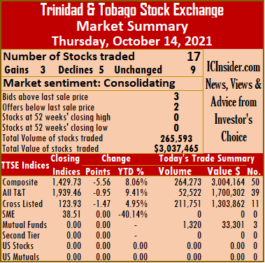

Market activity picked up on Thursday and resulted in the volume and value of stocks trading rising 158 and 90 percent higher, respectively than Wednesday, at the close of the Trinidad and Tobago Stock Exchange.

A total of 17 securities traded up from 16 on Wednesday, with three stocks rising, five declining and nine remaining unchanged. The Composite Index dropped 5.56 points to 1,429.73, the All T&T Index fell 0.95 points to close at 1,939.46 and the Cross-Listed Index declined 1.47 points to settle at 123.93.

A total of 17 securities traded up from 16 on Wednesday, with three stocks rising, five declining and nine remaining unchanged. The Composite Index dropped 5.56 points to 1,429.73, the All T&T Index fell 0.95 points to close at 1,939.46 and the Cross-Listed Index declined 1.47 points to settle at 123.93.

A total of 265,593 shares traded for $3,037,465 compared to 102,882 units at $1,598,024 on Wednesday. An average of 15,623 units traded at $178,674 compared to 6,430 shares at $99,877 on Wednesday, with trading month to date averaging 38,244 units at $277,872 versus 40,560 units at $288,030. The average trade for September amounts to 36,606 units at $425,940.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s remained at $24.50 while exchanging 45 shares, Ansa McAl ended trading 186 stock units at $57.80, Calypso Macro Investment Fund exchanged 120 units at $16.51. Clico Investment Fund shed 13 cents to end at $26.10, with 1,200 stocks crossing the exchange, GraceKennedy declined 4 cents to close at $6.26 with the swapping of 204,501 shares, Guardian Holdings closed at $32.60 in an exchange of 1,000 stocks. JMMB Group dipped 1 cent to $2.23, trading 6,000 units,  Massy Holdings fell $1 to $83, with 17,367 stock units changing hands, National Enterprises finished the trading of 5,085 shares at $3.25. Point Lisas ended at $3, after exchanging 500 stock units, Prestige Holdings ended at $7.25 with an exchange of 135 stocks. Republic Financial Holdings remained at $135.70, with 95 stock units changing hands, Scotiabank traded 158 stocks at $62, Trinidad & Tobago NGL popped 13 cents to $17.63, with 100 units crossing the market. Trinidad Cement climbed 6 cents to close at $4.06 in trading 25,949 shares and West Indian Tobacco rose 1 cent to $30.94 in an exchange of 1,902 stocks.

Massy Holdings fell $1 to $83, with 17,367 stock units changing hands, National Enterprises finished the trading of 5,085 shares at $3.25. Point Lisas ended at $3, after exchanging 500 stock units, Prestige Holdings ended at $7.25 with an exchange of 135 stocks. Republic Financial Holdings remained at $135.70, with 95 stock units changing hands, Scotiabank traded 158 stocks at $62, Trinidad & Tobago NGL popped 13 cents to $17.63, with 100 units crossing the market. Trinidad Cement climbed 6 cents to close at $4.06 in trading 25,949 shares and West Indian Tobacco rose 1 cent to $30.94 in an exchange of 1,902 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Activity picks up on Trinidad Exchange

Trading drops on JSE USD Market – Wednesday

In trading on Wednesday, the volume and value of shares changing hands dived by 94 percent from Tuesday’s trading at the close of the JSE US dollar market, with no stocks declining in price.

In trading on Wednesday, the volume and value of shares changing hands dived by 94 percent from Tuesday’s trading at the close of the JSE US dollar market, with no stocks declining in price.

Five securities traded compared to six on Tuesday, with prices of two rising and three ending unchanged.

The US Denominated Equities Index rallied 1.61 points to end at 186.85. The PE Ratio, a measure that computes appropriate stock values, averages 11.8 based on ICInsider.com’s 2021-22 earnings forecast.

Overall, just 11,180 shares traded for US$1,080, down from 176,358 units at US$17,759 on Tuesday. Trading averaged 2,236 units at US$216, compared to 29,393 shares at US$2,960 on Tuesday and the month to date averages 41,259 at US$5,493 versus 45,324 units at US$6,043 on Tuesday. September ended with an average of 853,681 units for US$132,197.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than the last selling prices and one with a bid lower offer.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than the last selling prices and one with a bid lower offer.

