The strong start for Jamaican stocks faltered after interest rates on Treasury bills peaked in April, sending the market into reverse from then until year end. Regardless the Junior Market index posted a 16.3 percent gain for the year, but 62 percent of the stocks recorded gains in 2022.

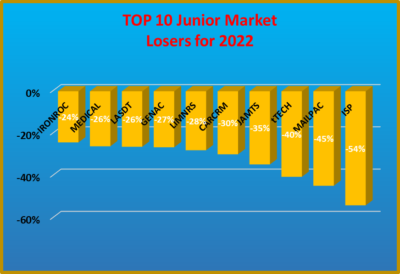

The market peaked at a record high in early May, but it ended the year with 29 stocks with gains compared with 18 losers that fell from 4 percent to 54 percent, with ISP Finance being the worst performer, followed by a 45 percent fall in Mailpac and 40 percent for tTech, with five 2022 IPO stocks being in the TOP15. Fosrich bolted 312 percent for the year to be the leading stock on the overall JSE market in 2022.

The market peaked at a record high in early May, but it ended the year with 29 stocks with gains compared with 18 losers that fell from 4 percent to 54 percent, with ISP Finance being the worst performer, followed by a 45 percent fall in Mailpac and 40 percent for tTech, with five 2022 IPO stocks being in the TOP15. Fosrich bolted 312 percent for the year to be the leading stock on the overall JSE market in 2022.

The 2022 new listing, Spur Tree Spices, came in at number 2, an ICInsider.com 2022 TOP 15 selection, posted gains of 250 percent.  MFS Partners, formerly SSL Venture Capital, came in at number three with 202 percent following the acquisition by a new majority owner and a new business model and Stationery and Office Supplies, an ICTOP15 pick, came in with gains of 145 percent after robust increases in revenues and profit for the year.

MFS Partners, formerly SSL Venture Capital, came in at number three with 202 percent following the acquisition by a new majority owner and a new business model and Stationery and Office Supplies, an ICTOP15 pick, came in with gains of 145 percent after robust increases in revenues and profit for the year.

The Main Market declined at the end of the year, with the JSE Main Index down 10.2 percent after it struggled to rise a mere two percent by mid-May at its peak for the year.

Technical tools forecast likely market developments well ahead of when they do occur. Junior Market performance was telegraphed from January 2022 by the attached technical chart showing trendlines pointing to a level to a likely high for 2022 beyond 3,800 points. The market index exceeded the upper end in February and remained there until July and pulled below it in the second half of the year ending up just below the lower level in the Middle of November with an initial public offering that drained resources from the secondary market.

Junior Market performance was telegraphed from January 2022 by the attached technical chart showing trendlines pointing to a level to a likely high for 2022 beyond 3,800 points. The market index exceeded the upper end in February and remained there until July and pulled below it in the second half of the year ending up just below the lower level in the Middle of November with an initial public offering that drained resources from the secondary market.

62% Junior Market stocks gained in 2022

PE expansion highly likely in 2019

An overall view of stocks indicates that the main market continues to be steered higher by an upward sloping support line as well the 45 and 125 day moving averages, lending support just below. The Junior Market is currently guided by an upward rising long-term support line, pointing to more gains ahead.

An overall view of stocks indicates that the main market continues to be steered higher by an upward sloping support line as well the 45 and 125 day moving averages, lending support just below. The Junior Market is currently guided by an upward rising long-term support line, pointing to more gains ahead.

The market is also supported by a golden cross. The golden cross is a strong bullish long-term signal. The market needs the fuel of rising profits.

Profit performance, in 2018 was mixed, but helped move some stocks higher, falling interest rates however, pushed up PE ratios to 16.5 times 2018 earnings by year end, up from 14 at the end of 2017. PE ratios on average are set to rise above current levels toward 20 in 2019. The Junior Market has 10 stocks and the main market has 6, trading around and above this level. Investors seem more at ease with higher PE ratio than in the past, with interest rates now around 2 percent and economic stability now in the system.

