Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the volume of stocks exchanged declining 60 percent after 10 percent fewer dollars changed hands than on Monday, resulting in trading in eight securities, compared to seven on Monday with prices of three rising, three declining and two ending unchanged.

The market closed with an exchange of 180,495 shares for US$53,094 from 452,800 units at US$59,221 on Monday.

The market closed with an exchange of 180,495 shares for US$53,094 from 452,800 units at US$59,221 on Monday.

Trading averaged 22,562 units at US$6,637 versus 64,686 shares at US$8,460 on Monday, with a month to date average of 52,795 shares at US$6,559 compared to 57,731 units at US$6,546 on the previous day and January with an average of 42,169 units for US$5,037.

The US Denominated Equities Index popped 1.76 points to end at 255.60.

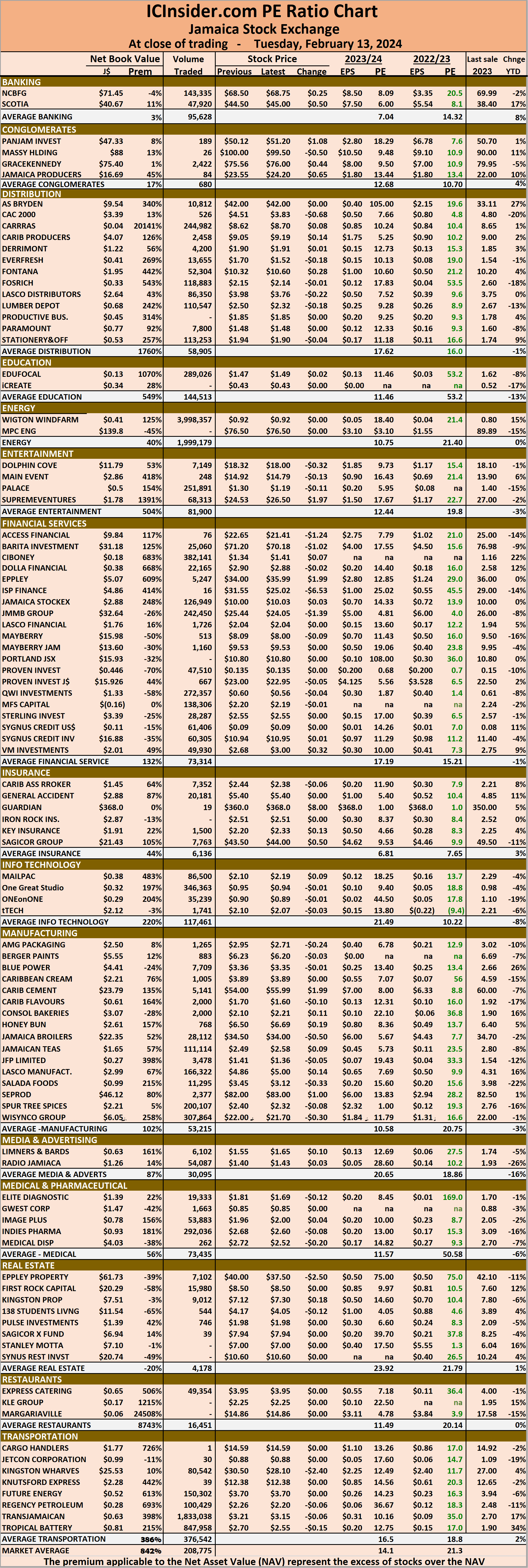

The PE Ratio, a measure used in computing appropriate stock values, averages 10.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share climbed 0.62 of one cent to end at 4.7 US cents after an exchange of 1,080 shares, Proven Investments rose 0.01 of a cent to 13.5 US cents with a transfer of 47,510 units, Sterling Investments fell 0.24 of a cent and ended at 1.61 US cents as investors exchanged 3,066 shares.  Sygnus Credit Investments ended at 8.9 US cents, with 61,406 stock units changing hands, Sygnus Real Estate Finance USD share dipped 0.3 of a cent to close at 6.7 US cents with an exchange of 4,935 shares and Transjamaican Highway remained at 2 US cents with traders dealing in 25,000 stock units.

Sygnus Credit Investments ended at 8.9 US cents, with 61,406 stock units changing hands, Sygnus Real Estate Finance USD share dipped 0.3 of a cent to close at 6.7 US cents with an exchange of 4,935 shares and Transjamaican Highway remained at 2 US cents with traders dealing in 25,000 stock units.

