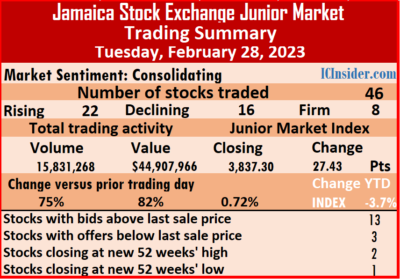

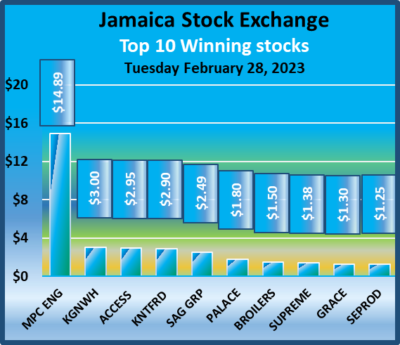

The Junior Market of the Jamaica Stock Exchange squeezed out a modest gain on Tuesday to close out the month after a 75 percent rise in the volume of stocks traded, with an 82 percent increase in value compared with Monday, after 46 securities changed hands, up from with 42 on Monday and ended with prices of 22 rising, 15 declining and nine trading unchanged.

A total of 15,831,268 shares were exchanged for $44,907,966 up from 9,033,630 units at $24,644,140 on Monday.

A total of 15,831,268 shares were exchanged for $44,907,966 up from 9,033,630 units at $24,644,140 on Monday.

Trading averaged 344,158 shares at $976,260 up from 215,086 units at $586,765 on Monday, with trading month to date averaging 318,024 units at $782,332 compared with 316,508 stock units at $771,083 on the previous day. Trading in January averaged 239,755 shares at $646,375.

JFP Ltd led trading with 3.02 million shares for 19.1 percent of total volume, followed by Fosrich with 2.13 million units for 13.4 percent of the day’s trade, Indies Pharma with 1.73 million units for 10.9 percent, Dolla Financial with 1.71 million units for 10.8 percent market share, Spur Tree Spices with 1.56 million units for 9.9 percent and Regency Petroleum with 1.39 million units for 8.8 percent market share.

At the close, the Junior Market Index gained 27.43 points to settle at 3,837.30.

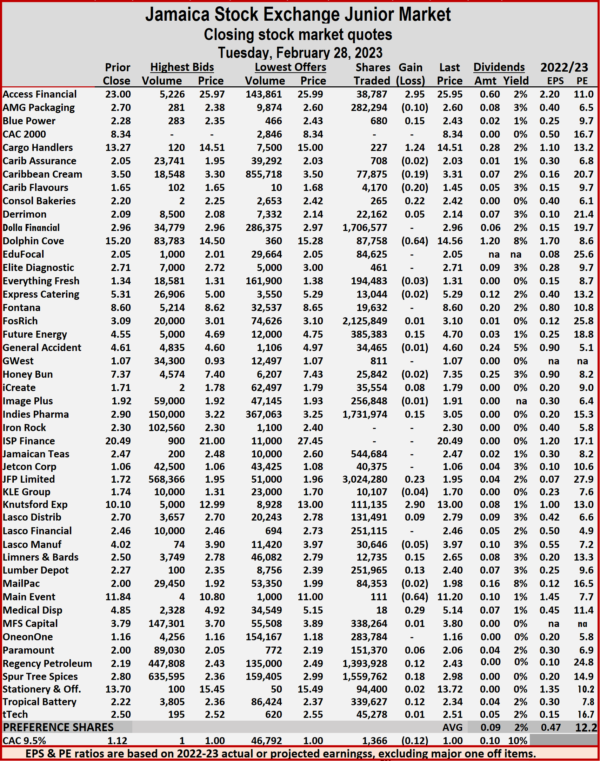

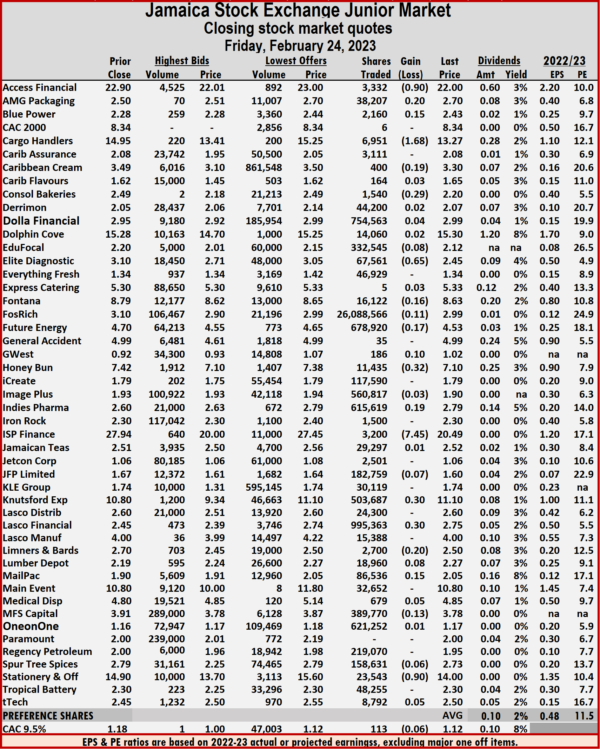

The PE Ratio, a measure of computing appropriate stock values, averages 12.2. PE ratios of Junior Market stocks are computed using the last traded price in conjunction with ICInsider.com’s projected earnings for the financial years ending between November 2022 and August 2023.

The PE Ratio, a measure of computing appropriate stock values, averages 12.2. PE ratios of Junior Market stocks are computed using the last traded price in conjunction with ICInsider.com’s projected earnings for the financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and 3 with lower offers.

