The volume of stocks traded declined 60 percent with 53 percent lower value than on Friday, with trading taking place in 58 securities the same number as on Friday, with 18 rising, 26 declining and 14 ending unchanged in trading activity on the Jamaica Stock Exchange Main Market on Monday.

A total of 9,529,184 shares were traded for $38,472,860 compared with 24,040,809 units at $81,535,879 on Friday.

A total of 9,529,184 shares were traded for $38,472,860 compared with 24,040,809 units at $81,535,879 on Friday.

Trading averaged 164,296 shares at $663,325 versus 414,497 stocks at $1,405,791 on Friday and month to date, an average of 249,752 units at $1,016,812 compared with 294,006 units at $1,199,867 on the previous day. May closed with an average of 226,361 units at $1,362,447.

Wigton Windfarm led trading with 3.84 million shares for 40.3 percent of the total volume, Transjamaican Highway followed with 2.58 million units for 27 percent of the day’s trade and Radio Jamaica with 622,238 units for 6.5 percent market share.

The All Jamaican Composite Index dropped 1,262.06 points to close trading at 369,455.98, the JSE Main Index lost 279.16 points to settle at 335,318.38 and the JSE Financial Index lost 0.06 points and concluded trading at 75.19.

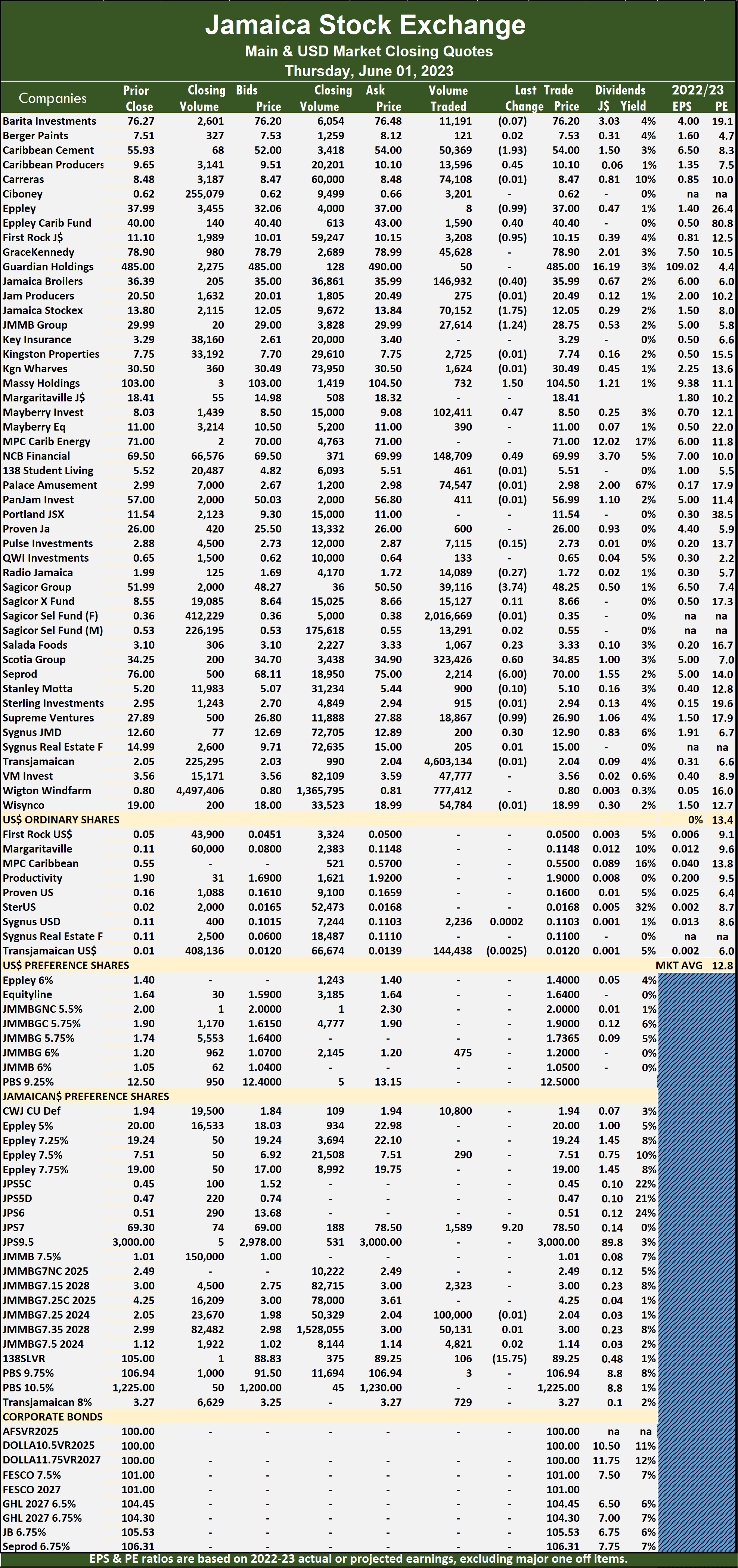

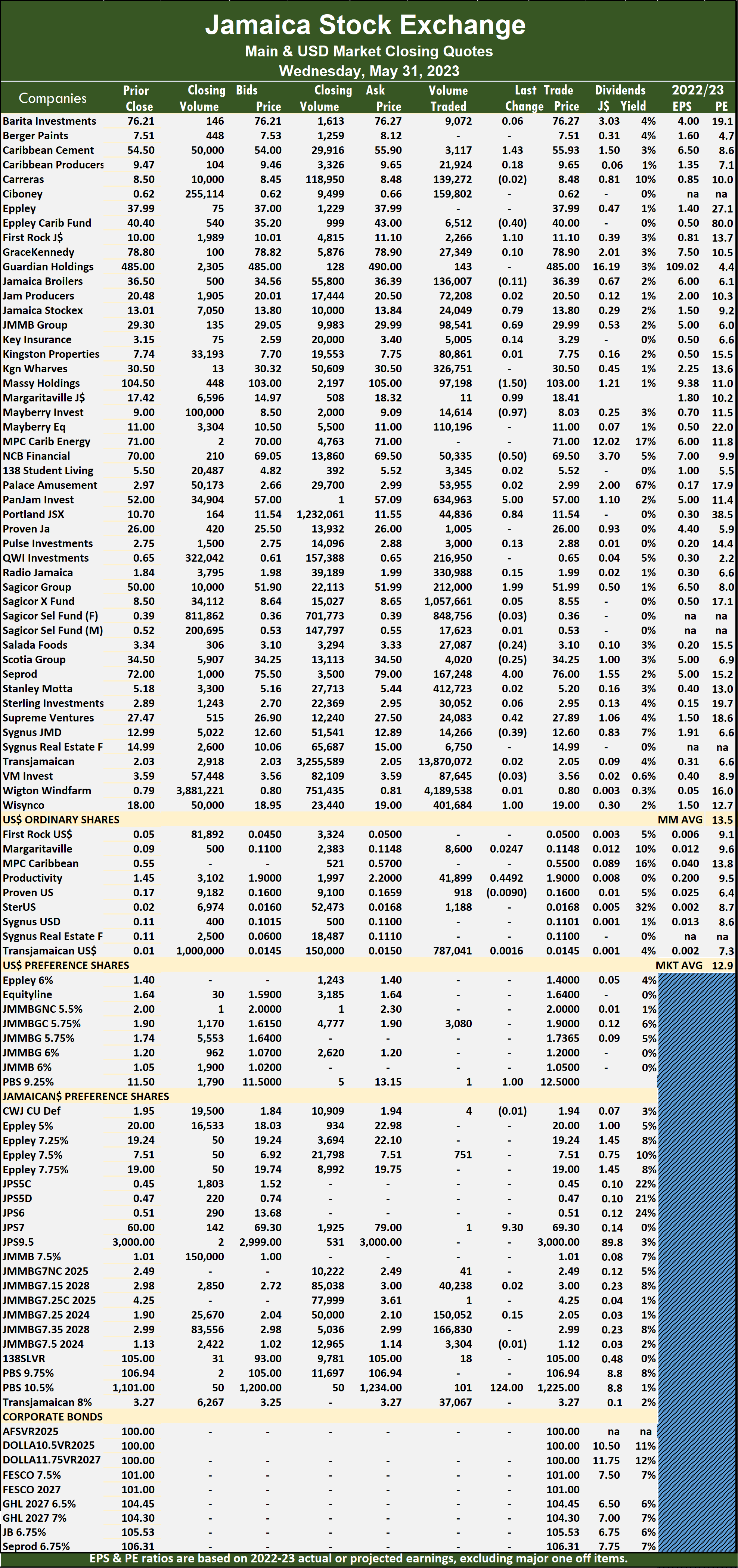

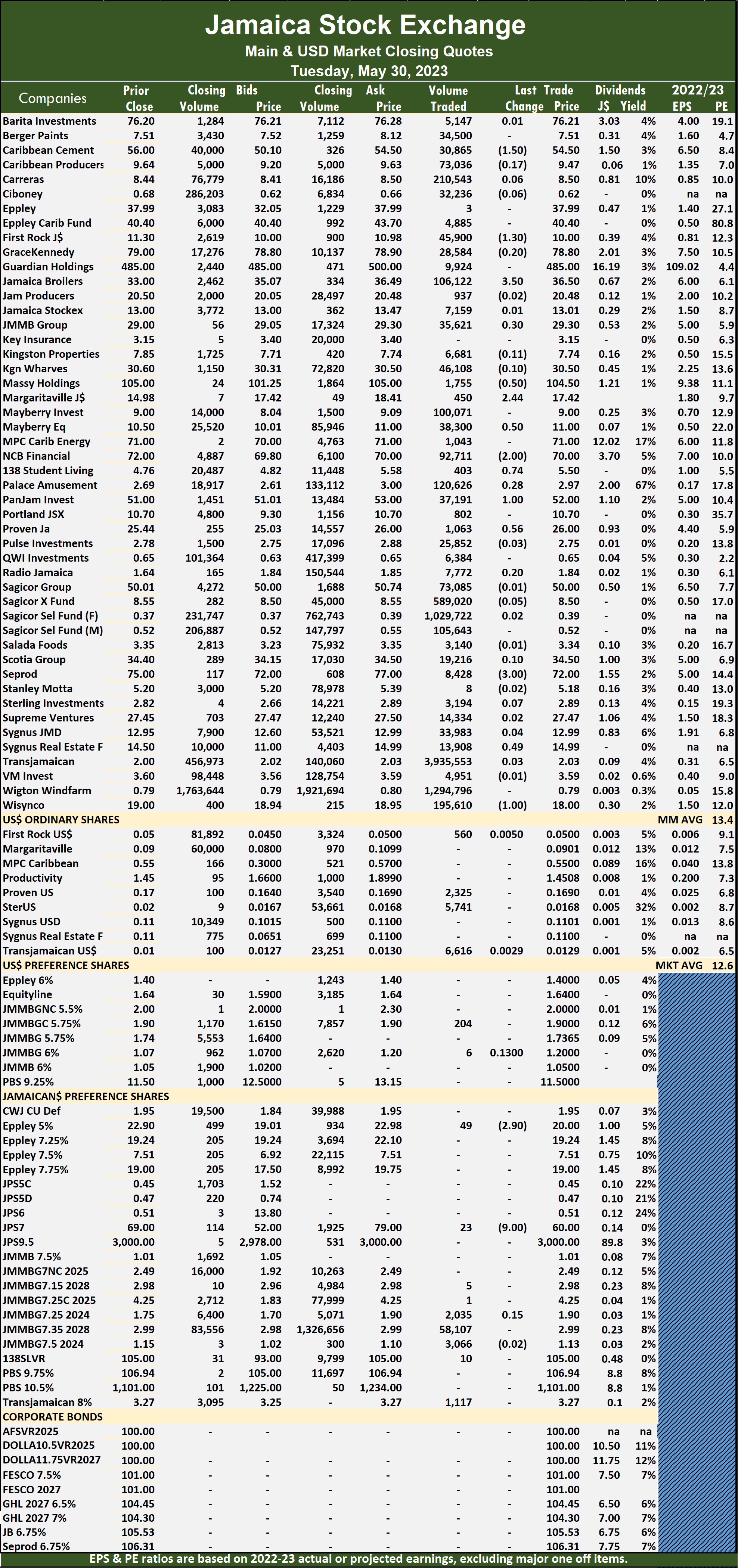

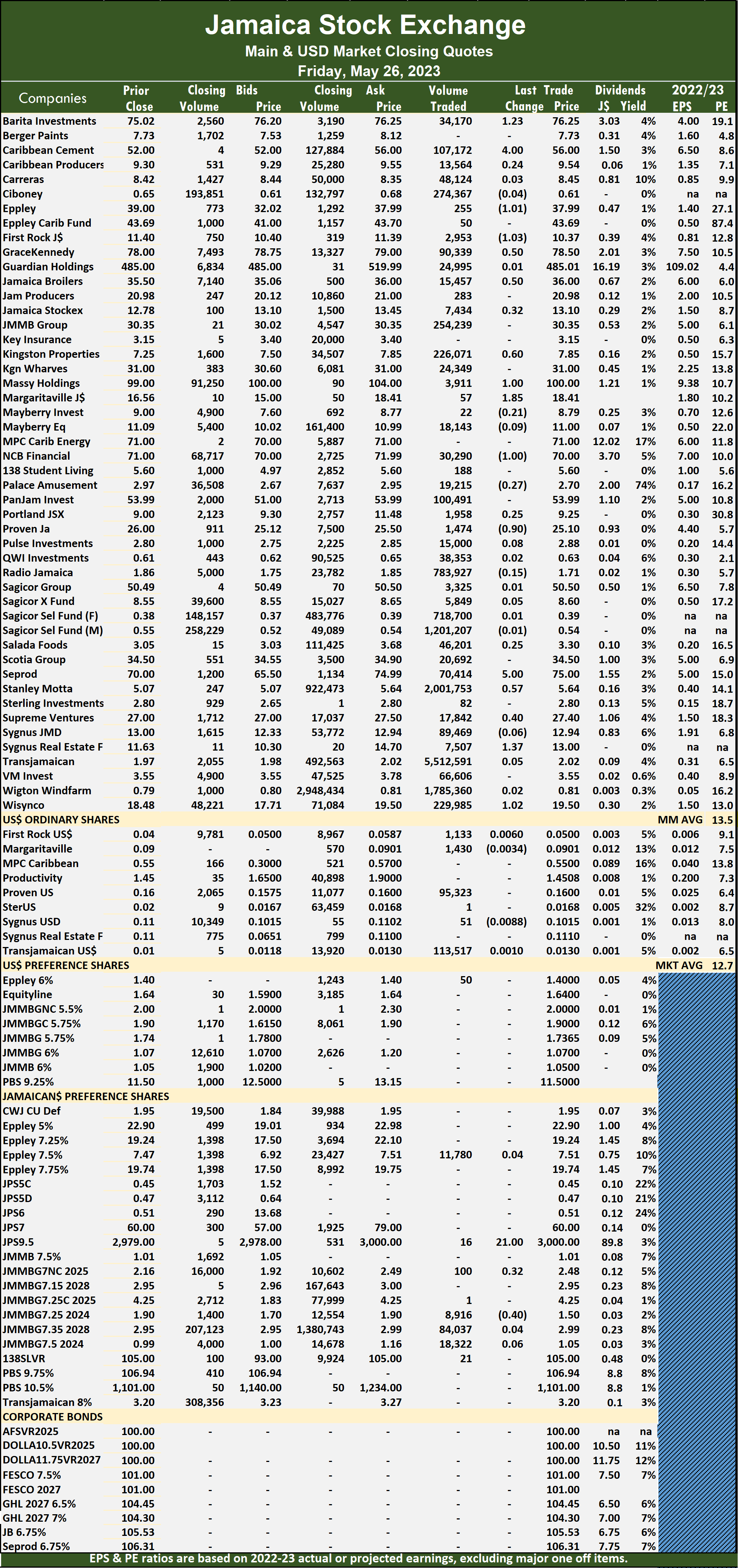

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and five with lower offers.

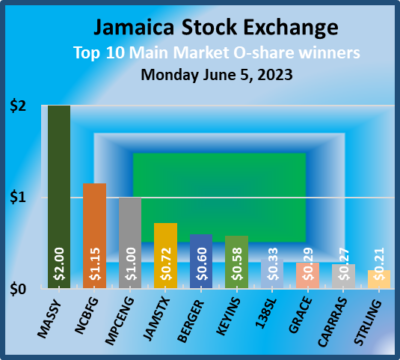

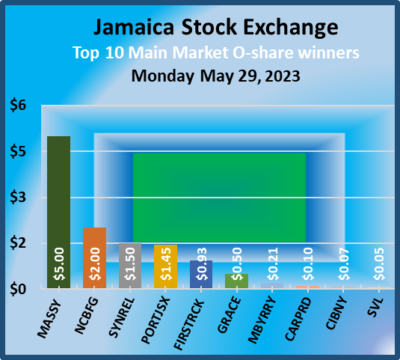

