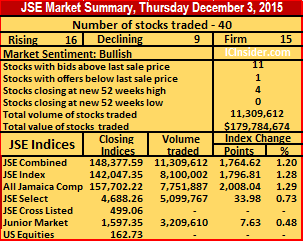

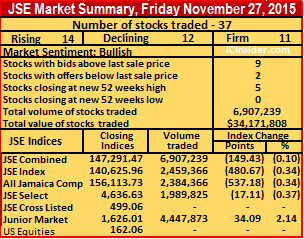

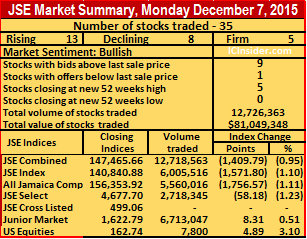

A total of 13 securities recorded gains and 8 declined as 5 stocks closed at a 52 weeks’ high but the JSE Market Index dropped 1,571.80 points to 140,840.88 the all Jamaica Composite Index dived 1,756.57 points to end at 156,353.92 and the JSE combined index erased 1,409.79 points to close at 147,465.66.

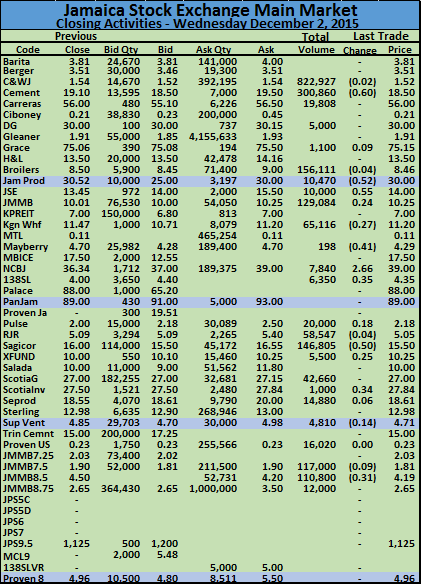

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator had a reading of 9 stocks with bids higher than their last selling prices and 1 with a lower offer.

