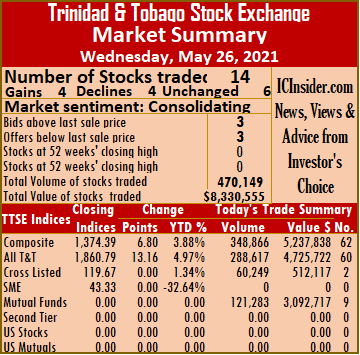

Market activity ended on Wednesday after 16 percent shares fewer shares with a 17 percent lower value traded than on Tuesday, resulting in an equal number of stocks rising and falling at the close of trading on the Trinidad and Tobago Stock Exchange.

At the close, 14 traded compared to 16 on Tuesday, with four stocks rising, four declining and six remaining unchanged. The Composite Index rose 6.80 points to 1,374.39, the All T&T Index advanced 13.16 points to 1,860.79 and the Cross-Listed Index remained unchanged at 119.67.

At the close, 14 traded compared to 16 on Tuesday, with four stocks rising, four declining and six remaining unchanged. The Composite Index rose 6.80 points to 1,374.39, the All T&T Index advanced 13.16 points to 1,860.79 and the Cross-Listed Index remained unchanged at 119.67.

A total of, 470,149 shares traded, for $8,330,555 compared to 560,040 units at $9,978,704 on Tuesday.

An average of 33,582 units traded at $595,040 for the day, compared to 35,003 at $623,669 on Tuesday. The average trade for the month to date amounts to 26,066 units at $406,977 versus 25,666 units at $396,966. The average trade for April ended at 11,472 units at $184,959.

The Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Agostini’s remained at $24.40 with an exchange of 30 shares, Angostura Holdings ended at $15 after exchanging 1,200 units, Ansa Mcal rose 2 cents to $56.75 after exchanging 3,053 shares. Clico Investment Fund ended at $25.50, exchanging 121,283 shares, First Citizens Bank rose $1.50 in closing at $50 after trading 8,617 units, Guardian Holdings lost 18 cents in closing at $32.32 in switching ownership of 25,226 stocks, Massy Holdings dropped $6.24 to close at $68.51 with an exchange of 55 units. National Flour Mills settled at $2.30 while exchanging 130,465 stocks, NCB Financial Group closed at $8.50 with the swapping of 60,249 shares, Prestige Holdings fell 44 cents to end at $6.55 in an exchange of 909 shares. Scotiabank gained $1 to end at $57 after clearing the market with 22,486 units, Trinidad & Tobago NGL gained 89 cents to close at $17.84 after exchanging 91,271 stock units, Unilever Caribbean closed at $16.33, with 2,058 stocks crossing the market and West Indian Tobacco fell 1 cent to end at $32.48 with the swapping of 3,247 shares.

National Flour Mills settled at $2.30 while exchanging 130,465 stocks, NCB Financial Group closed at $8.50 with the swapping of 60,249 shares, Prestige Holdings fell 44 cents to end at $6.55 in an exchange of 909 shares. Scotiabank gained $1 to end at $57 after clearing the market with 22,486 units, Trinidad & Tobago NGL gained 89 cents to close at $17.84 after exchanging 91,271 stock units, Unilever Caribbean closed at $16.33, with 2,058 stocks crossing the market and West Indian Tobacco fell 1 cent to end at $32.48 with the swapping of 3,247 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