In the preference segment, JMMB Group US8.5% preference share gained 0.17 of a cent and ended at US$1.05 while exchanging 37,408 units and Productive Business Solutions 9.25% preference share sank 42 cents in closing at US$11.06 with investors transferring 90 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading declined on JSE USD Market

Flat profit at Wisynco Group

Wisynco Group reported flat profits of $1.2 billion, in the December quarter, from revenues that grew 9.3 percent to $13.25 billion from $12.1 billion in 2022, while revenues rose by 12 percent from $24 billion for the half year to December 2022 to $27 billion in the six months to December 2023, with profits rising nearly 11 percent to $2.77 billion from $2.5 billion in 2022.

Other operating and finance income made a solid contribution to profits with the December quarter reporting $228 million up from $144 million in 2022 and for the half year to December $452 million from $287 million in 2022.

Gross profit margin fell in the second quarter to 33.3 percent, down from 34.7 percent for the same quarter last year, with a Gross Profit of $4.4 billion, 4.7 percent greater than the $4.2 billion of the prior year’s second quarter. According to the company’s management, “this key performance indicator was also adversely affected by the production constraints in November and December 2023 which effectively caused a lower absorption of our fixed costs and limited our product mix for optimal shopper takeup.” The half year performance saw a Gross profit of $9.2 billion up 8 percent from $8.5 billion and the gross profit margin slipped to 34.2 percent versus 35.5 percent in 2022.

Selling and distribution expenses for the quarter amounted to $2.6 billion or 13 percent more than the $2.3 billion for the corresponding quarter of the prior year and rose per cent to $5 billion for the half year from $4.4 billion in 2022.

Wata one of Wisynco best known brands

Administrative expenses climbed 14 percent in the second quarter and for the year to date to $502 million for the second quarter from $439 million in 2022 and $1 billion for the half year from $894 million in 2022. Finance costs fell to $17 million in the second quarter from $99 million in 2022 and for the half year, it declined from $249 million to just $21 million.

For the year to December, earnings per share attributable to stockholders of the group was 32 cents for the quarter and 74 cents for the half year, up from 67 cents in 2020. ICInsider.com’s projection is for earnings of $1.80 per share in 2024, with the stock now trading at $22 with a PE of 12.

Since December 2022 the group added $3 billion to fixed assets and now has loans of $3.6 billion, with cash and investments standing at $11.5 billion and shareholders’ equity of $24 billion.

The Company declared a dividend of 23 cents per share payable to shareholders on March 7.

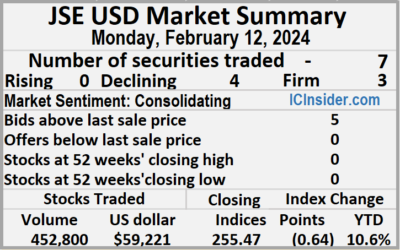

Slippage for JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with the volume of stocks changing hands jumping 528 percent after a 1,990 percent surge in the amount of US dollars that changed hands compared to Friday, resulting in trading in seven securities, compared to five on Friday and ended with no price gains, after four stocks declined and three ended unchanged.

The market closed with trading of 452,800 shares for US$59,221 up from 72,092 units at just US$2,833 on Friday.

The market closed with trading of 452,800 shares for US$59,221 up from 72,092 units at just US$2,833 on Friday.

Trading averaged 64,686 units at US$8,460 versus 14,418 shares at US$567 on Friday, with a month to date average of 57,731 shares at US$6,546 compared with 56,572 units at US$6,228 on the previous trading day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index lost 0.80 points to wrap up trading at 255.39.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Proven Investments ended at 13.49 US cents with investors dealing in 2,184 stocks, Sterling Investments dipped 0.15 of a cent to 1.85 US cents in an exchange of 5,366 units,  Sygnus Credit Investments remained at 8.9 US cents, with 1,050 shares crossing the market and Transjamaican Highway fell 0.05 of a cent to close at 2 US cents with traders dealing in 403,502 stock units.

Sygnus Credit Investments remained at 8.9 US cents, with 1,050 shares crossing the market and Transjamaican Highway fell 0.05 of a cent to close at 2 US cents with traders dealing in 403,502 stock units.

In the preference segment, JMMB Group US8.5% preference share sank 10.17 cents and ended at US$1.0483, with 39,898 shares crossing the exchange, Sygnus Credit Investments US 8% ended at US$10.50 with investors swapping 100 stock units and Sygnus Credit Investments E8.5% dipped 75 cents in closing at US$11 after an exchange of 700 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Two Lasco companies head to JSE Main Market

Lasco Distributors and Lasco Manufacturing will be graduating to the main market of the Jamaica Stock Exchange, effective Wednesday, March 27, 2024.

The companies state in their report to investors and posted on the Jamaica Stock Exchange stated that the exchange approved to graduate to the Main Market.

The Lasco companies were some of the early listings on the Junior Market in 2010, with a listing on October 12, 2010.

In the first year of listing on the Junior Market, Lasco Manufacturing generated revenues of $2.97 billion and a profit of $401 million after tax and reported for the nine months to December last year, revenues of $9.24 billion and profit of $1.7 billion, with Shareholders’ equity climbing to $12.3 billion from $830 million at the end of March 2011.

