For the second consecutive day, Main Market stocks moved ahead of the previous day’s close, with the JSE index surpassing 388,000 points in early on Wednesday, just as it played out on Tuesday, with the market failing to hang to the gains at the close of trading.

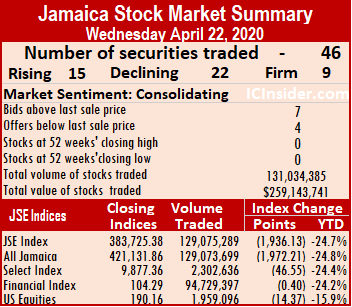

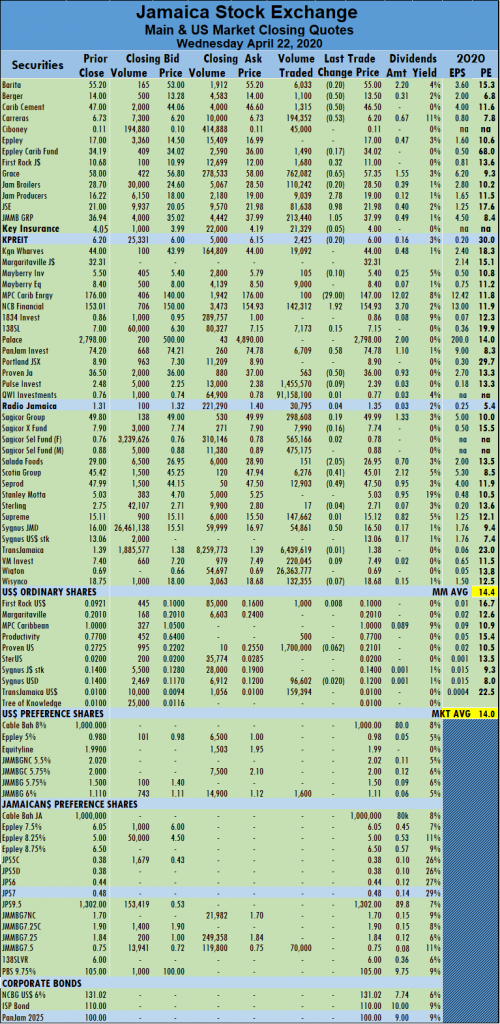

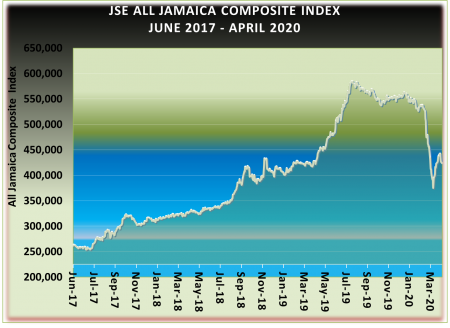

At the close, the JSE All Jamaican Composite Index declined by 1,972.21 points to 421,131.86, the JSE Market Index fell 1,936.13 points to 383,725.38 and the JSE Financial Index slid 0.40 points to 104.29. The Main Market has gone seven days without closing with gains in the Indices.

At the close, the JSE All Jamaican Composite Index declined by 1,972.21 points to 421,131.86, the JSE Market Index fell 1,936.13 points to 383,725.38 and the JSE Financial Index slid 0.40 points to 104.29. The Main Market has gone seven days without closing with gains in the Indices.

