Kingston Wharves had a hand in the clobbering the Jamaica Stock Exchange Main Market got on Thursday, with a block of 21.2 million units traded down to $36, some $2.50 lower than the last traded price on Wednesday. Elsewhere market activity ended with the volume of shares trading rising 1,419 percent and the value 3,391 percent higher than Wednesday as the number of stocks advancing and declining were equal.

Kingston Wharves traded 21 million shares.

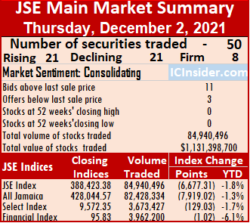

The All Jamaican Composite Index plunged 7,919.02 points to 428,044.57, following the 1,705 points fall Wednesday. The JSE Main Index dived 6,677.31 points, on top of the 2,730 points fall Wednesday, to 388,423.38 and the JSE Financial Index slipped 1.02 points to 95.83. A total of 50 securities traded down from 51 on Wednesday, with 21 rising, 21 declining and eight ending unchanged.

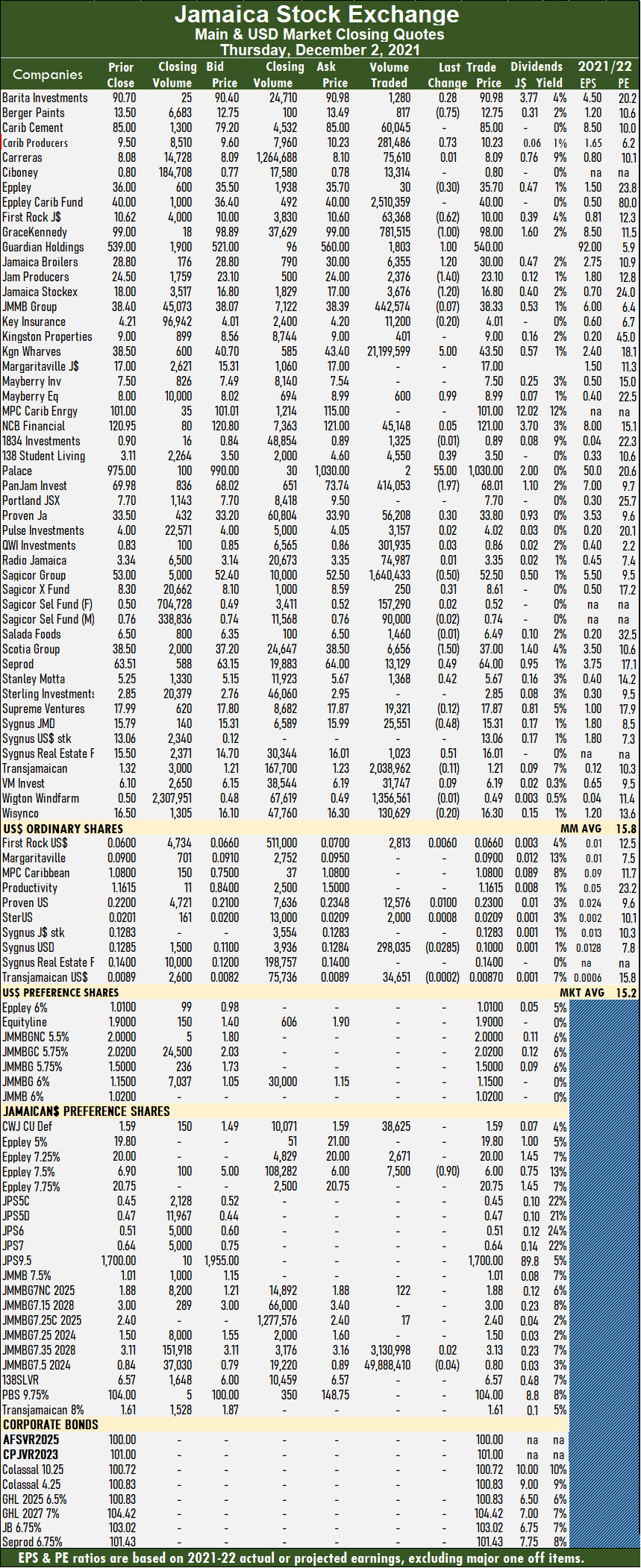

The PE Ratio, a formula for computing appropriate stock values, averages 15.8. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial year ending between the current year and August 2022.

