NCB Financial traded 16.55m shares on the JSE on Thursday.

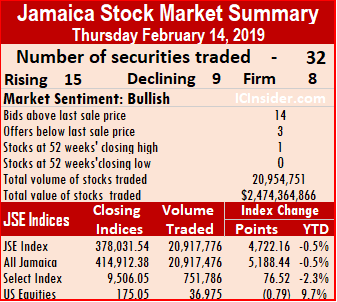

Gains in 15 stocks against 9 with losses sent the main market of the Jamaica Stock Exchange surging at the end of trading on Thursday. NCB Financial traded more than $16.5 million shares but had little impact on the indices.

At the close, the JSE All Jamaican Composite Index jumped 5,188.44 points to 414,912.38 and the JSE Index surged 4,722.16 points to 378,031.54.

The main and US markets traded 32 securities, compared to 35 securities trading on Wednesday, with Jamaica Stock Exchange and Wisynco Group trading at 52 weeks intraday highs but PanJam Investments ended at a 52 weeks’ closing high as supply of the stock is very limited.

Main market activity ended with, 20,917,776 units valued at $2,473,285,188 changing hands, compared to 9,650,019 valued at $141,880,042 on Wednesday.

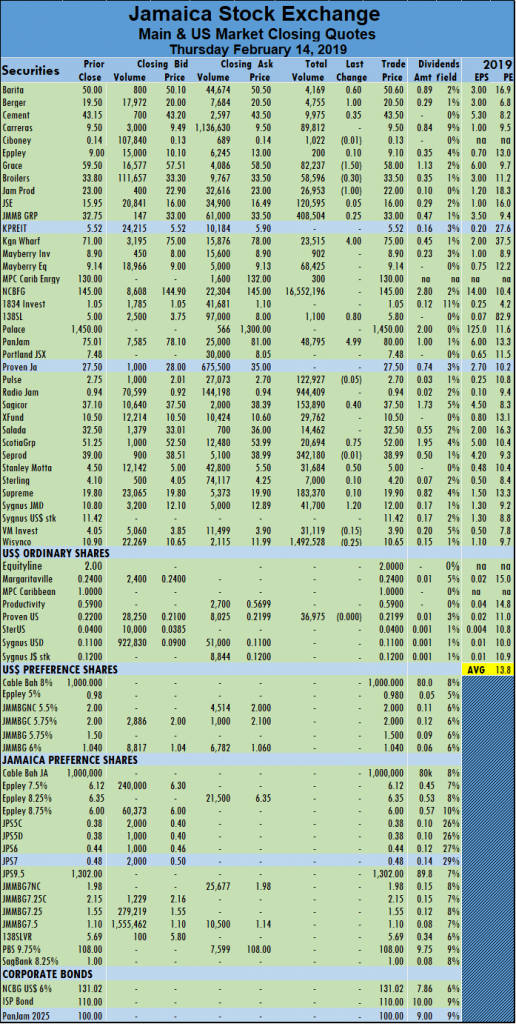

NCB Financial Group led trading with 16.55 million shares for 79 percent of the day’s volume, Wisynco Group was next with 1,492,528 shares, accounting for 7 percent of the total main market volume changing hands and Radio Jamaica ended with 944,409 shares, for 4.5 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 13 stocks ending with bids higher than their last selling prices and 3 closing with lower offers.

An average of 674,767 units valued at $79,783,393 compared to 292,425 units valued at an average of $4,299,395 for each security traded, on Wednesday. The average volume and value for the month to date, amounts to 351,464 shares with a value of $16,773,070 and previously, 318,056 shares with a value of $9,511,657. Trading for January resulted in an average of 101,980 units, valued at $3,042,494, for each security traded.

