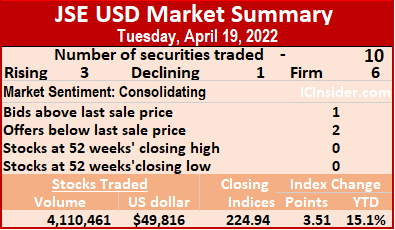

Trading on the Jamaica Stock Exchange US dollar market closed on Tuesday, with the volume of shares trading surging 2,380 percent over Thursday’s level with a 361 percent greater value, resulting in more stocks rising than falling.

A total of 10 securities traded, up from seven on Thursday, with three rising, one declining and six ending unchanged.

A total of 10 securities traded, up from seven on Thursday, with three rising, one declining and six ending unchanged.

The JSE US Denominated Equities Index gained 3.51 points to end at 224.94.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending to the end of August 2023.

A total of 4,110,461 shares were traded, for US$49,816 compared to 165,771 units at US$10,795 on Thursday.

Thursday. Trading averaged 411,046 units at US$4,982, compared to 23,682 shares at US$1,542 on Thursday, with month to date average of 138,341 shares at US$5,403 versus 101,489 units at US$5,460 on the previous day. March ended with an average of 59,258 units for US$6,669.

Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than the last selling price and two with lower offers.

At the close, First Rock Capital USD share finished at 7.95 US cents after trading 387 shares, Margaritaville ended unchanged at 16 US cents after exchanging 2,022 stock units, MPC Caribbean Clean Energy remained at US$1.26 after trading just one unit.  Productive Business Solutions ended at US$1.19 in an exchange of two units, Proven Investments fell 0.01 of a cent in closing at 24.99 US cents after exchanging 6,944 stock units, Sterling Investments rallied 0.24 of a cent to 2.24 US cents in clearing the market with 7,830 stocks. Sygnus Credit Investments USD share gained 0.44 of one cent in closing at 12.89 US cents with 16,836 shares changing hands, Sygnus Real Estate Finance USD share remained at 14.7 US cents with an exchange of 182 units and Transjamaican Highway rose 0.13 of a cent to close at 1.11 US cents with the swapping of 4,075,625 shares.

Productive Business Solutions ended at US$1.19 in an exchange of two units, Proven Investments fell 0.01 of a cent in closing at 24.99 US cents after exchanging 6,944 stock units, Sterling Investments rallied 0.24 of a cent to 2.24 US cents in clearing the market with 7,830 stocks. Sygnus Credit Investments USD share gained 0.44 of one cent in closing at 12.89 US cents with 16,836 shares changing hands, Sygnus Real Estate Finance USD share remained at 14.7 US cents with an exchange of 182 units and Transjamaican Highway rose 0.13 of a cent to close at 1.11 US cents with the swapping of 4,075,625 shares.

In the preference segment, JMMB Group 6% finished at US$1.1385 in trading 632 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big jump in JSE USD market trade

Trading drops on the TTSE

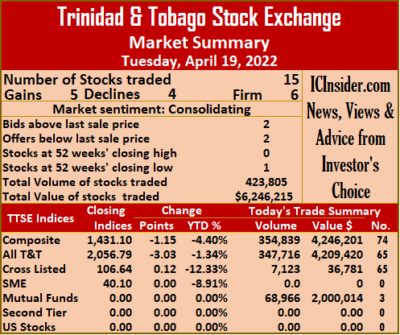

After closing for the long Easter holiday, market activity resumed on Tuesday and resulted in slightly more stocks rising than falling at the close of trading, after the volume and value of shares trading declined by 42 percent and 72 percent, respectively, below Thursday’s trade on the Trinidad and Tobago Stock Exchange.

Just 15 securities traded compared to 23 on Thursday, with five stocks rising, four declining, and six remaining unchanged, leaving the Composite Index in slipping 1.15 points to 1,431.10. The All T&T Index fell 3.03 points 2,056.79 and the Cross-Listed Index popped 0.12 points to settle at 106.64.

Just 15 securities traded compared to 23 on Thursday, with five stocks rising, four declining, and six remaining unchanged, leaving the Composite Index in slipping 1.15 points to 1,431.10. The All T&T Index fell 3.03 points 2,056.79 and the Cross-Listed Index popped 0.12 points to settle at 106.64.

A total of 423,805 shares traded for $6,246,215 down from 727,597 units at $22,712,917 on Thursday.

An average of 28,254 units traded at $416,414 compared to 31,635 shares at $987,518 on Thursday, with trading month to date averaging 48,355 units at $497,221 versus 49,804 units at $503,048. The average trade for March amounts to 36,197 units at $438,630.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and two stocks with lower offers.