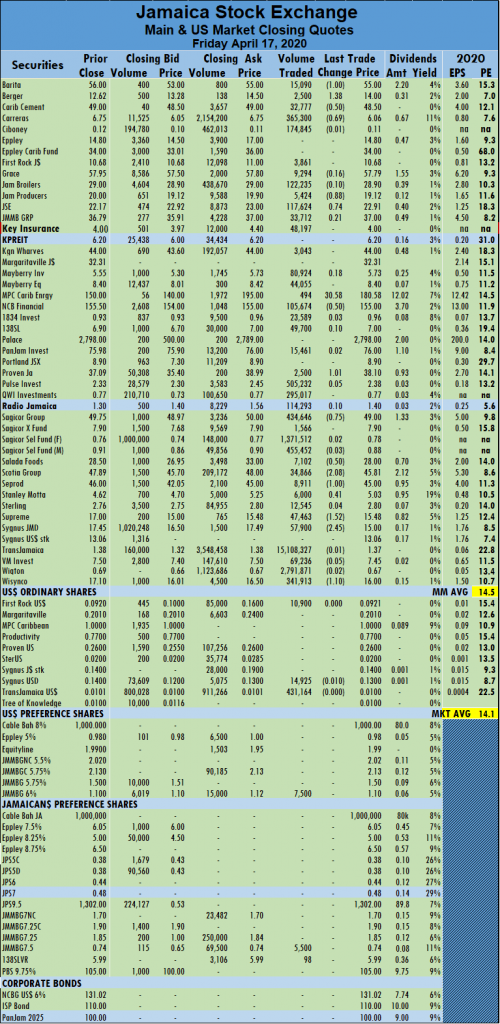

The market closed with 46 securities changing hands in the Main and US dollar markets with prices of 15 stocks advancing, 23 declining and eight securities trading firm. The JSE Main Market activity ended with 40 securities accounting vastly higher volume and value that on Tuesday as 129,075,289 units valued at $205,583,712 crossed the market, in contrast to 33,848,653 units valued at $70,459,639 from 39 securities on Tuesday.

QWI Investments led trading with 91.2 million shares for 70.6 percent of total volume, followed by Wigton Windfarm with 26.4 million units for 20.4 percent of the day’s trade and Trans Jamaican Highway with 6.4 million units for 5 percent market share. Pulse Investments was the only other stock trading more than one million units, as it ended trading with 1.46 million units.

The Market closed with an average of 3,226,882 units valued at $5,139,593 for each security traded, in contrast to 867,914 units valued at an average of $1,806,657 on Tuesday. The average volume and value for the month to date amount to 1,105,053 units valued at $3,825,298 for each security changing hands, compared to 960,218 units valued at $3,728,658 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

The Market closed with an average of 3,226,882 units valued at $5,139,593 for each security traded, in contrast to 867,914 units valued at an average of $1,806,657 on Tuesday. The average volume and value for the month to date amount to 1,105,053 units valued at $3,825,298 for each security changing hands, compared to 960,218 units valued at $3,728,658 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows seven stocks ending with bids higher than their last selling prices and four stocks closing with lower offers. The PE ratio of the market ended at 14, while the Main Market ended at 14.4 times 2020/21 earnings.

In the Main Market, Berger Paints lost 50 cents to end at $13.50, in transferring 1,100 units, Caribbean Cement closed at $46.50, with a loss of 50 cents after exchanging 1,315 units, Carreras finished 53 cents lower at $6.20, after trading 194,352 shares. First Rock Capital gained 32 cents swapping 1,680 units and closing at $11, Grace Kennedy shed 65 cents to end at $57.35, with 762,082 shares crossing the exchange, Jamaica Producers climbed $2.78 to $19, with 9,039 stock units changing hands. Jamaica Stock Exchange rose 98 cents to end at $21.98, in trading 81,638 shares, JMMB Group ended at $37.99, with gains of $1.05 and the exchanging 213,440 stock units, MPC Caribbean Clean Energy declined by $29 to $147, in swapping 100 units. NCB Financial Group closed $1.92 higher to $154.93, after transferring 142,312 shares, PanJam Investment gained 58 cents and ended at $74.78, trading 6,709 stock units, Proven Investments closed 50 cents lower to $36, in exchanging 563 shares. Salada Foods fell by $2.05 to $26.95 trading 151 units, Scotia Group lost 41 cents to finish at $45.01, with an exchange of 6,276 stock units, Seprod closed with a loss of 49 cents in transferring 12,903 stock units to finish at $47.50 and Sygnus Credit Investments picked up 50 cents to end at $16.50, with 54,861 shares changing hands.

Jamaica Stock Exchange rose 98 cents to end at $21.98, in trading 81,638 shares, JMMB Group ended at $37.99, with gains of $1.05 and the exchanging 213,440 stock units, MPC Caribbean Clean Energy declined by $29 to $147, in swapping 100 units. NCB Financial Group closed $1.92 higher to $154.93, after transferring 142,312 shares, PanJam Investment gained 58 cents and ended at $74.78, trading 6,709 stock units, Proven Investments closed 50 cents lower to $36, in exchanging 563 shares. Salada Foods fell by $2.05 to $26.95 trading 151 units, Scotia Group lost 41 cents to finish at $45.01, with an exchange of 6,276 stock units, Seprod closed with a loss of 49 cents in transferring 12,903 stock units to finish at $47.50 and Sygnus Credit Investments picked up 50 cents to end at $16.50, with 54,861 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

The market closed with three stocks rising, four declining, while five stocks closed unchanged. Trading volume passing through the market was 122,510 shares valued at $2,132,461 compared to 128,175 shares for $6,531,309 on Tuesday.