At the close, Berger Paints popped 60 cents in closing at $8.11 after an exchange of 1,059 shares, Caribbean Cement fell $3.85 to $52 after investors traded 22,874 stocks, Eppley Caribbean Property Fund dipped $2.60 to end at $40.40 with 184 stock units changing hands. Guardian Holdings dropped $2 to close at $480 in an exchange of 1,450 units, Jamaica Broilers declined 94 cents to $35, with 63,678 stocks crossing the market, Jamaica Stock Exchange increased 72 cents to $13.72 after 11,001 shares crossed the exchange. Key Insurance rallied 58 cents to close at $3.38 with shareholders swapping 100 stock units, Massy Holdings climbed $2 to end at $102, with 557 units clearing the market,  MPC Caribbean Clean Energy rallied $1 to $71 in an exchange of 84 stocks. NCB Financial rose $1.15 to $69.75 with 40,595 stock units changing hands, 138 Student Living rallied 33 cents to $5.48 as investors traded 1,033 units, Pan Jamaica Group lost $4.04 in closing at $50.05 after 2,252 shares were traded, Sagicor Group shed $1 to end $49.50, with 16,683 stocks changing hands. Scotia Group dropped 65 cents to end at $34.10, with 36,625 stock units crossing the market, Seprod shed $1.46 to close at $68.54 with a transfer of 22,768 units, Supreme Ventures declined 30 cents to $26.50 as 111,196 shares passed through the market and Wisynco Group lost 39 cents and ended at $18.50 in switching ownership of 6,227 shares.

MPC Caribbean Clean Energy rallied $1 to $71 in an exchange of 84 stocks. NCB Financial rose $1.15 to $69.75 with 40,595 stock units changing hands, 138 Student Living rallied 33 cents to $5.48 as investors traded 1,033 units, Pan Jamaica Group lost $4.04 in closing at $50.05 after 2,252 shares were traded, Sagicor Group shed $1 to end $49.50, with 16,683 stocks changing hands. Scotia Group dropped 65 cents to end at $34.10, with 