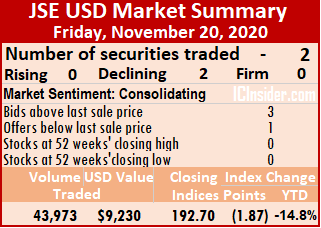

Prices closed mixed on the US dollar market of the Jamaica Stock Exchange on Tuesday, with the market index rising after exchanging 35 percent fewer shares than on Monday.

At the close of the market, trading ended with four securities changing hands compared to five on Monday and ended with the prices of one rising, one declining and two remaining unchanged.

At the close of the market, trading ended with four securities changing hands compared to five on Monday and ended with the prices of one rising, one declining and two remaining unchanged.

The JSE USD Equities Index rose 5.44 points to settle at 188.28. The average PE Ratio ended at 13.3 based on ICInsider.com’s forecast of 2020-21 earnings.

The market closed with an exchange of 201,406 shares at US$1,935 compared to 390,138 units at US$11,832 on Monday.

Trading averaged 50,352 units changing hands at a mere US$484, in contrast to an average of 78,028 shares at US$2,366 on Monday. Month to date trading averaged 50,758 units at US$4,959 in contrast to 50,782 units at US$5,218 on Monday. By comparison, trading in October averaged 697,808 units for US$17,320.

Investor’s Choice bid-offer indicator reading shows three stocks ending with bids higher than their last selling prices and one with a lower offer.

At the close of the market, First Rock Capital Investment gained 0.05 of a cent and closed at 8.65 US cents in an exchange of 1,055 units, Productive Business Solutions remained at 66 US cents, with 51 units changing hands, Proven Investments lost 0.48 of a cent to end at 25.50 US cents, in trading 300 units and Transjamaican Highway remained at 0.85 of 1 US cent after a transfer of 200,000 shares.

At the close of the market, First Rock Capital Investment gained 0.05 of a cent and closed at 8.65 US cents in an exchange of 1,055 units, Productive Business Solutions remained at 66 US cents, with 51 units changing hands, Proven Investments lost 0.48 of a cent to end at 25.50 US cents, in trading 300 units and Transjamaican Highway remained at 0.85 of 1 US cent after a transfer of 200,000 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

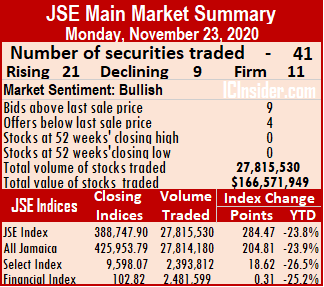

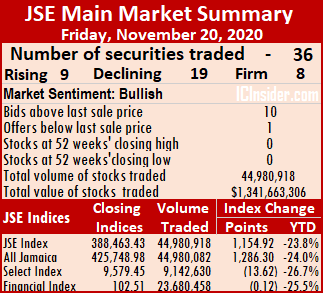

Trading ended with 37 companies changing hands compared to 31 on Friday and concluded with the prices of 17 stocks rising, prices of 16 falling and four with prices ending unchanged.

Trading ended with 37 companies changing hands compared to 31 on Friday and concluded with the prices of 17 stocks rising, prices of 16 falling and four with prices ending unchanged. The Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four with lower offers.

