Sygnus Credit Investments commanded 89 percent of the stocks traded on the JSE USD market on Friday after an exchange of 7.4 million units of the company’s shares and driving the overall volume of the market up by a huge 3,226 percent over Thursday, with a value that was 1,610 percent greater.

Sygnus Credit Investments traded most shares on the USD market.

Overall, 8,332,589 shares traded in exchange for US$1,043,788 compared to 250,508 units at US$61,050 on Thursday.

Trading ended with six securities changing hands, compared to eight on Thursday with the prices of three stocks rising, none declining and three remaining unchanged.

The JSE USD Equity Index slipped 2.26 points to end at 188.95 at the close.

The PE Ratio, a measure that computes an appropriate stock value, averages 12.1 based on ICInsider.com’s forecast of 2021-22 earnings.

Trading averaged 1,388,765 units at US$173,965, compared to 31,314 shares at US$7,631 on Thursday. The average month to date comes out at 205,146 units at US$20,168 in contrast to 122,568 units at US$9,438 on Thursday. June ended with an average of 87,444 units for US$6,162.

Investor’s Choice bid-offer indicator shows one stock ending with the bid higher than the last selling price and three with lower offers.

At the close, First Rock Capital gained 0.1 of a cent to close at 8 US cents, with 285 shares changing hands, Margaritaville settled at 9 US cents with an exchange of 30,000 units, Proven Investments ended at 24 US cents with 4,218 stocks traded. Sygnus Credit Investments rose 0.2 of a cent to 14 US cents, with a transfer of 7,427,937 stock units and Transjamaican Highway gained 0.05 of a cent to close at 0.8 of a US cent with 865,149 shares crossing the exchange.

At the close, First Rock Capital gained 0.1 of a cent to close at 8 US cents, with 285 shares changing hands, Margaritaville settled at 9 US cents with an exchange of 30,000 units, Proven Investments ended at 24 US cents with 4,218 stocks traded. Sygnus Credit Investments rose 0.2 of a cent to 14 US cents, with a transfer of 7,427,937 stock units and Transjamaican Highway gained 0.05 of a cent to close at 0.8 of a US cent with 865,149 shares crossing the exchange.

In the preference segment, JMMB Group 6% closed at US$1.03 with 4,000 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

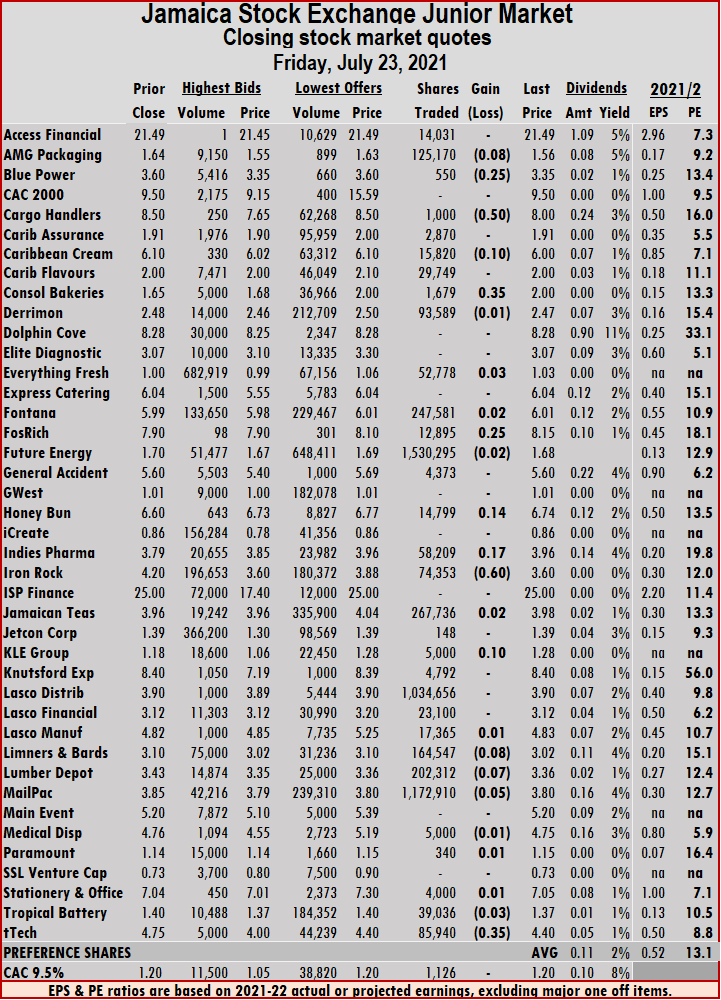

Market activity led to 33 securities trading, similar to Thursday, and ended with 11 stocks rising, 13 declining and nine ending unchanged.