In main market activity, Barita Investments rose 60 cents to close at $50.60, in trading 4,169 shares, Berger Paints jumped $1 to end at $20.50, with 4,755 stock units trading, Caribbean Cement finished with a gain of 35 cents to end at $43.50, with an exchange of 9,975 shares. Grace Kennedy traded 82,237 stock units but lost $1.50 to end at $58, Jamaica Broilers finished trading 58,596 shares and lost 30 cents to end at $33.50, Jamaica Producers fell 41 to close at $22, with 26,953 shares trading, JMMB Group gained 25 cents in concluded trading of 408,504 shares at $33,. Kingston Wharves rose $4 to close at $75, with  23,515 units changing hands, 183 Student Living rose 80 cents trading 1,100 shares at $5.80. PanJam Investment jumped $4.99 in ending at a 52 weeks closing high of $80, trading 48,795 units, Sagicor Group gained 40 cents and ended trading 153,890 stock units at $37.50, Scotia Group added 75 cents trading 20,694 shares at $52, Stanley Motta gained 50 cents to end at $5, with an exchange of 31,684 shares. Sygnus Credit Investments rose $1.20 to end at $12 with an exchange of 41,700 shares, Victoria Mutual Investments rose 35 cents to settle at $4.05, with 30,867 shares changing hands and Wisynco Group fell 25 cents and concluded trading of 1,492,528 shares $10.65, after trading at a 52 weeks’ intraday high of $12. Trading over the past 4 days have significantly dried up supply of the stock.

23,515 units changing hands, 183 Student Living rose 80 cents trading 1,100 shares at $5.80. PanJam Investment jumped $4.99 in ending at a 52 weeks closing high of $80, trading 48,795 units, Sagicor Group gained 40 cents and ended trading 153,890 stock units at $37.50, Scotia Group added 75 cents trading 20,694 shares at $52, Stanley Motta gained 50 cents to end at $5, with an exchange of 31,684 shares. Sygnus Credit Investments rose $1.20 to end at $12 with an exchange of 41,700 shares, Victoria Mutual Investments rose 35 cents to settle at $4.05, with 30,867 shares changing hands and Wisynco Group fell 25 cents and concluded trading of 1,492,528 shares $10.65, after trading at a 52 weeks’ intraday high of $12. Trading over the past 4 days have significantly dried up supply of the stock.

Trading in the US dollar market resulted in 36,975 units valued at US$8,057 changing hands with Proven Investments being the sole stock trading, with the price closing at 21.99 US cents. The JSE USD Equities Index fell 0.79 points to close at 175.05.

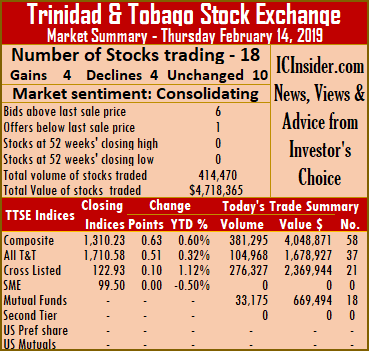

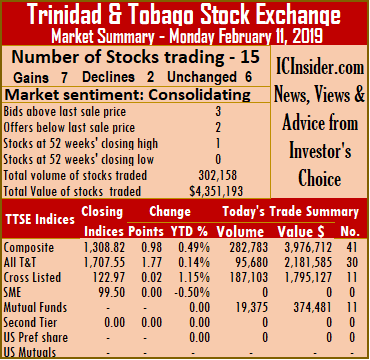

Market activity on the Trinidad & Tobago Stock Exchange ended on Thursday with 18 securities changing hands against 13 on Wednesday, with 4 advancing, 4 declining and 10 remaining unchanged.

Market activity on the Trinidad & Tobago Stock Exchange ended on Thursday with 18 securities changing hands against 13 on Wednesday, with 4 advancing, 4 declining and 10 remaining unchanged. exchanging 692 shares.

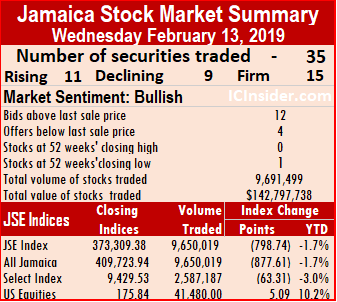

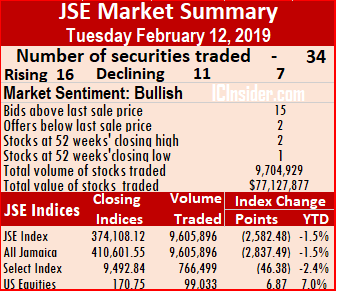

exchanging 692 shares. Trading on the main market of the Jamaica Stock Exchange ended on Wednesday with the market indices and ending with more declines even as advancing stocks were more than declining ones.