At the close, First Rock Capital USD share remained at 7 US cents with 5,090 shares changing hands, Sterling Investments settled at 2.09 US cents with a transfer of 519 stocks, Sygnus Credit Investments USD share popped 2.47 cents to finish at 13.47 US cents with 3,800 stock units traded and Transjamaican Highway ended at 0.9 of a cent with 1,685 units crossing the exchange.

In the preference segment, JMMB Group 5.75% preference share climbed 30.3 cents to close at US$2.323 with 86 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

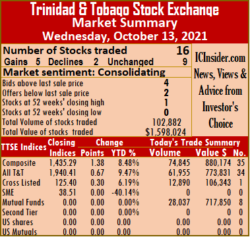

Trading volume drops on TTSE

Activity fell markedly on the Trinidad and Tobago Stock Exchange on Wednesday after fewer securities traded and resulted in 76 percent fewer shares changing hands with 63 percent lower value than on Tuesday, leaving more stocks rising than falling at the close.

Sixteen securities traded down from 20 on Tuesday at the close, with five rising, two declining and nine remaining unchanged. The Composite Index popped 1.38 points to 1,435.29, the All T&T Index rose 0.67 points to close at 1,940.41 and the Cross-Listed Index added 0.30 points to settle at 125.40.

Sixteen securities traded down from 20 on Tuesday at the close, with five rising, two declining and nine remaining unchanged. The Composite Index popped 1.38 points to 1,435.29, the All T&T Index rose 0.67 points to close at 1,940.41 and the Cross-Listed Index added 0.30 points to settle at 125.40.

A total of 102,882 shares traded, for $1,598,024 down from 422,298 units at $4,331,345 on Tuesday. An average of 6,430 units traded at $99,877, down from 21,115 at $216,567 on Tuesday, with trading month to date averaging 40,560 units at $288,030 compared to 44,201 units at $308,100. The average trade for September amounts to 36,606 units at $425,940.

Investor’s Choice bid-offer indicator shows four stocks ending, with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s traded 1,000 shares at $24.50, Angostura Holdings remained at $17.10, with an exchange of 200 stock units, Ansa McAl popped 30 cents to $57.80 in exchanging 30 units.  Calypso Macro Investment Fund added 1 cent in closing at a 52 weeks’ high of $16.51 with an exchange of 1,600 stock units, Clico Investment Fund spiked 13 cents to $26.23 while exchanging 26,437 stock units, Guardian Holdings dipped 15 cents to end at $32.60, in exchanging 9,385 units. Massy Holdings shed 50 cents and ended at $84 in trading 1,085 shares, National Enterprises remained at $3.25 with 625 stocks changing hands, National Flour Mills rallied 7 cents to close at $2.11 in exchanging 2,329 stocks. NCB Financial Group remained at $8.25 after trading 12,890 stock units, One Caribbean Media closed at $4.86, with 41,200 shares crossing the exchange, Republic Financial Holdings remained at $135.70 in an exchange of 208 units. Scotiabank traded 155 stocks at $62, Trinidad & Tobago NGL remained at $17.50, with 4,362 stock units crossing the market, Unilever Caribbean finished trading at $16.40, with 1,176 units changing hands and West Indian Tobacco inched 1 cent higher to $30.93 with the swapping of 200 shares.

Calypso Macro Investment Fund added 1 cent in closing at a 52 weeks’ high of $16.51 with an exchange of 1,600 stock units, Clico Investment Fund spiked 13 cents to $26.23 while exchanging 26,437 stock units, Guardian Holdings dipped 15 cents to end at $32.60, in exchanging 9,385 units. Massy Holdings shed 50 cents and ended at $84 in trading 1,085 shares, National Enterprises remained at $3.25 with 625 stocks changing hands, National Flour Mills rallied 7 cents to close at $2.11 in exchanging 2,329 stocks. NCB Financial Group remained at $8.25 after trading 12,890 stock units, One Caribbean Media closed at $4.86, with 41,200 shares crossing the exchange, Republic Financial Holdings remained at $135.70 in an exchange of 208 units. Scotiabank traded 155 stocks at $62, Trinidad & Tobago NGL remained at $17.50, with 4,362 stock units crossing the market, Unilever Caribbean finished trading at $16.40, with 1,176 units changing hands and West Indian Tobacco inched 1 cent higher to $30.93 with the swapping of 200 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