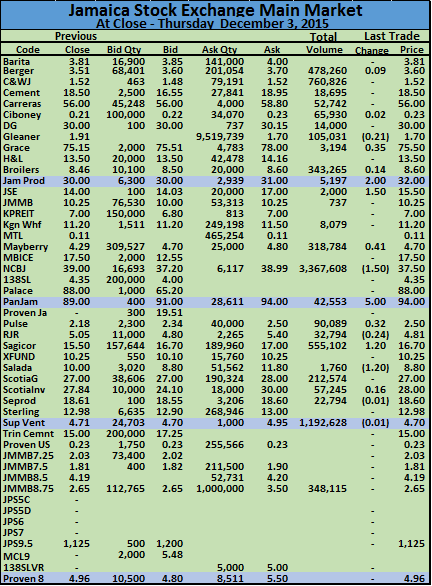

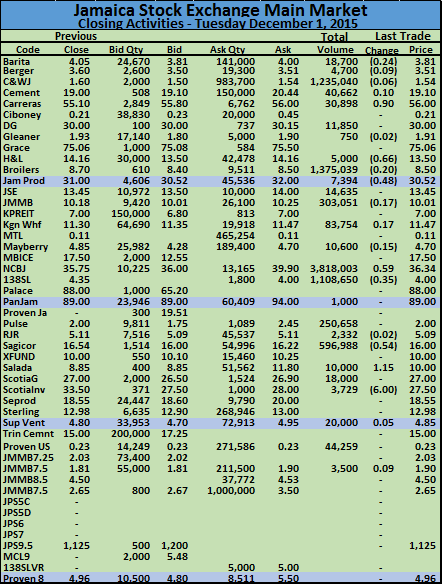

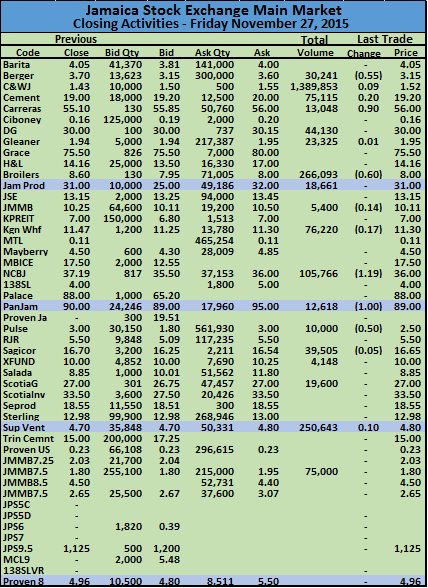

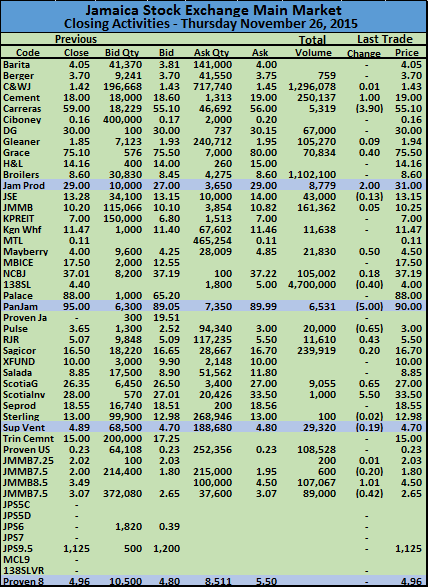

In trading, Berger Paints ended with 43,063 units trading at $3.45 after gaining 30 cents,

Cable and Wireless closed with 2,427,885 units changing hands down to $1.35 for a loss of 14 cents, Caribbean Cement closed trading at $17 having lost 1 cent with 29,527 shares changing hands. Carreras closed at $56 with 6,893 units trading. Ciboney closed at a 52 weeks’ closing high of 24 cents with 125,816 shares changing hands, Gleaner Company traded 65,126 shares at $1.40, Grace Kennedy ended with 116,251 units changing hands with a gain of 49 cents to $76, a 52 weeks’ closing high, Jamaica Broilers lost 48 cents in trading 48,100 shares, to close at $8.02. Jamaica Producers rose by 50 cents to close at $32 with 917,122 units trading, JMMB Group lost 35 cents in trading 396,832 shares, to close at $10. Kingston Wharves traded 1,000 units to end at $11.50, with a gain of 20 cents,

Cable and Wireless closed with 2,427,885 units changing hands down to $1.35 for a loss of 14 cents, Caribbean Cement closed trading at $17 having lost 1 cent with 29,527 shares changing hands. Carreras closed at $56 with 6,893 units trading. Ciboney closed at a 52 weeks’ closing high of 24 cents with 125,816 shares changing hands, Gleaner Company traded 65,126 shares at $1.40, Grace Kennedy ended with 116,251 units changing hands with a gain of 49 cents to $76, a 52 weeks’ closing high, Jamaica Broilers lost 48 cents in trading 48,100 shares, to close at $8.02. Jamaica Producers rose by 50 cents to close at $32 with 917,122 units trading, JMMB Group lost 35 cents in trading 396,832 shares, to close at $10. Kingston Wharves traded 1,000 units to end at $11.50, with a gain of 20 cents,  Mayberry Investments ended with 61,048 shares changing hands with a gain of 30 cents to $5, National Commercial Bank ended at $39.99, having risen $2.49 and closed with 6,460 units changing hands at a 52 weeks’ closing high. Pulse Investments had 32,620 units trading at $2.50, Radio Jamaica lost 44 cents in trading 1,000 units at $4.06, Sagicor Group with 108,541 units changing hands, ended at $16.70, Sagicor Real Estate Fund ended with 22,365 shares trading, to finish at $10.25. Scotia Group had 21,181 shares changing hands at $27.50 to record a 32 cents gain, Supreme Ventures closed with 1,105,941 units changing hands, 20 cents lower at $4.70 and Jamaica Money Market Brokers 7.50% preference share rose 9 cents and ended trading 445,500 units at $1.90.

Mayberry Investments ended with 61,048 shares changing hands with a gain of 30 cents to $5, National Commercial Bank ended at $39.99, having risen $2.49 and closed with 6,460 units changing hands at a 52 weeks’ closing high. Pulse Investments had 32,620 units trading at $2.50, Radio Jamaica lost 44 cents in trading 1,000 units at $4.06, Sagicor Group with 108,541 units changing hands, ended at $16.70, Sagicor Real Estate Fund ended with 22,365 shares trading, to finish at $10.25. Scotia Group had 21,181 shares changing hands at $27.50 to record a 32 cents gain, Supreme Ventures closed with 1,105,941 units changing hands, 20 cents lower at $4.70 and Jamaica Money Market Brokers 7.50% preference share rose 9 cents and ended trading 445,500 units at $1.90.