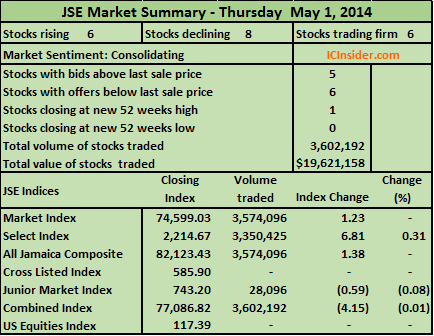

In Thursday’s trading on the Jamaica Stock Exchange, the market was directionless with advancing stocks numbering just below declining ones and the IC market indicator showing investors in a tussle over the immediate future direction of the market. Prices of 6 stocks rose and 8 declined as 20 securities traded resulting in 3,602,192 shares changing hands valued at $19,621,158 in another lacklustre session.

Main Market| All advancing shares in the market was in the main market and all but one stock that declined was also in this market, but the indices moved up slightly, with the JSE Market Index inching up by just 1.23 points to 74,599.03 and the JSE All Jamaican Composite index edging up by only 1.38 points to close at 82,123.43.

Main Market| All advancing shares in the market was in the main market and all but one stock that declined was also in this market, but the indices moved up slightly, with the JSE Market Index inching up by just 1.23 points to 74,599.03 and the JSE All Jamaican Composite index edging up by only 1.38 points to close at 82,123.43.

Gains| Stocks recording gains at the end of trading in the main market are Berger Paints trading 89,657 unitss to close with a gain of a cent at $1.68, Caribbean Cement gained 21 cents to close at $3.91 with 20,500 units changing hands, Carreras traded 443 shares to close 6 cents higher at $33.56, Ciboney with 50,000 shares by increasing by a cent to close at 12 cents for a new 52 weeks high, Grace Kennedy 7,439 shares with a gain of $1 to close at $58 and Jamaica Money Market Brokers with 451,214 ordinary shares to close up by 4 cents at $7.24.

Firm| There were only 5 stocks in the main market to close without a change in price as Gleaner with 228,484 shares closed at $1.10, Hardware & Lumber traded 3,300 units and closed at $11.70, Mayberry Investments with 3,060 units closed at $1.70, Scotia Group had 59,888 units changing hands to close at $20.62 and Seprod traded 685 shares in closing at $10.84.

Declines| The number of stocks that declined in the main market are Cable & Wireless with 1,500,888 units while losing a cent to end at 40 cents, Desnoes & Geddes with 76,472 shares to end at $4.30 as the price lost 30 cents, Jamaica Broilers with 450,872 shares to close at $4.86, down 4 cents, Jamaica Producers that traded 6,600 units to close at $18.26 while losing 4 cents, National Commercial Bank 571,665 shares as the price closed with a 10 cents lost, at $18, Sagicor Group had 50,529 units changing hands to close with a fall of 71 cents to $9.50 and Salada Foods 2,400 shares to close 45 cents lower, to end at $7.50

Junior Market| The JSE Junior Market Index declined by 0.59 points to close at 743.20 as only 2 junior market stocks traded at the end of the trading session.

Gains| No stock gained at the end of trading in the junior market.

Firm Trades| Lasco Manufacturing was the only stock in the junior market that traded to close at the same price as the previous trading day with 27,096 units to end at $1.20.

Declines| Caribbean Producers was the only stock declining in the junior market at the end of trading as the price fell 9 cents to close at $2.91 as it traded a mere 1,000 units.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 5 stocks with the bid higher than the last selling price and 6 stocks with offers that were lower.

Market directionless

Proven – growth by acquisition

Proven Investments‘ growth by acquisition took a leap forward with the announcement that they came to an agreement with conglomerate Grace Kennedy to acquire all the shares of First Global Financial Services Limited (FGFS) from First Global Holdings Limited. The agreement was signed on April 24, 2014. This acquisition is subject to regulatory approval. Grace Kennedy stated in a release to the Jamaica Stock Exchange that the transaction is valued at $3.05 billion but excludes the seat on the exchange that the Grace group will keep.

First Global Financial Services Limited, FGFS was established in April 2004, as part of the Grace Kennedy Financial Services Division re-branding and consolidation exercise, when George & Branday Securities Ltd assumed the First Global brand name of First Global Financial Services Limited. Later, FGFS acquired the operations of FGB Securities Limited, First Global Stockbrokers Limited, Grace Kennedy Properties Limited, First Global Insurance Limited, and Grace Pension Management Limited.