A total of 84,940,496 shares traded for $1,131,398,700 versus 5,593,564 units at $32,410,085 on Wednesday. JMMB Group 7.5% led trading with 58.7 percent of total volume for an exchange of 49.89 million shares, followed by Kingston Wharves with 25 percent after trading 21.2 million units, JMMB Group 7.35% – 2028 accounted for 3.7 percent with 3.13 million units, Eppley Caribbean Property Fund delivered 3 percent after trading 2.51 million units, Transjamaican Highway accounted for 2.4 percent with 2.04 million units and Sagicor Group with 1.9 percent for exchange of 1.64 million units.

Trading averages 1,698,810 units at $22,627,974, versus 109,678 shares at $635,492 on Wednesday and month to date, an average of 896,377 units at $11,522,859. November closed with an average of 233,949 units at $2,695,416.

Trading averages 1,698,810 units at $22,627,974, versus 109,678 shares at $635,492 on Wednesday and month to date, an average of 896,377 units at $11,522,859. November closed with an average of 233,949 units at $2,695,416.

Investor’s Choice bid-offer indicator shows eleven stocks ending with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments rose 28 cents to $90.98 in trading 1,280 stocks, Berger Paints shed 75 cents to settle at $12.75 with an exchange of 817 stock units, Caribbean Producers rose 73 cents to $10.23 after 281,486 units crossed the market. Eppley lost 30 cents to end at $35.70 with a transfer of 30 stocks, First Rock Capital fell 62 cents to $10 in switching ownership of 63,368 shares, GraceKennedy declined $1 to $98 with an exchange of 781,515 units. Guardian Holdings popped $1 to close at $540 with the swapping of 1,803 stock units,Jamaica Broilers spiked $1.20 in closing at $30 after 6,355 stocks changed hands, Jamaica Producers shed $1.40 to finish at $23.10 in transferring 2,376 shares. Jamaica Stock Exchange slipped $1.20 to $16.80 after trading 3,676 units, Kingston Wharves rallied $5 to close at $43.50 in exchanging 21,199,599 stock units, after the bulk of the shares traded at $36.  Mayberry Jamaican Equities rose 99 cents to $8.99, owners switching 600 stocks. 138 Student Living gained 39 cents in ending at $3.50 with 4,550 shares changing hands, Palace Amusement advanced $55 to $1,030 with two stock units clearing the market, PanJam Investment declined $1.97 to end at $68.01 in trading 414,053 units. Proven Investments gained 30 cents in closing at $33.80 with an exchange of 56,208 shares, Sagicor Group dipped 50 cents to $52.50 with the swapping of 1,640,433 stock units, Sagicor Real Estate Fund rallied 31 cents to $8.61 after exchanging 250 stocks. Scotia Group shed $1.50 to end at $37, with 6,656 shares crossing the market, Seprod gained 49 cents to settle at $64 in transferring 13,129 units, Stanley Motta gained 42 cents after ending at $5.67 in switching ownership of 1,368 stocks. Sygnus Credit Investments fell 48 cents to $15.31, with 25,551 units changing hands, Sygnus Real Estate Finance rose 51 cents to $16.01 after trading 1,023 stock units.

Mayberry Jamaican Equities rose 99 cents to $8.99, owners switching 600 stocks. 138 Student Living gained 39 cents in ending at $3.50 with 4,550 shares changing hands, Palace Amusement advanced $55 to $1,030 with two stock units clearing the market, PanJam Investment declined $1.97 to end at $68.01 in trading 414,053 units. Proven Investments gained 30 cents in closing at $33.80 with an exchange of 56,208 shares, Sagicor Group dipped 50 cents to $52.50 with the swapping of 1,640,433 stock units, Sagicor Real Estate Fund rallied 31 cents to $8.61 after exchanging 250 stocks. Scotia Group shed $1.50 to end at $37, with 6,656 shares crossing the market, Seprod gained 49 cents to settle at $64 in transferring 13,129 units, Stanley Motta gained 42 cents after ending at $5.67 in switching ownership of 1,368 stocks. Sygnus Credit Investments fell 48 cents to $15.31, with 25,551 units changing hands, Sygnus Real Estate Finance rose 51 cents to $16.01 after trading 1,023 stock units.

