The Jamaican dollar hit a low of $151.27 against the US dollar in August and has rebounded since to trade at $145.3 on Wednesday with one technical indicator showing that it could appreciate further.

The Jamaican dollar hit a low of $151.27 against the US dollar in August and has rebounded since to trade at $145.3 on Wednesday with one technical indicator showing that it could appreciate further.

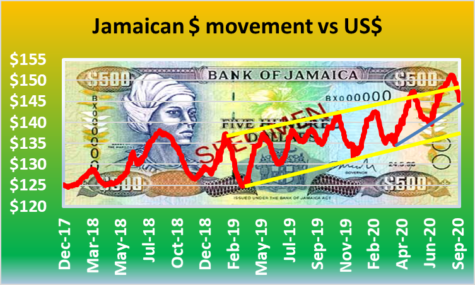

The local currency has been on an upward rise since December 2018 as it meanders slowly upwards to hit the low point in August. At the low, traders pushed it beyond the channel top, after moving within the channel as depicted by the yellow lines. It could return to the support line at around $138 later in the year but it could face resistance at the $144 region that it is within reach of currently.

In Wednesday’s trading, dealers sold $64.8 million at $145.306 having bought US$55.8 million at an average rate of $144.43. In trading, Scotia Bank bought US$8.5 million more than they sold. First Global, JMMB Bank, National Commercial Bank and Victoria Mutual Building Society sold far more US dollars than the bought.

In Wednesday’s trading, dealers sold $64.8 million at $145.306 having bought US$55.8 million at an average rate of $144.43. In trading, Scotia Bank bought US$8.5 million more than they sold. First Global, JMMB Bank, National Commercial Bank and Victoria Mutual Building Society sold far more US dollars than the bought.

Proven – growth by acquisition

Proven Investments‘ growth by acquisition took a leap forward with the announcement that they came to an agreement with conglomerate Grace Kennedy to acquire all the shares of First Global Financial Services Limited (FGFS) from First Global Holdings Limited. The agreement was signed on April 24, 2014. This acquisition is subject to regulatory approval. Grace Kennedy stated in a release to the Jamaica Stock Exchange that the transaction is valued at $3.05 billion but excludes the seat on the exchange that the Grace group will keep.

First Global Financial Services Limited, FGFS was established in April 2004, as part of the Grace Kennedy Financial Services Division re-branding and consolidation exercise, when George & Branday Securities Ltd assumed the First Global brand name of First Global Financial Services Limited. Later, FGFS acquired the operations of FGB Securities Limited, First Global Stockbrokers Limited, Grace Kennedy Properties Limited, First Global Insurance Limited, and Grace Pension Management Limited.

The acquisition will swell the assets of Proven which stood at US$146.4 million at the end of 2013. It is expected that the two entities will be merged resulting in a cut in operating cost. FGS is said to have $22 billion in assets plus assets managed for third parties off the balance sheet amounting to $60 billion. Not all of the assets may move over as some clients could opt to shift to other entities within the financial industry. If history is anything to go by, the bulk of the assets should continue with the new owners once the deal is concluded.

Grace plans to use the proceeds to expand First Global Bank locally and the group’s financial services regionally.

Related post | FX gains & securities boost Proven