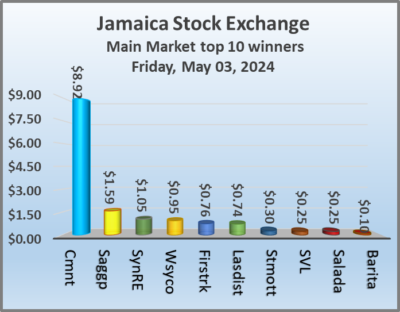

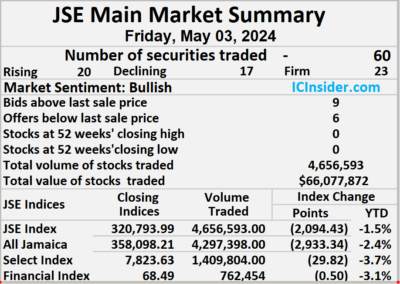

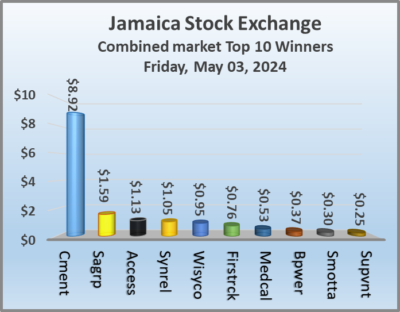

Trading on the Jamaica Stock Exchange Main Market ended on Friday, with Caribbean cement closing at a 52 weeks’ high after the price jumped $8.92 as the volume of stocks traded in the overall market declined by 58 percent with a 21 percent increase in value than on Thursday, with trading in 60 securities compared with 59 on Thursday and ending with prices of 20 stocks rising, 17 declining and 23 ending unchanged.

The market closed with 4,656,593 shares being traded for $66,077,872 compared with 11,013,773 units at $54,506,302 on Thursday.

The market closed with 4,656,593 shares being traded for $66,077,872 compared with 11,013,773 units at $54,506,302 on Thursday.

Trading averaged 77,610 shares at $1,101,298 compared to 186,674 units at $923,836 on Thursday and month to date, an average of 186,674 units at $1,030,646, in contrast with 242,131 units at $994,721 on the previous day and April that closed with an average of 680,802 units at $3,619,595.

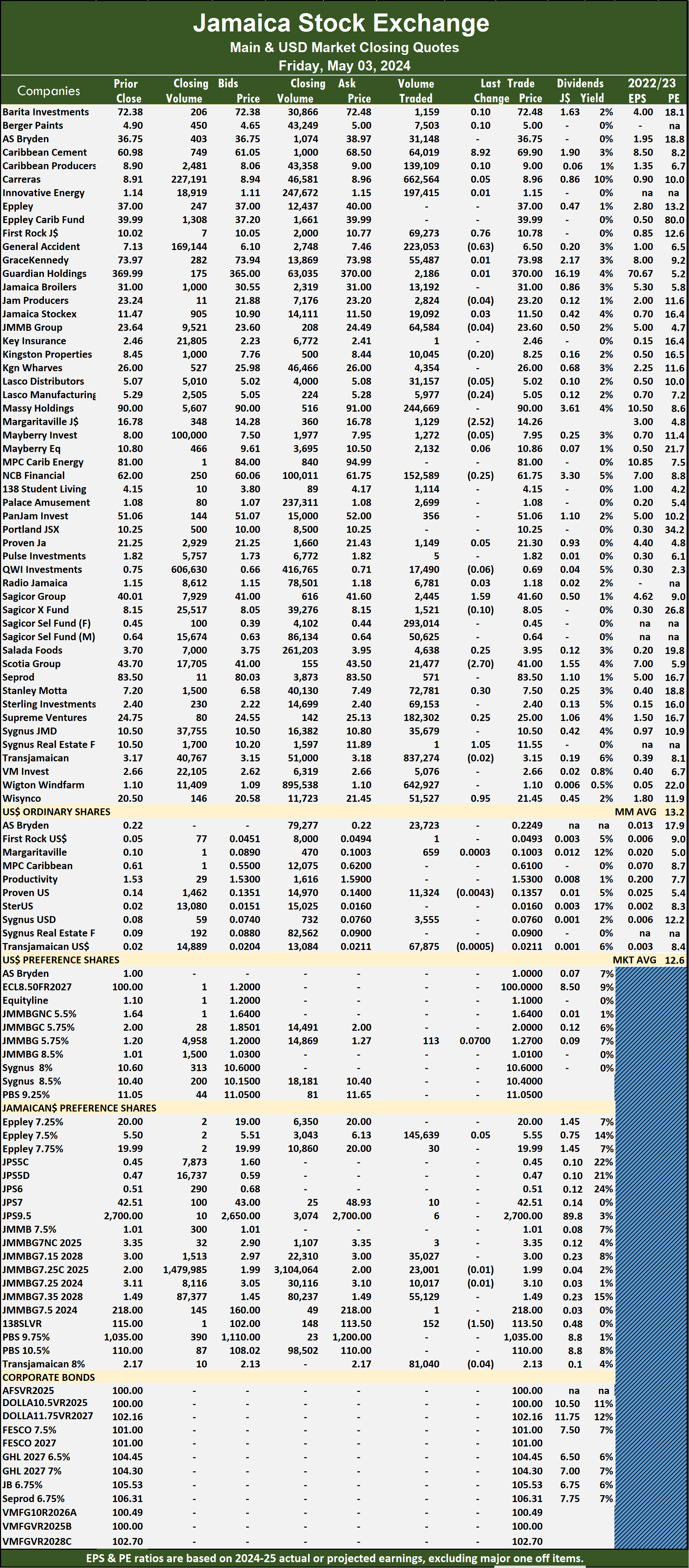

Transjamaican Highway led trading with 837,274 shares for 18 percent of total volume followed by Carreras with 662,564 units for 14.2 percent of the day’s trade and Wigton Windfarm with 642,927 stock units for 13.8 percent market share.

The All Jamaican Composite Index dropped 2,933.34 points to 358,098.21, the JSE Main Index declined 2,094.43 points to lock up trading at 320,793.99 and the JSE Financial Index dipped 0.50 points to settle at 68.49.