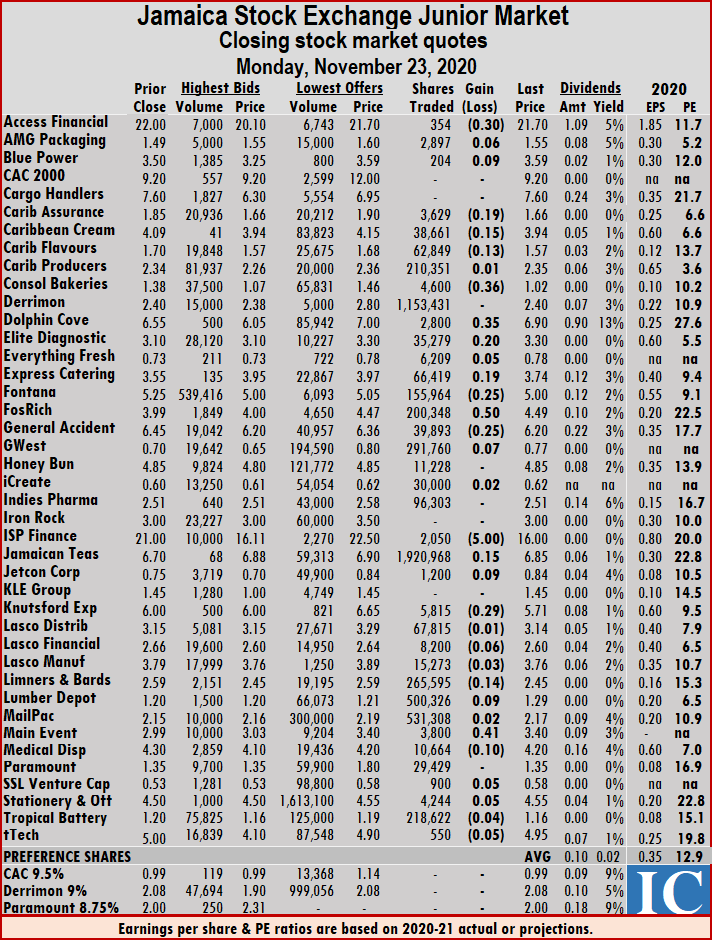

The Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four with lower offers. Fontana dropped 25 cents in an exchange of 155,964 shares to finish at $5, Fosrich jumped 50 cents to end at $4.49 with investors switching 200,348 stocks, General Accident fell 25 cents to $6.20, with 39,893 shares changing hands. GWest Corporation gained 7 cents, trading 291,760 units to close at 77 cents, iCreate gained 2 cents to finish at 62 cents with 30,000 stocks passing through the market, ISP Finance shed $5 to end at $16 with a transfer of 2,050 shares. Jamaican Teas traded 1,920,968 units and climbed 15 cents to $6.85, Jetcon Corporation increased by 9 cents to close at 84 cents with an exchange of 1,200 stocks, Knutsford Express dropped 29 cents to $5.71 with 5,815 shares changing hands. Lasco Distributors slipped 1 cent to $3.14 with 67,815 units traded, Lasco Financial lost 6 cents to end at $2.60 with 8,200 stock units passing through the market, Lasco Manufacturing declined 3 cents to $3.76 with investors switching ownership of 15,273 shares. Limners and Bards fell 14 cents to $2.45 with an exchange of 265,595 units, Lumber Depot gained 9 cents to finish at $1.29 with 500,326 stock units changing hands, Mailpac Group traded 531,308 shares and rose 2 cents to end at $2.17. Main Event advanced 41 cents to $3.40 with 3,800 units changing owners, Medical Disposables declined 10 cents to $4.20 with a transfer of 10,664 stock units, SSL Venture gained 5 cents to finish at 58 cents with an exchange of 900 shares. Stationery and Office Supplies increased by 5 cents to $4.55 with 4,244 stock units changing hands, Tropical Battery lost 4 cents to settle at $1.16 with investors switching ownership of 218,622 stocks and tTech dropped 5 cents to close at $4.95 with 550 shares changing hands.

