Victoria Mutual Building Society (VMBS) reports a slight increase in profit of $1 billion for 2014 up from $943 million in 2013.

Victoria Mutual Building Society (VMBS) reports a slight increase in profit of $1 billion for 2014 up from $943 million in 2013.

VMBS generated income of $7.2 billion in 2014 and in 2013 revenues of $6.5 million. The group ended with assets of $97 billion up from $86 billion. Equity capital rose to $11.35 billion from $10.37 in 2013. Mortgage loans rose $31 billion from$27 billion in 2013 and cash funds of $10 billion. Other major assets are Repos amounting to $16 billion, investments mostly in government securities $33.5 billion. VMBS is primarily in the business of providing home mortgages.

VMBS raises profit in 2014

Kremi profit up 40%

Revenue increased 11 percent for the February 2014 quarter, reaching $274 million but most of that is due to price increase and 19 percent to $1 billion for the twelve months.

Gross profit margin climbed to 28.44 percent in the latest quarter from 25.9 percent in the 2014 period but for the full year, the margin was at 27.59 percent compared to 23.67 percent for the 2014 period. Going forward, the margin should improve even more with the blast freezer installed in November, which management says will reduce utility cost and create capacity for greater production to enhance sales volume.

Administrative cost rose by 37.7 percent to $168.8 million for the full year and by 6.9 percent to $44.5 million for the quarter. The slower growth in the latest quarter is an indication that cost increase in the area is normalising and that is a god sign going forward. The company should also benefit from lower marketing cost in 2015 with the upfront cost for the rebranding and advertising picked up last year repeating in the current year. The last quarter reflects the lower on going marketing cost at just $6 million compared to $11.4 million in 2014 and $37.8 million for the full year versus $27 million in 2014. Finance cost in the quarter jumped to $10 million from $4 million in the prior year and an average of just over $5 million in the prior quarters. Based on the funds borrowed the cost going forward should be around $5 million per quarter subject to repayments and changes in interest rates if any.

Administrative cost rose by 37.7 percent to $168.8 million for the full year and by 6.9 percent to $44.5 million for the quarter. The slower growth in the latest quarter is an indication that cost increase in the area is normalising and that is a god sign going forward. The company should also benefit from lower marketing cost in 2015 with the upfront cost for the rebranding and advertising picked up last year repeating in the current year. The last quarter reflects the lower on going marketing cost at just $6 million compared to $11.4 million in 2014 and $37.8 million for the full year versus $27 million in 2014. Finance cost in the quarter jumped to $10 million from $4 million in the prior year and an average of just over $5 million in the prior quarters. Based on the funds borrowed the cost going forward should be around $5 million per quarter subject to repayments and changes in interest rates if any.Going forward the benefits of blast freezer will be reflected for the full year, while it only partially impacted the last quarter of the just concluded fiscal year. They increased prices around 15 percent ahead of the Christmas period and may have seen some cut back in volume in the quarter as a result. They should be able to recover volumes going forward and even expand on it as the shock effect of the price increase wears off and more retail outlets are added.

Importantly, electricity cost will fall from two standpoints one is the lower electricity cost around 20 percent from the peak last year and lower cost due to the faster freezing of ice cream thus using less energy. The cost of milk or milk powder is down quite sharply as well. With all of the above earnings of 2015/16 could land at 60 cents.

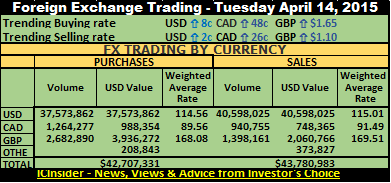

J$115 for each US$ on Tuesday

The Jamaican dollar selling rate was back slightly above 115 to the US dollar on Tuesday, but the local currency lost more value against the Canadian dollar and the British pound. Purchases of all currencies by dealers amounted to US$42,707,331 equivalent, compared with US$52,169,763, on Monday and selling of the equivalent of US$43,780,983 versus sale of US$39,781,633, on the previous trading day.

The Jamaican dollar selling rate was back slightly above 115 to the US dollar on Tuesday, but the local currency lost more value against the Canadian dollar and the British pound. Purchases of all currencies by dealers amounted to US$42,707,331 equivalent, compared with US$52,169,763, on Monday and selling of the equivalent of US$43,780,983 versus sale of US$39,781,633, on the previous trading day.