Trading on the main market of the Jamaica Stock Exchange ended on Wednesday with the market indices and ending with more declines even as advancing stocks were more than declining ones.

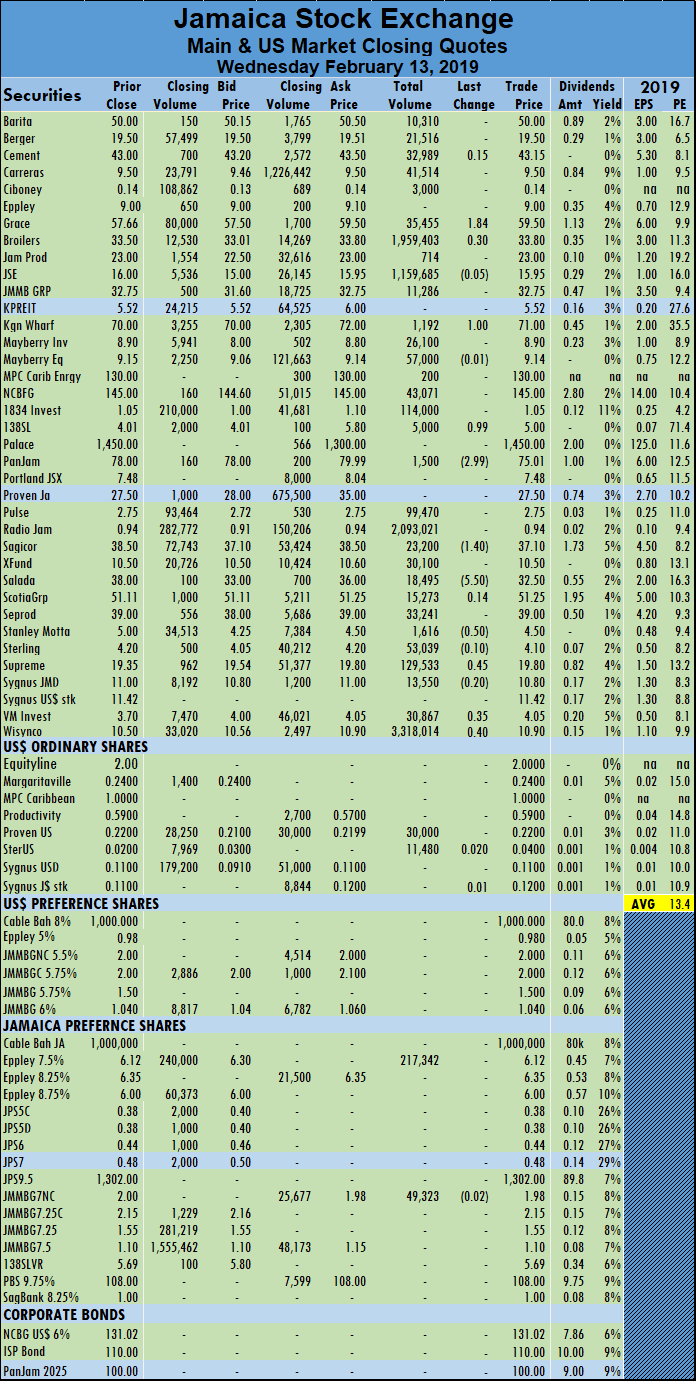

Stanley Motta fell 50 cents to end at $4.50, with an exchange of 1,616 shares, Supreme Ventures rose 45 cents and finished trading of 129,583 units at $19.80. Sygnus Credit Investments rose 75 cents to end at $11 with an exchange of 16,550 shares, Victoria Mutual Investments rose 35 cents to settle at $4.05, with 30,867 shares changing hands and Wisynco Group rose 40 cents and concluded trading of 3,318,014 shares $10.90.