Market activity led to 33 securities trading, similar to Thursday, and ended with 11 stocks rising, 13 declining and nine ending unchanged. Trading averages 160,841 units at $520,136 versus 111,343 at $263,357 on Thursday. Trading for the month to date averages 156,090 units at $447,181, versus 155,814 units at $442,949 on Thursday. June closed with an average of 225,705 units at $644,459.

Trading averages 160,841 units at $520,136 versus 111,343 at $263,357 on Thursday. Trading for the month to date averages 156,090 units at $447,181, versus 155,814 units at $442,949 on Thursday. June closed with an average of 225,705 units at $644,459. KLE Group rose 10 cents to $1.28 with 5,000 shares changing hands, Limners and Bards lost 8 cents to finish at $3.02 with a transfer of 164,547 stock units, Lumber Depot fell 7 cents to $3.36, with investors switching ownership of 202,312 units. Mailpac Group slipped 5 cents to $3.80, with 1,172,910 stocks traded and tTech dropped 35 cents to $4.40 with 85,940 shares crossing the exchange.

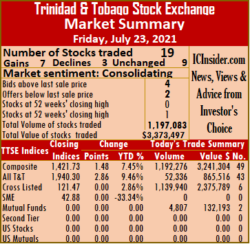

KLE Group rose 10 cents to $1.28 with 5,000 shares changing hands, Limners and Bards lost 8 cents to finish at $3.02 with a transfer of 164,547 stock units, Lumber Depot fell 7 cents to $3.36, with investors switching ownership of 202,312 units. Mailpac Group slipped 5 cents to $3.80, with 1,172,910 stocks traded and tTech dropped 35 cents to $4.40 with 85,940 shares crossing the exchange. At the close, 19 securities traded compared to 17 on Thursday, with seven rising, three declining and nine remaining unchanged. The Composite Index popped 1.48 points to 1,421.73, the All T&T Index rose 2.86 points to 1,940.30 and the Cross-Listed Index remained unchanged at 121.47.

At the close, 19 securities traded compared to 17 on Thursday, with seven rising, three declining and nine remaining unchanged. The Composite Index popped 1.48 points to 1,421.73, the All T&T Index rose 2.86 points to 1,940.30 and the Cross-Listed Index remained unchanged at 121.47. L.J Williams B share remained at $1.50, with 1,047 shares crossing the market, Massy Holdings dropped 55 cents to $80.05, with 2,319 stock units changing hands. National Enterprises popped 10 cents to $3.70 after just one stock unit was traded, National Flour Mills lost 4 cents to close at $2 in trading one stock, One Caribbean Media dropped 50 cents to close at a 52 weeks’ low of $4 a mere one share crossing the market. Point Lisas remained at $3.15 in exchanging at 1,001 stocks, Prestige Holdings gained 25 cents to end at $7.50, with 86 stock units changing hands, Scotiabank closed at $59.75, with 639 shares clearing the market. Trinidad & Tobago NGL remained at $18 after exchanging 4,031 stock units, Trinidad Cement increased 25 cents to close at $3.75 in exchanging 25,913 stocks and West Indian Tobacco popped 1 cent to $32.50 in switching ownership of 410 stocks.

