Jamaica Stock Exchange Junior Market will soon have its 46 listed company on its board soon, and the 100 listed company on the overall exchange, with the latest offering to the public set to open on August 12 and comes to market, solidifying and highlighting the change taking place in Jamaica’s economy where a young team of individuals with a bright idea can raise funds in the market with minimal fixed assets.

OneonOne Educational Services comes to market the prospectus states to sell 380 million shares to raise around $359 million net of cost. In reality, the issue is really for 271 million shares if the lenders convert their loans to shares. Only 121.25 million will be available to the bulk of applicants as the rest is earmarked for selected groups including 108.7 million due to investors currently holding convertible loans as such no new funds will be coming from this group of investors resulting in just $279 million in fresh capital being raised before expenses estimated $30 million. The offer will raise the number of issued capital from 1.52 billion shares to 1.9 billion.

OneonOne Educational Services comes to market the prospectus states to sell 380 million shares to raise around $359 million net of cost. In reality, the issue is really for 271 million shares if the lenders convert their loans to shares. Only 121.25 million will be available to the bulk of applicants as the rest is earmarked for selected groups including 108.7 million due to investors currently holding convertible loans as such no new funds will be coming from this group of investors resulting in just $279 million in fresh capital being raised before expenses estimated $30 million. The offer will raise the number of issued capital from 1.52 billion shares to 1.9 billion.

The company has a lot in common with the recent listing of EduFocal both being in the education area using technology to deliver the service to customers thus keeping cost low and profit margins high, but it is more slanted currently in serving the corporate sector. The company that started operating in 2015 is highly profitable and benefitted from the lockdown of the economies in the Caribbean region in the aftermath of the discovery of covid-19 that resulted in schools and many businesses being closed or operating at a lower capacity.

The service is a fully remote educational technology which delivers personalized education primarily to enterprises, governments, and individuals across the Caribbean and Latin American region. The company appears to be a provider of technological infrastructure for itself and clients as opposed to be the primary supplier of learning information, as opposed to what the name suggests. In keeping with the change in service offering, the name seems set to be changed from that of educational services to one that is less restrictive in perception.

The founders have been able to win the support of some heavy hitters within the business community, with Michael G. Bernard, former CEO of Carreras holding the position of Chairman, Douglas Orane as the mentor.

Ricardo Allen CEO of One to One

The Company was founded by Ricardo Allen, Rory White, Stephen Barnes and Christopher Rochester, to deliver large-scale personalized education through the utilization of advances in learning technology which employs sophisticated statistical algorithms, the prospectus states. They were later joined by R. Danvers Williams, Michael Bernard, Douglas Orane, John Bailey, Ian Forbes and the C.B. Facey Foundation and Sagicor Group through the Sagicor Sigma Funds.

As the date of this Prospectus, it is the intention of the Company to use the proceeds to further capitalize on the demand for its services across the region and to deliver on key long-term strategic contracts by continuing to invest in software development to meet the demand for their services.

In the past, the company provided contracts that involved one-time income and recurring annual income that have an average contract length of three years – which continued to generate revenues in 2021 along with a new product “Class-room in a Box” to provide offline content to individuals and schools. As of August 2021, 63 percent of the Company’s revenue was gained through these Business to Business contracts, and 37 percent through the Company’s end user consumers business line.

For the financial year 2020, a net profit of $55.4 million was generated compared to a loss of $9.7 million in 2019. The increase in profits the company states was due to new contracts acquired in response to the COVID-19 pandemic by providing services to the education sectors in Jamaica and other Caribbean territories. For 2021 net profit increased 21.75 percent to $67.5 million over 2020. The Company says it was able to negotiate long-term contracts with clients which provide stability in revenues.