At the close, Clico Investment Fund advanced 19 cents to end at $29 in switching ownership of 68,966 shares, First Citizens Group ended unchanged at $52 while exchanging 2,913 units, FirstCaribbean International Bank popped 6 cents to close at $5.86 after trading 5,300 stocks. GraceKennedy shed 9 cents in ending at $6, with an exchange of 350 stock units, Guardian Holdings declined $1.01 in closing at $26 in finishing trading of 148 stocks, JMMB Group finished at $2.43 in trading 1,463 shares.  Massy Holdings rallied 10 cents to $5.10 with an exchange of 156,651 units, National Enterprises remained at $3, with 6,000 stock units changing hands, National Flour Mills finished at $1.60 after 41,957 shares crossed the market. NCB Financial Group rose 2 cents to close at $6.12 after trading 10 units, Prestige Holdings fell 5 cents in closing at $7.05 in exchanging 2,964 stocks, Scotiabank remained at $80, with 3,000 stock units clearing the market. Trinidad & Tobago NGL added 1 cent to close at $20.61 in exchanging 11,408 stocks, Unilever Caribbean ended unchanged at $16 after 33,763 units crossed the market and West Indian Tobacco dipped 4 cents to a 52 weeks’ low of $23.95 with the swapping of 88,912 stock units.

Massy Holdings rallied 10 cents to $5.10 with an exchange of 156,651 units, National Enterprises remained at $3, with 6,000 stock units changing hands, National Flour Mills finished at $1.60 after 41,957 shares crossed the market. NCB Financial Group rose 2 cents to close at $6.12 after trading 10 units, Prestige Holdings fell 5 cents in closing at $7.05 in exchanging 2,964 stocks, Scotiabank remained at $80, with 3,000 stock units clearing the market. Trinidad & Tobago NGL added 1 cent to close at $20.61 in exchanging 11,408 stocks, Unilever Caribbean ended unchanged at $16 after 33,763 units crossed the market and West Indian Tobacco dipped 4 cents to a 52 weeks’ low of $23.95 with the swapping of 88,912 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Profit surges 156% at AMG Packaging

Profit at AMG Packaging surged 156 percent in the February quarter, to $18 million after tax from $7 million in 2021, even after suffering a loss on foreign exchange of $4 million versus a $4 million gain in the prior period. For the six months to February, profit jumped 150 percent to $53 million from $21 million in 2021.

The increase in profit follows moderate growth for 2021 over the previous year when the company posted $61 million after tax compared to $56 million in 2020.

The increase in profit follows moderate growth for 2021 over the previous year when the company posted $61 million after tax compared to $56 million in 2020.

Sale revenues rose 32 percent for the quarter, to $217 million from $165 million in 2021 and jumped 44 percent for the six months, to $487 million from $338 million in 2021.

The cost for inventories used in production increased slightly less than growth in revenues, with a rise of 30.5 percent in the latest quarter to $117 million compared to 2021, million ut cots rose faster than six months sales, after increasing 48.5 percent for the half year to $273 million. Direct costs rose well below the increase in revenues for both the quarter and six months, up just 10 percent to $38.7 million and 27 percent to $79 million for the six months.

Gross profit margin in the February quarter remained at 28 percent, similar to the 2021 half year and rose to 28.3 percent in the latest quarter from 24 percent for the 2021 quarter. Operating profit rose just 52.5 percent in the quarter to $61 million from $40 million and spiked 41 percent for the year to date, to $135 million from $93 million in 2021.

Administrative expenses rose 6 percent to $24 million in the quarter and 7 percent in the six months to $46 million. Depreciation increased to $7.6 million in the quarter from $6 in 2021 and $13.7 million for the six months from $12.3 million in 2021. The increased charge in the second quarter results from the addition to the factory and equipment for box production. The company will enjoy reduced production costs due to the new equipment that will replace an older machine. Finance costs declined in the quarter to $1.7 million, from $2 million in 2021 and $4.2 million to $3.6 million for the six months.

Taxation on profit moved from $919,135 in the February 2021 second quarter to $3.2 million in 2022 and for the half year, it jumped from $3 million to $13.5 million.

New addition to the AMG factory

Gross cash flow brought in $85 million. Increased working capital saw the amount falling to $52 million. Funds were reduced to $12 million after adding $26 million in fixed assets and loan payment of $10 million, thus pushing cash and equivalent on hand of $131 million at the start of the year, falling to $143 million at the end of February.

At the end of February, shareholders’ equity stood at $661 million, with long term borrowings at $99 million and short term at $13.5 million. Current assets ended the period at $509 million, including Inventories of $207 million, trade and other receivables of $150 million, and cash and bank balances of $143 million. Current liabilities ended the period at $188 million and resulted in net current assets ending at $321 million.

Earnings per share came out at 3 cents for the quarter and 10 cents for the year to date. IC Insider.com forecasts 35 cents per share for the fiscal year ending August 2022 and a 60 cents per share projection for 2023. The PE stands at 11 times the current year’s earnings and 6 times 2023 earnings based on the price of $3.70, the stock last traded on the Jamaica Stock Exchange Junior Market.