Stanley Motta fell 50 cents to end at $4.50, with an exchange of 1,616 shares, Supreme Ventures rose 45 cents and finished trading of 129,583 units at $19.80. Sygnus Credit Investments rose 75 cents to end at $11 with an exchange of 16,550 shares, Victoria Mutual Investments rose 35 cents to settle at $4.05, with 30,867 shares changing hands and Wisynco Group rose 40 cents and concluded trading of 3,318,014 shares $10.90.

shares and Trinidad & Tobago NGL declined 11 cents and completed trading of 68,154 units at $29.50.

shares and Trinidad & Tobago NGL declined 11 cents and completed trading of 68,154 units at $29.50.

gains in profit in the December quarter of $168 million versus $79 million in the similar period in 2017. JMMB Group 6% preference share was next with 1,799,538 shares and accounting for 18.7 percent of the total main market volume changing hands and 1834 Investments with 705,080 shares, for 7 percent of the day’s volume.

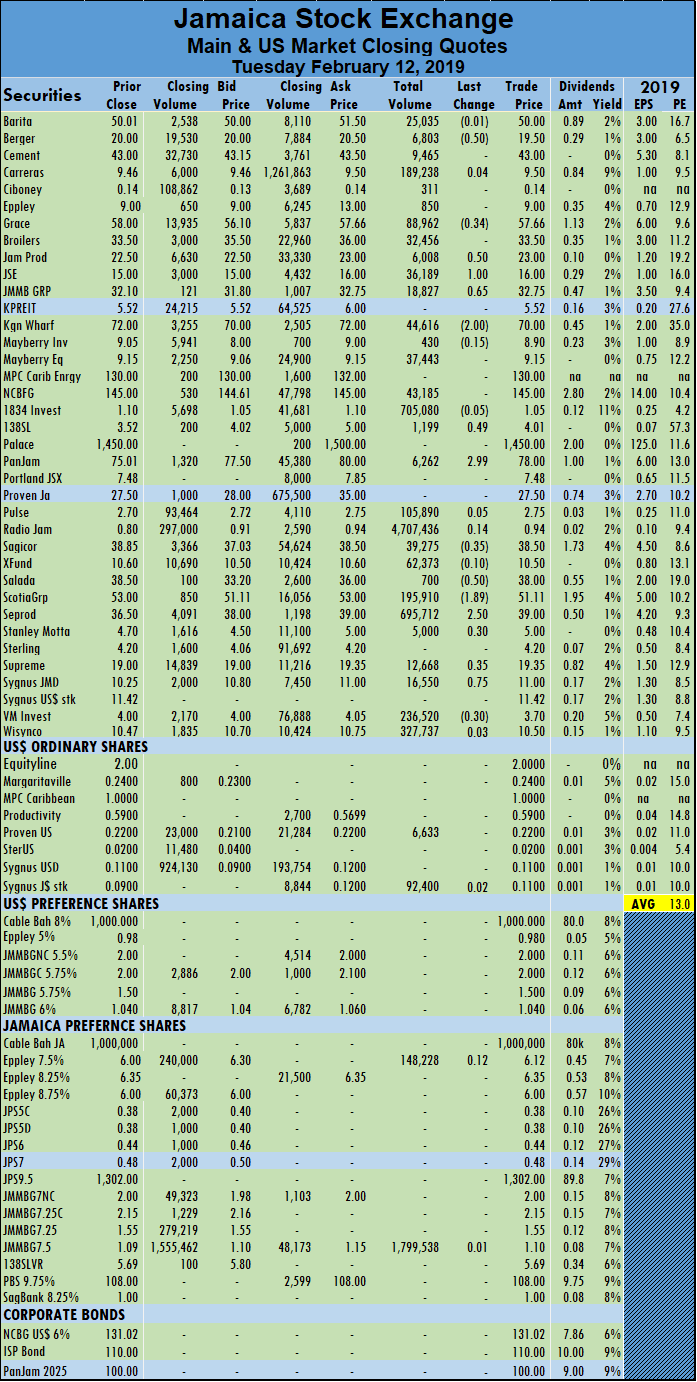

gains in profit in the December quarter of $168 million versus $79 million in the similar period in 2017. JMMB Group 6% preference share was next with 1,799,538 shares and accounting for 18.7 percent of the total main market volume changing hands and 1834 Investments with 705,080 shares, for 7 percent of the day’s volume. Kingston Wharves dropped $2 and settled at $70, with 44,616 units changing hands, 138 Student Living rose 49 cents and finished trading 1,199 shares at $4.01. PanJam Investment jumped $2.99 and ended at a 52 weeks’ closing high of $78, trading 6,262 units, Sagicor Group lost 35 cents and ended trading at $38.50, with 39,275 stock units, Salada Foods traded just 700 units, but lost 50 cents to close at $38, Scotia Group dropped $1.89 to finish trading 195,910 shares at $51.11. Seprod climbed $2.50 to finish trading of 695,712 shares at $39, Stanley Motta rose 30 cents to end at $5, with an exchange of 5,000 shares, Supreme Ventures rose 35 cents and finished trading of 12,668 units at $19.35. Sygnus Credit Investments rose 75 cents to end at $11 with an exchange of 16,550 shares and Victoria Mutual Investments lost 30 cents to settle at $3.70, with 236,520 shares changing hands.