36,625 stock units crossing the market, Seprod shed $1.46 to close at $68.54 with a transfer of 22,768 units, Supreme Ventures declined 30 cents to $26.50 as 111,196 shares passed through the market and Wisynco Group lost 39 cents and ended at $18.50 in switching ownership of 6,227 shares.

In the preference segment, Jamaica Public Service 7% fell $11.78 to close at $66.72 with investors transferring 191 stock units and JMMB Group 7.15% due 2028, dipped 32 cents in closing at $2.68 after an exchange of 20,041 units.

In the preference segment, Jamaica Public Service 7% fell $11.78 to close at $66.72 with investors transferring 191 stock units and JMMB Group 7.15% due 2028, dipped 32 cents in closing at $2.68 after an exchange of 20,041 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Kremi tops ICTOP10 Lasco Manufacturing in

Iron Rock Insurance ended the past week up 14 percent to $2.25 and Lasco Distributors climbed 11 percent to $2.77 after both jumped 34 percent and 21 percent, respectively, earlier in the week, with two new stocks entering the Junior Market ICTOP10. At the same time, the Main Market TOP10 delivered moderate up and down movements.

The Lasco Distributors price movement follows release of full year results with earnings of 38.5 cents per share, with ICInsider.com projecting earnings of 55 cents for the fiscal year ending March 2024, leaving much room for solid upside price movement in the months ahead.

The Lasco Distributors price movement follows release of full year results with earnings of 38.5 cents per share, with ICInsider.com projecting earnings of 55 cents for the fiscal year ending March 2024, leaving much room for solid upside price movement in the months ahead.