T&TSE market rises

USD stocks rose

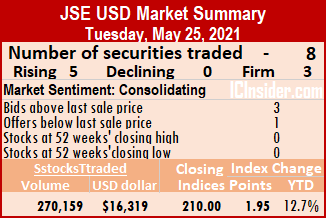

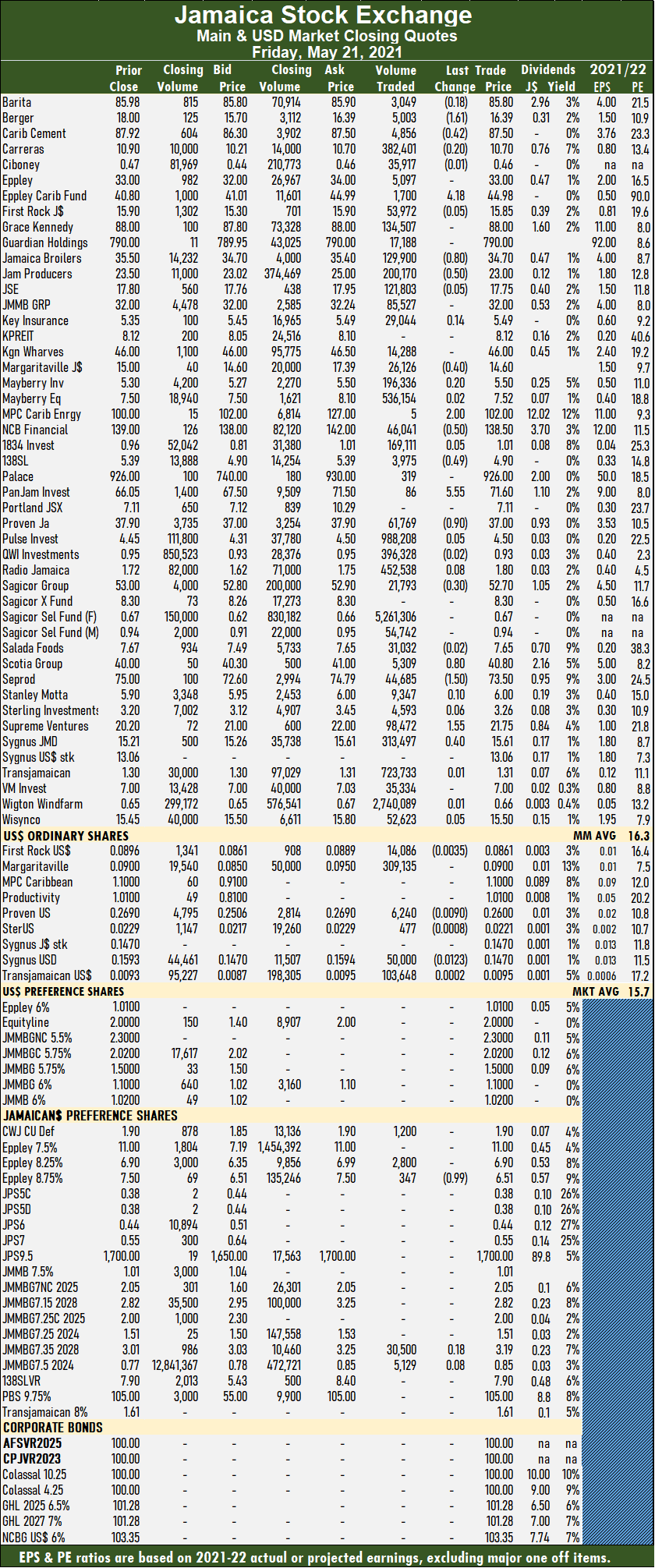

Market activity ended with the market rising after the number of securities trading climbed above Friday’s level on the US dollar market of the Jamaica Stock Exchange, resulting in eight securities changing hands, compared to six on Friday with prices of five stocks rising, none declining and three remaining unchanged.

The JSE USD Equity Index gained 1.95 points to end at 210.00. The average PE Ratio ends at 13.4 based on ICInsider.com’s forecast of 2021-22 earnings.

The JSE USD Equity Index gained 1.95 points to end at 210.00. The average PE Ratio ends at 13.4 based on ICInsider.com’s forecast of 2021-22 earnings.

Overall, 270,159 shares traded, for US$16,319 compared to 483,586 units at US$38,961 on Friday.

Trading averaged 33,720 units at US$2,040, in contrast to 80,598 shares at US$6,494 on Friday. Trading averaged 97,219 units for the month to date at US$11,568 in contrast to 103,810 units at US$12,476 on Friday. April ended with an average of 80,293 units for US$6,320.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and one with a lower offer.

