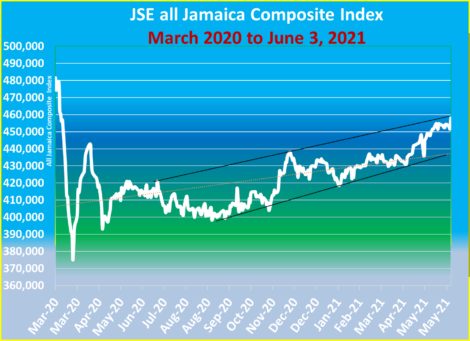

Main Market indices spiked on Thursday on reduced trading to close at the highest level since March 11 last year, with the All Jamaican Composite Index rocketed up 6,361.57 points to 458,032.39 and bettering the March 11 close of 556,092.64, still below the previous day’s 460,418.78 points close.

The parallel black lines form a channel for the JSE All jamaica Composite Index with the index now touching the top line. (Resistance).

The JSE Main Index spiked 5,470.02 points 425,630.09, just ahead of March 10, 2020, close, but below that of March 9 at 436,435.40 and the JSE Financial Index rose 1.42 points to settle at 105.90. The market is trading right up on the upper level of resistance of an upward sloping channel and could face major challenges in breaking through, in the short term.

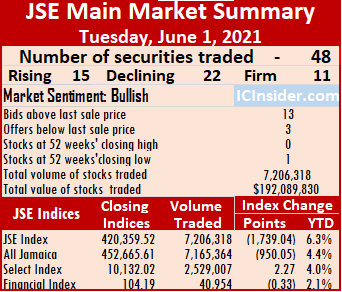

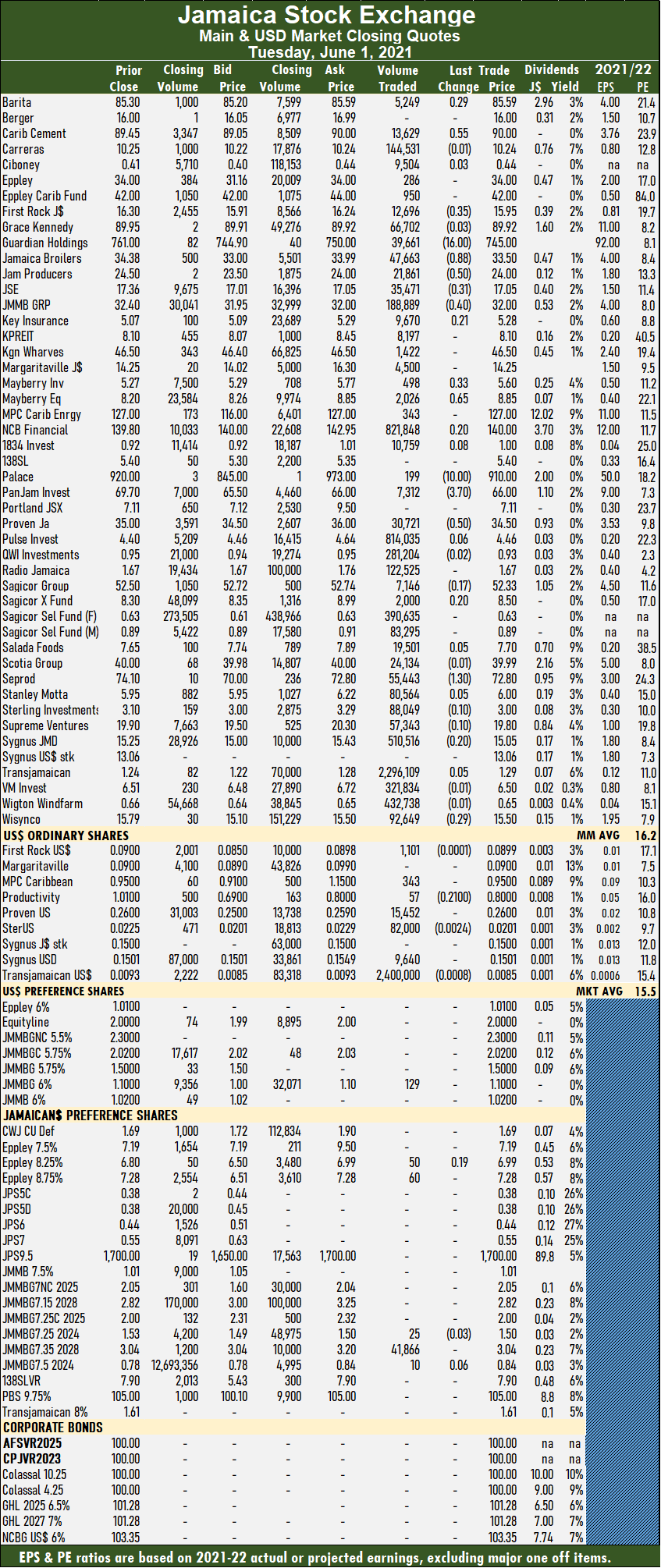

A total of 48 securities traded against 47 on Wednesday, with 24 stocks rising, 14 declining and 10 closing unchanged. The PE Ratio, a measure that determines an appropriate relative value of each stock, averages 16.3 based on ICInsider.com’s forecast of 2021-22 earnings.

The market closed with the volume and value traded declining 30 percent and 75 percent, respectively compared to Wednesday as 8,415,642 shares changed hands for $105,241,816 versus 12,077,813 units at $416,350,090 on Wednesday. Wigton Windfarm led trading with 32.6 percent of total volume for 2.74 million shares, followed by Sagicor Select Financial Fund with 19.3 percent for 1.63 million units and Pulse Investments with 9.1 percent after 768,244 units changed hands.

Trading averaged 175,326 units at $2,192,538, compared to 256,975 shares at $8,858,513 on Wednesday. Trading month to date averages 193,705 units at $4,990,781, in contrast to 202,991 units at $6,404,631 on Wednesday. May closed with an average of 439,937 units at $4,698,961.

Trading averaged 175,326 units at $2,192,538, compared to 256,975 shares at $8,858,513 on Wednesday. Trading month to date averages 193,705 units at $4,990,781, in contrast to 202,991 units at $6,404,631 on Wednesday. May closed with an average of 439,937 units at $4,698,961.

Investor’s Choice bid-offer indicator reading has 14 stocks ending with bids higher than their last selling prices and five with lower offers.