In US dollar trading, dealers bought US$37,573,862 compared to US$47,538,451 on Monday. The buying rate for the US dollar climbed 8 cents to $114.56 and US$40,598,025 was sold versus US$37,352,160 on Monday, the selling rate rose 2 cents to end at $115.01. The Canadian dollar buying rate inched up by 48 cents to $89.56 with dealers buying C$1,264,277 and selling C$940,755, at an average rate that climbed 26 cents to $91.49.

The rate for buying the British Pound gained $1.65 to $168.08 for the purchase of £2,682,890, while £1,398,161 was sold, at an average rate that jumped $1.10 to $169.51. At the end of trading it took J$121.57 to purchase the Euro, 70 cents less than on Monday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$119.22 for a fall of 58 cents from Monday’s rate. Other currencies bought, amounted to the equivalent of US$208,843, while the equivalent of US$373,827, was sold.

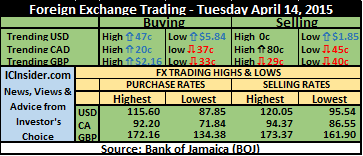

Highs & Lows| The highest buying rate for the US dollar, rose 47 cents to $115.60. The lowest buying rate dropped $5.84 to $87.85 and the highest selling rate remained unchanged at $120.05, but the lowest selling rate rose $1.85 to $95.54. The highest buying rate for the Canadian dollar inched up 20 cents to $92.20. The lowest buying rate fell 37 cents $71.84, but the highest selling rate rose 80 cents to $94.37 with the lowest selling rate falling 45 cents to $86.55. The highest buying rate for the British Pound, rose $2.16 to $172.16, the lowest buying rate was down 33 cents to $134.38 but the highest selling rate declined 29 cents to $173.37 and the lowest selling rate fell 40 cents to $161.90.

Highs & Lows| The highest buying rate for the US dollar, rose 47 cents to $115.60. The lowest buying rate dropped $5.84 to $87.85 and the highest selling rate remained unchanged at $120.05, but the lowest selling rate rose $1.85 to $95.54. The highest buying rate for the Canadian dollar inched up 20 cents to $92.20. The lowest buying rate fell 37 cents $71.84, but the highest selling rate rose 80 cents to $94.37 with the lowest selling rate falling 45 cents to $86.55. The highest buying rate for the British Pound, rose $2.16 to $172.16, the lowest buying rate was down 33 cents to $134.38 but the highest selling rate declined 29 cents to $173.37 and the lowest selling rate fell 40 cents to $161.90.

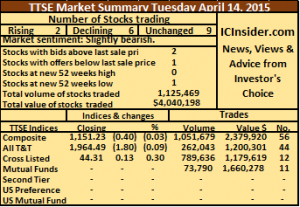

6 TTSE stocks fall 2 rose Tuesday

At the close of the market, the Composite Index fell 0.40 points to close at 1,151.23, the All T&T Index fell by just 1.80 points to 1,964.49 and the Cross Listed Index advanced by 0.13 points to close at 44.31.

Gains| Stocks increasing in price at the close are, First Citizens Bank traded 1,000 shares and closed 2 cents higher at $35.52 and Sagicor Financial Corporation gained 23 cents to end the at $6.25 with 2,000 shares.

Declines| Stocks declining at the end of trading are, Clico Investment Fund trading 73,790 shares valued at $1,660,278 to end at $22.50, with a 1 cent loss. Guardian Holdings trading 9,782 shares while falling by 27 cents to $14.20, National Enterprises in closing at a new 52 weeks’ low with 2,811 closed at $17.33, Republic Bank trading 825 shares while losing 1 cent, to close at $116. Scotia Investments fell 7 cents to close at $1.46 while trading 23,262 shares and Trinidad Cement lost 5 cents while contributing 113,491 shares with a value of $273,930 to end at $2.40.

Firm Trades| Stocks closing with prices unchanged at the end of trading are, ANSA Mcal trading 690 shares at $66.91, Grace Kennedy with 610 shares changing hands and ended at $3.55, JMMB Group traded 13,701 shares at 43 cents, Massy Holdings trading 2,868 shares to close at $63.05. National Commercial Bank had 750,063 shares changing hands for a value of $1,125,094 to end at $1.50, National Flour Mills with 120,703 shares being traded for $181,054 closing at $1.50, One Caribbean Media trading 7,555 shares at $22.30, Prestige Holdings with 2,168 shares ended at $10 and Scotiabank trading 150 units to close at $62.11.