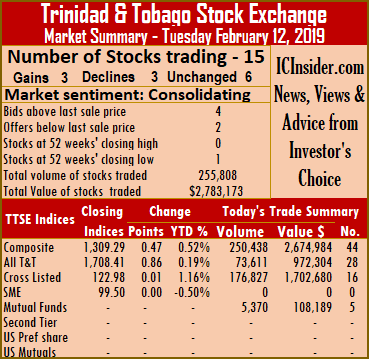

Kingston Wharves dropped $2 and settled at $70, with 44,616 units changing hands, 138 Student Living rose 49 cents and finished trading 1,199 shares at $4.01. PanJam Investment jumped $2.99 and ended at a 52 weeks’ closing high of $78, trading 6,262 units, Sagicor Group lost 35 cents and ended trading at $38.50, with 39,275 stock units, Salada Foods traded just 700 units, but lost 50 cents to close at $38, Scotia Group dropped $1.89 to finish trading 195,910 shares at $51.11. Seprod climbed $2.50 to finish trading of 695,712 shares at $39, Stanley Motta rose 30 cents to end at $5, with an exchange of 5,000 shares, Supreme Ventures rose 35 cents and finished trading of 12,668 units at $19.35. Sygnus Credit Investments rose 75 cents to end at $11 with an exchange of 16,550 shares and Victoria Mutual Investments lost 30 cents to settle at $3.70, with 236,520 shares changing hands. Market activity on the Trinidad & Tobago Stock Exchange ended on Tuesday with trading in 15 securities against 15 on Monday, with 4 advancing, 2 declining and 9 remaining unchanged.

Market activity on the Trinidad & Tobago Stock Exchange ended on Tuesday with trading in 15 securities against 15 on Monday, with 4 advancing, 2 declining and 9 remaining unchanged.