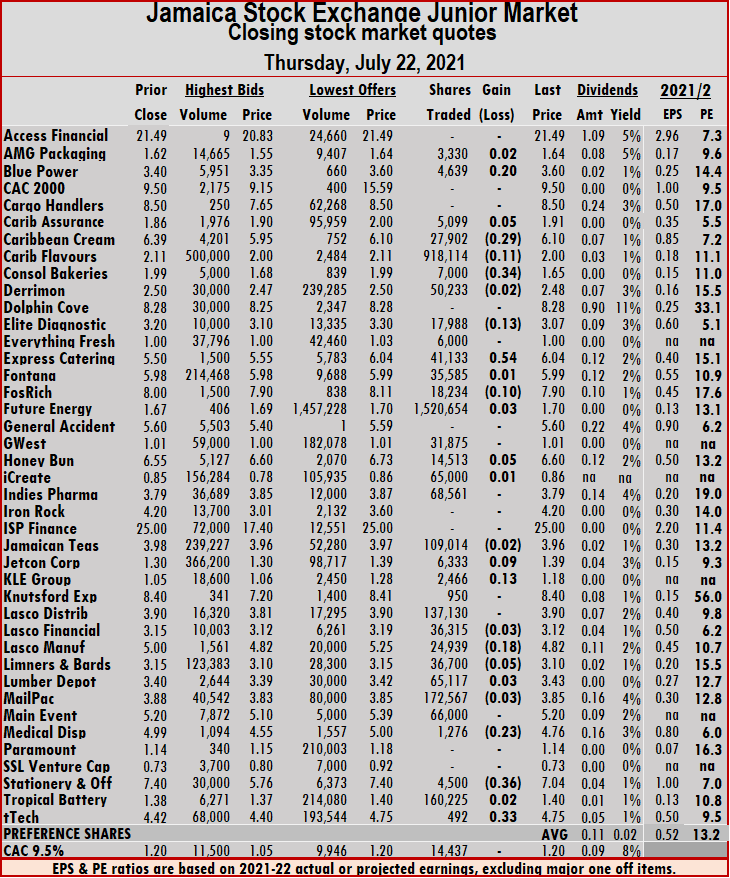

L.J Williams B share remained at $1.50, with 1,047 shares crossing the market, Massy Holdings dropped 55 cents to $80.05, with 2,319 stock units changing hands. National Enterprises popped 10 cents to $3.70 after just one stock unit was traded, National Flour Mills lost 4 cents to close at $2 in trading one stock, One Caribbean Media dropped 50 cents to close at a 52 weeks’ low of $4 a mere one share crossing the market. Point Lisas remained at $3.15 in exchanging at 1,001 stocks, Prestige Holdings gained 25 cents to end at $7.50, with 86 stock units changing hands, Scotiabank closed at $59.75, with 639 shares clearing the market. Trinidad & Tobago NGL remained at $18 after exchanging 4,031 stock units, Trinidad Cement increased 25 cents to close at $3.75 in exchanging 25,913 stocks and West Indian Tobacco popped 1 cent to $32.50 in switching ownership of 410 stocks. Market activity led to 33 securities trading compared to 34 on Wednesday and ended with the prices of 13 stocks each, rising and falling, leaving nine unchanged. At the close, the Junior Market Index dropped 11.87 points to settle at 3,335.20.

Market activity led to 33 securities trading compared to 34 on Wednesday and ended with the prices of 13 stocks each, rising and falling, leaving nine unchanged. At the close, the Junior Market Index dropped 11.87 points to settle at 3,335.20. At the close, Blue Power advanced 20 cents to $3.60 with an exchange of 4,639 shares, Caribbean Assurance Brokers rose 5 cents to end at $1.91, with 5,099 stocks changing hands, Caribbean Cream dropped 29 cents to finish at $6.10 with 27,902 units traded. Caribbean Flavours fell 11 cents to $2 with a transfer of 918,114 shares, Consolidated Bakeries dropped 34 cents to $1.65, with 7,000 stocks passing through the market, Elite Diagnostic slipped 13 cents to $3.07, with an exchange of 17,988 units. Express Catering rallied by 54 cents to end at $6.04 with 41,133 shares changing hands, Fosrich slipped 10 cents to $7.90 with 18,234 units traded, Honey Bun popped 5 cents to $6.60 with a transfer of 14,513 stocks. Jetcon Corporation rose 9 cents to $1.39 with investors switching ownership of 6,333 units, KLE Group spiked 13 cents to $1.18 with an exchange of 2,466 shares, Lasco Manufacturing slipped 18 cents to $4.82, with 24,939 stocks changing hands.

At the close, Blue Power advanced 20 cents to $3.60 with an exchange of 4,639 shares, Caribbean Assurance Brokers rose 5 cents to end at $1.91, with 5,099 stocks changing hands, Caribbean Cream dropped 29 cents to finish at $6.10 with 27,902 units traded. Caribbean Flavours fell 11 cents to $2 with a transfer of 918,114 shares, Consolidated Bakeries dropped 34 cents to $1.65, with 7,000 stocks passing through the market, Elite Diagnostic slipped 13 cents to $3.07, with an exchange of 17,988 units. Express Catering rallied by 54 cents to end at $6.04 with 41,133 shares changing hands, Fosrich slipped 10 cents to $7.90 with 18,234 units traded, Honey Bun popped 5 cents to $6.60 with a transfer of 14,513 stocks. Jetcon Corporation rose 9 cents to $1.39 with investors switching ownership of 6,333 units, KLE Group spiked 13 cents to $1.18 with an exchange of 2,466 shares, Lasco Manufacturing slipped 18 cents to $4.82, with 24,939 stocks changing hands.  Limners and Bards dipped 5 cents to $3.10 with 36,700 stock units traded, Medical Disposables fell 23 cents to $4.76 with a transfer of 1,276 units, Stationery and Office Supplies shed 36 cents to settle at $7.04 with 4,500 stocks changing hands and tTech jumped 33 cents to $4.75 with 492 shares crossing the exchange.