At the close, Berger Paints dived $2.26 to $13.79 in an exchange of 4,220 shares, Caribbean Cement popped $4.29 to $90 after a transfer of 5,060 stock units, Eppley spiked $4.25 higher at $36.25 with 2 units changing hands. Grace Kennedy shed 47 cents to end at $89.45 in trading 19,101 stock units, Guardian Holdings climbed $15 to close at $760 after clearing the market with 70,560 shares. Jamaica Producers dropped $1.50 to $23 in trading 73,386 stocks, Kingston Properties gained 39 cents to close at $8.46 in switching ownership of 3,915 stock units, Kingston Wharves lost 30 cents to end at $46.20 with the swapping of 951 units. Mayberry Investments rallied 89 cents to $6.39 in exchanging 455 shares, NCB Financial ended 89 cents higher at $143.89 after 30,479 stocks crossed the market, Palace Amusement dropped $34.80 to $985.20 in an exchange of 28 units. Proven Investments climbed $1.49 to $37 with a transfer of 31,764 stocks. Sagicor Group rallied 75 cents to $52.75 in trading 19,901 shares. Sagicor Real Estate Fund hammered out a 64 cents gain to end at $8.99 with 435 shares changing hands. Seprod rose $1.02 to $74.02 in switching ownership of 9,931 units, Supreme Ventures lost 45 cents in ending at $19.55 with 8,939 stocks crossing the exchange.  Sygnus Credit Investments gained 30 cents to settle at $15.30 in trading 25,434 stock units, Victoria Mutual Investments slipped 39 cents to $6.11 in the transfer of 185,406 shares and Wisynco Group popped 60 cents to $15.80 with the swapping of 130,777 stocks.

Sygnus Credit Investments gained 30 cents to settle at $15.30 in trading 25,434 stock units, Victoria Mutual Investments slipped 39 cents to $6.11 in the transfer of 185,406 shares and Wisynco Group popped 60 cents to $15.80 with the swapping of 130,777 stocks.

In the preference segment, Eppley 7.5% preference share spiked $2.31 to close at 52 weeks’ high of $9.50, trading 100 units and JMMB Group 7.15% – 2028 gained 43 cents ending at $3.25 with 59,930 stocks crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

The All Jamaican Composite Index declined 994.79 points to 451,670.82, the JSE Main Index lost 199.45 points to end at 420,160.07 and the JSE Financial Index gained 0.29 points to settle at 104.48.