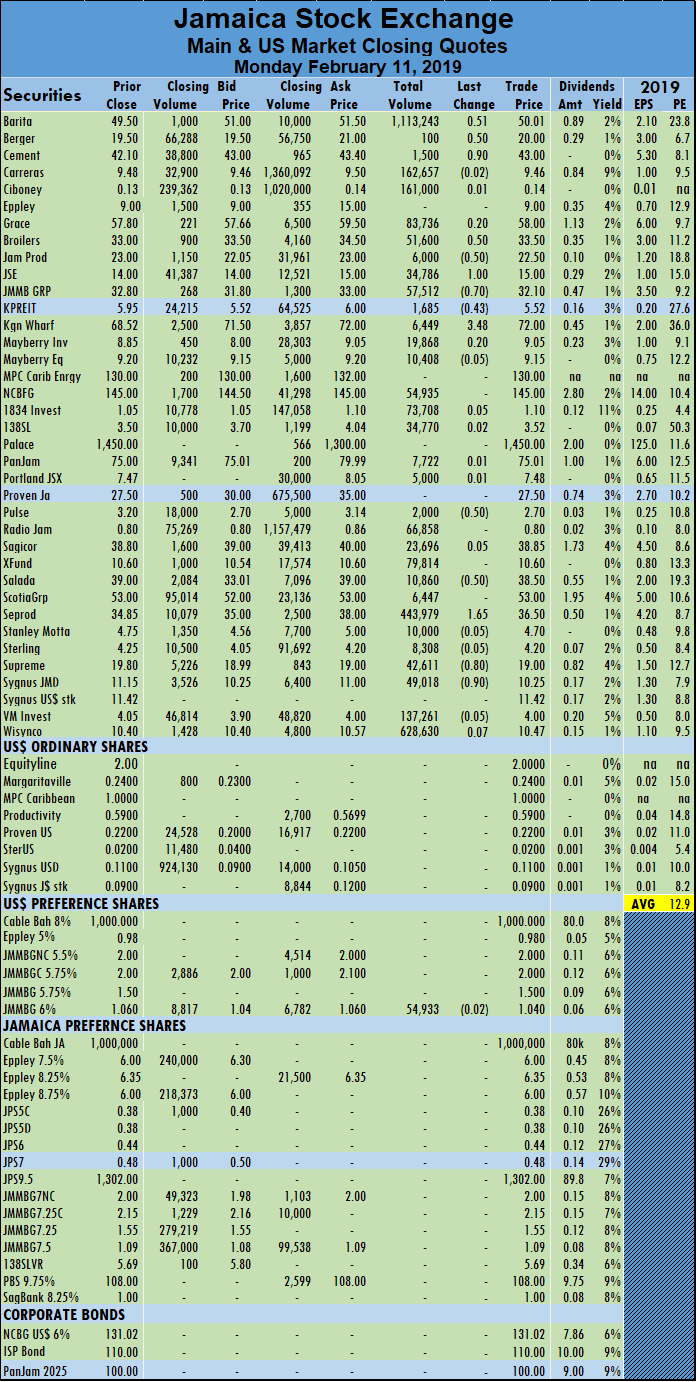

$22.50 and trading 6,000 shares, Jamaica Stock Exchange gained $1 and closed trading with 34,786 units changing hands, at a record close of $15, JMMB Group fell 70 cents concluded trading at $32.10, with 57,512 shares. Kingston Wharves rose $3.48 cents and settled at $72, with 6,449 units changing hands, Pulse Investments traded 2,000 units and lost 50 cents to close at $2.70, Salada Foods traded 10,860 units, but lost 50 cents to close at $38.50. Seprod rose $1.65 to finish trading of 443,979 shares at $36.50, Supreme Ventures lost 80 cents and finished trading 42,611 units at $19 and Sygnus Credit Investments lost 90 cents to end at $10.25 with an exchange of 49,018 shares.

$22.50 and trading 6,000 shares, Jamaica Stock Exchange gained $1 and closed trading with 34,786 units changing hands, at a record close of $15, JMMB Group fell 70 cents concluded trading at $32.10, with 57,512 shares. Kingston Wharves rose $3.48 cents and settled at $72, with 6,449 units changing hands, Pulse Investments traded 2,000 units and lost 50 cents to close at $2.70, Salada Foods traded 10,860 units, but lost 50 cents to close at $38.50. Seprod rose $1.65 to finish trading of 443,979 shares at $36.50, Supreme Ventures lost 80 cents and finished trading 42,611 units at $19 and Sygnus Credit Investments lost 90 cents to end at $10.25 with an exchange of 49,018 shares.

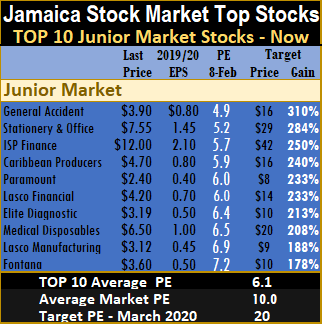

IC Insider.com TOP 10 selections return after a break. The selections, are based on 2019 earnings. Quite a number of the 2018 TOP 10 listings appear again in this year’s lists.

IC Insider.com TOP 10 selections return after a break. The selections, are based on 2019 earnings. Quite a number of the 2018 TOP 10 listings appear again in this year’s lists.

With EPS at 17 cents for the year, to December, full year results could hit 25 cents per share with 2020 moving higher as new product lines deliver more sales and profit.

With EPS at 17 cents for the year, to December, full year results could hit 25 cents per share with 2020 moving higher as new product lines deliver more sales and profit.  upgrade took place in 2018. The company will benefit from increased sales as the construction sector continues to grow and demand more cement to use in building.

upgrade took place in 2018. The company will benefit from increased sales as the construction sector continues to grow and demand more cement to use in building. discount of 37 percent to the overall market.

discount of 37 percent to the overall market.

