The Junior Market ICTOP15 is set for a significant upward climb over the next 15 months as solid economic growth continues and interest rates pull back in 2023. There will be a considerable uptick in Tourism arrivals for the winter season as the sector delivers record performance as it will have fully recovered from the disrupter to the industry in 2020 and deliver record revenues and profits for several companies.

The Junior Market ICTOP15 is set for a significant upward climb over the next 15 months as solid economic growth continues and interest rates pull back in 2023. There will be a considerable uptick in Tourism arrivals for the winter season as the sector delivers record performance as it will have fully recovered from the disrupter to the industry in 2020 and deliver record revenues and profits for several companies.

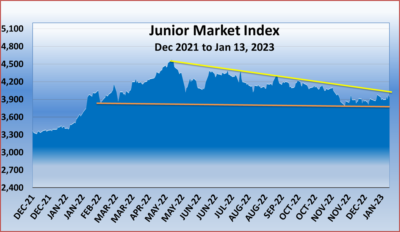

The Junior Market delivered gains for 31 companies in 2022 but underperformed expectations even as the value of shares traded jumped 130 percent to $16.34 billion in 2022 from just $7.1 billion in 2021.

Junior Market Index showing the market in consolidation mode since November ahead of a breakout.

The value of stocks trading in the first 11 months was higher than the previous year, with only December being lower than 2021. Trading slowed in the last three months, helped by new IPOs that pulled funds from the market. Interestingly, the market did not reflect much adverse reaction to the rise in interest rates in 2022.

In the first nine trading days of 2023, the value of stocks traded on the Junior Market rose 15 percent to $172.6 million, up from $149.8 million over the first nine trading days in 2022, and running well ahead of the last month of 2022. That this is unfolding against the drag of higher interest rates sends a powerful message of what lies ahead for the market. Admittedly, there were just 41 listed companies on the exchange at the start of 2022 compared with 47 in 2023, which is a nearly 15 percent increase, and is running well ahead of the last month of 2022. That the increased trading is happening against the drag of higher interest rates sends a powerful message of what lies ahead for the market—the clearest indicator of a booming tourism industry.

The surest sign that prices are heading higher for the Junior Market is that it currently trades around a PE of 13 based on 2022/23 earnings at the end of 2022, with the top 15 stocks representing 32 percent of the market, with PEsfrom 15 to 35, averaging 21, the average based on 2023/4 earnings is a mere 8.6 times.

This is the clearest sign of a boom time in Jamaica’s tourism industry.

Access Financial – EPS projected $2.65 and $4.25 for 2024.

The company suffered a major profit contraction from 2020 to 2022 due to increased loan loss provisions, the write-off of bad loans, and reduced lending. That seems to be behind them, with loans growing again and loan losses reduced.

Profit after Tax of $133 million for the six months ended September 2022, compared to $180 million for the prior period ended September 2021. This performance reflects a 7 percent increase in Operating Revenues in line with a growing loan portfolio. However, this was offset by a 14 percent increase in Operating costs due primarily to increased loan loss and provisions. Loans written off amount to $76 million, up from $58 million in 2021, while provisions fell from $61 million to $54 million.

Revenues for the September quarter from loan interest rose from $419 million to $446 million, but net fees and commission income on loans slipped from $107 million to $103 million and net profit ended at $55 million from $90 million in 2021.

Loans and advances now stand at $4.76 billion for September 2022, an increase of 9 percent year over year and 5.5 percent since March 2022, and reflecting an acceleration in the pace of lending, which augurs well for the second half, with the December quarter being the most critical period for growth.

The expected strong move in the stock price is expected in the latter part of 2024 with a big pick up in profits, investors should note that active selling in the stock is declining and if that continues, investors who want to buy into the stock will have to buy at increasing prices.

AMG Packaging back in ICTOP10

AMG Packaging Projection – EPS 50 cents for 2023

The company can deliver a gain of 350 percent in the stock price over the next 17 months. This is expected to flow from improvement in operations due to the installation of new equipment that became operational in the second quarter of 2022, allowing for greater efficiency and increased business opportunity. The company should benefit from cost reduction in some areas as prices of some inputs have declined since the 2022 results were released and should help improve profitability. With continued economic growth and restoration of the tourism industry, demand for boxes will grow and add to revenue with some cost reduction, as profit is expected to rise.

The fiscal year ended August produced a 41 per cent increase in revenues of $996 million over the 2021 outturn of $706 million with the fourth quarter rising 31 percent from $197 million to $257 million. Profit grew from $61 million in 2021 to $107 million for the 2022 fiscal year. Of note, operating profit for the fourth quarter increased 79 percent to $29.5 million, much faster than revenues—confirmation of input cost reduction also reflected in a decrease in its first quarter of the new year.

