Jamaica Producers former headquarters in Kingston Jamaica

Profit surged 102 percent in the September quarter, to $330 million from $164 million in 2019 for shareholders of Jamaica Producers. For the nine months to September, profit jumped 66 percent to $959 million from $578 million in 2019 on the back of a modest rise in revenues.

Sale revenues rose just 5 percent for the quarter, to $5.22 billion from $4.96 billion but gained a stronger 8 percent for the year to date, to hit $15.4 billion from $14.3 billion in 2019. The third-quarter revenues grew more slowly than second-quarter revenues, which increased 12 percent to $5.4 billion over the 2018 period and net profit attributable to shareholders increased then by 52 percent to $399 million.

The group’s main activities are port terminal operations, logistics, food and juice manufacturing, the cultivation, marketing and distribution of fresh produce, land management and the holding of investments. The group has operations in the UK, Europe, Jamaica and some other Caribbean countries.

The current year is not the only one that profits jumped sharply for the group. In 2018, profit attributable to the Group’s shareholders rose 66.5 percent for the June quarter over that of 2017 and 65 percent for the half-year from revenues that grew 20 percent and 25 percent, respectively. The group had significant growth in profit from ongoing operations in 2017 over 2016 with negligible profit from operations.

Improvement in profit margin in the half of the year to 34 percent from 31 percent in 2018 continued at the same pace in the September quarter with 34 percent from 29 percent in 2018 and for the year to September, 34 percent from 30 percent in 2018. The improved margin helped push gross profit up 24 percent in the quarter to $1.76 billion from $1.42 million and rose 23 percent for the year to date, to $5.3 billion from $4.3 billion in 2019.

Selling, administration and other operating expenses rose 18 percent to $958 million in the quarter and increased 14 percent in the nine months to $2.8 million. Finance cost declined in the quarter, to $78 million from $89 million in 2018 and from $234 million to $277 million for the nine months.

Earnings per share (EPS) came out at 29.4 cents for the quarter and 85.5 cents for the nine months. EPS should end the fiscal year ending December to $1.25 with a PE ratio of 17 at the price of $21.50 it last traded on the main market of the Jamaica Stock Exchange and is in line with the average for main market stocks. The net asset value ended at $12.30, with the stock selling at 1.75 book value.

Gross cash flow brought in $3.7 billion, growth in receivables, investment transactions, purchase of fixed assets and the paying of $125 million in dividends resulted in cash funds at the ending at $927 million. At the end of September, shareholders’ equity stood at $14 billion, with borrowings at just $6 billion. Net current assets ended the period at $6.4 billion inclusive of trade and other receivables of $9 million, cash and bank balances of $927 million. Current liabilities stood at $3.2 billion at the end of September.

Jamaica Producers is a buy for the medium to long term.

potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. The increased values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. The increased values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

2019, then the company should go on to record a strong increase in profit in the 2020 fiscal year that starts this month.

2019, then the company should go on to record a strong increase in profit in the 2020 fiscal year that starts this month.

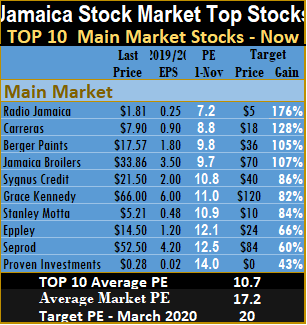

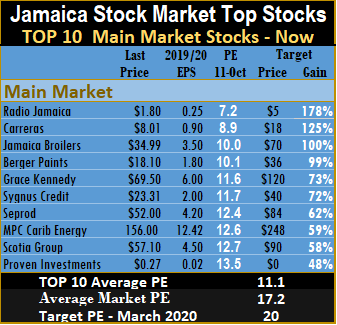

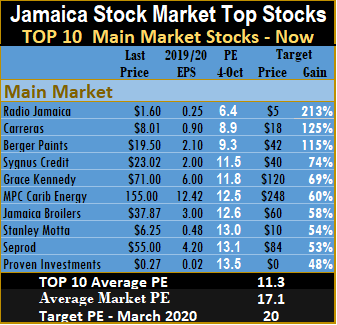

The main market slipped on each trading day, this past week with the market index dropping more than 11,000 points and has corrected nearly 8 percent from the peak in August while the Junior Market fell 65 points but the TOP 10 stocks had one change.

The main market slipped on each trading day, this past week with the market index dropping more than 11,000 points and has corrected nearly 8 percent from the peak in August while the Junior Market fell 65 points but the TOP 10 stocks had one change.