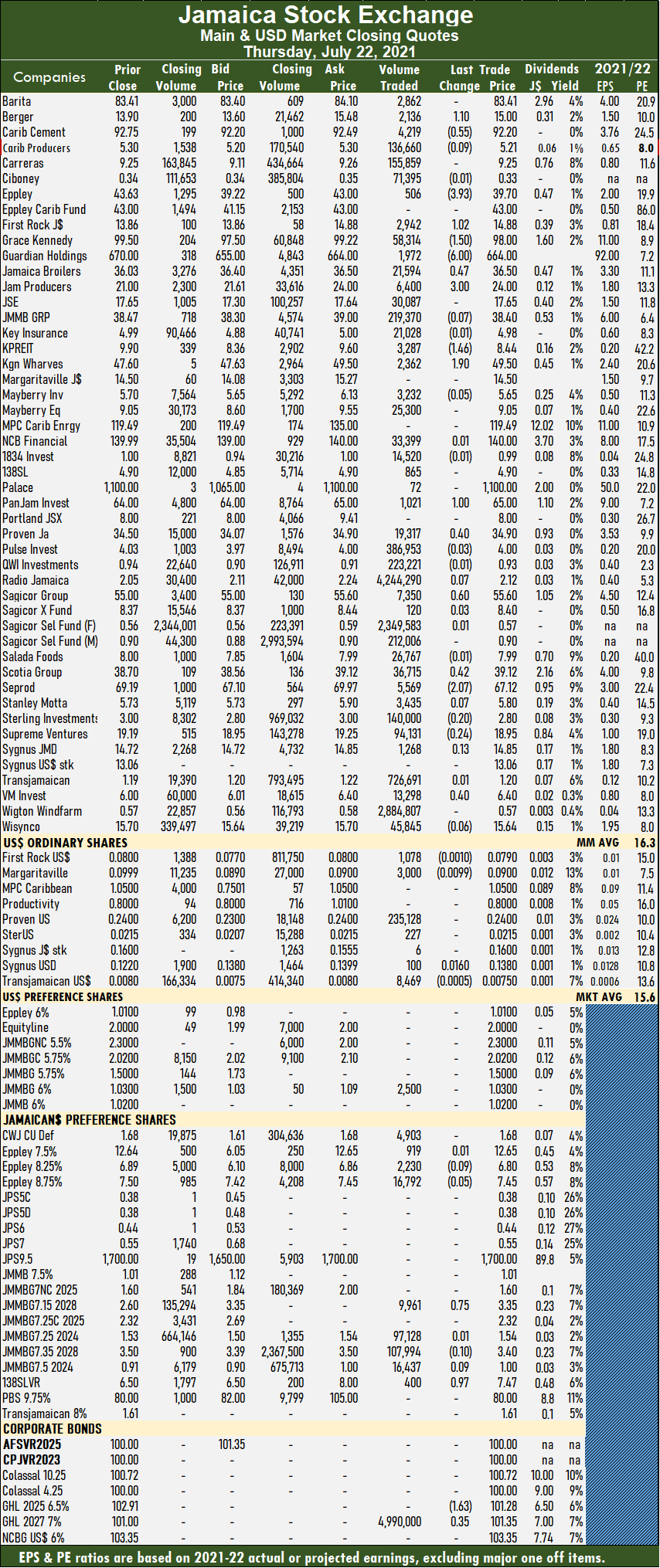

Limners and Bards dipped 5 cents to $3.10 with 36,700 stock units traded, Medical Disposables fell 23 cents to $4.76 with a transfer of 1,276 units, Stationery and Office Supplies shed 36 cents to settle at $7.04 with 4,500 stocks changing hands and tTech jumped 33 cents to $4.75 with 492 shares crossing the exchange. At the close, the All Jamaican Composite Index added 1,435.41 points to 456,996.38, the JSE Main Index rose 944.89 points to end at 419,409.14 and the JSE Financial Index lost 0.07 points to 103.17.

At the close, the All Jamaican Composite Index added 1,435.41 points to 456,996.38, the JSE Main Index rose 944.89 points to end at 419,409.14 and the JSE Financial Index lost 0.07 points to 103.17. Trading averaged 240,337 units at $897,464, compared to 139,495 shares at $1,919,540 on Wednesday. Trading month to date, averages 342,188 units at $19,740,077, in contrast to 349,306 units at $21,057,034 on Wednesday. June ended with an average of 249,610 units at $3,877,606.

Trading averaged 240,337 units at $897,464, compared to 139,495 shares at $1,919,540 on Wednesday. Trading month to date, averages 342,188 units at $19,740,077, in contrast to 349,306 units at $21,057,034 on Wednesday. June ended with an average of 249,610 units at $3,877,606. Radio Jamaica popped 7 cents to end at a 52 weeks’ closing high of $2.12 after hitting a high of $2.35 in trading 4,244,290 stock units, Sagicor Group rose 60 cents to $55.60 with the swapping of 7,350 units, Scotia Group rallied 42 cents to $39.12 in exchanging 36,715 shares, Seprod fell $2.07 to $67.12 in transferring 5,569 units, Sterling Investments lost 20 cents to end at $2.80 in exchanging 140,000 stock units, Supreme Ventures dipped 24 cents to $18.95 in trading 94,131 shares and Victoria Mutual Investments popped 40 cents to end at $6.40 in switching ownership of 13,298 stock units.