Knutsford Express revenues & profit nearing normal

Knutsford Express, the Montego Bay based cross country luxury transport, is set to deliver increased revenues and profit for the fiscal year to May, compared to 2021, but the results will be far from normal levels, nine months’ results to February show.

Revenues and profit for the third quarter reveal that things are not far from normal, following the economic fallout in 2020 from the impact of the covid-19 virus. Revenues for the nine months rose 70 percent to $775 million from $456 million in 2021 and delivered a profit of $52 million, a big turnaround from a loss of $55 million in 2021, but the third quarter numbers saw revenues jumping 63 percent to $301 million from $185 million same the similar quarter in 2021 with a profit of $37 million compared to a slight loss of $1 million.

Knutsford Express

Revenues in the latest quarter are just 5 percent below the $318 million generated in the February 2020 quarter when the company reported a profit of $40 million before tax and for the nine months with revenues then, of $925 million or 20 percent higher than the current period, with a profit of $113 million before tax.

Administrative and other operating costs rose 39 percent from $515 million in the nine months to February 2021 to $716 million in 2022, with the third quarter ending with $258 million, up 38 percent versus $187 million in 2021. Depreciation rose from $87 million for the nine months in 2021 to $107 million in 2022. Finance cost amounts to $7 million in the 2022 latest quarter against $4 million in 2021 and year to date $17 million, compared to $11.4 million in 2021.

Gross cash flow brought in $190 million, a $144 million addition to fixed assets offset by loan inflows of $50 million, increased payables and dividends paid of $40 million, resulting in cash on hand at the beginning of the period of $132 million falling by $36 million.

At the end of February, shareholders’ equity stood at $845 million, with long term borrowings at $223 million and short term debt at $21 million. Current assets ended the period at $357 million, including trade and other assets of $103 million, cash and equivalent of $236 million. Current liabilities amount to $94 million at the close of the period and net current assets of $263 million.

Earnings per share for the quarter was 8 cents and 9 cents for the nine months. ICInsider.com projections suggest earnings per share for the fiscal year to May at 20 cents and 2023 at 50 cents.

The February quarter results fall in a period when tourism flows to the country were down around a third compared with the 2020 period, suggesting a better period ahead for traffic as the company benefitted from patronage from visitors coming into the island. Accordingly, the coming fiscal year should see the company’s revenues and profit bouncing sharply over that of the current fiscal year.

The stock last traded on the Junior Market of the Jamaica Stock Exchange at $7.99, with a PE of 40 versus the market average of 24, the PE falls to 16 versus 13 for the market.

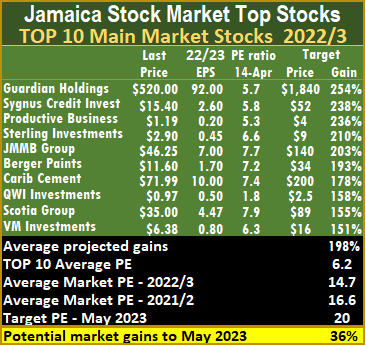

ICTOP10 stocks score big gains

The action in the ICTOP10 listing the holiday shortened week shifted from Main Market stocks to the Junior Market, with four stocks putting in double digit increases, led by Elite Diagnostic, last week’s 14 percent decliner to rally this week by a stunning 43 percent to close at $3.67 after hitting a high in the past week of $4.23.

But Elite is not the only Junior Market stock posting solid gains. Jetcon rose 18 percent to close at $1.30, against a background of one or more investors seeking to buy a sizable number of shares. AMG Packaging and Caribbean Assurance Brokers climbed 16 percent while tTech added 7 percent to close the week at $4. Price movements in Main Market were more subdued than in the Junior Market, with JMMB Group the biggest mover dropping 11 percent from $51.89 to $46.25, followed by Guardian Holdings with a fall of 4 percent.

But Elite is not the only Junior Market stock posting solid gains. Jetcon rose 18 percent to close at $1.30, against a background of one or more investors seeking to buy a sizable number of shares. AMG Packaging and Caribbean Assurance Brokers climbed 16 percent while tTech added 7 percent to close the week at $4. Price movements in Main Market were more subdued than in the Junior Market, with JMMB Group the biggest mover dropping 11 percent from $51.89 to $46.25, followed by Guardian Holdings with a fall of 4 percent.

General Accident returned to the Junior Market TOP10 as tTech dropped out and VM Investments returns to the Top10 Main Market as Jamaica Stock Exchange fell out.

General Accident returned to the Junior Market TOP10 as tTech dropped out and VM Investments returns to the Top10 Main Market as Jamaica Stock Exchange fell out.

The average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 14.7, while the Junior Market PE for the Top 10 is at 5.9 versus the market at 13.2. The Junior Market TOP10 is projected to gain an average of 289 percent to May 2023 and the Main Market 192 percent.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Rate hike pushes earnings higher at Scotia

If there was much competition in the banking sector in Jamaica, Scotia Group would be on its way out of business, unless they mended the poor service there are currently dishing out to customers.