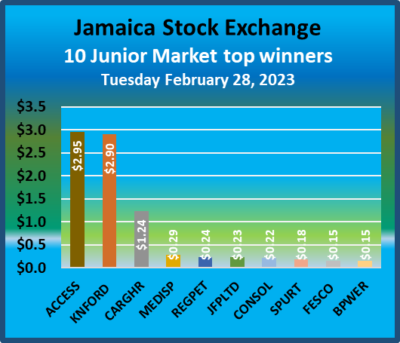

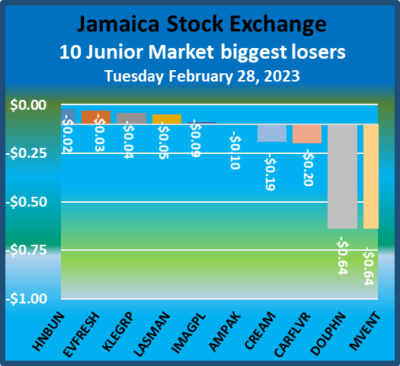

At the close, Access Financial climbed $2.95 to $25.95 after an exchange of 38,787 shares, AMG Packaging lost 10 cents ending at $2.60 after it traded at an intraday 52 weeks’ low of $2.25 and transferring 282,294 stock units, Blue Power gained 15 cents in closing at $2.43 with investors trading 680 units. Cargo Handlers advanced $1.24 to $14.51 with an exchange of 227 stocks, Caribbean Cream shed 19 cents to close at $3.31 after 77,875 stocks passed through the market, Caribbean Flavours dipped 20 cents to close at a 52 weeks’ low of $1.45 with 4,170 shares changing hands.  Consolidated Bakeries popped 22 cents in closing at $2.42 after a transfer of265 stock units, Dolphin Cove declined 64 cents to $14.56 as investors exchanged 87,758 units, Future Energy Source rallied 15 cents to end at $4.70 with the swapping of 385,383 units. iCreate gained 8 cents in ending at $1.79 after investors exchanged 35,554 stock units, Indies Pharma rose 15 cents to $3.05 in switching ownership of 1,731,974 shares, JFP Ltd gained 23 cents to close at $1.95 in trading 3,024,280 stocks. Knutsford Express advanced $2.90 to a 52 weeks’ high of $13 in an exchange of 111,135 shares, Lasco Distributors gained 9 cents to end at $2.79 with the swapping of 131,491 units, Limners and Bards popped 15 cents in closing at $2.65 with 12,735 stocks changing hands. Lumber Depot rose 13 cents ending at $2.40 with a transfer of 251,965 stock units, Main Event dipped 64 cents to $11.20 after exchanging 111 stock units, Medical Disposables popped 29 cents to finish at $5.14 after trading 18 stocks.

Consolidated Bakeries popped 22 cents in closing at $2.42 after a transfer of265 stock units, Dolphin Cove declined 64 cents to $14.56 as investors exchanged 87,758 units, Future Energy Source rallied 15 cents to end at $4.70 with the swapping of 385,383 units. iCreate gained 8 cents in ending at $1.79 after investors exchanged 35,554 stock units, Indies Pharma rose 15 cents to $3.05 in switching ownership of 1,731,974 shares, JFP Ltd gained 23 cents to close at $1.95 in trading 3,024,280 stocks. Knutsford Express advanced $2.90 to a 52 weeks’ high of $13 in an exchange of 111,135 shares, Lasco Distributors gained 9 cents to end at $2.79 with the swapping of 131,491 units, Limners and Bards popped 15 cents in closing at $2.65 with 12,735 stocks changing hands. Lumber Depot rose 13 cents ending at $2.40 with a transfer of 251,965 stock units, Main Event dipped 64 cents to $11.20 after exchanging 111 stock units, Medical Disposables popped 29 cents to finish at $5.14 after trading 18 stocks.  Regency Petroleum rallied 24 cents in closing at a record high of $2.43 with 1,393,928 shares crossing the exchange, Spur Tree Spices rose 18 cents to close at $2.98 in switching owners of 1,559,762 units and Tropical Battery gained 12 cents to end at $2.34 trading 339,627 stock units.

Regency Petroleum rallied 24 cents in closing at a record high of $2.43 with 1,393,928 shares crossing the exchange, Spur Tree Spices rose 18 cents to close at $2.98 in switching owners of 1,559,762 units and Tropical Battery gained 12 cents to end at $2.34 trading 339,627 stock units.

In the preference segment, CAC 2000 9.5% preference share lost 12 cents ending at $1 in exchanging 1,366 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on JSE USD Market

Only two securities were traded in the ordinary shares section of the Jamaica Stock Exchange US dollar market on Monday, leading to a 90 percent fall in the volume of stocks changing hands even as the value traded jumped 210 percent over that on Friday, resulting in the trading of seven securities, similar to Friday, with three rising, one declining and three unchanged.

A total of 32,455 shares were traded for US$13,457 compared with 318,483 units at US$4,336 on Friday.

A total of 32,455 shares were traded for US$13,457 compared with 318,483 units at US$4,336 on Friday.

Trading averaged 4,636 units at US$1,922 compared with 45,498 shares at US$619 on Friday, with a month to date average of 40,468 shares at US$2,015 compared with 42,593 units at US$2,021 on the previous trading day. January trading averaged 48,604 units for US$4,865.

The JSE USD Equities Index lost 0.92 points to end at 247.79.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and two with lower offers.

At the close, Sygnus Credit Investments USD share popped 0.4 cents to 10 US cents with an exchange of 170 shares and Transjamaican Highway dipped 0.04 of a cent in closing at 0.9 of one US cent in trading 26,571 stock units.

In the preference segment, Productive Business 9.25% preference share increased 10 cents to close at US$12.10, with 223 units crossing the market, Eppley 6% ended at US$1.15 with one stock unit changing hands, Equityline Mortgage Investment preference share remained at US$1.64 in switching ownership of one stock unit, JMMB Group 5.75% remained at US$2 after finishing with 5,000 shares trading and JMMB Group 6% rallied 0.03 of a cent in closing at US$1.07 as investors exchanged 489 stocks.