Local economic performance should have a positive impact on profit of most companies as demand grows in the system from greater employment that is expected to continue growing in 2019 as well as increased disposable income.

Nine IPOs made it to the market in the year with three in December, giving investors more investment choices than in 2017, with even more to come in 2019. ICreate will be the first IPO in 2019, but that is a new company, then Wigton Wind Farm’s IPO will be launched early 2019, but it is not one for all investors, as it is mainly an income play. However,

Junior Market stocks should out perform JSE main market stocks in 2019

there are others, namely, a central Jamaica manufacturing entity with a strong export base, the possibility of a paint company plus one in the BPO sector. IC Insider.com gathers that there are at least another three IPOs, that should make it to the market this year, but the Jamaica Stock Exchange is expecting 21 new listings for the year, including preference shares.

Business mergers and acquisitions are likely as some companies shed smaller segments of their operations and others, getting together for greater economies of scale. Stocks comprise different features. Growth plays an important role in many stock selections; examples are Access Financial Services, Elite Diagnostic, Fontana, Derrimon Trading, Jamaica Producers, Kingston Wharves, NCB Financial, PanJam Investment, Paramount Trading, as they grow by acquisition and expansion of current facilities. Carreras is a value play with good dividend yield along with Grace Kennedy.

Some impressive profit results

The latest set of listed companies to report financials show an array of impressive profits for a number of them, turn around situation in one and flat results for a few.

C&W reported a small loss of $138M for 2017 before tax.

Cable and Wireless reported a very small loss for 2017 down sharply from a billion loss in 2016 and is about to break out into a highly profitable period starting in 2018. The company that has chalked up accumulated losses of more than $48 billion reported losses of only $138 million before tax for 2017, and just $383 million after tax, flowing from a 9 percent rise in revenues to $27 billion with a big rise in mobile revenues by 54 percent to $15 billion while interest cost at $5.2 billion the company lost the year, down from a loss of $1.4 billion in 2016. With the sharp fall in interest rates locally interest cost should drop by around $2 billion in 2018 and plunge the company into an excellent profit position with continued growth in revenues. Unfortunately, the parent company wants to take over the company at a low price, after local shareholders have suffered losses for many years at just the stage when good times seem to be returning.

Newly listed FosRich Group posted an 81 percent increase in profit to $55 million and earnings per share of 14 cents from revenues that fell 9.5 percent to $1.05 billion, but helped by other income of $42 million comprising mostly interest and foreign exchange gains.

Jamaica Producers enjoyed strong gains in operating profits with an increase of 77 percent to $662 million after adjusting the 2016 results for non-recurring gains of $3.7 billion. Operating income for the year was up an impressive 34 percent resulting in gross profit rising from $3.24 billion to $5.14 billion. Earnings per share came in at 59 cents.

Stationery and Office Supplies that listed in August last year enjoyed a 29 percent bounce in revenues for the full year and 37 percent rise in the December quarter to record full year revenues of $906 million and a 78 percent rise in profits to $83 or earnings per share of 38 cents.

Stationery and Office Supplies that listed in August last year enjoyed a 29 percent bounce in revenues for the full year and 37 percent rise in the December quarter to record full year revenues of $906 million and a 78 percent rise in profits to $83 or earnings per share of 38 cents.

Kingston Wharves profit climbed 18 percent from $1.29 billion to $1.63 billion for 2018 from revenues that moved from $5.41 billion to $6.37 billion for a rise of 28 percent and ended with earnings per share of $1.14.

Grace Kennedy continues to struggle to increase profits ended 2018 with flat results of $4.15 billion versus $4.12 billion in 2016. The 2016 figures and one off gains that makes the 2018 better that it appears on the surface. Revenues rose from $88.3 billion to $92 billion in 2018 and other revenues slipped from $2.38 billion to $2.1 billion. The group reports $4.15 in earnings per share.

FosRich profit rose 77% for 2017.