Scotia Group stock could deliver handsomely in 2022.

The banking arm is delivering some atrocious customer service of late such as bouncing cheques for no funds when such accounts were adequately funded. Customers can’t get the use of the transfer of funds feature, for the credit cards are expired but no one within the bank advises of the expiration and the availability of the new card. Even when communication is made, with the bank, months pass without action. What about tokens that don’t work, leading to a nightmare trying to get the problem resolved. The service has rotted recently and they need to do something about it fast.

Though the service has gotten lousy of late and some may say it never was good, investors may find positives that they can profit from, at least that is what the group’s first quarter results to January this year show, thanks partly to the action by the country’s central bank. Most investors would not come to that conclusion from the net profit for the quarter compared to that in 2021, for while the 2021 quarterly profit came in at $1.75 billion, the latest results were only up marginally by $34 million to $1.784 billion. On the surface, there is nothing to get excited about, but closer examination tells a different story.

The results were vastly better than the $1.12 billion reported for the October quarter which suffered from a big drop in revenues. Loans fell in the quarter from $208 billion at the end of October to $201 billion at the end of January while investable funds grew to $339 billion from $321 billion at the end of October but net interest income climbed to $6.16 billion from $5.7 billion in the October quarter coming from a rise in gross interest income of $454 million quarter over quarter. Interest cost was static at $452 million. There was a strong improvement in net fee and commission income that rose from $1.1 billion in the October quarter to $1.5 billion but was a bit lower than the $1.67 billion in the January 2021 period, other revenues dropped from $973 million to $295 million in the latest quarter compared to January 2021.

Net interest income increase “was primarily attributable to an increase in interest earned on the investment portfolio and improved retail loan performance,” Scotia Group reported in their release of the quarterly results.

Audrey Tugwell Henry Scotia group’s CEO

Since the end of January, the Bank of Jamaica hiked the overnight rate to 4.50 percent from 2.5 percent, this move will drive an increase in net interest income for the group as the cost of funds will remain fairly flat while investments income balloons.

Expected credit losses on loans rose from $430 million in 2021 to $569 million in the January quarter this year but show an improvement over the $819 million in the October quarter. Net interest income after credit losses rose to $5.6 billion from $5.4 billion in 2021. Net fees and other income fell from $5.44 billion in the January 2021 quarter to $4.78 billion in 2022, resulting in a total net income of $10.37 billion, down from $10.8 billion in 2021.

Lower costs helped with the 2022 results, with expenses falling to $6 billion from $6.5 billion, net of asset tax of $1.36 billion in 2022 versus $1.26 billion in 2021, Other operating costs fell by $500 million from January 2021 to $2.8 billion in 2022.

Other comprehensive income shows an unrealized loss of $1 billion on investments compared to just $123 million in the 2021 first quarter.

Segment results provide another view of developments within the group that could point to the way forward. The Treasury segment delivered 22.4 percent more revenues from third parties to hit $763 million with a profit before tax of $138 million up from $120 in 2021. The retail division suffered a decline of 15 percent, with revenues from third parties hitting $4.57 billion from $5.38 billion in 2021 resulting in profit before tax of $103 million, down sharply from $492 million in 2021. Corporate and Commercial Banking pulled in net income of $2.7 billion, down from $2.8 billion, with profit surging to $1.44 billion versus $967 million in 2021. Investment Management pulled in $822 million in revenues with a profit of $404 million, from revenues of $878 million in 2021 with a profit of $718 million. The insurance division raked in $1.33 billion in revenues up from $984 million, with profit jumping to $857 million from $567 million. The segment classified as Other, generated revenues of $217 million and a profit of $175 million and delivered revenues of just $83 million and a profit of $30 million in 2022.

The Group’s assets grew by $38 billion or 6.9 percent to $591 billion at January 2022. This was predominantly, a result of the growth in cash resources of $42 billion or 32.4 percent due to increased deposits and places the group in a good position to expand the loan portfolio when demands pick up, with the resurgence now taking place in the wider economy.

A dividend of 35 cents per stock unit in respect of the first quarter, was approved for payment on April 20 to stockholders on record as of March 29.

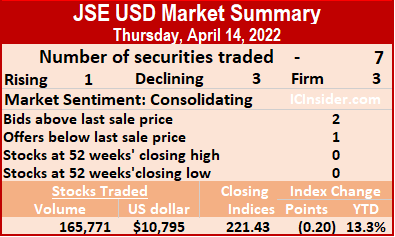

Trading drops on JSE USD market

Trading on Thursday ended with the volume and the value of stocks changing hands declining 28 percent and 80 percent, respectively, at the close of the Jamaica Stock Exchange US dollar market, compared to Wednesday and resulted in an even number of stocks rising than falling.