Radio Jamaica popped 7 cents to end at a 52 weeks’ closing high of $2.12 after hitting a high of $2.35 in trading 4,244,290 stock units, Sagicor Group rose 60 cents to $55.60 with the swapping of 7,350 units, Scotia Group rallied 42 cents to $39.12 in exchanging 36,715 shares, Seprod fell $2.07 to $67.12 in transferring 5,569 units, Sterling Investments lost 20 cents to end at $2.80 in exchanging 140,000 stock units, Supreme Ventures dipped 24 cents to $18.95 in trading 94,131 shares and Victoria Mutual Investments popped 40 cents to end at $6.40 in switching ownership of 13,298 stock units. Trading ended with eight securities changing hands, compared to seven on Wednesday, with the price of one rising, three declining and four ending unchanged.

Trading ended with eight securities changing hands, compared to seven on Wednesday, with the price of one rising, three declining and four ending unchanged. Margaritaville dropped 0.99 of a cent to 9 US cents, with 3,000 stocks crossing the market, Proven Investments ended trading at 24 US cents, with 235,128 stock units trading, Sterling Investments closed trading at 2.15 US cents in switching ownership of 227 units. Sygnus Credit Investments exchanged a mere 6 shares in ending trading at 16 US cents, Sygnus Credit Investments climbed 1.6 cents to 13.8 US cents after trading 100 stocks and Transjamaican Highway lost 0.05 of a cent after ending at 0.75 US cents in an exchange of 8,469 stocks.

Margaritaville dropped 0.99 of a cent to 9 US cents, with 3,000 stocks crossing the market, Proven Investments ended trading at 24 US cents, with 235,128 stock units trading, Sterling Investments closed trading at 2.15 US cents in switching ownership of 227 units. Sygnus Credit Investments exchanged a mere 6 shares in ending trading at 16 US cents, Sygnus Credit Investments climbed 1.6 cents to 13.8 US cents after trading 100 stocks and Transjamaican Highway lost 0.05 of a cent after ending at 0.75 US cents in an exchange of 8,469 stocks. In the end, 17 securities traded compared to 18 on Wednesday, with three rising, five declining and nine remaining unchanged. The Composite Index fell 3.99 points 1,420.25, the All T&T Index slipped 4.72 points to 1,937.44 and the Cross-Listed Index lost 0.45 points to close 121.47.

In the end, 17 securities traded compared to 18 on Wednesday, with three rising, five declining and nine remaining unchanged. The Composite Index fell 3.99 points 1,420.25, the All T&T Index slipped 4.72 points to 1,937.44 and the Cross-Listed Index lost 0.45 points to close 121.47. JMMB Group closed trading at $2.05 after exchanging 1,000 shares, L.J Williams B share settled at $1.50, after 9 stock units changed hands, Massy Holdings closed at $80.60, with the swapping of 228 shares. NCB Financial Group popped 1 cent to $8.01 after 9,252 stocks crossed the exchange, Republic Financial Holdings remained at $135.50, with an exchange of 1,851 shares, Scotiabank remained at $59.75 after 1,276 units traded. Trinidad & Tobago NGL dropped 14 cents to $18 with the swapping of 7,368 stocks, Trinidad Cement rallied 10 cents to end at $3.50 with an exchange of 2,000 units, Unilever Caribbean dipped 2 cents to $16.30, with 100 units crossing the exchange and West Indian Tobacco settled at $32.49 crossing the market 2,584 shares.

JMMB Group closed trading at $2.05 after exchanging 1,000 shares, L.J Williams B share settled at $1.50, after 9 stock units changed hands, Massy Holdings closed at $80.60, with the swapping of 228 shares. NCB Financial Group popped 1 cent to $8.01 after 9,252 stocks crossed the exchange, Republic Financial Holdings remained at $135.50, with an exchange of 1,851 shares, Scotiabank remained at $59.75 after 1,276 units traded. Trinidad & Tobago NGL dropped 14 cents to $18 with the swapping of 7,368 stocks, Trinidad Cement rallied 10 cents to end at $3.50 with an exchange of 2,000 units, Unilever Caribbean dipped 2 cents to $16.30, with 100 units crossing the exchange and West Indian Tobacco settled at $32.49 crossing the market 2,584 shares. Seven securities traded on Wednesday compared to five on Tuesday, with the price of one rising, three declining and three ending unchanged.

Seven securities traded on Wednesday compared to five on Tuesday, with the price of one rising, three declining and three ending unchanged. At the close, First Rock Capital settled at 8 US cents with 16,000 shares passing through the market, Proven Investments fell 0.05 of a cent to 24 US cents with 166,293 stocks changing hands, Sterling Investments remained at 2.15 US cents with 2,598 stock units traded. Sygnus Credit Investments popped 1 cent to 16 US cents in trading 12 units and Transjamaican Highway saw trading of 1,085,818 shares in closing at 0.80 US cents.