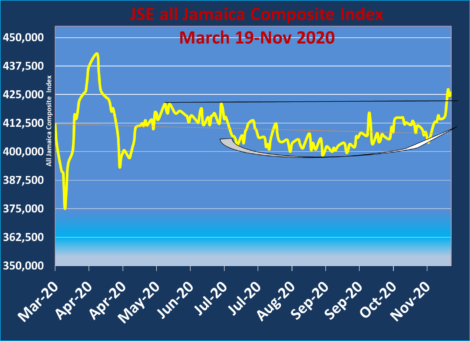

Fontana dropped 25 cents in an exchange of 155,964 shares to finish at $5, Fosrich jumped 50 cents to end at $4.49 with investors switching 200,348 stocks, General Accident fell 25 cents to $6.20, with 39,893 shares changing hands. GWest Corporation gained 7 cents, trading 291,760 units to close at 77 cents, iCreate gained 2 cents to finish at 62 cents with 30,000 stocks passing through the market, ISP Finance shed $5 to end at $16 with a transfer of 2,050 shares. Jamaican Teas traded 1,920,968 units and climbed 15 cents to $6.85, Jetcon Corporation increased by 9 cents to close at 84 cents with an exchange of 1,200 stocks, Knutsford Express dropped 29 cents to $5.71 with 5,815 shares changing hands. Lasco Distributors slipped 1 cent to $3.14 with 67,815 units traded, Lasco Financial lost 6 cents to end at $2.60 with 8,200 stock units passing through the market, Lasco Manufacturing declined 3 cents to $3.76 with investors switching ownership of 15,273 shares. Limners and Bards fell 14 cents to $2.45 with an exchange of 265,595 units, Lumber Depot gained 9 cents to finish at $1.29 with 500,326 stock units changing hands, Mailpac Group traded 531,308 shares and rose 2 cents to end at $2.17. Main Event advanced 41 cents to $3.40 with 3,800 units changing owners, Medical Disposables declined 10 cents to $4.20 with a transfer of 10,664 stock units, SSL Venture gained 5 cents to finish at 58 cents with an exchange of 900 shares. Stationery and Office Supplies increased by 5 cents to $4.55 with 4,244 stock units changing hands, Tropical Battery lost 4 cents to settle at $1.16 with investors switching ownership of 218,622 stocks and tTech dropped 5 cents to close at $4.95 with 550 shares changing hands. At the close, the All Jamaican Composite Index rose 204.81 points to 425,953.79, the Main Index advanced by 284.47 points to 388,747.9 and the JSE Financial Index gained 0.31 points to settle at 102.82.

At the close, the All Jamaican Composite Index rose 204.81 points to 425,953.79, the Main Index advanced by 284.47 points to 388,747.9 and the JSE Financial Index gained 0.31 points to settle at 102.82. Transjamaican Highway controlled a 12.7 percent market share with 3.54 million units and Sagicor Select Manufacturing & Distribution Fund accounted for 3.6 percent of the day’s trade in closing with one million units changing hands.