The All Jamaican Composite Index declined 994.79 points to 451,670.82, the JSE Main Index lost 199.45 points to end at 420,160.07 and the JSE Financial Index gained 0.29 points to settle at 104.48. Trading close with an average of 256,975 units at $8,858,513, compared to 150,132 shares at $4,001,871 on Tuesday. Trading month to date averages 202,991 units at $6,404,631, in contrast to 150,132 units at $4,001,871 on Tuesday. May closed with an average of 439,937 units at $4,698,961.

Trading close with an average of 256,975 units at $8,858,513, compared to 150,132 shares at $4,001,871 on Tuesday. Trading month to date averages 202,991 units at $6,404,631, in contrast to 150,132 units at $4,001,871 on Tuesday. May closed with an average of 439,937 units at $4,698,961. Scotia Group rose $1.01 to $41 after trading 47,810 stocks, Seprod gained 20 cents to close at $73 with the swapping of 12,488 units, Stanley Motta shed 20 cents to close at $5.80 after exchanging 10,000 shares. Sterling Investments picked up 29 cents to finish at $3.29 in switching ownership of 1,000 units, Supreme Ventures rallied 20 cents to $20 in trading 61,340 shares and Wisynco Group shed 30 cents in ending at $15.20 after an exchange of 121,439 stock units.

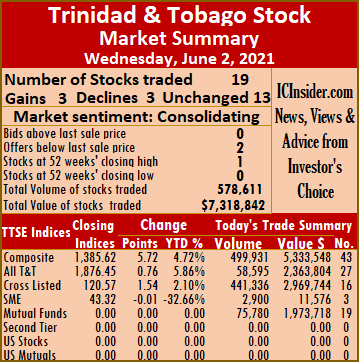

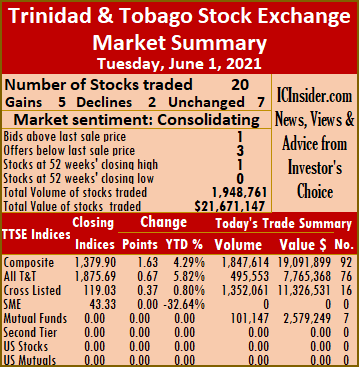

Scotia Group rose $1.01 to $41 after trading 47,810 stocks, Seprod gained 20 cents to close at $73 with the swapping of 12,488 units, Stanley Motta shed 20 cents to close at $5.80 after exchanging 10,000 shares. Sterling Investments picked up 29 cents to finish at $3.29 in switching ownership of 1,000 units, Supreme Ventures rallied 20 cents to $20 in trading 61,340 shares and Wisynco Group shed 30 cents in ending at $15.20 after an exchange of 121,439 stock units. At the close, 19 traded compared to 20 on Tuesday, with three stocks rising, three declining and 13 remaining unchanged. The Composite Index popped 5.72 points to 1,385.62, the All T$T Index gained 0.76 points to 1,876.45, and the Cross-Listed Index rose 1.54 points to end at 120.57.

At the close, 19 traded compared to 20 on Tuesday, with three stocks rising, three declining and 13 remaining unchanged. The Composite Index popped 5.72 points to 1,385.62, the All T$T Index gained 0.76 points to 1,876.45, and the Cross-Listed Index rose 1.54 points to end at 120.57. JMMB Group lost 6 cents in closing at $1.75 with a transfer of 80,103 stock units, Massy Holdings ended at $69.76 after exchanging 50 units, National Enterprises closed at $3 with the swapping of 3,030 stocks. NCB Financial Group remained at $8.50, trading 291,105 shares, One Caribbean Media was unchanged at $4.80 with 500 stocks clearing the market, Prestige Holdings closed at $6.55 in transferring 1,167 shares. Republic Financial Holdings dipped 5 cents to $134.95 after 19 stock units cleared the market with . Scotiabank ended at $57 after exchanging 23,938 shares, Trinidad & Tobago NGL closed at $17.50 in trading 6,105 stocks and Unilever Caribbean finished at $16.33 with the swapping of 300 stocks.

JMMB Group lost 6 cents in closing at $1.75 with a transfer of 80,103 stock units, Massy Holdings ended at $69.76 after exchanging 50 units, National Enterprises closed at $3 with the swapping of 3,030 stocks. NCB Financial Group remained at $8.50, trading 291,105 shares, One Caribbean Media was unchanged at $4.80 with 500 stocks clearing the market, Prestige Holdings closed at $6.55 in transferring 1,167 shares. Republic Financial Holdings dipped 5 cents to $134.95 after 19 stock units cleared the market with . Scotiabank ended at $57 after exchanging 23,938 shares, Trinidad & Tobago NGL closed at $17.50 in trading 6,105 stocks and Unilever Caribbean finished at $16.33 with the swapping of 300 stocks. Trading ended with five securities changing hands, compared to eight on Tuesday with the prices of one stock rising, two declining and two remaining unchanged.