In the preference segment, Eppley 7.50% preference share shed 90 cents to close at $6 in an exchange of 7,500 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading ended with five securities changing hands, compared to six on Wednesday, with three rising and two declining.

Trading ended with five securities changing hands, compared to six on Wednesday, with three rising and two declining. At the close, First Rock Capital USD share popped 0.6 of a cent to 6.6 US cents, with an exchange of 2,813 shares, Proven Investments increased 1 cent to 23 US cents after exchanging 12,576 stock units, Sterling Investments rose 0.08 of a cent in ending at 2.09 US cents after trading 2,000 stocks. Sygnus Credit Investments USD share lost 2.85 cents in closing at 10 US cents with 298,035 shares changing hands and Transjamaican Highway fell 0.02 of a cent to 0.87 US cents with 34,651 stocks crossing the market.

At the close, First Rock Capital USD share popped 0.6 of a cent to 6.6 US cents, with an exchange of 2,813 shares, Proven Investments increased 1 cent to 23 US cents after exchanging 12,576 stock units, Sterling Investments rose 0.08 of a cent in ending at 2.09 US cents after trading 2,000 stocks. Sygnus Credit Investments USD share lost 2.85 cents in closing at 10 US cents with 298,035 shares changing hands and Transjamaican Highway fell 0.02 of a cent to 0.87 US cents with 34,651 stocks crossing the market.

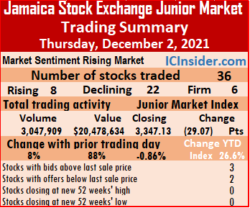

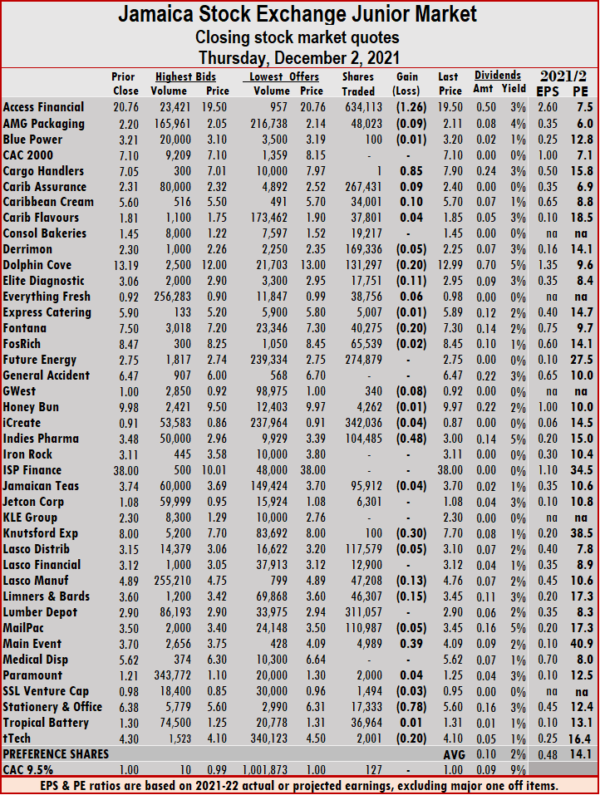

An interesting development in trading was the large block of Access Financial shares trading with the stock shedding $1.26 to close at $19.50, after a relatively large block of 634,113 shares cleared the market. the trade is a likely sign that the immediate future is bright for the stock. At the close, AMG Packaging dropped 9 cents to close at $2.11 with an exchange of 48,023 units, Cargo Handlers spiked 85 cents to $7.90 in trading one stock. Caribbean Assurance Brokers increased 9 cents to end at $2.40 with the swapping of 267,431 stock units, Caribbean Cream advanced 10 cents to $5.70 after exchanging 34,001 shares, Dolphin Cove lost 20 cents to end at $12.99, with 131,297 units changing hands. Elite Diagnostic declined 11 cents to $2.95 after exchanging 17,751 stocks, Everything Fresh rallied 6 cents to 98 cents, with 38,756 stock units crossing the market, Fontana fell 20 cents to $7.30 trading 40,275 stock units.