Lasco Distributors reported revenues of $6.76 billion and a profit of $306 million after tax for the year to March 2011 and generated revenues of $21.86 billion for the nine months to December last year and profit of $1.2 billion, with Shareholders’ equity climbing to $9.25 billion from $727 million at the end of September 2010.

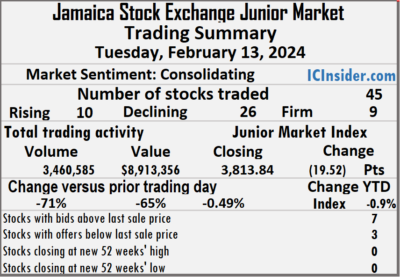

The market closed with an exchange of 3,460,585 shares for $8,913,356 down from 11,955,696 units at $25,250,753 on Monday.

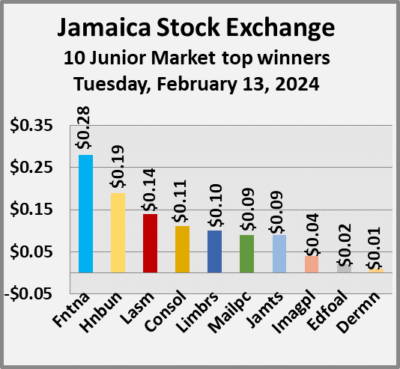

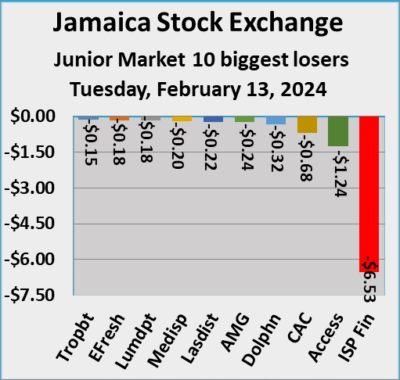

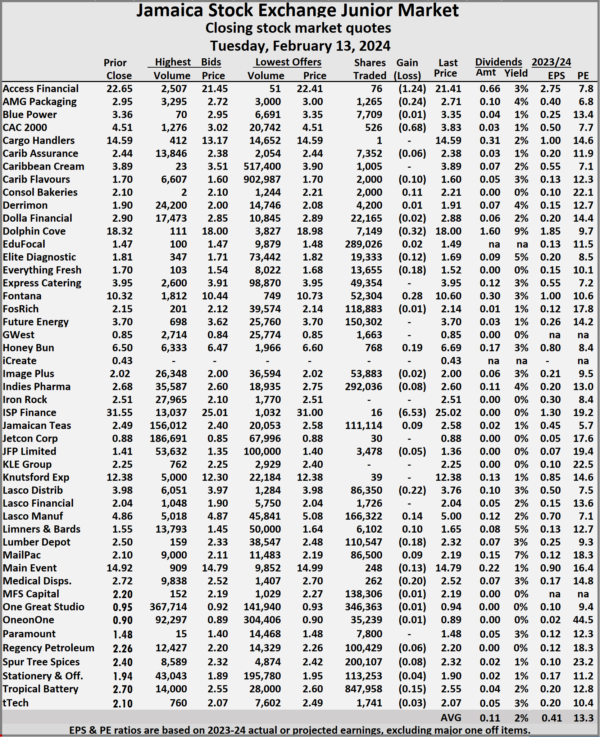

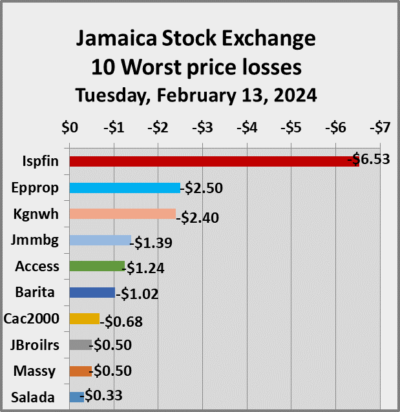

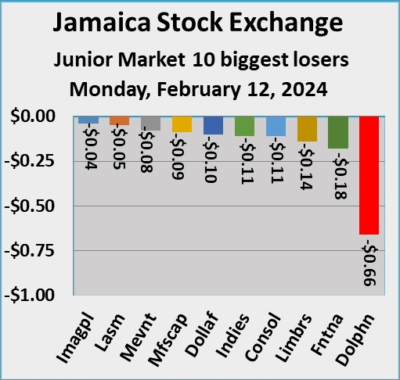

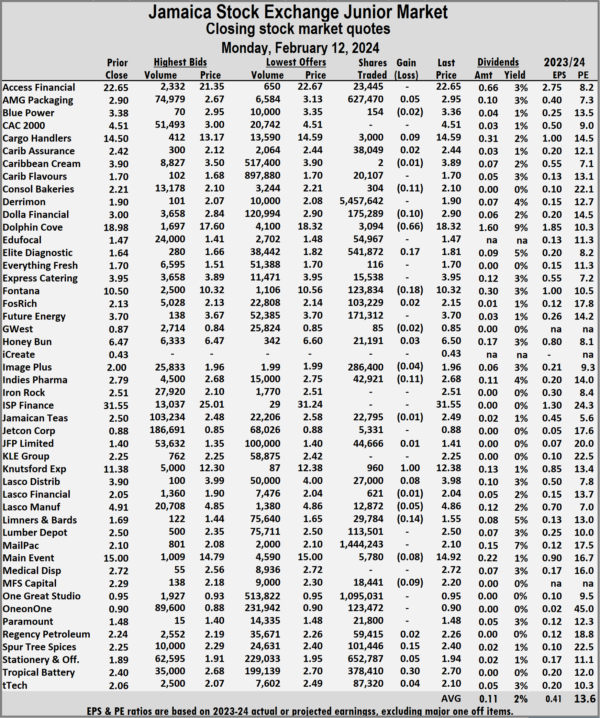

The market closed with an exchange of 3,460,585 shares for $8,913,356 down from 11,955,696 units at $25,250,753 on Monday. At the close, Access Financial dropped $1.24 to close at $21.41 with investors dealing in a mere 76 stock units, AMG Packaging shed 24 cents to close at $2.71 in an exchange of 1,265 shares, CAC 2000 declined 68 cents to end at $3.83 with traders dealing in 526 units. Caribbean Flavours lost 10 cents in closing at $1.60, with 2,000 stocks crossing the market, Consolidated Bakeries increased 11 cents and ended at $2.21 with investors trading 2,000 shares, Dolphin Cove skidded 32 cents to $18 and closed with an exchange of 7,149 units. Elite Diagnostic sank 12 cents in closing at $1.69 after a transfer of 19,333 stocks, Everything Fresh dipped 18 cents and ended at $1.52 in trading 13,655 stock units, Fontana climbed 28 cents to close at $10.60 after 52,304 shares passed through the market. Honey Bun rose 19 cents to end at $6.69 with investors transferring 768 stocks, Indies Pharma fell 8 cents in closing at $2.60 in an exchange of 292,036 units, ISP Finance dropped $6.33 to $25.02 with 16 stock units clearing the market. Jamaican Teas rallied 9 cents and ended at $2.58 with a transfer of 111,114 shares,