Caribbean Assurance Brokers – Projection EPS 30 cents for 2022 and 50 cents for 2023

The company earned a 10 percent increase in revenues of $432 million in the nine months to September 2022 compared to $392 million for 2021. For the third quarter, revenues rose 6 percent to $237 million over $224 million in the 2021 quarter.

Net profit amounted to $105 million for the nine months, while profit for the September quarter was flat with that of 2021 at $100 million. Expenses were well contained at $324 million for the nine months compared with $308 million to September 2021, but costs rose sharply from $121 million in the quarter to $136 million.

The growth trajectory suggests continued improvement in revenues going into 2023 that should contribute to a rise in profit. Recent financials show a picture of steady growth and there are no signs that will change in the short term, Investors will therefore need to understand how to play this stock in the short to medium term.

Caribbean Cream – EPS 2023 is 70 cents, and $1.30 for 2024

Caribbean Cream – EPS 2023 is 70 cents, and $1.30 for 2024

The company performed poorly in 2022, but there are signs in the September quarter results that things are on the mend operationally. After reporting good results for 2021 with a profit of $100 million to February, a slight loss was reported for the year to February 2022 as cost far outstripped growth in revenues—a development that the management never fully combatted.

If the company gets its house in order, it could be a stock to be reckoned with in 2023, despite a poor first half year in 2022 with revenues higher but lower profits than in 2021.

Revenues rose 22 percent to $1.25 billion for the half year to September 2022 compared to $1.03 billion in the previous year and by 33 percent for the quarter to $645 million, up from $486 million in 2021. Gross profit came in at $354 million for the half year, slightly down on the $371 million in the previous year, and the quarter raked in $189 million, a 24 percent increase above $153 million in the last year. While recovering some of the increased direct cost, the company is still not fully back to normal in the second quarter but is ahead of the first quarter. They faced increased prices across the board in various areas, with administrative expenses rising 14.5 percent for the half year and 21 percent in the second quarter, which they could not entirely pass on to the general public.

Notably, the second quarter numbers show an improving position over that of the first quarter and one would expect, all things being equal, the performance to carry over into the second half of the year with the final quarter, which covers the Christmas period, being the best and deliver growth in revenues and profits as a result.

The company continues to increase spending on capital expenditure to improve efficiency further. The financials show fixed assets at $1.35 billion from $858 million at the same time in 2021 and is up from $1.1 billion at the end of February 2022 as the company continues to spend to accommodate increased business activities.

Anthony Chang, Managing Director of Consolidated Bakeries

Consolidated Bakeries – EPS forecast 15 cents for 2022 and 55 cents for 2023.

The company reported impressive half year results that suggest a significant improvement in operations from a 35 percent rise in revenues. The third quarter showed continued strong growth in revenues of 21.5 percent. But that was inadequate to cover costs and resulted in a slight loss of $14.5 million in that period as distribution expenses surged $21 million over the previous year, wiping out more than an $11 million increase in gross profit. The company also suffered a reduction in gross margin in the September quarter, thus compounding the negative effect of increased costs. The December quarter usually delivers greater revenues than the September quarter and is expected to be profitable. With all the improvement in 2022, it is 2023 that should see marked improvement with a broader product range and strong growth in tourism and the local economy. In addition, some of the constraints in 2022 have started to dissipate with improved shipping and reduced cost from the Far East, which should help reduce costs in some areas of the company’s operations.

Dolphin Cove.

Dolphin Cove – EPS is projected at $2.30 for 2022 and $3.50 for 2023.

With the bulk of its income coming directly from the tourism industry, 2023 is going to be an excellent year for the company as the industry bounces back to normal levels that should see growth over 2019., the last full year of normalcy, and jump significantly over the first half of 2022 when the sector had 22 percent less stop over arrivals than in the same period for 2019. Visitor arrivals were up over 2019 in the latter part of 2022, suggesting a likely solid 53 percent jump in arrivals in the 2023 first quarter over that for 2022. The second quarter could equate to a 15 percent increase over the 2022 period and will profoundly impact revenues for the company.

The company stated in their third quarter results that they “ended the third quarter of the year with record financial results, with US$3.9 million in revenue, US$1.6 million more year over year and US$600,000 or 17 percent more, when compared to Q3-2019, which was the year before the pandemic. The flow of visitors to our parks has increased through the year – in Q3-2022, we welcomed double the number of guests in our parks than in Q3-2021 and 25 percent more than in Q3-2019. This is the second quarter with better attendance levels than in pre-pandemic times.”

Elite Diagnostic – EPS is projected at 50 cents for 2023 and $1 for 2024 for the September quarter; revenue increased $47 million from $141 million in the prior year to $188 million. Net profit for the quarter was $5.8 million compared to a loss of $515,000, an improvement of 1,229 percent over the corresponding period in the prior year, but would have been far greater except for increased cost to repair machines and downtime resulting in loss of revenues.