Lasco Manufacturing (LasM) and Caribbean Cream (Kremi) released improved full year results over those for 2022. Importantly, ICInsider.com forecast for the 2024 fiscal year is 70 cents per share for LasM and 90 cents for Kremi, with both entering the TOP10 this week, with one at the top and one at the bottom. Iron Rock Insurance and Edufocal fell from the Junior Market TOP10 to make way for the two stocks.

The stock rising in the ICTOP10 Junior Market, apart from those mentioned in the opening paragraph, is Consolidated Bakeries, with an increase of 4 percent to $2.27. At the same time, Caribbean Assurance Brokers, iCreate and One on One dipped 4 percent to $2.40, $1.26 and $1.10 respectively.

The price of Main Market listed Caribbean Producers, popped 5 percent in closing at $10.06, Key Insurance fell 11 percent to $2.80 and 138 Student Living lost 8 percent in value to close at $5.15.

The price of Main Market listed Caribbean Producers, popped 5 percent in closing at $10.06, Key Insurance fell 11 percent to $2.80 and 138 Student Living lost 8 percent in value to close at $5.15.

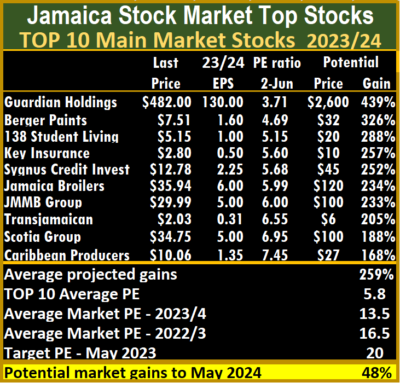

At the end of the week, the average PE for the JSE Main Market TOP10 is 5.9, well below the market average of 13.5. The Main Market TOP10 is projected to have an average of 259 percent, to May 2024, based on 2023 forecasted earnings.

The 15 most highly valued Main Market stocks are priced at a PE of 15 to 110, with an average of 28 and 19 excluding the highest PE stocks and 18 for the top half excluding the stocks with the highest valuation.

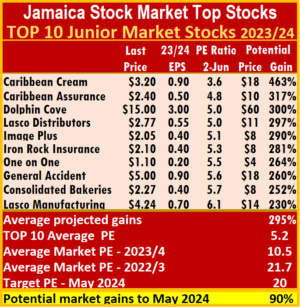

The Junior Market Top 10 PE sits at 5.3 compared with the market at 10.5. There are 10 stocks representing 21 percent of the market, with PEs from 15 to 24, averaging 19 are well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently. Junior Market is projected to rise by 295 percent to May 2024.

Lasco’s ICool drinks.

The differences between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the level of likely gains for ICTOP10 stocks.

In the market generally, Investors continue to nibble away at a number of stocks and, in the process, gradually reduce the supply of several stocks that are attractively priced as the market moves toward the summer months, the start of the stock market year.

A look behind the supply chain shows an ever decreasing number of stocks on offer. The list includes Caribbean Assurance Brokers with strong buying interest between $1.88 and $2.40, but limited selling above $2.50, Caribbean Cement, Caribbean Producers (CPJ), Fontana, Dolphin Cove, Honey Bun, Main Event,  Massey Holdings, Seprod, Transjamaican and Wisynco have started to look positive. Supplies of some stocks are being quietly sucked out of the market, setting the stage for a sustained rally sometime down the road. ICTOP10 focuses on likely yearly winners. Accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

Massey Holdings, Seprod, Transjamaican and Wisynco have started to look positive. Supplies of some stocks are being quietly sucked out of the market, setting the stage for a sustained rally sometime down the road. ICTOP10 focuses on likely yearly winners. Accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Insurance companies head ICTOP10

The JSE Main Market gained more than 7,000 points in the past week, but the Junior Market just closed a few points north of the prior week’s close, resulting in sizable changes in both markets’ ICTOP10 as insurance companies head TOP10.

Elsewhere the only other news of note was the passing of the Chairman and majority owner of the Lasco companies, the addition of two new directors at ISP Finance and the Bank of Jamaica issue of $35 billion in 28 days CDS with investors offering to buy just $35.24 billion, BOJ took up less than the amount offered with $34.45 billion being sterilized the amount offered and moved the total amount of CDs outstanding to a record $111.45 billion up from $109 billion the week before. The average interest rate climbed back above 8 to 8.24 percent.

Elsewhere the only other news of note was the passing of the Chairman and majority owner of the Lasco companies, the addition of two new directors at ISP Finance and the Bank of Jamaica issue of $35 billion in 28 days CDS with investors offering to buy just $35.24 billion, BOJ took up less than the amount offered with $34.45 billion being sterilized the amount offered and moved the total amount of CDs outstanding to a record $111.45 billion up from $109 billion the week before. The average interest rate climbed back above 8 to 8.24 percent.

Investors are nibbling at stocks that seem to be the market signal being sent, with gains in some of the ICTOP10 listings. Notable amongst them are Caribbean Assurance Brokers with solid buying interest between $1.88 and $2.09 but limited selling above $2.50, Caribbean Producers (CPJ), Dolphin Cove Massey Holdings, Transjamaican, and Wisynco have started to look positive. Supplies of some stocks are being quietly sucked out of the market and setting the stage for a sustained rally sometime down the road. Investors should look to July as an important month that could trigger a change in mood as investors anticipate second quarter results.

Action in the markets this past week resulted in four ICTOP10 Junior Market stocks recording significant losses of 6 to 26 percent, with only 2 with 4 percent gains. Everything Fresh dropped out of the TOP10 and iCreate returns after a brief absence. Main Market stocks were mixed, with one noted loss and two gains of note.

Action in the markets this past week resulted in four ICTOP10 Junior Market stocks recording significant losses of 6 to 26 percent, with only 2 with 4 percent gains. Everything Fresh dropped out of the TOP10 and iCreate returns after a brief absence. Main Market stocks were mixed, with one noted loss and two gains of note.

Stocks rising in the ICTOP10 Junior Market are Everything Fresh and One on One, which increased 4 percent to $$1.72 and $1.15, respectively. Iron Rock Insurance dropped 26 percent to $1.85, Consolidated Bakeries shed 10 percent to $2.19, while Dolphin Cove and Lasco Distributors lost 6 percent to end at $15.50 and $2.50, respectively.

The price of Main Market listed Transjamaican rose 6 percent to close at $2.02, Caribbean Producers popped 5 percent in closing at $9.54 and Key Insurance fell 14 percent to $3.15.

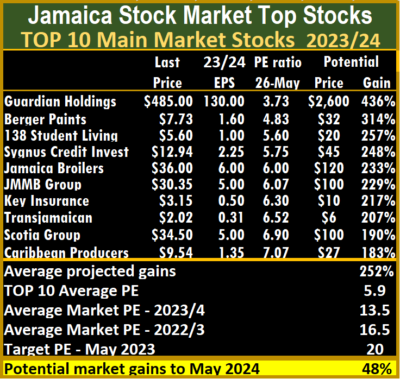

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.9, well below the market average of 13.5. The Main Market TOP10 is projected to have an average of 252 per cent, by May 2024, based on 2023 forecasted earnings.

