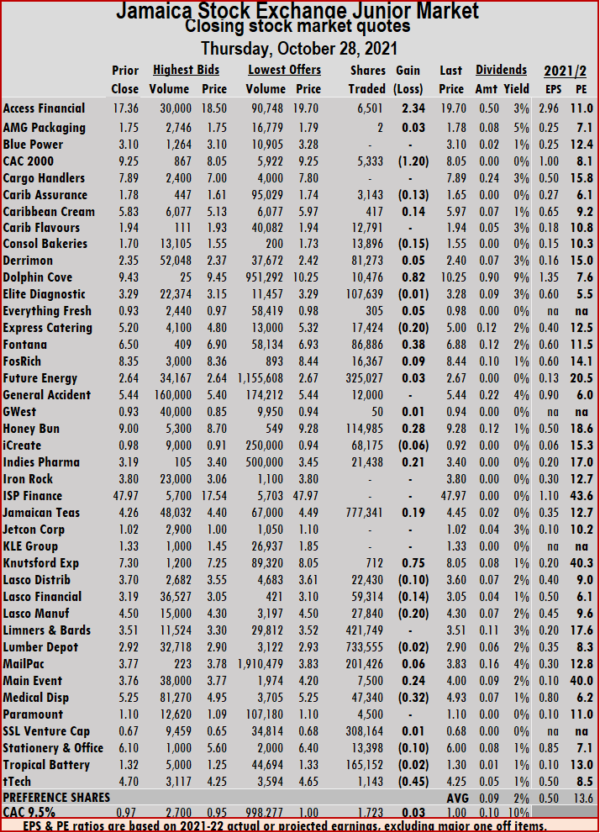

Shortly after the opening of trading on Thursday, Junior Market Index raced to 3,438 points but failed to hold on to those early gains and ended lower at the close of Wednesday, with the index dropping 18.39 points below Wednesday’s close, to finish at 3,388.76 as the value of stocks trading declined 13 percent below Wednesday at the close of the Jamaica Stock Exchange Junior Market.

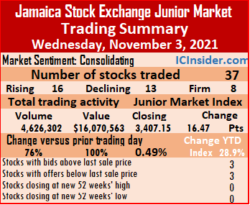

Market activity led to 41 securities trading, up from 37 on Wednesday and ended with 16 rising, 18 declining and seven left unchanged. Fontana and KLE Group ended trading at 52 weeks’ highs.

Market activity led to 41 securities trading, up from 37 on Wednesday and ended with 16 rising, 18 declining and seven left unchanged. Fontana and KLE Group ended trading at 52 weeks’ highs.