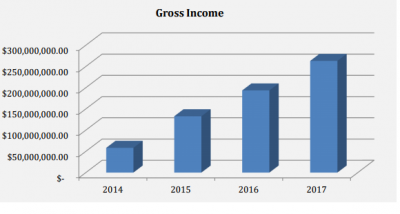

Revenues moved from $27.8 million in 2017 to $269 million in 2021 with the latter rising a significant $104 million over the $128.5 million in 2020. Revenues for 2019 ended at $36 million. For the nine months to May this year, revenues rose 24 percent to $194 million over the similar period in 2021, with a profit of $49 million pretax, up from $15 million in 2021.

The company projects revenues to hit $334 million by the end of the financial year to August with pretax profits of $105 million which would equate to earnings per share of 6.9 cents, with profits being free of taxation when listed on the Junior Market. The company states that the projected fourth quarter revenues of $140 million include existing contracts that are scheduled to produce $101 million in revenues over the 3-month period to August 2022 and an additional $39 million in revenues which are expected from the conversion of deals that are within the sales pipeline, from all indication the company seems on track to achieve this target with the fourth quarter appearing to reflect seasonality in revenues.

The earnings work out at a PE ratio of 14.5 just above the market average of 12.9 Based on where recent IPOs are valued investors can look for a price after listing around $1.50 but investors have priced many of them closer to 30 times 2022 earnings in which case a price of $2 is not out of the reckoning.

A highly welcomed feature of the prospectus is the projected income statement that shows figures for the 2025 fiscal year. Looking further ahead, the Company projects to retain $160 million in current contracts and recurring users, representing 37 percent of 2023 projected revenue, which suggests revenues of $433 million and a profit of $141 million for earnings per share of 7.5 cents with a PE of 14.2. For the fiscal year 2025, revenues are projected to reach $662 million, with a profit of $180 million, but the outcome may be vastly different than forecast. The forecast ICInsider.com gathers may be conservative, with Junior Market IPO candidates in the past enjoying a big jump in business flowing from the publicity associated with the IPO. ICInsider.com expects the IPO will provide a bounce to the company’s business.

Negatives, at the end of May, receivables amounted to $127 million 65 percent of revenues or close to eight months of revenues, which is not good and could lead to a high level of bad debts in the future, there are no comments in the prospectus to explain the high level of debt due, but the audit statements shows very little provision for expected credit loss, suggesting that management and the auditors consider the amounts to be collectable. Information gleaned by this publication suggests that there is an amount of around $60 million of the amount that the payment is differed based on certain conditions being met.

Another negative is amounts due from directors of $22.5 million, which is up from $14.5 million in August 2021 and $8 million in 2020, increased each year since 2017 when it was at $994,627. The audited financial statements state that the amount “is unsecured, interest free and have no fixed repayment terms.” The income tax law will treat these amounts as liable to taxes as they could be regarded as a distribution, there is no indication of arrangements that are in place to have the amount repaid mentioned in the prospectus.

ICInsider.com does not see the reason for the loans being converted to shares being a part of the IPO rather than for the shares being issued prior to the IPO and therefore reflects a more publicly acceptable picture of the wider public getting a higher percent of the issue than how it is currently presented. All of the above presents a picture to the discerning public, a view of a board with the majority being young and inexperienced and a sign of weakness going forward if not addressed early.

The directors of the company are Michael Bernard, chairman, Ricardo Allen, John Bailey holds a University of South Florida MBA degree in Business Administration, Karen Vaz has a BA degree and is vice president of HR and Information Technology at PanJam Group, Andrew Tyrone Wilson has BSC in Banking and Finance, Mischa McLeod-Hines has an MBA degree and is Vice President Capital Markets – Sagicor Investments and Andrew Dr Carol Granston, Instructional Designer and has served in the field of Education and Training for over thirty years.

The listing of the shares will be within a week from the closing of the issue. The broker for the offer is Sagicor Investments.

Subscribers for shares in the public offer of 74,062,500 Ordinary Shares in

Subscribers for shares in the public offer of 74,062,500 Ordinary Shares in

The directors of

The directors of

The public offer was oversubscribed by more than 10.5 times.

The public offer was oversubscribed by more than 10.5 times.