The 15 most highly valued Main Market stocks are priced at a PE of 15 to 93, with an average of 29 and 19 excluding the highest PE stocks and 19 for the top half excluding the stocks with the highest valuation.

The Junior Market Top 10 PE sits at 5.8 compared with the market at 10.9. There are 11 stocks representing 23 percent of the market, with PEs from 15 to 25, averaging 19, which is well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently. Junior  Market is projected to rise by 265 percent to May 2024.

Market is projected to rise by 265 percent to May 2024.

The differences between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

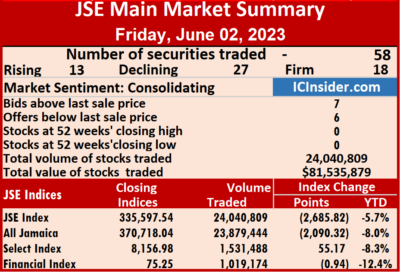

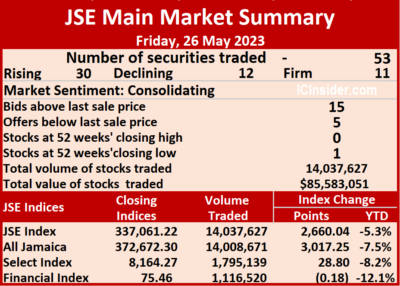

A total of 24,040,809 shares changed hands amounting to $81,535,879 up from 8,887,886 units at $52,849,273 on Thursday.

A total of 24,040,809 shares changed hands amounting to $81,535,879 up from 8,887,886 units at $52,849,273 on Thursday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

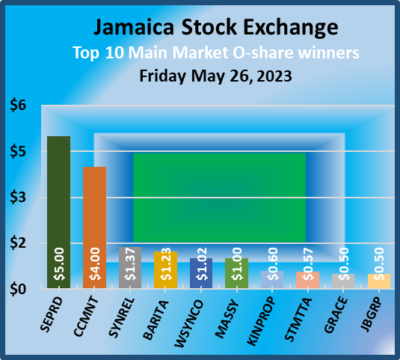

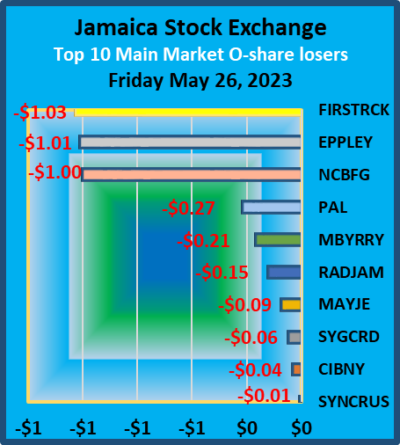

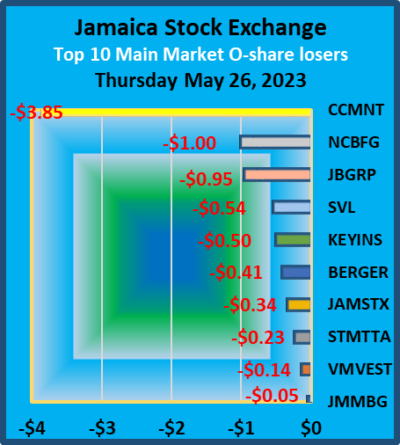

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. JMMB Group advanced $1.24 to close at $29.99 in an exchange of 4,998 stocks, Key Insurance dipped 49 cents to $2.80, with 24,924 shares changing hands, Massy Holdings lost $4.50 to end at $100 after an exchange of 105,204 stock units, MPC Caribbean Clean Energy fell $1 to $70 in switching ownership of 6 shares, NCB Financial lost $1.39 in closing at $68.60 with shareholders swapping 124,916 units, 138 Student Living dipped 36 cents to close at $5.15 after an exchange of 4,229 stocks, Pan Jamaica Group declined $2.90 ended at $54.09 while 12,829 units were exchanged, Portland JSX shed 54 cents to close at $11 with a transfer of 1,603 shares, Sagicor Group climbed $2.25 to end at $50.50 with an exchange of 8,854 stock units and Stanley Motta popped 30 cents to $5.40, with 15,163 stocks crossing the market.

JMMB Group advanced $1.24 to close at $29.99 in an exchange of 4,998 stocks, Key Insurance dipped 49 cents to $2.80, with 24,924 shares changing hands, Massy Holdings lost $4.50 to end at $100 after an exchange of 105,204 stock units, MPC Caribbean Clean Energy fell $1 to $70 in switching ownership of 6 shares, NCB Financial lost $1.39 in closing at $68.60 with shareholders swapping 124,916 units, 138 Student Living dipped 36 cents to close at $5.15 after an exchange of 4,229 stocks, Pan Jamaica Group declined $2.90 ended at $54.09 while 12,829 units were exchanged, Portland JSX shed 54 cents to close at $11 with a transfer of 1,603 shares, Sagicor Group climbed $2.25 to end at $50.50 with an exchange of 8,854 stock units and Stanley Motta popped 30 cents to $5.40, with 15,163 stocks crossing the market. In the preference segment, Productive Business 10.50% preference share rose $25 to $1250 as investors exchanged 300 stocks, JMMB Group 7.25% preference share fell 64 cents to close at $3.61 in an exchange of 12,880 stock units and 138 Student Living preference share dropped $1.25 to end at $88 with 83 shares clearing the market.

In the preference segment, Productive Business 10.50% preference share rose $25 to $1250 as investors exchanged 300 stocks, JMMB Group 7.25% preference share fell 64 cents to close at $3.61 in an exchange of 12,880 stock units and 138 Student Living preference share dropped $1.25 to end at $88 with 83 shares clearing the market. A total of 8,887,886 shares were traded for $52,849,273 compared to 4,443,891 units at $149,369,888 on Wednesday.

A total of 8,887,886 shares were traded for $52,849,273 compared to 4,443,891 units at $149,369,888 on Wednesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

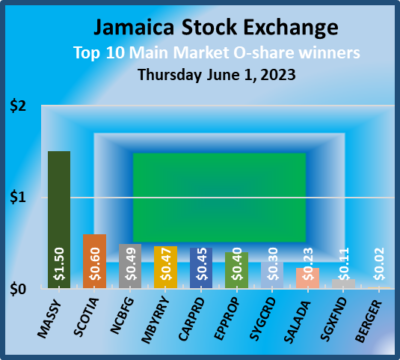

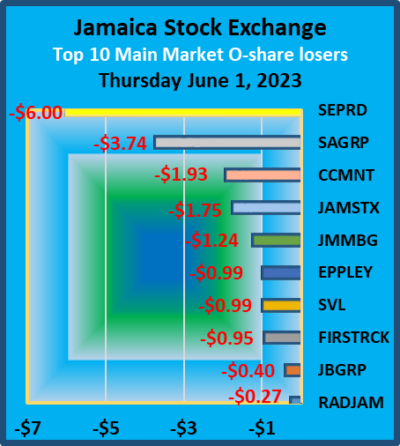

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Massy Holdings climbed $1.50 to $104.50 with investors transferring 732 shares. Mayberry Investments rallied 47 cents to end at $8.50, with 102,411 units crossing the market, NCB Financial popped 49 cents to $69.99 as 148,709 stock units passed through the market, Sagicor Group dipped $3.74 and ended at $48.25 after investors ended trading of 39,116 stocks. Scotia Group advanced 60 cents to close at $34.85 while exchanging 323,426 shares, Seprod declined $6 to $70 with an exchange of 2,214 units, Supreme Ventures fell 99 cents to end at $26.90 with shareholders swapping 18,867 stock units and Sygnus Credit Investments rallied 30 cents to $12.90 with a transfer of 200 stocks.