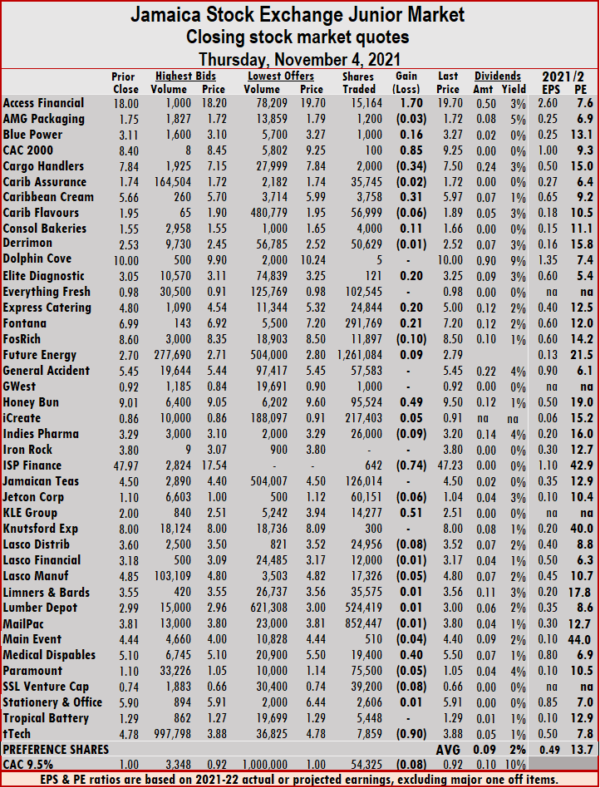

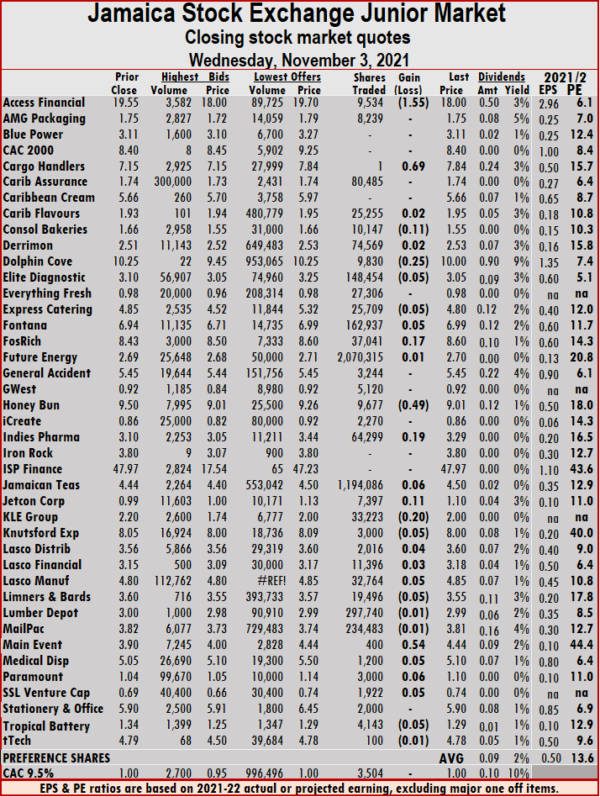

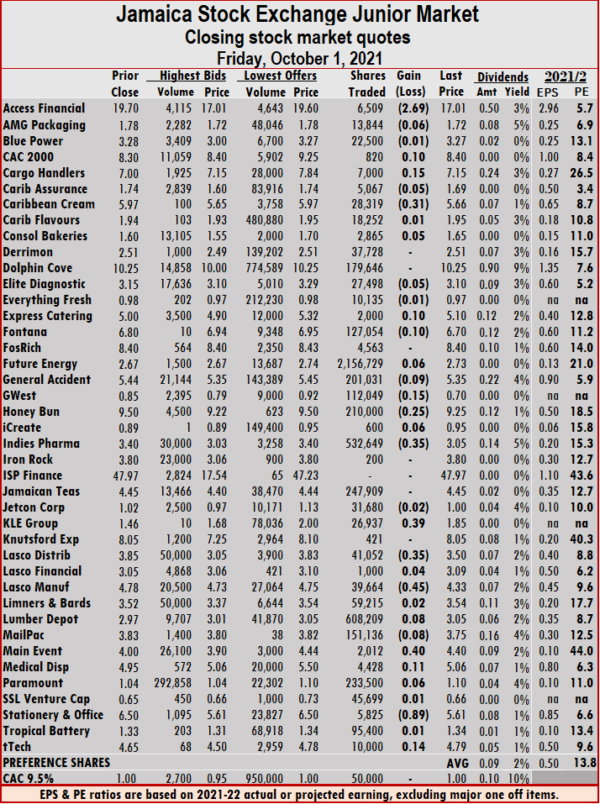

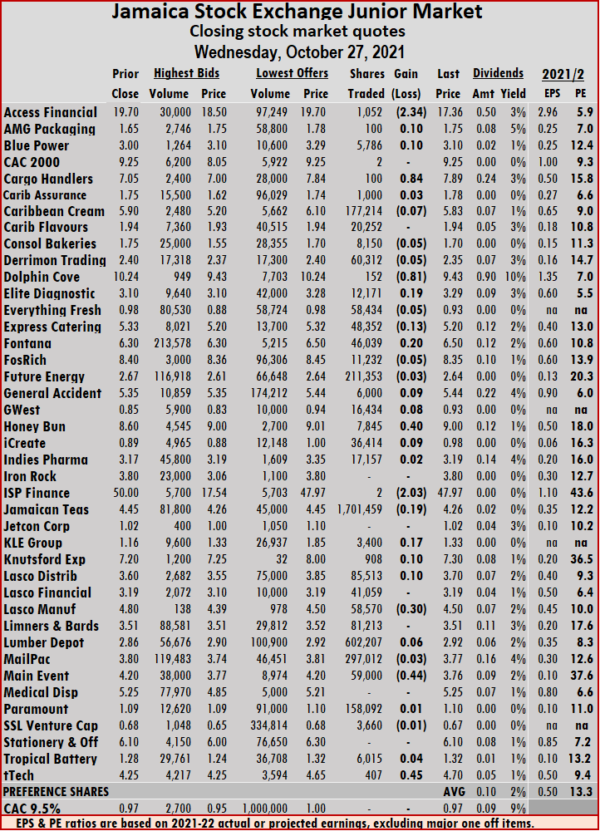

The PE Ratio, a measure used to compute appropriate stock values, averages 13.7. The PE ratio of each stock is shown in the chart below, is based on the earnings forecast done by ICInsider.com for companies with their financial year ending up to August 2022.

Trading ended with 4,133,325 shares changing hands for $14,013,135 down from 4,626,302 units at $16,070,563 on Wednesday. Future Energy Source ended with 30.5 percent of total volume as it led trading with 1.26 million shares, followed by Mailpac Group ended, with 20.6 percent after 852,447 units were traded and Lumber Depot 12.7 percent with 524,419 shares.

Trading averaged 100,813 shares at $341,784, down from 125,035 shares at $434,340 on Wednesday and month to date, an average of 108,735 units at $369,086, compared to 111,609 units at $378,991 on Wednesday. October average trade was 162,777 units at $557,275.

Trading averaged 100,813 shares at $341,784, down from 125,035 shares at $434,340 on Wednesday and month to date, an average of 108,735 units at $369,086, compared to 111,609 units at $378,991 on Wednesday. October average trade was 162,777 units at $557,275.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and two with lower offers.