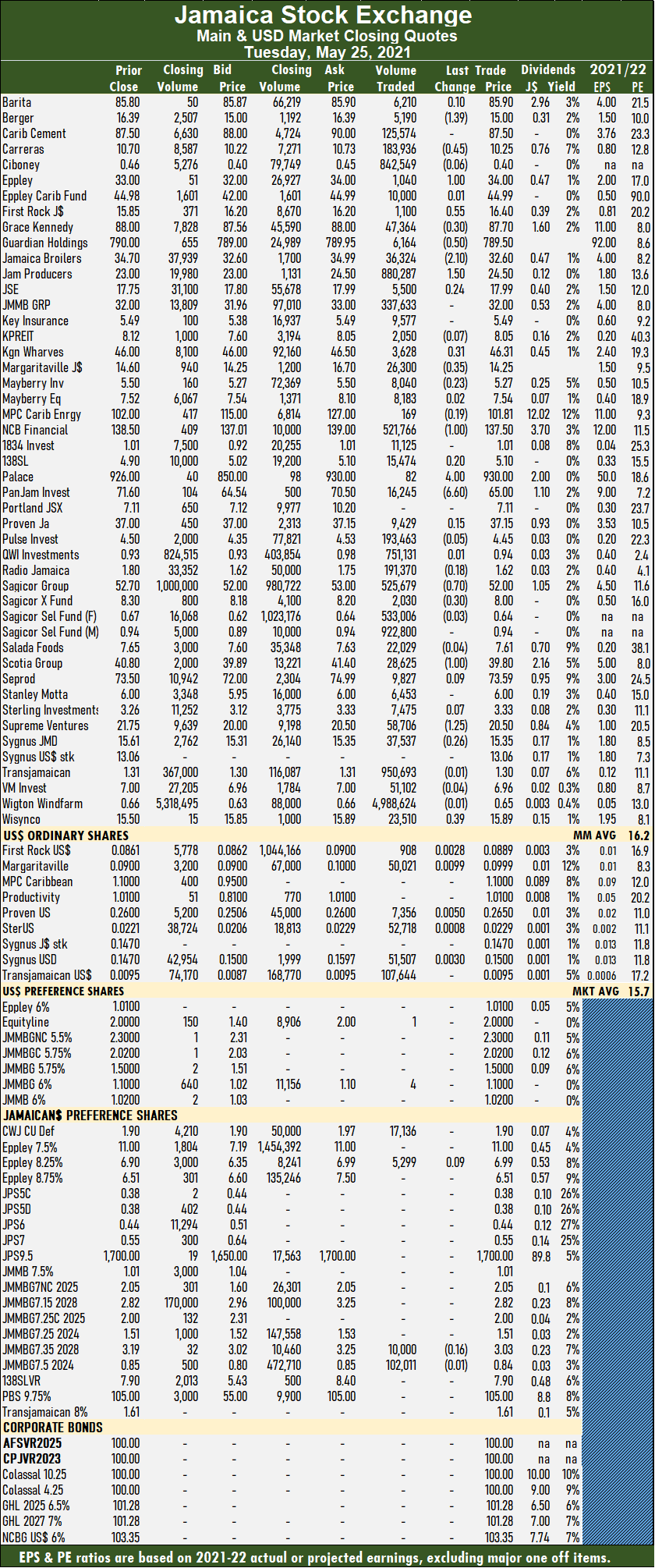

At the close, First Rock Capital added 0.028 of a cent to end at 8.89 US cents, with an exchange of 908 shares,  Margaritaville rose 0.099 to settle at 9.99 US cents trading 50,021 stocks, Proven Investment rose 0.05 of a cent in closing at 26.5 US cents, with 7,356 stock units changing hands. Sterling Investments gained 0.08 of a cent to end at 2.29 US cents in an exchange of 52,718 stock units, Sygnus Credit Investments gained 0.03 of a cent to close at 15 US cents after exchanging 51,507 shares and Transjamaican Highway closed at 0.95 US cents with the swapping of 107,644 units.

Margaritaville rose 0.099 to settle at 9.99 US cents trading 50,021 stocks, Proven Investment rose 0.05 of a cent in closing at 26.5 US cents, with 7,356 stock units changing hands. Sterling Investments gained 0.08 of a cent to end at 2.29 US cents in an exchange of 52,718 stock units, Sygnus Credit Investments gained 0.03 of a cent to close at 15 US cents after exchanging 51,507 shares and Transjamaican Highway closed at 0.95 US cents with the swapping of 107,644 units.

In the preference segment, Equityline Mortgage Investments traded just one stock at US$2 and JMMB Group 6% exchange just four shares at US$1.10.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Rising T&T stocks clobber others

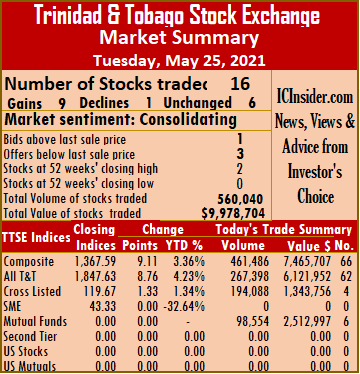

Massy Holdings jumped $7.75 to a 52 weeks’ high of $74.75, as market activity ended on Tuesday after 71 percent fewer shares valued 56 percent less than on Monday traded, resulting in rising stocks dominating declining ones at the close of trading on the Trinidad and Tobago Stock Exchange.

At the close, 16 traded compared to 15 on Monday, with nine stocks rising, one declining and six closing unchanged. The Composite Index climbed 9.11 points to 1,367.59, the All T&T Index rose 8.76 points to end at 1,847.63 and the Cross-Listed Index gained 1.33 points to settle at 119.67.

At the close, 16 traded compared to 15 on Monday, with nine stocks rising, one declining and six closing unchanged. The Composite Index climbed 9.11 points to 1,367.59, the All T&T Index rose 8.76 points to end at 1,847.63 and the Cross-Listed Index gained 1.33 points to settle at 119.67.

A total of, 560,040 shares were exchanged for $9,978,704, down sharply from 1,938,335 units at $22,585,268 on Monday.

An average of 35,003 units were traded at $623,669 down from 129,222 at $1,505,685 on Monday. The average trade month to date amounts to 25,666 units at $396,966 versus 25,061 units at $382,281. The average trade for April amounted to 11,472 units at $184,959.

The Investor’s Choice bid-offer indicator shows one stock ending with the bid higher than the last selling price and three with lower offers.

At the close, Angostura Holdings traded 1,450 shares at $15, Ansa McAL remained at $56.73 in exchanging 906 units, Clico Investment Fund gained 20 cents to close at $25.50 after transferring 98,554 stocks. First Citizens Bank advanced $1.70 to $48.50 with 35,283 shares crossing the market. Grace Kennedy rose 40 cents to end at a 52 weeks’ high of $5.25 in trading 94,028 units,  Guardian Holdings picked up 15 cents to close at $32.50 trading 27,000 stocks, JMMB Group remained at $1.81 in switching ownership of 60 shares. Massy Holdings jumped $7.75 to end at a 52 weeks’ high of $74.75 after 2,250 units crossed the exchange, National Flour Mills closed at $2.30 in trading 84,166 shares, NCB Financial Group traded 100,000 stocks at $8.50. Point Lisas gained 5 cents to settle at $3 in exchanging 1,248 stocks, Prestige Holdings lost 1 cent to end at $6.99 trading 222 units, Republic Financial Holdings closed at $135 in transferring 416 shares. Scotiabank advanced $1.10 to $56 after exchanging 31,802 units, Trinidad & Tobago NGL rose 46 cents to $16.95 in trading 81,953 shares and Unilever Caribbean added 1 cent in closing at $16.33 with the swapping of 702 shares.