The market closed with three stocks rising, four declining, while five stocks closed unchanged. Trading volume passing through the market was 122,510 shares valued at $2,132,461 compared to 128,175 shares for $6,531,309 on Tuesday. Republic Financial Holdings ended at $133, with a loss of 5 cents after swapping 98 stock units and Trinidad & Tobago NGL closed 9 cents lower at $16.90 after transferring 15,195 shares.

Republic Financial Holdings ended at $133, with a loss of 5 cents after swapping 98 stock units and Trinidad & Tobago NGL closed 9 cents lower at $16.90 after transferring 15,195 shares. Market activity resulted in six securities changing hands, with one stock rising, two declining and three left unchanged. The volume of shares traded was 1,959,096 units with a value of US$382,572, in contrast to 3,324,487 units for US$323,180 on Tuesday.

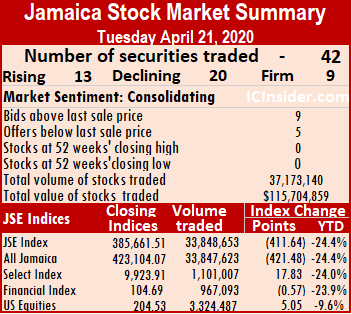

Market activity resulted in six securities changing hands, with one stock rising, two declining and three left unchanged. The volume of shares traded was 1,959,096 units with a value of US$382,572, in contrast to 3,324,487 units for US$323,180 on Tuesday. At the close of the market, the JSE All Jamaican Composite Index declined by 421.48 points to 423,104.07, the JSE Market Index fell 411.64 points to 385,661.51 and the JSE Financial Index lost 0.57 points to close at 104.69.

At the close of the market, the JSE All Jamaican Composite Index declined by 421.48 points to 423,104.07, the JSE Market Index fell 411.64 points to 385,661.51 and the JSE Financial Index lost 0.57 points to close at 104.69. The Market closed with an average of 867,914 units valued $1,806,657 for each security traded, in contrast to 755,502 units valued at an average of $1,774,456 on Monday. The average volume and value for the month to date amount to 960,218 units valued at $3,728,658 for each security changing hands, compared to 966,799 units valued at $3,877,090 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