At the close, Access Financial climbed $1.70 to $19.70 with the swapping of 15,164 shares, Blue Power spiked 16 cents to $3.27, trading 1,000 stock units, CAC 2000 rose 85 cents to end at $9.25 with an exchange of 100 stocks. Cargo Handlers shed 34 cents to close at $7.50 after exchanging 2,000 units, Caribbean Cream gained 31 cents in ending at $5.97 in swapping 3,758 stock units, Consolidated Bakeries popped 11 cents to $1.66 after 4,000 stocks changed hands. Elite Diagnostic advanced 20 cents to $3.25, trading 121 units, Express Catering increased 20 cents to $5 24,844 shares after crossing the exchange, Fontana rallied 21 cents to end at 52 weeks’ closing high of $7.20, as 291,769 stocks crossed the market. Fosrich declined 10 cents to close at $8.50, with 11,897 stock units changing hands, Future Energy Source increased 9 cents to $2.79, with 1,261,084 shares clearing the market, Honey Bun advanced 49 cents to close at $9.50 in switching ownership of 95,524 units.  Indies Pharma dropped 9 cents to end at $3.20, with 26,000 stock units crossing the market, ISP Finance fell 74 cents after finishing at $47.23 in trading 642 shares, KLE Group spiked 51 cents in closing at 52 weeks’ high of $2.51 in an exchange of 14,277 stocks. Lasco Distributors lost 8 cents to close at $3.52 while exchanging 24,956 units, Medical Disposables rose 40 cents to $5.50 in an exchange of 19,400 stocks, SSL Venture fell 8 cents in closing at 66 cents as 39,200 shares changed hands and tTech shed 90 cents to end at $3.88 in trading 7,859 units.

Indies Pharma dropped 9 cents to end at $3.20, with 26,000 stock units crossing the market, ISP Finance fell 74 cents after finishing at $47.23 in trading 642 shares, KLE Group spiked 51 cents in closing at 52 weeks’ high of $2.51 in an exchange of 14,277 stocks. Lasco Distributors lost 8 cents to close at $3.52 while exchanging 24,956 units, Medical Disposables rose 40 cents to $5.50 in an exchange of 19,400 stocks, SSL Venture fell 8 cents in closing at 66 cents as 39,200 shares changed hands and tTech shed 90 cents to end at $3.88 in trading 7,859 units.

In the preference segment, CAC 2000 9.5% preference shares dropped 8 cents to 92 cents trading 54,325 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

A rebounding Access is IC buy rated

Profit surged 216 percent after tax, to $90 million for the micro lender, Access Financial Services in the second quarter to September this year, from $29 million in 2020, with pretax profit spiking 287 percent from $33 million to $129 million, as the company’s turnaround continues to gather pace from the depressed 2020 pandemic effects.

For the six months to September, profit after tax jumped 192 percent to $180 million from just $62 million for the similar period in 2020, while profit before tax jumped 192 percent to $241 million from $82 million.

For the six months to September, profit after tax jumped 192 percent to $180 million from just $62 million for the similar period in 2020, while profit before tax jumped 192 percent to $241 million from $82 million.

Net operating income rose 9.4 percent from $887.5 million to $971 million for the six months and $457 million to $507 million for the September quarter.

The most important contributor to income, loan interest, rose 13.5 percent for the quarter to $419 million from $369 million in 2020 and rose 8.7 percent from $743 million to $807 million for the 2021 half year.

Operating expenses for the period fell 9 percent to $730 million, from $805 million in the prior year and from $424 million in the September quarter this year to $$378 million. The reduction partially helped from loan loss provision declining from $111 million in September 2020 quarter to $60 million this year and decreased 32 percent for the six months to $121 million from $178 million. In addition, loans written off fell to $58 million for the half year from $69 million in 2020 and at the end of June, loans written off was just $10 million compared to $39 million in 2020 for the similar period.

Earnings per share for the six months was 65 cents compared to 22 cents for the prior year and 33 cents for the quarter.

Access Financial Services head office.

ICInsider.com projects earnings per share of $2.40 for the current year and $4.80 for 2023, assuming that lending continues to grow in double digits per annum. The projection in earnings is one reason for the IC Buy RatedICTOP10 Dolphin Cove jumps 25% label others are good management, the provision of service in demand and good medium term growth prospects.

Loans rose from $3.89 billion to $4.38 billion year over year and are up 6 percent in the September quarter over June this year, representing a nearly 25 percent annual increase. Cash funds slipped from $683 million at the end of September 2020 to $397 million. Loans payable amounts to $2.54 billion from $2.7 billion at the end of September 2020. Stockholders’ Equity stands at $2.56 billion. Access will be paying a dividend of 10 cents per share on November 26, 2021, adding to a similar amount paid in August, 20 cents in July and 10 cents in February.

ICTOP10 Dolphin Cove jumps 25%

The highlights of the week for ICTOP10 stocks is the price movement of stocks, with the big moves being Dolphin Cove with a recovery of 25 percent back to $10.25 and 14 percent for Access Financial in the Junior market and 21 percent rise, with the Junior market closing over the 3,400 points level for the first time since July and is now close to a two year’s high. Caribbean Producers to $8 after it hit an all-time high of $9 on Wednesday to be up 186 percent for the year to Friday.