In the preference segment, Productive Business 9.25% preference share increased 10 cents to close at US$12.10, with 223 units crossing the market, Eppley 6% ended at US$1.15 with one stock unit changing hands, Equityline Mortgage Investment preference share remained at US$1.64 in switching ownership of one stock unit, JMMB Group 5.75% remained at US$2 after finishing with 5,000 shares trading and JMMB Group 6% rallied 0.03 of a cent in closing at US$1.07 as investors exchanged 489 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

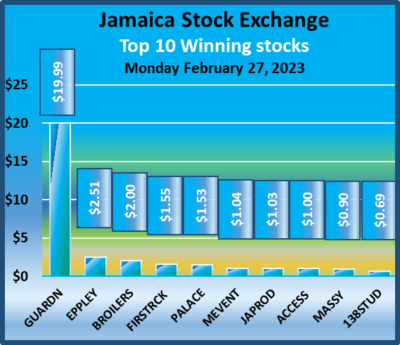

Main Market plunges as trading drops on Monday

The Junior Market of the Jamaica Stock Exchange inched higher at the close of trading on Monday but the Main Market dropped while JSE USD Market declined a tad, to start the week on a negative note as Palace Amusement traded with the issued number of shares now increased to 862 million units as it traded x-split at $5.94, to record a gain after the price maxed out for the day with a gain of 32 percent.

Trading levels dropped from that on Friday, with an exchange of just 14,950,243 shares in all three markets, down from 42,712,037 units on Friday, with a value of $100.26 million, well off from $322.7 million previously traded. Trading on the JSE USD market resulted in investors exchanging shares for US$13,457 compared to US$4,336 on Friday.

Trading levels dropped from that on Friday, with an exchange of just 14,950,243 shares in all three markets, down from 42,712,037 units on Friday, with a value of $100.26 million, well off from $322.7 million previously traded. Trading on the JSE USD market resulted in investors exchanging shares for US$13,457 compared to US$4,336 on Friday.

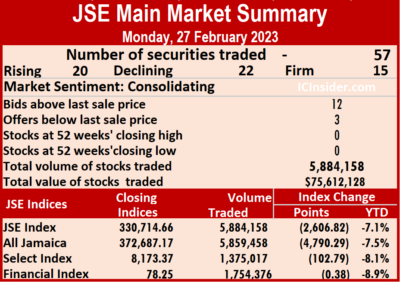

The JSE Combined Market Index fell 2,350.27 points to 343,477.95, the All Jamaican Composite Index dropped 4,790.29 points to 372,687.17, the JSE Main Index dropped 2,606.82 points to settle at 330,714.66, the Junior Market popped 8.41 points to 3,809.87 and the JSE USD Market Index slipped 0.92 points to end at 247.79.

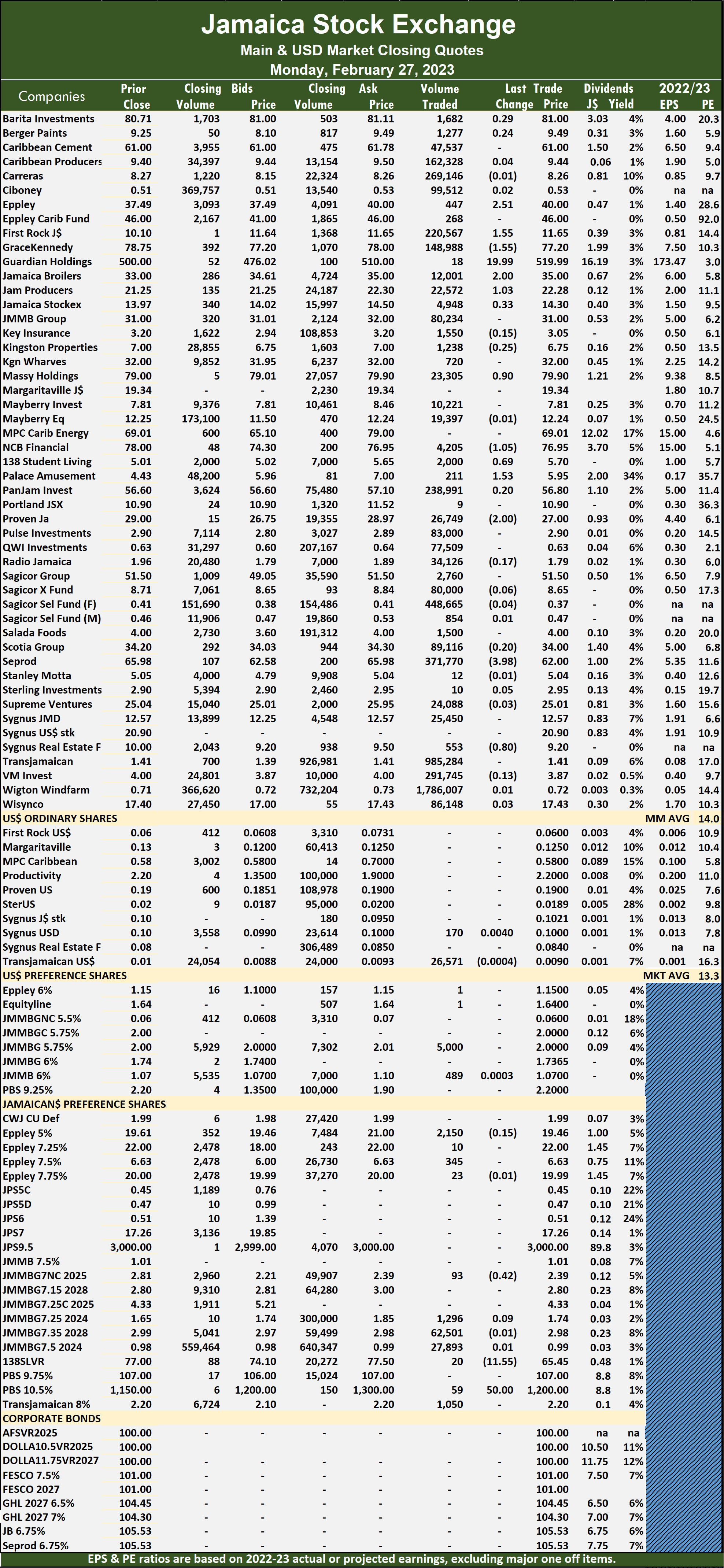

The market’s PE ratio ended at 19.6 based on 2021-22 earnings and 12.9 times those for 2022-23 at the close of trading.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors need pertinent information to successfully navigate many investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Q3 profit jumps 40% at Medical Disposables

