05 after 288,971 stocks cleared the market, Jamaica Stock Exchange shed 80 cents to close at $17.20 in transferring 3,410 stock units, Key Insurance popped 22 cents to $4.43 after exchanging 11,302 stocks. Mayberry Investments rallied 25 cents to $6 in exchanging 35,530 units, NCB Financial declined $2.99 to $130 in switching ownership of 5,487 shares, Palace Amusement dropped $135.99 to end at $999 with 152 stock units changing hands, Portland JSX shed 98 cents to $7.02 with the swapping of 23 stocks.

At the close, Barita Investments fell $1.43 to $90.97 in switching ownership of 188,629 shares, Caribbean Cement rose $1.20 to $107.20 in exchanging 2,613 stocks, Caribbean Producers gained 29 cents to end at $4.64 with 16,300 shares crossing the exchange, Eppley Caribbean Property Fund dropped $6.75 to $40 in trading 8,108 stock units, GraceKennedy slipped 50 cents to $101.50 with a transfer of 38,713 stocks, Guardian Holdings spiked $9 to $599 with 892 units changing hands, Jamaica Broilers fell $1.45 to $33 with the swapping of 104,714 shares. Jamaica Producers declined $2.45 to $22.05 after 288,971 stocks cleared the market, Jamaica Stock Exchange shed 80 cents to close at $17.20 in transferring 3,410 stock units, Key Insurance popped 22 cents to $4.43 after exchanging 11,302 stocks. Mayberry Investments rallied 25 cents to $6 in exchanging 35,530 units, NCB Financial declined $2.99 to $130 in switching ownership of 5,487 shares, Palace Amusement dropped $135.99 to end at $999 with 152 stock units changing hands, Portland JSX shed 98 cents to $7.02 with the swapping of 23 stocks.  Proven Investments fell 92 cents to $33.03 with 8,471 stock units crossing the market, Radio Jamaica rallied 25 cents to $3.75 in an exchange of 396,352 shares. Sagicor Group shed $1 in, ending at $57 after switching ownership of 10,741 stocks, Seprod popped $1.21 to $66 in trading 4,387 shares.

Proven Investments fell 92 cents to $33.03 with 8,471 stock units crossing the market, Radio Jamaica rallied 25 cents to $3.75 in an exchange of 396,352 shares. Sagicor Group shed $1 in, ending at $57 after switching ownership of 10,741 stocks, Seprod popped $1.21 to $66 in trading 4,387 shares.

Wigton price collapses

Wigton Windfarms’ shares traded below the IPO price of 50 cents on Friday as attempts to shield the price from falling after announcing a drop in revenues is finally giving way to selling pressure. The Wigton syndrome continues to plaque the Jamaica Stock market with irrational behavior of investors to be seen in the prices of many stocks.

Wigton traded nearly 90% of shares on Thursday.

On August 25, investors bought 5 million shares of Future Energy, up to $2.85 and for the next two trading day’s they just over 10 million units up to $3.29, with 15 million shares trading on the 30th at an average of $2.96. The stock is now trading at $2.04, with a PE ratio of 16, to be one of the more highly priced Junior Market stocks. What is happening here, when viewed against stocks with much lower PEs and good growth prospects?

There are thousands of new investors in the market brought on by several new listings on the market, with most listings creating good returns in a relatively short time for early investors.

There are thousands of new investors in the market brought on by several new listings on the market, with most listings creating good returns in a relatively short time for early investors.

Radio Jamaica another stock that traded as high as $4.65 on August 25, traded on Friday at $3.11 at a PE ratio of 7. Salada Foods continues to trade around the $7 region at a PE ratio of 43 times current year’s earnings. Wigton Windfarms that investors were not informed until late last year that the contract for their number 2 turbine provide for a reduction in rates for the supplying of electricity to JPS, belatedly traded down to 46 cents on Friday with few bids left in the system, and now trades at a PE of 12.5.

The stock market is a wonderful creation that has helped to enrich participants over the years, like any endeavor the more time spent studying and understanding it the better off those investors will be.

In the past, investors and scholars developed systems and methods to act as a guide to better investment decisions and thus reduce the love or dislike for a stock or other types of investments and thus reduce emotional decisions.

Technical analysis is a very useful tool used in the investment arena that carries coded messages for persons who understand them. They help investors to avoid excessive behavior in markets and telegraph future trends by using past market movements as the base.

The recent price movements for Radio Jamaica and Fesco show them breaking out of a channel that goes back for months, both companies released results that were price movers and both broke out, with the market not fully there as yet as prices moved too far too fast as such prices pulled back.

A few months after Wigton shares were listed in 2019, ICINsider.com wrote a piece to help investors better understand stock market behavior and prevent losses in the market. The piece captioned “Wigton price dreamers” was published in May of 2019. In light of the irrational trading in Fesco and Salada shares, elements of the article are highlighted below.

Salada Foods traded at a all-time high of $18 on Tuesday.

“Buy now, Ride the $3 wave”. That is the advice of one online investor to another, regarding the likely performance of the Wigton Windfarm stock after trading, on the first day of listing at 83 cents with a PE of 14, placing the value in the upper half of the most valued main market stocks. The premium over net asset value another measure of valuation is 291 percent above the net asset value. At $3, the stock would trade at a stunningly high PE ratio of 50 times 2019 and 2020 earnings. The only main market stock close to that valuation is Kingston Wharves (KW) at 35 times 2019 earnings and that is coming down from more than 50 times 2018 earnings when it traded at $85.

Unlike KW, which has less than 10 percent of the shareholding that will trade, amounting to a few million units, Wigton has billion of shares that will trade. The high liquidity of the shares almost ensures that they will not become overvalued.

Most investors who would be big buyers are more professional and are versed in the valuation levels of stocks. Accordingly, they are unlikely to be buying a stock that has doubtful expansion credentials at an inflated value. The most popular valuation tool, the PE ratio does not support a price much higher than $1.20, with EPS of 60 cents per share. A price of $1.20 equates to a high PE ratio of 20. Only a few stocks are valued close to this multiple and many of them have prospects for profits to grow. Wigton has no immediate prospects for growth in earnings, pricing it at 20 times EPS would therefore be unwise. The market will speak but the heavy selling on Friday when it first traded is more in line with the thinking that the top is not far off. Investors who buy shares above the accepted market norm will likely get crushed.

In the investment world staying close to the crowd with pricing is a prudent investment practice that tends to be less costly than trying to predict lofty heights for stocks to reach.

PE ratios are there to give a sense of appropriate values, when investors try to break away from where the bulk of investors place a value of a stock, they usually end up regret the move.