Trading ended with five securities changing hands, compared to eight on Tuesday with the prices of one stock rising, two declining and two remaining unchanged. At the close, First Rock Capital had an exchange of 44,814 shares at 8.99 US cents, Productive Business Solutions had trading of 9 stock units at 80 US cents, Proven Investments lost 0.1 of a cent to end at 25.9 US cents with 21,708 units changing hands. Sterling Investments slipped 0.01 of a cent to 2 US cents with a transfer of 52,000 stocks and Sygnus Credit Investments rose 0.48 of a cent to close at 15.49 US cents with 10,974 shares crossing the exchange.

At the close, First Rock Capital had an exchange of 44,814 shares at 8.99 US cents, Productive Business Solutions had trading of 9 stock units at 80 US cents, Proven Investments lost 0.1 of a cent to end at 25.9 US cents with 21,708 units changing hands. Sterling Investments slipped 0.01 of a cent to 2 US cents with a transfer of 52,000 stocks and Sygnus Credit Investments rose 0.48 of a cent to close at 15.49 US cents with 10,974 shares crossing the exchange. A total of 38 securities traded, similar to Tuesday, with 16 rising, 13 declining and nine closing unchanged.

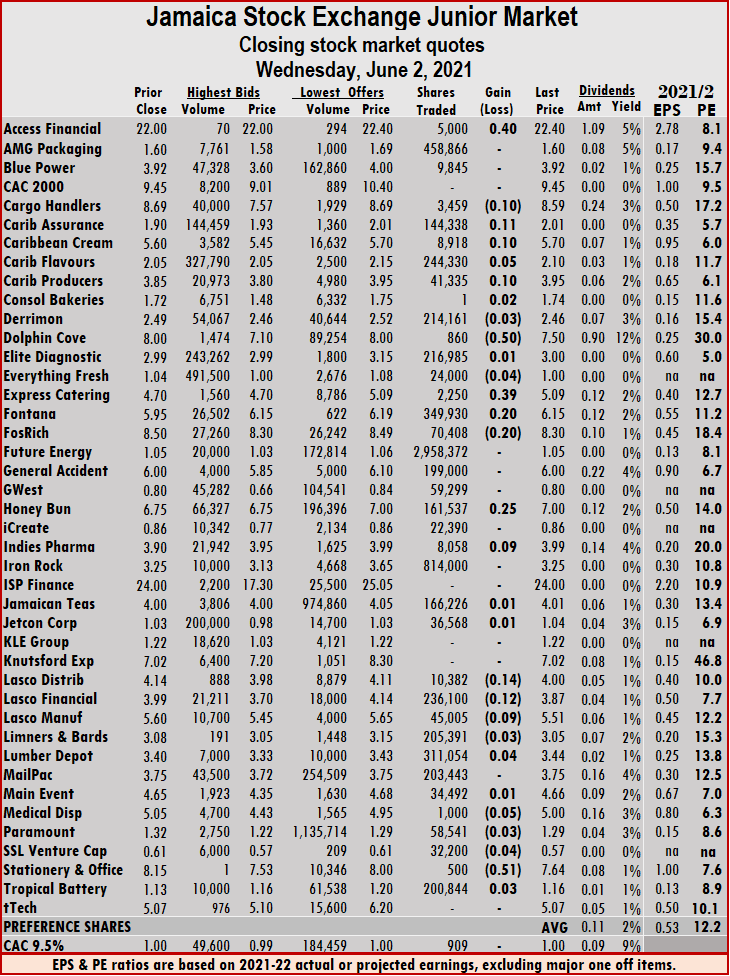

A total of 38 securities traded, similar to Tuesday, with 16 rising, 13 declining and nine closing unchanged. Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and three with lower offers. Lasco Distributors fell 14 cents to end at $4 with 10,382 shares traded, Lasco Financial lost 12 cents to finish at $3.87 with 236,100 units changing hands, after trading at an intraday 52 weeks high of $4.20. Lasco Manufacturing slipped 9 cents to $5.51, with a transfer of 45,005 stocks, Medical Disposables fell 5 cents to $5 with investors switching ownership of 1,000 stock units and Stationery and Office Supplies shed 51 cents to close at $7.64 with the 500 shares crossing the exchange.