Guardian Holdings picked up 15 cents to close at $32.50 trading 27,000 stocks, JMMB Group remained at $1.81 in switching ownership of 60 shares. Massy Holdings jumped $7.75 to end at a 52 weeks’ high of $74.75 after 2,250 units crossed the exchange, National Flour Mills closed at $2.30 in trading 84,166 shares, NCB Financial Group traded 100,000 stocks at $8.50. Point Lisas gained 5 cents to settle at $3 in exchanging 1,248 stocks, Prestige Holdings lost 1 cent to end at $6.99 trading 222 units, Republic Financial Holdings closed at $135 in transferring 416 shares. Scotiabank advanced $1.10 to $56 after exchanging 31,802 units, Trinidad & Tobago NGL rose 46 cents to $16.95 in trading 81,953 shares and Unilever Caribbean added 1 cent in closing at $16.33 with the swapping of 702 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

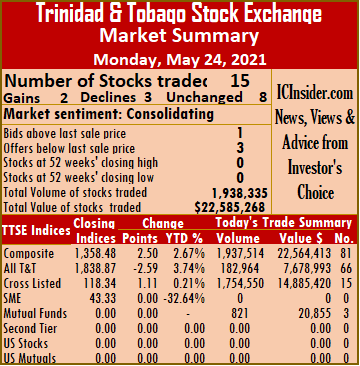

Sharp jump in trading on TTSE

The volume and value of stocks traded rose sharply on Monday, after exchanging 480 percent more shares valued 240 percent greater than on Friday and resulting in slightly more stocks falling than rising at the close of the Trinidad and Tobago Stock Exchange.

A total of 1,938,335 shares traded for $22,585,268 versus 334,379 units at $6,637,409 on Friday.

A total of 1,938,335 shares traded for $22,585,268 versus 334,379 units at $6,637,409 on Friday.

An average of 129,222 units traded at $1,505,685 compared to 20,899 at $414,838 on Friday. The average for the month to date amounts to 25,061 units at $382,261 versus 18,327 units at $309,647. The average trade for April amounted to 11,472 units at $184,959.

Fifteen securities traded against 16 on Friday, with two rising, five declining and eight closng unchanged. The Composite Index rose 2.50 points to 1,358.48, the All T&T Index lost 2.59 points to close at 1,838.87 and The Cross-Listed Index increased 1.11 points to settle at 118.34.

The Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than the last selling price and three with lower offers.

At the close, Agostini’s closed at $24.40 in exchanging 17,200 shares, Ansa Mcal ended at $56.73, with 16,544 shares changing hands, Clico Investment Fund shed 20 cents in ending at $25.30 with the swapping of 821 stock units. First Citizens Bank added 1 cent in closing at $46.80 trading 31,948 stock units. Guardian Holdings dropped 15 cents to close at $32.35 in exchanging 33,176 units, JMMB Group ended at $1.81 trading 284 units, Massy Holdings closed at $67, with 4,871 stocks crossing the market.  National Enterprises dipped 4 cents to $2.96, with 2,043 units switching owners, NCB Financial Group climbed 20 cents to $8.50, with 1,754,266 shares crossing the market, One Caribbean Media shed 39 cents to close at $4.50 while exchanging 399 shares. Republic Financial Holdings settled at $135 in an exchange of 1,062 shares, Scotiabank closed at $54.90 trading 51,984 stock units, Trinidad & Tobago NGL ended at $16.49 after 20,607 shares changed hands. Unilever Caribbean slipped 1 cent to $16.32 trading 83 stock units and West Indian Tobacco settled at $32.49 with an exchange of 3,047 shares.

National Enterprises dipped 4 cents to $2.96, with 2,043 units switching owners, NCB Financial Group climbed 20 cents to $8.50, with 1,754,266 shares crossing the market, One Caribbean Media shed 39 cents to close at $4.50 while exchanging 399 shares. Republic Financial Holdings settled at $135 in an exchange of 1,062 shares, Scotiabank closed at $54.90 trading 51,984 stock units, Trinidad & Tobago NGL ended at $16.49 after 20,607 shares changed hands. Unilever Caribbean slipped 1 cent to $16.32 trading 83 stock units and West Indian Tobacco settled at $32.49 with an exchange of 3,047 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Guardian Holdings in ICTOP10

Guardian Holdings moved into the IC TOP 10 following the release of a prospectus from NCB Global that is offering 2 million shares to the public at $790 each, with the stock price falling immediately, after by more than $110, to be in line with the public offer price, valuing the company’s shares at 8 times 2021 projected earnings.

Guardian Holdings now in ICInsider.com’s TOP10.