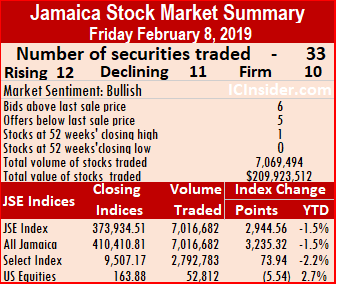

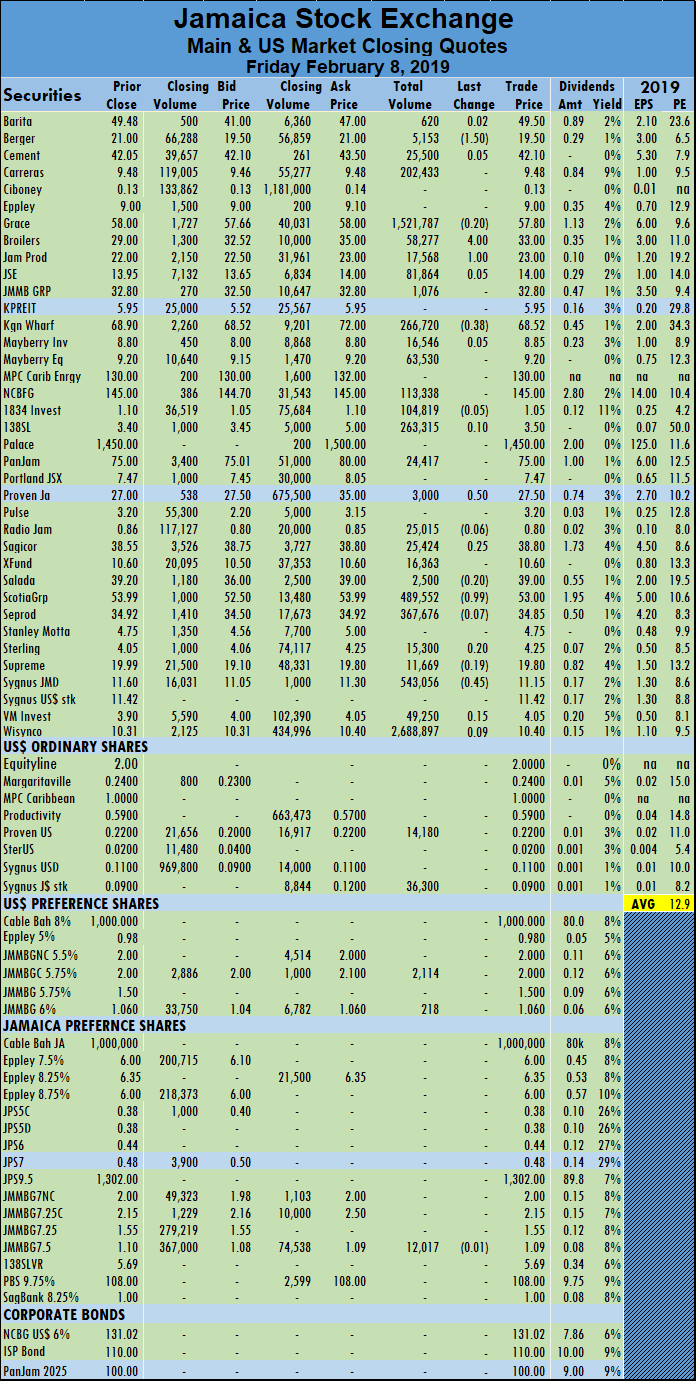

record close of $14, Kingston Wharves lost 38 cents and settled at $68.52, with 266,720 units changing hands. Proven Investments traded 3,000 units and rose 50 cents to close at $27.50, Sagicor Group rose 25 cents in trading 25,424 stock units, to close at $38.80, Scotia Group fell 99 cents and finished trading of 489,552 shares at $53 and Sygnus Credit Investments lost 45 cents to end at $11.15 with an exchange of 543,056 shares.

record close of $14, Kingston Wharves lost 38 cents and settled at $68.52, with 266,720 units changing hands. Proven Investments traded 3,000 units and rose 50 cents to close at $27.50, Sagicor Group rose 25 cents in trading 25,424 stock units, to close at $38.80, Scotia Group fell 99 cents and finished trading of 489,552 shares at $53 and Sygnus Credit Investments lost 45 cents to end at $11.15 with an exchange of 543,056 shares.