Supreme Ventures reports earnings per share at $44 cents from profits that are virtually flat with 2016 results coming from a 25 percent rise in revenues to $56.2 billion. Profit for the year ended at $1.197 billion from $1.178 billion. The 29017 suffered from write off of assets and impairment amounting to $484 million while repairs and maintenance rose by $110 million.

The 2017 listed Victoria Mutual Investments reports a 9 percent rise in profits to $346 million from a 19 percent rise in net income of $966 million and produced earnings per share of 29 cents.

Barita is back VM Investments out – TOP 10

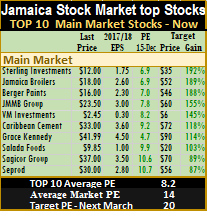

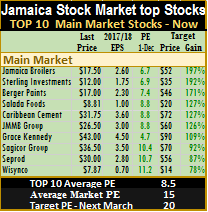

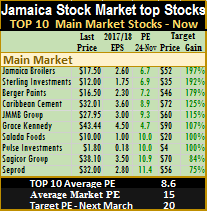

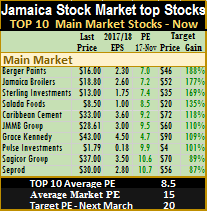

There is only one change to the TOP 10 lists, since we last reported on it, with Victoria Mutual Investments rising to more than $4 from the IPO price of $2.45, after listing in December and is replaced by Barita Investments.

There is only one change to the TOP 10 lists, since we last reported on it, with Victoria Mutual Investments rising to more than $4 from the IPO price of $2.45, after listing in December and is replaced by Barita Investments.

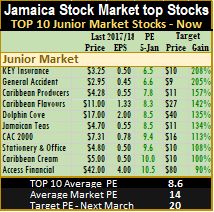

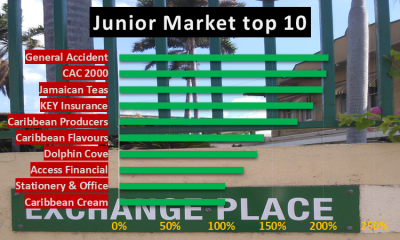

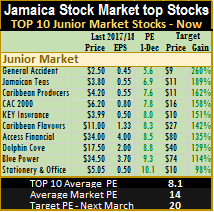

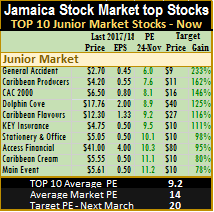

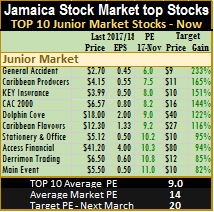

Junior market stocks show some noted position change due to price movements. Key Insurance slipped in price to move atop that list, while Jamaican Teas gained and moved into the second half of the listing. CAC2000 posted results that were just 2 cents lower than IC Insider.com’s forecast of 80 cents, with the price climbing to $7.31 at close of the week and should really be going higher based on those numbers. Access Financial climbed back to $42, pushing it to the bottom of the list.

Former TOP 10 listing, Main Event reported a 79 percent jump in earnings for 2018, to 38 cents per share before taxation, the price may bounce about for a while around the $6, until it is clear that 2018 earnings should hit 55 cents per share.

Former TOP 10 listing, Main Event reported a 79 percent jump in earnings for 2018, to 38 cents per share before taxation, the price may bounce about for a while around the $6, until it is clear that 2018 earnings should hit 55 cents per share.

With the Initial Public offerings (IPOS) out of the way, more life returned to the secondary market this past week with the main market enjoying buoyant volumes and the Junior Market recording some recovery with more buying interest.

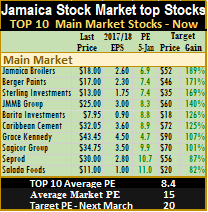

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 8.6 and 8.4 for the main market TOP 10.  The average PE for the overall main market is 15 and 13.6 for the Junior Market, based on 2017 estimated earnings.

The average PE for the overall main market is 15 and 13.6 for the Junior Market, based on 2017 estimated earnings.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 37 percent to the average of the market for Junior Market Top stocks and 44 percent for the main market.