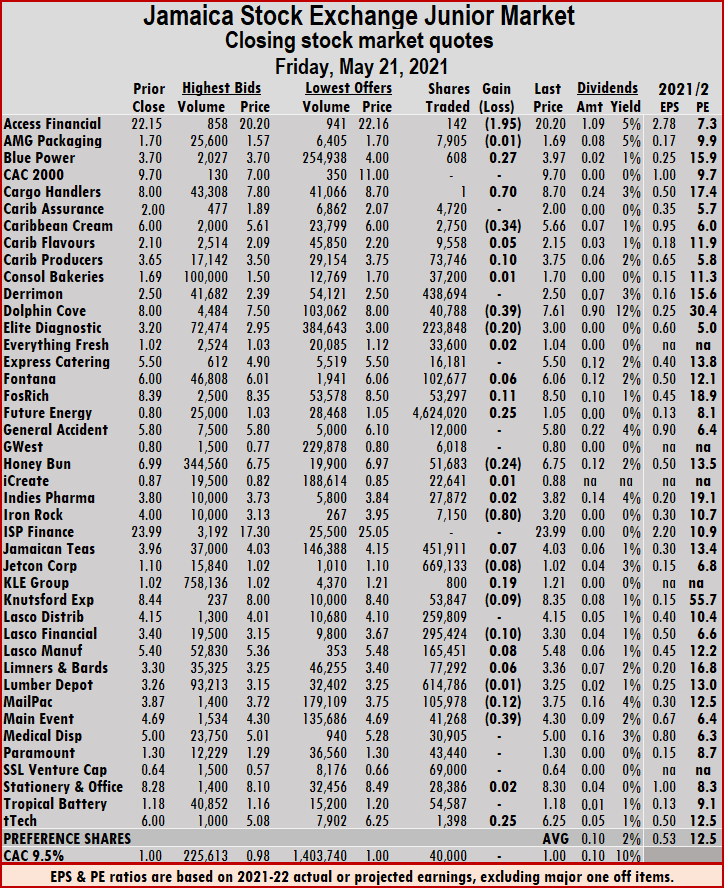

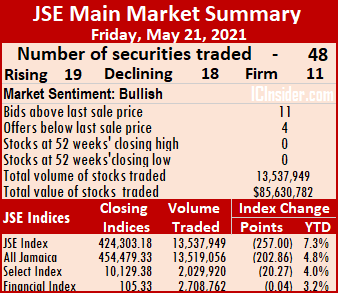

Elsewhere, with the passage of earnings season, the markets have lost most of their recent firepower to drive prices forward at a time when the Junior Market is trading at the very top of its upward sloping channel while the JSE Main Market is a few thousand points away and in facing much turbulence in attempting to break through the peak.

At the start of the past week, the Junior Market pulled back from last Friday’s close, to sit just above the 3,300 level but climbed on each succeeding day of the week, but pulled back slightly on Friday to close at 3,324 points just a few points higher than at the end of the previous week. At the same time, the JSE Main Market made attempts to come close to the 460,000 mark of the All Jamaica Composite Index but was rebuffed on each occasion and ended the week at 454,479.33, up from 451,713.66 at the close of the previous week.

The Junior Market has to decidedly break through the upper limit of the trading channel, to free it to move on to the next area of resistance, just over 4,000 mark, but the Main Market has room to run for a few thousand points before it hits the channel top at 460,000 points.

The Junior Market has to decidedly break through the upper limit of the trading channel, to free it to move on to the next area of resistance, just over 4,000 mark, but the Main Market has room to run for a few thousand points before it hits the channel top at 460,000 points.

There is a shakeup of the top three stocks in the Junior Market, this week. Elite Diagnostic heads the list, followed by Caribbean Assurance Brokers and Caribbean Producers, with potential to gain between 247 to 300 percent.  The top three Main Market stocks are Radio Jamaica in the number one spot, followed by Wisynco and PanJam Investments, with expected gains of 151 to 344 percent.

The top three Main Market stocks are Radio Jamaica in the number one spot, followed by Wisynco and PanJam Investments, with expected gains of 151 to 344 percent.

The targeted PE ratio for the market averages 20 based on profits of companies reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March 2021 with the average PE at 17 for Junior Stocks and 19 times for the Main Market. With interest rates on government paper below 5 percent and likely to remain there for a few years, the likelihood is for the average PE ratios to climb higher during the next twelve months or so.

The Junior Market with an average PE 12.5 based on ICInsider.com’s 2021-22 earnings, is currently trading well below the target, as well as the recent historical average of 17, this represents another 36 percent rise in the market that would equate to a rise of 60 percent to March 2022. The Junior Market Top 10 stocks average a mere 6.2 at just 50 percent of the market average, indicating substantial gains ahead. The JSE Main Market ended the week with an overall PE of 16.5, some distance from the 19 the market ended March, suggesting a 15 percent rise from now to March 2022. The Main Market TOP 10 trades at a PE of 7.9 or 48 percent of the PE of that market and well off the potential of 20.

The Junior Market with an average PE 12.5 based on ICInsider.com’s 2021-22 earnings, is currently trading well below the target, as well as the recent historical average of 17, this represents another 36 percent rise in the market that would equate to a rise of 60 percent to March 2022. The Junior Market Top 10 stocks average a mere 6.2 at just 50 percent of the market average, indicating substantial gains ahead. The JSE Main Market ended the week with an overall PE of 16.5, some distance from the 19 the market ended March, suggesting a 15 percent rise from now to March 2022. The Main Market TOP 10 trades at a PE of 7.9 or 48 percent of the PE of that market and well off the potential of 20.