Seven securities were traded versus six on Wednesday, with one rising, three declining and three ending unchanged. The JSE US Denominated Equities Index lost 0.20 points to end at 221.43.

Seven securities were traded versus six on Wednesday, with one rising, three declining and three ending unchanged. The JSE US Denominated Equities Index lost 0.20 points to end at 221.43.

The PE ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio incorporates ICInsider.com earnings forecasts for companies with financial year ending up to August 2023.

Overall, 165,771 shares traded for US$10,795 down from 230,992 units at US$54,610 on Wednesday. Trading averaged 23,682 units at US$1,542, compared to 38,499 shares at US$9,102 on Wednesday, with the month to date averaging 101,489 shares at US$5,460 versus 109,618 units at US$5,869 on the previous day. March ended with an average of 59,258 units for US$6,669.

Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than the last selling prices and one with a lower offer.

At the close, First Rock Capital USD share remained at 7.95 US cents with an exchange 1,238 shares, Margaritaville finished at 16 US cents in trading 124 units, Productive Business Solutions ended unchanged at US$1.19 while exchanging 653 stock units. Proven Investments rose 1 cent to close at 25 US cents with 13,416 stocks changing hands, Sterling Investments declined 0.25 of a cent to end at 2 US cents with 33,169 stock units crossing the market, Sygnus Credit Investments USD share shed 0.4 of a cent in ending at 12.45 US cents after an exchange of 41,171 shares and Transjamaican Highway dropped 0.07 of a cent to 0.98 of a US cent after trading 76,000 stocks.

At the close, First Rock Capital USD share remained at 7.95 US cents with an exchange 1,238 shares, Margaritaville finished at 16 US cents in trading 124 units, Productive Business Solutions ended unchanged at US$1.19 while exchanging 653 stock units. Proven Investments rose 1 cent to close at 25 US cents with 13,416 stocks changing hands, Sterling Investments declined 0.25 of a cent to end at 2 US cents with 33,169 stock units crossing the market, Sygnus Credit Investments USD share shed 0.4 of a cent in ending at 12.45 US cents after an exchange of 41,171 shares and Transjamaican Highway dropped 0.07 of a cent to 0.98 of a US cent after trading 76,000 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