An interesting development in trading was the large block of Access Financial shares trading with the stock shedding $1.26 to close at $19.50, after a relatively large block of 634,113 shares cleared the market. the trade is a likely sign that the immediate future is bright for the stock. At the close, AMG Packaging dropped 9 cents to close at $2.11 with an exchange of 48,023 units, Cargo Handlers spiked 85 cents to $7.90 in trading one stock. Caribbean Assurance Brokers increased 9 cents to end at $2.40 with the swapping of 267,431 stock units, Caribbean Cream advanced 10 cents to $5.70 after exchanging 34,001 shares, Dolphin Cove lost 20 cents to end at $12.99, with 131,297 units changing hands. Elite Diagnostic declined 11 cents to $2.95 after exchanging 17,751 stocks, Everything Fresh rallied 6 cents to 98 cents, with 38,756 stock units crossing the market, Fontana fell 20 cents to $7.30 trading 40,275 stock units.  GWest Corporation dropped 8 cents to end at 92 cents in trading 340 shares, Indies Pharma lost 48 cents in closing at $3 while exchanging 104,485 stocks, Knutsford Express declined 30 cents to end at $7.70 with an exchange of 100 units. Lasco Manufacturing shed 13 cents to $4.76 after trading 47,208 units, Limners and Bards fell 15 cents ending at $3.45 after an exchange of 46,307 shares, Main Event climbed 39 cents to $4.09 with 4,989 stocks crossing the market. Stationery and Office Supplies fell 78 cents to $5.60, with 17,333 stock units changing hands and tTech fell 20 cents to $4.10 in an exchange of 2,001 units.

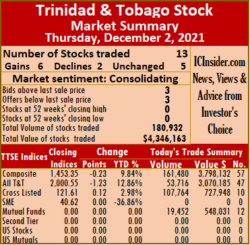

GWest Corporation dropped 8 cents to end at 92 cents in trading 340 shares, Indies Pharma lost 48 cents in closing at $3 while exchanging 104,485 stocks, Knutsford Express declined 30 cents to end at $7.70 with an exchange of 100 units. Lasco Manufacturing shed 13 cents to $4.76 after trading 47,208 units, Limners and Bards fell 15 cents ending at $3.45 after an exchange of 46,307 shares, Main Event climbed 39 cents to $4.09 with 4,989 stocks crossing the market. Stationery and Office Supplies fell 78 cents to $5.60, with 17,333 stock units changing hands and tTech fell 20 cents to $4.10 in an exchange of 2,001 units. At the close, 13 securities traded down from 15 on Wednesday, with six rising, two declining and five finishing unchanged. The Composite Index shed 0.23 points to 1,453.35, the All T&T Index fell 1.23 points to close at 2,000.55 and the Cross-Listed Index climbed 0.12 points to settle at 121.61.

At the close, 13 securities traded down from 15 on Wednesday, with six rising, two declining and five finishing unchanged. The Composite Index shed 0.23 points to 1,453.35, the All T&T Index fell 1.23 points to close at 2,000.55 and the Cross-Listed Index climbed 0.12 points to settle at 121.61. GraceKennedy dipped 1 cent in closing at $6.10 after exchanging 51,678 stock units, Guardian Holdings finished at $30.33, with 8,070 shares changing hands, Guardian Media rose 7 cents to end at $3.10 after trading 50 stocks. JMMB Group popped 2 cents to $2.28 in switching ownership of 6,360 stock units, Massy Holdings had an exchange of 20,191 shares at $95.58 while NCB Financial Group rallied 10 cents to $8.10 with 49,726 units crossing the market. Republic Financial Holdings ended at $138 in an exchange of 1,525 shares, Scotiabank increased $1 to $67 after 4,086 stocks crossed the market, Trinidad & Tobago NGL lost 25 cents to end at $18.50 after an exchange of 300 stock units and Trinidad Cement rallied 2 cents in closing at $3.87 after trading 350 shares.Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