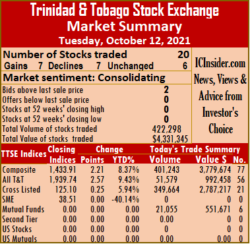

Trading volume bounced on Tuesday

The volume of shares traded soared by 1,258 percent as 1,032 percent more funds chased after stocks on Tuesday over Monday, resulting in an even number of stocks rising and falling at the close of the JSE USD market.

Trading ended with six securities changing hands, up from five on Monday with an equal split of two between rising stocks and those declining and closing unchanged.

Trading ended with six securities changing hands, up from five on Monday with an equal split of two between rising stocks and those declining and closing unchanged.

The JSE US Denominated Equities Index rallied 1.43 points to end at 185.24.

The PE Ratio, a measure that computes appropriate stock values, averages 11.5 based on ICInsider.com’s 2021-22 earnings forecast.

Overall, 176,358 shares traded for US$17,759 compared to just 12,988 units at US$1,569 on Monday. Trading averaged 29,393 units at US$2,960, compared to 2,598 shares at US$314 on Monday and month to date an average of 45,324 at US$6,043 in contrast to 47,600 units at US$6,484 on Monday. September ended with an average of 853,681 units for US$132,197.

Investor’s Choice bid-offer indicator shows three stocks ended with a bid higher than their last selling prices and one with a lower offer.

At the close, First Rock Capital settled at 7 US cents with an exchange of 12,674 shares, Margaritaville fell 0.49 of a cent to 9.5 US cents with 742 stocks traded, Proven Investments rose 1.6 cents to 24.6 US cents with a transfer of 2,455 units. Sterling Investments gained 0.09 of a cent to close at 2.09 US cents with 17,131 stock units passing through the market, Sygnus Credit Investments USD share declined by 2 cents to settle at 11 US cents with 142,800 stocks changing hands and Sygnus Real Estate Finance USD share finished unchanged at 14 US cents with 556 shares crossing the exchange.

Proven Investments rose 1.6 cents to 24.6 US cents with a transfer of 2,455 units. Sterling Investments gained 0.09 of a cent to close at 2.09 US cents with 17,131 stock units passing through the market, Sygnus Credit Investments USD share declined by 2 cents to settle at 11 US cents with 142,800 stocks changing hands and Sygnus Real Estate Finance USD share finished unchanged at 14 US cents with 556 shares crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Rising and declining stocks tie

Market activity ended on Tuesday and resulted in an equal number of stocks rising and falling at the close of trading, after trading 94 percent more shares, valued 36 percent less than on Monday, at the close of the Trinidad and Tobago Stock Exchange.

Trinidad & Tobago Stock Exchange Head Quarters

At the close, 20 securities traded, up from 17 on Monday, with seven rising and falling respectively and six remaining unchanged.

The Composite Index gained 2.21 points to close at 1,433.91, the All T&T Index rallied 2.57 points to 1,939.74 and the Cross-Listed Index advanced 0.25 points to settle at 125.10.

A total of 422,298 shares traded for $4,331,345 compared to 217,596 units at $6,809,352 on Monday. An average of 1,115 units traded at $216,567 versus 12,80 at $400,550 on Monday, and the month to date averaging 44,201 units at $308,100 versus 47,752 units at $322,182. The average trade for September amounted to 36,606 units at $425,940.

Investor’s Choice bid-offer indicator shows two stocks ending with higher bids than their last selling prices and none with a lower offer.