Market Watch| Investors should still keep a keen eye on Caribbean Cement for which supply seems to be declining and word that the company is close to an agreement in refinancing the leased assets that is expected to result in major savings in cost for 2018 onwards. FosRich and GWest Corporation, pulled back from  their highs this past week with FosRich hitting $2.50 in trading on Friday, this one could see some rebounding but GWest Corporation could decline some more. Others to be watched are, CAC2000, General Accident, Cable & Wireless, NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office. Wisynco pulled back this past week to $10.80 and may well trade around this level for a while with a PE of 15 times 2018 earnings, as profit taking continues.

their highs this past week with FosRich hitting $2.50 in trading on Friday, this one could see some rebounding but GWest Corporation could decline some more. Others to be watched are, CAC2000, General Accident, Cable & Wireless, NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office. Wisynco pulled back this past week to $10.80 and may well trade around this level for a while with a PE of 15 times 2018 earnings, as profit taking continues.

TOP 10 stocks – Watch for Wisynco

Wata produced by Wisynco

Movement in the TOP 10 lists, resulted in just one move out, while some changed positions notably on the list. Main Event was the sole stock dropping from the top list leaving room for Caribbean Cream to move in.

With the Initial Public offerings (IPOS) out of the way, more life returned to the secondary market this past week with the main market gaining strongly but Junior Market stocks continue to struggle but helped by gains in price of two new listings.

The year ahead will see a number of changes to the TOP listings with several of the current listing carrying over. Only ISP Finance so far is showing as a new likely TOP 10 listing for 2018 in the Junior Market.

The main market list is likely to see about 4 new entrants for 2018, with Cable & Wireless, Barita Investments, Palace Amusement and Wisynco depending on when it list, joining the top stocks. Radio Jamaica sits just below the TOP 10 and could well squeeze into the 10 by the start of 2018. Profit results for the fourth quarter, are likely to impact prices of most stocks as the information will provide important fuel for price movements.

The main market list is likely to see about 4 new entrants for 2018, with Cable & Wireless, Barita Investments, Palace Amusement and Wisynco depending on when it list, joining the top stocks. Radio Jamaica sits just below the TOP 10 and could well squeeze into the 10 by the start of 2018. Profit results for the fourth quarter, are likely to impact prices of most stocks as the information will provide important fuel for price movements.

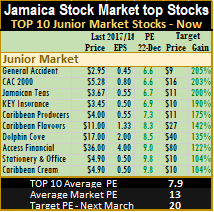

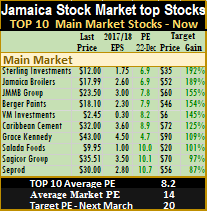

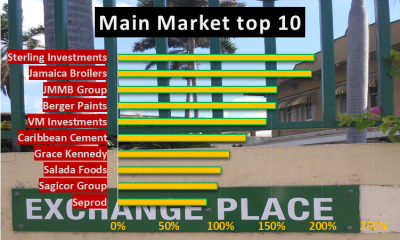

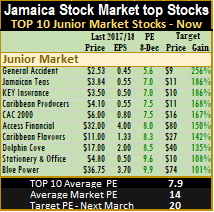

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 7.9 and 8.2 for the main market TOP 10. The average PE for the overall main market is 14.2 and 13.4 for the Junior Market, based on 2017 estimated earnings.

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 7.9 and 8.2 for the main market TOP 10. The average PE for the overall main market is 14.2 and 13.4 for the Junior Market, based on 2017 estimated earnings.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 41 percent to the average of the market for Junior Market Top stocks and 42 percent for the main market.

Market Watch| Investors should still keep a keen eye on Caribbean Cement for which supply seems to be declining with the focus on refinancing of leased assets that is expected to result in major savings in cost for 2018 onwards.  FosRich and GWest Corporation, the recent IPOs, started trading on the Junior Market last week with strong gains so far, they should be watched in the few trading days left for the year, to glean further directions as both are now richly priced. Others to be watched are, General Accident, Cable & Wireless , NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office. Wisynco could start trading this week and is expected to create some excitement with the issue more about twice oversubscribed.