The acquisition will swell the assets of Proven which stood at US$146.4 million at the end of 2013. It is expected that the two entities will be merged resulting in a cut in operating cost. FGS is said to have $22 billion in assets plus assets managed for third parties off the balance sheet amounting to $60 billion. Not all of the assets may move over as some clients could opt to shift to other entities within the financial industry. If history is anything to go by, the bulk of the assets should continue with the new owners once the deal is concluded.

Grace plans to use the proceeds to expand First Global Bank locally and the group’s financial services regionally.

Related post | FX gains & securities boost Proven

Securities traded up but prices mixed

There was trading in 16 securities on the Trinidad Stock Exchange on Wednesday, 4 advanced, 3 declined and 9 traded firm, as 157,712 shares traded with a value of $1,646,580.

Market activity lead to two new 52 weeks highs and moderate movements in the indices, with the Composite Index edging up 0.43 points to close at 1,169.87, the All T&T Index gaining 1.73 points, to close at 1,985.33 and the Cross Listed Index declining by 0.12 points to 46.49.

Gains| First Citizens Bank contributed 17,200 shares with a value of $596,996 and gained 70 cents, to close at $34.70, Praetorian Property Fund advanced by a cent to end at $3.41, as it traded 2,000 units, Republic Bank traded a mere 83 units, as the price moved up a cent, to close at $120.17 for a new 52 weeks high and Unilever Caribbean traded just 31 shares to close 2 cents higher at $58.22, a new 52 weeks high.

Gains| First Citizens Bank contributed 17,200 shares with a value of $596,996 and gained 70 cents, to close at $34.70, Praetorian Property Fund advanced by a cent to end at $3.41, as it traded 2,000 units, Republic Bank traded a mere 83 units, as the price moved up a cent, to close at $120.17 for a new 52 weeks high and Unilever Caribbean traded just 31 shares to close 2 cents higher at $58.22, a new 52 weeks high.

Firm Trades| Stocks trading with unchanged closing prices, are Angostura Holdings with 16,470 shares valued at $181,170, to close at $11, Flavorite Foods with 33 units at $7, Grace Kennedy with 45,600 shares changing hands for a value of $159,600 and closed at $3.50, National Flour Mills 10,000 shares at $1.26, Neal & Massy 100 shares at $66.31, Prestige Holdings 500 units at $9.35, Scotiabank 138 shares at $71, Trinidad Cement 895 units at $2.06 and West Indian Tobacco 216 units at $118.

Declines| Clico Investment Fund traded 13,277 shares valued at $288,603 as the price declined by 15 cents, to end at $21.70, Jamaica Money Market Brokers traded 6,300 shares to close down 2 cents to 54 cents and Sagicor Financial Corporation with a volume of 44,667 shares traded for $312,669 as the price shed 3 cents, to end at $7.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 5 stocks with bids higher than their last selling prices and 3 stocks with offers that were lower.

4 stocks at new highs on TTSE

Four stocks closed at new 52 weeks high, on the Trinidad Stock Exchange, on the final trading day of the week, as 5 stocks advanced and 2 declined.

Market activity resulted in the trading in 15 securities with 170,619 shares changing hands valued at $2,121,879. The Composite Index was down by 0.49 points to 1,171.28 while the All T&T Index fell by 0.98 points to close at 1,987.20 and the Cross Listed Index remained at 46.62.

Gains| Stocks advancing are Ansa Merchant Bank that contributed 1,280 shares at $38.49 by gaining 11 cents, One Caribbean Media 200 shares at $20 while gaining 25 cents to record a new 52 weeks high at the close, Republic Bank 6,854 shares at a new 52 weeks high of $120.11, with a gain of a cent, Unilever Caribbean 332 units to close at $58.20 for a 13 cents gain and LJ Williams B shares 11,650 units to close at 90 cents up 11 cents, both at new 52 weeks highs.