Profit after tax for the nine months to December last year fell 10.7 percent to $68 million at Medical Disposables, compared with $76 million in 2021. For the quarter, it rose from $37 million to $38. Profit after tax attributable to the company’s shareholders ended 2022 with $58 million, down 10.7 percent from $65 million in the previous year. For the quarter, it climbed 40 percent to $28 million after minority interest compared with $20 million in 2021.

Improved profit margins played a pivotal role in the company’s fortunes in the December quarter, with gross profit margin increasing from 26.8 percent in 2021 to 29 percent in 2022, helping to propel it to the most profitable quarter for the nine months of operations in 2022. Gross Profit margin for the nine months in 2022 increased to 27.26 percent from 25.85 percent in 2021.

Improved profit margins played a pivotal role in the company’s fortunes in the December quarter, with gross profit margin increasing from 26.8 percent in 2021 to 29 percent in 2022, helping to propel it to the most profitable quarter for the nine months of operations in 2022. Gross Profit margin for the nine months in 2022 increased to 27.26 percent from 25.85 percent in 2021.

Gross profit hit $273 million from sales of $941 million, up from $250 million from sales of $930 million in the second quarter to June. Gross profit for the December quarter improved by 16.6 percent or $39 million compared to the 2021 third quarter.

Sales for the third quarter grew by $66 million or 7.5 percent over the third quarter in 2021, moving from $875 million in the 2021 December quarter, driven by increased demand for pharmaceutical and consumer items, the report stated.

Sales increased by 10.8 percent or $270 million for the nine months to December 2022, to $2.76 billion from $2.49 billion in 2021 and delivered a 16.9 percent improvement in gross profit of $108 million to $753 million from $645 million in 2021.

Selling and administrative cost dipped in the December quarter, compared with the September quarter, to $78 million versus $83 million, while selling and distribution cost rose just $2 million to $114 million. Finance cost spoiled the party, jumping to $31 million from $28.5 million and “was due mainly to an overall upward adjustment in financing, particularly working capital. The increased usage of the working capital lines of credit was deemed necessary to hold greater levels of inventory in an effort to mitigate against any additional supply chain risks that could lead to further out-of-stock instances,” management stated in their report accompanying the Financials.

Medical Disposables traded at a new all-time high of $10.

“Out of stock issues continue to affect the Group’s profitability as suppliers are faced with global supply chain challenges within their operations. The availability of key speciality products such as vaccines and oncology medicines has become infrequent and inconsistent. Our internal estimates have tracked over $100 million in lost sales due to the shortages,” the company stated. That would translate to close to $30 million more in pretax profit.

The operations generated cash inflows of $109 million for the nine months, but working capital needs consumed it all as inventory rose sharply.

At the end of December, inventories increased by $360 million to $1.53 billion, up from $1.17 billion in December 2021. Receivables declined to $603 million at the end of December 2022 from $708 million at the end of 2021. Cash and bank balances rose to $128 from $72 million at the end of 2021. Loans due to lenders amount to $1.14 billion, up from $965 million at the end of 2021 and is just a bit less than shareholders’ equity, that stood at $1.17 billion compared with $1.07 billion at the end of 2021.

The profit for the nine months resulted in earnings per share of 11 cents for the quarter and 22 cents for the nine months.

The company’s focus is on organic growth and expansion from acquisitions where possible, in furtherance of this goal, management is placing a great deal of emphasis on staff retention and recruiting talented personnel to enhance its pool of above average talents. The initial impact will be increased staff costs that will be above the increased revenues, but that will pay good dividends in future years.

ICInsider.com projects earnings of 45 cents for the year and $1 for the fiscal year ending March 2024. At the last traded price of $4.85, the stock trades at 11 times this year’s earnings and five times that of 2024, suggesting much upside potential for the stock price, with the market average PE ratio now around 13 and with several priced above 15 times earnings.

Elite out Tropical back in ICTOP10

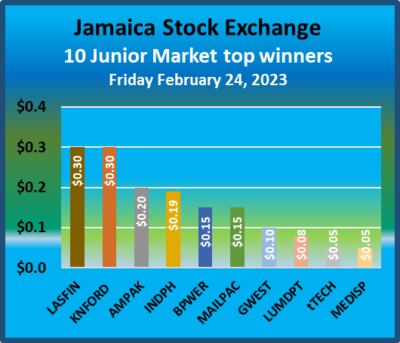

The Main Market of the Jamaica Stock Exchange closed the past week with gains in the indices. Still, the Junior Market suffered a significant loss on Friday to close the week with a loss following a sizable fall in the price of Fosrich. This most heavily weighted Junior Market stock fell from an average price of $3.20 at the previous week’s close down to $2.63.

ICTOP10 has only one new addition this week, in the Junior Market TOP10 and none in the Main Market, following major volatility in price movements in the listings.

ICTOP10 has only one new addition this week, in the Junior Market TOP10 and none in the Main Market, following major volatility in price movements in the listings.

In closing out the week, Iron Rock Insurance led stocks rising, with a gain of 13 percent to $2.30, followed by General Accident, that rose 6 percent to $4.99, while Main Event put on 4 percent to land at $10.80. Elite Diagnostic fell 21 percent to $2.45 as demand vanished for the stock following release of poor second quarter results. Paramount Trading fell 9 per cent to $2, Image Plus and Lasco Distributors dipped 5 percent to $1.90 and $2.60, respectively.