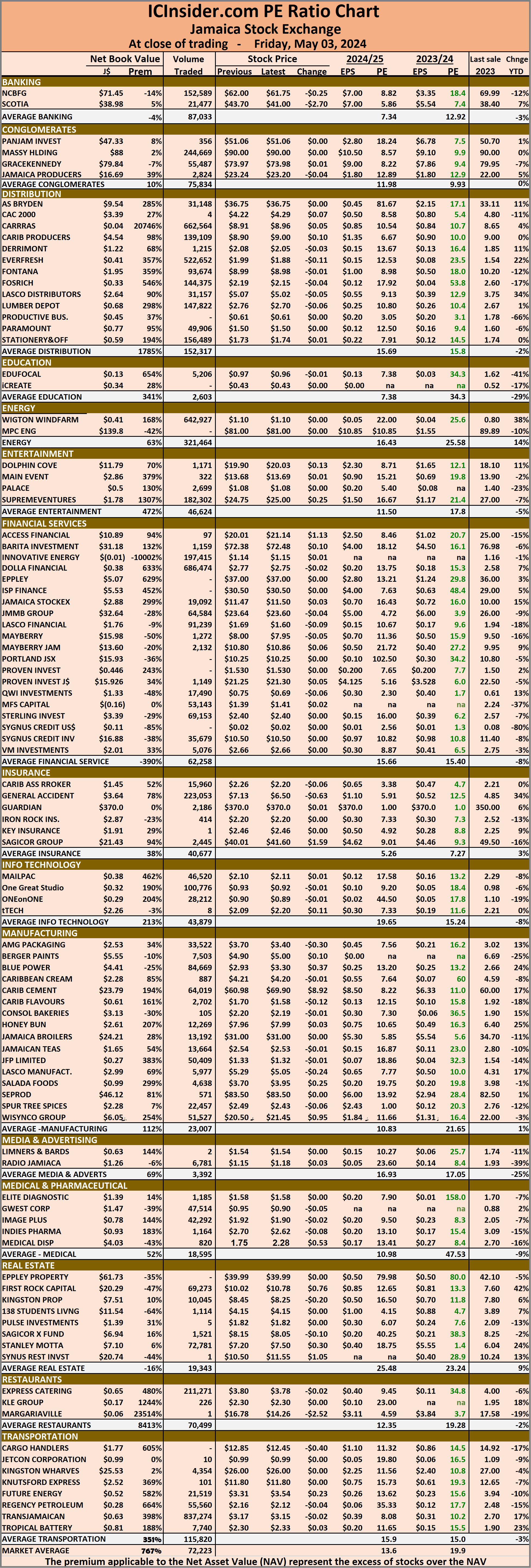

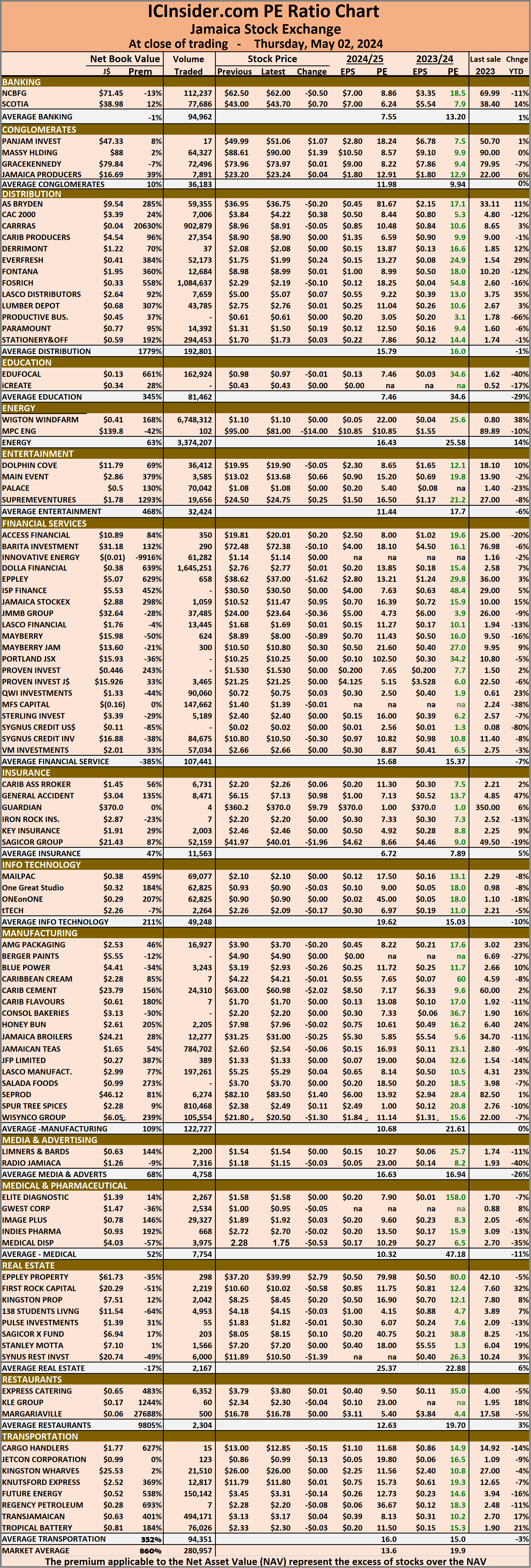

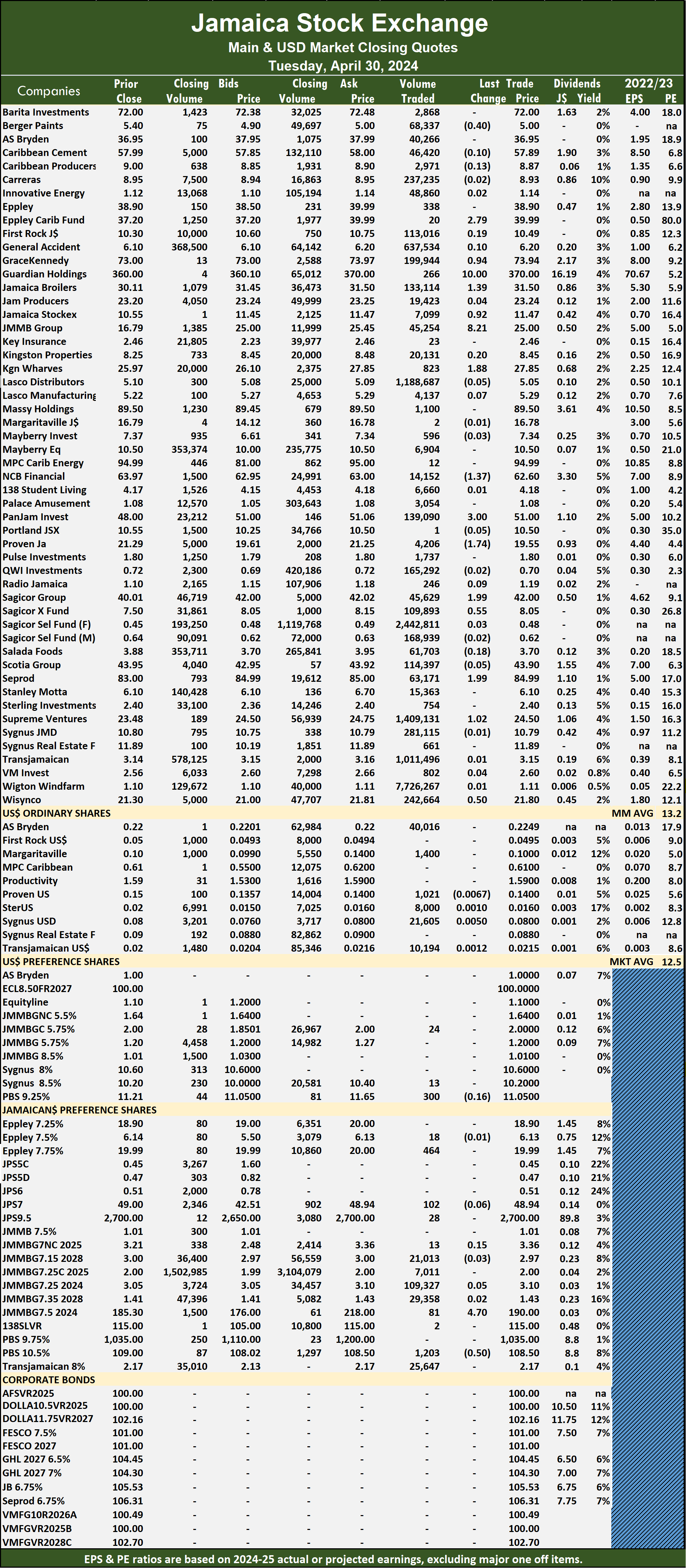

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and six with lower offers.

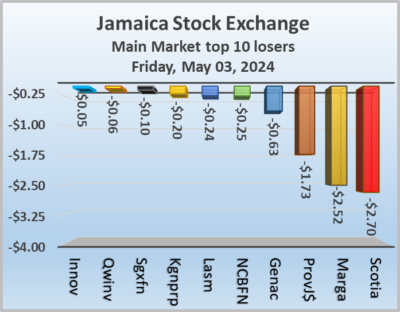

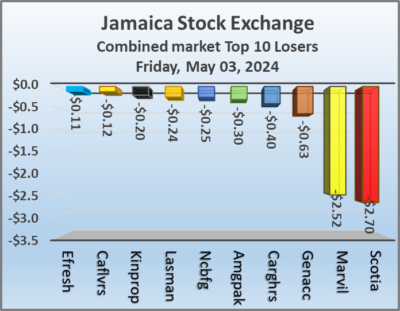

At the close, Caribbean Cement rallied $8.92 to finish at a 52 weeks’ high of $69.90 with an exchange of 64,019 units, as investors tried to get on board following the excellent first quarter results, First Rock Real Estate increased 76 cents to $10.78 after 69,273 stocks passed through the market, General Accident dropped 63 cents to end at $6.50 after investors ending in exchanging 223,053 shares. Kingston Properties fell 20 cents in closing at $8.25 with 10,045 stock units clearing the market, Lasco Manufacturing declined 24 cents and ended at $5.05 with a transfer of 5,977 shares, Margaritaville lost $2.52 to close at $14.26 as investors exchanged 1,129 units.  NCB Financial dipped 25 cents to $61.75 in switching ownership of 152,589 stocks, Sagicor Group popped $1.59 to finish at $41.60 with investors trading 2,445 stocks, Salada Foods advanced 25 cents and ended at $3.95 in an exchange of 4,638 shares. Scotia Group sank $2.70 to close at $41, with 21,477 units changing hands, Stanley Motta rose 30 cents in closing at $7.50 after an exchange of 72,781 stocks, Supreme Ventures gained 25 cents to end at $25 and closed with an exchange of 182,302 stock units. Sygnus Real Estate Finance climbed $1.05 in closing at $11.55 in an exchange of just one share and Wisynco Group popped 95 cents to $21.45 with 51,527 stock units crossing the market before the company released their third quarte results with flat earnings in the third quarter after tax .

NCB Financial dipped 25 cents to $61.75 in switching ownership of 152,589 stocks, Sagicor Group popped $1.59 to finish at $41.60 with investors trading 2,445 stocks, Salada Foods advanced 25 cents and ended at $3.95 in an exchange of 4,638 shares. Scotia Group sank $2.70 to close at $41, with 21,477 units changing hands, Stanley Motta rose 30 cents in closing at $7.50 after an exchange of 72,781 stocks, Supreme Ventures gained 25 cents to end at $25 and closed with an exchange of 182,302 stock units. Sygnus Real Estate Finance climbed $1.05 in closing at $11.55 in an exchange of just one share and Wisynco Group popped 95 cents to $21.45 with 51,527 stock units crossing the market before the company released their third quarte results with flat earnings in the third quarter after tax .