At the close, Access Financial dropped $1.24 to close at $21.41 with investors dealing in a mere 76 stock units, AMG Packaging shed 24 cents to close at $2.71 in an exchange of 1,265 shares, CAC 2000 declined 68 cents to end at $3.83 with traders dealing in 526 units. Caribbean Flavours lost 10 cents in closing at $1.60, with 2,000 stocks crossing the market, Consolidated Bakeries increased 11 cents and ended at $2.21 with investors trading 2,000 shares, Dolphin Cove skidded 32 cents to $18 and closed with an exchange of 7,149 units. Elite Diagnostic sank 12 cents in closing at $1.69 after a transfer of 19,333 stocks, Everything Fresh dipped 18 cents and ended at $1.52 in trading 13,655 stock units, Fontana climbed 28 cents to close at $10.60 after 52,304 shares passed through the market. Honey Bun rose 19 cents to end at $6.69 with investors transferring 768 stocks, Indies Pharma fell 8 cents in closing at $2.60 in an exchange of 292,036 units, ISP Finance dropped $6.33 to $25.02 with 16 stock units clearing the market. Jamaican Teas rallied 9 cents and ended at $2.58 with a transfer of 111,114 shares,  Lasco Distributors fell 22 cents to close at $3.76 after an exchange of 86,350 stock units, Lasco Manufacturing popped 14 cents to end at $5 after trading 166,322 stocks. Limners and Bards gained 10 cents in closing at $1.65 with an exchange of 6,102 units, Lumber Depot fell 18 cents to $2.32, with 110,547 shares crossing the market, Mailpac Group advanced 9 cents to end at $2.19 with investors exchanging 86,500 stock units, ahead of the company announcing the acquisition of MyCart Express, a Jamaican based courier service company. Main Event dipped 13 cents to close at $14.79 in switching ownership of 248 stocks, Medical Disposables sank 20 cents and ended at $2.52, with 262 stock units crossing the exchange, Spur Tree Spices shed 8 cents to $2.32 with investors swapping 200,107 shares and Tropical Battery declined 15 cents in closing at $2.55 after exchanging 847,958 units after the company reported a solid 45 percent growth in their first quarter profit.