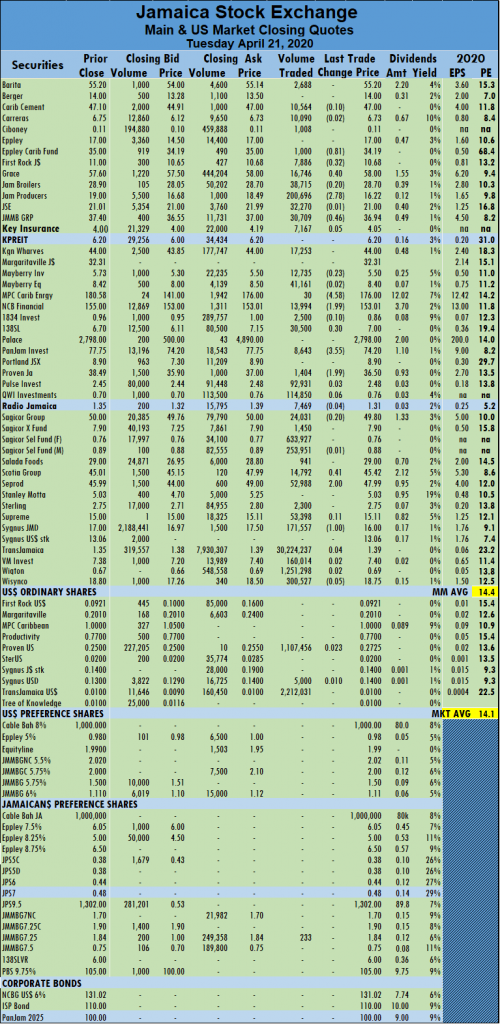

The Market closed with an average of 867,914 units valued $1,806,657 for each security traded, in contrast to 755,502 units valued at an average of $1,774,456 on Monday. The average volume and value for the month to date amount to 960,218 units valued at $3,728,658 for each security changing hands, compared to 966,799 units valued at $3,877,090 for each security traded. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Jamaica Producers fell by $2.78 to $16.22, after swapping 200,696 shares, JMMB Group shed 46 cents to finish at $36.94, with 30,709 shares changing hands, MPC Caribbean Clean Energy dropped to $176, with a loss of $4.58 trading a mere 30 units. NCB Financial Group declined $1.99 to $153.01, in transferring 13,994 stock units, 138 Student Living picked up 30 cents exchanging 30,500 shares and closed at $7, PanJam Investment ended the day at $74.20, after losing $3.55 after swapping 8,643 stock units. Proven Investments closed $1.99 lower to $36.50, with a transfer of 1,404 units, Scotia Group gained 41 cents to finish at $45.42, with an exchange of 14,792 units, Seprod added $2 to close at $47.99, in trading 52,988 shares and Sygnus Credit Investments closed at $16, with a loss of $1 after exchanging 171,557 shares.

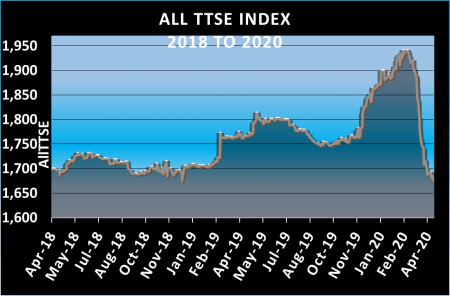

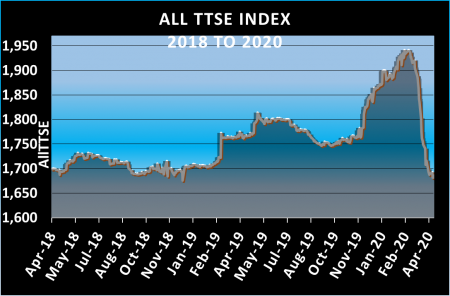

Jamaica Producers fell by $2.78 to $16.22, after swapping 200,696 shares, JMMB Group shed 46 cents to finish at $36.94, with 30,709 shares changing hands, MPC Caribbean Clean Energy dropped to $176, with a loss of $4.58 trading a mere 30 units. NCB Financial Group declined $1.99 to $153.01, in transferring 13,994 stock units, 138 Student Living picked up 30 cents exchanging 30,500 shares and closed at $7, PanJam Investment ended the day at $74.20, after losing $3.55 after swapping 8,643 stock units. Proven Investments closed $1.99 lower to $36.50, with a transfer of 1,404 units, Scotia Group gained 41 cents to finish at $45.42, with an exchange of 14,792 units, Seprod added $2 to close at $47.99, in trading 52,988 shares and Sygnus Credit Investments closed at $16, with a loss of $1 after exchanging 171,557 shares. At the close, the T&T Composite Index declined 5.59 points to 1,257.09, the All T&T Index dropped 11.10 points to end at 1,675.05 while the Cross Listed Index remained at 113.50.

At the close, the T&T Composite Index declined 5.59 points to 1,257.09, the All T&T Index dropped 11.10 points to end at 1,675.05 while the Cross Listed Index remained at 113.50. Republic Financial Holdings shed 50 cents in exchanging 241 units to close at $135 and Trinidad & Tobago NGL closed at $17, with a loss of 10 cents with 5,716 stock units changing hands.