At the close, Agostini’s traded 11,905 shares at $24.50, Angostura Holdings fell 1 cent to end at $17.10, with 7,595 stock units changing hands, Ansa McAl advanced 45 cents to $57.50 after exchanging 419 stocks. Clico Investment Fund climbed 10 cents to $26.10 with the swapping of 21,055 units, First Citizens Bank remained at $50.60 in trading 2,460 shares, FirstCaribbean International Bank traded 160 stock units at $6.50. GraceKennedy rose 4 cents to end at $6.30, with 36,000 stocks crossing the market, Guardian Holdings declined 5 cents to $32.75 in exchanging 228 units, JMMB Group increased 2 cents to close at $2.24 after trading 2,230 stock units.  L.J. Williams B share remained at $1.50 with 725 units crossing the market, Massy Holdings dropped 30 cents to $84.50, trading 315 shares, National Enterprises ended at $3.25 in an exchange of 3,000 stocks. National Flour Mills lost 2 cents in ending at $2.04 while exchanging 225 shares, NCB Financial Group rallied 5 cents to $8.25 trading 311,274 stock units, Prestige Holdings remained at $7.25 in switching ownership of 1,447 stocks. Scotiabank jumped $1 to $62 after 255 units crossed the market, Trinidad & Tobago NGL shed 4 cents in closing at $17.50, with 16,621 shares changing hands, Trinidad Cement dipped 5 cents to $4 trading 5,000 stock units. Unilever Caribbean popped 10 cents to close at $16.40 after an exchange of 230 stocks and West Indian Tobacco lost 2 cents to end at $30.92 in switching ownership of 1,154 units.

L.J. Williams B share remained at $1.50 with 725 units crossing the market, Massy Holdings dropped 30 cents to $84.50, trading 315 shares, National Enterprises ended at $3.25 in an exchange of 3,000 stocks. National Flour Mills lost 2 cents in ending at $2.04 while exchanging 225 shares, NCB Financial Group rallied 5 cents to $8.25 trading 311,274 stock units, Prestige Holdings remained at $7.25 in switching ownership of 1,447 stocks. Scotiabank jumped $1 to $62 after 255 units crossed the market, Trinidad & Tobago NGL shed 4 cents in closing at $17.50, with 16,621 shares changing hands, Trinidad Cement dipped 5 cents to $4 trading 5,000 stock units. Unilever Caribbean popped 10 cents to close at $16.40 after an exchange of 230 stocks and West Indian Tobacco lost 2 cents to end at $30.92 in switching ownership of 1,154 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