FosRich and GWest Corporation, the recent IPOs, started trading on the Junior Market last week with strong gains so far, they should be watched in the few trading days left for the year, to glean further directions as both are now richly priced. Others to be watched are, General Accident, Cable & Wireless , NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office. Wisynco could start trading this week and is expected to create some excitement with the issue more about twice oversubscribed.

n

TOP 10 stocks – Watch FosRich on Tuesday

With the Initial Public offerings (IPOS) out of the way, more life returned to the secondary market this past week resulting in some changes to the TOP 10 lists.

With the Initial Public offerings (IPOS) out of the way, more life returned to the secondary market this past week resulting in some changes to the TOP 10 lists.

Initial Public offerings for 2017 now seem to be over until they reappear in January, with Sygnus Capital Investments planning to be out of the block early. Others that were prepared to go in December could come to market in January, the start of what now appears to be another interesting year for local stocks. Coming Tuesday in the wider market, FosRich Group, the recent IPO will list and start trading on the Junior Market.

Prior to the past week, the focus on IPOs negatively affected trading in the secondary market with the Junior Market giving up almost all the gains make in the first half of the year and is still trading close to the low for the year.

Prior to the past week, the focus on IPOs negatively affected trading in the secondary market with the Junior Market giving up almost all the gains make in the first half of the year and is still trading close to the low for the year.

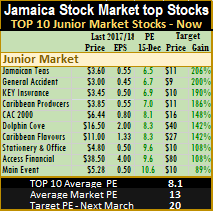

The past week ended with Main Event as the only new entrant into the TOP 10 Junior Market stocks, with Blue Power leaving, as the price rose back to the $44. Sagicor Group returns to the Main Market list pushing out Pulse Investments. Interestingly, General Accident jumped to $3 by week end with limited supplies and slipped to number 2 on the list.

Investors should bear in mind that as the year closes, there will be changes to the TOP list for 2018, with a number on the current list, expected to repeat, but there will be new ones.

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 8.1 and a PE of 8.2 for the main market TOP 10.

The average PE for the overall main market is 14.2 and 12.8 for the Junior Market, based on 2017 estimated earnings.

The average PE for the overall main market is 14.2 and 12.8 for the Junior Market, based on 2017 estimated earnings.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 36 percent to the average of the market for Junior Market Top stocks and 44 percent for the main market.

Market Watch| The two markets seem to have found support this past week after retreating sharply over the prior two weeks. Investors should still keep a keen eye on Caribbean Cement for which supply seems to be declining fast and a focus on refinancing leased assets is expected to result in major savings in cost for 2018 onwards. FosRich, the recent IPO that starts trading on the Junior Market on Tuesday, General Accident, Cable & Wireless that appears scarce under $1, NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office.

VM Investments in TOP 10

VM Investments press conference for launch its IPO. from left is Michael McMorris – Chairman of VMBS, Courtney Campbell Group CEO, Devon Barrett CEO of VMIL and Janice McKenley – Group Chief Financial Offer.

Initial Public offerings were all the rage in Jamaica Stock Market this past week, with three IPOS opening and closing during the week all being oversubscribed and one new one coming to market to open on Monday and expected to close on the same day.

The focus on IPOs negatively affected trading in the secondary market with the Junior Market giving up almost all of the gains make in the first half of the year. The week ended with no movement in and out of the TOP 10 Junior Market stocks but VM Investments is a new one in the Main Market list along Pulse Investments that returned with a fall in the stock price during the week, and out goes Wisynco and Sagicor Group.

As indicated last week, the bulk of Wisynco’s gain should come in the latter part of 2018, based on current operations

that should deliver earnings of 70 cents for the current year and $1 for the next fiscal as the company continues to recover from the ravages of the fire back in 2016. Much is expected from VM Investments that is priced to bounce well. Investors ought to bear in mind that that has the year closely, they will be changes to the TOP list for 2018, quite a number on the current list are expected to repeat in 2018.

that should deliver earnings of 70 cents for the current year and $1 for the next fiscal as the company continues to recover from the ravages of the fire back in 2016. Much is expected from VM Investments that is priced to bounce well. Investors ought to bear in mind that that has the year closely, they will be changes to the TOP list for 2018, quite a number on the current list are expected to repeat in 2018.