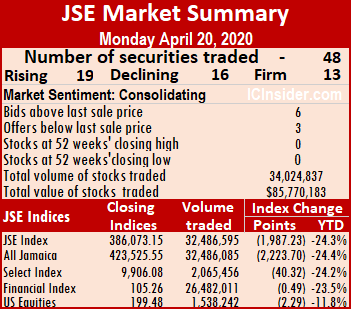

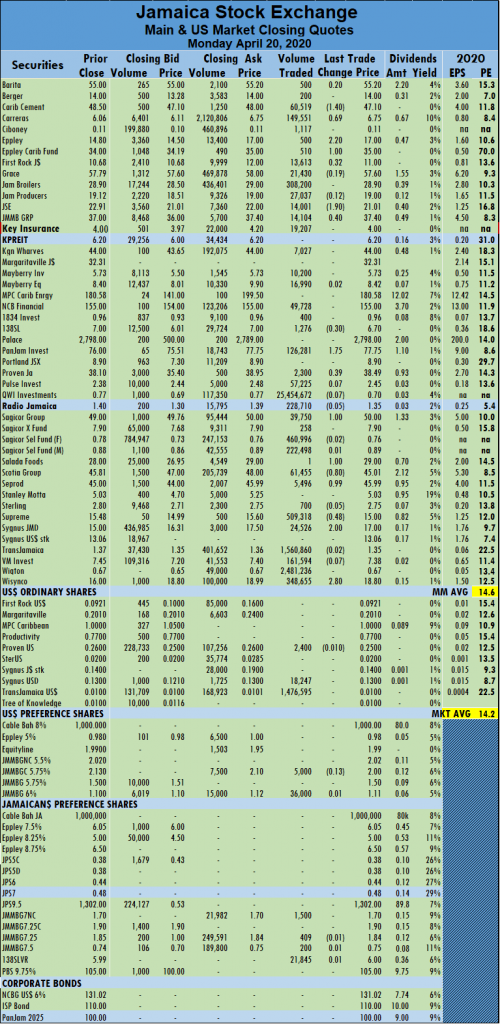

Republic Financial Holdings shed 50 cents in exchanging 241 units to close at $135 and Trinidad & Tobago NGL closed at $17, with a loss of 10 cents with 5,716 stock units changing hands. At the close, the JSE All Jamaican Composite Index declined by 2,223.70 points to 423,525.55, the JSE Market Index fell by 1,987.23 points to 386,073.15 and the JSE Financial Index lost 0.49 points to 105.26.

At the close, the JSE All Jamaican Composite Index declined by 2,223.70 points to 423,525.55, the JSE Market Index fell by 1,987.23 points to 386,073.15 and the JSE Financial Index lost 0.49 points to 105.26. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. 138 Student Living ended at $6.70, after a losing 30 cents swapping 1,276 units, PanJam Investment rose $1.75 to $77.75, with 126,281 shares changing hands. Proven Investments added 39 cents to finish at $38.49, with a transfer of 2,300 units, Sagicor Group closed at $50, after picking up $1 trading 39,750 shares, Salada Foods gained $1 swapping only I unit at $29. Scotia Group shed 80 cents to finish at $45.01, with an exchange of 61,455 shares, Seprod rose 99 cents to $45.99 trading 5,496 units, Supreme Ventures lost 48 cents transferring 509,318 shares to end at $15. Sygnus Credit Investments closed at $17, with gains of $2 swapping 24,526 stock units and Wisynco Group climbed $2.80 to $18.80, ending with 348,655 shares changing hands.

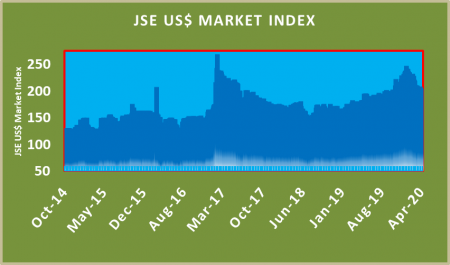

138 Student Living ended at $6.70, after a losing 30 cents swapping 1,276 units, PanJam Investment rose $1.75 to $77.75, with 126,281 shares changing hands. Proven Investments added 39 cents to finish at $38.49, with a transfer of 2,300 units, Sagicor Group closed at $50, after picking up $1 trading 39,750 shares, Salada Foods gained $1 swapping only I unit at $29. Scotia Group shed 80 cents to finish at $45.01, with an exchange of 61,455 shares, Seprod rose 99 cents to $45.99 trading 5,496 units, Supreme Ventures lost 48 cents transferring 509,318 shares to end at $15. Sygnus Credit Investments closed at $17, with gains of $2 swapping 24,526 stock units and Wisynco Group climbed $2.80 to $18.80, ending with 348,655 shares changing hands. Market activity resulted in five securities changing hands, with the price of one stock rising, two declining and two remaining unchanged. The volume of shares traded was 1,538,242 units value at US$67,633, in contrast to 464,489 units for US$15,549 on Friday. At the close, the market declined by 2.29 points to 199.48 and the PE ratio of the market closed with an average of 13.5 times 2020 earnings.

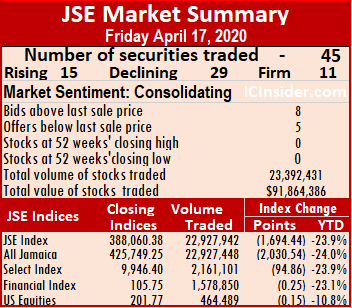

Market activity resulted in five securities changing hands, with the price of one stock rising, two declining and two remaining unchanged. The volume of shares traded was 1,538,242 units value at US$67,633, in contrast to 464,489 units for US$15,549 on Friday. At the close, the market declined by 2.29 points to 199.48 and the PE ratio of the market closed with an average of 13.5 times 2020 earnings. At the close, the JSE All Jamaican Composite Index declined by 2,030.54 points to 425,749.25, the JSE Market Index fell 1,694.44 points to 388,060.38 and the JSE Financial Index lost 0.25 points to 105.75.