Lasco Distributors fell 14 cents to end at $4 with 10,382 shares traded, Lasco Financial lost 12 cents to finish at $3.87 with 236,100 units changing hands, after trading at an intraday 52 weeks high of $4.20. Lasco Manufacturing slipped 9 cents to $5.51, with a transfer of 45,005 stocks, Medical Disposables fell 5 cents to $5 with investors switching ownership of 1,000 stock units and Stationery and Office Supplies shed 51 cents to close at $7.64 with the 500 shares crossing the exchange. Overall, 38 securities traded compared to 39 on Monday and ended, with 13 rising, 17 declining and eight closing unchanged.

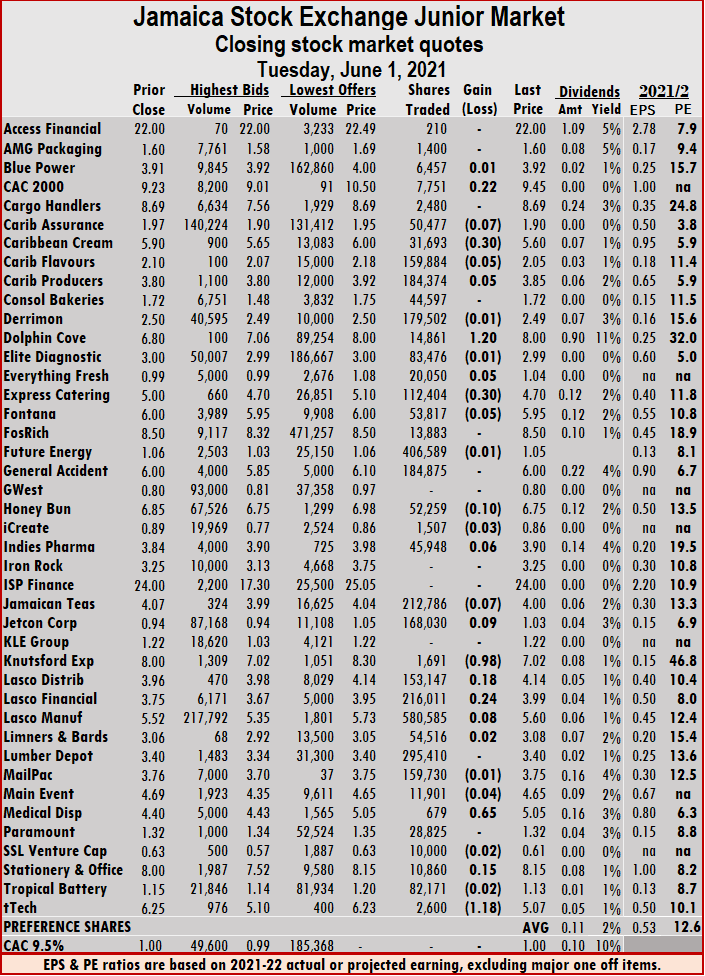

Overall, 38 securities traded compared to 39 on Monday and ended, with 13 rising, 17 declining and eight closing unchanged. Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and two with lower offers. Lasco Manufacturing rose 8 cents to $5.60 with 580,585 stock units changing hands, Medical Disposables jumped 65 cents to $5.05 with 679 stocks passing through the market. Stationery and Office Supplies gained 15 cents to end at $8.15 with 10,860 units traded and tTech dropped $1.18 to close at $5.07 with 2,600 shares crossing the exchange.

Lasco Manufacturing rose 8 cents to $5.60 with 580,585 stock units changing hands, Medical Disposables jumped 65 cents to $5.05 with 679 stocks passing through the market. Stationery and Office Supplies gained 15 cents to end at $8.15 with 10,860 units traded and tTech dropped $1.18 to close at $5.07 with 2,600 shares crossing the exchange. The All Jamaican Composite Index shed 950.05 points to 452,665.61, the JSE Main Index declined 1,739.04 points to end at 4420,359.52 and the JSE Financial Index lost 0.33 points to settle at 104.19.