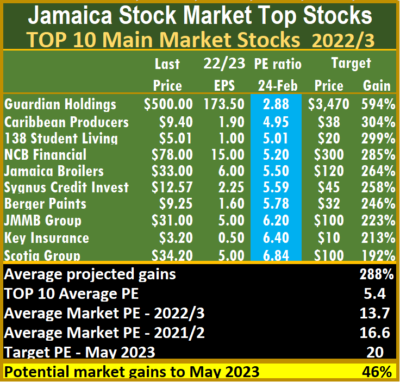

Five stocks rose in the Main MarketTOP10, with the price of Key Insurance rising 7 percent to $3.20, Sygnus Credit Investments rose 5 percent to $12.57, while 138 Student Living and Scotia Group popped 4 percent higher to $5.01 and $34.20, respectively. Berger Paints dropped 8 percent to $9.25, Caribbean Producers, Guardian Holdings and Jamaica Broilers lost 3 percent.

Earnings per share for Elite Diagnostic was revised down to 28 cents per share for the current year, following a small loss of $7 million in the December quarter, even as revenues rose a solid 20 percent or $30 million over the same quarter in 2021, resulting in the stock dropping out of the ICTOP10, to be replaced by Tropical Battery that is returning after a short absence.

Earnings per share for Elite Diagnostic was revised down to 28 cents per share for the current year, following a small loss of $7 million in the December quarter, even as revenues rose a solid 20 percent or $30 million over the same quarter in 2021, resulting in the stock dropping out of the ICTOP10, to be replaced by Tropical Battery that is returning after a short absence.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.4, well below the market average of 13.7, while the Junior Market Top 10 PE sits at 6.5 compared with the market at 11.6. The differences are important indicators of the level of the undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 213 percent and the Main Market TOP10 by an average of 288 percent to May this year, assuming the market gets back to last year’s valuation. The primary concern for the Main Market achieving such gains by May is that the list is dominated by financial companies that are out of favour and may need to get to the summer months before the full interest of investors is visible.

The Junior Market has 13 stocks representing 27 percent of the market, with PEs from 15 to 27 averaging 19 compared with the above average of the market. The top half of the market has an average PE of 17. The above average shows the extent of potential gains for the TOP 10 stocks.

The situation in the Main Market is similar, with the 17 highest valued stocks priced at a PE of 15 to 109, with an average of 32 and 23 excluding the highest valued stocks and 21 for the top half excluding the highest valued stocks.

The situation in the Main Market is similar, with the 17 highest valued stocks priced at a PE of 15 to 109, with an average of 32 and 23 excluding the highest valued stocks and 21 for the top half excluding the highest valued stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Trading levels dropped from that on Monday, in exchanging 32,208,706 shares in all three markets, compared to 14,950,243 units on Monday, with a value of $134.7 million, up from $100.26 million previously traded. Trading on the JSE USD market resulted in investors exchanging shares for US$14,037 compared to US$13,457 on Monday.

Trading levels dropped from that on Monday, in exchanging 32,208,706 shares in all three markets, compared to 14,950,243 units on Monday, with a value of $134.7 million, up from $100.26 million previously traded. Trading on the JSE USD market resulted in investors exchanging shares for US$14,037 compared to US$13,457 on Monday. Investors need pertinent information to successfully navigate investment options in stock markets. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors need pertinent information to successfully navigate investment options in stock markets. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making. The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers. A total of 5,884,158 shares were exchanged for $75,612,128, down from 9,589,463 units at $231,326,583 on Friday.

A total of 5,884,158 shares were exchanged for $75,612,128, down from 9,589,463 units at $231,326,583 on Friday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

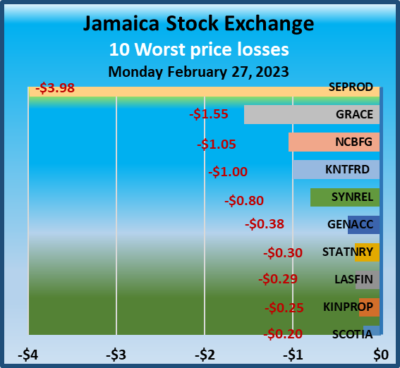

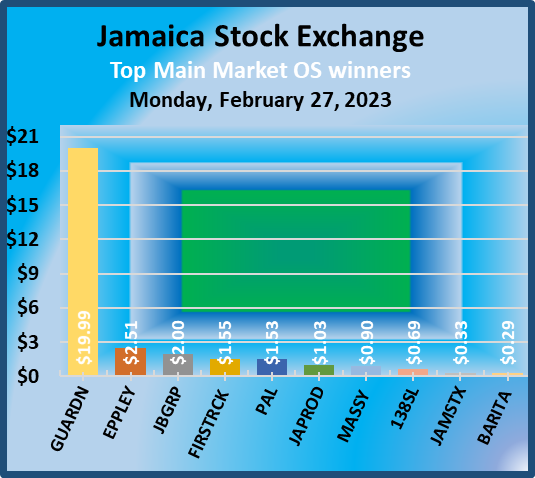

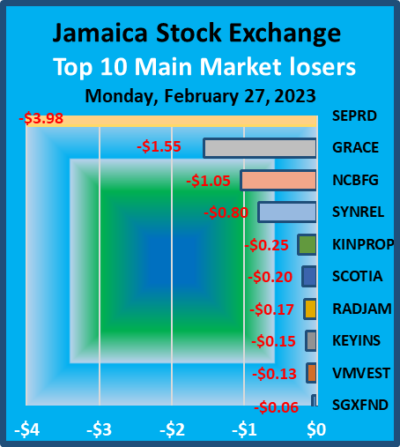

The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Massy Holdings gained 90 cents to settle at $79.90 in switching ownership of 23,305 units, NCB Financial shed $1.05 to end at $76.95 in trading 4,205 shares, 138 Student Living popped 69 cents to $5.70 after exchanging 2,000 stock units. Palace Amusement rose $1.45 to $5.95 after 211 stocks passed through the market, following the 600 to 1 stock split taking effect on the market, Proven Investments declined $2 to $27 after a transfer of 26,749 units, Seprod dipped $3.98 to close at $62 after swapping of 371,770 shares and Sygnus Real Estate Finance fell 80 cents to $9.20 after trading 553 stock units.