Firm Trades| Stocks trading unchanged are Clico Investment Fund 3,763 shares to end at $21.85, First Caribbean International Bank contributed 21,520 shares with a value of $123,740 and closed at $5.75, Grace Kennedy 20,000 units at $3.50, Jamaica Money Market Brokers saw 21,000 shares changing hands valued at $11,790 as the price closed at 59 cents. National Commercial Bank had 26,435 shares changing hands for a value of $30,665 as it closed $1.16, National Flour Mills traded 22,175 shares for $27,941 to close at $1.26, Neal & Massy traded 3,494 shares to close at $66.31 and Sagicor Financial Corporation 4,100 units to close at $7.05,

Firm Trades| Stocks trading unchanged are Clico Investment Fund 3,763 shares to end at $21.85, First Caribbean International Bank contributed 21,520 shares with a value of $123,740 and closed at $5.75, Grace Kennedy 20,000 units at $3.50, Jamaica Money Market Brokers saw 21,000 shares changing hands valued at $11,790 as the price closed at 59 cents. National Commercial Bank had 26,435 shares changing hands for a value of $30,665 as it closed $1.16, National Flour Mills traded 22,175 shares for $27,941 to close at $1.26, Neal & Massy traded 3,494 shares to close at $66.31 and Sagicor Financial Corporation 4,100 units to close at $7.05,

Declines| Stocks declining are First Citizens Bank traded 8,500 shares valued at $197,169 as the price slipped by a cent to end at $34.99, and Guardian Holdings 11,765 shares at 25 cents lower at $13.50.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 3 stocks with the bids that were higher than their last selling prices and only 1 stock with the offer that is lower.

Strong arbitrage position in JMMB in JSE & TTSE

Jamaica Money Market Brokers (JMMB) closed at 56 cents, the equivalent of JS$9.50 while it closed at J$7.50 in Jamaica, providing investors with a great arbitrage position, with a huge 26 percent price difference at the end of trading.

Trading overall in the Trinidad Stock market on Wednesday saw 12 securities changing hands of which 5 advanced, 5 declined and 2 traded firm resulting in the Composite Index declining by 4.54 points to close at 1,173.08, the All T&T Index falling by 8.83 points to close at 1,990.79 and the Cross Listed Index easing by 0.03 points to close at 46.62. Trading resulted in 653,357 shares changing hands, valued at $6,420,588.

Gains| (JMMB) was the volume leader with 186,000 shares changing hands for a value of $103,300, closing 3 cents higher to end at 56 cents, National Enterprises gained 2 cents to close at $18.27, National Flour Mills added 110,000 shares valued at $138,600 to close a cent higher at $1.26, a 52 weeks high, Neal & Massy traded only 35 units at $66.31 for a one cent gain.

Gains| (JMMB) was the volume leader with 186,000 shares changing hands for a value of $103,300, closing 3 cents higher to end at 56 cents, National Enterprises gained 2 cents to close at $18.27, National Flour Mills added 110,000 shares valued at $138,600 to close a cent higher at $1.26, a 52 weeks high, Neal & Massy traded only 35 units at $66.31 for a one cent gain.

Declines| First Caribbean International Bank traded 15,072 shares at $5.75, down a cent, First Citizens Bank 3,581 shares at $36.07, down 28 cents Grace Kennedy with 161,400 shares traded for $564,975 and fell 13 cents to $3.50, Scotiabank with 215 shares, close at $70.10, down $1.90 and Trinidad Cement contributed 118,574 shares with a value of $243,723 to close at $2.05.

Firm Trades| Angostura Holdings 900 shares to close at $11.00, Sagicor Financial Corporation had only 50 units changing hands to end at $7.05.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 2 stocks with the bids higher than their last selling price and 3 stocks with offers that were lower.

Trinidad’s sleepy market

Stock market activity in Trinidad on Tuesday, saw trading in 13 securities, of which 3 advanced, 2 declined and 8 traded firm as 603,335 shares changed hands, for $7,429,236. The Composite Index edged up by 0.41 points to 1,177.62, the All T&T Index declined by 0.14 points to close at 1,999.62 and the Cross Listed Index inched up by 0.13 points to 46.65.

Gains| Clico Investment Fund traded 70,814 shares valued at $1,540,905 and gained 6 cents, to end the day at $21.76. Jamaica Money Market Brokers with 230,942 shares changing hands for a value of $122,179, closed 3 cents higher at 53 cents, Republic Bank with 955 units at $120.05 up 2 cents, a new 52 weeks high.

Gains| Clico Investment Fund traded 70,814 shares valued at $1,540,905 and gained 6 cents, to end the day at $21.76. Jamaica Money Market Brokers with 230,942 shares changing hands for a value of $122,179, closed 3 cents higher at 53 cents, Republic Bank with 955 units at $120.05 up 2 cents, a new 52 weeks high.