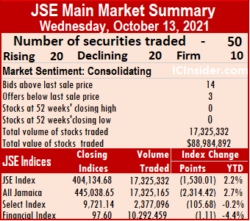

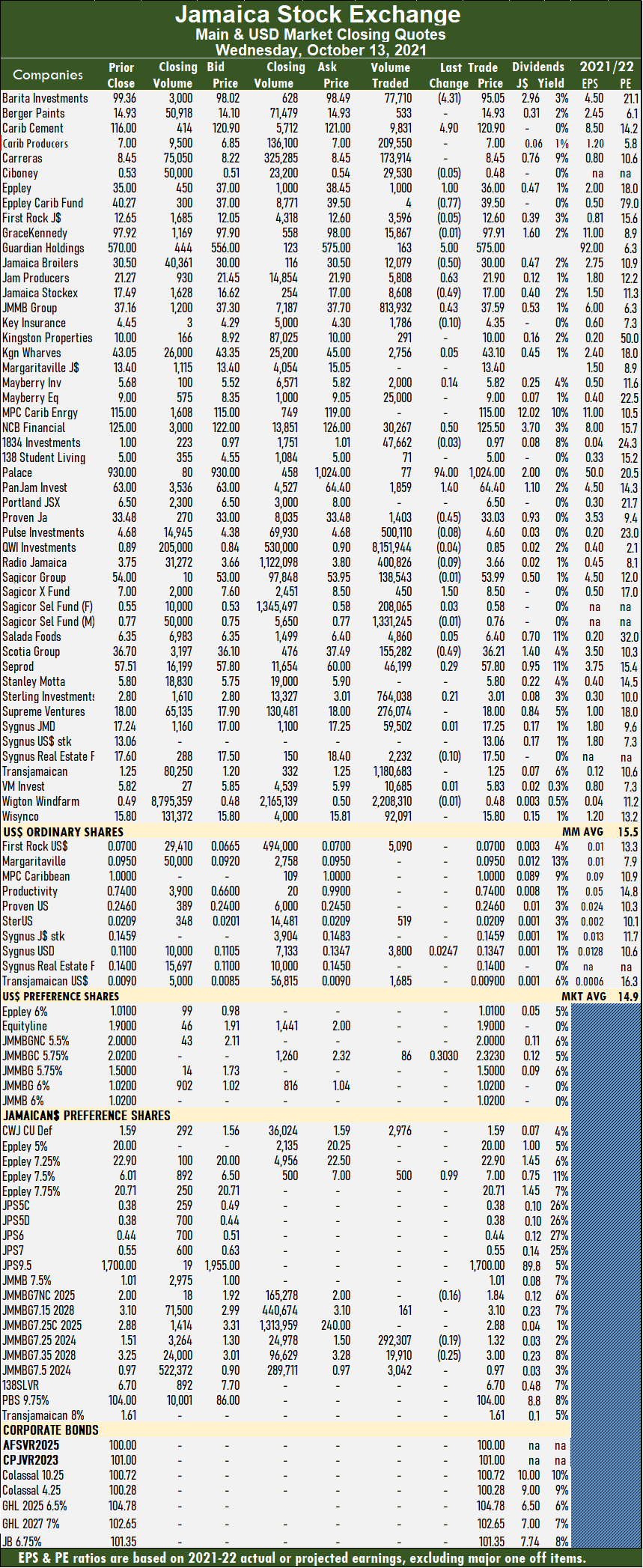

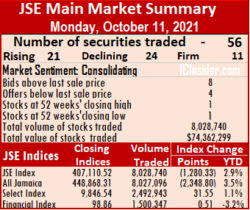

The All Jamaican Composite Index dropped 2,314.42 points to settle at 445,038.65, the Main Index fell 1,530.01 points to 404,134.68 and the JSE Financial Index lost 1.11 points to end at 97.60.

The All Jamaican Composite Index dropped 2,314.42 points to settle at 445,038.65, the Main Index fell 1,530.01 points to 404,134.68 and the JSE Financial Index lost 1.11 points to end at 97.60. September closed with an average of 335,669 units at $7,507,404.

September closed with an average of 335,669 units at $7,507,404. Scotia Group shed 49 cents to close at a 52 weeks’ low of $36.21 in trading 155,282 stock units, Seprod gained 29 cents to close at $57.80 with the swapping of 46,199 shares and Sterling Investments traded 764,038 shares and gained 21 cents to close at $3.01.

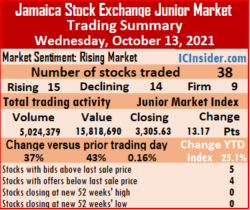

Scotia Group shed 49 cents to close at a 52 weeks’ low of $36.21 in trading 155,282 stock units, Seprod gained 29 cents to close at $57.80 with the swapping of 46,199 shares and Sterling Investments traded 764,038 shares and gained 21 cents to close at $3.01. A total of 38 securities traded compared to 36 on Tuesday and ended with 15 rising, 14 declining and nine, closing unchanged.

A total of 38 securities traded compared to 36 on Tuesday and ended with 15 rising, 14 declining and nine, closing unchanged. Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and four with lower offers.