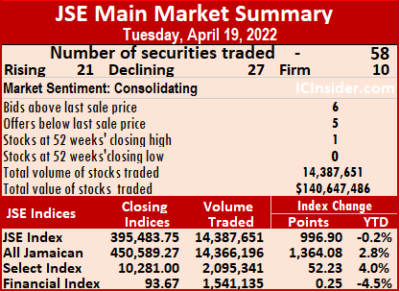

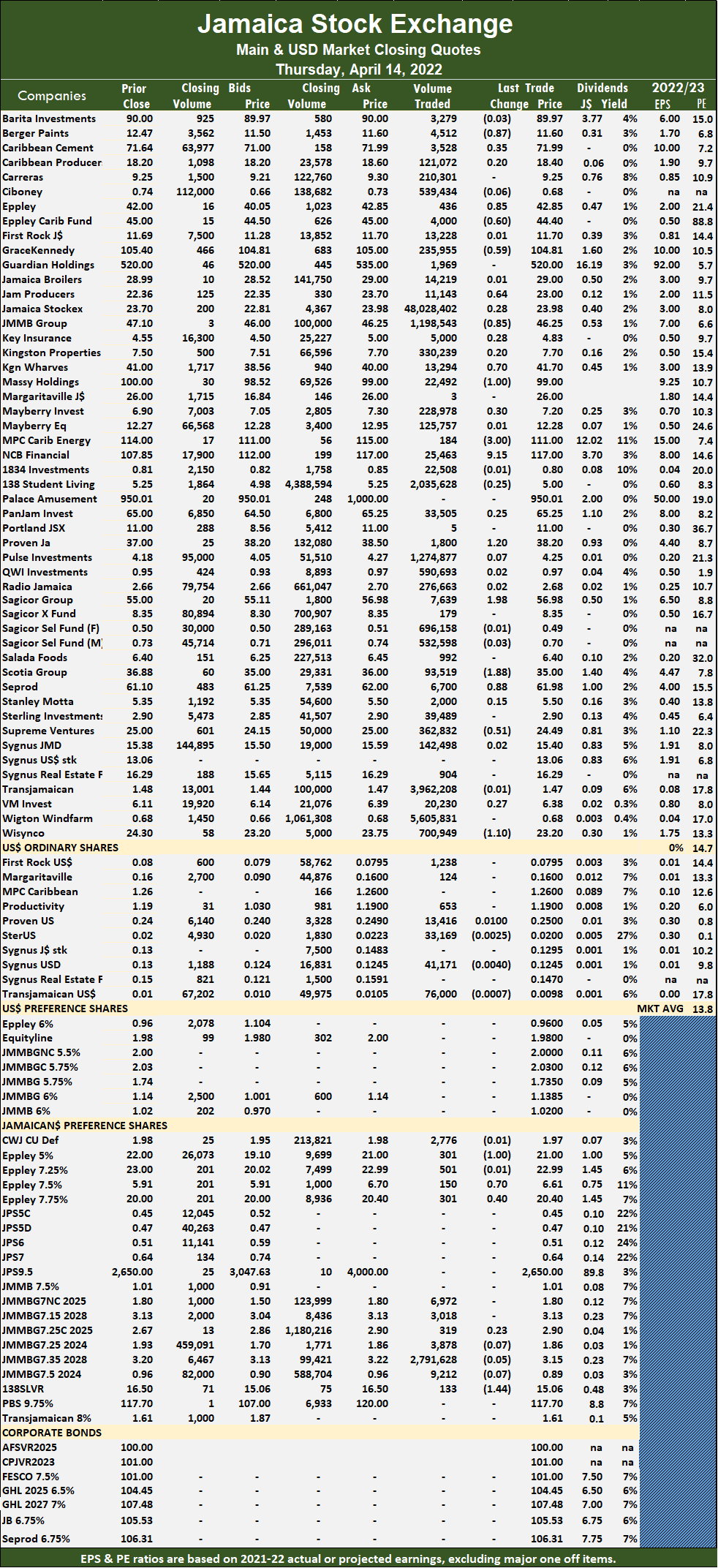

The All Jamaican Composite Index rose 1,364.08 points to settle at 450,589.27, the JSE Main Index gained 996.90 points to end at 395,483.75 and the JSE Financial Index rallied 0.25 points to settle at 93.67.

The All Jamaican Composite Index rose 1,364.08 points to settle at 450,589.27, the JSE Main Index gained 996.90 points to end at 395,483.75 and the JSE Financial Index rallied 0.25 points to settle at 93.67. Trading averaged 248,063 units at $2,424,957, down from 1,172,850 shares at $21,257,393 on Thursday and month to date, an average of 717,999 units at $7,333,227 versus 765,733 units at $7,831,791 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