Sygnus Credit Investment gave back the 5 percent increase last week to end at $17.80. Berger Paints and Proven Investments both gave up 3 percent during the week, while Junior Market Lasco Financial gave up six percent at the end of the week in closing at $3.05 and Caribbean Assurance Brokers lost three percent, from $1.79 to $1.74 as Medical Disposables rose four percent to $4.95 after hitting an intraday high of $5.80 on Friday and Lumber Depot rose four percent to $2.97.

Sygnus Credit Investment gave back the 5 percent increase last week to end at $17.80. Berger Paints and Proven Investments both gave up 3 percent during the week, while Junior Market Lasco Financial gave up six percent at the end of the week in closing at $3.05 and Caribbean Assurance Brokers lost three percent, from $1.79 to $1.74 as Medical Disposables rose four percent to $4.95 after hitting an intraday high of $5.80 on Friday and Lumber Depot rose four percent to $2.97.

There are no additions to the ICTOP10 this week, but with company results increasingly appearing, the markets could benefit from some of them. Caribbean Cement released third quarter results and investors responded negatively to them with the third quarter profit, down sharply from bot 2020 third quarter and the previous two quarters. The stock propped higher to close the week at $114 after it fell to almost $100. This stock now looks like one for 2022 as it seems fully valued based on probable results for 2021. Jamaica Stock Exchange released third quarter numbers with higher 2021 income and profit helped considerably by two big one off type trades in August and September, as such, investors should be careful that they do not read too much into those results about exciting prospects. Mayberry Investments released results for the year to September with profit up for the nine months from a loss of $664 million to a profit of $513 million and a profit of $224 million, down from $298 million in September 2020 quarter. Other comprehensive income that is positive for the nine months rising from a fall of $5 billion in 2020 to a surplus of $1.2 billion but a loss of $861 million for the September 2021 quarter. The company will be paying a hefty dividend of 32 cents per share.  The company will be paying a hefty dividend of 32 cents per share. Lasco Manufacturing and Lasco Distributor reported second quarter results. The former enjoyed a 13 percent increase in revenues to $4.65 billion and a 6 percent rise in profit to $782 million after increased taxation in the period versus a lower rate in 2020. The distributing company enjoyed a 15 percent rise in revenues to $11.6 billion and a 14 percent fall in after tax profit to $197 million.

The company will be paying a hefty dividend of 32 cents per share. Lasco Manufacturing and Lasco Distributor reported second quarter results. The former enjoyed a 13 percent increase in revenues to $4.65 billion and a 6 percent rise in profit to $782 million after increased taxation in the period versus a lower rate in 2020. The distributing company enjoyed a 15 percent rise in revenues to $11.6 billion and a 14 percent fall in after tax profit to $197 million.

As 2021 slowly crawls to a close, the focus should be on 2022 and the current year’s values to determine the appropriate valuation of each stock for a hold or fold decision. Most of the top 2021 stocks will not make the top 10 in 2022, but some will. The IC 80/20 rule, with a long 40 year history, shows an average of only two of the top ten stocks in a year repeat in the following one, while 4 out of 10 of the worst performing stocks will end up as TOP 10 winners in the succeeding year.

The top seven stocks so far, with gains of 52 to 231 percent, are; Future Energy, Jamaican Teas, Fosrich, ISP Finance, Lumber Depot, Express Catering and Honey Bun. In the Main market, Caribbean Cement, Caribbean Producers, Salada Foods, Radio Jamaica and Grace.

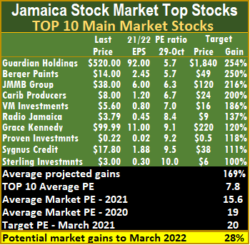

The top three Main Market stocks are Guardian Holdings, Berger Paints and JMMB Group, with expected gains of 216 to 254 percent versus last weeks’ 238 to 264 percent.

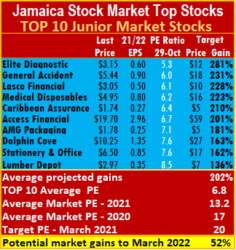

The top three stocks in the Junior Market have undergone a metamorphose with only are Elite Diagnostic, remaining in the top three this week and is followed by General Accident and Lasco Financial, with all three having the potential to gain between 228 and 281 percent, from 238 percent and 287 percent, previously.

The average gains projected for the TOP 10 Junior Market stocks moved from 213 percent last week to 202 percent and Main Market stocks moved from 173 percent to 169 percent.

The Junior Market closed the week with an average PE 13.2 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the historical average of 17 for the period to March this year, based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 6.8, with a 52 percent discount to that market’s PE.

The Junior Market closed the week with an average PE 13.2 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the historical average of 17 for the period to March this year, based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 6.8, with a 52 percent discount to that market’s PE.

The overall Junior Market can gain 51 percent to March next year, based on an average PE of 20 and 29 percent based on an average PE of 17. Seven stocks representing 15 percent of all Junior Market stocks with positive earnings are trading at or above this level, down from nine last week, indicating that many others will rise above the 17 mark in the weeks ahead.