Lasco Distributors fell 22 cents to close at $3.76 after an exchange of 86,350 stock units, Lasco Manufacturing popped 14 cents to end at $5 after trading 166,322 stocks. Limners and Bards gained 10 cents in closing at $1.65 with an exchange of 6,102 units, Lumber Depot fell 18 cents to $2.32, with 110,547 shares crossing the market, Mailpac Group advanced 9 cents to end at $2.19 with investors exchanging 86,500 stock units, ahead of the company announcing the acquisition of MyCart Express, a Jamaican based courier service company. Main Event dipped 13 cents to close at $14.79 in switching ownership of 248 stocks, Medical Disposables sank 20 cents and ended at $2.52, with 262 stock units crossing the exchange, Spur Tree Spices shed 8 cents to $2.32 with investors swapping 200,107 shares and Tropical Battery declined 15 cents in closing at $2.55 after exchanging 847,958 units after the company reported a solid 45 percent growth in their first quarter profit. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

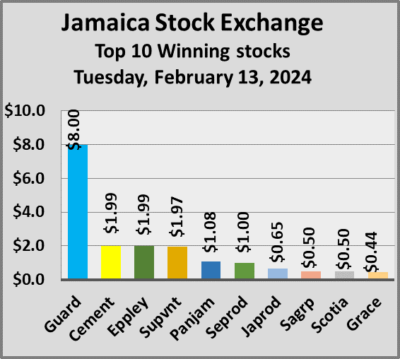

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the Combined Market Index shed 524.55 points to close at 347,021.46, the All Jamaican Composite Index advanced by 93.57 points to 370,839.06, the JSE Main Index sank 377.08 points to close at 334,406.36. The Junior Market Index fell 19.52 to 3,813.32. The JSE Main & Junior markets rose 0.21 points to 255.60.

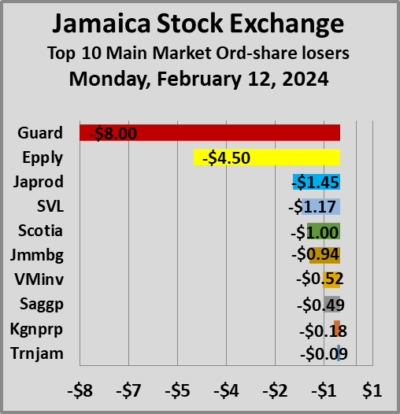

At the close of trading, the Combined Market Index shed 524.55 points to close at 347,021.46, the All Jamaican Composite Index advanced by 93.57 points to 370,839.06, the JSE Main Index sank 377.08 points to close at 334,406.36. The Junior Market Index fell 19.52 to 3,813.32. The JSE Main & Junior markets rose 0.21 points to 255.60. The major declining Main Market stocks are Eppley Caribbean Property Fund that fell $2.50 to close at $37.50, JMMB Group shedding $1.39 in closing at $24.05 and Kingston Wharves dropping $2.40 and ending at $28.10.

The major declining Main Market stocks are Eppley Caribbean Property Fund that fell $2.50 to close at $37.50, JMMB Group shedding $1.39 in closing at $24.05 and Kingston Wharves dropping $2.40 and ending at $28.10. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

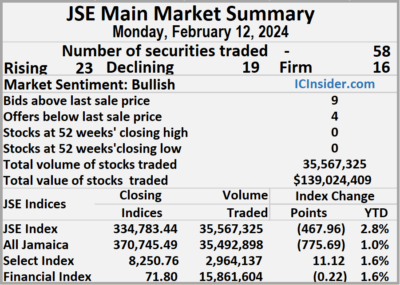

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed with 35,567,325 shares trading for $139,024,409 up from 15,118,549 units at $85,008,912 on Friday.

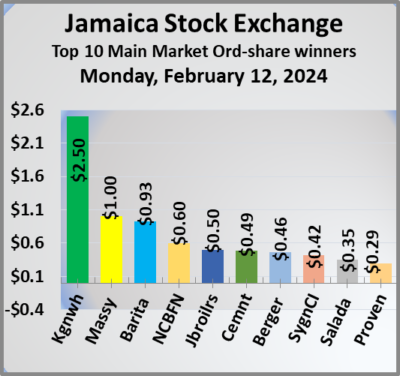

The market closed with 35,567,325 shares trading for $139,024,409 up from 15,118,549 units at $85,008,912 on Friday. The All Jamaican Composite Index dropped 775.69 points to end at 370,745.49, the JSE Main Index shed 467.96 points to close trading at 334,783.44 and the JSE Financial Index shed 0.22 points to end at 71.80.