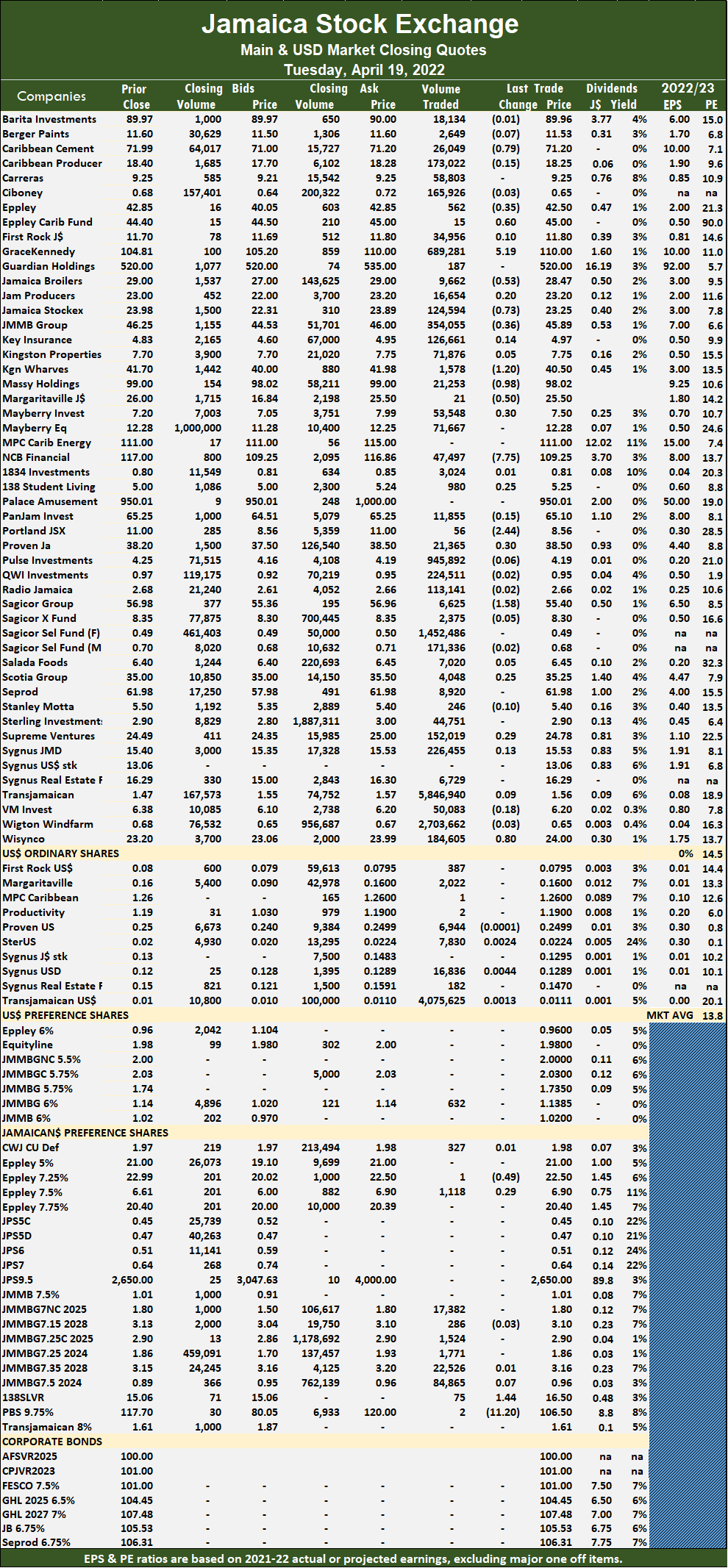

Trading averaged 248,063 units at $2,424,957, down from 1,172,850 shares at $21,257,393 on Thursday and month to date, an average of 717,999 units at $7,333,227 versus 765,733 units at $7,831,791 on the previous trading day. March closed with an average of 610,787 units at $6,967,031. Portland JSX fell $2.44 in closing at $8.56, with 56 stock units crossing the exchange, Proven Investments gained 30 cents to end at $38.50 while exchanging 21,365 shares, Sagicor Group lost $1.58 to end at $55.40 in an exchange of 6,625 stocks and Wisynco Group rose 80 cents to close at $24 after trading 184,605 units.

Portland JSX fell $2.44 in closing at $8.56, with 56 stock units crossing the exchange, Proven Investments gained 30 cents to end at $38.50 while exchanging 21,365 shares, Sagicor Group lost $1.58 to end at $55.40 in an exchange of 6,625 stocks and Wisynco Group rose 80 cents to close at $24 after trading 184,605 units.

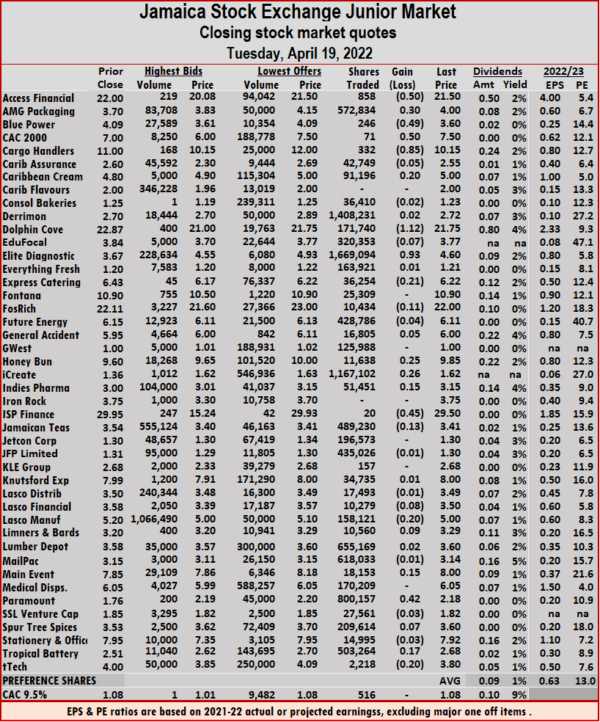

At the close, Access Financial dropped 50 cents to $21.50 in switching ownership of 858 shares, AMG Packaging rose 30 cents to end at a 52 weeks’ closing high of $4 after trading 572,834 stocks after trading at an intraday record high of $4.50, following the release of a continued surge in profit for the current fiscal year. Blue Power lost 49 cents in closing at $3.60 in exchanging 246 units. CAC 2000 advanced 50 cents to close at $7.50, with 71 stock units clearing the market, Cargo Handlers fell 85 cents to $10.15 with 332 shares changing hands, Caribbean Cream increased 20 cents to end at $5, with 91,196 stocks changing hands. Dolphin Cove declined $1.12 to $21.75 in trading 171,740 stock units, Elite Diagnostic rallied 93 cents in closing at 52 weeks’ high of $4.60 with the swapping of 1,669,094 units, Express Catering shed 21 cents to close at $6.22 after exchanging 36,254 stocks. Fosrich dropped 11 cents to $22 after finishing trading 10,434 units, Honey Bun popped 25 cents in closing at $9.85after exchanging 11,638 stock units, iCreate gained 26 cents to close at a 52 weeks’ high of $1.62 after trading 1,167,102 shares. Indies Pharma climbed 15 cents in ending at $3.15 with an exchange of 51,451 shares, ISP Finance shed 45 cents to close at $29.50, with 20 stocks crossing the market, Jamaican Teas fell 13 cents to end at $3.41 while exchanging 489,230 stock units.