The average PE for the JSE Main Market is 15.6, which is 22 percent less than the PE of 19 at the end of March and 28 percent below the target of 20 to March 2022. The Main Market  TOP 10 average PE is 7.8, representing a 50 percent discount to the market and well below the potential of 20. A total of 12 stocks or 25 percent of the market trade at or above a PE of 19, with most over 20, for an average PE of 25.5, suggesting that the accepted multiple maybe around 25 times the current year’s earnings.

TOP 10 average PE is 7.8, representing a 50 percent discount to the market and well below the potential of 20. A total of 12 stocks or 25 percent of the market trade at or above a PE of 19, with most over 20, for an average PE of 25.5, suggesting that the accepted multiple maybe around 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. The TOP10 is a selection of stocks that are most likely to deliver the largest gains within fifteen months. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on possible increases for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Mayberry Jamaica shed 50m Lumber shares

Lumber Depot dominated trading with

Lumber Depot, the 2019 spinoff of the Junior Market listed Blue Power, reported record first quarter results to July, with profit of $72 million, up from $30 million in 2020, with earnings per share of 10 cents and attracted increased buying in the stock as the results hit the exchange on September 8.

Mayberry Jamaican Equities (MJE) pounced on the renewed buying interest and sold just under 50 million units in the market up to October 20.MJE slashed their holdings of 181,538,726 shares, with 25.7 percent of total issued capital at the end of July to 132,468,464, but they remained the largest shareholder at 18.76 percent.

Over the same period, Blue Power Group, the second largest shareholder, reduced their 101,989,250 holdings to 14.4412 percent to 98,989,250 or 14.02 percent. Blue power in January held 113,989,250 shares, with a 16.14 percent holding. Kenneth Benjamin, a director of Blue Power, holdings in January of 49.95 million rose to 59,954,650 units or 8.4893 percent but slipped to 58.4 million in October.

Since October 20, the average daily trade in the stock has been 773,546 units, with the lowest trade, 522,227, on the 21 of the month.

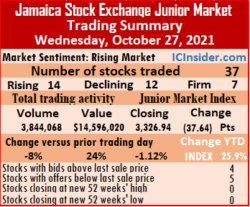

Overall, 37 securities traded, up from 35 on Tuesday and ended with 16 rising, 13 declining and eight closing unchanged.

Overall, 37 securities traded, up from 35 on Tuesday and ended with 16 rising, 13 declining and eight closing unchanged. At the close, Access Financial lost $1.55 in closing at $18, after trading 9,534 shares, Cargo Handlers climbed 69 cents to $7.84 in switching ownership of one stock unit, Consolidated Bakeries fell 11 cents, to $1.55 after an exchange of 10,147 units. Dolphin Cove dropped 25 cents to $10 while exchanging 9,830 stocks, Elite Diagnostic dipped 5 cents to end at $3.05 in trading 148,454 units, Express Catering shed 5 cents in closing at $4.80 after trading 25,709 stocks. Fontana rose 5 cents to $6.99 in exchanging 162,937 shares, Fosrich inched 17 cents up to end at $8.60, with 37,041 stock units crossing the exchange, Honey Bun dropped 49 cents to close at $9.01, clearing the market with 9,677 stocks. Indies Pharma gained 19 cents to $3.29 with an exchange of 64,299 shares, Jamaican Teas rose 6 cents in closing at $4.50, with 1,194,086 units changing hands, Jetcon Corporation popped 11 cents to $1.10, in trading 7,397 stock units. KLE Group shed 20 cents to close at $2 after exchanging 33,223 stocks, Knutsford Express fell 5 cents, to $8, with 3,000 shares crossing the market, Lasco Manufacturing rallied 5 cents to end at $4.85, in trading 32,764 stock units.

At the close, Access Financial lost $1.55 in closing at $18, after trading 9,534 shares, Cargo Handlers climbed 69 cents to $7.84 in switching ownership of one stock unit, Consolidated Bakeries fell 11 cents, to $1.55 after an exchange of 10,147 units. Dolphin Cove dropped 25 cents to $10 while exchanging 9,830 stocks, Elite Diagnostic dipped 5 cents to end at $3.05 in trading 148,454 units, Express Catering shed 5 cents in closing at $4.80 after trading 25,709 stocks. Fontana rose 5 cents to $6.99 in exchanging 162,937 shares, Fosrich inched 17 cents up to end at $8.60, with 37,041 stock units crossing the exchange, Honey Bun dropped 49 cents to close at $9.01, clearing the market with 9,677 stocks. Indies Pharma gained 19 cents to $3.29 with an exchange of 64,299 shares, Jamaican Teas rose 6 cents in closing at $4.50, with 1,194,086 units changing hands, Jetcon Corporation popped 11 cents to $1.10, in trading 7,397 stock units. KLE Group shed 20 cents to close at $2 after exchanging 33,223 stocks, Knutsford Express fell 5 cents, to $8, with 3,000 shares crossing the market, Lasco Manufacturing rallied 5 cents to end at $4.85, in trading 32,764 stock units.  Limners and Bards declined 5 cents to $3.55 with the swapping of 19,496 units, Main Event advanced 54 cents to close at $4.44, with 400 stock units clearing the market, Medical Disposables rallied 5 cents to end at $5.10 with an exchange of 1,200 units. Paramount Trading rose 6 cents to $1.10, with 3,000 stocks crossing the exchange, SSL Venture popped 5 cents to 74 cents in switching ownership of 1,922 shares and Tropical Battery lost 5 cents to end at $1.29 in trading 4,143 stock units.