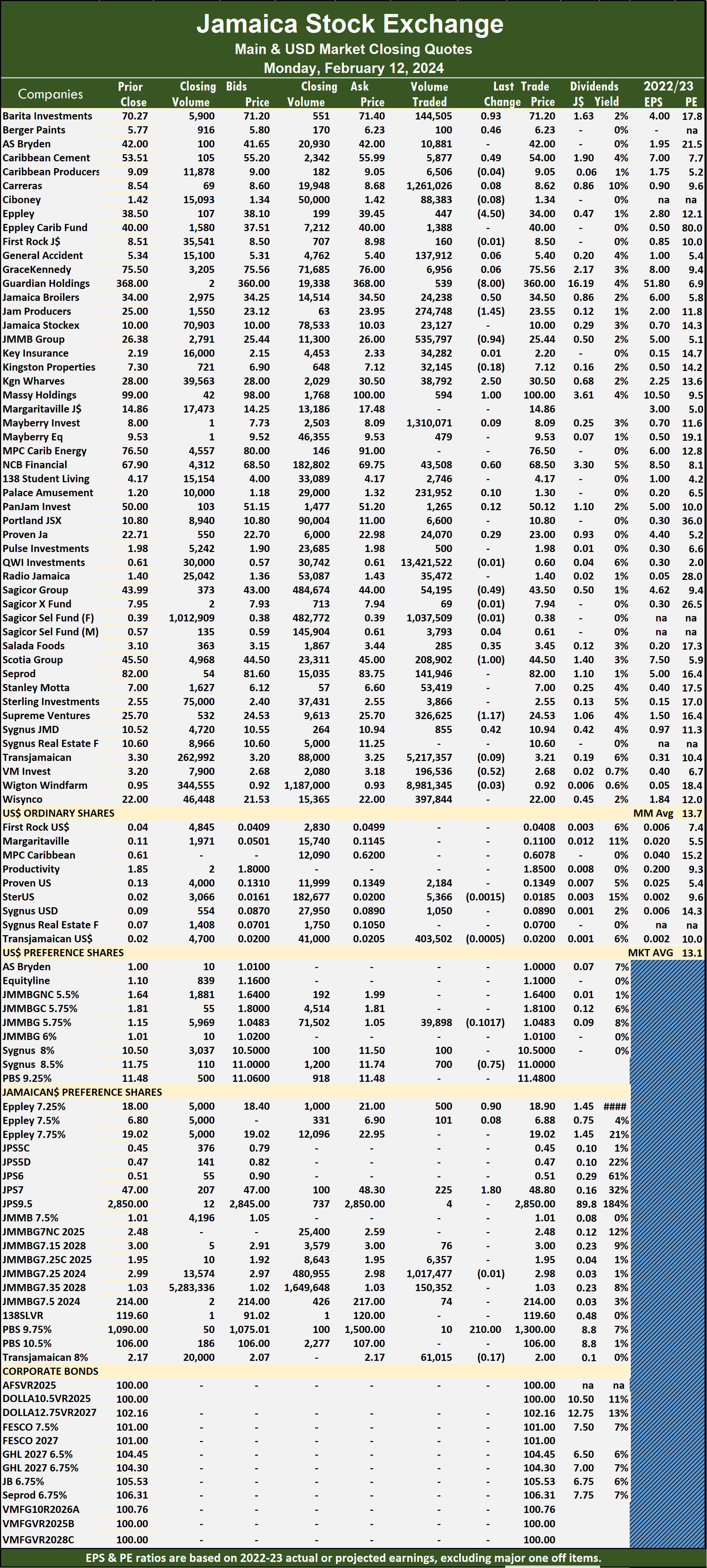

The All Jamaican Composite Index dropped 775.69 points to end at 370,745.49, the JSE Main Index shed 467.96 points to close trading at 334,783.44 and the JSE Financial Index shed 0.22 points to end at 71.80. JMMB Group fell 94 cents to $25.44 as investors traded 535,797 stock units, Kingston Wharves popped $2.50 to end at $30.50 after 38,792 shares were traded. Massy Holdings gained $1 and ended at $100 with investors transferring 594 units, NCB Financial rallied 60 cents to $68.50 after exchanging 43,508 stocks, Sagicor Group skidded 49 cents and ended at $43.50, with 54,195 stock units crossing the market. Salada Foods rose 35 cents to close at $3.45 with traders dealing in 285 shares, Scotia Group lost $1 to end at $44.50 and closed after an exchange of 208,902 units, Supreme Ventures dipped $1.17 to close at $24.53 with investors trading 326,625 stocks, Sygnus Credit Investments climbed 42 cents to $10.94 in an exchange of 855 stock units and Victoria Mutual Investments sank 52 cents to end at $2.68 changing hands 196,536 shares.