Massy Holdings gained 90 cents to settle at $79.90 in switching ownership of 23,305 units, NCB Financial shed $1.05 to end at $76.95 in trading 4,205 shares, 138 Student Living popped 69 cents to $5.70 after exchanging 2,000 stock units. Palace Amusement rose $1.45 to $5.95 after 211 stocks passed through the market, following the 600 to 1 stock split taking effect on the market, Proven Investments declined $2 to $27 after a transfer of 26,749 units, Seprod dipped $3.98 to close at $62 after swapping of 371,770 shares and Sygnus Real Estate Finance fell 80 cents to $9.20 after trading 553 stock units. in closing at $2.39 in switching ownership of 93 shares and 138 Student Living preference share declined $11.55 to $65.45with 20 stocks clearing the market.

in closing at $2.39 in switching ownership of 93 shares and 138 Student Living preference share declined $11.55 to $65.45with 20 stocks clearing the market. A total of 9,033,630 shares were traded for $24,644,140, down from 32,804,091 units at $91,381,630 on Friday.

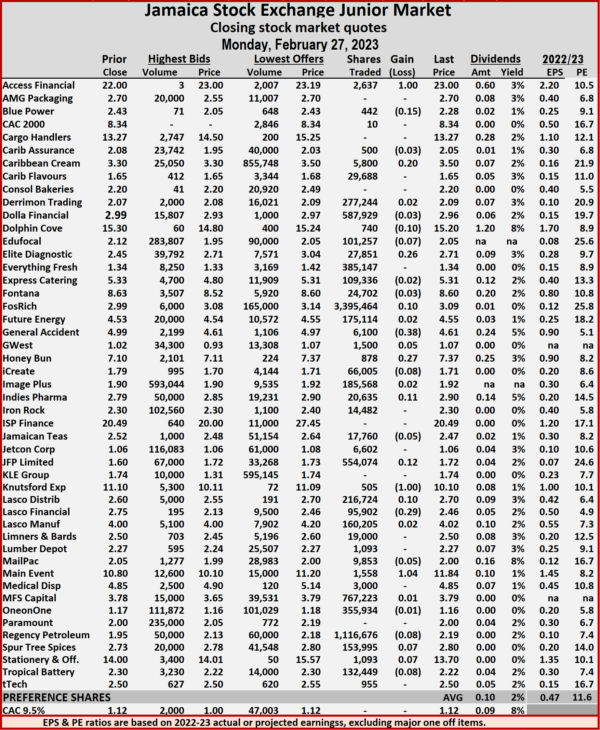

A total of 9,033,630 shares were traded for $24,644,140, down from 32,804,091 units at $91,381,630 on Friday. The PE Ratio, a measure used to compute appropriate stock values, averages 11.6. The PE ratios of Junior Market stocks are computed using the last traded stock price in conjunction with ICInsider.com’s projected earnings for the financial years ending between November 2022 and August 2023.

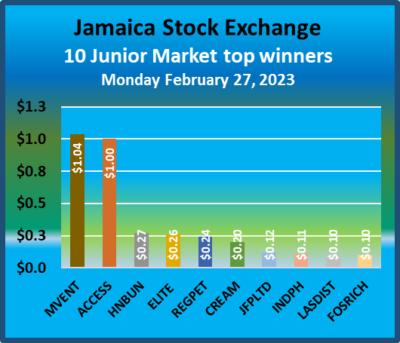

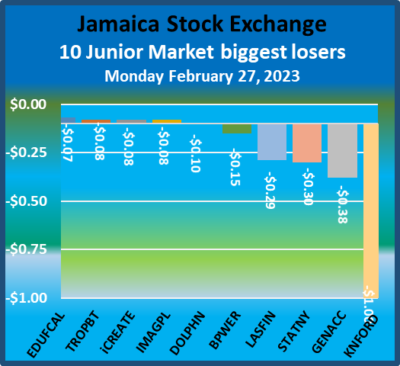

The PE Ratio, a measure used to compute appropriate stock values, averages 11.6. The PE ratios of Junior Market stocks are computed using the last traded stock price in conjunction with ICInsider.com’s projected earnings for the financial years ending between November 2022 and August 2023. Elite Diagnostic gained 26 cents to settle at $2.71 after 27,851 units passed through the market, Fosrich rose 10 cents to $3.09 as investors traded 3,395,464 stocks. General Accident shed 38 cents to end at $4.61 with a transfer of 6,100 shares, Honey Bun gained 27 cents to finish at $7.37 in exchanging 878 stock units, iCreate lost 8 cents to close at $1.71 in switching ownership of 66,005 stocks. Indies Pharma rallied 11 cents in closing at $2.90 with the swapping of 20,635 units, JFP Ltd gained 12 cents to close at $1.72 in an exchange of 554,074 stock units, Knutsford Express declined $1 to $10.10 in trading just 505 shares. Lasco Distributors popped 10 cents in ending at $2.70 with an exchange of 216,724 stock units, Lasco Financial lost 29 cents in closing at $2.46 with investors transferring 95,902 stocks, Main Event advanced $1.04 to $11.84 with 1,558 shares changing hands.