Firm Trades| Stocks closing with prices unchanged at the end of trading are, ANSA Mcal trading 690 shares at $66.91, Grace Kennedy with 610 shares changing hands and ended at $3.55, JMMB Group traded 13,701 shares at 43 cents, Massy Holdings trading 2,868 shares to close at $63.05. National Commercial Bank had 750,063 shares changing hands for a value of $1,125,094 to end at $1.50, National Flour Mills with 120,703 shares being traded for $181,054 closing at $1.50, One Caribbean Media trading 7,555 shares at $22.30, Prestige Holdings with 2,168 shares ended at $10 and Scotiabank trading 150 units to close at $62.11.IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 2 stocks with the bid higher than their last selling prices and 1 stock with the offer that was lower.

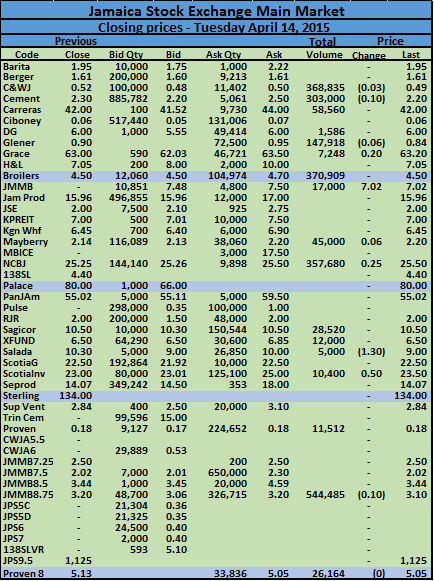

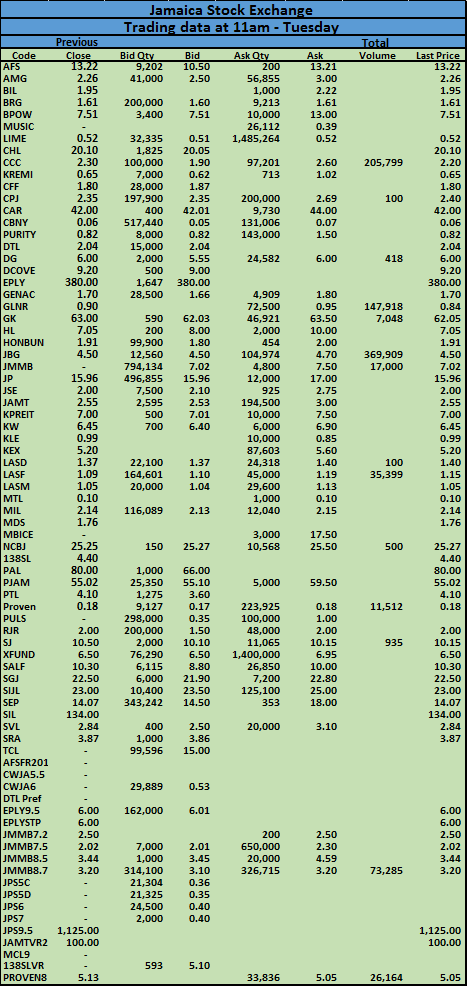

9 stocks down 8 up Tuesday

Activity on the Jamaica Stock Exchange, resulted in the prices of 8 stocks rising, 9 declining as 23 securities changed hands, ending in 2,465,588 units trading, valued at $17,727,553, in all market segments.

Main Market| The JSE Market Index lost 511.59 points to 84,808.30, the JSE All Jamaican Composite index fell 571.97 points to close at 93,537.92 and the JSE combined index declined by 441.31 points to close at 86,588.19.

Main Market| The JSE Market Index lost 511.59 points to 84,808.30, the JSE All Jamaican Composite index fell 571.97 points to close at 93,537.92 and the JSE combined index declined by 441.31 points to close at 86,588.19.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 11 stocks with bids higher than their last selling prices and just 3 with offers that were lower.

Caribbean Cement traded 303,000 shares to close at $2.20 after losing 10 cents and trading as high as $2.30, at the close there were 885,782 shares on the bid to buy at $2.20. Carreras had 58,560 shares changing hands at $42, Gleaner Company traded 147,918 shares at 84 cents, Jamaica Broilers Group had 370,909 units trading at the close at $4.50. JMMB Group, the holding company for Jamaica Money Market Brokers, traded 17,000 shares at 7.02 for a 3 cents loss but the stock closed with a bid to buy 10,851 shares at $7.48. National Commercial Bank traded 357,680 units while closing 25 cents higher at $25.50, but traded as low as $25.26 and Jamaica Money Market Brokers 8.75% preference share closed with 544,485 units trading at $3.10, down 10 cents.