“We continue to record increased revenues in most areas which had significantly declined during the height of the Covid-19 pandemic. However, unforeseen machine downtime during the period under review has negatively impacted our budgetary projections.” The company estimated a shortfall of $25 million in gross revenues due to extensive down time during August and September.

Despite the revenue loss, the latest quarterly results show growth of $176 million over the June quarter, a visible company trend for some years.

The company reported that a branch is slated for Montego Bay in late 2023. The 2023/24 fiscal year could be the breakout for the stock as profits continue to climb upward.

Everything Fresh – EPS is projected at $2.30 for 2022 and $3.50 for 2023

The stock could gain 170 percent in price. The company that sells most of the goods to the tourism sector came off three years of significant losses. Some of which occurred because of the disastrous acquisition by the company. The COVID-19 pandemic impacted the company negatively as the tourism sector was shuttered and only started to come back seriously in 2021 and more so in 2022. This is not the only negative impact the company has overcome in improving the results in 2022. Investors should see even growth over 2019, which was the best period before the pandemic for the sector.

For the nine months to September, revenues jumped 76 percent from $1.079 billion to $1.9 billion and generated a profit of $41 million from a loss of $24 million in 2021. The third quarter recorded revenues of $630 million, a 29 percent increase over $495 million in 2021, and delivered a profit of $9 million from $3.5 million in 2021. Profit for 2022 should end up around 10 cents per share and 35 cents in 2023, with the rebound in the tourism sector giving above average push on revenues. The company benefitted from the bounce in the tourism trade, with much more to come in 2023, as the first quarter will see a big jump in visitor arrivals over 2019 and 2022.

General Accident spreading wings

General Accident Insurance – EPS is projected at 70 cents for 2022 and $1.20 for 2023

For the nine months to September 2022, the company delivered after tax profit of $277 million with the Jamaican operation of General Accident writing premiums of $12 billion and contributing profit before Tax of $297 million. The Trinidad subsidiary registered premiums of $654 million, a 45 percent increase over the $451 million written for the prior year. The Barbados subsidiary wrote premiums of $291 million compared to $214 million for the preceding year. But the company expects the two subsidiaries to be in the black in 2022 and move into profit in 2023.

Investment income for the nine months ended September 2022 was $250 million compared to $148 million in the prior year. Notably, with interest rates trending upwards, there will be increases in consolidated investment income over the short to medium term.

Despite some concerns about the ability to get adequate reinsurance coverage, indications are that General Accident is in a healthy position and is poised to continue to do well and will record increased profits in 2022 and 2023 as operations in Barbados and Trinidad moved from a significant loss in 2021 to profit in 2022. In addition, the stock is an excellent one to hold for long-term investment purposes to benefit from continuous growth and high dividend payments.

Honey Bun – projected EPS of $1 per share for the 2023 fiscal year and $1.85 for 2024

Honey Bun – projected EPS of $1 per share for the 2023 fiscal year and $1.85 for 2024

Profit performance for the financial year to September was disappointing, with revenues surging sharply higher but increased cost eroded the revenue gains. It resulted in a mild reduction in profit for the year.

There are developments in the broader world economy that are set to result in cost reduction in some areas in 2023 that should contain cost increases and thus help deliver increased profit for the year.

For the year to August, revenues rose to $2.95 billion from $2.15 billion in 2021 and delivered a profit of $203 million, down from $219 million after taxation of $51 million and $72 million, respectively, and generated earnings per share of 43 cents versus 46 cents in 2021.

The most recent results ended a four-year run of increased profits, as cost pressure negated an impressive 38 percent surge in sales, but revenue growth pales in comparison to a 59 percent jump in raw material cost for the year, amongst other items reflecting major cost movements.

Gross profit margin fell from 48 percent over the last three years to 40 percent, but a combination of price adjustments and reduction in raw material cost should result in an improvement in the 2023 fiscal year. Raw material accounted for 29 percent of sales in 2021 but surged to 37 percent in the latest year, which will most likely be reversed in 2023. Selling and distribution costs rose 17 percent to $408 million from $348 million in the prior year. Administrative expenses jumped 32 percent to $531 million from $402 million in 2021. Depreciation jumped 25 percent to $91 million from $73 million. Staff costs rose 33 percent to $662 million, of which increased employment accounted for a portion as the number of employed persons climbed 7 percent from 219 to 235.