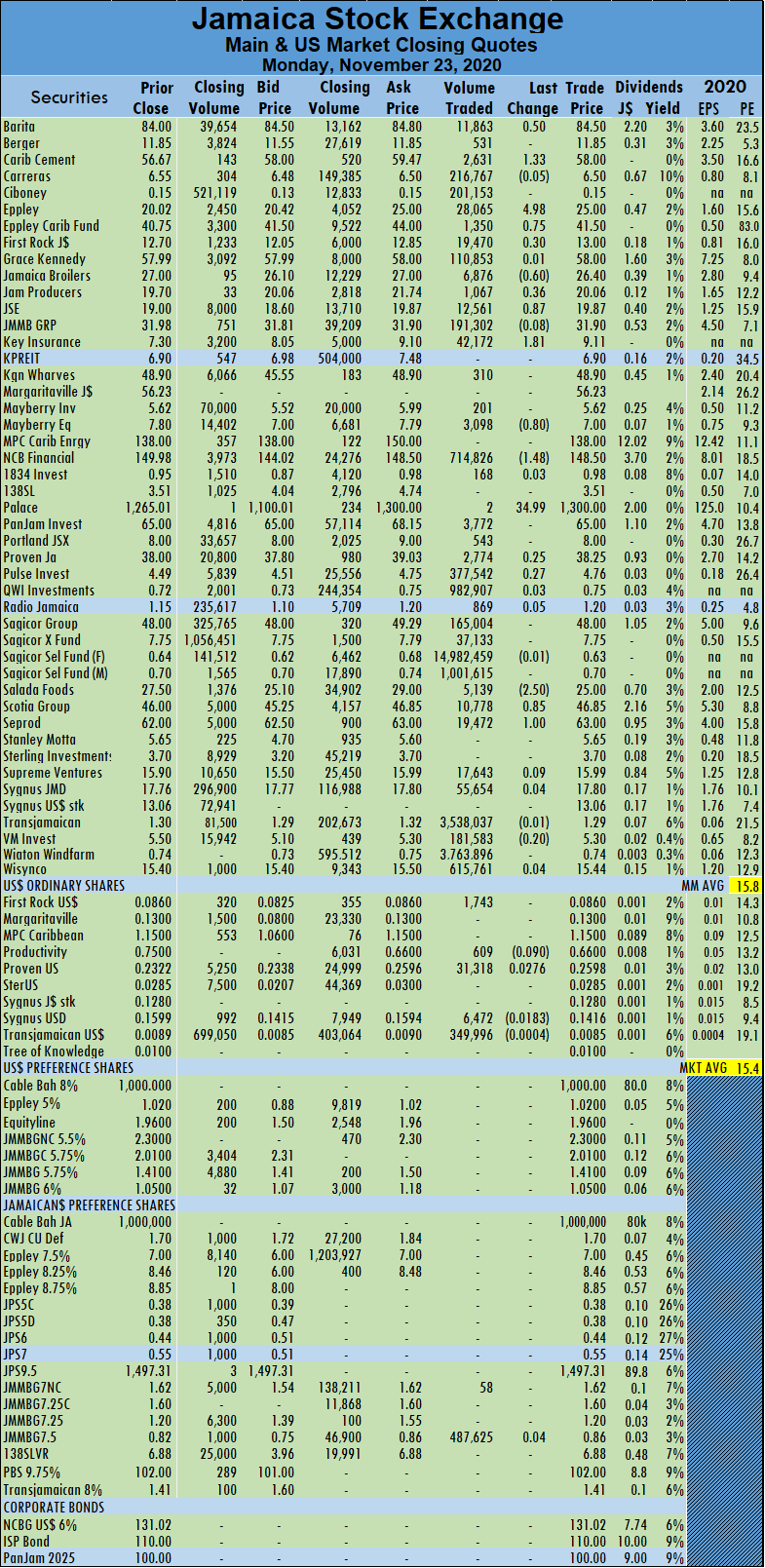

Transjamaican Highway controlled a 12.7 percent market share with 3.54 million units and Sagicor Select Manufacturing & Distribution Fund accounted for 3.6 percent of the day’s trade in closing with one million units changing hands. Mayberry Jamaican Equities shed 80 cents to settle at $7, after transferring 3,098 units, NCB Financial declined $1.48 to$148.50, in crossing the exchange with 714,826 shares, Palace Amusement climbed $34.99 to $1,300, with 2 units changing hands. Salada Foods fell $2.50 to $25, with 5,139 stock units crossing the market, Scotia Group rose 85 cents to end at $46.85, exchanging 10,778 shares and Seprod gained $1 to close at $63 trading 19,472 stock units.

Mayberry Jamaican Equities shed 80 cents to settle at $7, after transferring 3,098 units, NCB Financial declined $1.48 to$148.50, in crossing the exchange with 714,826 shares, Palace Amusement climbed $34.99 to $1,300, with 2 units changing hands. Salada Foods fell $2.50 to $25, with 5,139 stock units crossing the market, Scotia Group rose 85 cents to end at $46.85, exchanging 10,778 shares and Seprod gained $1 to close at $63 trading 19,472 stock units. Five securities changed hands on Monday compared to two on Friday and closed with the prices of one stock rising, three falling and one remained unchanged.

Five securities changed hands on Monday compared to two on Friday and closed with the prices of one stock rising, three falling and one remained unchanged. At the close of the market, First Rock Capital Investment remained at 8.6 US cents after exchanging 1,743 shares, Productive Business Solutions lost 9 US cents to close at 66 US cents, with 609 stock units trading, Proven Investments rose 2.76 US cents to 25.98 US cents after the trading of 31,318 units. Sygnus Credit Investments lost 1.83 US cents to settle at 14.16 US cents while exchanging 6,472 shares and Transjamaican Highway lost 0.04 of a cent and settled at 0.85 of a US cent after exchanging 349,996 units.

At the close of the market, First Rock Capital Investment remained at 8.6 US cents after exchanging 1,743 shares, Productive Business Solutions lost 9 US cents to close at 66 US cents, with 609 stock units trading, Proven Investments rose 2.76 US cents to 25.98 US cents after the trading of 31,318 units. Sygnus Credit Investments lost 1.83 US cents to settle at 14.16 US cents while exchanging 6,472 shares and Transjamaican Highway lost 0.04 of a cent and settled at 0.85 of a US cent after exchanging 349,996 units. Stocks rose to their highest level since mid-April on the Jamaican Stock Exchange Main Market in the past week, during the past week the Junior Market traded at the highest level in seven weeks, with moves in both markets confirming the bullish signal technical indicators been flashing for weeks.

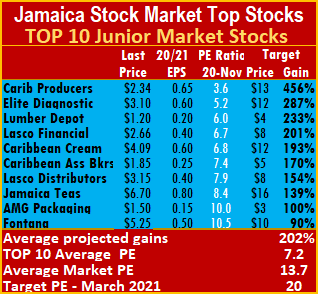

Stocks rose to their highest level since mid-April on the Jamaican Stock Exchange Main Market in the past week, during the past week the Junior Market traded at the highest level in seven weeks, with moves in both markets confirming the bullish signal technical indicators been flashing for weeks.

