The JSE Main Market lost over 15,000 points in two days.

The Jamaica Stock Exchange closed another day of trading with prices mostly down and taking a big trunk of the market indices, with it declining for a second day by more than 7,000 points.

The Main Market of the At the close, the JSE All Jamaican Composite Index dived 7,617.05 points to 427,779.79, the JSE Market Index dropped 7,118.10 points to 389,754.82 and the JSE Financial Index slid 2.36 points to 106.

The market closed with 49 securities changing hands in the Main and US dollar markets with prices of 16 stocks advancing, 22 declining and 11 securities trading firm. The JSE Main Market activity ended with 44 securities accounting for 146,823,904 units valued at $296,270,700, in contrast to 53,531,710 units valued at $153,340,745 from 44 securities on Wednesday.

Radio Jamaica led trading with 95 million shares for 65 percent of total volume followed Trans Jamaican Highway, with 36.6 million units for 25 percent of the day’s trade and Wigton Windfarm with 7.7 million units for 5 percent market share. Other stocks trading more than one million units were Jamaica Broilers with 2.6 million units and Sagicor Select Financial Fund with 2.7 million units.

The Market closed with an average of 3,336,907 units valued at $6,733,425 for each security traded, in contrast to 1,216,630 units valued at an average of $3,485,017 on Wednesday. The average volume and value for the month to date amount to 1,022,515 units valued at $4,256,393 for each security changing hands, compared to 779,477 units valued at $3,967,296 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

The Market closed with an average of 3,336,907 units valued at $6,733,425 for each security traded, in contrast to 1,216,630 units valued at an average of $3,485,017 on Wednesday. The average volume and value for the month to date amount to 1,022,515 units valued at $4,256,393 for each security changing hands, compared to 779,477 units valued at $3,967,296 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows eleven stocks ending with bids higher than their last selling prices and six stocks closing with lower offers. The PE ratio of the market ended at 14.1, while the Main Market ended at 14.5 times 2020/21 earnings.

In the Main Market, Barita Investments shed 51 cents trading 25,513 units and closed at $56, Berger Paints exchanged 1,045 stock units at $12.62, with a loss of $1.38, Caribbean Cement gained $1 to finish at $49, in transferring 38,537 units. Eppley fell $2.20 to $14.80, with 31,034 units changing hands, Eppley Caribbean Property Fund declined by $2 to $34, after trading 3,920 stock units, Jamaica Producers closed 49 cents lower to $20 after swapping 4,497 units. Jamaica Stock Exchange ended at $22.17, with a loss of $1.43 in transferring 112,597 shares, JMMB Group added 78 cents to finish at $36.79, in an exchange of 55,004 shares,  Kingston Wharves picked up 42 cents and closed at $44, with 26,422 units changing hands. MPC Caribbean Clean Energy sustained a loss of $33 in swapping 499 units and closed at $150, NCB Financial Group fell 50 cents to $155.50 trading 35,964 units, PanJam Investment shed 85 cents to close at $75.98, with an exchange of 9,929 stock units. Portland JSX picked up 80 cents in trading only one stock unit to end at $8.90, Sagicor Group finished at $49.75, with a loss of 77 cents in exchanging 86,774 shares, Salada Foods closed at $28.50, after losing $4.95 in exchanging 10,299 units. Scotia Group gained 39 cents swapping 50,079 shares and closed at $47.89, Seprod climbed $2 to $46, with 18,441 units crossing the exchange, Stanley Motta slipped 38 cents to $4.62, in swapping 4,200 stock units and Victoria Mutual Investments ended at $7.50, with a loss of 30 cents while transferring 420,041 shares.

Kingston Wharves picked up 42 cents and closed at $44, with 26,422 units changing hands. MPC Caribbean Clean Energy sustained a loss of $33 in swapping 499 units and closed at $150, NCB Financial Group fell 50 cents to $155.50 trading 35,964 units, PanJam Investment shed 85 cents to close at $75.98, with an exchange of 9,929 stock units. Portland JSX picked up 80 cents in trading only one stock unit to end at $8.90, Sagicor Group finished at $49.75, with a loss of 77 cents in exchanging 86,774 shares, Salada Foods closed at $28.50, after losing $4.95 in exchanging 10,299 units. Scotia Group gained 39 cents swapping 50,079 shares and closed at $47.89, Seprod climbed $2 to $46, with 18,441 units crossing the exchange, Stanley Motta slipped 38 cents to $4.62, in swapping 4,200 stock units and Victoria Mutual Investments ended at $7.50, with a loss of 30 cents while transferring 420,041 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading activity resulted in five securities changing hands, with one rising, one stock declining and three remaining unchanged, leading to the volume of 6,934,785 units changing hands with a value of US$80,338, in contrast to 648,937 units for US$25,614 on Wednesday.