Lasco Distributors’ EPS is projected at 50 cents for fiscal 2023 and 65 cents for 2024

Increasing revenues by 11 percent to $12.9 billion, improving gross margin that rose more than revenues with a growth of 16 percent and cost containment, delivered a 20 percent increase in after tax profits for the nine months to September 2022. This growth should pick up steam in the second half as revenues and profit after Tax climbed faster in the second quarter of the current fiscal year than in the first by 13.5 percent and 33 percent, respectively. The gross profit margin in the second quarter came in at 17.4 percent versus 16.35 percent in 2021. With the Jamaican economy continuing to record growth above forecast with more to come, Lasco is positioned to take advantage of that.

The company lost its appeal against Pfizer and the legal bills for the defendant will have to be met by Lasco, which may not have been provided for in the half year results. This could weigh down profit in the third quarter, but the effects will be behind them for the 2024 results.

Lasco Financial – EPS is projected at 50 cents for fiscal 2023 and 90 cents for 2024

Revenues rose 12.5 percent to $623 million for the second quarter of 2022 from $554 million in 2021. According to the company, “the increase in income is largely due to the general increase in business transactions. Profit for the three months also exceeds 2021-2022 by $24.7 million, closing at $154 million. Revenues for the six months amount to $1.19 billion, an increase of just 3.7 percent increase over the prior year. For the six months under review, total expenses increased by 5 percent from $857 million to $900 million. The company stated that the administrative expenses increased in line with the expansion of services and growth.”

Profit after Tax for the six months rose 17 percent to $157 million, over $134 million generated in 2021, while the quarter ended at $74 million, 26 percent above the $59 million in 2021.

With the December quarter being one of their biggest for revenues and profit, they should enjoy a bounce in the final quarter of 2022. Although not cast in stone, performance for the current fiscal year is well indicated from the results to date; as such, the next fiscal year is all important.

Lasco Manufacturing – EPS is projected at 60 cents for fiscal 2023 and 80 cents for 2024

After languishing in the doldrums for three years, the company reminded investors that they are not dead and are roaring back to deliver decent growth in revenues and profit for the current fiscal year and into the next. ICI nsider.com expects that the stock that traded as high as $6 in 2021 will surpass this level sooner than later and deliver a handsome gain.

Profit growth accelerated 23 percent for the three months to September to $469 million from $380 million in 2021 and from a rise of 13 percent in the six months to September 2021 from $782 million to $883 million in 2022. Gross profit margin fell in the first quarter to 34 percent but rebounded to 37 percent in the second quarter, bringing the year to date margin to 36 percent compared to 37 percent the previous year, suggesting importantly, the company has now restored the margins to 2020 levels.

Revenues also accelerated 22.6 percent in the second quarter to $2.87 billion from $2.33 billion in 2021, from a growth of 17.5 percent for the six months to $5.47 billion from $4.66 billion. Gross profit rose 18.4 percent to $1.07 billion in the quarter from $870 million in 2021 and climbed 15.3 percent to $1.97 billion for the six months compared to $1.71 billion in 2021.

Operating expenses rose 18.5 percent to $378 million in the 2022 September quarter versus $319 million in the comparable quarter in 2021 and 10.75 percent to $690 million for the six months to September 2022 versus $623 million last year.

Paramount Trading logo

Paramount Trading – EPS projected at 35 cents for fiscal 2023 and 50 cents for 2024

The stock can deliver gains of 465 percent over the next 18 months, making it an attractive, undervalued candidate for acquisition with a view of picking up handsome gains.

A classic turnaround case that pushed the stock up 59 percent in 2022, with more to come in 2023 as profit continues to grow.

The company was poorly impacted by the closure of businesses in the country with the advent of the Covid-19 pandemic, resulting in reduced revenues and profit for the 2021 fiscal year. But it enjoyed a 19 percent bounce in revenues in 2022, with profit jumping to $174 million. It followed that up with a 61 percent increase in revenues for the August quarter, with profit growing to $85 million in 2022 from $19 million. Second quarter results show continued improvement in profit from revenues that climbed 50 percent in the November quarter to $601 million and 55 percent for the half year to $1.2 billion ahead of the 2021 period. Profit surged 126 percent to November quarter to $65 million and 212 percent for the half year to $149 million.

The latest two quarterly numbers send a positive message about the likely outcome for the 2023 performance and beyond.

Tropical Battery – EPS projected at 30 cents for fiscal 2023

The total recovery of the tourism industry is set to propel growth in the wider economy above normal levels in 2023, thus providing increased spending that should boost sales and profit for Tropical. The company had an outstanding 2022 fiscal year, with profits soaring 127 percent over 2021 from a 31 percent rise in revenues over 2021 to $2.63 billion from $1.997 billion in 2021. In addition, the company is raising capital to fund an acquisition that should add to income and profit.

ICInsider.com projects earnings of 30 cents per share for 2023, with the price moving towards a $5 to $6 region during the year.

Check out ICInsider.com Stocks to Watch list.