In the preference segment, Productive Business Solutions 9.75% preference share shed $1.50 to finish at $113.50 with investors swapping 152 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

A Cemented Jump on the JSE Main Market

Caribbean Cement at 1 year high

Caribbean Cement buoyed by solid first quarter results jumped $8.92 to a 52 weeks’ high of $69.90 as investors placed buying pressure on the stock that is currently in low supply. The Jamaica Stock Exchange ended trading on Friday as the Junior Market rose moderately, as the Main and the JSE USD markets fell, with trading ended with the number of stocks changing hands falling, while the value greater than the previous day, resulting in prices of 32 shares rising and 38 declining.

At the close of the market, the JSE Combined Market Index dropped 1,966.60 points to 334,026, the All Jamaican Composite Index dived 2,933.34 points to 358,098.21. The JSE Main Index declined 2,094.43 points to 320,793.99. The Junior Market Index advanced 5.91 points to finish at 3,803.31 and the JSE USD Market Index shed 1.43 points to close at 236.44.

At the close of the market, the JSE Combined Market Index dropped 1,966.60 points to 334,026, the All Jamaican Composite Index dived 2,933.34 points to 358,098.21. The JSE Main Index declined 2,094.43 points to 320,793.99. The Junior Market Index advanced 5.91 points to finish at 3,803.31 and the JSE USD Market Index shed 1.43 points to close at 236.44.

At the close of trading, 7,495,887 shares were exchanged in all three markets, down from 16,848,224 units on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $73.15 million, just over the $68.79 million on the previous day and the JSE USD market closed with an exchange of 107,250 shares for US$8,800 compared to 98,700 units at US$20,672 on Thursday.

In Main Market activity, Transjamaican Highway led trading with 837,274 shares followed by Carreras with 662,564 stocks and Wigton Windfarm with 642,927 units.

In Junior Market trading, Dolla Financial led trading with 686,474 shares followed by Everything Fresh with 522,652 units and Express Catering with 211,271 stocks.

In the preference segment, Productive Business Solutions 9.75% preference share shed $1.50 to close at $113.50.

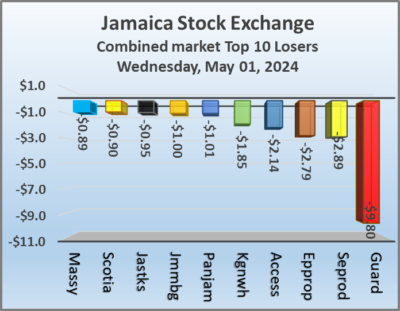

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.6 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.6 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

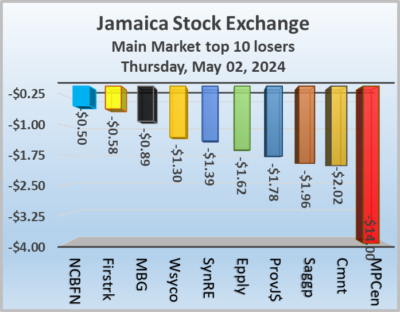

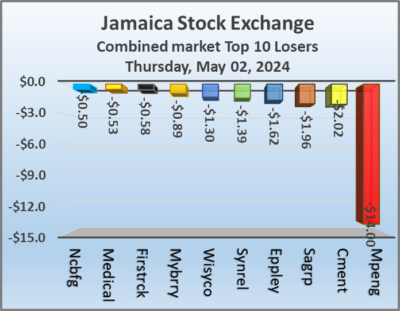

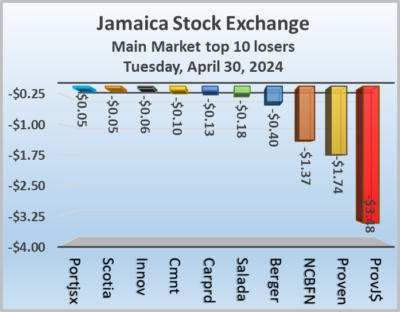

Rising JSE Main Market stocks top losers

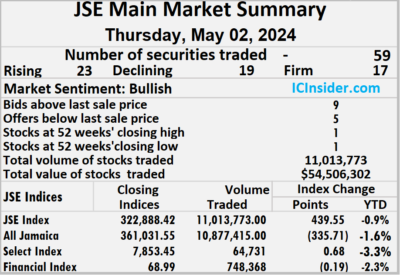

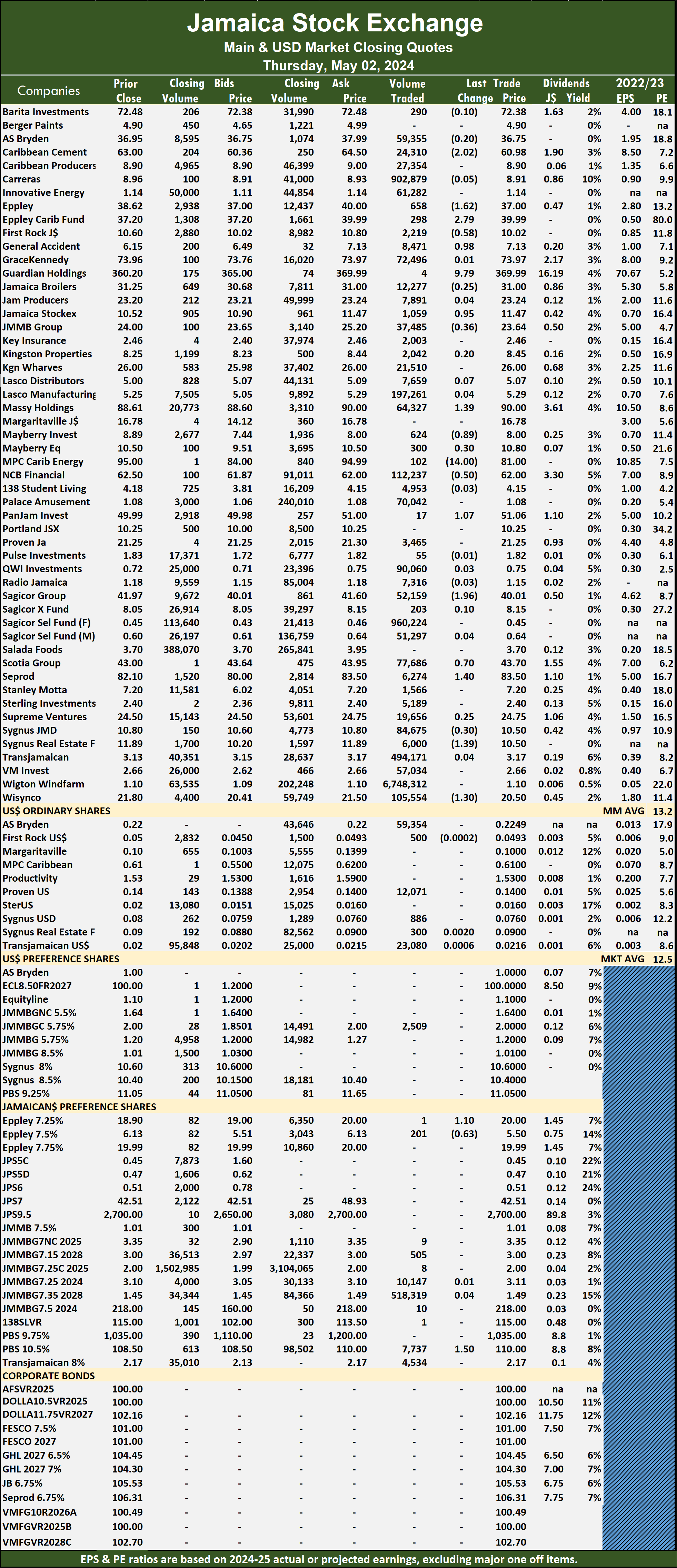

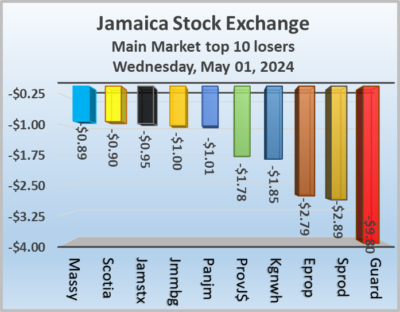

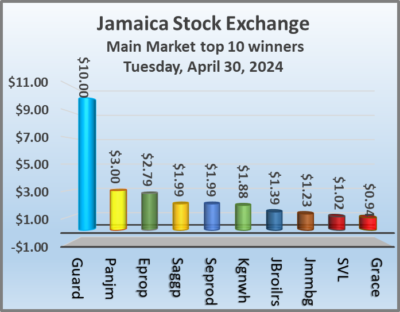

Rising stocks edged out those declining on the Jamaica Stock Exchange Main Market on Thursday, following a 37 percent dive in the volume of stocks traded with a value 13 percent lower than on Wednesday, after the market closed with trading in 59 securities as it was on Wednesday and ended with prices of 23 stocks rising, 19 declining and 17 ending unchanged.