The average projected gain for the Junior Market IC TOP 10 stocks is 225 percent and 162 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 225 percent and 162 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

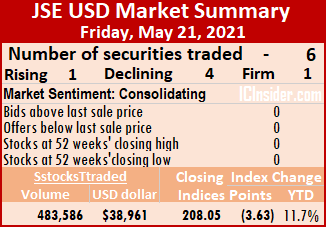

Falling stocks hit JSE USD market

Trading on Friday ended with the market declining after trading 125 percent more shares than on Thursday, on the US dollar market of the Jamaica Stock Exchange, resulting in declining stocks clobbering those rising.

Six securities changed hands, compared to four on Thursday with one stock rising, four declining and one closing unchanged.

Six securities changed hands, compared to four on Thursday with one stock rising, four declining and one closing unchanged.

The JSE USD Equity Index lost 3.63 points to end at 208.05. The average PE Ratio ends at 13.1 based on ICInsider.com’s forecast of 2021-22 earnings.

Overall, 483,586 shares traded, for US$38,961 compared to 214,841 units at US$54,388 on Thursday.

Trading averaged 80,598 units at US$6,494, in contrast to 53,710 shares at US$13,597 on Thursday. Trading for the month to date averages 103,810 units at US$12,476 in contrast to 105,595 units at US$12,936 on Thursday. April ended with an average of 80,293 units for US$6,320.

Investor’s Choice bid-offer indicator shows no stock ending trading with the bid higher than the last selling price and one with lower offers.

Investor’s Choice bid-offer indicator shows no stock ending trading with the bid higher than the last selling price and one with lower offers.

At the close, First Rock Capital declined by 0.35 of a cent to 8.61 US cents, trading 14,086 shares, Margaritaville ended trading of 309,135 stock units and closed at 9 US cents, Proven Investments lost 0.9 of a cent in closing at 26 US cents, with 6,240 stock units changing hands. Sterling Investments shed 0.08 of a cent to end at 2.21 US cents in an exchange of 477 stock units, Sygnus Credit Investments declined by 1.23 cents to 14.7 US cents after exchanging 50,000 stocks and Transjamaican Highway climbed 0.02 of a cent to end at 0.95 US cents with the swapping of 103,648 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

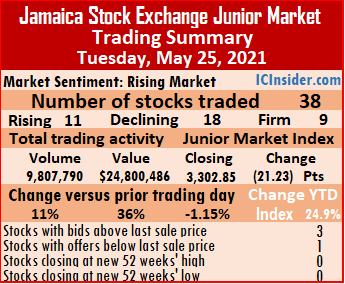

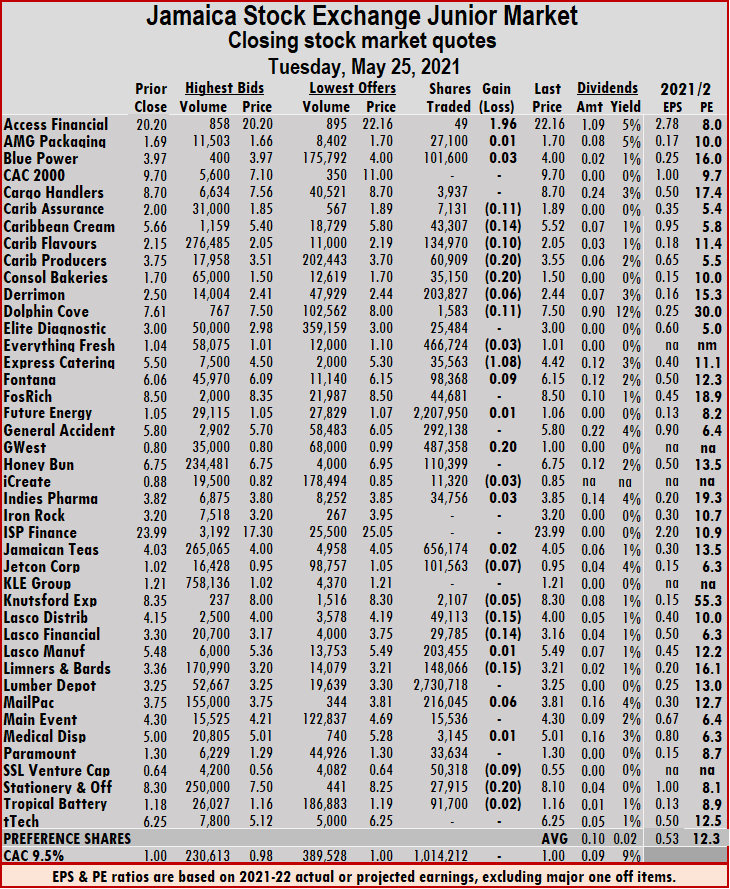

At the close, 38 securities traded, down from 41 on Friday and ended with 11 stocks rising, 18 declining and nine remaining unchanged.

