Jamaica’s Net Internal Reserves surged to a record US$5.14 billion at the end of March buoyed by a hefty US$438 million inflows in March, moving the reserves from US$4.7 billion at the end of February this year. The surge follows a US$770 million build in the reserves in 2023 that saw the total rising to $4.76 billion at the end of 2023.

Jamaica’s Net Internal Reserves surged to a record US$5.14 billion at the end of March buoyed by a hefty US$438 million inflows in March, moving the reserves from US$4.7 billion at the end of February this year. The surge follows a US$770 million build in the reserves in 2023 that saw the total rising to $4.76 billion at the end of 2023.

An examination of the financial statement of Jamaica’ central bank the inflows came from funds received mainly by the government of Jamaica.

ICInsider.com gather that the government was in the process of selling forward 20 years rental income for the two main international airports as such the inflows could well be related to this. The Minister of Finance in his budget presentation alluded to this.

Jamaica’s NIR at record US$5.14 billion

Jamaica’s NIR slips in January but

Jamaica’s Net International Reserves (NIR) fell by US$79 million in January this year to US$4.679 billion from US$4.758 billion at the end of 2023 and is up US$703 million above US$3.976 billion at the end of 2022, but data indicates the country in a far better foreign exchange position than the previous two years.

The Bank of Jamaica NIR report, states that the reserves represent 23.6 weeks of Estimated Gross Official Reserves in weeks of Goods & Services Imports, down from 25.2 weeks in December 2022.

The Bank of Jamaica NIR report, states that the reserves represent 23.6 weeks of Estimated Gross Official Reserves in weeks of Goods & Services Imports, down from 25.2 weeks in December 2022.

The decline follows the sale of $30 million to the market through the B-FXITT intervention on January 15th, $20 million on January 16th, $30 million on January 25 and US$20 million on January 26 totalling US$100 million and exceeding the reduction in the NIR in January, but the intervention seems to be on the decline since 2021. In January last year, the central bank intervened 5 times with sales of US$140 million and in January 2021 they pumped US$185.68 million into the system on six occasions.

Jamaica’s NIR jumps another $100m

Jamaica’s Net International Reserves (NIR) rose approximately US$113 in the first 10 days of 2024 data published by the country’s central bank, the Bank of Jamaica shows. The latest increase to the total of US$770 million that was added in 2023 to over US$870 million since the beginning of 2023.

The January inflows push the total at the close last year of US$4.76 billion to US$4.87 billion and just short of the US$5 billion mark. The build-up of the NIR comes against the background of the tight monetary policy pursued by the country’s central bank that has sucked local money from the financial market, by use of certificates of deposit (CDs). Over the past year, the Bank of Jamaica’s open market instruments mainly CDs have moved up by J$74 billion to $247 billion. Apart from funds being bought from the market, the NIR would also have grown by interest earned on the funds being held as reserves which could be around US$200 million per year based on current interest rates internationally.

The January inflows push the total at the close last year of US$4.76 billion to US$4.87 billion and just short of the US$5 billion mark. The build-up of the NIR comes against the background of the tight monetary policy pursued by the country’s central bank that has sucked local money from the financial market, by use of certificates of deposit (CDs). Over the past year, the Bank of Jamaica’s open market instruments mainly CDs have moved up by J$74 billion to $247 billion. Apart from funds being bought from the market, the NIR would also have grown by interest earned on the funds being held as reserves which could be around US$200 million per year based on current interest rates internationally.

Jamaica’ NIR jumps to record high

Jamaica’s net international reserves continue to scale new heights closing at the end of August 2023 jumped US$299 million to a record month end balance of US$4.43 billion, up from US$4.13 billion at the end of July.

Jamaica’s net international reserves continue to scale new heights closing at the end of August 2023 jumped US$299 million to a record month end balance of US$4.43 billion, up from US$4.13 billion at the end of July.