Massy Holdings climbed $1.50 to $104.50 with investors transferring 732 shares. Mayberry Investments rallied 47 cents to end at $8.50, with 102,411 units crossing the market, NCB Financial popped 49 cents to $69.99 as 148,709 stock units passed through the market, Sagicor Group dipped $3.74 and ended at $48.25 after investors ended trading of 39,116 stocks. Scotia Group advanced 60 cents to close at $34.85 while exchanging 323,426 shares, Seprod declined $6 to $70 with an exchange of 2,214 units, Supreme Ventures fell 99 cents to end at $26.90 with shareholders swapping 18,867 stock units and Sygnus Credit Investments rallied 30 cents to $12.90 with a transfer of 200 stocks. In the preference segment, Jamaica Public Service 7% advanced $9.20 and ended at $78.50 after a transfer of 1,589 units and 138 Student Living preference share shed $15.75 to close at $89.25 with 106 stock units clearing the market.

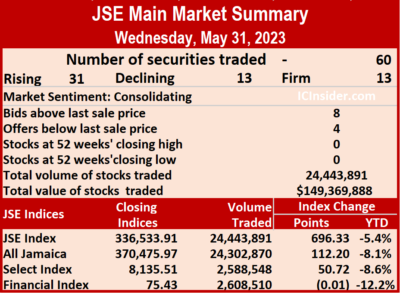

In the preference segment, Jamaica Public Service 7% advanced $9.20 and ended at $78.50 after a transfer of 1,589 units and 138 Student Living preference share shed $15.75 to close at $89.25 with 106 stock units clearing the market. A total of 24,443,891 shares were traded for $149,369,888 compared to 8,501,678 units at $53,413,585 on Tuesday.

A total of 24,443,891 shares were traded for $149,369,888 compared to 8,501,678 units at $53,413,585 on Tuesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

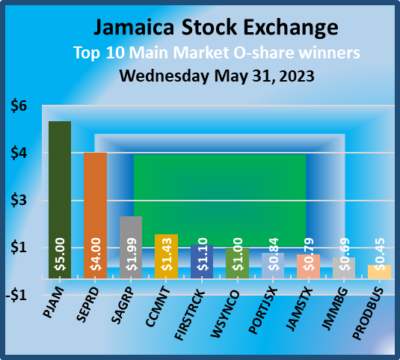

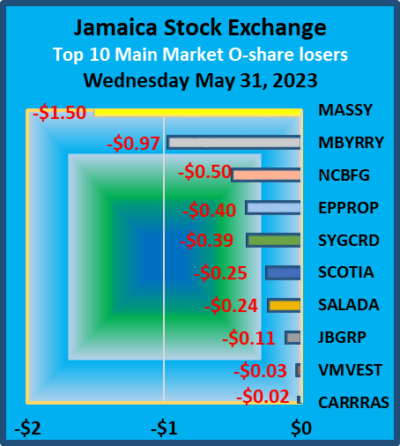

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Margaritaville rose 99 cents to close at $18.41 with shareholders swapping 11 stocks, Massy Holdings dipped $1.50 and ended at $103 while exchanging 97,198 stock units. Mayberry Investments shed 97 cents to close at $8.03 after exchanging 14,614 shares, NCB Financial lost 50 cents in closing at $69.50 with investors trading 50,335 shares, Pan Jamaica Group climbed $5 to $57 with 634,963 stocks crossing the exchange, Portland JSX increased 84 cents to $11.54 after 44,836 stock units passed through the market, Sagicor Group gained $1.99 in closing at $51.99, with 212,000 units crossing the market, Seprod rallied $4 to $76 in an exchange of 167,248 units, Supreme Ventures advanced 42 cents to end at $27.89 with 24,083 shares clearing the market, Sygnus Credit Investments fell 39 cents to close at $12.60 with a transfer of 14,266 stocks and Wisynco Group climbed $1 to close at $19, with 401,684 stock units crossing the market.

Margaritaville rose 99 cents to close at $18.41 with shareholders swapping 11 stocks, Massy Holdings dipped $1.50 and ended at $103 while exchanging 97,198 stock units. Mayberry Investments shed 97 cents to close at $8.03 after exchanging 14,614 shares, NCB Financial lost 50 cents in closing at $69.50 with investors trading 50,335 shares, Pan Jamaica Group climbed $5 to $57 with 634,963 stocks crossing the exchange, Portland JSX increased 84 cents to $11.54 after 44,836 stock units passed through the market, Sagicor Group gained $1.99 in closing at $51.99, with 212,000 units crossing the market, Seprod rallied $4 to $76 in an exchange of 167,248 units, Supreme Ventures advanced 42 cents to end at $27.89 with 24,083 shares clearing the market, Sygnus Credit Investments fell 39 cents to close at $12.60 with a transfer of 14,266 stocks and Wisynco Group climbed $1 to close at $19, with 401,684 stock units crossing the market. In the preference segment, Productive Business 10.50% preference share popped $124 to $1225 in an exchange of 101 stocks and Jamaica Public Service 7% increased by $9.30 and ended at $69.30 with one stock unit changing hands.

In the preference segment, Productive Business 10.50% preference share popped $124 to $1225 in an exchange of 101 stocks and Jamaica Public Service 7% increased by $9.30 and ended at $69.30 with one stock unit changing hands. A total of 8,501,678 shares were traded for $53,413,585 compared to 19,055,221 units at $86,952,533 on Monday.

A total of 8,501,678 shares were traded for $53,413,585 compared to 19,055,221 units at $86,952,533 on Monday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Massy Holdings drifted 50 cents lower to close at $104.50 after trading 1,755 stocks, Mayberry Jamaican Equities increased 50 cents in closing at $11 after 38,300 stocks cleared the market, NCB Financial fell $2 to end at $70 with an exchange of 92,711 shares. 138 Student Living gained 74 cents to end at $5.50 with a transfer of 403 shares, Pan Jamaica Group rallied $1 and ended at $52 with an exchange of 37,191 stock units, Proven Investments climbed 56 cents to $26, with 1,063 stock units crossing the market. Seprod shed $3 in closing at $72 as investors exchanged 8,428 units, Sygnus Real Estate Finance gained 49 cents to end at $14.99 and closed with an exchange of 13,908 stock units and Wisynco Group declined $1 to close at $18 after 195,610 shares changed hands.