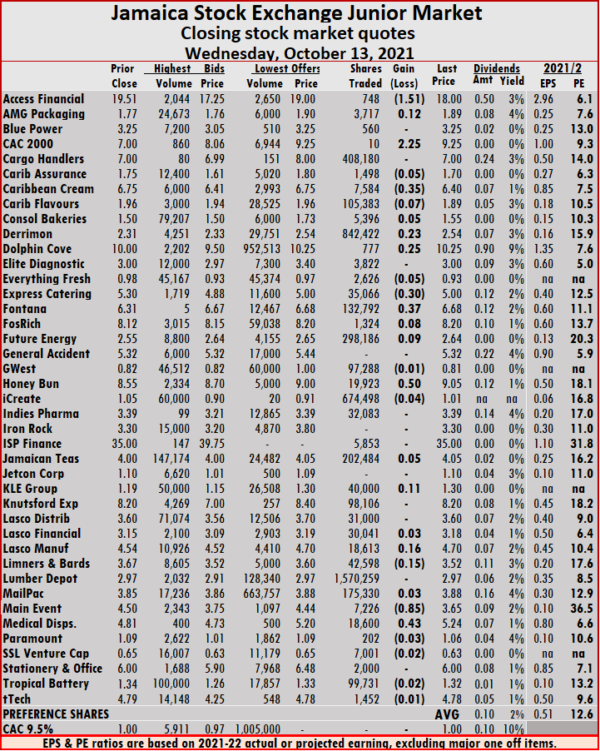

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and four with lower offers. Jamaican Teas advanced 5 cents to $4.05 in trading 202,484 stock units, KLE Group climbed 11 cents to $1.30, with 40,000 units changing hands, Lasco Manufacturing increased 16 cents to end at $4.70 in trading 18,613 stocks. Limners and Bards shed 15 cents to $3.52 with the swapping of 42,598 shares, Main Event declined 85 cents to close at $3.65 after trading 7,226 stock units and Medical Disposables spiked 43 cents to close at $5.24 while exchanging 18,600 stock units.

Jamaican Teas advanced 5 cents to $4.05 in trading 202,484 stock units, KLE Group climbed 11 cents to $1.30, with 40,000 units changing hands, Lasco Manufacturing increased 16 cents to end at $4.70 in trading 18,613 stocks. Limners and Bards shed 15 cents to $3.52 with the swapping of 42,598 shares, Main Event declined 85 cents to close at $3.65 after trading 7,226 stock units and Medical Disposables spiked 43 cents to close at $5.24 while exchanging 18,600 stock units. Thirty six securities traded compared to 37 on Monday and ended, with 15 rising, 14 declining and seven, closing unchanged.