The main factor driving the reserve is a reduction of amounts due to the International Monetary Fund (IMF) of $362 million moving the figure from US$508 million in short term debt down to US$146 million at the end of August.

At the end of December last year, the reserves stood at US$3.978 billion and have climbed US$456 million for the year to date.

Jamaica’s reserves spike US$100m

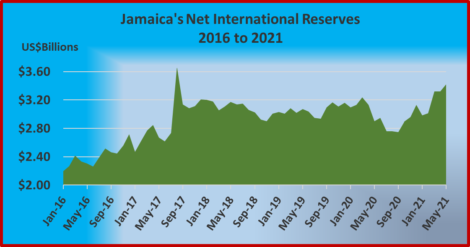

Jamaica’s Net International Reserves climbed US$100 million higher in May to reach US$3.42 billion from US$3.32 at the end of April after a $300 million surge in March with a rise of US$303 to US$3.32 billion from US$3.016 billion at the end of February, this year.

The country’s gross reserves are now at US$4.35 billion and include US$930 million due to the International Monetary Fund. The increase in May comes at a time when inflows from tourism are at the highest levels since March 2020 as the sector makes rapid strides in recovery, with May having the highest number of overseas visitors since the country reopened its borders to tourist in June last year. Reports from the tourism industry suggest that visitor arrival numbers for June and July will be appreciably better than for May and should add to foreign currency inflows into the country and most likely the NIR as well.

The country’s gross reserves are now at US$4.35 billion and include US$930 million due to the International Monetary Fund. The increase in May comes at a time when inflows from tourism are at the highest levels since March 2020 as the sector makes rapid strides in recovery, with May having the highest number of overseas visitors since the country reopened its borders to tourist in June last year. Reports from the tourism industry suggest that visitor arrival numbers for June and July will be appreciably better than for May and should add to foreign currency inflows into the country and most likely the NIR as well.

The country is also benefitting from a continued increase in remittances inflows that became evident since May 2020.

The reserves are at the highest sustained levels in the country’s history. The net reserves represent an estimated 30.57 weeks of Goods & Services imports for Jamaica.

Jamaica’s NIR continues to rise

Net International Reserves (NIR) US$69 to close out November at US$2,963 up from US$2,893 in October. Jamaica’s NIR had a big jump of US$146 million in October from US$2.75 billion at the end of September.

Net International Reserves (NIR) US$69 to close out November at US$2,963 up from US$2,893 in October. Jamaica’s NIR had a big jump of US$146 million in October from US$2.75 billion at the end of September.

Gross reserves rose by $73 million to $3.93 billion that includes US$970 million due to the International Monetary Fund. The October increase was the first major rise in net reserves for 2020. In March, the NIR rose to US$3.24 billion from US$3.13 billion, slipped to US$2.9 billion in May and ended July at a low of US$2.76 billion. The NIR now represents 38 weeks of goods and service imports, the Central Bank states.

Jamaica’s International Reserves jump US$92m

Jamaica’s Net International Reserves rose US$92 million to from US$3.116 billion at the end of November last to US$3.2 billion at the end of December, Bank of Jamaica reported.

Jamaica’s Net International Reserves rose US$92 million to from US$3.116 billion at the end of November last to US$3.2 billion at the end of December, Bank of Jamaica reported.

The latest reported level of reserves amount to 40.14 weeks of goods imports and 23.25 weeks of goods and services Imports, the report from the country’s central bank stated.

BOJ did not state how the increase arose, IC Insider.com monitoring of the daily foreign exchange trading, shows that dealers were selling off excess foreign currency in December.

Jamaica’s Net International Reserves slipped by just US$32 million in September according to data just released by the country’s central bank – Bank Of Jamaica ( BOJ).

Jamaica’s Net International Reserves slipped by just US$32 million in September according to data just released by the country’s central bank – Bank Of Jamaica ( BOJ). Jamaica’s

Jamaica’s