At the close, 38 securities traded, down from 41 on Friday and ended with 11 stocks rising, 18 declining and nine remaining unchanged. At the close, Access Financial advanced $1.96 to finish at $22.16, trading 49 shares, Caribbean Assurance Brokers dropped 11 cents to close at $1.89, after 7,131 stock units crossed the market, Caribbean Cream fell 14 cents to $5.52, with 43,307 shares changing hands, Caribbean Flavours dropped 10 cents to end at $2.05 in exchanging 134,970 units. Caribbean Producers shed 20 cents to close at $3.55, with 60,909 stocks clearing the market, Consolidated Bakeries shed 20 cents in ending at $1.50 after exchanging 35,150 shares, Derrimon Trading dropped 6 cents to $2.44, with 203,827 stock units changing hands. Dolphin Cove lost 11 cents to end at $7.50 after trading 1,583 stock units, Express Catering lost $1.08 to end at $4.42 with an exchange of 35,563 units. Fontana climbed 9 cents to $6.15, trading 98,368 stocks, Gwest Corporation climbed 20 cents to $1 in switching ownership of 487,358 units. Jetcon Corporation shed 7 cents in closing at 95 cents after trading 101,563 units, Knutsford Express fell 5 cents to $8.30 in switching ownership of 2,107 stock units, Lasco Distributors lost 15 cents to end at $4 with an exchange of 49,113 stocks.

At the close, Access Financial advanced $1.96 to finish at $22.16, trading 49 shares, Caribbean Assurance Brokers dropped 11 cents to close at $1.89, after 7,131 stock units crossed the market, Caribbean Cream fell 14 cents to $5.52, with 43,307 shares changing hands, Caribbean Flavours dropped 10 cents to end at $2.05 in exchanging 134,970 units. Caribbean Producers shed 20 cents to close at $3.55, with 60,909 stocks clearing the market, Consolidated Bakeries shed 20 cents in ending at $1.50 after exchanging 35,150 shares, Derrimon Trading dropped 6 cents to $2.44, with 203,827 stock units changing hands. Dolphin Cove lost 11 cents to end at $7.50 after trading 1,583 stock units, Express Catering lost $1.08 to end at $4.42 with an exchange of 35,563 units. Fontana climbed 9 cents to $6.15, trading 98,368 stocks, Gwest Corporation climbed 20 cents to $1 in switching ownership of 487,358 units. Jetcon Corporation shed 7 cents in closing at 95 cents after trading 101,563 units, Knutsford Express fell 5 cents to $8.30 in switching ownership of 2,107 stock units, Lasco Distributors lost 15 cents to end at $4 with an exchange of 49,113 stocks. Lasco Financial fell 14 cents to $3.16, with 29,785 stock units crossing the exchange, Limners and Bards fell 15 cents to $3.21 after 148,066 units cleared the exchange. Mailpac Group rose 6 cents $3.81 after exchanging 216,045 units, SSL Venture declined 9 cents to 55 cents in an exchange of 50,318 stocks and Stationery and Office Supplies fell 20 cents to $8.10, trading 27,915 shares.

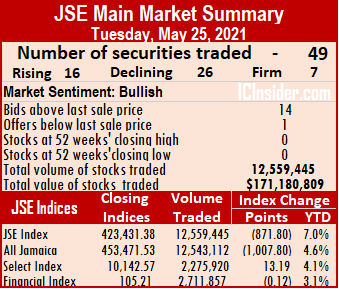

Lasco Financial fell 14 cents to $3.16, with 29,785 stock units crossing the exchange, Limners and Bards fell 15 cents to $3.21 after 148,066 units cleared the exchange. Mailpac Group rose 6 cents $3.81 after exchanging 216,045 units, SSL Venture declined 9 cents to 55 cents in an exchange of 50,318 stocks and Stationery and Office Supplies fell 20 cents to $8.10, trading 27,915 shares. The All Jamaican Composite Index dropped 1,007.80 points to 453,471.53, the JSE Main Index fell 871.80 points to 423,431.38 and JSE Financial Index slipped 0.12 points to 105.21.

The All Jamaican Composite Index dropped 1,007.80 points to 453,471.53, the JSE Main Index fell 871.80 points to 423,431.38 and JSE Financial Index slipped 0.12 points to 105.21. Investor’s Choice bid-offer indicator shows 14 stocks ending with bids higher than their last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator shows 14 stocks ending with bids higher than their last selling prices and one with a lower offer. Sagicor Real Estate Fund lost 30 cents to close at $8 while trading 2,030 shares, Scotia Group fell $1 to $39.80 in exchanging 28,625 units, Supreme Ventures fell $1.25 to $20.50 in trading 58,706 stocks and Wisynco gained 39 cents to finish at $15.89 after exchanging 23,510 stocks.