Trading ended on the Main Market with 11,013,773 shares with value of $54,506,302 from 17,557,651 units at $62,870,817 on Wednesday.

Trading ended on the Main Market with 11,013,773 shares with value of $54,506,302 from 17,557,651 units at $62,870,817 on Wednesday.

Trading averaged 186,674 shares at $923,836 compared to 297,587 units at $1,065,607 on Wednesday and month to date, an average of 242,131 units at $994,721 compared with April that ended with an average of 680,802 units at $3,619,595.

Wigton Windfarm led trading with 6.75 million shares for 61.3 percent of total volume followed by Sagicor Select Financial Fund with 960,224 units for 8.7 percent of the day’s trade and Carreras with 902,879 stocks for 8.2 percent market share.

The All Jamaican Composite Index slipped 335.71 points to 361,031.55, the JSE Main Index gained 439.55 points to end the day at 322,888.42 and the JSE Financial Index fell 0.19 points to close at 68.99.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and five with lower offers.

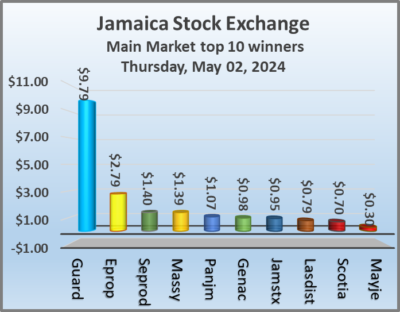

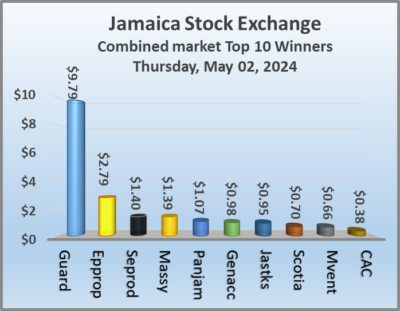

At the close, Caribbean Cement shed $2.02 to finish at $60.98, after trading at an intraday 52 weeks’ high of 65.90 and ending with 24,310 stock units crossing the market, with supply being meagre at the close and suggesting the price is set to jump sharply the days ahead, following blow out first quarter results. Eppley sank $1.62 to $37 with an exchange of 658 shares, Eppley Caribbean Property Fund popped $2.79 to end at $39.99 and closed with an exchange of 298 stocks. First Rock Real Estate skidded 58 cents in closing at $10.02 with investors trading 2,219 units, General Accident increased 98 cents and ended at 52 weeks’ high $7.13 after hitting an intraday high of $8.01 with a transfer of 8,471 shares, leaving just five offers on the board at the close with prices between $7.13 and $9. Guardian Holdings climbed $9.79 to close at $369.99 after investors ended trading a mere four stock units. Jamaica Stock Exchange rose 95 cents to $11.47 with investors dealing in 1,059 stocks, JMMB Group lost 36 cents to end at 52 weeks’ low of $23.64 in an exchange of 37,485 units, Massy Holdings rallied $1.39 in closing at $90 with traders dealing in 64,327 shares.

At the close, Caribbean Cement shed $2.02 to finish at $60.98, after trading at an intraday 52 weeks’ high of 65.90 and ending with 24,310 stock units crossing the market, with supply being meagre at the close and suggesting the price is set to jump sharply the days ahead, following blow out first quarter results. Eppley sank $1.62 to $37 with an exchange of 658 shares, Eppley Caribbean Property Fund popped $2.79 to end at $39.99 and closed with an exchange of 298 stocks. First Rock Real Estate skidded 58 cents in closing at $10.02 with investors trading 2,219 units, General Accident increased 98 cents and ended at 52 weeks’ high $7.13 after hitting an intraday high of $8.01 with a transfer of 8,471 shares, leaving just five offers on the board at the close with prices between $7.13 and $9. Guardian Holdings climbed $9.79 to close at $369.99 after investors ended trading a mere four stock units. Jamaica Stock Exchange rose 95 cents to $11.47 with investors dealing in 1,059 stocks, JMMB Group lost 36 cents to end at 52 weeks’ low of $23.64 in an exchange of 37,485 units, Massy Holdings rallied $1.39 in closing at $90 with traders dealing in 64,327 shares.  Mayberry Group dropped 89 cents to finish at $8 in an exchange of 624 units, Mayberry Jamaican Equities gained 30 cents and ended at $10.80, with 300 stocks clearing the market, MPC Caribbean Clean Energy fell $14 to close at $81 with a transfer of 102 stock units. NCB Financial slipped 50 cents to $62 after an exchange of 112,237 shares, Pan Jamaica advanced $1.07 to finish at $51.06 in trading 17 stocks, Sagicor Group dipped $1.96 and ended at $40.01 after 52,159 units crossed the market. Scotia Group rose 70 cents in closing at $43.70 in switching ownership of 77,686 stock units, Seprod rallied $1.40 to close at $83.50 as investors exchanged 6,274 shares, Sygnus Credit Investments declined 30 cents to end at $10.50 after 84,675 stock units passed through the market. Sygnus Real Estate Finance shed $1.39 to $10.50, with 6,000 units crossing the exchange and Wisynco Group fell $1.30 to end at $20.50 with investors swapping 105,554 stocks.

Mayberry Group dropped 89 cents to finish at $8 in an exchange of 624 units, Mayberry Jamaican Equities gained 30 cents and ended at $10.80, with 300 stocks clearing the market, MPC Caribbean Clean Energy fell $14 to close at $81 with a transfer of 102 stock units. NCB Financial slipped 50 cents to $62 after an exchange of 112,237 shares, Pan Jamaica advanced $1.07 to finish at $51.06 in trading 17 stocks, Sagicor Group dipped $1.96 and ended at $40.01 after 52,159 units crossed the market. Scotia Group rose 70 cents in closing at $43.70 in switching ownership of 77,686 stock units, Seprod rallied $1.40 to close at $83.50 as investors exchanged 6,274 shares, Sygnus Credit Investments declined 30 cents to end at $10.50 after 84,675 stock units passed through the market. Sygnus Real Estate Finance shed $1.39 to $10.50, with 6,000 units crossing the exchange and Wisynco Group fell $1.30 to end at $20.50 with investors swapping 105,554 stocks.

In the preference segment, Eppley 7.25% preference share popped $1.10 in closing at $20 after an exchange of just one share. Eppley 7.50% preference share dipped 63 cents and ended at $5.50, with 201 stocks changing hands and Sygnus Credit Investments C10.5% gained $1.50 to close at $110 with investors transferring 7,737 units.

In the preference segment, Eppley 7.25% preference share popped $1.10 in closing at $20 after an exchange of just one share. Eppley 7.50% preference share dipped 63 cents and ended at $5.50, with 201 stocks changing hands and Sygnus Credit Investments C10.5% gained $1.50 to close at $110 with investors transferring 7,737 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Moderate trading for Jamaica Stock Exchange

The Main and the USD markets of the Jamaica Stock Exchange rose moderately at the end of trading on Thursday but the Junior Market closed moderately lower as trading ended with fewer shares changing hands at a lower value than the previous day, resulting in prices of 35 shares rising and 38 declining.

At the close of the market, the JSE Combined Market Index rose 324.91 points to 335,992.60, the All Jamaican Composite Index declined by 335.71 points to end trading at 361,031.55, the JSE Main Index climbed 439.55 points to end trading at 322,888.42. The Junior Market Index fell 13.84 points to close at 3,797.40 and the JSE USD Market Index rallied 3.15 points to conclude trading at 237.87.

At the close of the market, the JSE Combined Market Index rose 324.91 points to 335,992.60, the All Jamaican Composite Index declined by 335.71 points to end trading at 361,031.55, the JSE Main Index climbed 439.55 points to end trading at 322,888.42. The Junior Market Index fell 13.84 points to close at 3,797.40 and the JSE USD Market Index rallied 3.15 points to conclude trading at 237.87.

At the close of trading, 16,848,224 shares were exchanged in all three markets, down from 21,758,231 units on Wednesday, with the value of stocks traded on the Junior and Main markets amounted to $68.79 million, compared with $71.03 million on the previous trading day and the JSE USD market closed with an exchange of 98,700 shares for US$20,672 compared to 148,890 units at US$30,599 on Wednesday.

In Main Market activity, Wigton Windfarm led trading with 6.75 million shares followed by Sagicor Select Financial Fund with 960,224 stocks and Carreras with 902,879 units.

In Junior Market trading, Dolla Financial led trading with 1.65 million shares followed by Fosrich with 1.08 million stocks and Spur Tree Spices with 810,468 units.