Elite Diagnostic gained 26 cents to settle at $2.71 after 27,851 units passed through the market, Fosrich rose 10 cents to $3.09 as investors traded 3,395,464 stocks. General Accident shed 38 cents to end at $4.61 with a transfer of 6,100 shares, Honey Bun gained 27 cents to finish at $7.37 in exchanging 878 stock units, iCreate lost 8 cents to close at $1.71 in switching ownership of 66,005 stocks. Indies Pharma rallied 11 cents in closing at $2.90 with the swapping of 20,635 units, JFP Ltd gained 12 cents to close at $1.72 in an exchange of 554,074 stock units, Knutsford Express declined $1 to $10.10 in trading just 505 shares. Lasco Distributors popped 10 cents in ending at $2.70 with an exchange of 216,724 stock units, Lasco Financial lost 29 cents in closing at $2.46 with investors transferring 95,902 stocks, Main Event advanced $1.04 to $11.84 with 1,558 shares changing hands.  Regency Petroleum gained 24 cents in ending at a record $2.19 after 1,116,676 units passed through the market, Stationery and Office Supplies dipped 30 cents to end at $13.70 in switching ownership of 1,093 stocks and Tropical Battery lost 8 cents in closing at $2.22 while trading 132,449 stock units.

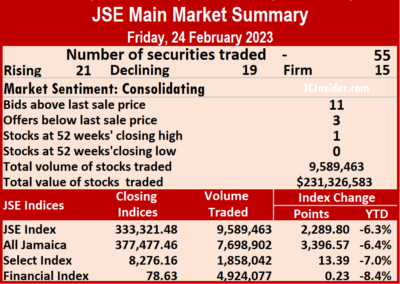

Regency Petroleum gained 24 cents in ending at a record $2.19 after 1,116,676 units passed through the market, Stationery and Office Supplies dipped 30 cents to end at $13.70 in switching ownership of 1,093 stocks and Tropical Battery lost 8 cents in closing at $2.22 while trading 132,449 stock units. A total of 9,589,463 shares were traded for $231,326,583 up from 6,903,600 units at $128,999,772 on Thursday.

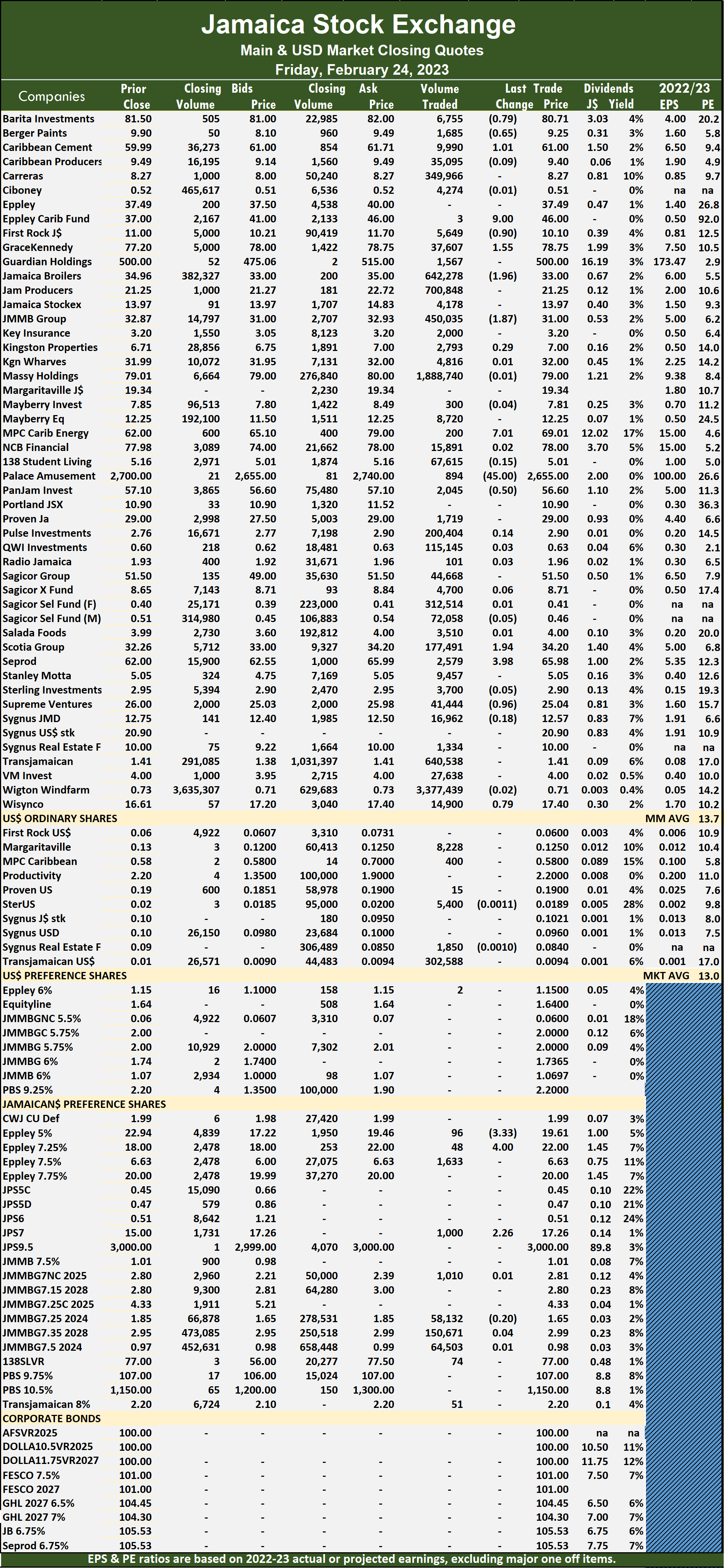

A total of 9,589,463 shares were traded for $231,326,583 up from 6,903,600 units at $128,999,772 on Thursday. The PE Ratio, a formula to ascertain appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