JMMB Group fell 94 cents to $25.44 as investors traded 535,797 stock units, Kingston Wharves popped $2.50 to end at $30.50 after 38,792 shares were traded. Massy Holdings gained $1 and ended at $100 with investors transferring 594 units, NCB Financial rallied 60 cents to $68.50 after exchanging 43,508 stocks, Sagicor Group skidded 49 cents and ended at $43.50, with 54,195 stock units crossing the market. Salada Foods rose 35 cents to close at $3.45 with traders dealing in 285 shares, Scotia Group lost $1 to end at $44.50 and closed after an exchange of 208,902 units, Supreme Ventures dipped $1.17 to close at $24.53 with investors trading 326,625 stocks, Sygnus Credit Investments climbed 42 cents to $10.94 in an exchange of 855 stock units and Victoria Mutual Investments sank 52 cents to end at $2.68 changing hands 196,536 shares. Jamaica Public Service 7% popped $1.80 and ended at $48.80 as 225 units passed through the market and Productive Business Solutions 10.5 % preference share advanced $210 to close at $1,300 with 10 stock units crossing the exchange.

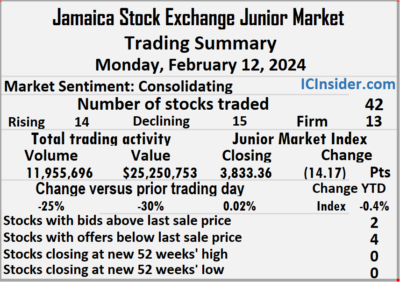

Jamaica Public Service 7% popped $1.80 and ended at $48.80 as 225 units passed through the market and Productive Business Solutions 10.5 % preference share advanced $210 to close at $1,300 with 10 stock units crossing the exchange. The market ended trading on Monday as 11,955,696 shares changed hands at $25,250,753 down from 15,974,371 units at $35,900,988 on Friday.

The market ended trading on Monday as 11,955,696 shares changed hands at $25,250,753 down from 15,974,371 units at $35,900,988 on Friday. Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and four with lower offers.

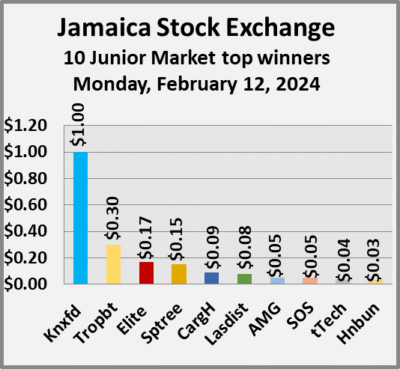

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and four with lower offers. Knutsford Express gained $1 and ended at $12.38 after an exchange of 960 stock units, Lasco Distributors popped 8 cents to end at $3.98 in an exchange of 27,000 shares. Limners and Bards skidded 14 cents to close at $1.55, with investors trading 29,784 stocks, Main Event dropped 8 cents to $14.92 with a transfer of 5,780 units, MFS Capital Partners dipped 9 cents and ended at $2.20 with 18,441 stock units changing hands. Spur Tree Spices advanced 15 cents to close at $2.40 with investors trading 101,446 shares and Tropical Battery climbed 30 cents to end at $2.70 after a transfer of 378,410 stock units.

Knutsford Express gained $1 and ended at $12.38 after an exchange of 960 stock units, Lasco Distributors popped 8 cents to end at $3.98 in an exchange of 27,000 shares. Limners and Bards skidded 14 cents to close at $1.55, with investors trading 29,784 stocks, Main Event dropped 8 cents to $14.92 with a transfer of 5,780 units, MFS Capital Partners dipped 9 cents and ended at $2.20 with 18,441 stock units changing hands. Spur Tree Spices advanced 15 cents to close at $2.40 with investors trading 101,446 shares and Tropical Battery climbed 30 cents to end at $2.70 after a transfer of 378,410 stock units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading on Monday, the JSE Combined Market Index dipped 563.01 points to close at 347,546.01, the All Jamaican Composite Index dropped 775.69 points to cease trading at 370,745.49, the JSE Main Index shed 467.96 points to culminate at 334,783.44. The Junior Market Index fell 14.17 points to conclude trading at 3,833.36 and the JSE USD Market Index skidded 0.80 points to 255.39.