Trading activity resulted in five securities changing hands, with one rising, one stock declining and three remaining unchanged, leading to the volume of 6,934,785 units changing hands with a value of US$80,338, in contrast to 648,937 units for US$25,614 on Wednesday. At the close, the T&T Composite Index gained 0.03 points to 1,260.48. The All T&T Index rose 0.06 points to end at 1,681.79 while the Cross Listed Index was unchanged at 113.50.

At the close, the T&T Composite Index gained 0.03 points to 1,260.48. The All T&T Index rose 0.06 points to end at 1,681.79 while the Cross Listed Index was unchanged at 113.50. Losers│ Angostura Holdings fell 46 cents to a 52 weeks’ low of $14, with 1,000 stock units crossing the market, Guardian Holdings lost 5 cents transferring 20,030 shares and closed at $17.95 and Scotiabank shed 10 cents to end at $54.60, with an exchange of 1,177 stock units.

Losers│ Angostura Holdings fell 46 cents to a 52 weeks’ low of $14, with 1,000 stock units crossing the market, Guardian Holdings lost 5 cents transferring 20,030 shares and closed at $17.95 and Scotiabank shed 10 cents to end at $54.60, with an exchange of 1,177 stock units. The market closed with 50 securities changing hands in the Main and US dollar markets with prices of nine stocks advancing, 28 declining and 13 securities trading firm. The JSE Main Market activity ended with 44 securities accounting for 53,531,710 units valued at $153,340,745, in contrast to 21,215,763 units valued at $102,509,485 from 46 securities on Tuesday.

The market closed with 50 securities changing hands in the Main and US dollar markets with prices of nine stocks advancing, 28 declining and 13 securities trading firm. The JSE Main Market activity ended with 44 securities accounting for 53,531,710 units valued at $153,340,745, in contrast to 21,215,763 units valued at $102,509,485 from 46 securities on Tuesday. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. NCB Financial Group declined by $2 to $156 transferring 98,627 shares, PanJam Investment picked up 83 cents to close at $76.83, after trading 24,331 units, Proven Investments climbed $2.95 to $37 after exchanging 940 units. Sagicor Group dropped $2.98 to end at $50.52, after trading 179,780 shares, Sagicor Real Estate Fund gained 41 cents to close at $7.99, with 41,292 units changing hands. Salada Foods closed at $33.45, after climbing $5.05 in swapping a mere 120 units. Scotia Group shed 45 cents to finish at $47.50 in transferring 17,694 units, Seprod lost $3 to end at $44, with an exchange of 33,846 units, Stanley Motta lost 65 cents to close at $5, in swapping 36,575 stock units. Supreme Ventures dropped $1.99 to $17, after trading 131,365 shares, Victoria Mutual Investments ended at $7.80, with a loss of $1.20 in transferring 518,294 shares and Wisynco Group fell by $2.49 to $17, with 667,525 shares changing hands.

NCB Financial Group declined by $2 to $156 transferring 98,627 shares, PanJam Investment picked up 83 cents to close at $76.83, after trading 24,331 units, Proven Investments climbed $2.95 to $37 after exchanging 940 units. Sagicor Group dropped $2.98 to end at $50.52, after trading 179,780 shares, Sagicor Real Estate Fund gained 41 cents to close at $7.99, with 41,292 units changing hands. Salada Foods closed at $33.45, after climbing $5.05 in swapping a mere 120 units. Scotia Group shed 45 cents to finish at $47.50 in transferring 17,694 units, Seprod lost $3 to end at $44, with an exchange of 33,846 units, Stanley Motta lost 65 cents to close at $5, in swapping 36,575 stock units. Supreme Ventures dropped $1.99 to $17, after trading 131,365 shares, Victoria Mutual Investments ended at $7.80, with a loss of $1.20 in transferring 518,294 shares and Wisynco Group fell by $2.49 to $17, with 667,525 shares changing hands. The market ended with 648,937 shares trading valued at US$25,614, in contrast to 285,192 units for US$123,486 on Tuesday, as one stock rose, one declined, leaving four unchanged. The PE ratio of the market closed with an average of 13.7 times 2020 earnings.

