The markets are changing, with the Main Market up for three consecutive weeks but the Junior Market meandering for the last four weeks. Against this backdrop, there was one change to the TOP10, with iCreate coming in and Dolla Financial falling out, but Dolla and Honey Bun, that slipped out the previous week, sit immediately below the TOP10.

There were no significant winners for the past week in both markets’ TOP10 as losers dominated. The Junior market had Consolidated Bakeries falling 11 percent to $2.17 and general Accident down 10 percent to $5.40 and Lasco Distributors down 3 percent, with the stock selling at just 5.5 times 2023 estimated earnings and only 8.5 times the company’s nine month results. By any stretch, the stock is considerably undervalued and there are more profits to come in the current fiscal year.

There were no significant winners for the past week in both markets’ TOP10 as losers dominated. The Junior market had Consolidated Bakeries falling 11 percent to $2.17 and general Accident down 10 percent to $5.40 and Lasco Distributors down 3 percent, with the stock selling at just 5.5 times 2023 estimated earnings and only 8.5 times the company’s nine month results. By any stretch, the stock is considerably undervalued and there are more profits to come in the current fiscal year.

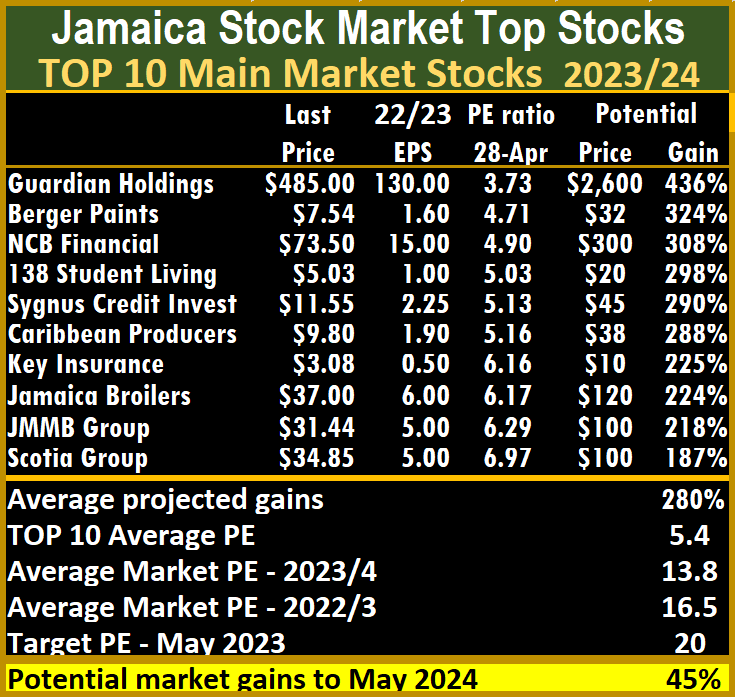

Main Market stocks had a 13 percent fall in Key Insurance after the price closed at $3.08, Berger Paints contracted by 9 percent to $7.54 and 138 Student Living slipped 5 percent to $5.03, while Jamaica Broilers rose just 3 percent to $37.

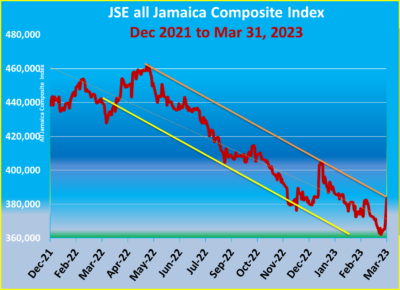

Stocks are being prepped to rally, with early signals that interest rates will be declining across the board sooner than later. This stems from the continued slide of rates on BOJ CDs since March, that saw the rate falling by 23 percent to 8.11 percent against a background where inflation since November last year is running at less than one percent per annum.

At the week’s close, Image Plus released full year results showing profit after tax jumping 125.6 percent to $213 million or 21 cents per share. ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously.