GraceKennedy dipped 1 cent in closing at $6.10 after exchanging 51,678 stock units, Guardian Holdings finished at $30.33, with 8,070 shares changing hands, Guardian Media rose 7 cents to end at $3.10 after trading 50 stocks. JMMB Group popped 2 cents to $2.28 in switching ownership of 6,360 stock units, Massy Holdings had an exchange of 20,191 shares at $95.58 while NCB Financial Group rallied 10 cents to $8.10 with 49,726 units crossing the market. Republic Financial Holdings ended at $138 in an exchange of 1,525 shares, Scotiabank increased $1 to $67 after 4,086 stocks crossed the market, Trinidad & Tobago NGL lost 25 cents to end at $18.50 after an exchange of 300 stock units and Trinidad Cement rallied 2 cents in closing at $3.87 after trading 350 shares.Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Income from sales jumped 49 percent to $936 million for the September quarter, up from $630 million in 2020 and climbed 42 percent for the six months ended September 2021 to $1.62 billion, from $1.14 billion in the prior year.

Income from sales jumped 49 percent to $936 million for the September quarter, up from $630 million in 2020 and climbed 42 percent for the six months ended September 2021 to $1.62 billion, from $1.14 billion in the prior year.

A total of six securities traded, compared to eight on Tuesday with one rising, two declining and three ending unchanged.

A total of six securities traded, compared to eight on Tuesday with one rising, two declining and three ending unchanged. Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than their last selling prices and none with a lower offer.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than their last selling prices and none with a lower offer. The All Jamaican Composite Index fell 1,704.80 points to 435,963.59, the JSE Main Index dived 2,729.98 points to 395,100.69 and the JSE Financial Index shed 1.43 points to end at 96.85.

The All Jamaican Composite Index fell 1,704.80 points to 435,963.59, the JSE Main Index dived 2,729.98 points to 395,100.69 and the JSE Financial Index shed 1.43 points to end at 96.85. Investor’s Choice bid-offer indicator shows 11 stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows 11 stocks ending with bids higher than their last selling prices and four with lower offers. Scotia Group spiked 75 cents to end at $38.50 with 36,434 units crossing the market, Seprod popped 31 cents to $63.51 in switching ownership of 7,381 shares, Supreme Ventures rallied 49 cents in closing at $17.99 and trading 16,389 stocks. Sygnus Credit Investments popped 59 cents to $15.79 in transferring 60,631 stock units, Sygnus Real Estate Finance shed 51 cents to close at $15.50 in trading 2,224 units and Wisynco Group dipped 43 cents to $16.50 with the swapping of 80,624 stocks.