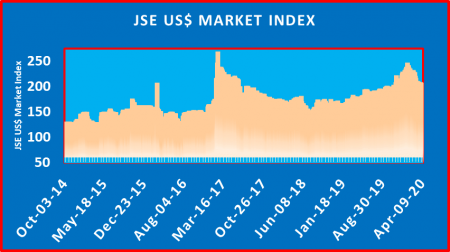

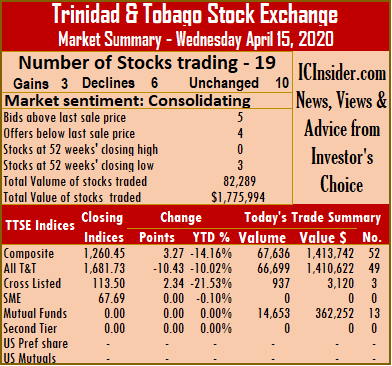

The market ended with 648,937 shares trading valued at US$25,614, in contrast to 285,192 units for US$123,486 on Tuesday, as one stock rose, one declined, leaving four unchanged. The PE ratio of the market closed with an average of 13.7 times 2020 earnings. The T&T Composite Index rose 3.27 points to 1,260.45. The All T&T Index dropped 10.43 points to end at 1,681.73 while the Cross Listed Index gained 2.34 points at 113.50.

The T&T Composite Index rose 3.27 points to 1,260.45. The All T&T Index dropped 10.43 points to end at 1,681.73 while the Cross Listed Index gained 2.34 points at 113.50. Firm Trades│ Ansa Merchant Bank closed at $36.30, with an exchange of 30 units, Calypso Macro Index Fund traded 370 units at $15.88, First Citizens transferred 806 stock units at $38.15, JMMB Group closed with a transfer 500 units at $2. Massy Holdings remained at $50, in an exchange of 1,733 stock units, National Flour closed at $1.20, with 10,700 shares crossing the market. Point Lisas swapped 130 units at $3.45, Republic Financial Holdings traded unchanged at $135, with 100 units changing hands and Unilever Caribbean traded 9,032 shares at $18.02.

Firm Trades│ Ansa Merchant Bank closed at $36.30, with an exchange of 30 units, Calypso Macro Index Fund traded 370 units at $15.88, First Citizens transferred 806 stock units at $38.15, JMMB Group closed with a transfer 500 units at $2. Massy Holdings remained at $50, in an exchange of 1,733 stock units, National Flour closed at $1.20, with 10,700 shares crossing the market. Point Lisas swapped 130 units at $3.45, Republic Financial Holdings traded unchanged at $135, with 100 units changing hands and Unilever Caribbean traded 9,032 shares at $18.02.

The Market closed with an average of 461,212 units valued at $2,228,467 for each security traded, in contrast to 909,064 units valued at an average of $10,809,850 on Thursday. The average volume and value for the month to date amount to 728,184 units valued at $4,031,021 for each security changing hands, compared to 765,512 units valued at $4,319,932 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

The Market closed with an average of 461,212 units valued at $2,228,467 for each security traded, in contrast to 909,064 units valued at an average of $10,809,850 on Thursday. The average volume and value for the month to date amount to 728,184 units valued at $4,031,021 for each security changing hands, compared to 765,512 units valued at $4,319,932 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Jamaica Stock Exchange ended $2.39 higher at $24.74, after swapping 16,514 units, JMMB Group closed at $39, with gains of $1 exchanging 73,496 shares. MPC Caribbean Clean Energy soared $44 to $184, with 375 stock units crossing the exchange, 138 Student Living added 30 cents to reach $7, in transferring 52,564 units, Proven Investments fell $3.95 to $34.05, in swapping 185,350 shares. Sagicor Group closed $2.50 higher to $53.50, in an exchange of 60,754 units, Scotia Group gained 35 cents to finish at $47.95 after trading 20,574 stock units, Seprod declined by $2 to $47, with 101,771 shares changing hands. Supreme Ventures rose $1.99 to $18.99, in transferring 65,409 shares, Sygnus Credit Investments shed 40 cents trading 153,409 shares and closed at $17.60 and Wisynco Group added 49 cents to end at $19.49, with 336,917 shares crossing the exchange.