At the week’s close, Image Plus released full year results showing profit after tax jumping 125.6 percent to $213 million or 21 cents per share. ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index this past week, with the supply of some stocks falling sharply.

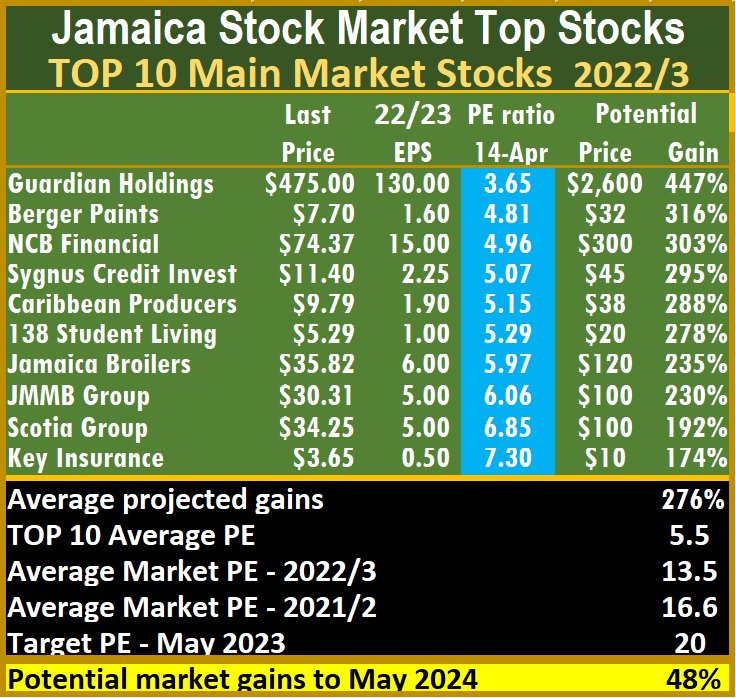

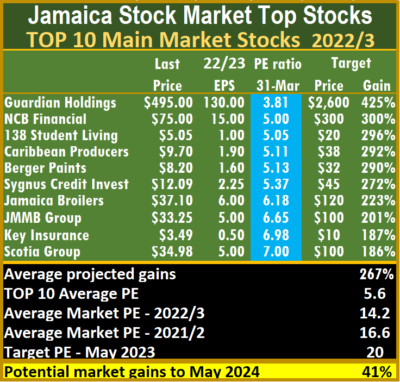

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.4, well below the market average of 13.8, while the Junior Market Top 10 PE sits at 5.9 compared with the market at 11.6. The differences are important indicators of the level of likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 257 percent and the Main Market TOP10 by an average of 280 percent to May 2024, based on 2023 forecasted earnings.

The Junior Market has 11 stocks representing 23 percent of the market, with PEs from 15to 27, averaging 21, well above the market’s average. The top half of the market has an average PE of 17, suggesting that this may currently be the lowest fair value for Junior Market stocks.

The 18 highest valued Main Market stocks are priced at a PE of 15 to 115, with an average of 29 and 20 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

The 18 highest valued Main Market stocks are priced at a PE of 15 to 115, with an average of 29 and 20 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index this past week, with the supply of some stocks falling sharply.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index this past week, with the supply of some stocks falling sharply. The 16 highest valued Main Market stocks are priced at a PE of 15 to 114, with an average of 31 and 21 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

The 16 highest valued Main Market stocks are priced at a PE of 15 to 114, with an average of 31 and 21 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

Honey Bun’s return to the TOP10 Junior Market list this past week should enjoy increased investors’ interest with an expected jump in revenues and profits for the first quarter with the Easter coming at the beginning of April versus the 17th of April last year as well as improvement of gross profit margin that slipped last year.

Honey Bun’s return to the TOP10 Junior Market list this past week should enjoy increased investors’ interest with an expected jump in revenues and profits for the first quarter with the Easter coming at the beginning of April versus the 17th of April last year as well as improvement of gross profit margin that slipped last year. The above average shows the extent of potential gains for the TOP 10 stocks.