At the close of Friday, the average PE ratio for Junior Market Top stocks ended the week at 7.9 and a PE of 8 for the main market TOP 10. The average PE for  the overall main market is 14.1 and 12.6 for the Junior Market, based on 2017 estimated earnings.

the overall main market is 14.1 and 12.6 for the Junior Market, based on 2017 estimated earnings.

At the close of the week, discount for both the main and Junior markets have virtually merged, with the IC Insider.com’s TOP 10 stocks now trading at an average discount of 44 percent to the average of the market for Junior Market Top stocks and 46 percent for the main market.

Market Watch| The two markets retreated sharply over the past two weeks and broken through support levels with some individual stocks pulling back and pushing the market index down markedly, but the main market seems to have found a bottom and may be on the way up now  that the major IPOs are closed. The junior market could be going through a consolidation phase for a while, at least that is what the market seems to be suggesting.

that the major IPOs are closed. The junior market could be going through a consolidation phase for a while, at least that is what the market seems to be suggesting.

Investors should still keep a keen eye on Caribbean Cement for which supply seems to be declining fast, Cable & Wireless that appears scarce under $1, NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office.

Jam Teas, Blue Power & Wisynco in TOP 10

In a week of big price movements in the market three new stocks moved into the TOP 10 at the close of the last week. Wisynco that IPO debut this week just makes it into the main market TOP 10, suggesting there should be some gains ahead.

In a week of big price movements in the market three new stocks moved into the TOP 10 at the close of the last week. Wisynco that IPO debut this week just makes it into the main market TOP 10, suggesting there should be some gains ahead.

The bulk of Wisynco’s gain should come in the latter part of 2018 based on current operations that should deliver earnings of 70 cents for the current year and $1 for the next fiscal. Blue Power slipped in price to re-enter the top Junior Market list while Jamaican Teas rose based on fall in price and estimated earnings for 2018 fiscal year. Out of the TOP 10 Junior Market, are Derrimon Trading and Main Event that rose to $6. Wisynco pushed Pulse Investments out of the main market TOP 10.

At the close of Friday, the average PE ratio for Junior Market Top stocks dropped sharply from 9.2 last week to at 8.1 and a PE at 8.5 for the main market TOP 10. The average PE for the overall main market is 14.3 and 12.9 for Junior Market, based on 2017 estimated earnings.

At the close of Friday, the average PE ratio for Junior Market Top stocks dropped sharply from 9.2 last week to at 8.1 and a PE at 8.5 for the main market TOP 10. The average PE for the overall main market is 14.3 and 12.9 for Junior Market, based on 2017 estimated earnings.

At the close of the week, discount for both the main and Junior markets have virtually merged, with the IC Insider.com’s TOP 10 stocks now trading at an average discount of 42 percent to the average of the market for Junior Market Top stocks and 43 percent for the main market.

Market Watch| The two markets retreated sharply and broken through support levels with some individual stocks pulling back and pushing the market index down markedly.

This week the focus could be on the three IPOs that opening in days.

This week the focus could be on the three IPOs that opening in days.

Investors should still keep a keen eye on Caribbean Cement for which supply seems to be declining fast, Cable & Wireless that appears scarce under $1, NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office.

Derrimon out Kremi is back in TOP 10

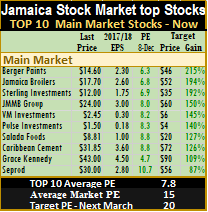

Derrimon Trading reentered the TOP 10 last week but has spent just one week rising during the week from $6.50 to $8 and is replaced by Caribbean Cream, the only new entrant to the TOP list.