Jamaica Stock Exchange ended $2.39 higher at $24.74, after swapping 16,514 units, JMMB Group closed at $39, with gains of $1 exchanging 73,496 shares. MPC Caribbean Clean Energy soared $44 to $184, with 375 stock units crossing the exchange, 138 Student Living added 30 cents to reach $7, in transferring 52,564 units, Proven Investments fell $3.95 to $34.05, in swapping 185,350 shares. Sagicor Group closed $2.50 higher to $53.50, in an exchange of 60,754 units, Scotia Group gained 35 cents to finish at $47.95 after trading 20,574 stock units, Seprod declined by $2 to $47, with 101,771 shares changing hands. Supreme Ventures rose $1.99 to $18.99, in transferring 65,409 shares, Sygnus Credit Investments shed 40 cents trading 153,409 shares and closed at $17.60 and Wisynco Group added 49 cents to end at $19.49, with 336,917 shares crossing the exchange.

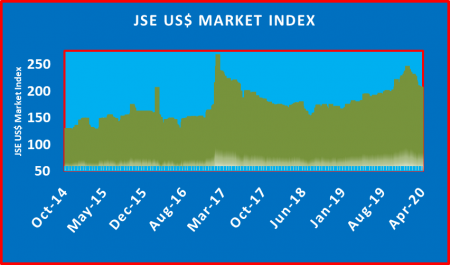

The market closed with three stocks rising, the price of one declining and three stocks closing unchanged. The market ended with 285,192 units valued at US$123,486 changing hands, in contrast to 147,823 units for US$12,944 on Thursday from just three stocks. At the close, the market index gained 0.62 points to end at 202.99 and the PE ratio ended at an average of 13.6 times 2020 earnings.

The market closed with three stocks rising, the price of one declining and three stocks closing unchanged. The market ended with 285,192 units valued at US$123,486 changing hands, in contrast to 147,823 units for US$12,944 on Thursday from just three stocks. At the close, the market index gained 0.62 points to end at 202.99 and the PE ratio ended at an average of 13.6 times 2020 earnings. The T&T Composite Index gained 1.38 points to 1,257.18. The All T&T Index rose 2.75 points to end at 1,692.16 while the Cross Listed Index was unchanged at 111.16.

The T&T Composite Index gained 1.38 points to 1,257.18. The All T&T Index rose 2.75 points to end at 1,692.16 while the Cross Listed Index was unchanged at 111.16. Trinidad & Tobago NGL climbed 99 cents to $19.50, with 39,090 shares changing hands.

Trinidad & Tobago NGL climbed 99 cents to $19.50, with 39,090 shares changing hands.

The Market closed with an average of 909,064 units valued at $10,809,850 for each security traded, in contrast to 543,596 units valued at $2,706,411 on Wednesday. The average volume and value for the month to date amount to 765,512 units valued at $4,319,932 for each security changing hands, compared to 745,075 units valued at $3,238,279 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

The Market closed with an average of 909,064 units valued at $10,809,850 for each security traded, in contrast to 543,596 units valued at $2,706,411 on Wednesday. The average volume and value for the month to date amount to 765,512 units valued at $4,319,932 for each security changing hands, compared to 745,075 units valued at $3,238,279 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Portland JSX exchanged 16,000 units and rose 80 cents to end at $8.10. Proven Investments shed 50 cents to finish at $38, in swapping 3,000 shares, Sagicor Group picked up 50 cents to reach $51, with an exchange of 5,271,009 stock units, Salada Foods dropped $4.30 to close at $28.40 trading 121,898 shares. Seprod added $1 and closed at $49, after transferring 26,237 units, Supreme Ventures exchanged 201,920 shares after rising 99 cents to close at $17, Sygnus Credit Investments traded 147,833 shares and gained 50 cents to end at $18. Victoria Mutual Investments ended at $9, with gains of $1 after trading 858,125 shares and Wisynco Group closed $1.50 higher at $19, in exchanging 2,848,031 shares.

Portland JSX exchanged 16,000 units and rose 80 cents to end at $8.10. Proven Investments shed 50 cents to finish at $38, in swapping 3,000 shares, Sagicor Group picked up 50 cents to reach $51, with an exchange of 5,271,009 stock units, Salada Foods dropped $4.30 to close at $28.40 trading 121,898 shares. Seprod added $1 and closed at $49, after transferring 26,237 units, Supreme Ventures exchanged 201,920 shares after rising 99 cents to close at $17, Sygnus Credit Investments traded 147,833 shares and gained 50 cents to end at $18. Victoria Mutual Investments ended at $9, with gains of $1 after trading 858,125 shares and Wisynco Group closed $1.50 higher at $19, in exchanging 2,848,031 shares.