Massy Holdings drifted 50 cents lower to close at $104.50 after trading 1,755 stocks, Mayberry Jamaican Equities increased 50 cents in closing at $11 after 38,300 stocks cleared the market, NCB Financial fell $2 to end at $70 with an exchange of 92,711 shares. 138 Student Living gained 74 cents to end at $5.50 with a transfer of 403 shares, Pan Jamaica Group rallied $1 and ended at $52 with an exchange of 37,191 stock units, Proven Investments climbed 56 cents to $26, with 1,063 stock units crossing the market. Seprod shed $3 in closing at $72 as investors exchanged 8,428 units, Sygnus Real Estate Finance gained 49 cents to end at $14.99 and closed with an exchange of 13,908 stock units and Wisynco Group declined $1 to close at $18 after 195,610 shares changed hands. In the preference segment, Eppley 5% preference share dropped $2.90 and ended at $20 in an exchange of 49 stocks and Jamaica Public Service 7% declined $9 to close at $60 while exchanging 23 units.

In the preference segment, Eppley 5% preference share dropped $2.90 and ended at $20 in an exchange of 49 stocks and Jamaica Public Service 7% declined $9 to close at $60 while exchanging 23 units.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Massy Holdings advanced $5 to close at a 52 weeks’ high of $105, with 3,524 shares crossing the market, with the price still around 11 percent lower than in Trinidad. Mayberry Jamaican Equities fell 50 cents to $10.50 after a transfer of 171,230 shares, NCB Financial rose $2 and ended at $72 with investors transferring 50,904 units, 138 Student Living dipped 84 cents to close at $4.76 after trading 28,560 stocks, Pan Jamaica Group shed $2.99 to end at $51 with 2,058 stock units clearing the market. Portland JSX gained $1.45 to close at $10.70 in an exchange of 35 stocks, Proven Investments rose 34 cents to $25.44 with an exchange of 2,022 shares, Sagicor Group fell 49 cents in closing at $50.01, with 2,042 units changing hands, Seprod traded 61,632 shares at $75 after the price hit a 52 weeks’ intraday high of $79.80. Stanley Motta lost 44 cents to close at $5.20 after an exchange of 3,011,831 stock units, Sygnus Real Estate Finance rallied $1.50 to end at $14.50 after exchanging 2,734 shares and

Massy Holdings advanced $5 to close at a 52 weeks’ high of $105, with 3,524 shares crossing the market, with the price still around 11 percent lower than in Trinidad. Mayberry Jamaican Equities fell 50 cents to $10.50 after a transfer of 171,230 shares, NCB Financial rose $2 and ended at $72 with investors transferring 50,904 units, 138 Student Living dipped 84 cents to close at $4.76 after trading 28,560 stocks, Pan Jamaica Group shed $2.99 to end at $51 with 2,058 stock units clearing the market. Portland JSX gained $1.45 to close at $10.70 in an exchange of 35 stocks, Proven Investments rose 34 cents to $25.44 with an exchange of 2,022 shares, Sagicor Group fell 49 cents in closing at $50.01, with 2,042 units changing hands, Seprod traded 61,632 shares at $75 after the price hit a 52 weeks’ intraday high of $79.80. Stanley Motta lost 44 cents to close at $5.20 after an exchange of 3,011,831 stock units, Sygnus Real Estate Finance rallied $1.50 to end at $14.50 after exchanging 2,734 shares and  Wisynco Group declined 50 cents to close at $19 with shareholders swapping 162,231 stocks.

Wisynco Group declined 50 cents to close at $19 with shareholders swapping 162,231 stocks. A total of 14,037,627 shares were traded for $85,583,051, compared with 9,017,684 units at $47,750,582 on Thursday.

A total of 14,037,627 shares were traded for $85,583,051, compared with 9,017,684 units at $47,750,582 on Thursday. The All Jamaican Composite Index jumped 3,017.25 points to 372,672.30, the JSE Main Index climbed 2,660.04 points to 337,061.22 and the JSE Financial Index declined 0.18 points to end at 75.46.

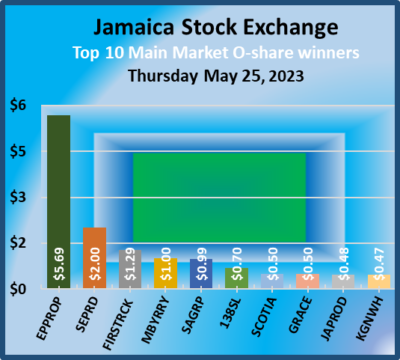

The All Jamaican Composite Index jumped 3,017.25 points to 372,672.30, the JSE Main Index climbed 2,660.04 points to 337,061.22 and the JSE Financial Index declined 0.18 points to end at 75.46. Jamaica Stock Exchange rallied 32 cents to close at $13.10 after an exchange of 7,434 shares, Kingston Properties gained 60 cents to end at $7.85, with 226,071 stocks crossing the market, Margaritaville rose $1.85 in closing at $18.41 in an exchange of 57 stock units. Massy Holdings rallied $1 to end at $100 with 3,911 stocks changing hands, NCB Financial lost $1 in ending at $70 in an exchange of 30,290 shares, Proven Investments dropped 90 cents to close at $25.10 after 1,474 units changed hands, Seprod gained $5 in closing at $75 as investors exchanged 70,414 stock units. Stanley Motta rose 57 cents to end at $5.64 and closed with 2,001,753 units being traded, Supreme Ventures advanced 40 cents to $27.40 as 17,842 shares crossed the market, Sygnus Real Estate Finance climbed $1.37 in closing at $13 after a transfer of 7,507 stocks and Wisynco Group increased $1.02 ended at $19.50 after an exchange of 229,985 stocks.

Jamaica Stock Exchange rallied 32 cents to close at $13.10 after an exchange of 7,434 shares, Kingston Properties gained 60 cents to end at $7.85, with 226,071 stocks crossing the market, Margaritaville rose $1.85 in closing at $18.41 in an exchange of 57 stock units. Massy Holdings rallied $1 to end at $100 with 3,911 stocks changing hands, NCB Financial lost $1 in ending at $70 in an exchange of 30,290 shares, Proven Investments dropped 90 cents to close at $25.10 after 1,474 units changed hands, Seprod gained $5 in closing at $75 as investors exchanged 70,414 stock units. Stanley Motta rose 57 cents to end at $5.64 and closed with 2,001,753 units being traded, Supreme Ventures advanced 40 cents to $27.40 as 17,842 shares crossed the market, Sygnus Real Estate Finance climbed $1.37 in closing at $13 after a transfer of 7,507 stocks and Wisynco Group increased $1.02 ended at $19.50 after an exchange of 229,985 stocks. In the preference segment, Jamaica Public Service 9.5% popped $21 to close at $3000 in trading 16 shares, JMMB Group 7% preference share rallied 32 cents to $2.48 with investors transferring 100 stock units and JMMB Group 7.25% due 2024 preference share shed 40 cents to end at $1.50 after shareholders ended trading 8,916 units.