Firm Trades| Stock trading unchanged are Agostini’s with 471 units at $17.75, ANSA McAL 10 shares at $66.49, Angostura Holdings 10 shares at $11, National Flour Mills with a volume of 172,504 shares traded for $215,574 to close at $1.25, Point Lisas Industrial Port Development 300 shares at $3.65, Sagicor Financial Corporation 13,200 shares to close at $7.05, Guardian Media 957 units at $19.75 and West Indian Tobacco which added 17,501 shares valued at $2,065,118 to close at $118.

Declines First Citizens Bank contributed 88,671 shares with a value of $3,223,211 to close 4 cents lower at $36.35, Grace Kennedy traded 7,000 units to close with a one cent fall at $3.63.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 3 stocks with the bid higher than the last selling price and 5 stocks with offers that were lower.

Grace doing better than bottom-line

2013 was a remarkable year for Grace Kennedy despite reporting lower profit after tax compared to 2012. Remarkable indeed, as the 2013 net results speaks volumes about the Group’s profit potential going forward.

The Group’s profit after tax was $3.22 billion, which was slightly lower than the 2012’s $3.48 billion. The results for 2013 suffered from some restructuring cost in the insurance segment, losses picked up from the government debt exchange program and increased taxation due to a number of factors. By comparison, the 2012 prior year enjoyed a much lower tax cost from the lowering of the Jamaican tax rate to 25 percent and utilization of previous year’s tax losses. In 2013, the changes in taxation dragged down a 24 percent increase in profit before tax of $5.08 billion compared to $4.1 billion in 2012, resulting in earnings per share coming out at $9.65 versus $10.41 in 2012. On the upside, in 2013, the Group benefited from a sharp increase in gains in foreign currencies trading and holdings and from changes in pension liabilities at Hardware & Lumber.

Pretax profit was up 32 percent in the final quarter of the year, well off from the 53 percent growth in the second quarter, but well above the 14 percent in the first quarter and the flat profits in the third quarter.

Total revenues gained 11 percent for the year to $69.53 billion. The December quarter grew by 14 percent compared to 4 percent in the first quarter of the year and 11 percent in quarters two and three. Other income grew sharply by 65 percent to $1.7 billion helped by a big jump in foreign exchange gains. Expenses, on the other hand, grew by 9.85 percent to reach $63.9 billion.

Total revenues gained 11 percent for the year to $69.53 billion. The December quarter grew by 14 percent compared to 4 percent in the first quarter of the year and 11 percent in quarters two and three. Other income grew sharply by 65 percent to $1.7 billion helped by a big jump in foreign exchange gains. Expenses, on the other hand, grew by 9.85 percent to reach $63.9 billion.

Segment performance | Revenue changes varied from segment to segment with money services gaining 14.4 percent to $5.54 billion, food trading 11 percent to hit $44.6 billion, retail and trading 8.3 percent to $6.8 billion, banking only 3.6 percent to reach $5.54 billion and 2.2 percent for insurance to $4.76 billion. Segment profit saw food trading increasing 23 percent to $1.3 billion, banking was flat at $676 million, insurance fell to $109 million from $384 million but money transfer services grew by 20.6 percent to $1.88 billion and retail and trading 98 percent.

The insurance, banking and money services segments launched new products. There was some fallout in the division however, due to the debt exchange, structural changes and a claims review in the insurance segment. These negatively impacted the profitability of the segments.

Regional performance | Jamaica accounts for 64 percent of revenues with a moderate increase in 2013 of 6 percent to $43 billion. The UK enjoyed a 17 percent increase, USA 13 percent, Canada 20 percent, other European countries 57 percent and Africa 91 percent. Changes in currency rates would have played a big role in the growth in the overseas markets.

Grace should go on to earn between $12 to 13 per share in 2014 making the stock extremely cheap.

Grace Kennedy is an IC Insider Buy Rated stock.

Related posts | Grace’s profit up 41% in June quarter | Grace looking up

Grace dividend coming

The Board of Directors of Grace Kennedy will consider the payment of an interim dividend to be paid in December 2013 at a meeting scheduled for Thursday, November 7, 2013. Last year the company paid a dividend of 70 cents per share on December 18.

Grace Kennedy earlier this year increased its dividend partially in line with the increase in profits for the period. Accordingly, the company paid an interim dividend of 78 cents per share on September 30 this year.

The previous dividend paid was 70 cents per stock unit on March 27, 2013 and in September 2012, a dividend of 70 cents per share was paid.

Grace Kennedy is an IC Insider Buy Rated Stock

Related posts | Grace’s profit up 41% in June quarter | Buy Rated: Some gains, some losses