Limners and Bards declined 5 cents to $3.55 with the swapping of 19,496 units, Main Event advanced 54 cents to close at $4.44, with 400 stock units clearing the market, Medical Disposables rallied 5 cents to end at $5.10 with an exchange of 1,200 units. Paramount Trading rose 6 cents to $1.10, with 3,000 stocks crossing the exchange, SSL Venture popped 5 cents to 74 cents in switching ownership of 1,922 shares and Tropical Battery lost 5 cents to end at $1.29 in trading 4,143 stock units. A total of 35 securities trading down from 41 on Monday and ended with 19 rising, 11 declining and five closing unchanged.

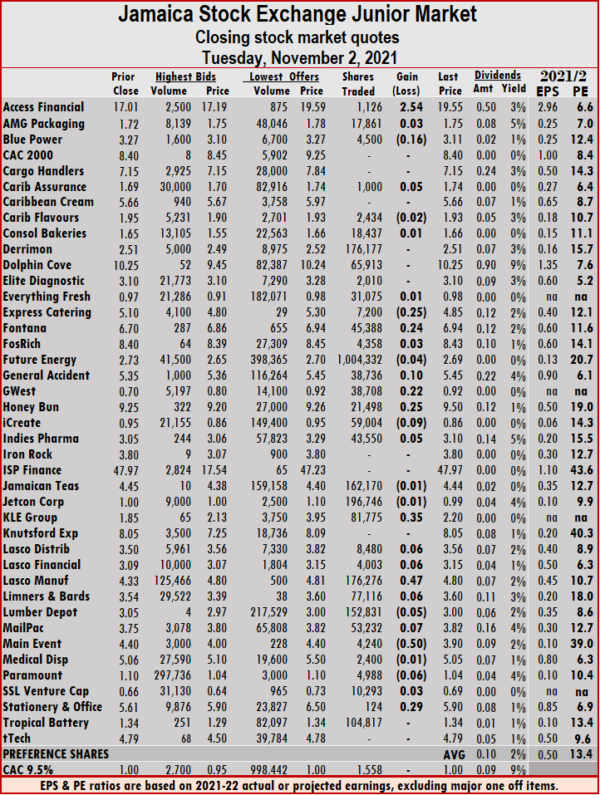

A total of 35 securities trading down from 41 on Monday and ended with 19 rising, 11 declining and five closing unchanged. Trading averaged 74,982 shares at $229,312 versus 130,760 shares at $456,818 on Monday and for the month to date an average of 105,072 units at $352,046. October closed with an average of 162,777 units at $557,275.

Trading averaged 74,982 shares at $229,312 versus 130,760 shares at $456,818 on Monday and for the month to date an average of 105,072 units at $352,046. October closed with an average of 162,777 units at $557,275. Lasco Financial rose 6 cents to $3.15 while exchanging 4,003 stock units, Lasco Manufacturing increased 47 cents to $4.80, with 176,276 stocks clearing the market, Limners and Bards popped 6 cents in closing at $3.60 in exchanging 77,116 units, Mailpac Group increased 7 cents to close at $3.82, with 53,232 stocks crossing the market, Main Event fell 50 cents to $3.90 trading 4,240 shares, Paramount Trading declined 6 cents to close at $1.04 in an exchange of 4,988 stock units and Stationery and Office Supplies popped 29 cents to end at $5.90 in an exchange of 124 units.

Lasco Financial rose 6 cents to $3.15 while exchanging 4,003 stock units, Lasco Manufacturing increased 47 cents to $4.80, with 176,276 stocks clearing the market, Limners and Bards popped 6 cents in closing at $3.60 in exchanging 77,116 units, Mailpac Group increased 7 cents to close at $3.82, with 53,232 stocks crossing the market, Main Event fell 50 cents to $3.90 trading 4,240 shares, Paramount Trading declined 6 cents to close at $1.04 in an exchange of 4,988 stock units and Stationery and Office Supplies popped 29 cents to end at $5.90 in an exchange of 124 units. Overall, 41 securities traded up from 35 on Friday and ended with 17 rising, 17 declining and seven, closing unchanged.

Overall, 41 securities traded up from 35 on Friday and ended with 17 rising, 17 declining and seven, closing unchanged. Trading averaged 130,760 shares at $456,818 in contrast to 126,170 shares at $424,566 on Friday. Trading in October closed with an average of 162,777 units at $557,275.

Trading averaged 130,760 shares at $456,818 in contrast to 126,170 shares at $424,566 on Friday. Trading in October closed with an average of 162,777 units at $557,275. Lasco Manufacturing shed 45 cents ending at $4.33, with 39,664 stocks crossing the market after the company released good half year results with a strong indication that the stock is undervalued. Main Event spiked 40 cents in closing at $4.40 after trading 2,012 stocks, Medical Disposables popped 11 cents to $5.06 after exchanging 4,428 shares, Stationery and Office Supplies fell 89 cents to $5.61 in exchanging 5,825 units and tTech rallied 14 cents to $4.79 while trading 10,000 stock units.