In the preference segment, Eppley 7.25% preference share popped $1.10 to $20, Eppley 7.50% preference share dipped 63 cents to end at $5.50 and Sygnus Credit Investments C10.5% gained $1.50 to close at $110.

In the preference segment, Eppley 7.25% preference share popped $1.10 to $20, Eppley 7.50% preference share dipped 63 cents to end at $5.50 and Sygnus Credit Investments C10.5% gained $1.50 to close at $110.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.6 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

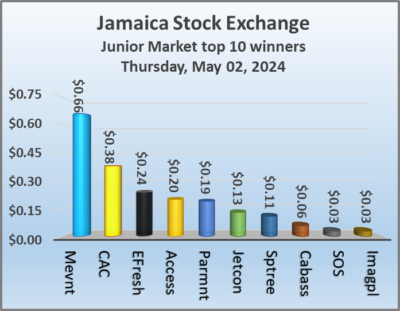

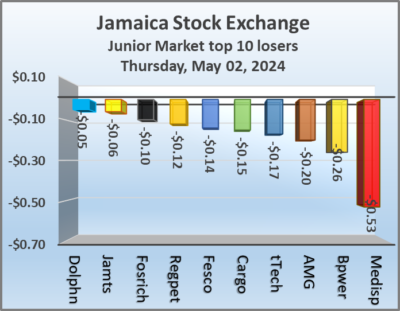

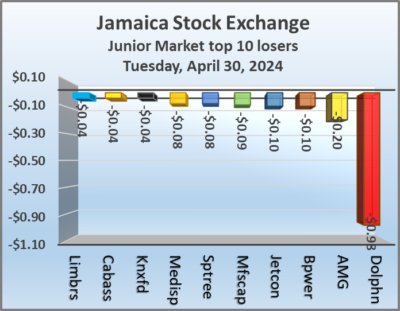

Trading jumps on the Junior Market

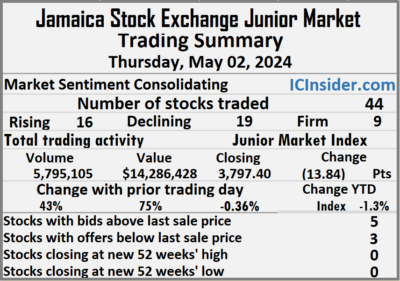

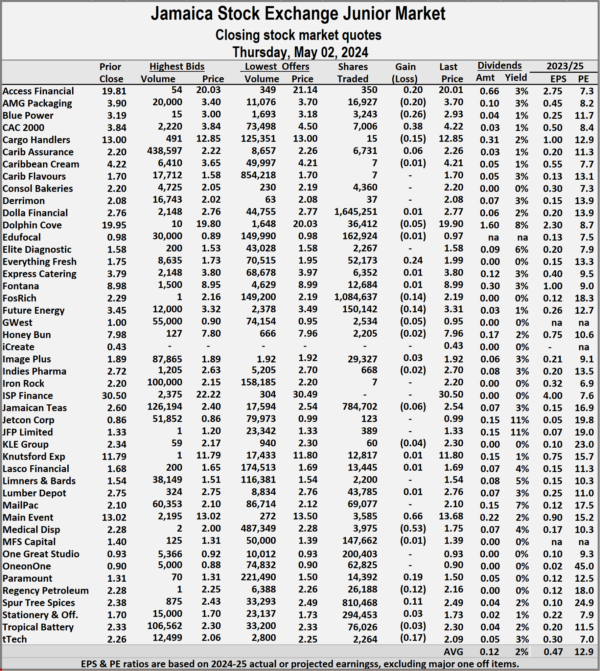

Stocks mostly declined at the close on the Junior Market of the Jamaica Stock Exchange on Thursday, after trading in 44 securities compared with 43 on Wednesday and ending with prices of 16 rising, 19 declining and nine ending unchanged following a 43 percent rise in the volume of stocks following a 75 percent jump in value over Wednesday.

The market closed with 5,795,105 shares being traded for $14,286,428 up from 4,063,270 units at $8,160,284 on Wednesday.

The market closed with 5,795,105 shares being traded for $14,286,428 up from 4,063,270 units at $8,160,284 on Wednesday.

Trading averaged 131,707 shares at $324,692, up from 94,495 units at $189,774 on Wednesday with for the month to date, averaging 113,315 units at $258,008 compared to April with an average of 204,118 units at $439,599.

Dolla Financial led trading with 1.65 million shares for 28.4 percent of total volume followed by Fosrich with 1.08 million units for 18.7 percent of the day’s trade and Spur Tree Spices with 810,468 stock units for 14 percent market share.

At the close of trading, the Junior Market Index lost 13.84 points to lock up trading at 3,797.40, with market down 1.3 percent for the year to date.

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Access Financial climbed 20 cents to finish at $20.01 with 350 share clearing the market, AMG Packaging skidded 20 cents to $3.70 in an exchange of 16,927 stocks, Blue Power sank 26 cents in closing at $2.93, with investors trading 3,243 shares. CAC 2000 rose 38 cents to close at $4.22, with 7,006 stock units crossing the market, Cargo Handlers declined 15 cents to end at $12.85 as investors exchanged 15 shares, Caribbean Assurance Brokers gained 6 cents and ended at $2.26, with 6,731 stock units changing hands. Consolidated Bakeries fell 15 cents to $2.05 with traders dealing in 4,360 stocks, Dolphin Cove slipped 5 cents to end at $19.90, after trading at an intraday 52 weeks’ high of $20.03 before closing with an exchange of 36,412 units, Everything Fresh popped 24 cents in closing at $1.99 with investors trading 52,173 shares.  Fosrich lost 10 cents to close at $2.19 after an exchange of 1,084,637 units, Future Energy dipped 14 cents to finish at $3.31 after 150,142 stocks passed through the market, GWest Corporation dropped 5 cents and ended at 95 cents in switching ownership of 2,534 stock units. Jamaican Teas shed 6 cents to end at $2.54 with 784,702 shares crossing the market, Jetcon Corporation rallied 13 cents and ended at 99 cents in an exchange of 123 stock units, Main Event increased 66 cents to close at $13.68 with investors swapping 3,585 units. Medical Disposables fell 53 cents to finish at $1.75 after an exchange of 3,975 stocks, Paramount Trading advanced 19 cents to end at $1.50 in trading 14,392 shares, Regency Petroleum slipped 12 cents in closing at $2.16 after a transfer of 26,188 units. Spur Tree Spices popped 11 cents to $2.49, with 810,468 stocks crossing the exchange and tTech lost 17 cents to end at $2.09 with a transfer of 2,264 stock units.

Fosrich lost 10 cents to close at $2.19 after an exchange of 1,084,637 units, Future Energy dipped 14 cents to finish at $3.31 after 150,142 stocks passed through the market, GWest Corporation dropped 5 cents and ended at 95 cents in switching ownership of 2,534 stock units. Jamaican Teas shed 6 cents to end at $2.54 with 784,702 shares crossing the market, Jetcon Corporation rallied 13 cents and ended at 99 cents in an exchange of 123 stock units, Main Event increased 66 cents to close at $13.68 with investors swapping 3,585 units. Medical Disposables fell 53 cents to finish at $1.75 after an exchange of 3,975 stocks, Paramount Trading advanced 19 cents to end at $1.50 in trading 14,392 shares, Regency Petroleum slipped 12 cents in closing at $2.16 after a transfer of 26,188 units. Spur Tree Spices popped 11 cents to $2.49, with 810,468 stocks crossing the exchange and tTech lost 17 cents to end at $2.09 with a transfer of 2,264 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Carib Cement hits one year high