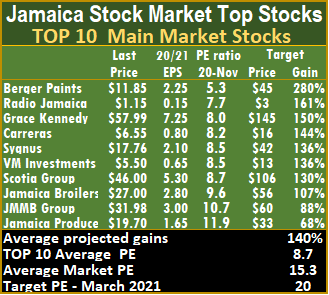

Eppley lost its Main Market TOP 10 position with the price moving up from $18.97 to $20.02 and is replaced by Jamaica Producers.

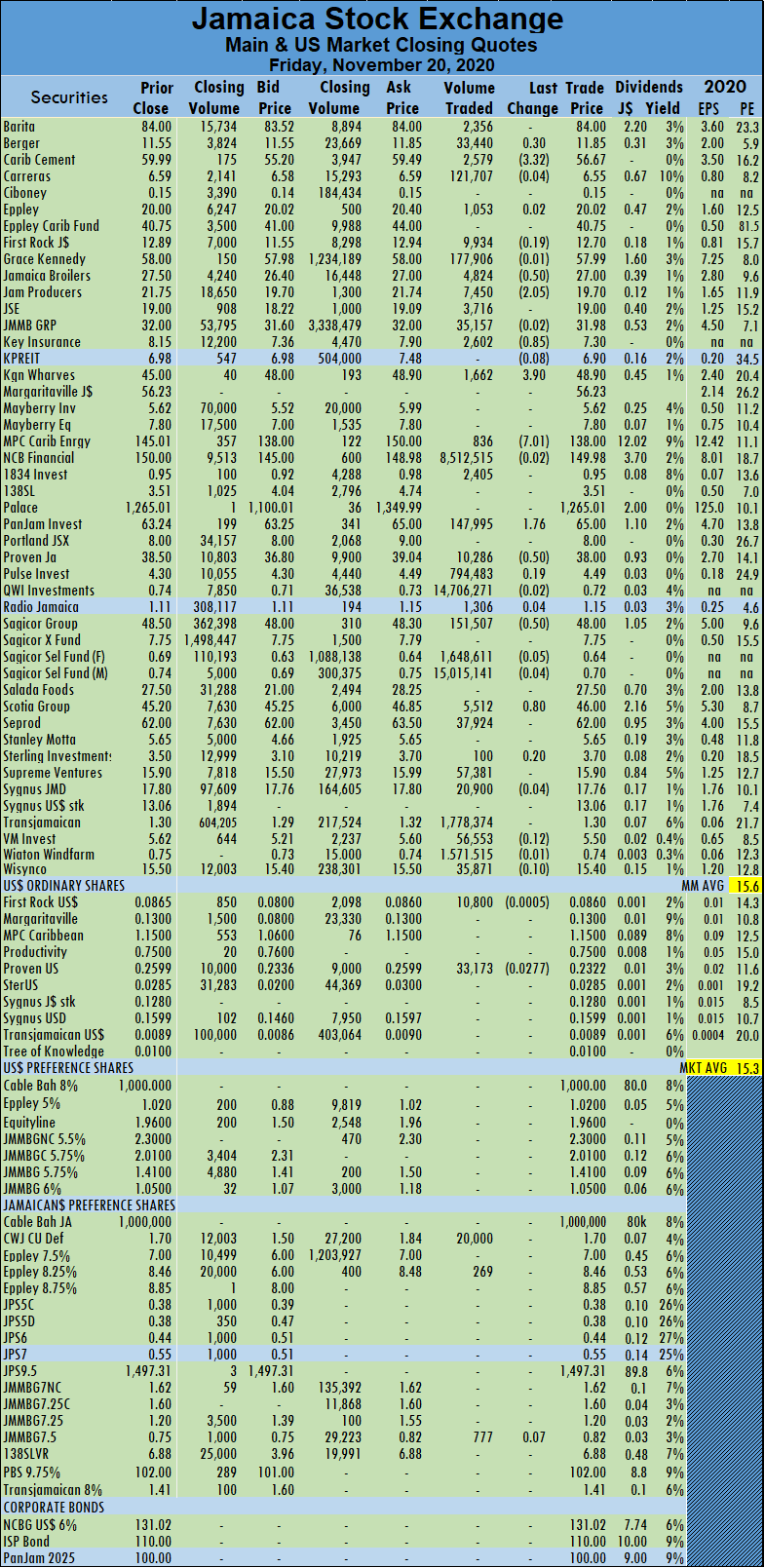

Eppley lost its Main Market TOP 10 position with the price moving up from $18.97 to $20.02 and is replaced by Jamaica Producers. The JSE Main Market ended the week, with an overall PE of 15.3 and the Junior Market 13.7, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 7.2 at just 53 percent to the average of the Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.7 or 57 percent of the PE of that market.