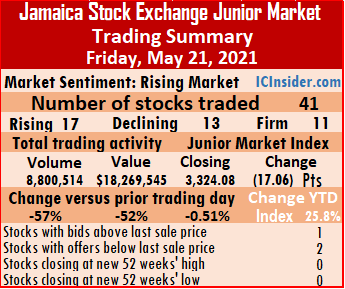

Sagicor Real Estate Fund lost 30 cents to close at $8 while trading 2,030 shares, Scotia Group fell $1 to $39.80 in exchanging 28,625 units, Supreme Ventures fell $1.25 to $20.50 in trading 58,706 stocks and Wisynco gained 39 cents to finish at $15.89 after exchanging 23,510 stocks. At the close, Access Financial fell $1.95 to $20.20 after exchanging 142 shares, Blue Power climbed 27 cents to $3.97, trading 608 shares. Cargo Handlers rose 70 cents to $8.70, with one stock unit changing hands, Caribbean Cream dropped 34 cents $5.66 in exchanging 2,750 units, Caribbean Flavours increased 5 cents to $2.15, with 9,558 stock units crossing the market. Caribbean Producers advanced 10 cents to end at $3.75 with the swapping of 73,746 units, Dolphin Cove lost 39 cents to end at $7.61 in trading 40,788 units. Elite Diagnostic fell 20 cents to $3 in switching ownership of 223,848 units, Fontana advanced 6 cents to $6.06 while exchanging 102,677 stocks. Fosrich advanced 11 cents to $8.50, trading 53,297 units, Future Energy Source climbed 3 cents to $1.05 in exchanging 4,624,020 units, Honey Bun fell 24 cents to $6.75 with the swapping of 51,683 stock units. Iron Rock Insurance declined 80 cents to $3.20 with the swapping of 7,150 stock units. Jamaican Teas rose 7 cents to $4.03, with 451,911 stocks hanging hands, Jetcon Corporation lost 8 cents in ending at $1.02 after exchanging 669,133 stock units, KLE Group rose 19 cents to close at $1.21 with an exchange of 800 stocks.

At the close, Access Financial fell $1.95 to $20.20 after exchanging 142 shares, Blue Power climbed 27 cents to $3.97, trading 608 shares. Cargo Handlers rose 70 cents to $8.70, with one stock unit changing hands, Caribbean Cream dropped 34 cents $5.66 in exchanging 2,750 units, Caribbean Flavours increased 5 cents to $2.15, with 9,558 stock units crossing the market. Caribbean Producers advanced 10 cents to end at $3.75 with the swapping of 73,746 units, Dolphin Cove lost 39 cents to end at $7.61 in trading 40,788 units. Elite Diagnostic fell 20 cents to $3 in switching ownership of 223,848 units, Fontana advanced 6 cents to $6.06 while exchanging 102,677 stocks. Fosrich advanced 11 cents to $8.50, trading 53,297 units, Future Energy Source climbed 3 cents to $1.05 in exchanging 4,624,020 units, Honey Bun fell 24 cents to $6.75 with the swapping of 51,683 stock units. Iron Rock Insurance declined 80 cents to $3.20 with the swapping of 7,150 stock units. Jamaican Teas rose 7 cents to $4.03, with 451,911 stocks hanging hands, Jetcon Corporation lost 8 cents in ending at $1.02 after exchanging 669,133 stock units, KLE Group rose 19 cents to close at $1.21 with an exchange of 800 stocks. Knutsford Express declined 9 cents to $8.35 while exchanging 53,847 stock units, Lasco Financial lost 10 cents in closing at $3.30, with 295,424 stocks switching ownership, Lasco Manufacturing climbed 8 cents to $5.48 in trading 165,451 units. Limners and Bards gained 6 cents to close at $3.36 after 77,292 units changed hands, Mailpac Group declined 12 cents to $3.75 in an exchange of 105,978 stocks. Main Event declined 39 cents in closing at $4.30 after trading 41,268 shares and tTech rose 25 cents to $6.25 with 1,398 shares clearing the market.

Knutsford Express declined 9 cents to $8.35 while exchanging 53,847 stock units, Lasco Financial lost 10 cents in closing at $3.30, with 295,424 stocks switching ownership, Lasco Manufacturing climbed 8 cents to $5.48 in trading 165,451 units. Limners and Bards gained 6 cents to close at $3.36 after 77,292 units changed hands, Mailpac Group declined 12 cents to $3.75 in an exchange of 105,978 stocks. Main Event declined 39 cents in closing at $4.30 after trading 41,268 shares and tTech rose 25 cents to $6.25 with 1,398 shares clearing the market. Trading closed with an average of 282,041 units at $1,783,975, compared to 525,290 shares at $9,415,262 on Thursday. Trading month to date averages 320,145 units at $3,595,710, in contrast to 322,750 units at $3,719,589 on Thursday. Trading in April averaged 234,200 units at $1,772,561.

Trading closed with an average of 282,041 units at $1,783,975, compared to 525,290 shares at $9,415,262 on Thursday. Trading month to date averages 320,145 units at $3,595,710, in contrast to 322,750 units at $3,719,589 on Thursday. Trading in April averaged 234,200 units at $1,772,561. Seprod shed $1.50 to close at $73.50 with an exchange of 44,685 stock units, Supreme Ventures rose $1.55 to close at $21.75 in trading 98,472 stocks and Sygnus Credit Investments gained 40 cents to finish at $15.61 after exchanging 313,497 stocks.

Seprod shed $1.50 to close at $73.50 with an exchange of 44,685 stock units, Supreme Ventures rose $1.55 to close at $21.75 in trading 98,472 stocks and Sygnus Credit Investments gained 40 cents to finish at $15.61 after exchanging 313,497 stocks.