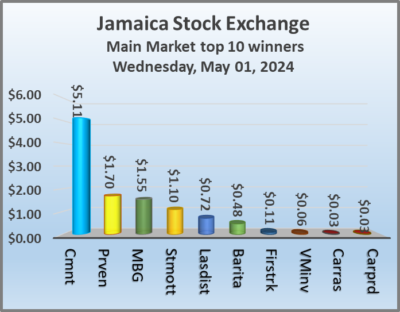

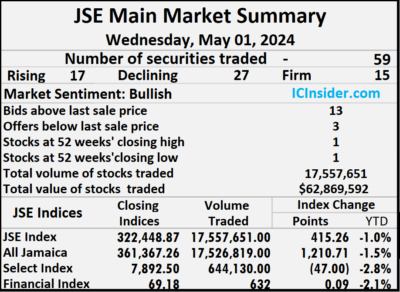

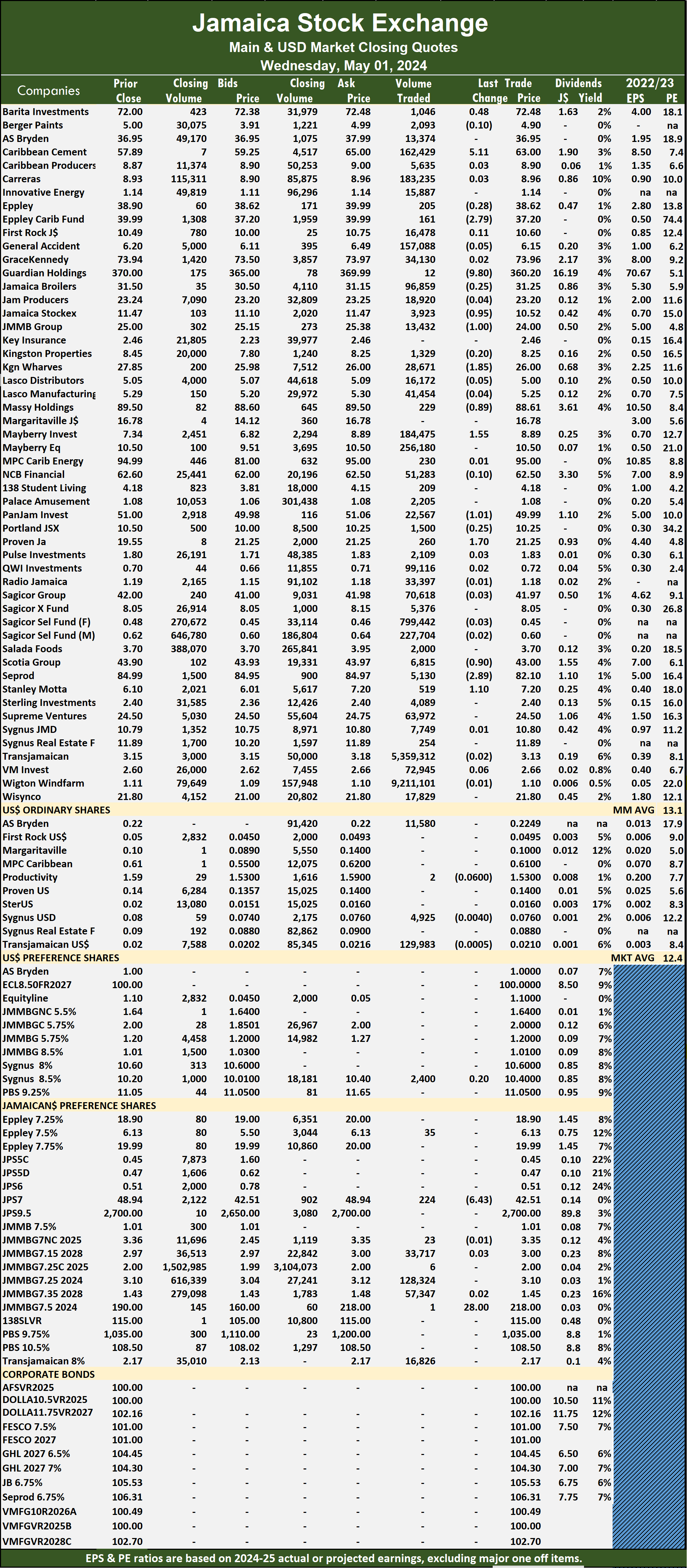

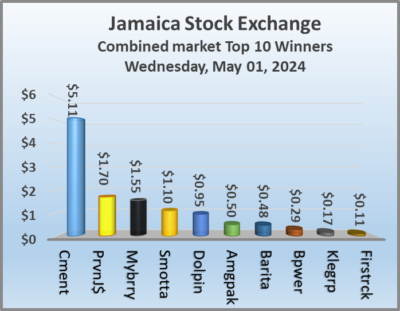

Caribbean Cement surged $5.11 to close at a 52 weeks’ high of $63 on the Jamaica Stock Exchange Main Market on Wednesday in response to solid first quarter results and helped in the trading of 59 securities compared with 65 on Tuesday, with prices of 17 rising, 27 declining and 15 ending unchanged following a modest drop in the volume of stocks traded after a 45 percent drop in the value compared with Tuesday.

The market closed with trading in 17,557,651 shares for $62,870,817 compared with 17,048,881 units at $114,820,484 on Tuesday.

The market closed with trading in 17,557,651 shares for $62,870,817 compared with 17,048,881 units at $114,820,484 on Tuesday.

Trading averaged 297,587 shares at $1,065,607 compared with 262,290 stock units at $1,766,469 on Tuesday compared with April with an average of 680,802 units at $3,619,595.

Wigton Windfarm was the leading traded stock with 9.21 million units for 52.5 percent of total volume followed by Transjamaican Highway with 5.36 million stocks for 30.5 percent of the day’s trade and Sagicor Select Financial Fund with 799,442 units for 4.6 percent market share.

The All Jamaican Composite Index gained 1,210.71 points to end at 361,367.26, the JSE Main Index increased 415.26 points to 322,448.87 and the JSE Financial Index inched 0.09 points higher to end the day at 69.18.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments increased 48 cents and ended at $72.48 after a transfer of 1,046 shares, Caribbean Cement jumped $5.11 to close at a 52 weeks’ high of $63 after 162,429 units were traded, Eppley Caribbean Property Fund fell $2.79 to end at $37.20 after 161 shares passed through the market. Guardian Holdings dropped $9.80 in closing at $360.20 after an exchange of 12 stock units, Jamaica Stock Exchange sank 95 cents to close at $10.52, with 3,923 shares crossing the market, JMMB Group dipped $1 to finish at $24 as investors exchanged 13,432 stock units.  Kingston Wharves lost $1.85 to close at $26 with 28,671 units clearing the market, Massy Holdings declined by 89 cents to finish at $88.61 after an exchange of 229 stocks, Mayberry Group rose $1.55 to close at $8.89 with investors trading 184,475 shares. Pan Jamaica shed $1.01 to end at $49.99, with 22,567 units crossing the exchange, Proven Investments rallied $1.70 to close at $21.25 in switching ownership of 260 stocks, Scotia Group skidded 90 cents to close at $43 with traders dealing in 6,815 stock units. Seprod slipped $2.89 to $82.10 in an exchange of 5,130 shares and Stanley Motta popped $1.10 to finish at $7.20, with 519 stocks crossing the market.

Kingston Wharves lost $1.85 to close at $26 with 28,671 units clearing the market, Massy Holdings declined by 89 cents to finish at $88.61 after an exchange of 229 stocks, Mayberry Group rose $1.55 to close at $8.89 with investors trading 184,475 shares. Pan Jamaica shed $1.01 to end at $49.99, with 22,567 units crossing the exchange, Proven Investments rallied $1.70 to close at $21.25 in switching ownership of 260 stocks, Scotia Group skidded 90 cents to close at $43 with traders dealing in 6,815 stock units. Seprod slipped $2.89 to $82.10 in an exchange of 5,130 shares and Stanley Motta popped $1.10 to finish at $7.20, with 519 stocks crossing the market.

In the preference segment, Jamaica Public Service 7% sank $6.43 and ended at $42.51 with an exchange of 224 units and 138 Student Living preference share gained $28 in closing at $218 after trading just one stock unit.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

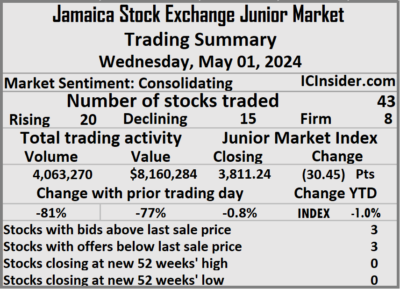

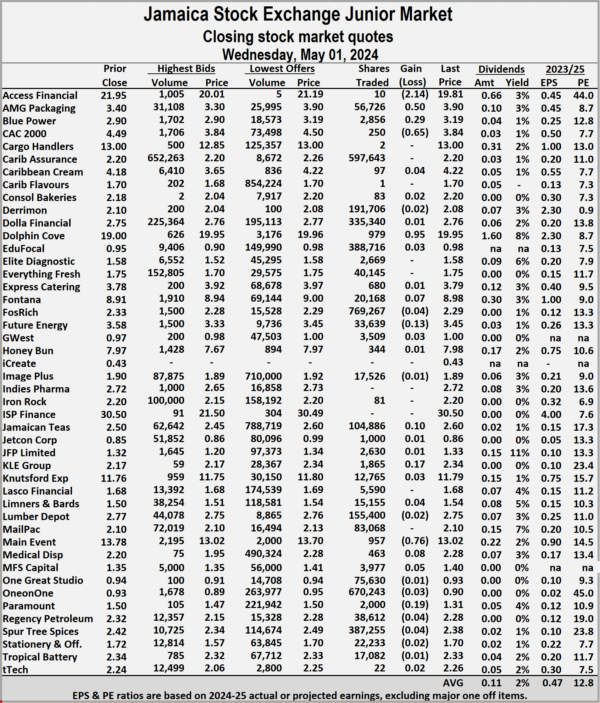

Junior Market gives up month-end gains

The Junior Market of the Jamaica Stock Exchange dropped on Wednesday, following the month-end push on Tuesday and ended with an 81 percent plunge in the volume of stocks traded, with a 77 percent lower value than on Tuesday after trading in 43 securities compared with 45 on the prior day and ending with prices of 20 rising, 15 declining and eight closing unchanged.