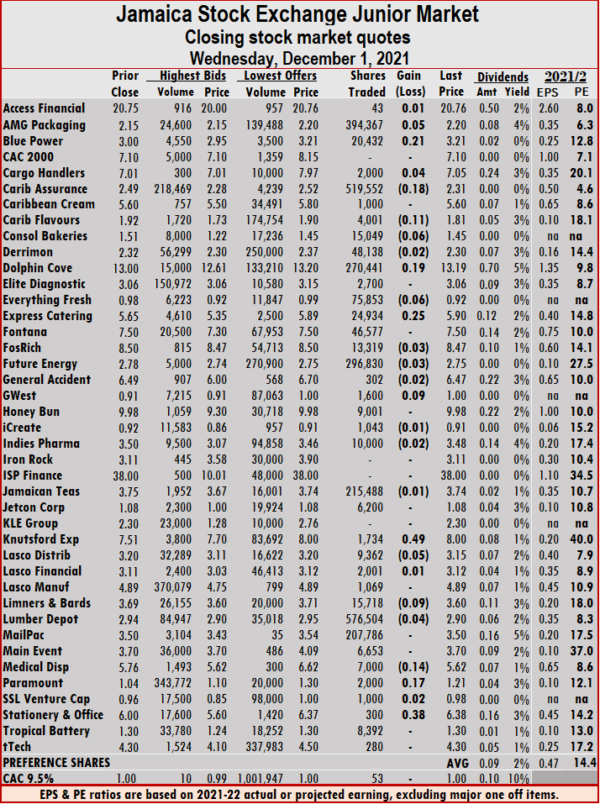

Scotia Group spiked 75 cents to end at $38.50 with 36,434 units crossing the market, Seprod popped 31 cents to $63.51 in switching ownership of 7,381 shares, Supreme Ventures rallied 49 cents in closing at $17.99 and trading 16,389 stocks. Sygnus Credit Investments popped 59 cents to $15.79 in transferring 60,631 stock units, Sygnus Real Estate Finance shed 51 cents to close at $15.50 in trading 2,224 units and Wisynco Group dipped 43 cents to $16.50 with the swapping of 80,624 stocks. At the close, AMG Packaging popped 5 cents after closing at $2.20 with the swapping of 394,367 shares, Blue Power rose 21 cents to $3.21, with 20,432 stocks crossing the market, Cargo Handlers climbed 4 cents to end at $7.05 after exchanging 2,000 stock units. Caribbean Assurance Brokers shed 18 cents to $2.31, with 519,552 units crossing the market, Caribbean Flavours fell 11 cents to $1.81 with 4,001 stocks changing hands, Consolidated Bakeries declined 6 cents in closing at $1.45 in exchanging 15,049 units. Dolphin Cove popped 19 cents to $13.19 after trading 270,441 shares, Everything Fresh fell 6 cents to 92 cents with an exchange of 75,853 stock units, Express Catering increased 25 cents to close at $5.90 in exchanging 24,934 units. Fosrich dropped 3 cents to end at $8.47 after trading 13,319 stocks, Future Energy Source slipped 3 cents to $2.75, with 296,830 shares changing hands, GWest Corporation rallied 9 cents to close at $1 in switching ownership of 1,600 stock units.

At the close, AMG Packaging popped 5 cents after closing at $2.20 with the swapping of 394,367 shares, Blue Power rose 21 cents to $3.21, with 20,432 stocks crossing the market, Cargo Handlers climbed 4 cents to end at $7.05 after exchanging 2,000 stock units. Caribbean Assurance Brokers shed 18 cents to $2.31, with 519,552 units crossing the market, Caribbean Flavours fell 11 cents to $1.81 with 4,001 stocks changing hands, Consolidated Bakeries declined 6 cents in closing at $1.45 in exchanging 15,049 units. Dolphin Cove popped 19 cents to $13.19 after trading 270,441 shares, Everything Fresh fell 6 cents to 92 cents with an exchange of 75,853 stock units, Express Catering increased 25 cents to close at $5.90 in exchanging 24,934 units. Fosrich dropped 3 cents to end at $8.47 after trading 13,319 stocks, Future Energy Source slipped 3 cents to $2.75, with 296,830 shares changing hands, GWest Corporation rallied 9 cents to close at $1 in switching ownership of 1,600 stock units.  Knutsford Express gained 49 cents in ending at $8 after trading 1,734 units, Lasco Distributors fell 5 cents in closing at $3.15 after exchanging 9,362 stocks, Limners and Bards dropped 9 cents to end at $3.60, with 15,718 shares crossing the exchange. Lumber Depot shed 4 cents to $2.90 while exchanging 576,504 stock units, Medical Disposables lost 14 cents to end at $5.62, with 7,000 stocks clearing the market, Paramount Trading advanced 17 cents in closing at $1.21 after exchanging 2,000 units and Stationery and Office Supplies popped 38 cents to $6.38 in an exchange of 300 stock units.