The JSE Main Market ended the week, with an overall PE of 15.3 and the Junior Market 13.7, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 7.2 at just 53 percent to the average of the Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.7 or 57 percent of the PE of that market.

Since the start of the year,

Since the start of the year,

Transjamaican Highway controlled 4 percent market share, with 1.78 million units Sagicor Select Financial Fund accounted for 3.7 percent with 1.65 million units and Wigton Windfarm controlled 3.5 percent of the market with 1.57 million units.

Transjamaican Highway controlled 4 percent market share, with 1.78 million units Sagicor Select Financial Fund accounted for 3.7 percent with 1.65 million units and Wigton Windfarm controlled 3.5 percent of the market with 1.57 million units. MPC Caribbean Clean Energy dropped $7.01 in closing at $138 trading 836 units, Pan Jam Investment closed at $65, with gains of $1.76, trading 147,995 shares, Proven Investments shed 50 cents in closing at $38, with 10,286 stock units changing hands. Sagicor Group finished at $48, after losing 50 cents exchanging 151,507 shares and Scotia Group rose 80 cents to settle at $46 trading 5,512 units.

MPC Caribbean Clean Energy dropped $7.01 in closing at $138 trading 836 units, Pan Jam Investment closed at $65, with gains of $1.76, trading 147,995 shares, Proven Investments shed 50 cents in closing at $38, with 10,286 stock units changing hands. Sagicor Group finished at $48, after losing 50 cents exchanging 151,507 shares and Scotia Group rose 80 cents to settle at $46 trading 5,512 units. At the close of the market, trading ended with two securities changing hands compared to six on Thursday and closed with the prices of two declining.

At the close of the market, trading ended with two securities changing hands compared to six on Thursday and closed with the prices of two declining. The Investor’s Choice bid-offer indicator reading for the market shows four stocks ending with bids higher than their last selling prices and none with lower offers.

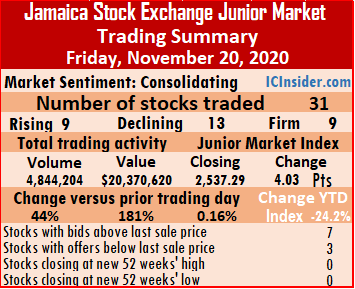

The Investor’s Choice bid-offer indicator reading for the market shows four stocks ending with bids higher than their last selling prices and none with lower offers. The Market Index gained 4.03 points to settle at 2,537.29 and the market closed with an average PE Ratio of 12.6 based on ICInsider.com’s forecast of 2020-21 earnings.

The Market Index gained 4.03 points to settle at 2,537.29 and the market closed with an average PE Ratio of 12.6 based on ICInsider.com’s forecast of 2020-21 earnings. The Investor’s Choice bid-offer indicator reading shows seven stocks ended with bids higher than their last selling prices and three with lower offers.