At the close, Access Financial dropped 50 cents to $21.50 in switching ownership of 858 shares, AMG Packaging rose 30 cents to end at a 52 weeks’ closing high of $4 after trading 572,834 stocks after trading at an intraday record high of $4.50, following the release of a continued surge in profit for the current fiscal year. Blue Power lost 49 cents in closing at $3.60 in exchanging 246 units. CAC 2000 advanced 50 cents to close at $7.50, with 71 stock units clearing the market, Cargo Handlers fell 85 cents to $10.15 with 332 shares changing hands, Caribbean Cream increased 20 cents to end at $5, with 91,196 stocks changing hands. Dolphin Cove declined $1.12 to $21.75 in trading 171,740 stock units, Elite Diagnostic rallied 93 cents in closing at 52 weeks’ high of $4.60 with the swapping of 1,669,094 units, Express Catering shed 21 cents to close at $6.22 after exchanging 36,254 stocks. Fosrich dropped 11 cents to $22 after finishing trading 10,434 units, Honey Bun popped 25 cents in closing at $9.85after exchanging 11,638 stock units, iCreate gained 26 cents to close at a 52 weeks’ high of $1.62 after trading 1,167,102 shares. Indies Pharma climbed 15 cents in ending at $3.15 with an exchange of 51,451 shares, ISP Finance shed 45 cents to close at $29.50, with 20 stocks crossing the market, Jamaican Teas fell 13 cents to end at $3.41 while exchanging 489,230 stock units.  Lasco Manufacturing declined 20 cents to $5, with 158,121 units crossing the market, Main Event popped 15 cents to $8 in an exchange of 18,153 units, Paramount Trading increased 42 cents in closing at $2.18 in exchanging 800,157 stocks after the company posted nine months results showing continued improvement in earnings. Tropical Battery gained 17 cents to close at $2.68 in switching ownership of 503,264 stock units and tTech lost 20 cents in ending at $3.80 after 2,218 shares changed hands.

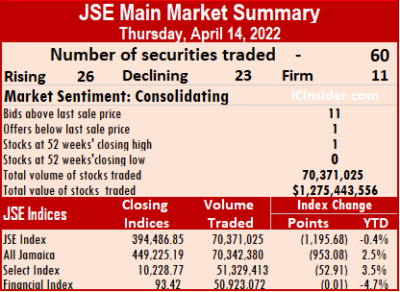

Lasco Manufacturing declined 20 cents to $5, with 158,121 units crossing the market, Main Event popped 15 cents to $8 in an exchange of 18,153 units, Paramount Trading increased 42 cents in closing at $2.18 in exchanging 800,157 stocks after the company posted nine months results showing continued improvement in earnings. Tropical Battery gained 17 cents to close at $2.68 in switching ownership of 503,264 stock units and tTech lost 20 cents in ending at $3.80 after 2,218 shares changed hands. The All Jamaican Composite Index lost 953.08 points to settle at 449,225.19, the JSE Main Index fell 1,195.68 points to close at 394,486.85 and the JSE Financial Index slipped 0.01 points to 93.42. Trading ended with 60 securities against 59 on Wednesday, with 26 rising, 23 declining and 11 ending unchanged.

The All Jamaican Composite Index lost 953.08 points to settle at 449,225.19, the JSE Main Index fell 1,195.68 points to close at 394,486.85 and the JSE Financial Index slipped 0.01 points to 93.42. Trading ended with 60 securities against 59 on Wednesday, with 26 rising, 23 declining and 11 ending unchanged. JMMB Group 7.35% – 2028 closed with 2.79 million units for 4 percent market share, 138 Student Living ended with 2.04 million units for 2.9 percent market share and Pulse Investments exchanged 1.27 million units for 1.8 percent market share.

JMMB Group 7.35% – 2028 closed with 2.79 million units for 4 percent market share, 138 Student Living ended with 2.04 million units for 2.9 percent market share and Pulse Investments exchanged 1.27 million units for 1.8 percent market share. NCB Financial rallied $9.15 to end at $117, with 25,463 units crossing the market, Proven Investments rose $1.20 in closing at $38.20 after exchanging 1,800 stocks, Sagicor Group increased $1.98 to $56.98 in an exchange of 7,639 stock units. Scotia Group dropped $1.88 in ending at $35 after exchanging 93,519 shares, Seprod climbed 88 cents to end at $61.98 with the swapping of 6,700 units, Supreme Ventures declined 51 cents in closing at $24.49 in an exchange of 362,832 stock units and Wisynco Group shed $1.10 to close at $23.20 after trading 700,949 shares.

NCB Financial rallied $9.15 to end at $117, with 25,463 units crossing the market, Proven Investments rose $1.20 in closing at $38.20 after exchanging 1,800 stocks, Sagicor Group increased $1.98 to $56.98 in an exchange of 7,639 stock units. Scotia Group dropped $1.88 in ending at $35 after exchanging 93,519 shares, Seprod climbed 88 cents to end at $61.98 with the swapping of 6,700 units, Supreme Ventures declined 51 cents in closing at $24.49 in an exchange of 362,832 stock units and Wisynco Group shed $1.10 to close at $23.20 after trading 700,949 shares.