The above average shows the extent of potential gains for the TOP 10 stocks.

Another positive development is the average inflation rate running at 45 percent less than the same time last year and averaging 2.4 percent per annum since November last year. Foreign exchange inflows have been strong, with the NIR growing at $66 million in February and 220 million in March, putting it at a record end of month level as initial data suggest that tourism arrivals and foreign exchange generated by that industry exceed the similar period in 2019, the last year without the impact of covid-19 negatively affecting the sector. On top of those positive developments, corporate profits are expected to enjoy a good bounce for the majority of companies for the first quarter.

Another positive development is the average inflation rate running at 45 percent less than the same time last year and averaging 2.4 percent per annum since November last year. Foreign exchange inflows have been strong, with the NIR growing at $66 million in February and 220 million in March, putting it at a record end of month level as initial data suggest that tourism arrivals and foreign exchange generated by that industry exceed the similar period in 2019, the last year without the impact of covid-19 negatively affecting the sector. On top of those positive developments, corporate profits are expected to enjoy a good bounce for the majority of companies for the first quarter.

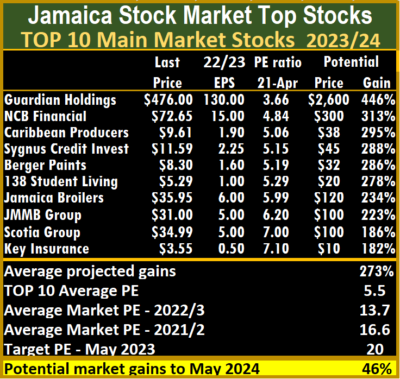

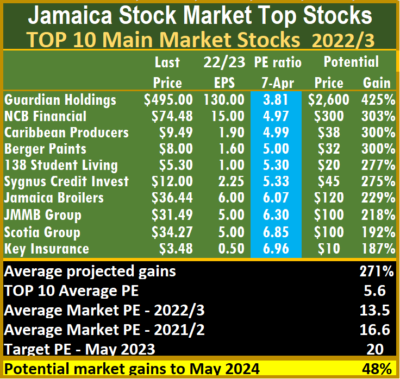

Main Market TOP 10 is 5.6, well below the market average of 13.5, while the Junior Market Top 10 PE sits at 5.7 compared with the market at 11.1. The differences are important indicators of the likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 256 percent and the Main Market TOP10, an average of 271 percent, to May 2024, based on 2023 forecasted earnings.

Main Market TOP 10 is 5.6, well below the market average of 13.5, while the Junior Market Top 10 PE sits at 5.7 compared with the market at 11.1. The differences are important indicators of the likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 256 percent and the Main Market TOP10, an average of 271 percent, to May 2024, based on 2023 forecasted earnings. The above average shows the extent of potential gains for the TOP 10 stocks.

The above average shows the extent of potential gains for the TOP 10 stocks.

At the end of the past week, in the Junior Market TOP10 four stocks gained and five declined. KLE Group jumped 16 percent to $1.69 and Tropical Battery rose 7 percent to close at $2.08. General Accident dropped 16 percent to $5 and Everything Fresh fell 6 percent to close at $1.45.

At the end of the past week, in the Junior Market TOP10 four stocks gained and five declined. KLE Group jumped 16 percent to $1.69 and Tropical Battery rose 7 percent to close at $2.08. General Accident dropped 16 percent to $5 and Everything Fresh fell 6 percent to close at $1.45. The Main Market 19 highest valued stocks are priced at a PE of 15 to 115, with an average of 29 and 21 excluding the most valued stocks and 20.5 for the top half excluding the stocks with the highest valuation.

The Main Market 19 highest valued stocks are priced at a PE of 15 to 115, with an average of 29 and 21 excluding the most valued stocks and 20.5 for the top half excluding the stocks with the highest valuation.