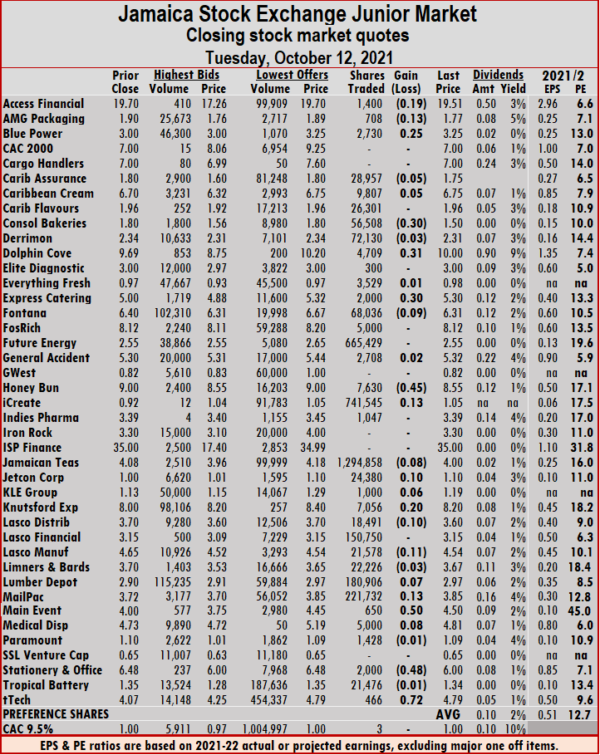

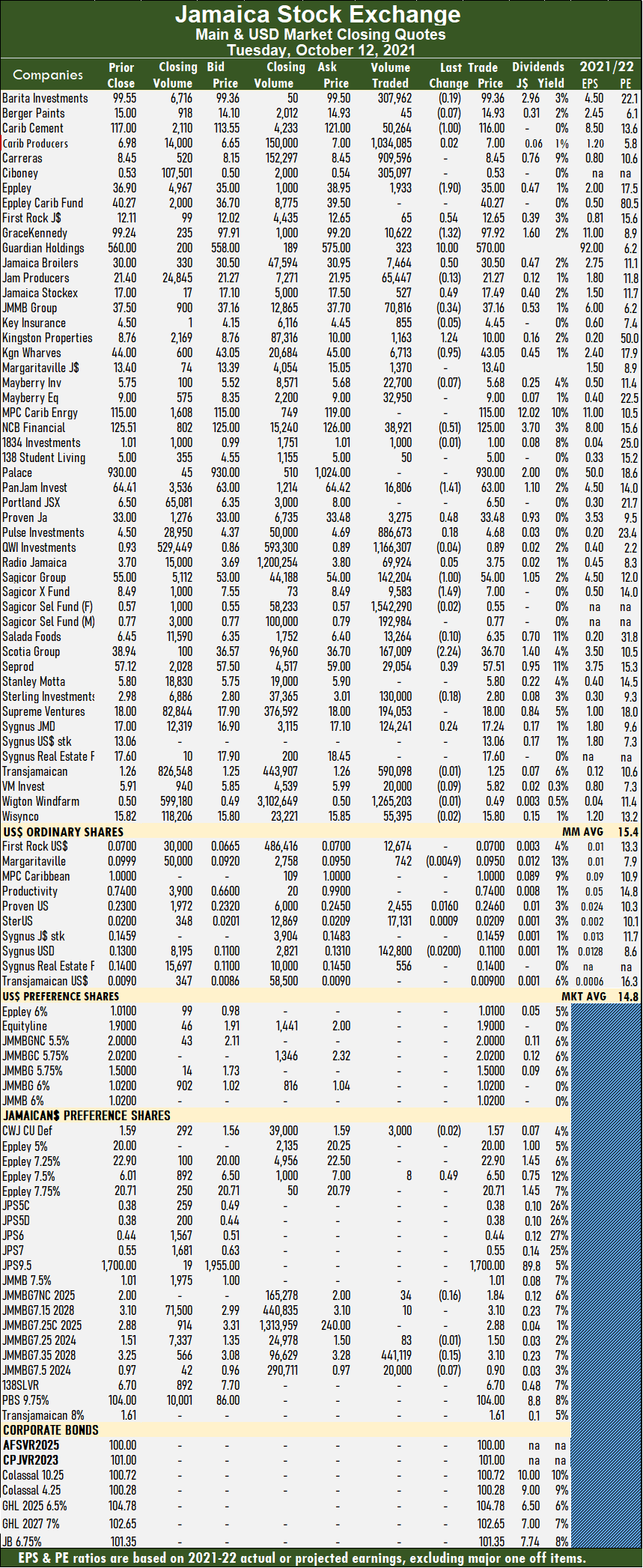

Thirty six securities traded compared to 37 on Monday and ended, with 15 rising, 14 declining and seven, closing unchanged. At the close, Access Financial shed 19 cents at $19.51 in trading 1,400 shares, AMG Packaging declined 13 cents to $1.77, with 08 stocks crossing the exchange, Blue Power gained 25 cents to end at $3.25 in an exchange of 2,730 units. Caribbean Assurance Brokers fell 5 cents to $1.75 after 28,957 stock units crossed the market, Caribbean Cream popped 5 cents to $6.75, with an exchange of 9,807 units, Consolidated Bakeries dropped 30 cents in closing at $1.50 in switching ownership of 56,508 shares. Dolphin Cove rallied 31 cents to $10 while exchanging 4,709 stock units, Express Catering spiked 30 cents to $5.30 with the swapping of 2,000 stocks, Fontana fell 9 cents to $6.31, with 68,036 shares changing hands. Honey Bun fell 45 cents to $8.55 in exchanging 7,630 stocks, iCreate increased 13 cents to $1.05 trading 741,545 units, Jamaican Teas lost 8 cents in closing at $4 with an exchange of 1,294,858 stock units. Jetcon Corporation rose 10 cents to $1.10 after exchanging 24,380 stock units, KLE Group climbed 6 cents to close at $1.19, trading 1,000 shares, Knutsford Express advanced 20 cents to $8.20, with 7,056 units crossing the market. Lasco Distributors declined 10 cents to $3.60 after exchanging 18,491 stocks, Lasco Manufacturing shed 11 cents in closing at $4.54 after trading 21,578 units, Lumber Depot rose 7 cents to $2.97 trading 180,906 shares.