The market closed with an exchange of 4,063,270 shares for $8,160,284 compared with 20,940,690 units at $35,353,286 on Tuesday.

The market closed with an exchange of 4,063,270 shares for $8,160,284 compared with 20,940,690 units at $35,353,286 on Tuesday.

Trading averaged 94,495 shares at $189,774 compared to 465,349 units at $785,629 on Tuesday compared to April with an average of 204,118 units at $439,599.

Fosrich was the lead trade with 769,267 shares for 18.9 percent of total volume followed by ONE on ONE Educational that ended with 670,243 units for 16.5 percent of the day’s trade and Caribbean Assurance Brokers with 597,643 units for 14.7 percent market share.

At the close of trading, the Junior Market Index dropped 30.45 points to settle at 3,811.24.

The Junior Market ended trading with an average PE Ratio of 12.8, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.8, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Access Financial dropped $2.14 to end at $19.81, with an exchange of 10 shares, AMG Packaging climbed 50 cents and ended at $3.90 with a transfer of 56,726 stocks, Blue Power rose 29 cents to $3.19 with 2,856 shares crossing the market. CAC 2000 fell 65 cents to end at $3.84 with an exchange of 250 stock units, Dolphin Cove rallied 95 cents in closing at $19.95 after 979 shares passed through the market, Fontana popped 7 cents to close at $8.98 with investors swapping 20,168 stock units.  Future Energy skidded 13 cents to close at $3.45 with 33,639 units clearing the market, Jamaican Teas gained 10 cents to close at $2.60 as investors traded 104,886 stocks, KLE Group advanced 17 cents to finish at $2.34 in trading 1,865 units. Main Event lost 76 cents after ending at $13.02, with 957 shares crossing the exchange, Medical Disposables gained 8 cents to end at $2.28, with 463 stock units changing hands, MFS Capital Partners climbed 5 cents in closing at $1.40 in an exchange of 3,977 stocks and Paramount Trading slipped 19 cents to $1.31 with investors trading 2,000 units.

Future Energy skidded 13 cents to close at $3.45 with 33,639 units clearing the market, Jamaican Teas gained 10 cents to close at $2.60 as investors traded 104,886 stocks, KLE Group advanced 17 cents to finish at $2.34 in trading 1,865 units. Main Event lost 76 cents after ending at $13.02, with 957 shares crossing the exchange, Medical Disposables gained 8 cents to end at $2.28, with 463 stock units changing hands, MFS Capital Partners climbed 5 cents in closing at $1.40 in an exchange of 3,977 stocks and Paramount Trading slipped 19 cents to $1.31 with investors trading 2,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Cement pops $5.11 to $63 on record profit

Following the release of first quarter results with profit surging by 546 percent to $1.9 billion compared to just $289 million in 2023, Caribbean Cement climbed $5.11 to $63 and helped push the Main Market index higher at the close of trading on the Jamaica Stock Exchange on Wednesday, but the Junior Market JSE USD market closed lower, with trading ending with the number and the value of stocks changing hands falling, from that of the previous day and resulting in prices of 35 shares rising and 39 declining.

At the close of the market, the JSE Combined Market Index popped 185.88 points to 335,667.69, the All Jamaican Composite Index climbed 1,210.71 points to 361,367.26, the JSE Main Index increased 415.26 points to 322,448.87. The Junior Market Index shed 30.45 points to close at 3,811.24 and the JSE USD Market Index sank 6.14 points to close at 234.72.

At the close of the market, the JSE Combined Market Index popped 185.88 points to 335,667.69, the All Jamaican Composite Index climbed 1,210.71 points to 361,367.26, the JSE Main Index increased 415.26 points to 322,448.87. The Junior Market Index shed 30.45 points to close at 3,811.24 and the JSE USD Market Index sank 6.14 points to close at 234.72.

At the close of trading, 21,758,231 shares were exchanged in all three markets, down from 38,032,128 units on Tuesday, with the value of stocks traded on the Junior and Main markets amounts to $71.03 million, well below the $150.17 million on the previous trading day and the JSE USD market closed with an exchange of 148,890 shares for US$30,599 compared to 82,573 units at US$14,855 on Tuesday.

In Main Market activity, Wigton Windfarm led trading with 9.21 million shares followed by Transjamaican Highway with 5.36 million units and Sagicor Select Financial Fund with 799,442 stocks.

In Junior Market trading, Fosrich led trading with 769,267 shares followed by ONE on ONE Educational with 670,243 stock units and Caribbean Assurance Brokers with 597,643 units.

At the close of trading the Main Market listed

In the preference segment, Jamaica Public Service 7% sank $6.43 and ended at $42.51 and 138 Student Living preference share gained $28 in closing at $218.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.90 on 2023-24 earnings and 13.6 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.90 on 2023-24 earnings and 13.6 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

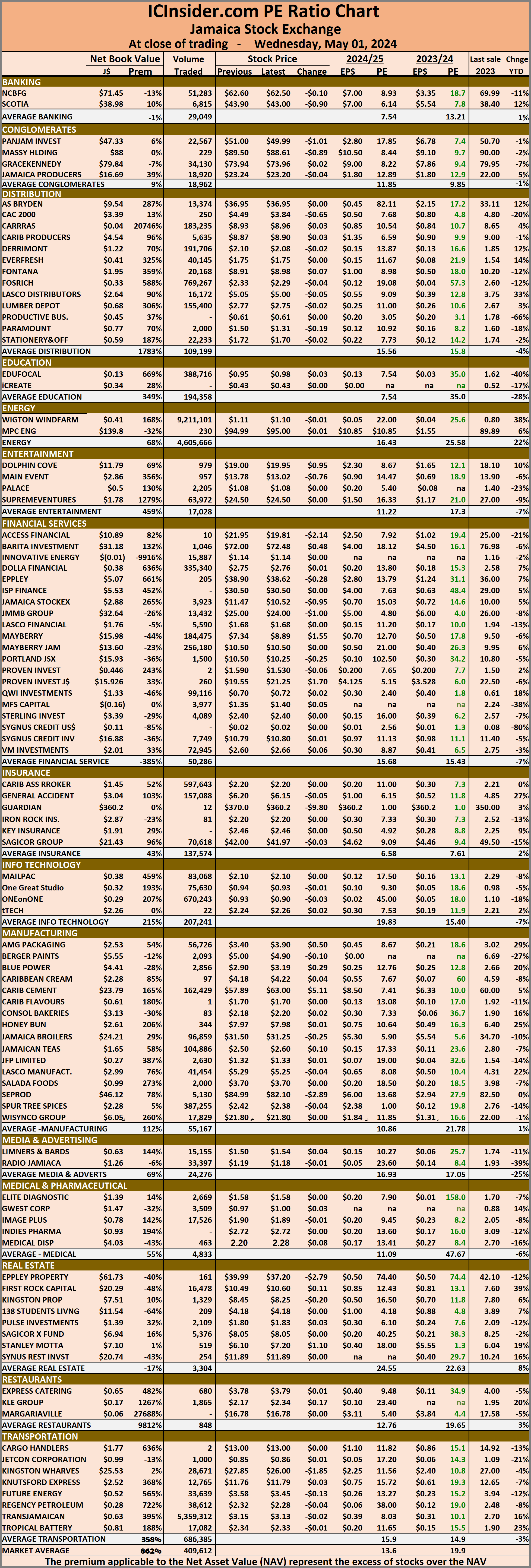

Main Market rises to close out April

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks changing hands rising 25 percent and the value 42 percent more than on Monday, with trading in 65 securities up from 62 on Monday, with prices of 29 stocks rising, 19 declining and 17 ending unchanged.

The market closed with trading of 17,048,881 shares for $114,820,484 compared with 13,649,755 units at $80,716,595 on Monday.

The market closed with trading of 17,048,881 shares for $114,820,484 compared with 13,649,755 units at $80,716,595 on Monday.

Trading averaged 262,290 shares at $1,766,469 compared with 220,157 units at $1,301,881 on Monday with trading month to date averaging 680,802 stock units at $3,619,595, in comparison with 703,378 units at $3,719,556 on the previous day and March that closed with an average of 828,473 units at $2,341,254.

Wigton Windfarm led trading with 7.73 million shares for 45.3 percent of total volume followed by Sagicor Select Financial Fund with 2.44 million units for 14.3 percent of the day’s trade, Supreme Ventures with 1.41 million stock units for 8.3 percent market share, Lasco Distributors ended with 1.19 million units for 7 percent of the stocks traded and Transjamaican Highway with 1.01 million units for 5.9 percent of total volume.