Jamaica Broilers Group had 370,909 units trading at the close at $4.50. JMMB Group, the holding company for Jamaica Money Market Brokers, traded 17,000 shares at 7.02 for a 3 cents loss but the stock closed with a bid to buy 10,851 shares at $7.48. National Commercial Bank traded 357,680 units while closing 25 cents higher at $25.50, but traded as low as $25.26 and Jamaica Money Market Brokers 8.75% preference share closed with 544,485 units trading at $3.10, down 10 cents.

Salada Foods traded just 5,000 shares but lost $1.30 in closing at $9, Scotia Investments traded 10,400 units to close 5o cents up at $23.50,

4 juniors up 2 down on Tuesday

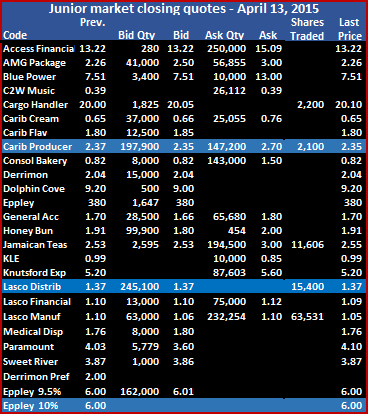

Activity on the Junior Market closed with 6 securities traded ending with 149,771 units changing hands valued at $179,558. The JSE Junior Market Index gained 4.29 points to close at 732.18, with the price of 4 stocks advancing and 2 declining.

Activity on the Junior Market closed with 6 securities traded ending with 149,771 units changing hands valued at $179,558. The JSE Junior Market Index gained 4.29 points to close at 732.18, with the price of 4 stocks advancing and 2 declining.

Stocks trading in the junior market are, Access Financial Services traded 200 shares at $13.21, as the price eased 1 cent, Caribbean Cream closed trading with 10,000 shares, to end with a 5 cents decline at a new low of 60 cents. The stock was initially recorded as trading at 76 cents at the start of market, but that trade was eventually cancelled, as the price it attempted to trade at, was in excess of 15 percent initially permitted, effectively triggering the initial circuit breaker and thus the freeze. Trading in the stock was suspended for an hour before it was permitted to trade again. At the close there was a bid to buy 47,000 units at 60 cents.Caribbean Producers traded only 100 shares at $2.40, Lasco Distributors saw 51,418 units changing hands at $1.40 to gain 3 cents, Lasco Financial Services had 84,053 units trading to close at $1.10, after gaining a cent, after trading as high as $1.15 and Lasco Manufacturing put through 4,000 shares at 1.06 to gain 1 cent.

Trading in the stock was suspended for an hour before it was permitted to trade again. At the close there was a bid to buy 47,000 units at 60 cents.Caribbean Producers traded only 100 shares at $2.40, Lasco Distributors saw 51,418 units changing hands at $1.40 to gain 3 cents, Lasco Financial Services had 84,053 units trading to close at $1.10, after gaining a cent, after trading as high as $1.15 and Lasco Manufacturing put through 4,000 shares at 1.06 to gain 1 cent.

The market closed with AMG Packaging having a bid for 41,000 shares to buy at $2.50, compared to a last sale of $2.26.

Kremi trade cancelled

In trading Caribbean Cream attempted to trade at 76 cents in response to the 40 percent jump in full year results, but the trade was cancelled and trading in the stock halted for an hour as the price at which the trade was attempted exceeded 15 percent from the last traded price of 65 cents.

but the trade was cancelled and trading in the stock halted for an hour as the price at which the trade was attempted exceeded 15 percent from the last traded price of 65 cents.

The halt on trading in the stock is now lifted and the stock can trade as high as 84 cents today but the lowest offer is at $1.02 for a mere 713 shares then at $1.15 is 100,000 units and at $1.20 one offer of 200,000 shares. Elsewhere, Caribbean Cement traded 205,799 shares at $2.20, Gleaner 147,918 at 84 cents and Jamaica Broilers 309,906 at $4.50. So far 14 securities have traded.

The JSE main market indices are down by more than 400 pints so far while the junior market is up 5.66 points to 733.55, the All Jamaican Composite Index is down 551 points to 93,559.07 and the JSE index is off 493 points to 84827.22.