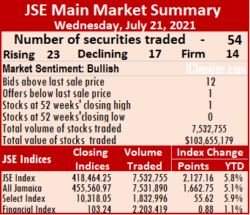

At the close, First Rock Capital settled at 8 US cents with 16,000 shares passing through the market, Proven Investments fell 0.05 of a cent to 24 US cents with 166,293 stocks changing hands, Sterling Investments remained at 2.15 US cents with 2,598 stock units traded. Sygnus Credit Investments popped 1 cent to 16 US cents in trading 12 units and Transjamaican Highway saw trading of 1,085,818 shares in closing at 0.80 US cents. At the close, the All Jamaican Composite Index advanced 1,662.75 points to 455,560.97, the JSE Main Index climbed 2,127.16 points to end at 418,464.25 and the JSE Financial Index rose 0.88 points to 103.24.

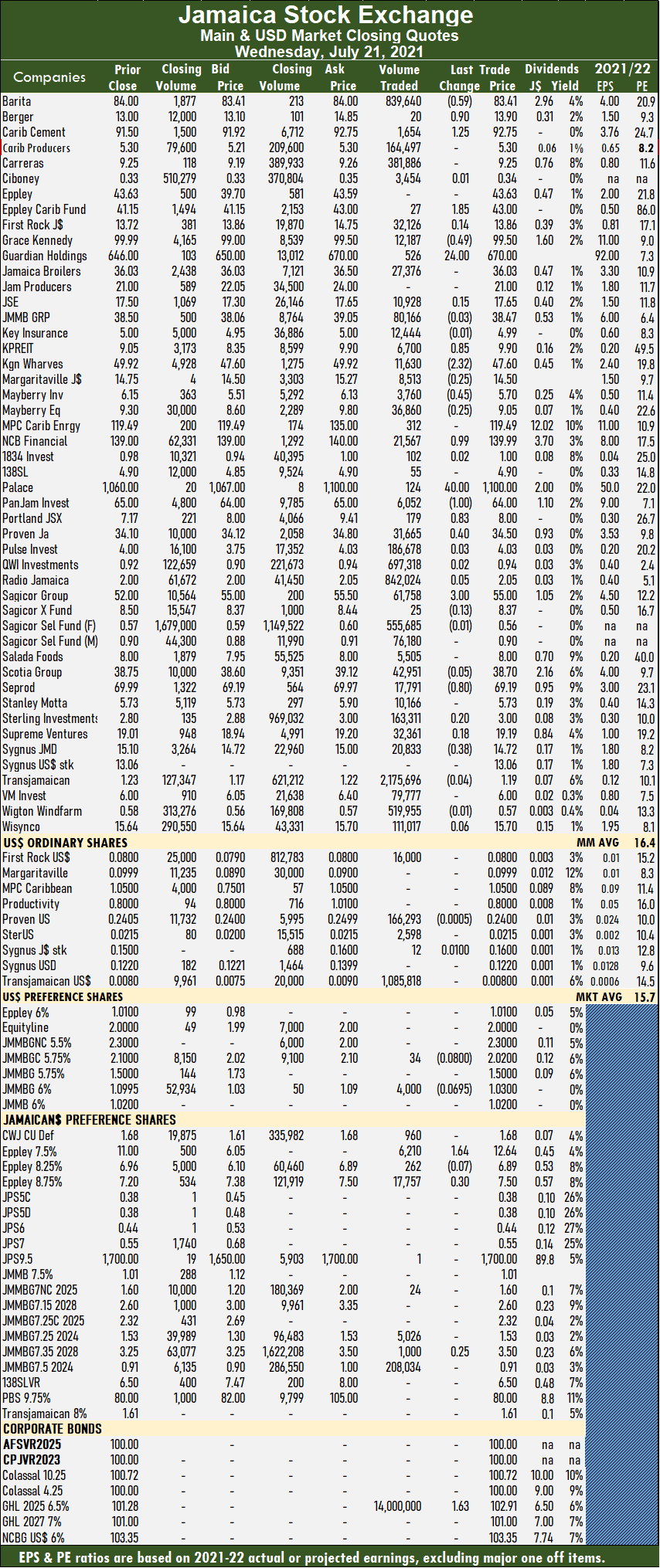

At the close, the All Jamaican Composite Index advanced 1,662.75 points to 455,560.97, the JSE Main Index climbed 2,127.16 points to end at 418,464.25 and the JSE Financial Index rose 0.88 points to 103.24. At the close, Barita Investments shed 59 cents to end at $83.41 with a transfer of 839,640 shares, Berger Paints spiked 90 cents to $13.90 in exchanging 20 stock units, Caribbean Cement popped $1.25 to $92.75 with 1,654 units crossing the market. Eppley Caribbean Property Fund spiked $1.85 to $43 with the swapping of 27 stocks, Grace Kennedy lost 49 cents to close at $99.50 in switching ownership of 12,187 units. Guardian Holdings surged $24 to $670 in trading 526 stocks, Kingston Properties rallied 85 cents to $9.90 in exchanging 6,700 stock units, Kingston Wharves declined $2.32 to $47.60, with 11,630 shares changing hands. Margaritaville fell 25 cents to $14.50 with 8,513 units crossing the exchange, Mayberry Investments shed 45 cents to $5.70 with the swapping of 3,760 shares, Mayberry Jamaican Equities fell 25 cents to $9.05 in switching ownership of 36,860 stocks. NCB Financial rose 99 cents to $139.99 in switching ownership of 21,567 stock units, Palace Amusement climbed $40 to $1,100 in trading 124 stocks, PanJam Investment slipped $1 to $64 after an exchange of 6,052 units. Portland JSX rose 83 cents to $8 in trading 179 stock units, Proven Investments picked up 40 cents to close at $34.50 after trading 31,665 stocks, Radio Jamaica popped 5 cents to end at a 52 weeks’ high of $2.05 while exchanging 842,024 shares.