The All Jamaican Composite Index gained 2,671.92 points to end at 360,156.55, the JSE Main Index climbed 1,606.70 points to conclude trading at 322,033.61 and the JSE Financial Index rallied 0.49 points to culminate at 69.09.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Berger Paints fell 40 cents and ended at a 52 weeks’ low of $5 in trading 68,337 stocks, Eppley Caribbean Property Fund rallied $2.79 to $39.99 after an exchange of 20 units, GraceKennedy rose 94 cents to close at $73.94 with a transfer of 199,944 shares. Guardian Holdings advanced $10 to end at $370 with 266 stock units crossing the market, Jamaica Broilers popped $1.39 in closing at $31.50 in an exchange of 133,114 shares, Jamaica Stock Exchange increased 92 cents to finish at $11.47 with investors transferring 7,099 units. JMMB Group climbed $1.23 to $25 after exchanging 45,254 stocks, Kingston Wharves gained $1.88 to end at $27.85 with investors trading 823 stock units, NCB Financial skidded $1.37 in closing at $62.60 after a transfer of 14,152 shares.  Pan Jamaica popped $3 and ended at $51 with 139,090 stocks crossing the exchange, Proven Investments lost $1.74 to close at $19.55 with investors dealing in 4,206 units, Sagicor Group advanced $1.99 to finish at $42 in an exchange of 45,629 stock units. Sagicor Real Estate Fund rose 55 cents and ended at $8.05, with 109,893 shares passing through the market, Seprod rallied $1.99 to $84.99 and closed with an exchange of 63,171 stocks, Supreme Ventures gained $1.02 to end at $24.50 with 1,409,131 stocks clearing the market and Wisynco Group climbed 50 cents in closing at $21.80 with an exchange of 242,664 units.

Pan Jamaica popped $3 and ended at $51 with 139,090 stocks crossing the exchange, Proven Investments lost $1.74 to close at $19.55 with investors dealing in 4,206 units, Sagicor Group advanced $1.99 to finish at $42 in an exchange of 45,629 stock units. Sagicor Real Estate Fund rose 55 cents and ended at $8.05, with 109,893 shares passing through the market, Seprod rallied $1.99 to $84.99 and closed with an exchange of 63,171 stocks, Supreme Ventures gained $1.02 to end at $24.50 with 1,409,131 stocks clearing the market and Wisynco Group climbed 50 cents in closing at $21.80 with an exchange of 242,664 units.

In the preference segment, 138 Student Living preference share gained $4.70 to close at $190 after investors ended trading 81 shares and Sygnus Credit Investments C10.5% sank 50 cents to finish at $108.50, with 1,203 stocks crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

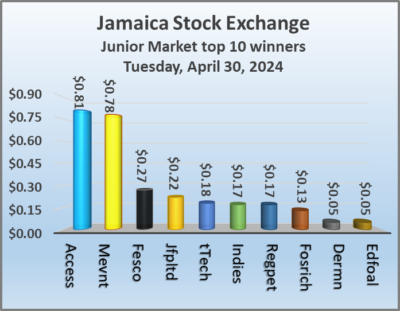

Trading jumped on the Junior Market

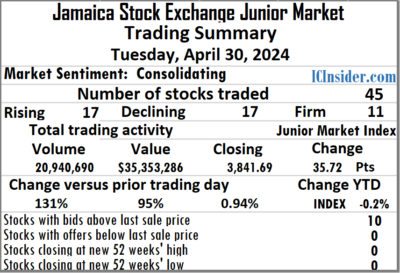

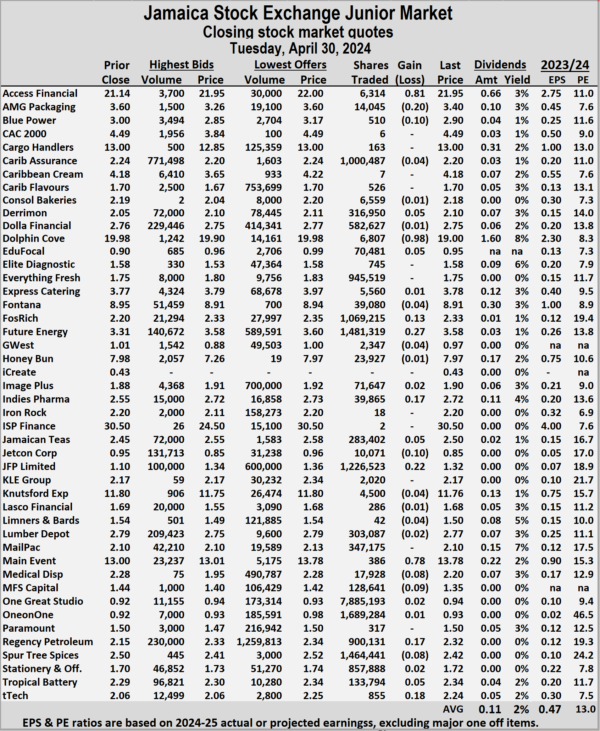

The Junior Market of the Jamaica Stock Exchange ended trading on Tuesday closing the month with gains and ended with a 131 percent rise in the volume of stocks traded, after a 95 percent rise in value compared with Monday with trading in all 45 tradeable securities compared similarly to Monday and ending with prices of 17 rising, 17 declining and 11 closing unchanged.

The market closed with trading of 20,940,690 shares at $35,353,286 up from 9,071,987 units at $18,144,139 on Monday.

The market closed with trading of 20,940,690 shares at $35,353,286 up from 9,071,987 units at $18,144,139 on Monday.

Trading averaged 465,349 shares at $785,629 compared to 201,600 units at $403,203 on Monday with trading the month to date, averaging 204,118 stock units at $439,599 compared to 190,559 units for $421,638 on the previous day and March averaging 221,659 units at $464,382.

One Great Studio led trading with 7.89 million shares for 37.7 percent of total volume followed by ONE on ONE Educational with 1.69 million units for 8.1 percent of the day’s trade, Future Energy ended with 1.48 million units for 7.1 percent market share, Spur Tree Spices chipped in with 1.46 million units for 7 percent of trading, JFP Ltd with 1.23 million units for 5.9 percent of share traded and Fosrich with 1.07 million units for 5.1 percent of total volume.

At the close of trading, the Junior Market Index advanced 35.72 points to end the day at 3,841.69, with the month closing a fraction lower than the start of the year, but the market closed lower than the close in March.

The Junior Market ended trading with an average PE Ratio of 13, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 13, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Access Financial gained 81 cents in closing at $21.95 with investors swapping 6,314 stock units, AMG Packaging lost 20 cents to end at $3.40 and closed with an exchange of 14,045 shares, Blue Power shed 10 cents to end at $2.90 with investors dealing in 510 stocks. Derrimon Trading popped 5 cents to close at $2.10 in an exchange of 316,950 units, Dolphin Cove fell 98 cents to finish at $19 with traders dealing in 6,807 shares, EduFocal climbed 5 cents and ended at 95 cents after a transfer of 70,481 stock units. Fosrich increased 13 cents to $2.33 in trading 1,069,215 units, Future Energy rose 27 cents and ended at $3.58, with 1,481,319 stocks crossing the market, Indies Pharma rallied 17 cents to $2.72 after investors traded 39,865 shares. Jamaican Teas advanced 5 cents to end at $2.50 after 283,402 stock units passed through the market, Jetcon Corporation slipped 10 cents in closing at 85 cents with investors trading 10,071 stocks, JFP Ltd popped 22 cents to finish at $1.32, with 1,226,523 units crossing the exchange. Main Event increased 78 cents to $13.78 with investors transferring 386 stocks, Medical Disposables sank 8 cents to end at $2.20, with 17,928 units crossing the market, MFS Capital Partners dropped 9 cents in closing at $1.35 with an exchange of 128,641 shares. Regency Petroleum climbed 17 cents and ended at $2.32 with 900,131 stock units clearing the market, Spur Tree Spices declined 8 cents to close at $2.42 in switching ownership of 1,464,441 shares, Tropical Battery rose 5 cents to finish at $2.34 after exchanging 133,794 units and tTech rallied 18 cents to $2.24 with a transfer of 855 stocks.

Indies Pharma rallied 17 cents to $2.72 after investors traded 39,865 shares. Jamaican Teas advanced 5 cents to end at $2.50 after 283,402 stock units passed through the market, Jetcon Corporation slipped 10 cents in closing at 85 cents with investors trading 10,071 stocks, JFP Ltd popped 22 cents to finish at $1.32, with 1,226,523 units crossing the exchange. Main Event increased 78 cents to $13.78 with investors transferring 386 stocks, Medical Disposables sank 8 cents to end at $2.20, with 17,928 units crossing the market, MFS Capital Partners dropped 9 cents in closing at $1.35 with an exchange of 128,641 shares. Regency Petroleum climbed 17 cents and ended at $2.32 with 900,131 stock units clearing the market, Spur Tree Spices declined 8 cents to close at $2.42 in switching ownership of 1,464,441 shares, Tropical Battery rose 5 cents to finish at $2.34 after exchanging 133,794 units and tTech rallied 18 cents to $2.24 with a transfer of 855 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.