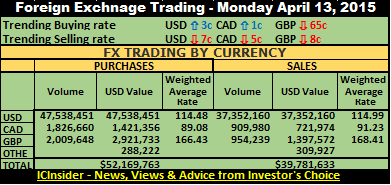

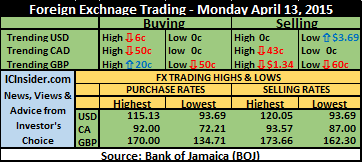

J$ slips below 115 to US$ on Monday

The Jamaican dollar selling rate slipped back slightly below 115 to the US dollar on Monday, but the local currency also made gains on the Canadian dollar and the British pound. Purchases of all currencies by dealers amounted to US$52,169,763 equivalent, compared with US$34,310,557, on Friday and selling of the equivalent of US$39,781,633 versus sale of US$39,722,654, on the previous trading day.

The Jamaican dollar selling rate slipped back slightly below 115 to the US dollar on Monday, but the local currency also made gains on the Canadian dollar and the British pound. Purchases of all currencies by dealers amounted to US$52,169,763 equivalent, compared with US$34,310,557, on Friday and selling of the equivalent of US$39,781,633 versus sale of US$39,722,654, on the previous trading day.

In US dollar trading, dealers bought US$47,538,451 compared to US$31,736,664 on Friday. The buying rate for the US dollar climbed 3 cents to $114.48 and US$37,352,160 was sold versus US$38,071,864 on Friday, the selling rate fell 7 cents to end at $114.99. The Canadian dollar buying rate inched up by 1 cent to $89.08 with dealers buying C$1,826,660, and selling C$909,980, at an average rate that fell 5 cents to $91.23. The rate for buying the British Pound fell 65 cents to $166.43 for the purchase of £2,009,648, while £954,239 was sold, at an average rate of $168.41, for an 8 cents decline. At the end of trading it took J$122.27 to purchase the Euro, 51 cents less than on Friday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$119.79 for a fall of 38 cents on Friday’s rate. Other currencies bought, amounted to the equivalent of US$288,222 while the equivalent of US$309,927, was sold.

In US dollar trading, dealers bought US$47,538,451 compared to US$31,736,664 on Friday. The buying rate for the US dollar climbed 3 cents to $114.48 and US$37,352,160 was sold versus US$38,071,864 on Friday, the selling rate fell 7 cents to end at $114.99. The Canadian dollar buying rate inched up by 1 cent to $89.08 with dealers buying C$1,826,660, and selling C$909,980, at an average rate that fell 5 cents to $91.23. The rate for buying the British Pound fell 65 cents to $166.43 for the purchase of £2,009,648, while £954,239 was sold, at an average rate of $168.41, for an 8 cents decline. At the end of trading it took J$122.27 to purchase the Euro, 51 cents less than on Friday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$119.79 for a fall of 38 cents on Friday’s rate. Other currencies bought, amounted to the equivalent of US$288,222 while the equivalent of US$309,927, was sold.

Highs & Lows| The highest buying rate for the US dollar, declined 6 cents to $115.13. The lowest buying and the highest selling rates remained unchanged at $93.69 and $120.05, respectively and lowest selling rate rose $3.69 to $93.69. The highest buying rate for the Canadian dollar fell 50 cents to $92, the lowest buying rate remained at $72.21, but the highest selling rate fell 43 cents to $93.57 with the lowest selling rate holding at $87. The highest buying rate for the British Pound, rose 20 cents to $170, the lowest buying rate was down 50 cents to $134.71 but the highest selling rate declined $1.34 to $173.66 and the lowest selling rate fell 60 cents to $162.30.

Highs & Lows| The highest buying rate for the US dollar, declined 6 cents to $115.13. The lowest buying and the highest selling rates remained unchanged at $93.69 and $120.05, respectively and lowest selling rate rose $3.69 to $93.69. The highest buying rate for the Canadian dollar fell 50 cents to $92, the lowest buying rate remained at $72.21, but the highest selling rate fell 43 cents to $93.57 with the lowest selling rate holding at $87. The highest buying rate for the British Pound, rose 20 cents to $170, the lowest buying rate was down 50 cents to $134.71 but the highest selling rate declined $1.34 to $173.66 and the lowest selling rate fell 60 cents to $162.30.