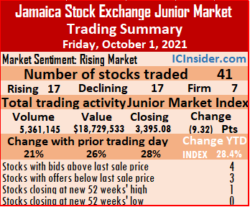

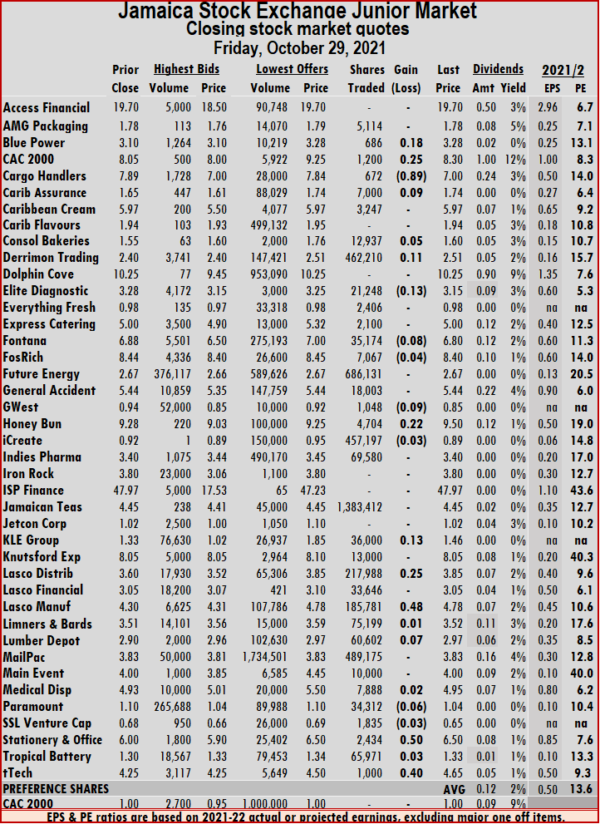

Lasco Manufacturing shed 45 cents ending at $4.33, with 39,664 stocks crossing the market after the company released good half year results with a strong indication that the stock is undervalued. Main Event spiked 40 cents in closing at $4.40 after trading 2,012 stocks, Medical Disposables popped 11 cents to $5.06 after exchanging 4,428 shares, Stationery and Office Supplies fell 89 cents to $5.61 in exchanging 5,825 units and tTech rallied 14 cents to $4.79 while trading 10,000 stock units. Trading closed Friday, with the volume and value of stocks traded rising modestly over Thursday as the Jamaica Stock Exchange Junior Market closed out the week and month with the market index surging 42.50 points to close at 3,404.40, to be up 108 points for the month, with a gain just under 29 percent for the year to date.

Trading closed Friday, with the volume and value of stocks traded rising modestly over Thursday as the Jamaica Stock Exchange Junior Market closed out the week and month with the market index surging 42.50 points to close at 3,404.40, to be up 108 points for the month, with a gain just under 29 percent for the year to date.  Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three stocks with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three stocks with lower offers. KLE Group popped 13 cents to $1.46 with an exchange of 36,000 stocks, Lasco Distributors rose 25 cents to end at $3.85 in trading 217,988 stock units. Lasco Manufacturing climbed 48 cents to $4.78 with the swapping of 185,781 units, Lumber Depot spiked 7 cents to close at $2.97 with 60,602 stocks clearing the market, Paramount Trading lost 6 cents to close at $1.04 in switching ownership of 34,312 shares, Stationery and Office Supplies increased 50 cents to close at $6.50 after exchanging 2,434 stock units and tTech advanced 40 cents to $4.65 1,000 stocks changing hands.

KLE Group popped 13 cents to $1.46 with an exchange of 36,000 stocks, Lasco Distributors rose 25 cents to end at $3.85 in trading 217,988 stock units. Lasco Manufacturing climbed 48 cents to $4.78 with the swapping of 185,781 units, Lumber Depot spiked 7 cents to close at $2.97 with 60,602 stocks clearing the market, Paramount Trading lost 6 cents to close at $1.04 in switching ownership of 34,312 shares, Stationery and Office Supplies increased 50 cents to close at $6.50 after exchanging 2,434 stock units and tTech advanced 40 cents to $4.65 1,000 stocks changing hands. At the close, the Junior Market Index rallied 34.96 points to end at 3,361.90, after 36 securities traded compared to 37 on Wednesday and ended with 18 rising, 14 declining and four closing unchanged.

At the close, the Junior Market Index rallied 34.96 points to end at 3,361.90, after 36 securities traded compared to 37 on Wednesday and ended with 18 rising, 14 declining and four closing unchanged. Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer. Lasco Manufacturing lost 20 cents to $4.30 after 27,840 shares crossed the exchange, Mailpac Group advanced 6 cents to $3.83 in exchanging 201,426 stocks, Main Event gained 24 cents to end at $4 with 7,500 shares changing hands. Medical Disposables fell 32 cents in closing at $4.93, after trading 47,340 stocks, Stationery and Office Supplies shed 10 cents to $6 with an exchange of 13,398 stock units and tTech fell 45 cents to end at $4.25, after 1,143 units crossed the market.