In the preference segment, Jamaica Public Service 9.5% popped $21 to close at $3000 in trading 16 shares, JMMB Group 7% preference share rallied 32 cents to $2.48 with investors transferring 100 stock units and JMMB Group 7.25% due 2024 preference share shed 40 cents to end at $1.50 after shareholders ended trading 8,916 units. At the close of trading, 9,017,684 shares valued at $47,750,582 were exchanged, down from 17,951,966 shares at $68,245,213 Wednesday.

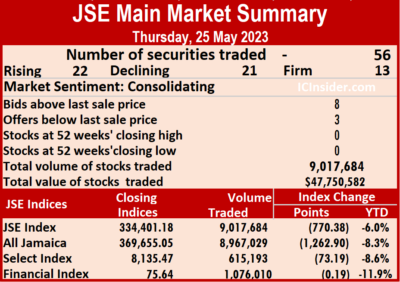

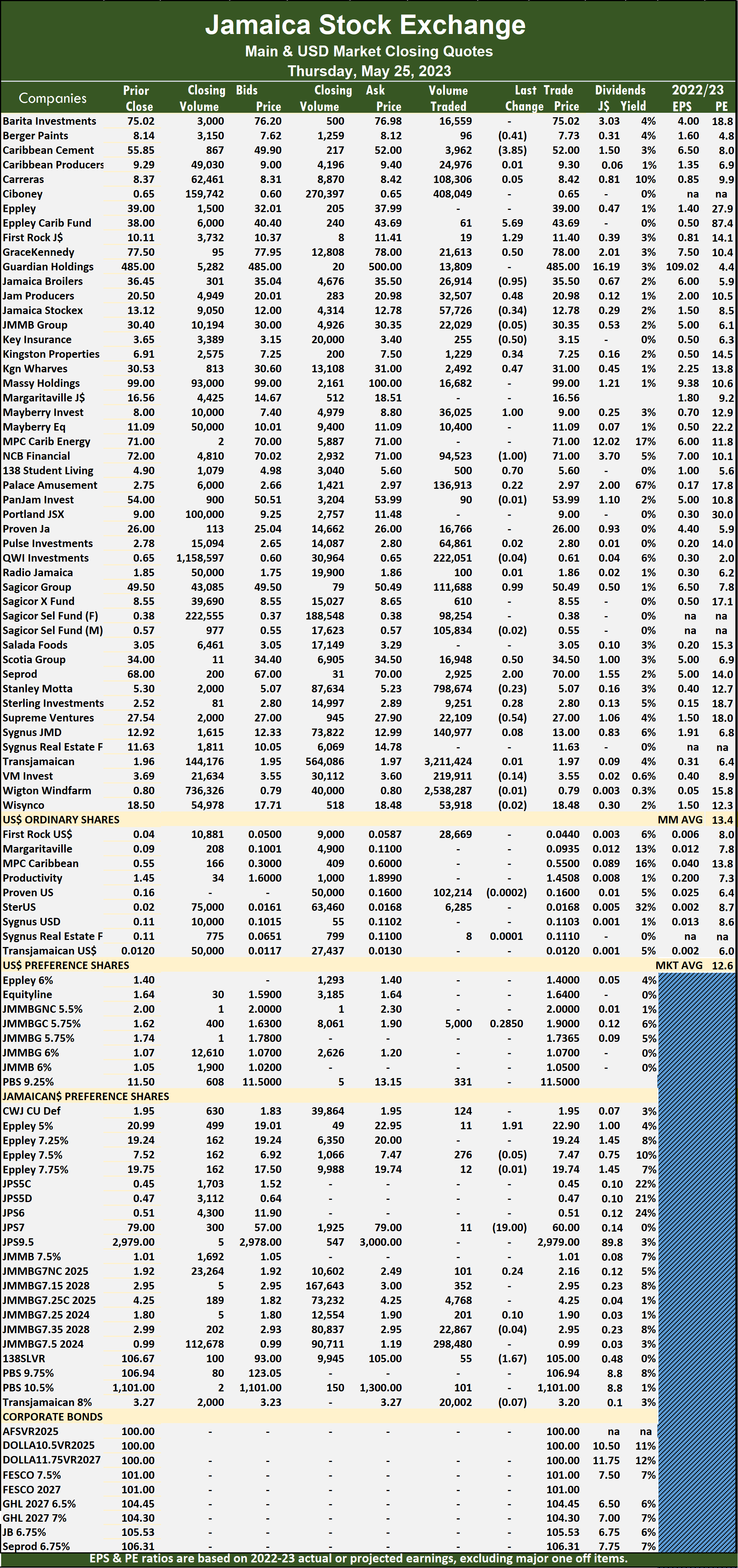

At the close of trading, 9,017,684 shares valued at $47,750,582 were exchanged, down from 17,951,966 shares at $68,245,213 Wednesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending up to August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending up to August 2023. Key Insurance dipped 50 cents to $3.15 with shareholders swapping 255 shares, Kingston Properties popped 34 cents to close at $7.25 after a transfer of 1,229 stock units, Kingston Wharves gained 47 cents to end at $31 with 2,492 units being traded. Mayberry Investments rallied $1 to $9, with an exchange of 36,025 stocks, NCB Financial lost $1 to close at $71 as investors traded 94,523 shares, 138 Student Living popped 70 cents to $5.60, with 500 stock units crossing the exchange, Sagicor Group rallied 99 cents in closing at $50.49 following the trading of 111,688 units. Scotia Group advanced 50 cents to end at $34.50 and closed with an exchange of 16,948 stocks, Seprod climbed $2 in closing at $70 after trading 2,925 stocks and Supreme Ventures dropped 54 cents and ended at $27 with investors transferring 22,109 shares.

Key Insurance dipped 50 cents to $3.15 with shareholders swapping 255 shares, Kingston Properties popped 34 cents to close at $7.25 after a transfer of 1,229 stock units, Kingston Wharves gained 47 cents to end at $31 with 2,492 units being traded. Mayberry Investments rallied $1 to $9, with an exchange of 36,025 stocks, NCB Financial lost $1 to close at $71 as investors traded 94,523 shares, 138 Student Living popped 70 cents to $5.60, with 500 stock units crossing the exchange, Sagicor Group rallied 99 cents in closing at $50.49 following the trading of 111,688 units. Scotia Group advanced 50 cents to end at $34.50 and closed with an exchange of 16,948 stocks, Seprod climbed $2 in closing at $70 after trading 2,925 stocks and Supreme Ventures dropped 54 cents and ended at $27 with investors transferring 22,109 shares. In the preference segment, Eppley 5% preference share gained $1.91 to close at $22.90, with 11 units clearing the market, Jamaica Public Service 7% dropped $19 to $60 after 11 stock units passed through the market and 138 Student Living preference share fell $1.67 to close at $105 with an exchange of 55 shares.

In the preference segment, Eppley 5% preference share gained $1.91 to close at $22.90, with 11 units clearing the market, Jamaica Public Service 7% dropped $19 to $60 after 11 stock units passed through the market and 138 Student Living preference share fell $1.67 to close at $105 with an exchange of 55 shares.