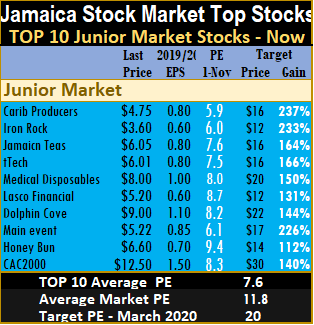

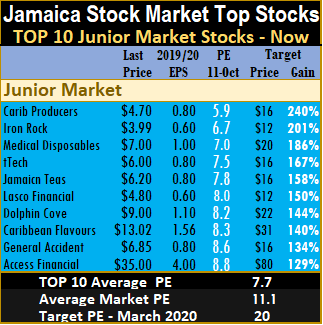

The main market closed the week with the overall PE of 17.2 and the Junior Market at 11.8 based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks average is at 7.8 and the main market PE fell to 10.8 from 11.1 for the previous week.

The main market closed the week with the overall PE of 17.2 and the Junior Market at 11.8 based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks average is at 7.8 and the main market PE fell to 10.8 from 11.1 for the previous week. Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

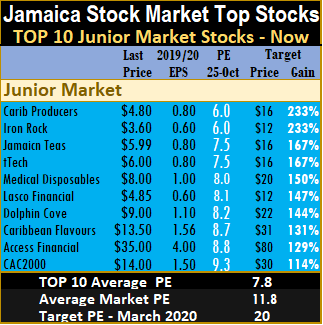

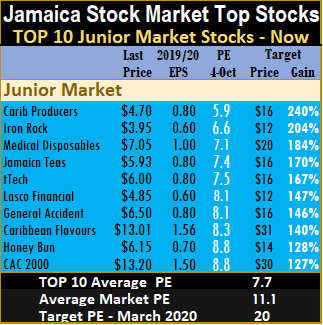

followed by Iron Rock with potential gains of 204 percent and Jamaican Teas with 158 percent.

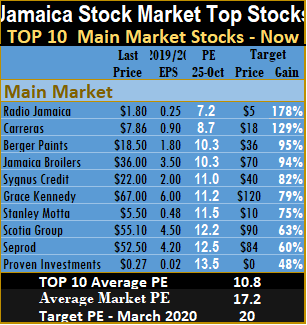

followed by Iron Rock with potential gains of 204 percent and Jamaican Teas with 158 percent. The main market, closed the week with the overall PE of 17.3, inching up from 17.2 for the previous week and the Junior Market rose to 12 from 11.1 last week based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks average rose to 7.9 from 7.7 and the main market PE remains at 11.1.

The main market, closed the week with the overall PE of 17.3, inching up from 17.2 for the previous week and the Junior Market rose to 12 from 11.1 last week based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks average rose to 7.9 from 7.7 and the main market PE remains at 11.1. PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

with projected gains of 240 percent as the leader, followed by Iron Rock Insurance with potential gains of 201 percent and Medical Disposables with 186 percent.

with projected gains of 240 percent as the leader, followed by Iron Rock Insurance with potential gains of 201 percent and Medical Disposables with 186 percent.

The PE ratio for Junior Market Top 10 stocks average remains at 7.7 and the main market PE at 11.1, up from 10.4 at the close of the previous week.

The PE ratio for Junior Market Top 10 stocks average remains at 7.7 and the main market PE at 11.1, up from 10.4 at the close of the previous week. the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Profit at

Profit at

The results for the final quarter were affected negatively by major turn about-turn in foreign exchange movements with a gain of $856,000 in the third quarter moving to a loss of $219,000 in the fourth quarter. Additionally, while interest income for the third quarter was $979,000 it slipped to just $728,000 in the final quarter, most likely due to change in the value of the Jamaican dollar. The effect of those changes is that a $1 million profit for the third quarter was not reproduced in the final quarter, even with more funds deployed in higher income-generating assets than the securities they were in before. The profit for the final quarter came out at just $124,000, well off from the fourth-quarter profit. Going forward, the company will be using borrowed funds to supplement its resources that will help in boosting revenues, profit and allowed for growth in its business.

The results for the final quarter were affected negatively by major turn about-turn in foreign exchange movements with a gain of $856,000 in the third quarter moving to a loss of $219,000 in the fourth quarter. Additionally, while interest income for the third quarter was $979,000 it slipped to just $728,000 in the final quarter, most likely due to change in the value of the Jamaican dollar. The effect of those changes is that a $1 million profit for the third quarter was not reproduced in the final quarter, even with more funds deployed in higher income-generating assets than the securities they were in before. The profit for the final quarter came out at just $124,000, well off from the fourth-quarter profit. Going forward, the company will be using borrowed funds to supplement its resources that will help in boosting revenues, profit and allowed for growth in its business. Buy Rated Junior Market stocks have two new entrants this week with

Buy Rated Junior Market stocks have two new entrants this week with

Market activity, left Caribbean Producers with projected gains of 240 percent as the leading Junior Market stock with likely gains, followed by

Market activity, left Caribbean Producers with projected gains of 240 percent as the leading Junior Market stock with likely gains, followed by  Carreras sits at the number two spot with projected gains of 125 percent with the price slipping a bit during the week and

Carreras sits at the number two spot with projected gains of 125 percent with the price slipping a bit during the week and  TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.