At the close of trading on Monday, the JSE Combined Market Index dipped 563.01 points to close at 347,546.01, the All Jamaican Composite Index dropped 775.69 points to cease trading at 370,745.49, the JSE Main Index shed 467.96 points to culminate at 334,783.44. The Junior Market Index fell 14.17 points to conclude trading at 3,833.36 and the JSE USD Market Index skidded 0.80 points to 255.39. At the close of trading on the Main Market, Barita Investments increased by 93 cents to $71.20, Kingston Wharves popped $2.50 to end at $30.50, Massy Holdings gained $1 and ended at $100

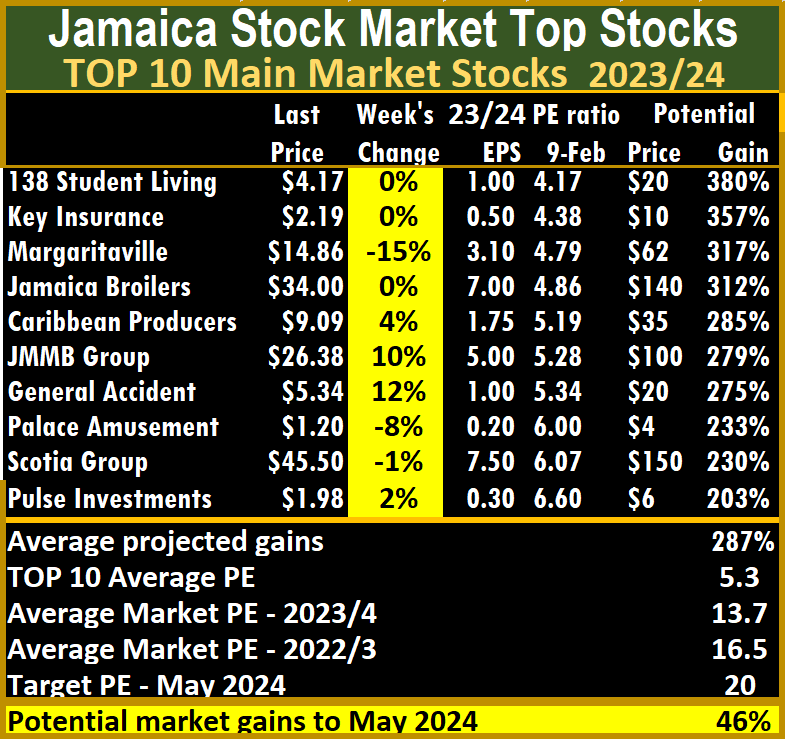

At the close of trading on the Main Market, Barita Investments increased by 93 cents to $71.20, Kingston Wharves popped $2.50 to end at $30.50, Massy Holdings gained $1 and ended at $100 Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. During the week new results were released to the market, with mostly positive profit outcomes that should aid the prices of stocks going forward as the results help to lay a foundation for prices in the short term as this provides investors with a better sense of valuations of these companies. There will be more releases this week as the deadline date for their release is this week for companies that have not opted for 60 days publication of audited accounts.

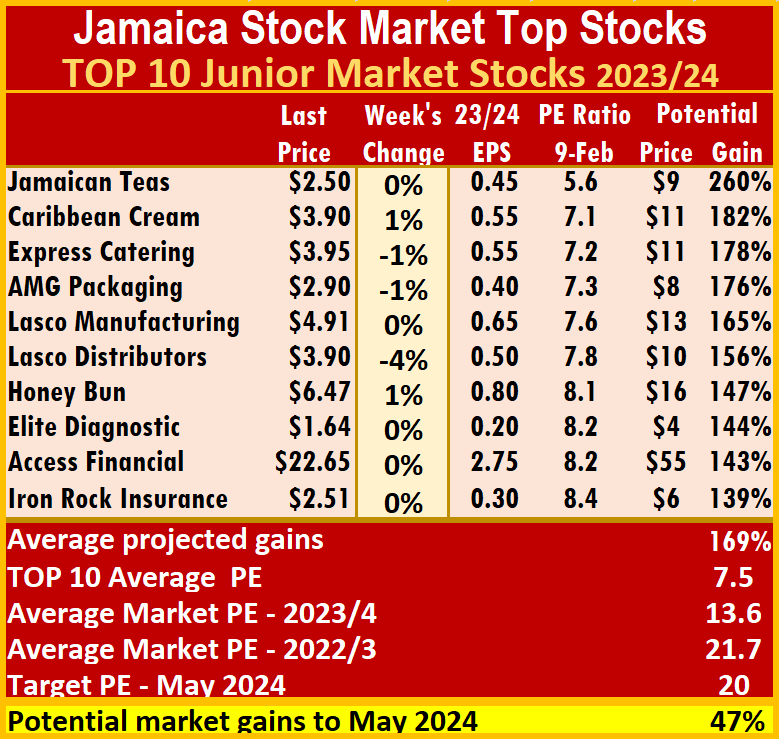

During the week new results were released to the market, with mostly positive profit outcomes that should aid the prices of stocks going forward as the results help to lay a foundation for prices in the short term as this provides investors with a better sense of valuations of these companies. There will be more releases this week as the deadline date for their release is this week for companies that have not opted for 60 days publication of audited accounts. As was the case for the previous week the markets closed with no addition to the ICInsider.com TOP 10 stocks.

As was the case for the previous week the markets closed with no addition to the ICInsider.com TOP 10 stocks. Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.