The All Jamaican Composite Index shed 950.05 points to 452,665.61, the JSE Main Index declined 1,739.04 points to end at 4420,359.52 and the JSE Financial Index lost 0.33 points to settle at 104.19. Investor’s Choice bid-offer indicator reading has 13 stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator reading has 13 stocks ending with bids higher than their last selling prices and three with lower offers. PanJam Investment declined $3.70 to close at $66 in transferring 7,312 units, Proven Investments lost 50 cents to close at $34.50 with 30,721 stock units clearing the market. Sagicor Real Estate Fund gained 20 cents ending at $8.50 and exchanging 2,000 shares. Seprod fell $1.30 to end at $72.80, with 55,443 shares crossing the exchange, Sygnus Credit Investments lost 20 cents to close at $15.05 in trading 510,516 stock units and Wisynco Group ended 29 cents lower at $15.50 in an exchange of 92,649 stocks.

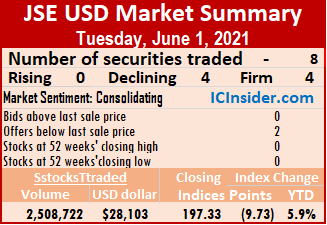

PanJam Investment declined $3.70 to close at $66 in transferring 7,312 units, Proven Investments lost 50 cents to close at $34.50 with 30,721 stock units clearing the market. Sagicor Real Estate Fund gained 20 cents ending at $8.50 and exchanging 2,000 shares. Seprod fell $1.30 to end at $72.80, with 55,443 shares crossing the exchange, Sygnus Credit Investments lost 20 cents to close at $15.05 in trading 510,516 stock units and Wisynco Group ended 29 cents lower at $15.50 in an exchange of 92,649 stocks. Transjamaican Highway was the volume leader accounting for 2.51 million of the 2,508,722 shares traded, with a value of US$28,103 compared to 460,180 units trading at US$70,670 on Monday.

Transjamaican Highway was the volume leader accounting for 2.51 million of the 2,508,722 shares traded, with a value of US$28,103 compared to 460,180 units trading at US$70,670 on Monday. Proven Investments remained at 26 US cents with a transfer of 15,452 stock units, Sterling Investments fell 0.24 of a cent to 2.01 US cents with 82,000 shares traded, Sygnus Credit Investments ended at 15.01 US cents after trading 9,640 stocks and Transjamaican Highway declined by 0.08 of a cent to finish at 0.85 US cents with 2,400,000 units crossing the exchange.

Proven Investments remained at 26 US cents with a transfer of 15,452 stock units, Sterling Investments fell 0.24 of a cent to 2.01 US cents with 82,000 shares traded, Sygnus Credit Investments ended at 15.01 US cents after trading 9,640 stocks and Transjamaican Highway declined by 0.08 of a cent to finish at 0.85 US cents with 2,400,000 units crossing the exchange.

NCB Financial Group close at $8.50 in an exchange of 1,303,500 units, National Enterprises traded 20,281 stock units at $3 after rising 4 cents, National Flour exchanged 218,348 units at $2.30, Republic Financial Holdings closed at $135 after trading 48 stock units, Scotiabank closed at $57, with 16,069 stock units clearing the market, Trinidad & Tobago NGL lost $1 to close at $17.50 after trading 26,322 stock units. Trinidad Cement ended at $3.30, with an exchange of 39 stock units, Unilever Caribbean closed at $16.33 after exchanging 8,297 stocks and West Indian Tobacco lost 1 cent to end at $32.50 after trading 305 shares.

NCB Financial Group close at $8.50 in an exchange of 1,303,500 units, National Enterprises traded 20,281 stock units at $3 after rising 4 cents, National Flour exchanged 218,348 units at $2.30, Republic Financial Holdings closed at $135 after trading 48 stock units, Scotiabank closed at $57, with 16,069 stock units clearing the market, Trinidad & Tobago NGL lost $1 to close at $17.50 after trading 26,322 stock units. Trinidad Cement ended at $3.30, with an exchange of 39 stock units, Unilever Caribbean closed at $16.33 after exchanging 8,297 stocks and West Indian Tobacco lost 1 cent to end at $32.50 after trading 305 shares. The company enjoyed a ten-year tax profit break and is now subject to full taxation as of October 12, last year.

The company enjoyed a ten-year tax profit break and is now subject to full taxation as of October 12, last year. The principal activity of the company is the distribution of the manufactured products of Lasco Manufacturing that includes soy-based products, juice drinks, water and packaging of milk-based products and Pharmaceutical and other products manufactured by third parties.

The principal activity of the company is the distribution of the manufactured products of Lasco Manufacturing that includes soy-based products, juice drinks, water and packaging of milk-based products and Pharmaceutical and other products manufactured by third parties.