At the close, Barita Investments shed 59 cents to end at $83.41 with a transfer of 839,640 shares, Berger Paints spiked 90 cents to $13.90 in exchanging 20 stock units, Caribbean Cement popped $1.25 to $92.75 with 1,654 units crossing the market. Eppley Caribbean Property Fund spiked $1.85 to $43 with the swapping of 27 stocks, Grace Kennedy lost 49 cents to close at $99.50 in switching ownership of 12,187 units. Guardian Holdings surged $24 to $670 in trading 526 stocks, Kingston Properties rallied 85 cents to $9.90 in exchanging 6,700 stock units, Kingston Wharves declined $2.32 to $47.60, with 11,630 shares changing hands. Margaritaville fell 25 cents to $14.50 with 8,513 units crossing the exchange, Mayberry Investments shed 45 cents to $5.70 with the swapping of 3,760 shares, Mayberry Jamaican Equities fell 25 cents to $9.05 in switching ownership of 36,860 stocks. NCB Financial rose 99 cents to $139.99 in switching ownership of 21,567 stock units, Palace Amusement climbed $40 to $1,100 in trading 124 stocks, PanJam Investment slipped $1 to $64 after an exchange of 6,052 units. Portland JSX rose 83 cents to $8 in trading 179 stock units, Proven Investments picked up 40 cents to close at $34.50 after trading 31,665 stocks, Radio Jamaica popped 5 cents to end at a 52 weeks’ high of $2.05 while exchanging 842,024 shares. Sagicor Group advanced $3 to $55 in switching ownership of 61,758 shares, Seprod fell 80 cents to $69.19 with 17,791 shares changing hands, Sterling Investments gained 20 cents to end at $3 with 163,311 units crossing the market and Sygnus Credit Investments lost 38 cents after ending at $14.72 in trading 20,833 units.

Sagicor Group advanced $3 to $55 in switching ownership of 61,758 shares, Seprod fell 80 cents to $69.19 with 17,791 shares changing hands, Sterling Investments gained 20 cents to end at $3 with 163,311 units crossing the market and Sygnus Credit Investments lost 38 cents after ending at $14.72 in trading 20,833 units. Market activity led to 34 securities trading compared to 37 on Tuesday and ended, with nine stocks rising, 23 declining and two closing unchanged. At the close, the Junior Market Index fell 22.01 points to settle at 3,347.07.