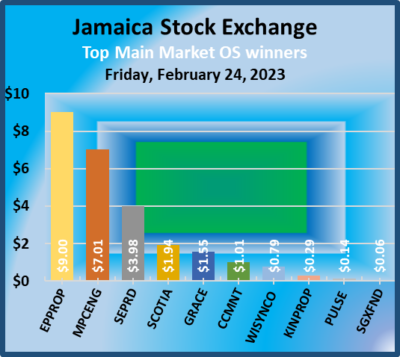

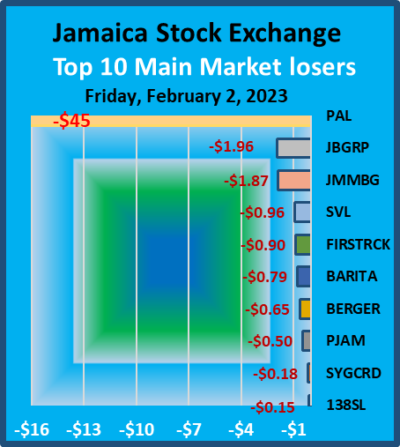

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. GraceKennedy rose $1.55 to $78.75 with a transfer of 37,607 shares. Jamaica Broilers declined $1.96 to close at $33 with investors trading 642,278 stocks, JMMB Group fell $1.87 in closing at $31 in an exchange of 450,035 units, MPC Caribbean Clean Energy rallied $7.01 to end at $69.01 with 200 stocks changing hands.

GraceKennedy rose $1.55 to $78.75 with a transfer of 37,607 shares. Jamaica Broilers declined $1.96 to close at $33 with investors trading 642,278 stocks, JMMB Group fell $1.87 in closing at $31 in an exchange of 450,035 units, MPC Caribbean Clean Energy rallied $7.01 to end at $69.01 with 200 stocks changing hands.  Supreme Ventures shed 96 cents to close at $25.04 in switching ownership of 41,444 units and Wisynco Group gained 79 cents to end at $17.40 as investors traded 14,900 stock units.

Supreme Ventures shed 96 cents to close at $25.04 in switching ownership of 41,444 units and Wisynco Group gained 79 cents to end at $17.40 as investors traded 14,900 stock units.

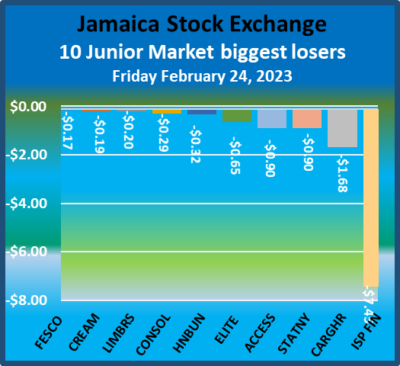

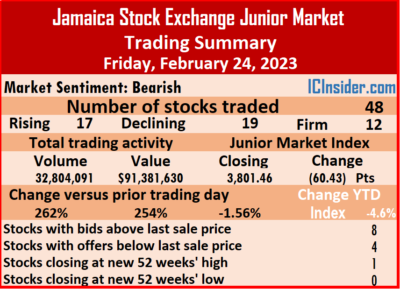

At the close, the Junior Market Index fell 60.43 points to 3,801.46.

At the close, the Junior Market Index fell 60.43 points to 3,801.46. Consolidated Bakeries dipped 29 cents to close at $2.20 after trading 1,540 stock units. EduFocal lost 8 cents to end at $2.12 with 332,545 units changing hands, Elite Diagnostic shed 65 cents to a 52 weeks’ low of $2.45 with investors swapping 67,561 shares, Fontana fell 16 cents to end at $8.63 with an exchange of 16,122 shares. Fosrich lost 11 cents in closing at $2.99 with the swapping of 26,088,566 stock units, with the price hitting an intraday 52 weeks’ low of $2.50, Future Energy Source dipped 17 cents to $4.53 with 678,920 units changing hands, GWest Corporation gained 10 cents in ending at $1.02 in transferring 186 stocks. Honey Bun declined 32 cents to end at $7.10 trading 11,435 units, Indies Pharma advanced 19 cents to $2.79 in switching ownership of 615,619 shares, ISP Finance dropped $7.45 to settle at $20.49 after an exchange of 3,200 stock units. Knutsford Express rose 30 cents to end at $11.10, with 503,687 stocks clearing the market, Lasco Financial gained 30 cents to close at $2.75 as investors exchanged 995,363 stock units,

Consolidated Bakeries dipped 29 cents to close at $2.20 after trading 1,540 stock units. EduFocal lost 8 cents to end at $2.12 with 332,545 units changing hands, Elite Diagnostic shed 65 cents to a 52 weeks’ low of $2.45 with investors swapping 67,561 shares, Fontana fell 16 cents to end at $8.63 with an exchange of 16,122 shares. Fosrich lost 11 cents in closing at $2.99 with the swapping of 26,088,566 stock units, with the price hitting an intraday 52 weeks’ low of $2.50, Future Energy Source dipped 17 cents to $4.53 with 678,920 units changing hands, GWest Corporation gained 10 cents in ending at $1.02 in transferring 186 stocks. Honey Bun declined 32 cents to end at $7.10 trading 11,435 units, Indies Pharma advanced 19 cents to $2.79 in switching ownership of 615,619 shares, ISP Finance dropped $7.45 to settle at $20.49 after an exchange of 3,200 stock units. Knutsford Express rose 30 cents to end at $11.10, with 503,687 stocks clearing the market, Lasco Financial gained 30 cents to close at $2.75 as investors exchanged 995,363 stock units,  Limners and Bards shed 20 cents in closing at $2.50 in an exchange of 2,700 shares. Lumber Depot popped 8 cents to end at $2.27 after a transfer of 18,960 stocks, Mailpac Group rallied 15 cents to $2.05 with the swapping of 86,536 units, MFS Capital Partners lost 13 cents to close at $3.78 trading 389,770 shares and Stationery and Office Supplies fell 90 cents to $14 after 23,543 units passed through the market.

Limners and Bards shed 20 cents in closing at $2.50 in an exchange of 2,700 shares. Lumber Depot popped 8 cents to end at $2.27 after a transfer of 18,960 stocks, Mailpac Group rallied 15 cents to $2.05 with the swapping of 86,536 units, MFS Capital Partners lost 13 cents to close at $3.78 trading 389,770 shares and Stationery and Office Supplies fell 90 cents to $14 after 23,543 units passed through the market.