Lasco Manufacturing lost 20 cents to $4.30 after 27,840 shares crossed the exchange, Mailpac Group advanced 6 cents to $3.83 in exchanging 201,426 stocks, Main Event gained 24 cents to end at $4 with 7,500 shares changing hands. Medical Disposables fell 32 cents in closing at $4.93, after trading 47,340 stocks, Stationery and Office Supplies shed 10 cents to $6 with an exchange of 13,398 stock units and tTech fell 45 cents to end at $4.25, after 1,143 units crossed the market. For a second consecutive day, 37 stocks traded and ended with 18 rising, 15 declining and four closing unchanged.

For a second consecutive day, 37 stocks traded and ended with 18 rising, 15 declining and four closing unchanged. At the close, Access Financial dropped $2.34 in closing at $17.36 in exchanging 1,052 shares, AMG Packaging climbed 10 cents to $1.75 with the swapping of 100 stock units, Blue Power advanced 10 cents to $3.10 after trading 5,786 stocks. Cargo Handlers spiked 84 cents to $7.89 after 100 units crossed the exchange, Caribbean Cream shed 7 cents to close at $5.83, with 177,214 stocks changing hands, Consolidated Bakeries declined 5 cents to close at $1.70 in switching ownership of 8,150 shares. Derrimon Trading fell 5 cents in closing at $2.35 after exchanging 60,312 stock units, Dolphin Cove lost 81 cents to end at $9.43 in trading 152 units, Elite Diagnostic popped 19 cents to $3.29 after trading 12,171 shares. Everything Fresh fell 5 cents to 93 cents with an exchange of 58,434 stock units, Express Catering lost 13 cents to end at $5.20 after trading 48,352 units, Fontana climbed 20 cents to $6.50 in an exchange of 46,039 stocks. Fosrich fell 5 cents to close at $8.35, with 11,232 units crossing the exchange, General Accident popped 9 cents to $5.44 with 6,000 shares changing hands, GWest Corporation rallied 8 cents in closing at 93 cents while exchanging 16,43 stocks. Honey Bun increased 40 cents to $9, with 7,845 stock units clearing the market, iCreate rose 9 cents to 98 cents after 36,414 units crossed the exchange, ISP Finance dropped $2.03 to end at $47.97 trading just two stock units. Jamaican Teas shed 19 cents to close at $4.26 with an exchange of 1,701,459 stocks, KLE Group gained 17 cents in closing at $1.33, with 3,400 shares changing hands, Knutsford Express popped 10 cents to $7.30 after exchanging 908 stocks.

At the close, Access Financial dropped $2.34 in closing at $17.36 in exchanging 1,052 shares, AMG Packaging climbed 10 cents to $1.75 with the swapping of 100 stock units, Blue Power advanced 10 cents to $3.10 after trading 5,786 stocks. Cargo Handlers spiked 84 cents to $7.89 after 100 units crossed the exchange, Caribbean Cream shed 7 cents to close at $5.83, with 177,214 stocks changing hands, Consolidated Bakeries declined 5 cents to close at $1.70 in switching ownership of 8,150 shares. Derrimon Trading fell 5 cents in closing at $2.35 after exchanging 60,312 stock units, Dolphin Cove lost 81 cents to end at $9.43 in trading 152 units, Elite Diagnostic popped 19 cents to $3.29 after trading 12,171 shares. Everything Fresh fell 5 cents to 93 cents with an exchange of 58,434 stock units, Express Catering lost 13 cents to end at $5.20 after trading 48,352 units, Fontana climbed 20 cents to $6.50 in an exchange of 46,039 stocks. Fosrich fell 5 cents to close at $8.35, with 11,232 units crossing the exchange, General Accident popped 9 cents to $5.44 with 6,000 shares changing hands, GWest Corporation rallied 8 cents in closing at 93 cents while exchanging 16,43 stocks. Honey Bun increased 40 cents to $9, with 7,845 stock units clearing the market, iCreate rose 9 cents to 98 cents after 36,414 units crossed the exchange, ISP Finance dropped $2.03 to end at $47.97 trading just two stock units. Jamaican Teas shed 19 cents to close at $4.26 with an exchange of 1,701,459 stocks, KLE Group gained 17 cents in closing at $1.33, with 3,400 shares changing hands, Knutsford Express popped 10 cents to $7.30 after exchanging 908 stocks.  Lasco Distributors rose 10 cents to close at $3.70 with 85,513 units changing hands, Lasco Manufacturing lost 30 cents to end at $4.50 while exchanging 58,570 stock units, Lumber Depot rose 6 cents to $2.92 with the swapping of 602,207 shares. Main Event dropped 44 cents in closing at $3.76 in trading 59,000 stock units and tTech rallied 45 cents in closing at $4.70 in switching ownership of 407 units.

Lasco Distributors rose 10 cents to close at $3.70 with 85,513 units changing hands, Lasco Manufacturing lost 30 cents to end at $4.50 while exchanging 58,570 stock units, Lumber Depot rose 6 cents to $2.92 with the swapping of 602,207 shares. Main Event dropped 44 cents in closing at $3.76 in trading 59,000 stock units and tTech rallied 45 cents in closing at $4.70 in switching ownership of 407 units.