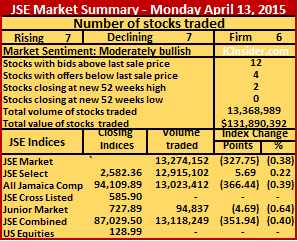

D&G at new high with $64m trade

Sagicor Investments bought the block as brokers for the buyer. Carreras was the other major traded to take place in the market with 1.3 million shares in ten separate trades. NCB Capital Market sold from in house inventory with Scotia Investments being the broker doing the vast majority of the buying. With the exception of 370 shares which traded at $43, the rest traded at $42.

Activity elsewhere on the Jamaica Stock Exchange, resulted in the prices of 7 stocks rising, 7 declining as 20 securities changed hands, ending in 13,368,989 units trading, valued at $131,890,39, in all market segments.

Main Market| The JSE Market Index lost 327.75 points to 85,319.89, the JSE All Jamaican Composite index fell 366.44 points to close at 94,109.89 and the JSE combined index dropped 351.94 points to close at 87,029.50

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 12 stocks with bids higher than their last selling prices and 4 with offers that were lower.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 12 stocks with bids higher than their last selling prices and 4 with offers that were lower.Carreras traded 1,300,000 at $42 for a $1 fall, Grace Kennedy with 47,691 shares closed trading at $63 for a $2 fall, Jamaica Money Market Brokers 7.50% preference share, closed with 250,000 units at $2.02, to record a 2 cents gain, Jamaica Producers Group lost $1.04 in trading only 200 shares and ended at $15.96. Sagicor Group traded 50,268 shares between $10.03 and $10.50 before closing at $10.50, Scotia Group ended up trading 354,932 shares for 45 cents higher at $22.50, Scotia Investments had 20,000 shares changing hands at $23 for a decline of 80 cents and Supreme Ventures closing with 36,120 units at $2.84, a decline of 11 cents.

Stocks with good interest to buy are Berger Paints with 200,000 units on the bid at $1.60, Jamaica Broilers with the bid at $4.50 to buy 239,065 shares, JMMB Group with 807,884 shares on the bid at $7.02. Jamaica Producers has buyers for 496,855 units at $15.96, Radio Jamaica 200,000 shares at $1.50, Sagicor Group 341,717 shares on the bid at $10.06 and Scotia Investments with the bid at $23 to buy 133,940 shares.

Stocks with good interest to buy are Berger Paints with 200,000 units on the bid at $1.60, Jamaica Broilers with the bid at $4.50 to buy 239,065 shares, JMMB Group with 807,884 shares on the bid at $7.02. Jamaica Producers has buyers for 496,855 units at $15.96, Radio Jamaica 200,000 shares at $1.50, Sagicor Group 341,717 shares on the bid at $10.06 and Scotia Investments with the bid at $23 to buy 133,940 shares.There is strong interest to sell Sagicor Real Estate X Fund with 1,400,000 being offered at $6.95 and Jamaica Money Market Brokers 8.75% preference share at $3.20 for 400,000 units.

7 junior stocks set to rise

At the close of the market, there were 7 stocks with bids higher than their last selling prices and only 1 with the offer that was lower. The junior market ended with 5 securities closing with no bids to buy and 12 securities that had no stocks being offered for sale. Noted amongst the stocks with higher bids are AMG Packaging with a bid of $2.50 against the last selling price of $2.26. The company reported 35 percent increase in 6 months profit and an even greater increase in the November quarter Caribbean Cream reported increased profit for the full year and the February quarter of $49 million or 13 cents for the twelve months and 5 cents for the quarter or $18 million. .

The bid for the stock is 66 cents versus the last price of 65 cents. Caribbean Flavours, Lasco Financial, Lasco Manufacturing and Medical Disposables all have bids higher than the last selling prices. The three Lasco companies should be reporting full year results at the end of April.

The bid for the stock is 66 cents versus the last price of 65 cents. Caribbean Flavours, Lasco Financial, Lasco Manufacturing and Medical Disposables all have bids higher than the last selling prices. The three Lasco companies should be reporting full year results at the end of April.Stocks trading in the junior market are, Cargo Handlers that gained 10 cents in trading 2,200 shares, to close at an all-time high of $20.10. Caribbean Producers with 2,100 units put on 5 cents to $2.35, Jamaican Teas gained 2 cents to end at $2.55 while trading 11,606 shares, 15,400 Lasco Distributors’ shares traded at $1.37 and Lasco Manufacturing lost 5 cents in closing at $1.05 while trading 63,531 shares.