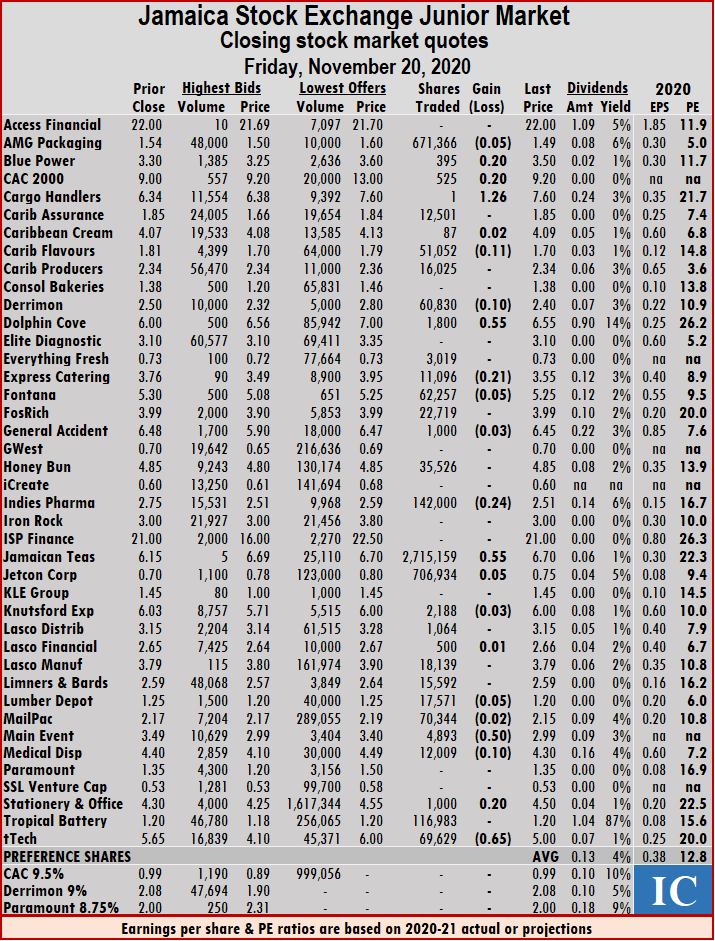

The Investor’s Choice bid-offer indicator reading shows seven stocks ended with bids higher than their last selling prices and three with lower offers. Jamaican Teas exchanged 2,715,159 units and advanced 55 cents to end at $6.70, Jetcon Corporation gained 5 cents trading 706,934 shares to finish at 75 cents, Knutsford Express slid 3 cents to $6 with 2,188 units passing through the market. Lasco Financial rose 1 cent to close at $2.66 with a transfer of 500 stock units, Lumber Depot declined by 5 cents to $1.20 with an exchange of 17,571 shares, Mailpac Group lost 2 cents to finish at $2.15 with 70,344 stock units changing hands. Main Event dropped 50 cents to $2.99 with 4,893 shares traded, Medical Disposables fell 10 cents to close at $4.30 with 12,009 shares passing through the market, Stationery and Office Supplies advanced 20 cents to end at $4.50, with the ownership of 1,000 shares switching and tTech shed 65 cents to finish at $5 with 69,629 units crossing the exchange.

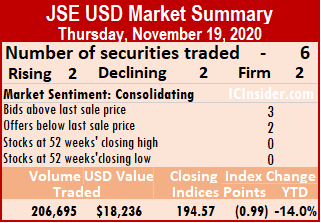

Jamaican Teas exchanged 2,715,159 units and advanced 55 cents to end at $6.70, Jetcon Corporation gained 5 cents trading 706,934 shares to finish at 75 cents, Knutsford Express slid 3 cents to $6 with 2,188 units passing through the market. Lasco Financial rose 1 cent to close at $2.66 with a transfer of 500 stock units, Lumber Depot declined by 5 cents to $1.20 with an exchange of 17,571 shares, Mailpac Group lost 2 cents to finish at $2.15 with 70,344 stock units changing hands. Main Event dropped 50 cents to $2.99 with 4,893 shares traded, Medical Disposables fell 10 cents to close at $4.30 with 12,009 shares passing through the market, Stationery and Office Supplies advanced 20 cents to end at $4.50, with the ownership of 1,000 shares switching and tTech shed 65 cents to finish at $5 with 69,629 units crossing the exchange. At the close of the market, six securities changed hands compared to four on Wednesday and closed with the prices of two stocks rising, two declining and two remaining unchanged.

At the close of the market, six securities changed hands compared to four on Wednesday and closed with the prices of two stocks rising, two declining and two remaining unchanged. At the close of the market, Margaritaville traded 100 shares at 13 US cents, MPC Caribbean Clean Energy settled at US$1.15, in exchanging 52 units. Proven Investments lost 0.09 of a cent and ended at 25.99 US cents trading 16,244 stocks, Sygnus Credit Investments shed 1.01 US cents to close at 15.99 US cents, with 90,118 units changing hands and Transjamaican Highway gained 0.04 of a cent to end at 0.89 of a US cent after exchanging 100,000 shares.

At the close of the market, Margaritaville traded 100 shares at 13 US cents, MPC Caribbean Clean Energy settled at US$1.15, in exchanging 52 units. Proven Investments lost 0.09 of a cent and ended at 25.99 US cents trading 16,244 stocks, Sygnus Credit Investments shed 1.01 US cents to close at 15.99 US cents, with 90,118 units changing hands and Transjamaican Highway gained 0.04 of a cent to end at 0.89 of a US cent after exchanging 100,000 shares.