Derrimon Trading reentered the TOP 10 last week but has spent just one week rising during the week from $6.50 to $8 and is replaced by Caribbean Cream, the only new entrant to the TOP list.

Jamaica Broilers slipped to $17.50 during the week and moved to the top of the main market listing with Berger Paints moving to Number 3 position having closed at $16.50 on Friday while Salada Foods rose to $10 and fell to 7th spot.

At the close of Friday, the average PE ratio for  Junior Market Top stocks is at 9.2 and a PE at 8.6 for the main market TOP 10. The average PE for the overall main market is 14.7 and 14.4 for Junior Market, based on 2017 estimated earnings.

Junior Market Top stocks is at 9.2 and a PE at 8.6 for the main market TOP 10. The average PE for the overall main market is 14.7 and 14.4 for Junior Market, based on 2017 estimated earnings.

At the close of the week, IC Insider.com’s TOP 10 stocks now trade at an average discount of 34 percent to the average of the market for Junior Market Top stocks and 42 percent for the main market.

Market Watch| The two markets have retreated to be testing support and some individual stocks seem to be more in a mood for profit taking than wanting to move much higher currently, as such stocks may not gain

much during the week ahead, but that is difficult to know. Investors should nevertheless keep a keen eye on Caribbean Cement for which supply seems to be declining fast, Cable & Wireless that appears scarce under $1, NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office.

much during the week ahead, but that is difficult to know. Investors should nevertheless keep a keen eye on Caribbean Cement for which supply seems to be declining fast, Cable & Wireless that appears scarce under $1, NCB Financial, Berger Paints, JMMB Group, Main Event, Lasco Financial, Paramount Trading and Stationery and Office.

Derrimon & Main Event in TOP 10

Main Event moved into the top list of Junior market stocks along with Derrimon Trading, this week, replacing Jamaican Teas and Caribbean Cream that entered the list last week and Pulse Investments and Sagicor Group are in the Main market listing.

Main Event moved into the top list of Junior market stocks along with Derrimon Trading, this week, replacing Jamaican Teas and Caribbean Cream that entered the list last week and Pulse Investments and Sagicor Group are in the Main market listing.

Main Event fell back to $5.50 at the end of the past week, from $5.75, the week before, to reenter the list, while Jamaican Teas came in for some buying that lifted the price slightly, to $4.10, to see it leaving. Radio Jamaica is removed from the list as six months’ results suggest that earnings will be hard pressed to exceed the 6 cents reported for the 2017 fiscal year. Also out is Cable & Wireless, with nine months’ results suggesting lower profit than originally projected for the full year to December.

Derrimon Trading reported net profit for this three months to September from core business, jumping 56 percent to $27 million over the $17.5 million reported for the corresponding period in 2016. The consolidated net profit for the nine months was $132 million, up 22 percent over the corresponding period in 2016.

Earnings per share amounted to 48 cents for the nine months and seems on track to end the year at 60 cents.

Earnings per share amounted to 48 cents for the nine months and seems on track to end the year at 60 cents.

On Friday Lasco Financial, a former TOP 10 stock, hit a new record high of $6.60 following the reported profit that more than doubled in the September quarter to $100 million and up 63 percent to $167 million for the six months as well as from news of the acquisition of CrediScotia operations.

At the close of Friday, the average PE ratio for Junior Market Top stocks is at 9 and a PE at 8.5 for the main market TOP 10. The average PE for the overall main market is 15 and 14 for Junior Market, based on 2017 estimated earnings.

At the close of the week, IC Insider.com’s TOP 10 stocks now trade at an average discount of 35 percent to the average of the market for Junior Market Top stocks and 43 percent for the main market.

At the close of the week, IC Insider.com’s TOP 10 stocks now trade at an average discount of 35 percent to the average of the market for Junior Market Top stocks and 43 percent for the main market.

Market Watch| Investors should keep a keen eye for Caribbean Cement, Cable & Wireless that appears scarce under $1, NCB Financial, Berger Paints, JMMB Group, Lasco Financial, Paramount Trading, Derrimon Trading and Stationery and Office.