At the close, Access Financial shed 19 cents at $19.51 in trading 1,400 shares, AMG Packaging declined 13 cents to $1.77, with 08 stocks crossing the exchange, Blue Power gained 25 cents to end at $3.25 in an exchange of 2,730 units. Caribbean Assurance Brokers fell 5 cents to $1.75 after 28,957 stock units crossed the market, Caribbean Cream popped 5 cents to $6.75, with an exchange of 9,807 units, Consolidated Bakeries dropped 30 cents in closing at $1.50 in switching ownership of 56,508 shares. Dolphin Cove rallied 31 cents to $10 while exchanging 4,709 stock units, Express Catering spiked 30 cents to $5.30 with the swapping of 2,000 stocks, Fontana fell 9 cents to $6.31, with 68,036 shares changing hands. Honey Bun fell 45 cents to $8.55 in exchanging 7,630 stocks, iCreate increased 13 cents to $1.05 trading 741,545 units, Jamaican Teas lost 8 cents in closing at $4 with an exchange of 1,294,858 stock units. Jetcon Corporation rose 10 cents to $1.10 after exchanging 24,380 stock units, KLE Group climbed 6 cents to close at $1.19, trading 1,000 shares, Knutsford Express advanced 20 cents to $8.20, with 7,056 units crossing the market. Lasco Distributors declined 10 cents to $3.60 after exchanging 18,491 stocks, Lasco Manufacturing shed 11 cents in closing at $4.54 after trading 21,578 units, Lumber Depot rose 7 cents to $2.97 trading 180,906 shares.  Mailpac Group climbed 13 cents to $3.85 with the swapping of 221,732 stock units, Main Event rallied 50 cents to $4.50 trading 650 stocks, Medical Disposables popped 8 cents to close at $4.81 in switching ownership of 5,000 shares. Stationery and Office Supplies dropped 48 cents to $6, with 2,000 stocks clearing the market and tTech spiked 72 cents to $4.79 while exchanging 466 units.

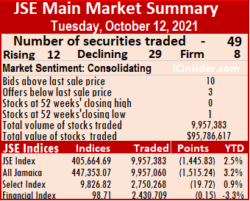

Mailpac Group climbed 13 cents to $3.85 with the swapping of 221,732 stock units, Main Event rallied 50 cents to $4.50 trading 650 stocks, Medical Disposables popped 8 cents to close at $4.81 in switching ownership of 5,000 shares. Stationery and Office Supplies dropped 48 cents to $6, with 2,000 stocks clearing the market and tTech spiked 72 cents to $4.79 while exchanging 466 units. The All Jamaican Composite Index shed 1,515.24 points to 447,353.07, the JSE Main Index dropped 1,445.83 points to 405,664.69 and the JSE Financial Index lost 0.15 points to end at 98.71.

The All Jamaican Composite Index shed 1,515.24 points to 447,353.07, the JSE Main Index dropped 1,445.83 points to 405,664.69 and the JSE Financial Index lost 0.15 points to end at 98.71. September closed with an average of 335,669 units at $7,507,404.Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and three with lower offers.

September closed with an average of 335,669 units at $7,507,404.Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and three with lower offers. Scotia Group declined $2.24 to a 52 week’s low of $36.70 in transferring 167,009 units, Seprod gained 39 cents in closing at $57.51 with 29,054 shares clearing the market and Sygnus Credit Investments picked up 24 cents to end at $17.24 in exchanging 124,241 stocks.

Scotia Group declined $2.24 to a 52 week’s low of $36.70 in transferring 167,009 units, Seprod gained 39 cents in closing at $57.51 with 29,054 shares clearing the market and Sygnus Credit Investments picked up 24 cents to end at $17.24 in exchanging 124,241 stocks. Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and four with lower offers. Pulse Investments dipped 53 cents to close at $4.50 with 1,157,544 shares crossing the market, Sagicor Group spiked $2.98 in closing at $55 after 92,433 stocks cleared the market, Scotia Group rose $1.84 to $38.94 with an exchange of 2,211 stock units. Seprod declined $5.98 to $57.12 with 76,822 units changing hands and Sygnus Real Estate Finance shed $1.35 to end at $17.60 in switching ownership of 1,645 stocks.

Pulse Investments dipped 53 cents to close at $4.50 with 1,157,544 shares crossing the market, Sagicor Group spiked $2.98 in closing at $55 after 92,433 stocks cleared the market, Scotia Group rose $1.84 to $38.94 with an exchange of 2,211 stock units. Seprod declined $5.98 to $57.12 with 76,822 units changing hands and Sygnus Real Estate Finance shed $1.35 to end at $17.60 in switching ownership of 1,645 stocks.