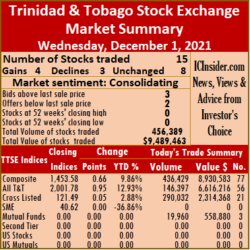

Knutsford Express gained 49 cents in ending at $8 after trading 1,734 units, Lasco Distributors fell 5 cents in closing at $3.15 after exchanging 9,362 stocks, Limners and Bards dropped 9 cents to end at $3.60, with 15,718 shares crossing the exchange. Lumber Depot shed 4 cents to $2.90 while exchanging 576,504 stock units, Medical Disposables lost 14 cents to end at $5.62, with 7,000 stocks clearing the market, Paramount Trading advanced 17 cents in closing at $1.21 after exchanging 2,000 units and Stationery and Office Supplies popped 38 cents to $6.38 in an exchange of 300 stock units. Overall, 15 securities traded down from 18 on Tuesday, with four rising, three falling and eight unchanged.

Overall, 15 securities traded down from 18 on Tuesday, with four rising, three falling and eight unchanged. Massy Holdings rose $5.58 to $95.58 after an exchange of 19,305 units, National Enterprises ended trading 7,000 stocks at $3.25, NCB Financial Group remained at $8 after 286,882 stocks changed hands. Republic Financial Holdings ended at $138 with an exchange of 7,274 shares, Scotiabank declined $1 to close at $66 in trading 28,710 stock units, Trinidad & Tobago NGL advanced 25 cents to $18.75, with 19,576 units crossing the exchange. Trinidad Cement remained at $3.85 after 10,915 stock units crossed the market, Unilever Caribbean lost 19 cents in ending at $16 after an exchange of 1,017 stocks and West Indian Tobacco ended unchanged at $29.26 with 15,503 units changing hands.

Massy Holdings rose $5.58 to $95.58 after an exchange of 19,305 units, National Enterprises ended trading 7,000 stocks at $3.25, NCB Financial Group remained at $8 after 286,882 stocks changed hands. Republic Financial Holdings ended at $138 with an exchange of 7,274 shares, Scotiabank declined $1 to close at $66 in trading 28,710 stock units, Trinidad & Tobago NGL advanced 25 cents to $18.75, with 19,576 units crossing the exchange. Trinidad Cement remained at $3.85 after 10,915 stock units crossed the market, Unilever Caribbean lost 19 cents in ending at $16 after an exchange of 1,017 stocks and West Indian Tobacco ended unchanged at $29.26 with 15,503 units changing hands. For the three months to September, profit before tax rose 30 percent to $81 million from $62 million in 2020 and after an increased charge of 488 percent in profit tax, profit ended 23 percent lower than in 2020, at $43 million.

For the three months to September, profit before tax rose 30 percent to $81 million from $62 million in 2020 and after an increased charge of 488 percent in profit tax, profit ended 23 percent lower than in 2020, at $43 million. Gross cash flow brought in $356 million, but growth in working capital, purchase of fixed assets of $101 million, increased investments of $34 million and paying $59.4 million dividends reduced to gross intake to $104 million. At the end of September, shareholders’ equity stood at $1 billion, with long term borrowings at a mere $16 million and short term at $6 million. Current assets ended the period at $637 million, including trade and other receivables of $108 million, up from $723 million in 2020, with cash and bank balances of $404 million. Investments in stocks amount to $96 million, up from $61 million in 2020. Current liabilities ended the period at S230 million. Net current assets ended the period at $407 billion, but the company could draw down on the investment in shares that would swell net current assets.

Gross cash flow brought in $356 million, but growth in working capital, purchase of fixed assets of $101 million, increased investments of $34 million and paying $59.4 million dividends reduced to gross intake to $104 million. At the end of September, shareholders’ equity stood at $1 billion, with long term borrowings at a mere $16 million and short term at $6 million. Current assets ended the period at $637 million, including trade and other receivables of $108 million, up from $723 million in 2020, with cash and bank balances of $404 million. Investments in stocks amount to $96 million, up from $61 million in 2020. Current liabilities ended the period at S230 million. Net current assets ended the period at $407 billion, but the company could draw down on the investment in shares that would swell net current assets.