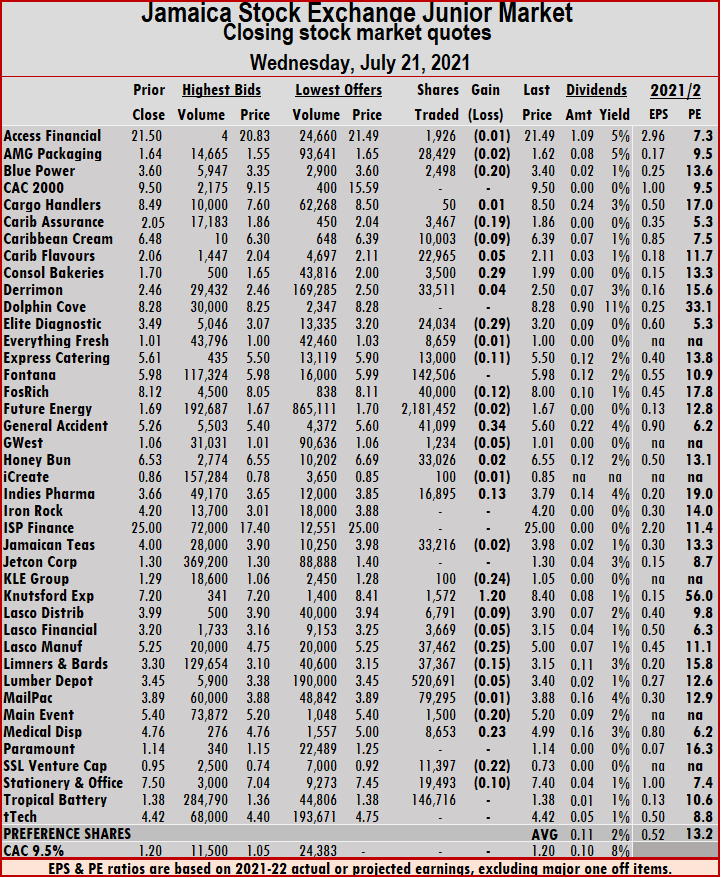

Market activity led to 34 securities trading compared to 37 on Tuesday and ended, with nine stocks rising, 23 declining and two closing unchanged. At the close, the Junior Market Index fell 22.01 points to settle at 3,347.07. At the close, Blue Power dropped 20 cents to $3.40 with an exchange of 2,498 shares, Caribbean Assurance Brokers fell 19 cents to $1.86 with 3,467 units changing hands, Caribbean Cream lost 9 cents to finish at $6.39, with 10,003 stocks traded. Caribbean Flavours rose 5 cents to $2.11, with a transfer of 22,965 shares, Consolidated Bakeries rallied 29 cents to a 52 weeks’ high of $1.99, with investors switching ownership of 3,500 units, Elite Diagnostic shed 29 cents to $3.20 with an exchange of 24,034 stocks. Express Catering declined 11 cents to $5.50, with 13,000 shares changing hands, Fosrich fell 12 cents to $8 with 40,000 units traded, General Accident advanced 34 cents to $5.60 with a transfer of 41,099 stocks. GWest Corporation slipped 5 cents to $1.01, with 1,234 shares passing through the market, Indies Pharma rallied 13 cents to $3.79 with an exchange of 16,895 units, KLE Group dropped 24 cents to $1.05 with 100 stocks changing hands. Knutsford Express spiked $1.20 to $8.40, with 1,572 shares traded, Lasco Distributors lost 9 cents to close at $3.90 with a transfer of 6,791 units, Lasco Financial slipped 5 cents to $3.15 with 3,669 stocks passing through the market.

At the close, Blue Power dropped 20 cents to $3.40 with an exchange of 2,498 shares, Caribbean Assurance Brokers fell 19 cents to $1.86 with 3,467 units changing hands, Caribbean Cream lost 9 cents to finish at $6.39, with 10,003 stocks traded. Caribbean Flavours rose 5 cents to $2.11, with a transfer of 22,965 shares, Consolidated Bakeries rallied 29 cents to a 52 weeks’ high of $1.99, with investors switching ownership of 3,500 units, Elite Diagnostic shed 29 cents to $3.20 with an exchange of 24,034 stocks. Express Catering declined 11 cents to $5.50, with 13,000 shares changing hands, Fosrich fell 12 cents to $8 with 40,000 units traded, General Accident advanced 34 cents to $5.60 with a transfer of 41,099 stocks. GWest Corporation slipped 5 cents to $1.01, with 1,234 shares passing through the market, Indies Pharma rallied 13 cents to $3.79 with an exchange of 16,895 units, KLE Group dropped 24 cents to $1.05 with 100 stocks changing hands. Knutsford Express spiked $1.20 to $8.40, with 1,572 shares traded, Lasco Distributors lost 9 cents to close at $3.90 with a transfer of 6,791 units, Lasco Financial slipped 5 cents to $3.15 with 3,669 stocks passing through the market.  Lasco Manufacturing shed 25 cents to $5 with an exchange of 37,462 shares, Limners and Bards fell 15 cents to $3.15, with 37,367 units changing hands, Lumber Depot lost 5 cents to settle at $3.40 with 520,691 stocks traded. Main Event dropped 20 cents to $5.20 with a transfer of 1,500 shares, Medical Disposables climbed 23 cents to $4.99 with investors switching ownership of 8,653 stocks, SSL Venture declined by 22 cents to 73 cents with 11,397 units changing hands and Stationery and Office Supplies fell 10 cents to $7.40 with 19,493 shares crossing the exchange.

Lasco Manufacturing shed 25 cents to $5 with an exchange of 37,462 shares, Limners and Bards fell 15 cents to $3.15, with 37,367 units changing hands, Lumber Depot lost 5 cents to settle at $3.40 with 520,691 stocks traded. Main Event dropped 20 cents to $5.20 with a transfer of 1,500 shares, Medical Disposables climbed 23 cents to $4.99 with investors switching ownership of 8,653 stocks, SSL Venture declined by 22 cents to 73 cents with 11,397 units changing hands and Stationery and Office Supplies fell 10 cents to $7.40 with 19,493 shares crossing the exchange.