At the close, the JSE All Jamaican Composite Index declined by 2,030.54 points to 425,749.25, the JSE Market Index fell 1,694.44 points to 388,060.38 and the JSE Financial Index lost 0.25 points to 105.75. IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows eight stocks ending with bids higher than their last selling prices and five stocks closing with lower offers. The PE ratio of the market ended at 14.1, while the Main Market ended at 14.5 times 2020/21 earnings.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows eight stocks ending with bids higher than their last selling prices and five stocks closing with lower offers. The PE ratio of the market ended at 14.1, while the Main Market ended at 14.5 times 2020/21 earnings. MPC Caribbean Clean Energy jumped by $30.58 after transferring 494 units to end at $180.58, NCB Financial Group shed 50 cents to close at $155, with an exchange of 105,674 shares, Proven Investments picked up $1.01 to finish at $38.10, in swapping 2,500 units. Sagicor Group closed at $49, with a loss of 75 cents with 434,646 shares crossing the exchange, Salada Foods lost 50 cents after swapping 7,102 units at $28, Scotia Group fell by $2.08 to $45.81, with a transfer of 34,866 stock units. Seprod dropped $1 to close at $45, in trading 8,911 units, Stanley Motta picked up 41 cents to finish at $5.03, in exchanging 6,000 units, Supreme Ventures ended at $15.48, with a loss of $1.52 and the swapping of 47,463 shares. Sygnus Credit Investments closed at $15, after losing $2.45 trading 57,900 shares and Wisynco Group ended the exchanging of 341,913 stock units at $16, with a loss of $1.10.

MPC Caribbean Clean Energy jumped by $30.58 after transferring 494 units to end at $180.58, NCB Financial Group shed 50 cents to close at $155, with an exchange of 105,674 shares, Proven Investments picked up $1.01 to finish at $38.10, in swapping 2,500 units. Sagicor Group closed at $49, with a loss of 75 cents with 434,646 shares crossing the exchange, Salada Foods lost 50 cents after swapping 7,102 units at $28, Scotia Group fell by $2.08 to $45.81, with a transfer of 34,866 stock units. Seprod dropped $1 to close at $45, in trading 8,911 units, Stanley Motta picked up 41 cents to finish at $5.03, in exchanging 6,000 units, Supreme Ventures ended at $15.48, with a loss of $1.52 and the swapping of 47,463 shares. Sygnus Credit Investments closed at $15, after losing $2.45 trading 57,900 shares and Wisynco Group ended the exchanging of 341,913 stock units at $16, with a loss of $1.10. Market activity resulted in four securities changing hands, with the price of one stock rising, two stocks declining and one remaining unchanged at the close. Trading accounted for just 464,489 units with a value of US$15,549, in contrast to 6,934,785 units for US$80,338 on Thursday.

Market activity resulted in four securities changing hands, with the price of one stock rising, two stocks declining and one remaining unchanged at the close. Trading accounted for just 464,489 units with a value of US$15,549, in contrast to 6,934,785 units for US$80,338 on Thursday. The volume of stocks passing through the market climbed to 1,005,498 units valued at $14,272,854 from the trading 12 securities, compared to 109,579 shares for $7,714,973 from 14 securities on Thursday. The market closed with two stocks rising and one declining, while nine were unchanged with the T&T Composite Index gaining 2.20 points to end at 1,262.68. The All T&T Index rose advanced by 4.36 points to end at 1,686.15 while the Cross Listed Index remained at 113.50.

The volume of stocks passing through the market climbed to 1,005,498 units valued at $14,272,854 from the trading 12 securities, compared to 109,579 shares for $7,714,973 from 14 securities on Thursday. The market closed with two stocks rising and one declining, while nine were unchanged with the T&T Composite Index gaining 2.20 points to end at 1,262.68. The All T&T Index rose advanced by 4.36 points to end at 1,686.15 while the Cross Listed Index remained at 113.50. Losers│ Clico Investments shed 20 cents to finish at $24.90, after the transfer of 197 stock units.

Losers│ Clico Investments shed 20 cents to finish at $24.90, after the transfer of 197 stock units.